Cost of car insurance in Australia is a topic that often sparks anxiety and confusion. Navigating the complex world of insurance premiums can be overwhelming, with numerous factors influencing the final cost. From your age and driving history to the type of vehicle you own and where you live, numerous variables come into play, making it crucial to understand the intricacies of car insurance in Australia.

This guide delves into the factors that shape car insurance costs, exploring the different types of coverage available, and providing insights into how to secure the best rates. We’ll also address common claims and exclusions, offering valuable tips for reducing your premiums and ensuring you have the right coverage to protect yourself on the road.

Factors Influencing Car Insurance Costs in Australia

Car insurance premiums in Australia are influenced by a variety of factors, reflecting the complexity of assessing risk and ensuring fair pricing for drivers. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premiums.

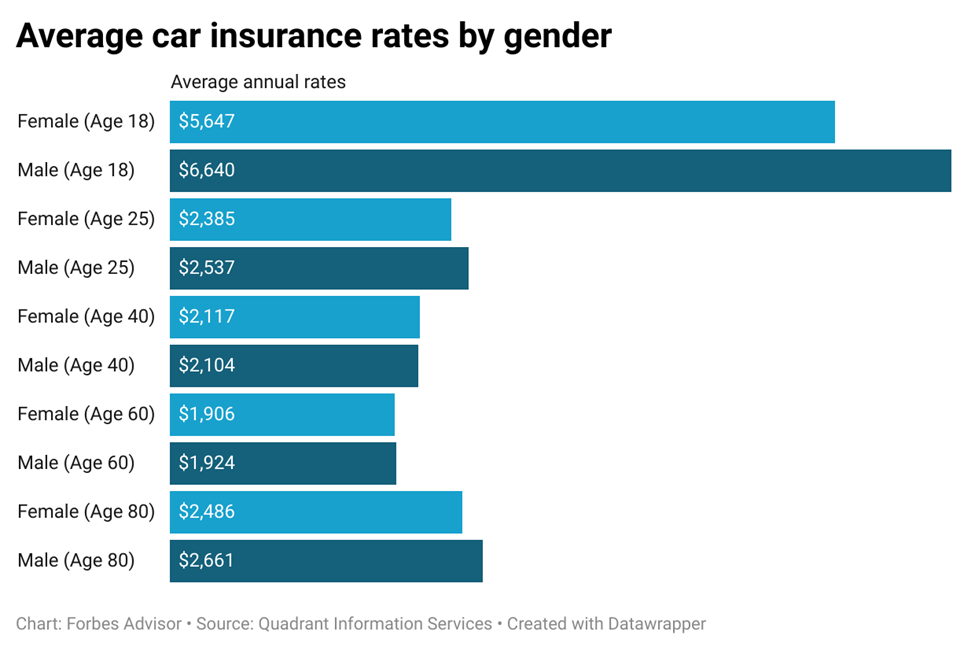

Age and Driving Experience

Your age and driving experience are significant factors in determining your car insurance premiums. Younger drivers, particularly those with less experience, are statistically more likely to be involved in accidents. This increased risk translates into higher premiums for young drivers. As you gain experience and age, your premiums generally decrease. This is because insurance companies consider you a lower risk due to your accumulated driving knowledge and improved judgment.

Driving History

Your driving history plays a crucial role in determining your insurance premiums. A clean driving record with no accidents, traffic violations, or claims will generally result in lower premiums. Conversely, having a history of accidents, speeding tickets, or insurance claims can significantly increase your premiums. Insurance companies use this information to assess your risk profile and adjust your premiums accordingly. For example, if you have had a recent accident, you might be considered a higher risk and therefore charged higher premiums.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. High-performance cars, luxury vehicles, and expensive sports cars are generally more expensive to repair or replace in case of an accident. Consequently, insurance companies charge higher premiums for these vehicles. Conversely, older, less expensive vehicles may attract lower premiums due to their lower repair costs. For instance, a brand new BMW M3 will likely have higher insurance premiums compared to a five-year-old Toyota Corolla.

Location

Your location also plays a role in determining your car insurance premiums. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher premiums. This is because insurance companies consider these factors to be indicative of a higher risk of accidents and claims. For example, living in a densely populated city with heavy traffic might result in higher premiums compared to living in a rural area with less traffic.

Insurance Company’s Risk Assessment Model

Insurance companies utilize sophisticated risk assessment models to determine your premiums. These models consider various factors, including your age, driving history, vehicle type, location, and other relevant data points. They analyze historical data and statistical trends to identify patterns and predict the likelihood of accidents and claims. This allows them to accurately assess your risk and charge premiums that reflect your individual risk profile.

Types of Car Insurance in Australia

In Australia, there are various types of car insurance policies available to suit different needs and budgets. Understanding the coverage provided by each type of insurance is crucial to making an informed decision.

Comprehensive Car Insurance

Comprehensive car insurance offers the most extensive coverage, protecting you against a wide range of risks. This type of insurance covers damage to your vehicle, regardless of who is at fault, including incidents such as accidents, theft, fire, and natural disasters. It also covers third-party liability, meaning you are protected against claims made by other parties for damage or injury caused by your vehicle.

Comprehensive car insurance provides the most comprehensive protection, covering both your vehicle and third-party liabilities.

Third-Party Property Damage Insurance

This type of insurance covers damage to other people’s property caused by your vehicle. It does not cover damage to your own vehicle, but it protects you from financial liability for any damage you may cause to another person’s property. This policy is typically less expensive than comprehensive insurance.

Third-party property damage insurance provides coverage for damage to other people’s property but not for damage to your own vehicle.

Third-Party Fire and Theft Insurance

This type of insurance offers coverage for damage to your vehicle caused by fire or theft. It does not cover damage resulting from accidents or other incidents. It also includes third-party liability, protecting you from claims made by other parties for damage or injury caused by your vehicle.

Third-party fire and theft insurance covers damage to your vehicle caused by fire or theft, along with third-party liability.

Advantages and Disadvantages of Different Types of Car Insurance

- Comprehensive Car Insurance:

- Advantages: Provides the most comprehensive coverage, protecting you against a wide range of risks, including damage to your own vehicle and third-party liabilities. It offers peace of mind and financial security in case of an accident or other incidents.

- Disadvantages: The most expensive type of car insurance due to the extensive coverage provided.

- Third-Party Property Damage Insurance:

- Advantages: More affordable than comprehensive insurance, providing protection against financial liability for damage caused to other people’s property.

- Disadvantages: Does not cover damage to your own vehicle, leaving you responsible for repair costs in case of an accident.

- Third-Party Fire and Theft Insurance:

- Advantages: Offers protection against damage to your vehicle caused by fire or theft, along with third-party liability. More affordable than comprehensive insurance but provides more coverage than third-party property damage insurance.

- Disadvantages: Does not cover damage resulting from accidents or other incidents, leaving you responsible for repair costs in case of an accident.

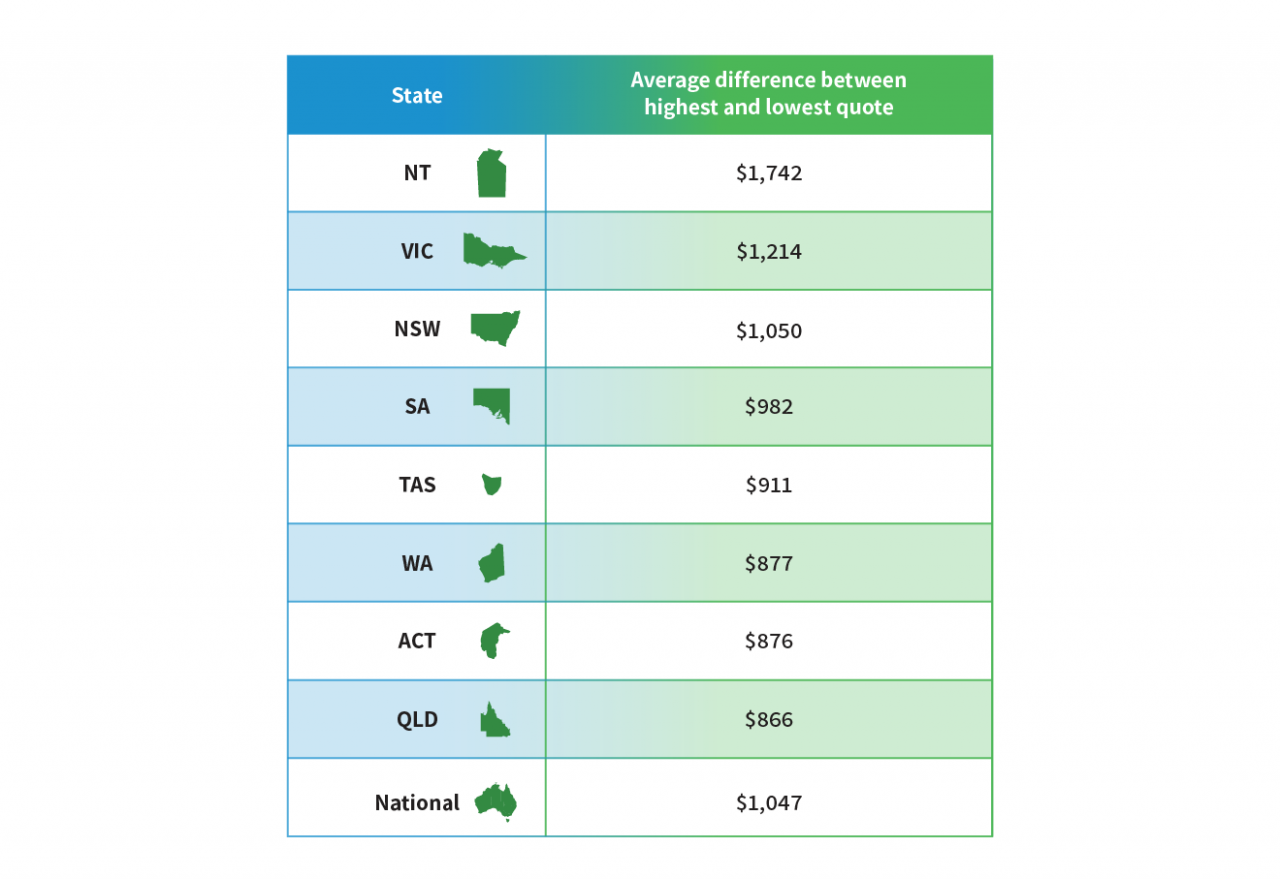

Cost Comparison Across Insurance Providers: Cost Of Car Insurance In Australia

Comparing car insurance quotes from different providers is essential to find the most suitable and affordable option. This section will delve into the price variations among major insurance providers in Australia, highlighting key factors that influence the cost of car insurance.

Price Variations Across Providers

The price of car insurance can vary significantly between different insurance providers, even for identical coverage and risk profiles. Several factors contribute to these price differences:

- Provider’s Risk Assessment: Each insurer uses its own proprietary risk assessment model to determine the likelihood of a claim. These models factor in various elements, such as driving history, vehicle type, age, and location. This means that even with identical coverage, the premium you receive may differ based on the insurer’s perception of your risk.

- Profit Margins: Insurers have different profit margins, which directly impact the premiums they charge. Some insurers aim for higher profit margins, leading to potentially higher premiums, while others prioritize customer acquisition and may offer more competitive pricing.

- Operational Costs: The cost of running an insurance business varies between providers. Factors like administrative expenses, marketing campaigns, and claims handling processes influence the premiums charged. Insurers with efficient operations can often offer lower premiums.

- Reinsurance Costs: Insurers often purchase reinsurance to manage their risk exposure. The cost of reinsurance can vary depending on market conditions and the insurer’s risk profile. These costs can be reflected in the premiums charged to policyholders.

- Competition in the Market: The level of competition in the insurance market can influence pricing. Highly competitive markets tend to drive down premiums as insurers strive to attract customers. Conversely, less competitive markets may see higher premiums.

Sample Price Comparison

The table below provides a hypothetical comparison of average premiums for different types of car insurance offered by four major insurance providers in Australia:

| Provider | Comprehensive | Third Party Fire & Theft | Third Party Property | Deductible | Additional Benefits |

|---|---|---|---|---|---|

| AAMI | $1,200 | $750 | $500 | $500 | Roadside Assistance, New Car Replacement |

| NRMA | $1,300 | $800 | $550 | $400 | Roadside Assistance, Windscreen Repair |

| RACQ | $1,150 | $700 | $480 | $600 | Roadside Assistance, Rental Car Reimbursement |

| Suncorp | $1,250 | $780 | $520 | $550 | Roadside Assistance, Accident Forgiveness |

Note: These figures are hypothetical and intended for illustrative purposes only. Actual premiums will vary based on individual factors such as driving history, vehicle type, location, and coverage options.

Tips for Reducing Car Insurance Costs

Car insurance premiums in Australia can vary significantly depending on various factors, and finding ways to lower your costs is a common goal for many drivers. By implementing a few practical strategies, you can potentially save money on your car insurance premiums.

Driving Habits

Your driving habits have a significant impact on your car insurance premiums. Insurance companies consider factors like your driving history, age, and the number of kilometers you drive annually.

- Maintain a clean driving record: A history of accidents, speeding tickets, or other driving offenses can increase your premiums. Driving safely and avoiding violations can help you maintain a good driving record and potentially lower your insurance costs.

- Consider your annual mileage: If you drive fewer kilometers, you may qualify for lower premiums. Some insurance companies offer discounts for drivers with lower annual mileage.

- Avoid risky driving behaviors: Driving under the influence of alcohol or drugs, speeding, or engaging in reckless driving can significantly increase your insurance premiums.

Safety Features

Modern vehicles are equipped with various safety features that can lower your insurance premiums.

- Anti-theft devices: Installing security systems like alarms, immobilizers, and GPS trackers can deter theft and potentially reduce your insurance premiums.

- Advanced safety technologies: Vehicles with features like automatic emergency braking, lane departure warning, and blind-spot monitoring are often considered safer and may qualify for lower premiums.

Discounts

Insurance companies offer various discounts to reduce premiums for eligible policyholders.

- No claims bonus: This discount is typically awarded for each year you remain claim-free. The longer you go without making a claim, the higher the discount you may receive.

- Multi-policy discounts: If you bundle your car insurance with other insurance policies, such as home or health insurance, you may be eligible for a discount.

- Occupation discounts: Certain occupations, like teachers or nurses, may qualify for discounts due to their lower risk profiles.

- Other discounts: Insurance companies may offer discounts for safe driving courses, good student records, or membership in certain organizations.

Negotiating Lower Premiums

Don’t be afraid to negotiate with insurance companies to try and get a better deal.

- Shop around: Compare quotes from multiple insurance providers to find the most competitive rates. Use online comparison tools or contact insurance companies directly.

- Be prepared to discuss your needs: Clearly explain your driving habits, vehicle details, and desired coverage to ensure you’re getting the right policy for your needs.

- Don’t be afraid to ask for a discount: If you qualify for any discounts, make sure you mention them during the negotiation process.

- Consider increasing your excess: A higher excess (the amount you pay upfront before your insurance covers the rest) can often lead to lower premiums. However, ensure you can afford the excess if you need to make a claim.

Common Claims and Exclusions

Car insurance in Australia is designed to protect you financially in the event of an accident, theft, or other covered incidents. However, it’s essential to understand the common claims that are typically covered and the exclusions that may limit your coverage.

Common Car Insurance Claims

Common car insurance claims in Australia typically involve incidents such as accidents, theft, and natural disasters.

- Accidents: This includes collisions with other vehicles, objects, or even pedestrians. The severity of the accident determines the extent of the claim.

- Theft: If your car is stolen, comprehensive car insurance can cover the cost of replacing it or the value of the car if it’s recovered but damaged.

- Natural Disasters: Car insurance policies can cover damage caused by natural disasters like floods, bushfires, and hailstorms.

Exclusions and Limitations

While car insurance provides financial protection, it’s important to be aware of the exclusions and limitations that may apply.

- Driving Under the Influence: Most policies exclude coverage if you’re driving under the influence of alcohol or drugs.

- Unlicensed Driving: Driving without a valid driver’s license will likely void your insurance coverage.

- Modifications: Significant modifications to your car, especially those that affect its performance or safety, might not be covered.

- Wear and Tear: Normal wear and tear on your car, such as worn tires or faded paint, is generally not covered.

- Pre-existing Conditions: Damage to your car that existed before you purchased insurance is unlikely to be covered.

- Acts of War: Damage caused by acts of war or terrorism is usually excluded from coverage.

Making a Claim, Cost of car insurance in australia

The process of making a claim varies depending on the insurance provider, but generally involves these steps:

- Contact Your Insurer: Immediately notify your insurer about the incident, providing details of the event and any injuries or damages.

- Provide Documentation: You’ll likely need to provide supporting documents, such as police reports, medical records, or repair estimates.

- Assessment and Investigation: The insurer will assess the claim and may conduct an investigation to verify the details.

- Claim Settlement: Once the claim is approved, the insurer will settle the claim based on the policy terms and conditions.

Factors Affecting Claim Settlement

Several factors can influence the settlement of your car insurance claim:

- Policy Coverage: The type of coverage you have and the specific terms and conditions of your policy will determine the extent of the payout.

- Excess: This is the amount you’ll need to pay out-of-pocket before your insurer covers the remaining costs.

- Level of Fault: If you’re partially or fully responsible for the incident, your claim may be reduced or denied.

- Market Value of Your Car: The insurer will typically pay out the market value of your car, which may be less than what you paid for it.

Closing Summary

Ultimately, understanding the cost of car insurance in Australia is vital for making informed decisions about your coverage. By carefully considering your needs, exploring different providers, and taking advantage of available discounts, you can find the best insurance policy that fits your budget and provides the necessary protection. Remember, having adequate car insurance is essential for peace of mind on the road, ensuring you’re covered in the event of an accident or unforeseen incident.

Expert Answers

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if your circumstances change, such as a change in your driving history, vehicle ownership, or address.

What are the common exclusions in car insurance policies?

Common exclusions in car insurance policies often include intentional acts, driving under the influence, racing, and using the vehicle for commercial purposes. It’s essential to carefully review your policy document for specific exclusions.

Can I get a discount on my car insurance if I have a clean driving record?

Yes, most insurance companies offer discounts for drivers with a clean driving record. This is often a significant factor in determining your premium.

What are the benefits of having comprehensive car insurance?

Comprehensive car insurance provides broader coverage than third-party policies, including protection against damage to your own vehicle from incidents like theft, fire, and natural disasters.