Do we need health insurance in Australia? This question has become increasingly relevant as the cost of healthcare continues to rise, leaving many Australians questioning the necessity of private insurance. The Australian healthcare system, with its publicly funded Medicare system, provides a safety net for essential medical services, but it often comes with long wait times and limited coverage for specialized treatments. This leaves individuals navigating a complex landscape of options, trying to balance affordability with the need for comprehensive healthcare.

This article delves into the intricacies of the Australian healthcare system, exploring the costs and benefits of private health insurance, and examining the factors that influence the need for this coverage. We will also discuss alternative healthcare options and consider future trends that may shape the landscape of healthcare access in Australia.

The Australian Healthcare System

Australia boasts a unique healthcare system that blends universal public coverage with private health insurance options. Understanding the structure of this system is crucial for navigating its benefits and limitations.

Medicare

Medicare is Australia’s universal healthcare scheme, funded through taxes and providing essential healthcare services to all Australian citizens and permanent residents. It covers a wide range of medical services, including:

- Doctor consultations

- Hospital stays

- Some medications

- Basic dental care for children

- Mental health services

Medicare plays a vital role in ensuring access to healthcare for all Australians, regardless of their income or employment status. However, it does have some limitations:

- It does not cover all medical expenses, such as private hospital rooms or certain specialist treatments.

- There may be waiting times for elective surgeries and certain specialist consultations.

- It does not cover dental care for adults, physiotherapy, or alternative therapies.

Private Health Insurance

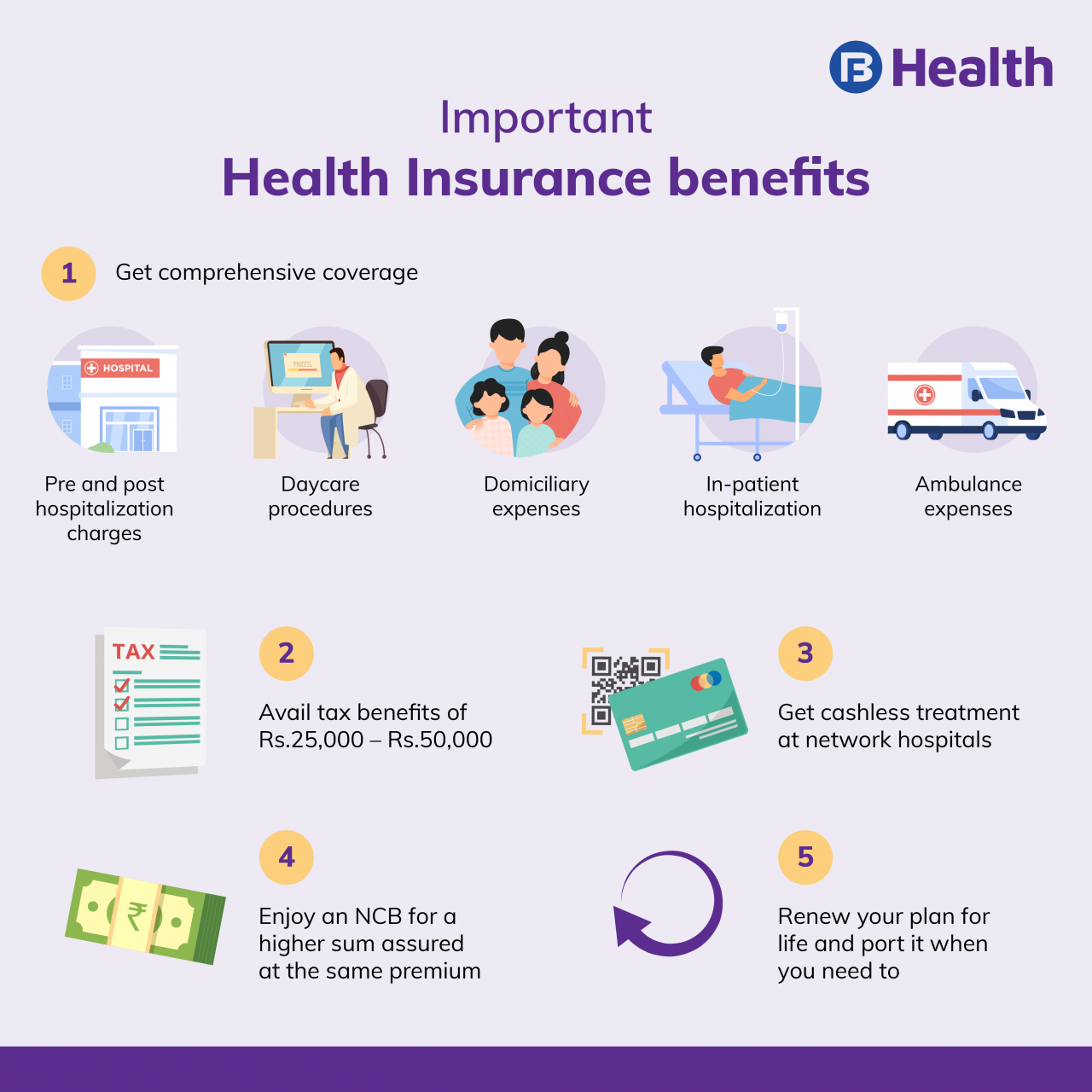

Private health insurance provides additional coverage beyond Medicare, offering benefits such as:

- Private hospital rooms

- Faster access to specialist consultations and elective surgeries

- Coverage for dental care, physiotherapy, and alternative therapies

While private health insurance can enhance healthcare access and provide greater choice, it comes at an additional cost. The premiums for private health insurance can vary significantly depending on the level of coverage and the age of the insured individual.

Government Role

The Australian government plays a significant role in healthcare, providing funding for Medicare and regulating the private health insurance industry. It also invests in public hospitals and medical research.

The government’s commitment to healthcare is reflected in the significant proportion of the federal budget allocated to this sector. This funding ensures the sustainability of Medicare and the provision of quality healthcare services to all Australians.

Benefits and Limitations

The Australian healthcare system offers several benefits, including:

- Universal access to essential healthcare services through Medicare

- A strong public hospital system

- Government investment in medical research and innovation

- The option to supplement Medicare with private health insurance

However, the system also faces some challenges:

- Waiting times for elective surgeries and certain specialist consultations can be long.

- Medicare does not cover all medical expenses, leaving some individuals with significant out-of-pocket costs.

- The rising cost of private health insurance can be a burden for some households.

- There are concerns about the sustainability of the healthcare system in the long term, given the aging population and increasing demand for services.

Costs and Benefits of Health Insurance: Do We Need Health Insurance In Australia

Navigating the world of private health insurance in Australia can feel like a complex maze. Understanding the costs involved and the potential benefits you can reap is crucial to making an informed decision about whether private health insurance is right for you.

Comparing Costs and Out-of-Pocket Expenses, Do we need health insurance in australia

The cost of private health insurance varies significantly depending on the level of cover you choose, your age, your location, and the insurer you select. However, it’s important to compare the costs of private health insurance plans with the potential out-of-pocket expenses you might face for healthcare services if you don’t have private health insurance.

- Private Health Insurance Premiums: The monthly premiums you pay for private health insurance will depend on the level of cover you choose, your age, and your location. For example, a comprehensive hospital cover with extras could cost you anywhere from $100 to $500 per month.

- Out-of-Pocket Expenses: Without private health insurance, you may face significant out-of-pocket expenses for healthcare services, such as hospital stays, surgery, and specialist consultations. For example, a hospital stay for a major operation could cost tens of thousands of dollars, and you would be responsible for paying this amount yourself.

Benefits Offered by Private Health Insurance Policies

Private health insurance offers a range of benefits, depending on the level of cover you choose. Here’s a breakdown of the different types of policies and the benefits they provide:

- Hospital Cover: This type of cover provides financial assistance for hospital stays, surgeries, and other medical procedures. The level of cover you choose will determine the types of hospitals and treatments you have access to. For example, some policies offer cover for public hospitals only, while others offer cover for both public and private hospitals.

- Extras Cover: This type of cover provides financial assistance for a range of healthcare services, such as dental, physiotherapy, and optical care. The level of cover you choose will determine the types of services you have access to and the amount of financial assistance you receive.

Potential Savings and Advantages of Private Health Insurance

Private health insurance can offer a range of potential savings and advantages, including:

- Reduced Out-of-Pocket Expenses: Private health insurance can significantly reduce your out-of-pocket expenses for healthcare services. For example, you may be able to access private hospitals, which generally have shorter waiting times for treatment, without having to pay the full cost of your treatment.

- Access to Specialist Care: Private health insurance can give you access to specialist care, such as private hospitals and specialists, without having to wait for long periods on public waiting lists.

- Tax Rebates: The Australian government provides tax rebates for private health insurance premiums, which can help to offset the cost of your premiums.

- Peace of Mind: Having private health insurance can provide peace of mind knowing that you have financial protection in case of unexpected illness or injury.

Factors Influencing the Need for Health Insurance

The decision to obtain health insurance in Australia is a personal one, influenced by a range of factors. These factors can be broadly categorized into individual characteristics, financial considerations, and family dynamics.

Age and Health Status

The need for health insurance is often linked to age and health status. As individuals age, they are more likely to experience health issues requiring specialized care.

- Older individuals may be more susceptible to chronic conditions like heart disease, diabetes, and arthritis, which may necessitate frequent medical visits, hospitalizations, and specialized treatments. Health insurance can provide coverage for these costs, helping to manage the financial burden associated with aging.

- Individuals with pre-existing conditions may face higher premiums or even be denied coverage if they don’t have health insurance. This underscores the importance of securing insurance before health problems arise, as it can provide peace of mind and financial protection in case of unexpected health events.

Lifestyle Choices

Lifestyle choices can significantly impact the need for health insurance.

- Individuals with active lifestyles, engaging in sports or physically demanding activities, may be more prone to injuries and require access to private healthcare for faster recovery and rehabilitation. Health insurance can provide access to specialists, physiotherapists, and other services that may not be readily available through the public system.

- Smokers and individuals with unhealthy dietary habits are at a higher risk of developing health issues that may require specialized care. Health insurance can provide coverage for these costs, reducing the financial burden associated with preventable health problems.

Income and Financial Stability

Income and financial stability play a crucial role in determining the need for health insurance.

- Individuals with higher incomes may be more likely to afford private health insurance, which offers access to faster treatment times, a wider range of specialists, and private hospital facilities. Health insurance can be seen as an investment in their health and well-being, ensuring they have access to the best possible care.

- Individuals with lower incomes may find it difficult to afford health insurance, particularly if they have pre-existing conditions or face high premiums. They may rely on the public healthcare system, which provides essential medical services but may have longer wait times for elective procedures.

Family Size and Individual Needs

The size and needs of a family can also influence the decision to obtain health insurance.

- Families with young children may find health insurance beneficial as it can provide coverage for a wide range of medical expenses, including immunizations, regular check-ups, and potential accidents. Health insurance can offer peace of mind and financial security, knowing that their children have access to quality healthcare.

- Families with individuals with specific needs, such as chronic conditions or disabilities, may find health insurance essential for managing their health and accessing specialized care. Health insurance can provide coverage for ongoing treatments, medications, and specialized services, ensuring their well-being and independence.

Alternatives to Private Health Insurance

While private health insurance offers numerous benefits, it’s not the only option for accessing quality healthcare in Australia. The public healthcare system, known as Medicare, provides a comprehensive safety net for all Australians, and other alternatives exist to address specific healthcare needs.

Public Healthcare System

Australia’s public healthcare system, Medicare, is funded through taxes and provides universal access to essential healthcare services. It covers a wide range of services, including:

- Doctor consultations

- Hospital stays

- Some diagnostic tests

- Prescription medications

Medicare is a significant benefit for Australians, offering financial protection against the costs of essential healthcare. However, it has limitations, including potential waiting times for elective surgeries and limited access to certain specialist services or treatments.

Community Health Centers

Community health centers provide a range of healthcare services, often focusing on preventative care and addressing the needs of specific communities. They are generally funded by a combination of government grants, private donations, and user fees. These centers offer services such as:

- General practitioner consultations

- Mental health services

- Family planning

- Immunizations

- Chronic disease management

Community health centers provide accessible and affordable healthcare, particularly for disadvantaged communities. However, their services may be limited compared to private hospitals, and they may have longer wait times for certain services.

Table Comparing Healthcare Options

| Option | Cost | Accessibility | Service Quality |

|—|—|—|—|

| Medicare | Free at point of service (with some out-of-pocket expenses) | Widely accessible | Essential services covered, but may have wait times for elective surgeries and limited access to specialist services |

| Private Health Insurance | Monthly premiums | Varies depending on coverage | Access to private hospitals, shorter wait times for elective surgeries, wider range of services |

| Community Health Centers | Sliding scale fees or free | Accessible to specific communities | Focus on preventative care and addressing community needs, but services may be limited compared to private hospitals |

Future Trends and Considerations

The Australian healthcare system is constantly evolving, driven by factors such as technological advancements, demographic shifts, and changing public health priorities. Understanding these trends is crucial for individuals to make informed decisions about their healthcare needs and whether private health insurance is right for them.

Emerging Healthcare Technologies and Their Impact

The rapid development and adoption of new technologies are transforming the healthcare landscape. These advancements have the potential to enhance access, efficiency, and quality of care while also influencing the role of private health insurance.

- Telehealth: The rise of telehealth services, such as virtual consultations and remote monitoring, is expanding access to healthcare, particularly in rural and remote areas. This increased accessibility may reduce the need for traditional hospital visits and potentially lower the demand for private health insurance.

- Artificial Intelligence (AI): AI is playing an increasingly significant role in healthcare, from diagnosis and treatment planning to drug discovery and personalized medicine. AI-powered tools can improve accuracy, efficiency, and cost-effectiveness, potentially leading to a shift in the way healthcare is delivered and the types of services covered by insurance.

- Genomics and Personalized Medicine: Advances in genomics are enabling personalized medicine, tailoring treatments to individual genetic profiles. This personalized approach may require more specialized and complex healthcare services, potentially increasing the demand for comprehensive private health insurance coverage.

Factors to Consider When Deciding on Private Health Insurance

Individuals should consider several factors when deciding whether to purchase private health insurance, taking into account their personal circumstances, financial situation, and healthcare needs.

- Health Status: Individuals with pre-existing conditions or a higher risk of developing health problems may benefit from private health insurance, as it can provide access to specialized treatments and faster waiting times.

- Age and Lifestyle: Younger individuals with healthy lifestyles may not see the immediate need for private health insurance. However, as they age and their risk of health issues increases, the benefits of coverage become more apparent.

- Financial Situation: Private health insurance premiums can be significant, so it’s crucial to consider affordability and weigh the costs against the potential benefits. Individuals with limited financial resources may find that the out-of-pocket costs associated with public healthcare are more manageable.

- Waiting Times: While the Australian public healthcare system provides universal access, waiting times for elective surgeries and specialist consultations can be lengthy. Private health insurance can reduce these waiting times, providing faster access to treatment.

- Choice of Provider: Private health insurance allows individuals to choose their own doctors and hospitals, offering more flexibility and potentially a higher level of care.

- Government Incentives: The Australian government offers incentives for individuals to take out private health insurance, such as tax rebates and lower premiums for younger individuals. These incentives can make private health insurance more affordable and attractive.

Ultimate Conclusion

Ultimately, the decision of whether or not to purchase private health insurance is a personal one, influenced by individual circumstances, financial capabilities, and health priorities. By understanding the intricacies of the Australian healthcare system, the costs and benefits of different options, and the potential future trends, individuals can make informed decisions about their healthcare coverage and ensure access to the medical care they need.

Quick FAQs

What are the main benefits of private health insurance in Australia?

Private health insurance offers several benefits, including shorter wait times for elective surgeries, access to a wider range of medical specialists, and coverage for services not covered by Medicare, such as dental and optical care.

How much does private health insurance cost in Australia?

The cost of private health insurance varies depending on the level of coverage, age, and health status. It’s essential to compare different plans and providers to find the most suitable and affordable option.

Can I get private health insurance if I’m already on Medicare?

Yes, you can have both Medicare and private health insurance. Medicare provides basic coverage, while private health insurance supplements it with additional benefits.

What are the main drawbacks of private health insurance in Australia?

Private health insurance can be expensive, and the premiums can increase over time. It’s important to carefully consider the cost-benefit analysis before making a decision.