- Introduction to Courier Goods in Transit Insurance in Australia

- Types of Courier Goods in Transit Insurance Policies

- Key Coverage Components

- Factors Influencing Insurance Premiums

- Claims Process and Procedures: Courier Goods In Transit Insurance Australia

- Choosing the Right Insurance Provider

- Case Studies and Examples

- Closure

- FAQ

Courier goods in transit insurance Australia is a crucial aspect of safeguarding your business’s shipments. Navigating the Australian landscape for courier goods insurance requires a clear understanding of the risks involved, the available coverage options, and the factors that influence premium costs. This guide delves into the intricacies of this essential insurance, providing insights into the types of policies, key coverage components, and the claims process.

From the common risks associated with transporting goods across Australia, like theft, damage, and natural disasters, to the importance of choosing the right insurance provider, this comprehensive overview empowers you to make informed decisions about protecting your valuable shipments.

Introduction to Courier Goods in Transit Insurance in Australia

Courier goods in transit insurance is an essential aspect of safeguarding businesses and individuals in Australia. It provides financial protection against various risks associated with transporting goods, ensuring peace of mind and minimizing potential financial losses.

Australian Insurance Landscape for Courier Goods, Courier goods in transit insurance australia

The Australian insurance landscape for courier goods is diverse, with numerous insurers offering specialized policies tailored to different needs. These policies typically cover risks such as damage, loss, and theft during transit, offering comprehensive protection for valuable shipments.

Common Risks Associated with Transporting Goods in Australia

Transporting goods in Australia presents several risks that can impact the integrity and value of shipments. These risks include:

- Accidents and Collisions: Road accidents and collisions can result in damage or loss of goods during transit.

- Natural Disasters: Australia experiences various natural disasters, such as floods, bushfires, and cyclones, which can significantly disrupt transportation and damage goods.

- Theft and Pilferage: The risk of theft and pilferage is present throughout the transportation process, particularly in high-value goods.

- Weather Conditions: Extreme weather conditions, such as heavy rain, snow, or extreme heat, can damage sensitive goods during transit.

- Mechanical Failures: Vehicle breakdowns or mechanical failures can delay shipments and potentially damage goods.

- Human Error: Mistakes made during loading, unloading, or handling can lead to damage or loss of goods.

Types of Courier Goods in Transit Insurance Policies

Courier goods in transit insurance in Australia comes in various forms, each tailored to specific needs and offering different levels of protection. Understanding these policy types is crucial for businesses and individuals to ensure their shipments are adequately covered.

All Risks Coverage

All risks coverage is the most comprehensive type of courier goods in transit insurance. This policy provides protection against a wide range of perils, including:

- Loss or damage due to accidents, fire, theft, and natural disasters.

- Coverage for delays, strikes, and civil unrest.

- Protection against mishandling, pilferage, and spoilage.

All risks policies are ideal for high-value shipments, fragile goods, or items susceptible to damage or loss during transit.

For example, a jewelry retailer shipping a collection of diamond rings would likely opt for all risks coverage to ensure maximum protection.

Named Perils Coverage

Named perils policies offer protection against specific perils listed in the policy document. Common named perils include:

- Fire, theft, and accidents.

- Natural disasters such as floods and earthquakes.

- Acts of vandalism or malicious damage.

This type of policy is often more affordable than all risks coverage, but it provides less comprehensive protection.

For instance, a business shipping a pallet of construction materials might choose named perils coverage as the goods are less susceptible to theft or damage from mishandling.

Specific Peril Coverage

Specific peril coverage provides protection against a single, specific peril, such as theft or fire. This is the most limited type of courier goods in transit insurance, but it can be cost-effective if the risk of a particular peril is high.

A business shipping a large quantity of flammable materials might opt for specific peril coverage against fire to minimize premiums while ensuring protection against the most significant risk.

Other Policy Types

In addition to the primary types discussed above, other specialized policies are available, such as:

- Transit Delay Coverage: This policy provides compensation for delays in transit, covering financial losses due to missed deadlines or disrupted supply chains.

- War Risks Coverage: This policy protects shipments against damage or loss due to acts of war or terrorism. This is particularly relevant for international shipments.

- Special Cargo Coverage: This policy caters to specific types of cargo, such as hazardous materials, livestock, or perishable goods, offering tailored protection against specific risks associated with those items.

Key Coverage Components

Courier goods in transit insurance policies offer a comprehensive set of coverage components designed to protect businesses from various risks associated with the transportation of goods. Understanding these components is crucial for businesses to make informed decisions about their insurance needs and ensure adequate protection for their valuable shipments.

Each coverage component plays a vital role in mitigating potential financial losses, providing peace of mind and enabling businesses to focus on their core operations.

Coverage Components

The essential coverage components typically included in most courier goods in transit insurance policies are:

- Loss or Damage to Goods: This covers the financial loss incurred due to the damage or destruction of goods during transit. This coverage protects against various perils, including accidents, theft, fire, and natural disasters. For example, if a shipment of electronics is damaged in a road accident, this coverage would reimburse the insured for the cost of the damaged goods.

- Delay in Delivery: This component provides coverage for financial losses incurred due to delays in delivery. It protects against situations where shipments are delayed due to unforeseen circumstances, such as traffic congestion, bad weather, or port closures. For instance, if a shipment of perishable goods is delayed due to a snowstorm, this coverage would compensate the insured for the loss of value of the goods due to spoilage.

- Liability Coverage: This coverage protects businesses against legal liability arising from damage to third-party property or injuries caused by the insured goods during transit. This component is particularly important for businesses transporting hazardous materials or goods that could potentially cause harm to others. For example, if a shipment of chemicals spills and causes damage to a nearby building, this coverage would cover the insured’s legal liability for the damages.

- War Risks: This component provides coverage for losses caused by war, civil unrest, or terrorism. It is particularly relevant for businesses shipping goods internationally or through regions prone to political instability. For example, if a shipment is damaged or lost due to a war-related incident, this coverage would compensate the insured for the loss.

| Coverage Component | Definition |

|---|---|

| Loss or Damage to Goods | Covers financial losses incurred due to damage or destruction of goods during transit. |

| Delay in Delivery | Provides coverage for financial losses incurred due to delays in delivery. |

| Liability Coverage | Protects businesses against legal liability arising from damage to third-party property or injuries caused by the insured goods during transit. |

| War Risks | Provides coverage for losses caused by war, civil unrest, or terrorism. |

Factors Influencing Insurance Premiums

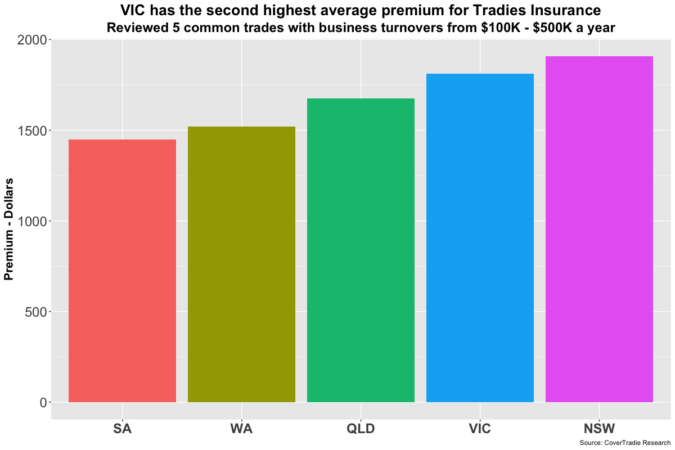

The cost of courier goods in transit insurance is determined by several factors, each playing a significant role in premium calculations. Understanding these factors is crucial for businesses to effectively manage their insurance costs and ensure adequate coverage.

Value of Goods

The value of the goods being transported is a primary determinant of the insurance premium. The higher the value of the goods, the greater the potential risk for the insurer, resulting in a higher premium.

For instance, a shipment of high-value electronics will command a higher premium compared to a shipment of basic household goods.

Nature of Goods

The nature of the goods being transported also influences the premium. Goods that are fragile, perishable, or hazardous pose a greater risk of damage or loss, leading to higher premiums.

For example, a shipment of glassware will be subject to a higher premium than a shipment of durable metal parts.

Destination and Transit Route

The destination and transit route of the goods impact the premium due to varying levels of risk associated with different locations and routes. Areas with higher crime rates or unstable political situations may carry higher premiums.

A shipment from Sydney to Melbourne may have a lower premium than a shipment from Sydney to a remote outback location.

Mode of Transportation

The mode of transportation used for the shipment influences the premium. Air transport, being faster but more susceptible to delays and potential damage, generally carries higher premiums compared to road transport.

A shipment by air will likely have a higher premium than a shipment by road.

Security Measures

The security measures implemented by the courier company significantly impact the premium. Companies with robust security protocols, such as GPS tracking, security escorts, and secure storage facilities, may qualify for lower premiums.

A courier company employing advanced tracking systems and secure storage facilities might receive a lower premium compared to one with minimal security measures.

Claims History

The claims history of the insured party plays a role in premium calculations. Businesses with a history of frequent claims may face higher premiums due to the perceived higher risk.

A courier company with a history of frequent claims for lost or damaged goods might face a higher premium compared to a company with a clean claims history.

Policy Deductibles

Policy deductibles, the amount the insured party pays out-of-pocket before the insurance coverage kicks in, also affect premiums. Higher deductibles generally lead to lower premiums, as the insurer assumes less financial risk.

A policy with a $100 deductible may have a lower premium than a policy with a $50 deductible.

Insurance Coverage Limits

The insurance coverage limits, the maximum amount the insurer will pay for a claim, also impact premiums. Higher coverage limits generally lead to higher premiums, as the insurer assumes a greater financial liability.

A policy with a $10,000 coverage limit may have a higher premium than a policy with a $5,000 coverage limit.

Claims Process and Procedures: Courier Goods In Transit Insurance Australia

The claims process for courier goods in transit insurance in Australia is designed to be straightforward and efficient. It typically involves several steps, from reporting the claim to receiving compensation.

Following the proper procedures and providing the necessary documentation can significantly increase your chances of a successful claim.

Steps in the Claims Process

The claims process for courier goods in transit insurance typically involves the following steps:

- Report the Claim: Contact your insurer as soon as possible after discovering the loss or damage to your goods. You’ll need to provide them with basic details about the incident, such as the date and location of the loss, the nature of the damage, and the value of the lost or damaged goods.

- Provide Supporting Documentation: Your insurer will likely require you to provide documentation to support your claim. This may include the following:

- Copy of your insurance policy

- Proof of purchase for the goods

- Courier consignment note or tracking information

- Photographs or video footage of the damaged goods

- Police report (if applicable)

- Investigate the Claim: The insurer will investigate the claim to verify the details and determine the cause of the loss or damage. This may involve contacting the courier company and reviewing any relevant documentation.

- Negotiate the Settlement: Once the investigation is complete, the insurer will assess the claim and determine the amount of compensation payable. You may have the opportunity to negotiate the settlement amount with the insurer.

- Receive Compensation: If the claim is approved, the insurer will pay you the agreed-upon compensation. This may be paid directly to you or to the courier company, depending on the terms of your insurance policy.

Tips for Maximizing Your Chances of a Successful Claim

To maximize your chances of a successful claim, consider the following tips:

- Keep Accurate Records: Maintain detailed records of all your shipments, including the date, value of the goods, and any relevant documentation.

- Choose a Reputable Insurer: Select an insurer with a proven track record of handling claims fairly and efficiently.

- Read Your Policy Carefully: Understand the terms and conditions of your policy, including the coverage limits, exclusions, and claim procedures.

- Report Claims Promptly: Contact your insurer as soon as possible after discovering a loss or damage. Delaying your claim could jeopardize your right to compensation.

- Cooperate with the Insurer: Provide all necessary documentation and information to the insurer in a timely manner. This will help to expedite the claims process.

Choosing the Right Insurance Provider

Selecting the right courier goods in transit insurance provider is crucial for businesses that rely on the safe and timely delivery of their goods. The right provider can offer comprehensive coverage, competitive premiums, and exceptional customer service, ensuring peace of mind and financial protection in the event of unforeseen circumstances.

Key Considerations for Selecting a Provider

Businesses should consider several factors when choosing a courier goods in transit insurance provider. These include:

- Coverage: Ensure the provider offers comprehensive coverage that aligns with the specific needs of your business, including coverage for damage, loss, theft, and delays. Consider the types of goods you transport, their value, and the geographical areas you operate in.

- Premiums: Compare premiums from different providers to find the most competitive rates. Factors influencing premiums include the value of the goods, the distance they are transported, and the risk profile of the business.

- Claims Process: A straightforward and efficient claims process is crucial. Inquire about the provider’s claims procedures, turnaround times, and the availability of 24/7 support.

- Customer Service: Look for a provider with a reputation for excellent customer service. Consider factors like responsiveness, communication, and the availability of dedicated account managers.

- Financial Stability: Choose a provider with a strong financial track record and a solid reputation for paying claims promptly and fairly.

Comparing Provider Strengths and Weaknesses

When comparing different providers, consider their strengths and weaknesses based on factors like coverage, premiums, and customer service.

- Coverage: Some providers may offer specialized coverage for specific industries or types of goods. For example, a provider specializing in high-value electronics may offer additional coverage for damage caused by static electricity.

- Premiums: Providers may offer discounts for businesses with a good safety record or for those that utilize specific security measures during transit.

- Customer Service: Some providers may offer dedicated account managers who can provide personalized support and advice. Others may have online portals or mobile apps for easy access to policy information and claims procedures.

Reputable Insurance Providers and Their Key Features

Here is a table listing some reputable courier goods in transit insurance providers in Australia and their key features:

| Provider | Key Features |

|---|---|

| Allianz | Comprehensive coverage, competitive premiums, dedicated account managers, online portal for policy management. |

| AIG | Specialized coverage for various industries, flexible policy options, 24/7 claims support, strong financial stability. |

| QBE | Competitive premiums, extensive network of brokers, online claims reporting, focus on customer satisfaction. |

| Suncorp | Comprehensive coverage, competitive premiums, dedicated claims team, online policy management. |

Case Studies and Examples

Real-world examples can vividly demonstrate the value of courier goods in transit insurance in Australia. These case studies illustrate how this type of insurance can protect businesses from unexpected events and mitigate financial losses.

Scenarios Where Insurance Coverage Proved Essential

Here are some scenarios where courier goods in transit insurance played a crucial role in protecting businesses:

- Damaged Goods During Transport: A furniture retailer in Melbourne shipped a high-value antique table to a customer in Sydney. During transport, the truck carrying the table was involved in an accident, resulting in significant damage to the table. The retailer had courier goods in transit insurance, which covered the cost of repairs, allowing them to fulfill the customer’s order without incurring a significant financial loss.

- Theft of Goods in Transit: A jewelry store in Brisbane shipped a consignment of valuable diamonds to a customer in Perth. Unfortunately, the consignment was stolen during transit. The jewelry store’s courier goods in transit insurance covered the full value of the stolen diamonds, protecting them from a major financial setback.

- Natural Disasters: A clothing manufacturer in Adelaide shipped a large order of garments to a retailer in Darwin. A cyclone struck Darwin, damaging the warehouse where the goods were stored. The manufacturer’s courier goods in transit insurance covered the cost of the damaged garments, ensuring they could fulfill the retailer’s order.

How Insurance Can Mitigate Financial Losses

Courier goods in transit insurance can help businesses mitigate financial losses in several ways:

- Compensation for Damaged or Lost Goods: Insurance policies cover the cost of replacing or repairing damaged or lost goods, ensuring businesses can fulfill orders and maintain customer satisfaction.

- Protection Against Unexpected Events: Insurance provides a financial safety net against unforeseen events like accidents, theft, or natural disasters, protecting businesses from significant financial losses.

- Peace of Mind: Knowing that their goods are insured provides businesses with peace of mind, allowing them to focus on their core operations without worrying about potential risks during transit.

Closure

By understanding the nuances of courier goods in transit insurance in Australia, businesses can mitigate financial risks, safeguard their shipments, and focus on the core operations of their enterprise. Whether you’re a small business or a large corporation, investing in comprehensive insurance is a strategic move that ensures peace of mind and protects your bottom line.

FAQ

What are the most common risks associated with courier goods in transit in Australia?

Common risks include theft, damage during transport, natural disasters, accidents, and delays.

How do I choose the right courier goods in transit insurance provider?

Consider factors like coverage options, premium costs, claims handling process, reputation, and customer service when selecting an insurance provider.

What happens if my shipment is lost or damaged during transit?

You would need to file a claim with your insurance provider. They will investigate the incident and, if approved, provide compensation based on the policy terms.