Cost of life insurance in Australia is a crucial aspect of financial planning, ensuring your loved ones are protected in the event of your passing. Understanding the different types, factors influencing costs, and tips for finding affordable options is essential. This comprehensive guide delves into the intricacies of life insurance in Australia, providing insights into its importance, pricing dynamics, and strategies for securing the best coverage.

Life insurance in Australia comes in various forms, each designed to meet specific needs. Term life insurance provides coverage for a fixed period, while permanent life insurance offers lifelong protection. Understanding the key features and benefits of each type is crucial for choosing the right policy. Factors such as age, health, lifestyle, and coverage amount significantly impact premiums. Insurers carefully assess risk profiles to determine premiums, ensuring a fair balance between coverage and cost.

Understanding Life Insurance in Australia

Life insurance is a crucial financial safety net for individuals and families in Australia. It provides financial protection against the unexpected loss of income due to death or disability, ensuring that loved ones are financially secure during difficult times.

Types of Life Insurance in Australia

There are several types of life insurance available in Australia, each catering to different needs and circumstances. Understanding the differences between these types is essential for choosing the right policy that aligns with your personal requirements.

- Term Life Insurance: This type of life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a fixed payout, known as the death benefit, to your beneficiaries if you pass away during the policy term. Term life insurance is generally more affordable than other types of life insurance and is suitable for individuals with a temporary need for coverage, such as young families with a mortgage or dependents.

- Permanent Life Insurance: This type of life insurance provides coverage for your entire life, as long as you continue to pay the premiums. It offers a guaranteed death benefit, and some policies also accumulate cash value that you can borrow against or withdraw. Permanent life insurance is more expensive than term life insurance but provides long-term financial security. It is suitable for individuals who require lifelong coverage, such as those with substantial assets or a family legacy to protect.

- Total and Permanent Disability (TPD) Insurance: This type of life insurance provides a lump sum payout if you become totally and permanently disabled, meaning you are unable to work for the rest of your life. TPD insurance is designed to cover your lost income and ongoing expenses, allowing you to maintain your lifestyle despite your disability. It is suitable for individuals with a high income or those who rely on their earnings to support their family.

- Trauma Insurance: This type of life insurance provides a lump sum payout if you are diagnosed with a serious illness or injury, such as cancer, heart attack, or stroke. Trauma insurance helps cover the financial costs associated with treatment, rehabilitation, and ongoing expenses, allowing you to focus on your recovery. It is suitable for individuals who are concerned about the financial burden of a major health event.

Key Features and Benefits of Life Insurance

Life insurance offers several key features and benefits that can provide financial peace of mind and protect your loved ones:

- Financial Protection: Life insurance provides a financial safety net for your family in the event of your death or disability. It can help cover funeral expenses, outstanding debts, mortgage payments, and living expenses, ensuring that your loved ones are financially secure during a difficult time.

- Peace of Mind: Knowing that your family is financially protected in the event of your death or disability can provide you with peace of mind and allow you to focus on other aspects of your life.

- Flexibility: Life insurance policies offer various customization options, allowing you to tailor the coverage to your specific needs and budget. You can choose the level of coverage, the policy term, and the payout options.

- Investment Potential: Some types of life insurance, such as permanent life insurance, offer investment features that allow you to accumulate cash value over time. This can provide you with additional financial security and flexibility.

Situations Where Each Type of Life Insurance Would Be Suitable

The best type of life insurance for you will depend on your individual circumstances and needs. Here are some examples of situations where each type of life insurance would be suitable:

- Term Life Insurance: A young couple with a mortgage and young children would benefit from term life insurance to ensure their family is financially protected if one of them passes away.

- Permanent Life Insurance: A wealthy individual with a substantial estate and a family legacy to protect would benefit from permanent life insurance to ensure their assets are passed on to their heirs.

- Total and Permanent Disability (TPD) Insurance: A high-income earner with a family to support would benefit from TPD insurance to protect their income and lifestyle in the event of a disabling injury or illness.

- Trauma Insurance: An individual with a family history of cancer or heart disease would benefit from trauma insurance to cover the financial costs associated with a serious health event.

Factors Influencing Life Insurance Costs

The cost of life insurance in Australia is determined by several factors that reflect the individual’s risk profile and the coverage they require. These factors are carefully considered by insurers to ensure premiums accurately reflect the likelihood of a claim being made.

Age

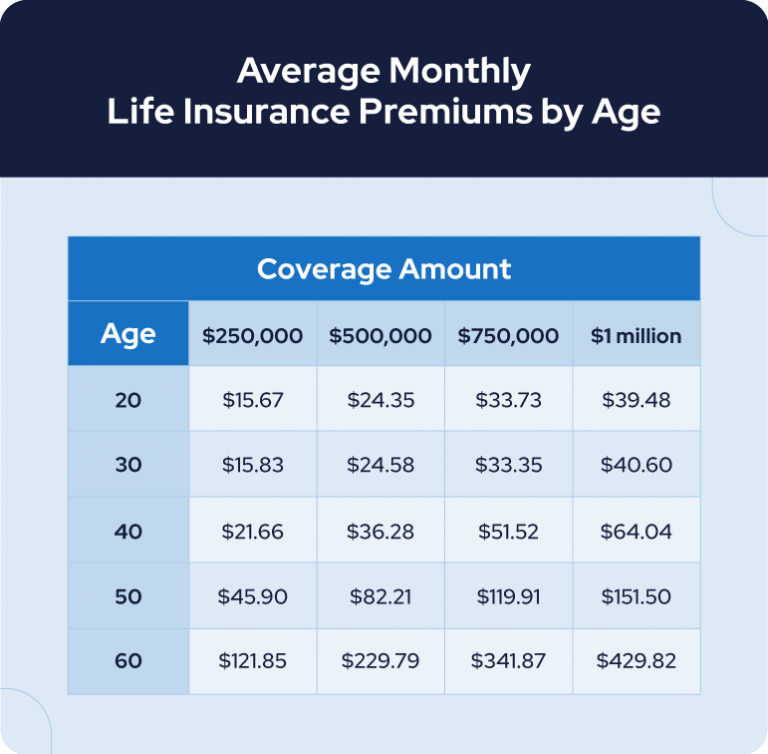

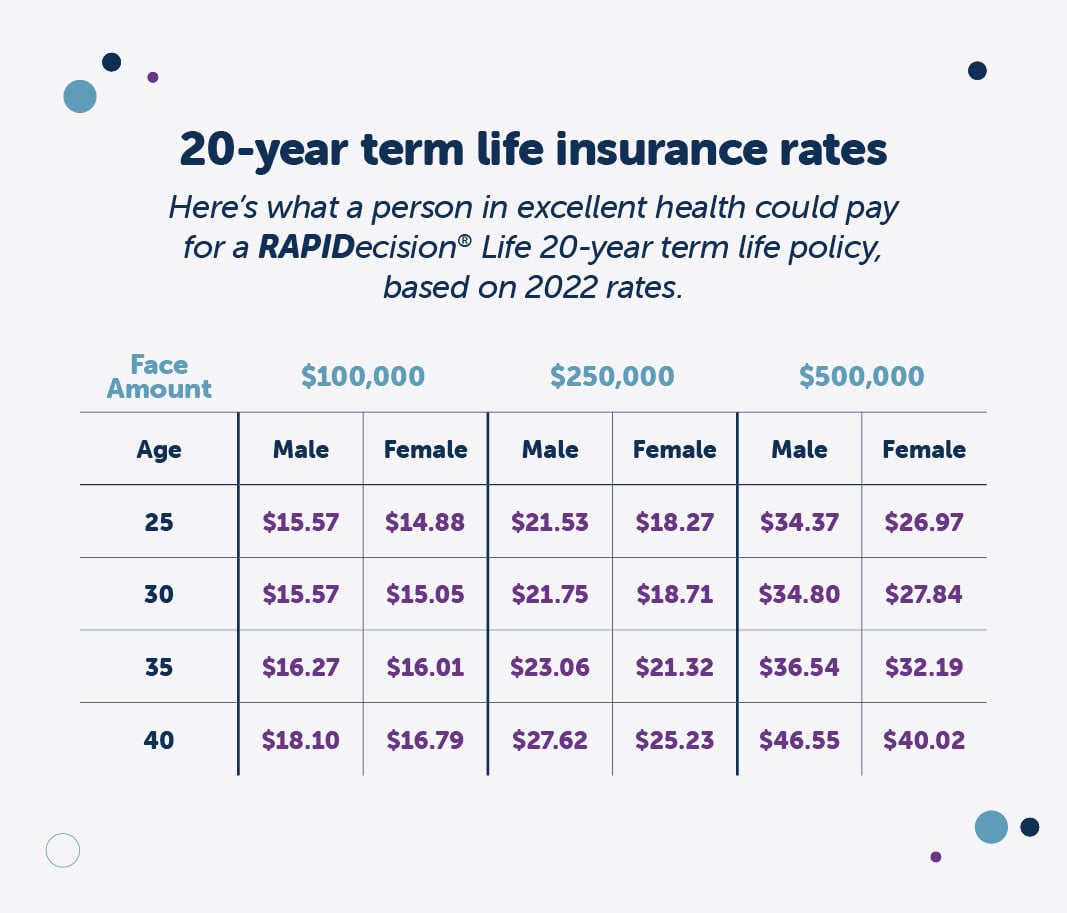

Age is a significant factor influencing life insurance premiums. Younger individuals generally have a lower risk of dying prematurely, resulting in lower premiums. As people age, their risk of mortality increases, leading to higher premiums. This is because life expectancy decreases with age, making it more likely for an insurer to have to pay out a death benefit.

Health

An individual’s health status plays a crucial role in determining life insurance costs. Insurers assess medical history, current health conditions, and lifestyle habits to determine the risk associated with insuring a particular person. For example, individuals with pre-existing health conditions or unhealthy lifestyles may face higher premiums as they are statistically more likely to experience health issues that could lead to death.

Lifestyle

Lifestyle factors such as smoking, excessive alcohol consumption, and dangerous hobbies can significantly impact life insurance premiums. These activities increase the risk of premature death and therefore result in higher premiums. Insurers often ask about these factors during the application process to assess the risk associated with each individual.

Coverage Amount

The amount of coverage chosen also influences life insurance costs. A higher coverage amount means a larger death benefit will be paid out in the event of the policyholder’s death. Consequently, higher coverage amounts typically result in higher premiums. This is because the insurer assumes a greater financial risk with larger coverage amounts.

Cost Comparison and Market Trends: Cost Of Life Insurance In Australia

Understanding the cost of life insurance in Australia is crucial for making informed decisions. Comparing prices from different providers and staying informed about market trends can help you find the most suitable and affordable policy.

Life Insurance Cost Comparison

Life insurance premiums vary significantly depending on factors such as age, health, lifestyle, and the type and amount of coverage you choose. Here is a table comparing average premiums for different life insurance plans:

| Plan Type | Average Annual Premium |

|---|---|

| Term Life Insurance (20-year term, $500,000 coverage) | $500 – $1,500 |

| Whole Life Insurance ( $500,000 coverage) | $2,000 – $5,000 |

| Total and Permanent Disability Insurance ( $50,000 monthly benefit) | $1,000 – $3,000 |

It’s important to note that these are just average premiums, and actual costs can vary significantly depending on individual circumstances. It’s always recommended to obtain quotes from multiple providers to compare prices and find the best deal.

Life Insurance Pricing Trends

Life insurance pricing is influenced by several factors, including:

- Interest rates: Lower interest rates can lead to higher premiums as insurers need to earn a higher return on their investments to cover policy payouts.

- Inflation: Rising inflation can increase the cost of living and therefore the amount of coverage needed, leading to higher premiums.

- Healthcare costs: Increasing healthcare costs can impact the cost of life insurance, especially for policies that include critical illness cover.

- Longevity: Australians are living longer, which can increase the likelihood of insurers having to pay out claims, potentially leading to higher premiums.

In recent years, there has been a trend towards more affordable life insurance products, driven by competition and increased consumer demand for value. Some providers have introduced simpler, online-only policies with lower premiums. However, it’s essential to carefully consider the coverage offered before choosing a policy based solely on price.

Tips for Finding Affordable Life Insurance

Finding affordable life insurance in Australia can feel like a daunting task. However, by understanding the factors that influence costs and employing smart strategies, you can significantly reduce your premiums.

Comparing Quotes from Multiple Insurers

It is crucial to compare quotes from multiple insurers to find the most competitive rates. This involves obtaining quotes from a variety of insurance providers, including both online and traditional companies. By comparing quotes, you can identify insurers offering the most affordable premiums for your specific needs.

- Utilize online comparison websites: Websites like comparethemarket.com.au and iSelect.com.au allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

- Contact insurers directly: Reaching out to insurers directly allows you to discuss your individual needs and obtain personalized quotes.

Understanding Policy Terms and Conditions

The terms and conditions of your life insurance policy are crucial for understanding its coverage, limitations, and potential costs. These terms determine the specifics of your policy and its impact on your financial protection.

Waiting Periods

Waiting periods, also known as exclusion periods, are the timeframes after you purchase your policy during which certain conditions are not covered. For example, a waiting period might apply to claims related to pre-existing medical conditions. Understanding the waiting periods in your policy is crucial to ensure you have adequate coverage for specific health issues.

Exclusions, Cost of life insurance in australia

Exclusions specify conditions or events that are not covered by your life insurance policy. These can include things like suicide, death due to illegal activities, or certain pre-existing conditions. Understanding the exclusions in your policy helps you identify any potential gaps in your coverage and allows you to make informed decisions about your life insurance needs.

Benefits

Life insurance benefits are the financial payouts provided to your beneficiaries upon your death. The type and amount of benefits depend on the policy you choose. Common benefits include:

- Death Benefit: This is the primary benefit of life insurance, a lump-sum payment made to your beneficiaries upon your death. The amount is determined by the policy’s coverage.

- Terminal Illness Benefit: This benefit provides a lump-sum payment if you are diagnosed with a terminal illness. This can be used to cover medical expenses, end-of-life care, or other financial needs.

- Total and Permanent Disability Benefit: This benefit provides a regular income stream if you become totally and permanently disabled. This can help cover your living expenses and maintain your financial security.

Making Claims

The process of making a claim involves notifying your insurer of a covered event, providing necessary documentation, and completing any required forms. It is essential to understand the specific steps involved in the claims process for your policy to ensure a smooth and efficient experience.

Policy Limitations

Every life insurance policy has limitations, which are restrictions on the coverage provided. These can include:

- Maximum Benefit: The maximum amount of money payable under the policy.

- Maximum Coverage: The maximum amount of coverage available for certain types of events, such as death or disability.

- Claim Limits: Restrictions on the number or types of claims you can make under the policy.

Importance of Financial Planning

Life insurance is an integral component of comprehensive financial planning, ensuring financial security for your loved ones in the event of your untimely demise. It acts as a safety net, providing financial stability and peace of mind, allowing your dependents to navigate life’s challenges without the added burden of financial strain.

Financial Consequences of Not Having Life Insurance

The absence of life insurance can have severe financial repercussions, potentially leaving your family vulnerable and struggling to cope with unexpected expenses.

| Scenario | Potential Financial Consequences |

|---|---|

| Outstanding Mortgage | Without life insurance, your family may face the daunting task of repaying the remaining mortgage balance, potentially leading to foreclosure or significant financial hardship. |

| Outstanding Debts | Credit card debt, personal loans, or other financial obligations can become overwhelming for your family without life insurance, jeopardizing their financial stability. |

| Loss of Income | The sudden loss of your income can leave your family struggling to cover essential living expenses, such as rent, utilities, food, and healthcare. |

| Education Expenses | Life insurance can help ensure your children’s education remains a priority, providing them with the financial support they need to pursue their academic goals. |

| Funeral Expenses | Funeral costs can be substantial, and without life insurance, your family may face significant financial pressure at a time of immense grief. |

Closing Summary

Navigating the complexities of life insurance in Australia requires careful consideration of your individual needs and financial goals. By understanding the factors influencing costs, comparing quotes from multiple insurers, and seeking professional advice, you can secure affordable and comprehensive life insurance protection. Remember, life insurance is not just a financial product but a vital component of a robust financial plan, ensuring the financial well-being of your loved ones in your absence.

FAQ Guide

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your dependents, outstanding debts, and desired lifestyle for your family. It’s recommended to consult with a financial advisor to determine the appropriate coverage.

Can I get life insurance if I have a pre-existing medical condition?

Yes, but you may face higher premiums or be required to undergo medical assessments. It’s important to be upfront about your medical history with insurers to ensure accurate pricing and coverage.

What are the tax implications of life insurance?

Life insurance payouts are generally tax-free in Australia. However, certain conditions may apply, so it’s advisable to seek professional financial advice for specific tax implications.