- Overview of Private Health Insurance in Australia

- Factors Influencing the Cost of Private Health Insurance

- Breakdown of Private Health Insurance Costs: Cost Of Private Insurance In Australia

- Government Incentives and Rebates

- Comparison with Public Healthcare

- Tips for Saving on Private Health Insurance

- Future Trends in Private Health Insurance Costs

- Conclusion

- FAQ Corner

Cost of private insurance in Australia is a significant consideration for many individuals and families. Navigating the complexities of private health insurance can be daunting, with a myriad of factors influencing premiums and coverage options. This guide delves into the intricacies of private health insurance costs in Australia, providing insights into key factors, government incentives, and strategies for saving.

From understanding the different types of policies available to exploring the impact of age, health status, and coverage level on premiums, this comprehensive overview equips readers with the knowledge needed to make informed decisions about their private health insurance needs. It also examines the role of government rebates and incentives, providing a balanced perspective on the cost-benefit analysis of private health insurance in the Australian context.

Overview of Private Health Insurance in Australia

Private health insurance plays a significant role in the Australian healthcare system, providing Australians with access to a wider range of medical services and treatments, including elective surgery, private hospital care, and ancillary benefits like dental and physiotherapy. It complements the publicly funded Medicare system, which provides essential healthcare services.

Types of Private Health Insurance Policies

Private health insurance policies in Australia are categorized into various types, each offering different levels of coverage and benefits.

- Hospital Cover: This type of policy covers the cost of private hospital accommodation, medical care, and surgery. It can be tailored to include specific procedures or a broader range of services.

- Extras Cover: Extras cover provides benefits for non-hospital medical services such as dental, physiotherapy, optical, and chiropractor services. The level of coverage can vary significantly between policies.

- Combined Hospital and Extras Cover: This policy combines the benefits of both hospital and extras cover, offering comprehensive health insurance coverage.

Percentage of Australians with Private Health Insurance

The percentage of Australians with private health insurance has been relatively stable in recent years. According to the Australian Prudential Regulation Authority (APRA), as of June 2023, approximately 48% of Australians had private health insurance.

This statistic highlights the significant role private health insurance plays in the Australian healthcare landscape.

Factors Influencing the Cost of Private Health Insurance

The cost of private health insurance in Australia is determined by a variety of factors. These factors are designed to reflect the individual’s risk profile and the level of coverage they choose. The premium you pay will depend on your age, health status, and the level of coverage you select.

Age

Your age is a significant factor in determining your private health insurance premium. Generally, younger people are considered to be at a lower risk of needing medical care, so they tend to pay lower premiums. As you age, your risk of needing medical care increases, so your premiums will also increase.

Health Status

Your health status can also impact your private health insurance premium. People with pre-existing medical conditions may be required to pay higher premiums. This is because they are considered to be at a higher risk of needing medical care.

Coverage Level

The level of coverage you choose will also impact your premium. Higher levels of coverage, such as comprehensive hospital cover, will typically result in higher premiums. This is because you are paying for a wider range of medical services.

Private Health Insurance Providers

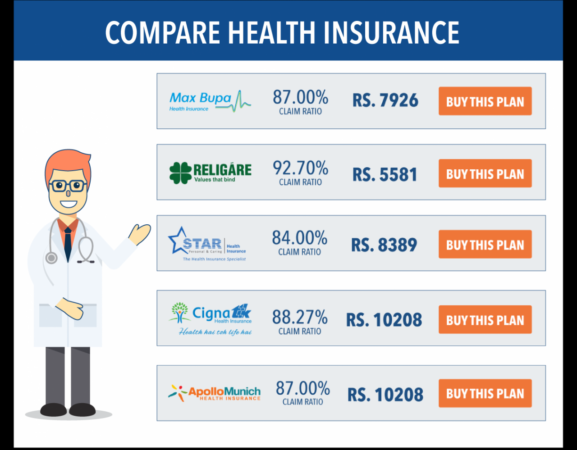

The cost of private health insurance can vary significantly between different providers. It is important to compare quotes from multiple providers to find the best value for your needs. You should also consider the provider’s reputation, customer service, and claims process.

Breakdown of Private Health Insurance Costs: Cost Of Private Insurance In Australia

Private health insurance premiums are calculated based on several factors, including your age, location, chosen level of cover, and the insurer’s administrative costs. Understanding the components of these premiums can help you make informed decisions about your health insurance.

Components of Private Health Insurance Premiums

The cost of private health insurance is broken down into several components. These components contribute to the overall premium you pay.

- Hospital Cover: This component covers your hospital costs, including accommodation, surgery, and other medical procedures. Hospital cover is typically the most expensive part of your private health insurance.

- Extras Cover: This component covers a range of health-related expenses not covered by Medicare, such as dental, physiotherapy, and optical. Extras cover can be tailored to your individual needs and budget.

- Ancillary Benefits: These are additional benefits offered by some insurers, such as ambulance cover, travel insurance, or mental health support. Ancillary benefits can increase your premium but provide comprehensive coverage.

Costs Associated with Hospital Cover

Hospital cover is essential for those who want to have more choice and control over their healthcare. It covers a wide range of medical expenses incurred during hospital stays.

- Premiums: These are the regular payments you make for your hospital cover. Premiums vary depending on your age, location, chosen level of cover, and the insurer.

- Co-payments: These are the out-of-pocket payments you make for certain services, such as hospital accommodation or specialist consultations. Co-payments can vary depending on the insurer and the type of service.

- Excess Fees: These are the fixed fees you pay towards the cost of your hospital stay. Excess fees can vary depending on the insurer and the level of cover you choose.

Costs Associated with Extras Cover

Extras cover provides coverage for a wide range of health-related expenses not covered by Medicare. This can include services such as dental, physiotherapy, optical, and chiropractic care.

- Premiums: These are the regular payments you make for your extras cover. Premiums vary depending on the level of cover you choose and the insurer.

- Co-payments: These are the out-of-pocket payments you make for certain services, such as dental checkups or physiotherapy sessions. Co-payments can vary depending on the insurer and the type of service.

- Benefit Limits: These are the maximum amounts the insurer will pay for certain services. For example, your extras cover may have a limit on the amount you can claim for dental work in a year.

Costs Associated with Ancillary Benefits

Ancillary benefits are additional benefits offered by some insurers that can provide extra protection and peace of mind.

- Ambulance Cover: This covers the cost of ambulance transport in the event of an emergency.

- Travel Insurance: This provides coverage for medical expenses and other emergencies while you are traveling overseas.

- Mental Health Support: This provides access to mental health services, such as counseling or therapy.

Government Incentives and Rebates

The Australian government plays a significant role in supporting private health insurance by offering various incentives and rebates to policyholders. These measures aim to encourage Australians to take up private health insurance and reduce the burden on the public healthcare system.

Government Rebates

The government provides a significant financial incentive for Australians to take out private health insurance in the form of a rebate. This rebate is a percentage of the premium paid, and it varies depending on your age and income. The rebate is designed to offset the cost of private health insurance and make it more affordable for individuals and families.

The government rebate is calculated based on a combination of factors, including:

- Your age

- Your income

- The type of private health insurance policy you hold

- The level of cover you choose

For example, a single person earning $60,000 per year who holds a basic hospital cover policy could receive a government rebate of up to 30% of their premium.

Impact of Incentives on Cost, Cost of private insurance in australia

Government incentives and rebates have a significant impact on the cost of private health insurance. By providing a financial incentive, the government effectively reduces the cost of private health insurance for policyholders. This makes private health insurance more affordable and encourages more Australians to take it up.

“The government’s commitment to supporting private health insurance through rebates and incentives is crucial in ensuring that Australians have access to quality healthcare.”

The government’s role in supporting private health insurance is vital in ensuring a strong and sustainable healthcare system in Australia.

Comparison with Public Healthcare

The Australian public healthcare system, known as Medicare, is a universal healthcare system funded by the government through taxes. It provides essential healthcare services to all Australian citizens and permanent residents. Private health insurance offers additional benefits and choices beyond what Medicare covers, but it comes at an additional cost.

Cost Comparison

The cost of private health insurance varies depending on the level of cover and the individual’s circumstances. However, it is generally more expensive than Medicare, which is funded through taxes. Medicare is free at the point of service for most essential healthcare services, while private health insurance requires monthly premiums.

Benefits Comparison

Medicare provides access to essential healthcare services such as GP consultations, hospital admissions, and some specialist consultations. Private health insurance offers a wider range of benefits, including:

- Faster access to elective surgery

- Choice of hospital and doctor

- Coverage for extras such as dental, physiotherapy, and optical

- Private hospital rooms

Waiting Times and Access to Services

Waiting times for elective surgery can be significantly shorter with private health insurance compared to Medicare. Private hospitals typically have shorter waiting lists due to their ability to manage patient flow more effectively. However, access to some specialist services may still be limited, even with private health insurance.

Situations Where Private Health Insurance Might Be Beneficial

Private health insurance can be beneficial in situations where:

- Individuals require elective surgery and want to avoid long waiting times

- Individuals prefer to have a choice of hospital and doctor

- Individuals require access to extras such as dental, physiotherapy, and optical

- Individuals are concerned about the potential for out-of-pocket expenses for healthcare services

Tips for Saving on Private Health Insurance

Navigating the world of private health insurance in Australia can be a bit of a maze, especially when it comes to keeping costs down. But with a little savvy and some smart strategies, you can find ways to reduce your premiums and make your coverage more affordable.

Choosing the Right Policy

Finding the right policy is the first step to saving money. It’s not just about the cheapest option; it’s about finding the right balance between coverage and cost. Here’s what to consider:

- Assess Your Needs: Think about your health needs, your family’s needs, and your risk tolerance. Do you have pre-existing conditions? Are you prone to specific health issues? This will help you determine the level of coverage you require.

- Compare Policies: Don’t settle for the first policy you see. Use online comparison tools or contact insurance brokers to compare policies from different providers. Pay attention to the benefits, exclusions, and premium costs.

- Consider Excess: A higher excess means a lower premium. If you’re generally healthy and confident in your ability to cover smaller medical expenses, a higher excess can significantly reduce your premium.

- Look for Discounts: Many insurers offer discounts for things like paying your premium annually, bundling your insurance with other policies (like car or home insurance), or being part of a particular group or organization.

Negotiating Premiums

Don’t be afraid to negotiate with your insurer. Here are some tactics to try:

- Shop Around: Let your current insurer know you’re considering other options. This can sometimes prompt them to offer a better deal to keep your business.

- Loyalty Discounts: If you’ve been with the same insurer for a long time, inquire about loyalty discounts or special offers. Insurers sometimes reward long-term customers.

- Bundling: If you have other insurance policies with the same provider, ask about bundling discounts. This can lead to significant savings.

Taking Advantage of Discounts and Incentives

The Australian government offers several incentives to encourage people to take out private health insurance. Here are some key benefits:

- Medicare Levy Surcharge: If you earn above a certain income threshold and don’t have private health insurance, you’ll have to pay an additional Medicare Levy Surcharge. This can be a significant cost, so having private health insurance can save you money.

- Lifetime Health Cover: If you take out private health insurance before you turn 31, you’ll receive a discount on your premiums for the rest of your life. This is a great way to lock in lower premiums for the long term.

- Government Rebates: The government provides rebates on private health insurance premiums, which can reduce your out-of-pocket costs.

Future Trends in Private Health Insurance Costs

Predicting the future of private health insurance costs is a complex task, as numerous factors can influence its trajectory. However, analyzing current trends and considering potential influences can provide valuable insights into what the future might hold.

Impact of Technology

Technological advancements have the potential to both increase and decrease private health insurance costs. For instance, the rise of telemedicine and virtual healthcare consultations could potentially lower costs by reducing the need for expensive in-person appointments. However, new technologies and treatments, such as advanced medical imaging and gene therapy, can also lead to higher costs. The long-term impact of technology on private health insurance costs will depend on how these advancements are implemented and adopted within the healthcare system.

Influence of an Aging Population

Australia’s aging population is a significant factor that will likely contribute to rising private health insurance costs. As the population ages, the demand for healthcare services, particularly for chronic diseases and complex treatments, is expected to increase. This increased demand can lead to higher healthcare utilization, putting upward pressure on insurance premiums.

Healthcare Inflation

Healthcare inflation, which is the increase in the cost of healthcare goods and services over time, is another major driver of rising private health insurance costs. Factors contributing to healthcare inflation include rising costs of medical equipment, pharmaceuticals, and labor. The Australian government has implemented measures to control healthcare inflation, but it remains a significant challenge.

Government Policies and Regulations

Changes in government policies and regulations can also impact private health insurance costs. For example, the government may introduce new incentives or rebates to encourage more Australians to take out private health insurance. Alternatively, the government may tighten regulations on insurance providers, which could affect their pricing strategies.

Conclusion

In conclusion, understanding the cost of private health insurance in Australia is crucial for individuals and families seeking to secure their healthcare needs. While the costs can vary significantly, a comprehensive understanding of factors influencing premiums, government incentives, and strategies for saving can empower individuals to make informed choices. By carefully considering their health insurance options and utilizing available resources, Australians can navigate the complexities of private health insurance and find the best coverage at a price that fits their budget.

FAQ Corner

What are the main types of private health insurance policies in Australia?

The main types of private health insurance policies in Australia include hospital cover, extras cover, and combined policies that offer both hospital and extras cover.

Is private health insurance mandatory in Australia?

Private health insurance is not mandatory in Australia. However, individuals over 30 years of age who do not have private health insurance may be subject to the Medicare Levy Surcharge, an additional tax.

How often are private health insurance premiums reviewed?

Private health insurance premiums are typically reviewed annually, with adjustments based on factors such as claims experience, healthcare costs, and government policies.