Content insurance calculator in Australia can be a valuable tool for homeowners and renters looking to secure the right coverage for their belongings. This online calculator helps you assess your risk factors and determine the appropriate premium for your unique needs, ensuring your valuables are protected against unforeseen events.

Navigating the world of insurance can be daunting, but understanding how content insurance calculators work can make the process more manageable. These calculators take into account factors such as the value of your possessions, your location, and the level of coverage you desire. By inputting this information, you can receive a personalized estimate of your potential premiums, allowing you to compare different policies and choose the one that best suits your budget and requirements.

Introduction to Content Insurance in Australia

Content insurance is a type of insurance that protects your belongings from damage or loss. It’s essential for Australians, as it can help you recover financially if your possessions are damaged or stolen. This type of insurance covers items that are typically not included in your home or building insurance policy.

Content insurance offers financial protection for your belongings in various situations, such as fire, theft, natural disasters, or accidental damage.

Types of Content Covered

Content insurance policies typically cover a wide range of items, including:

- Furniture: Sofas, beds, tables, chairs, and other household furniture.

- Electronics: Televisions, computers, laptops, smartphones, and other electronic devices.

- Personal belongings: Clothing, jewelry, artwork, sporting equipment, and other personal items.

- Household appliances: Washing machines, dryers, refrigerators, ovens, and other appliances.

- Other items: Books, CDs, DVDs, and other valuables.

Scenarios Where Content Insurance Is Crucial

Here are some scenarios where content insurance can be invaluable:

- Fire: A fire in your home can destroy all your belongings, leaving you with nothing. Content insurance can help you replace these items.

- Theft: If your home is burgled, content insurance can help you recover the value of stolen items.

- Natural disasters: Natural disasters like floods, storms, and earthquakes can cause significant damage to your home and belongings. Content insurance can help you rebuild your life after a disaster.

- Accidental damage: Accidents can happen, and they can damage your belongings. Content insurance can help you pay for repairs or replacements.

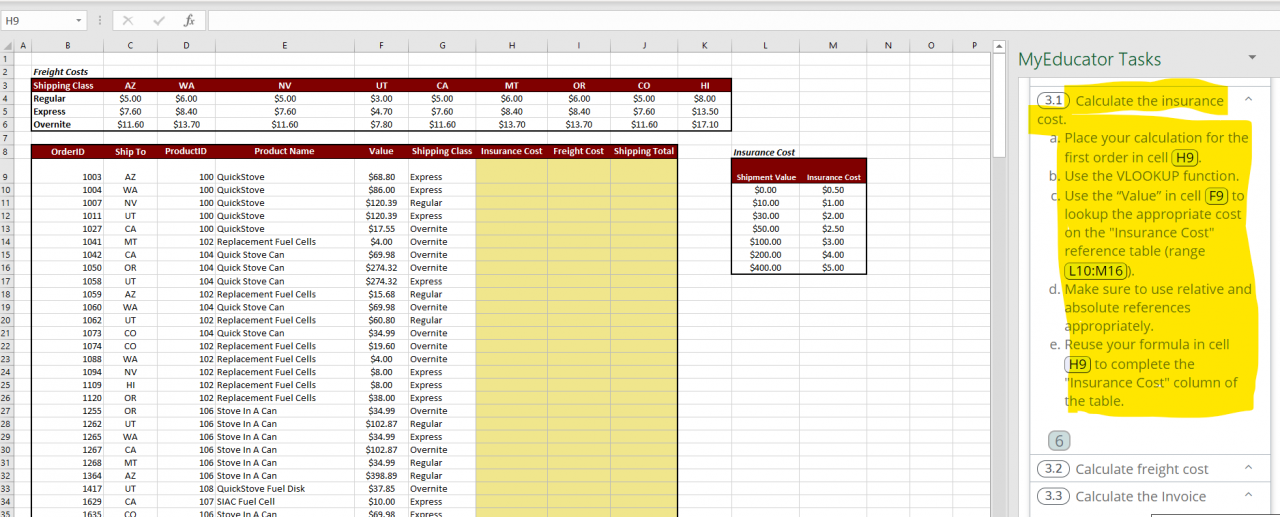

Understanding Content Insurance Calculators

Content insurance calculators are online tools that provide estimates for the cost of insuring your belongings. These calculators are designed to be user-friendly and offer a quick way to understand your insurance needs and potential costs.

How Content Insurance Calculators Work

Content insurance calculators gather information about your belongings to assess your risk and determine an estimated premium. This information is typically collected through a series of questions, including:

- Type of property: This includes the type of dwelling you live in, such as a house, apartment, or townhouse.

- Location: The location of your property influences the risk of theft, natural disasters, and other potential perils.

- Value of your belongings: The calculator requires you to provide an estimated value of your possessions, including furniture, electronics, jewelry, and other valuables.

- Security measures: Information about your home security system, alarms, and other safety features can affect the premium.

- Claims history: Your past claims history, if any, is also a factor in determining the premium.

Based on the information you provide, the calculator uses a complex algorithm to calculate an estimated premium. This algorithm takes into account various risk factors and historical data to determine the likelihood of claims and the potential cost of insuring your belongings.

Key Features and Benefits

- Convenience: Online calculators are accessible from anywhere with an internet connection, making it easy to get an estimate at your convenience.

- Speed: Calculators provide instant estimates, allowing you to quickly compare different insurance options.

- Transparency: Most calculators allow you to see how your premium is calculated, providing a clear understanding of the factors that influence the cost.

- Comparison: Using multiple calculators can help you compare different insurance providers and their offerings.

It is important to note that online calculators provide estimates only. The final premium may vary depending on the specific insurance provider and policy you choose. It is always recommended to contact an insurance broker or agent for a more accurate quote and personalized advice.

Factors Influencing Content Insurance Costs

Content insurance premiums are not fixed and can vary significantly based on several factors. Understanding these factors is crucial for obtaining the right level of coverage at a reasonable price.

Factors Influencing Content Insurance Premiums

Several factors influence content insurance premiums, and it’s important to understand how each factor can impact your overall cost. Here’s a breakdown of key factors:

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Value of Your Contents | The total value of your insured belongings, including furniture, electronics, artwork, and personal possessions. | Higher value = Higher premium | A home with expensive furniture and electronics will have a higher premium than a home with basic furnishings. |

| Location | Your property’s location, including factors like crime rates, natural disaster risk, and proximity to fire hazards. | Higher risk = Higher premium | A home in a high-crime area or a region prone to earthquakes will likely have a higher premium than a home in a safer, less-risk-prone location. |

| Type of Property | The type of property you own, whether it’s a house, apartment, or unit. | Higher risk = Higher premium | A detached house with a separate garage may have a higher premium than a unit in a secure apartment building. |

| Security Features | The security features you have in place, such as alarms, security cameras, and strong locks. | Higher security = Lower premium | A home with an alarm system and security cameras will likely have a lower premium than a home without these features. |

| Claims History | Your previous claims history, including the number and type of claims you’ve made. | Higher claims history = Higher premium | A policyholder with a history of frequent claims may have a higher premium than a policyholder with no claims or a limited claims history. |

| Deductible | The amount you agree to pay out of pocket in the event of a claim. | Higher deductible = Lower premium | Choosing a higher deductible can reduce your premium, as you are taking on more financial responsibility. |

| Policy Coverage | The scope of your insurance coverage, including specific perils covered and exclusions. | Broader coverage = Higher premium | A policy with comprehensive coverage for a wide range of perils will likely have a higher premium than a policy with more limited coverage. |

| Insurer’s Risk Appetite | The insurer’s willingness to take on risk, which can vary between companies. | Higher risk appetite = Lower premium (potentially) | Some insurers may offer lower premiums if they are willing to take on more risk, while others may have stricter underwriting policies that result in higher premiums. |

Choosing the Right Content Insurance Policy

Choosing the right content insurance policy can be a daunting task, especially with the vast array of options available in the Australian market. This section aims to guide you through the process of selecting a policy that best suits your individual needs and circumstances.

Understanding Policy Types and Coverage Options

Content insurance policies are broadly classified into two main categories:

- Standalone Content Insurance: This type of policy provides coverage specifically for your personal belongings, regardless of where they are located. It’s an ideal choice for individuals who have valuable items that need protection beyond their home, such as expensive jewelry, artwork, or musical instruments.

- Home and Contents Insurance: This combined policy offers coverage for both your home structure and its contents. It’s often a more cost-effective option for homeowners who need comprehensive protection for their property and belongings.

Within each category, there are numerous variations in coverage options. Some common coverage inclusions include:

- Accidental Damage: Covers damage to your belongings caused by accidents, such as spills, falls, or breakages.

- Theft: Protects against the loss of your belongings due to theft, including burglary and robbery.

- Natural Disasters: Provides coverage for damage caused by natural events, such as floods, bushfires, and earthquakes.

- Accidental Loss: Covers the loss of your belongings due to unforeseen circumstances, such as accidental destruction or disappearance.

Factors to Consider When Choosing a Policy

When choosing a content insurance policy, it’s crucial to consider the following factors:

- Value of Your Belongings: Determine the total value of your belongings and ensure that the chosen policy provides sufficient coverage. You may need to provide a detailed inventory of your possessions to accurately assess their value.

- Location of Your Belongings: Consider the location of your belongings and whether they are stored in your home, a storage unit, or elsewhere. Some policies may offer additional coverage for items stored off-premises.

- Coverage Limits and Exclusions: Carefully review the policy’s coverage limits and exclusions to ensure that your belongings are adequately protected. Certain items, such as cash, jewelry, and artwork, may have specific coverage limits or exclusions.

- Premium Costs: Compare premiums from different insurers to find the most affordable option that meets your needs. Consider factors such as deductibles, coverage limits, and policy features.

- Insurer Reputation and Customer Service: Research the insurer’s reputation and customer service record to ensure they are reliable and responsive in case of a claim.

Comparing Different Policy Types and Coverage Options

| Policy Type | Coverage Options | Pros | Cons |

|---|---|---|---|

| Standalone Content Insurance | Covers personal belongings, regardless of location |

|

|

| Home and Contents Insurance | Covers both home structure and contents |

|

|

Getting a Quote and Choosing the Right Policy, Content insurance calculator in australia

Once you’ve carefully considered the factors mentioned above, you can start getting quotes from different insurers. Be sure to provide accurate information about your belongings and their value. You can use online comparison tools or contact insurers directly to obtain quotes.

When comparing quotes, pay attention to the following:

- Premium Costs: Compare the annual premium costs of different policies.

- Deductibles: The deductible is the amount you’ll need to pay out-of-pocket before your insurance coverage kicks in.

- Coverage Limits: Check the coverage limits for specific items, such as jewelry, artwork, or electronics.

- Exclusions: Pay close attention to the policy’s exclusions, which are items or events that are not covered.

- Policy Features: Consider additional features offered by different insurers, such as accidental damage coverage, theft protection, and natural disaster coverage.

After carefully reviewing the quotes and comparing policy features, you can choose the policy that best suits your needs and budget. It’s also advisable to seek professional advice from an insurance broker to ensure you have the right level of coverage.

Outcome Summary

By utilizing a content insurance calculator in Australia, you can gain valuable insights into your coverage needs and make informed decisions about protecting your possessions. Remember to carefully consider your individual circumstances, compare different policy options, and seek professional advice when necessary. With the right insurance plan in place, you can have peace of mind knowing that your belongings are safe and secure.

Common Queries: Content Insurance Calculator In Australia

What types of content are covered by content insurance in Australia?

Content insurance typically covers a wide range of personal belongings, including furniture, electronics, clothing, jewelry, and artwork. Specific coverage may vary depending on the insurer and policy.

How do I know if I need content insurance in Australia?

If you own or rent a property and have valuable possessions, it’s generally recommended to have content insurance. It protects your belongings against various risks, such as fire, theft, natural disasters, and accidental damage.

What are some tips for saving on content insurance in Australia?

You can potentially save on your premiums by increasing your excess, bundling your insurance policies, maintaining a good claims history, and taking steps to reduce your risk, such as installing security systems or smoke alarms.