- Overview of Healthcare Insurance in Australia

- Factors Affecting Healthcare Insurance Costs

- Cost Comparison of Different Insurance Providers

- Government Subsidies and Rebates

- Tips for Reducing Healthcare Insurance Costs: Cost Of Healthcare Insurance In Australia

- Future Trends in Healthcare Insurance Costs

- Closure

- Helpful Answers

Navigating the cost of healthcare insurance in Australia can feel like a complex maze, especially with the diverse options and factors influencing premiums. This guide aims to shed light on the Australian healthcare system, exploring the role of Medicare and private health insurance, and providing insights into the key elements that shape the cost of coverage. From age and health status to location and policy coverage, we delve into the intricacies of determining your healthcare insurance premiums.

Understanding these factors empowers individuals to make informed decisions about their healthcare coverage, ensuring they find the right balance between affordability and comprehensive protection.

Overview of Healthcare Insurance in Australia

Australia has a universal healthcare system known as Medicare, which provides essential medical services to all Australian citizens and permanent residents. However, Medicare does not cover all medical expenses, and many Australians choose to supplement their coverage with private health insurance.

Private health insurance in Australia provides additional coverage for medical expenses not covered by Medicare, such as:

* Private hospital care

* Dental care

* Physiotherapy

* Optical care

* Mental health services

Types of Private Health Insurance, Cost of healthcare insurance in australia

Private health insurance in Australia is generally categorized into three main types: hospital, extras, and combined policies.

- Hospital cover: This type of policy covers the costs associated with private hospital care, including accommodation, surgery, and other related services. It can provide access to private hospitals and specialists, shorter waiting times, and a wider range of treatment options.

- Extras cover: This type of policy covers the costs of various health services that are not covered by Medicare, such as dental, optical, physiotherapy, and chiropractic care. Extras policies offer different levels of coverage and benefits, with premiums varying accordingly.

- Combined cover: These policies combine hospital and extras cover, providing comprehensive coverage for a wide range of medical expenses. Combined policies are typically more expensive than standalone hospital or extras policies, but they offer greater peace of mind and financial protection.

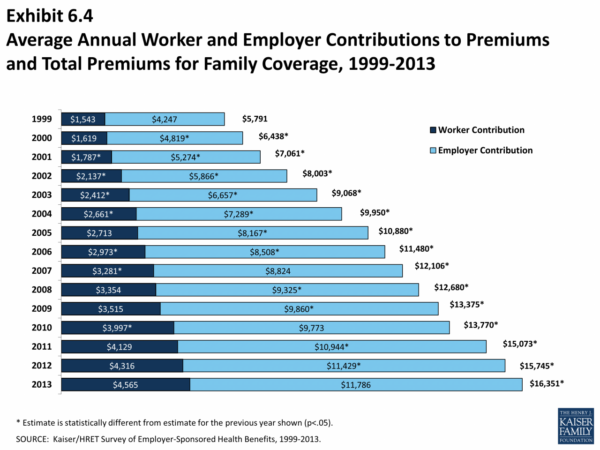

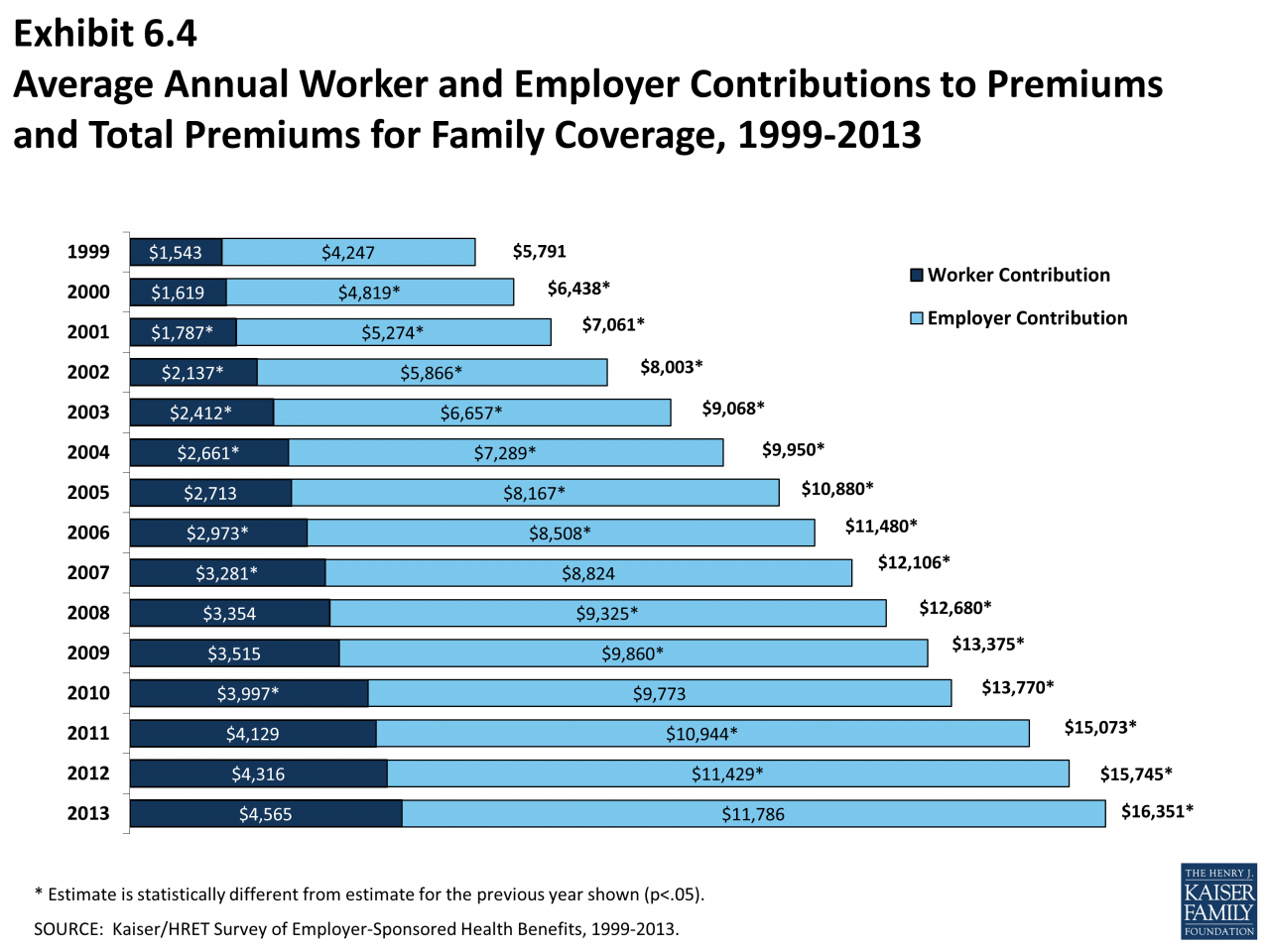

Factors Influencing the Cost of Private Health Insurance

Several factors influence the cost of private health insurance in Australia, including:

- Age: Younger people generally pay lower premiums than older people, as they are statistically less likely to require expensive medical care.

- Health status: People with pre-existing medical conditions may face higher premiums, as they are more likely to require medical treatment.

- Location: Premiums can vary depending on the location, as the cost of living and healthcare costs can differ across different regions.

- Policy coverage: The level of coverage and benefits offered by a policy will significantly impact the premium. Policies with comprehensive coverage and higher benefits will typically be more expensive.

Factors Affecting Healthcare Insurance Costs

The cost of healthcare insurance in Australia is influenced by a variety of factors, including age, health status, location, and the level of coverage. Understanding these factors can help individuals make informed decisions about their healthcare insurance needs and budget accordingly.

Age and Healthcare Insurance Premiums

Age is a significant factor in determining healthcare insurance premiums. Generally, older individuals tend to have higher premiums than younger individuals. This is due to the increased likelihood of needing healthcare services as people age.

The rationale behind age-based pricing is that older individuals statistically have a higher risk of experiencing health issues and requiring more medical care.

For instance, a 65-year-old individual may be more likely to require hospitalization, surgery, or ongoing medication compared to a 25-year-old individual. Insurance companies use actuarial data to calculate premiums based on the probability of claims being made by different age groups.

Health Status and Insurance Costs

An individual’s health status significantly impacts healthcare insurance costs. Individuals with pre-existing conditions or lifestyle choices that increase their risk of health issues typically face higher premiums.

Pre-existing Conditions

Pre-existing conditions are health conditions that an individual has before they apply for healthcare insurance. These conditions can include diabetes, heart disease, or asthma. Insurance companies may consider pre-existing conditions when determining premiums because these conditions can increase the likelihood of needing healthcare services.

Lifestyle Choices

Lifestyle choices, such as smoking, excessive alcohol consumption, or a sedentary lifestyle, can also impact insurance costs. These choices can increase the risk of developing health problems, leading to higher premiums.

Insurance companies may offer discounts for individuals who demonstrate healthy lifestyle habits, such as non-smoking or regular exercise.

Regional Variations in Healthcare Insurance Costs

The cost of healthcare insurance can vary across different Australian states and territories. These variations can be attributed to factors such as the cost of living, the availability of healthcare providers, and the prevalence of certain health conditions.

State and Territory Comparisons

For example, healthcare insurance premiums in metropolitan areas may be higher than in regional areas due to higher costs of living and a greater concentration of healthcare providers. Similarly, states with a higher prevalence of certain health conditions, such as cardiovascular disease, may have higher premiums.

Policy Coverage and Insurance Premiums

The level of coverage provided by a healthcare insurance policy is directly related to the premium. Comprehensive policies that cover a wide range of services, including hospital stays, surgery, and specialist consultations, generally cost more than basic policies.

Policy Coverage and Cost

For example, a policy that covers all hospital expenses, including private rooms and elective surgery, will likely be more expensive than a policy that only covers essential hospital services. Individuals should carefully consider their healthcare needs and budget when choosing a healthcare insurance policy.

Cost Comparison of Different Insurance Providers

Choosing the right private health insurance provider can be a daunting task, especially when you consider the wide range of options and varying costs. Understanding the different premium structures and benefits offered by various providers is crucial to making an informed decision.

Average Premiums of Major Providers

This table compares the average monthly premiums of four major private health insurance providers in Australia, based on different policy types and age groups. Keep in mind that these are just average figures and actual premiums can vary depending on individual factors like location, health status, and chosen cover.

| Provider | Policy Type | Age Group | Average Monthly Premium |

|---|---|---|---|

| Medibank | Hospital Cover Only | 25-34 | $120 |

| Bupa | Hospital and Extras Cover | 45-54 | $250 |

| NIB | Top Hospital Cover | 65+ | $380 |

| HCF | Basic Hospital Cover | 18-24 | $80 |

Key Benefits and Features of Different Policy Types

The following section provides an overview of the key benefits and features of different policy types, highlighting the differences between them.

Hospital Cover Only

Hospital cover only policies provide financial assistance for hospital stays, including surgery, accommodation, and other related costs. They typically don’t cover extras like dental, physiotherapy, or optical services.

Hospital and Extras Cover

Hospital and extras cover policies combine hospital cover with coverage for a range of health-related services outside of hospitals, such as dental, optical, physiotherapy, and chiropractor services. This type of policy offers a more comprehensive level of coverage but generally comes with higher premiums.

Top Hospital Cover

Top hospital cover policies offer the highest level of coverage for hospital stays, providing access to private hospitals and specialists, and often including additional benefits like ambulance cover and overseas medical expenses. These policies are typically the most expensive but provide the most comprehensive coverage.

Basic Hospital Cover

Basic hospital cover policies provide the minimum level of coverage required to meet the government’s “minimum essential benefits” criteria. These policies typically cover essential hospital services like surgery, accommodation, and some medical tests. They often have lower premiums than other types of hospital cover but provide less comprehensive coverage.

Government Subsidies and Rebates

The Australian government provides subsidies and rebates to encourage people to take out private health insurance and make it more affordable. These government initiatives play a significant role in shaping the overall cost of healthcare insurance in Australia.

Eligibility Criteria for Government Subsidies

The government provides subsidies to individuals and families based on their age, income, and family situation. The eligibility criteria for these subsidies are Artikeld below:

- Age: Individuals aged 30 years and older receive a higher level of subsidy compared to younger individuals. This is because older individuals are more likely to require healthcare services.

- Income: The government considers income levels to determine the level of subsidy an individual receives. Individuals with lower incomes receive a higher level of subsidy. For example, a single person with an income of $90,000 will receive a lower subsidy than a single person with an income of $50,000.

- Family Situation: The government also takes into account family size and dependents when determining the level of subsidy. For example, a family with two children will receive a higher subsidy than a single person.

Types of Rebates for Private Health Insurance

The government provides a range of rebates to help reduce the cost of private health insurance premiums. The main types of rebates available are:

- Private Health Insurance Rebate: This is a direct rebate paid by the government to individuals who have private health insurance. The rebate is based on the individual’s age, income, and family situation.

- Lifetime Health Cover Discount: This discount is available to individuals who take out private health insurance before turning 31 years old. The discount reduces the cost of premiums over time, with the maximum discount being 10% after 10 years of continuous cover.

Impact of Government Initiatives on Healthcare Insurance Costs

Government subsidies and rebates have a significant impact on the overall cost of private health insurance in Australia. These initiatives make private health insurance more affordable for individuals and families, particularly those with lower incomes. The Lifetime Health Cover discount also encourages younger individuals to take out private health insurance early, which helps to reduce the overall cost of healthcare in the long term.

Tips for Reducing Healthcare Insurance Costs: Cost Of Healthcare Insurance In Australia

In Australia, healthcare insurance can be a significant expense. However, there are several strategies you can employ to minimize your premiums and make health insurance more affordable. This section will explore practical tips, including comparing quotes, negotiating with providers, and exploring alternative options.

Comparing Quotes and Negotiating with Providers

The first step towards reducing your healthcare insurance costs is to shop around and compare quotes from different providers. Many online comparison websites allow you to enter your details and receive quotes from various insurers in minutes. This process helps you identify the most competitive premiums and coverage options available.

Once you have a few quotes, don’t hesitate to negotiate with providers. Explain your needs and budget, and see if they can offer you a more favorable rate. Many insurers are willing to negotiate, especially if you are a long-term customer or have a good claims history.

Exploring Alternative Options

If you’re struggling to find affordable health insurance, consider exploring alternative options, such as joining a health fund or taking advantage of group discounts.

- Health Funds: Joining a health fund can often provide access to lower premiums and better coverage. Health funds are non-profit organizations that offer health insurance to their members. They typically negotiate lower rates with healthcare providers and pass those savings on to their members.

- Group Discounts: Many employers offer group health insurance plans to their employees. These plans can often provide access to lower premiums and better coverage than individual plans.

Making Healthy Lifestyle Choices

While it may seem counterintuitive, making healthy lifestyle choices can actually help you reduce your healthcare insurance premiums. By adopting a healthy lifestyle, you are less likely to require medical attention, which in turn can lead to lower insurance costs.

- Eating a Healthy Diet: A balanced diet can help reduce your risk of developing chronic diseases such as heart disease, stroke, and diabetes. These conditions can lead to increased healthcare costs, so maintaining a healthy diet can help you save money on your insurance premiums in the long run.

- Regular Exercise: Regular exercise can improve your overall health and well-being. It can also help reduce your risk of developing chronic diseases, leading to lower insurance premiums.

- Quitting Smoking: Smoking is a major risk factor for many chronic diseases. Quitting smoking can significantly improve your health and reduce your insurance premiums.

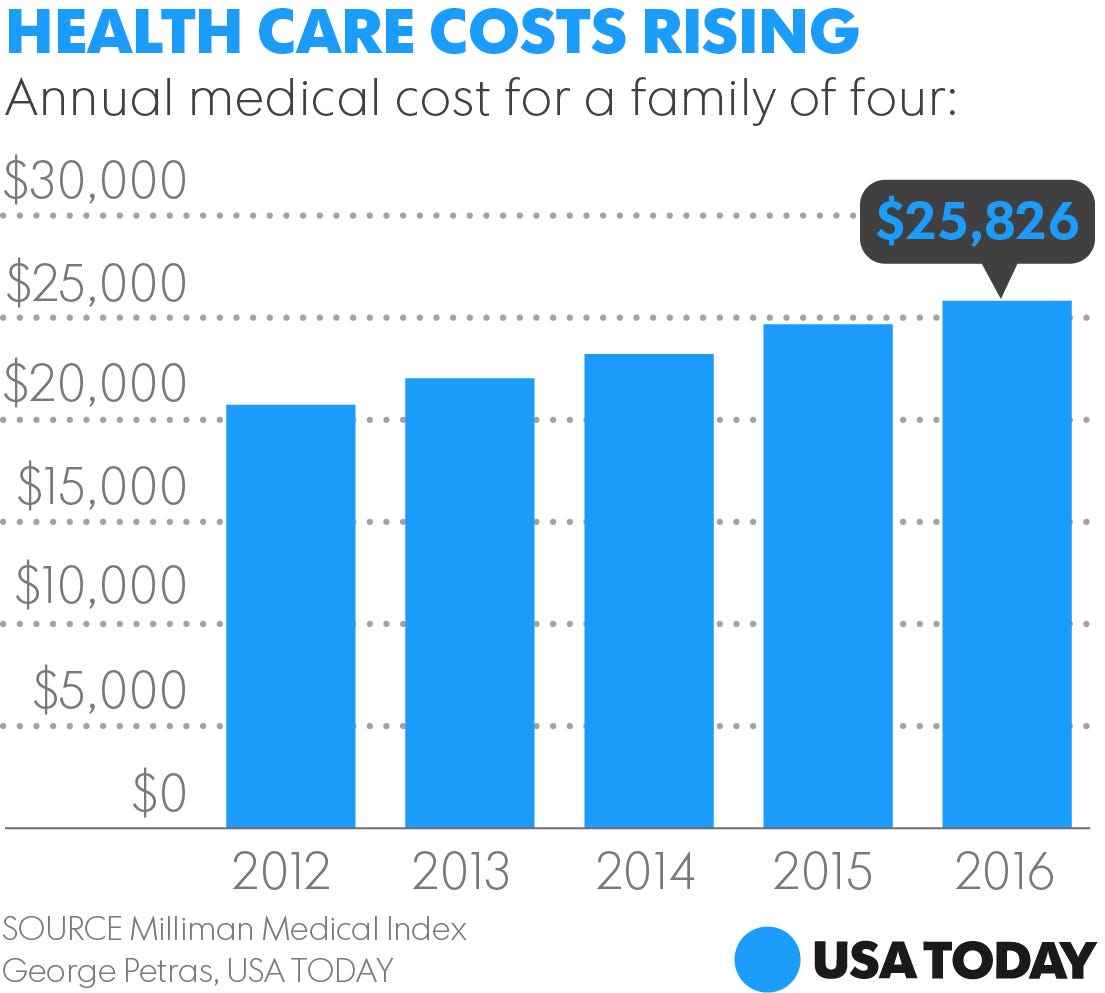

Future Trends in Healthcare Insurance Costs

The cost of healthcare insurance in Australia is expected to continue to rise in the coming years, driven by a combination of factors, including technological advancements, an aging population, and evolving consumer preferences. While these trends pose challenges, they also present opportunities for innovation and improved healthcare outcomes.

Technological Advancements and Healthcare Costs

Technological advancements are transforming the healthcare landscape, impacting both costs and access to care. While some technologies may initially increase costs, their long-term impact is likely to be multifaceted.

- Advanced Treatments and Diagnostics: The development of innovative treatments and diagnostic tools, such as gene therapy and personalized medicine, can lead to higher initial costs. However, these advancements can also improve treatment effectiveness, reduce hospital stays, and ultimately lead to lower overall healthcare expenses in the long run.

- Telehealth and Remote Monitoring: The rise of telehealth and remote patient monitoring technologies offers potential cost savings by reducing the need for in-person visits and hospital admissions. These technologies can also improve patient engagement and adherence to treatment plans, leading to better health outcomes.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning are increasingly being used in healthcare for tasks such as disease prediction, drug discovery, and personalized treatment recommendations. These technologies can potentially improve efficiency, reduce errors, and optimize resource allocation, leading to cost savings.

Impact of an Aging Population

Australia’s aging population is a significant factor influencing healthcare costs. As the population ages, the demand for healthcare services, particularly for chronic diseases, is expected to increase.

- Rising Healthcare Needs: Older individuals are more likely to have chronic health conditions, requiring more frequent and complex medical care. This increased demand can lead to higher healthcare costs, impacting insurance premiums.

- Increased Pressure on Healthcare System: The growing number of older individuals puts pressure on the healthcare system, potentially leading to longer wait times for services and increased costs associated with managing the demand.

- Government Spending on Healthcare: The Australian government is likely to face increasing financial pressure to fund healthcare services for an aging population. This could result in changes to healthcare policies, including potential adjustments to Medicare benefits and insurance subsidies.

Emerging Trends in Healthcare Insurance Market

The healthcare insurance market is constantly evolving, with emerging trends influencing future costs.

- Personalized Insurance Plans: As consumer preferences shift towards personalized experiences, insurance providers are offering tailored plans based on individual needs and risk profiles. This trend can lead to more competitive pricing and potentially lower costs for certain individuals.

- Focus on Wellness and Prevention: Increasing emphasis on preventative care and wellness programs is likely to impact healthcare costs. Insurance providers are offering incentives and programs to encourage healthy behaviors, potentially reducing the incidence of chronic diseases and associated healthcare expenses.

- Digital Transformation: The adoption of digital technologies in healthcare insurance is transforming the industry. Online platforms, mobile apps, and data analytics are improving efficiency, streamlining processes, and potentially reducing administrative costs.

Closure

Ultimately, understanding the cost of healthcare insurance in Australia is crucial for individuals seeking to secure their health and well-being. By exploring the factors influencing premiums, comparing providers, and utilizing available resources, Australians can navigate this complex landscape and make informed choices that best suit their individual needs and circumstances.

Helpful Answers

What is Medicare?

Medicare is Australia’s universal healthcare system, providing essential medical services to all Australian citizens and permanent residents.

What are the different types of private health insurance?

Private health insurance in Australia comes in three main types: hospital, extras, and combined. Hospital covers hospital costs, extras covers services like dental and physiotherapy, and combined policies offer both.

How can I reduce my healthcare insurance costs?

You can reduce your costs by comparing quotes, negotiating with providers, joining a health fund, and making healthy lifestyle choices.