Do rebates cover extras insurance in Australia? This is a question that many Australians ask themselves when considering their health insurance options. Extras insurance, which covers a range of services like dental, optical, and physiotherapy, can significantly impact your out-of-pocket expenses. But, are you eligible for a rebate on your extras insurance premiums? Understanding the ins and outs of rebates can help you save money and make informed decisions about your health insurance coverage.

In Australia, rebates are government subsidies designed to make health insurance more affordable. These rebates are calculated based on your age, income, and family situation. While the exact amount of your rebate may vary, it can make a substantial difference in your overall health insurance costs.

Rebates in Australia

Rebates are essentially discounts offered by insurance companies to policyholders in Australia. These discounts can reduce your overall insurance premium, making insurance more affordable.

Types of Rebates

Insurance companies offer a variety of rebates in Australia, each designed to reward certain behaviors or circumstances. Here are some common types of rebates:

- Loyalty Rebates: These are given to policyholders who have maintained their insurance policy with the same company for a specific period. The longer you stay with the insurer, the larger the rebate you may receive.

- Safety Rebates: These are offered to policyholders who demonstrate safe driving practices, such as having a clean driving record or installing safety features in their vehicles.

- Bundling Rebates: Insurers often offer discounts when you bundle multiple insurance policies with them, such as home and car insurance.

- Group Rebates: These rebates are available to individuals who are part of a specific group, such as a professional organization or an employee group.

- Pay-in-Full Rebates: Some insurers offer discounts if you pay your insurance premium in full upfront, rather than in installments.

- Early Payment Rebates: Similar to pay-in-full rebates, early payment rebates are offered for paying your premium before the due date.

Examples of Common Rebates

Here are some real-world examples of common insurance rebates offered by Australian insurers:

- AAMI offers a loyalty rebate for car insurance, increasing with the duration of the policy. They also offer a safe driving rebate for drivers with a clean record and a bundling rebate for combining home and car insurance.

- NRMA provides a loyalty rebate for car insurance, along with a safety rebate for drivers who install safety features in their vehicles. They also offer a group rebate for members of certain organizations.

- Suncorp offers a loyalty rebate for car and home insurance, as well as a bundling rebate for combining multiple policies.

Extras Insurance Coverage

Extras insurance is a type of health insurance in Australia that covers the costs of a wide range of health services not typically covered by basic hospital and medical insurance. It aims to provide financial assistance for essential healthcare services, allowing individuals to access treatments and services without significant out-of-pocket expenses.

Types of Services Covered

Extras insurance policies typically cover a broad range of services, depending on the specific policy chosen. These services often fall under categories such as:

- Dental: This covers dental treatments like check-ups, cleanings, fillings, and extractions. Some policies may also cover more advanced treatments like crowns, bridges, and dentures.

- Optical: This covers eye examinations, glasses, contact lenses, and some eye surgery procedures.

- Physiotherapy: This covers treatment for musculoskeletal injuries and conditions, including massages, exercise programs, and manual therapy.

- Chiropractic: This covers treatment for spinal problems and other musculoskeletal conditions, including adjustments and manual therapy.

- Psychology: This covers consultations with psychologists for mental health issues, such as anxiety, depression, and stress.

- Hearing: This covers hearing tests, hearing aids, and other devices to assist with hearing loss.

- Podiatry: This covers treatment for foot and ankle problems, including orthotics, nail care, and other foot-related services.

- Massage Therapy: This covers massage therapy treatments for relaxation and pain relief.

- Alternative Therapies: This can include coverage for services such as acupuncture, naturopathy, and homeopathy.

Common Extras Insurance Benefits

Here are some common examples of extras insurance benefits:

- Dental: Many policies offer annual limits on dental expenses, such as a fixed amount per year for check-ups, cleanings, and fillings. Some policies also offer a percentage rebate on more expensive treatments like crowns and dentures.

- Optical: Policies often provide a fixed amount towards the cost of new glasses or contact lenses, with a maximum limit per year or policy period. Some policies may also offer a percentage rebate on eye surgery procedures.

- Physiotherapy: Many policies offer a set number of physiotherapy sessions per year, with a maximum limit on the total cost covered. Some policies may also cover the cost of exercise programs and manual therapy.

Rebates and Extras Insurance

Rebates are essentially discounts offered by insurance providers, and they can be applied to your extras insurance premiums. These rebates can be a great way to save money on your health insurance, but it’s important to understand how they work and how to qualify for them.

Rebates for Extras Insurance

Rebates for extras insurance can be offered for a variety of reasons, such as:

- Loyalty Rebates: Some insurers offer rebates to customers who have been with them for a certain period of time. These rebates are usually a percentage of your premium and can be a good way to reward long-term customers.

- Health Rebates: These rebates are based on your health status and lifestyle choices. For example, you might be eligible for a rebate if you are a non-smoker, have a healthy weight, or participate in regular exercise. These rebates are usually designed to encourage healthy living.

- Family Rebates: Some insurers offer family rebates for policies that cover multiple family members. These rebates can help to make health insurance more affordable for families.

- Group Rebates: If you are part of a group, such as an employer or a professional organization, you may be eligible for a group rebate. These rebates are often negotiated by the group with the insurer and can be a significant discount on your premium.

Rebate Eligibility Criteria

The eligibility criteria for rebates vary depending on the insurer and the specific policy. Here are some common criteria:

- Policy Type: Some rebates are only available for certain types of extras insurance policies, such as those that cover dental, optical, or physiotherapy.

- Policy Term: Some rebates are only available if you have held the policy for a certain period of time, such as one year or more.

- Claims History: Some insurers offer rebates to policyholders who have not made any claims in a certain period of time. This is a way to reward customers who are healthy and don’t need to use their insurance.

- Health Status: As mentioned earlier, some insurers offer rebates based on your health status. This may include factors such as your age, weight, smoking status, and whether you have any pre-existing medical conditions.

Common Rebate Scenarios

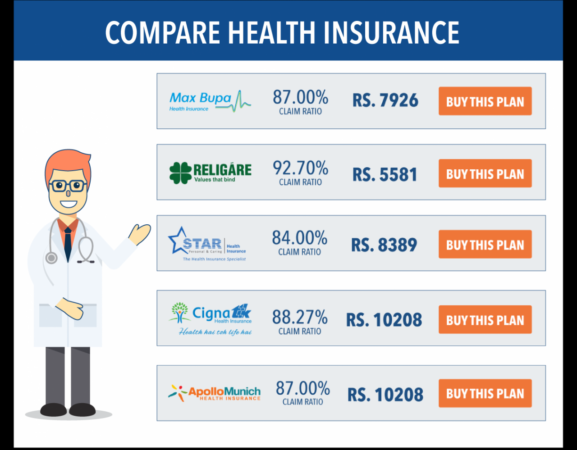

Here is a table outlining some common rebate scenarios for extras insurance in Australia:

| Scenario | Rebate Eligibility | Rebate Amount |

|---|---|---|

| Policyholder has been with the insurer for 5 years | Loyalty rebate | 10% of premium |

| Policyholder is a non-smoker and has a healthy weight | Health rebate | 5% of premium |

| Policyholder has a family policy covering 4 members | Family rebate | $50 per month |

| Policyholder is a member of a professional organization | Group rebate | 15% of premium |

Factors Influencing Rebates: Do Rebates Cover Extras Insurance In Australia

Rebates on extras insurance in Australia are not a fixed amount, and they can vary considerably based on a range of factors. Understanding these factors can help you make informed decisions about your extras insurance and maximize your potential savings.

Individual Circumstances, Do rebates cover extras insurance in australia

The amount of rebate you receive is heavily influenced by your individual circumstances. These factors include:

- Age: Younger individuals generally pay lower premiums and receive smaller rebates, while older individuals often pay higher premiums and receive larger rebates. This is because older individuals are more likely to require medical services and therefore receive greater benefits from their extras insurance.

- Health Status: Your health status can also influence your rebate. Individuals with pre-existing health conditions or a history of using extras insurance services may receive higher rebates. This is because they are more likely to utilize their extras insurance benefits, leading to higher claim costs for the insurer.

- Lifestyle: Your lifestyle can also play a role. Individuals who engage in high-risk activities or have a history of health issues may be eligible for higher rebates. This is because they are more likely to require medical services and therefore receive greater benefits from their extras insurance.

- Occupation: Your occupation can also influence your rebate. Individuals in high-risk occupations, such as construction or mining, may receive higher rebates due to their increased risk of injury or illness.

Policy Terms

The terms of your extras insurance policy can also significantly impact your rebate.

- Coverage: The type and level of coverage you choose can affect your rebate. Policies with comprehensive coverage, such as dental, optical, and physiotherapy, generally come with higher premiums and larger rebates. Conversely, policies with limited coverage, such as only dental or optical, may have lower premiums and smaller rebates.

- Excess: The excess you choose to pay on your policy can also influence your rebate. Higher excesses generally lead to lower premiums and smaller rebates. Conversely, lower excesses typically result in higher premiums and larger rebates.

- Waiting Periods: The waiting periods for specific services can also impact your rebate. Policies with shorter waiting periods generally have higher premiums and larger rebates. Conversely, policies with longer waiting periods may have lower premiums and smaller rebates.

Insurer Practices

Insurers also play a role in determining rebate amounts.

- Rebate Policy: Each insurer has its own rebate policy, which Artikels the criteria for determining rebate amounts. Some insurers may offer larger rebates for certain services or groups of individuals, while others may focus on providing broader coverage with smaller rebates.

- Claims Experience: The insurer’s claims experience can also affect your rebate. If an insurer experiences a high number of claims for a particular service, it may adjust its rebate policy to reflect this. This can lead to higher premiums and smaller rebates for that service.

- Profitability: The insurer’s profitability can also influence its rebate policy. If an insurer is experiencing high profits, it may offer larger rebates to attract new customers or retain existing ones. Conversely, if an insurer is facing financial challenges, it may reduce its rebate offerings to improve its profitability.

Obtaining Information on Rebates

Finding information about rebates for extras insurance is crucial for maximizing your savings. Rebates can vary significantly depending on the insurer, your policy, and your individual circumstances. Several avenues can be explored to gather this information.

Accessing Insurer Websites

Insurer websites are a valuable resource for information on rebates. They often have dedicated sections on their website outlining rebate policies, eligibility criteria, and available rebate options. You can usually find this information under “Rebates,” “Promotions,” or “Special Offers.” Many insurers also have online calculators or tools that allow you to estimate your potential rebate based on your specific circumstances.

Contacting Customer Service

Directly contacting the insurer’s customer service department is another effective way to obtain detailed information about rebates. Customer service representatives can provide personalized guidance, answer your questions, and clarify any uncertainties you may have. They can also inform you about any special promotions or limited-time rebates that may be available.

Consulting with Financial Advisors

For comprehensive guidance and advice, consider consulting with a financial advisor. Financial advisors are well-versed in insurance products and can help you understand the intricacies of rebates. They can also assess your individual needs and recommend the most suitable extras insurance policy and rebate options that align with your financial goals.

Final Wrap-Up

Navigating the world of health insurance rebates can be complex, but it’s essential to understand how they can impact your extras insurance. By carefully researching your options, comparing policies, and understanding the factors that influence rebate eligibility, you can make the most of this government support and ensure you’re getting the best possible coverage for your needs.

Answers to Common Questions

What are the different types of rebates available for extras insurance in Australia?

The type of rebate you receive depends on your individual circumstances, including your age, income, and family situation. There are several categories of rebates, including the Lifetime Health Cover (LHC) rebate, the Private Health Insurance Rebate (PHIR), and the Family Tax Benefit Part A (FTBA) rebate.

Can I claim a rebate for extras insurance even if I don’t have hospital cover?

Yes, you can still claim a rebate for extras insurance, even if you don’t have hospital cover. The rebate amount will be based on your individual circumstances and the specific extras insurance policy you choose.

How do I know if I’m eligible for a rebate on my extras insurance?

The best way to determine your rebate eligibility is to contact your health insurer directly. They can provide you with personalized information based on your individual situation and the specific policy you’re considering.

Is there a limit on the amount of rebate I can receive for extras insurance?

Yes, there are limits on the amount of rebate you can receive for extras insurance. The maximum rebate amount is determined by the Australian government and can vary based on your age and income.