- Cruise Insurance Basics

- Australian Cruise-Specific Risks

- Medical Coverage Considerations

- Cancellation and Interruption Coverage

- Luggage and Personal Belongings Coverage: Do You Need Travel Insurance For A Cruise In Australia

- Additional Coverage Options

- Choosing the Right Insurance Provider

- Final Summary

- FAQ Compilation

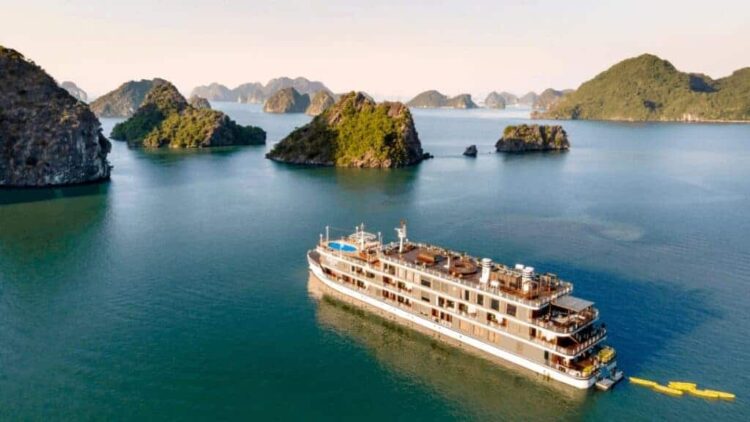

Do you need travel insurance for a cruise in Australia? This question often arises when planning a trip to this beautiful continent. While the allure of Australia’s stunning coastlines and diverse wildlife is undeniable, it’s essential to consider the potential risks associated with cruising in this region. From unexpected weather conditions to potential medical emergencies, having adequate travel insurance can provide peace of mind and safeguard your investment.

This comprehensive guide explores the importance of travel insurance for cruises in Australia, covering various aspects from essential coverage options to crucial considerations for choosing the right insurance provider. We’ll delve into the specific risks you might encounter, the benefits of having insurance, and the steps involved in obtaining and activating your policy.

Cruise Insurance Basics

Cruise insurance is a specialized type of travel insurance designed to protect you against unexpected events that could disrupt your cruise vacation or lead to significant financial losses. While it’s not mandatory in Australia, it’s highly recommended for peace of mind and financial security.

Key Coverage Options

Cruise insurance policies typically offer a range of coverage options, including:

- Medical Expenses: Covers medical costs incurred during your cruise, including emergency medical evacuation.

- Trip Cancellation and Interruption: Provides reimbursement for non-refundable cruise costs if you need to cancel or interrupt your trip due to covered reasons, such as illness, injury, or family emergencies.

- Baggage Loss or Damage: Offers compensation for lost or damaged luggage while on your cruise.

- Personal Accident and Emergency Medical Expenses: Covers medical expenses and personal accident benefits in case of an accident or injury during your cruise.

- Cruise Ship Evacuation: Reimburses expenses related to evacuation from the ship in case of an emergency.

- Repatriation: Covers the cost of transporting you back home in case of a medical emergency or death.

Benefits of Cruise Insurance in Australia

Cruise insurance offers numerous benefits for travelers in Australia, including:

- Financial Protection: It safeguards you against unexpected expenses related to medical emergencies, trip cancellations, and other unforeseen events, potentially saving you thousands of dollars.

- Peace of Mind: Knowing you have insurance coverage can reduce stress and allow you to enjoy your cruise without worrying about potential risks.

- Access to Emergency Services: Insurance companies provide access to 24/7 emergency assistance services, offering support and guidance in case of an emergency.

- Coverage for Pre-existing Conditions: Some policies offer coverage for pre-existing medical conditions, which can be crucial for individuals with health concerns.

- Legal and Advocacy Support: Insurance providers can provide legal and advocacy support in case of disputes or claims with the cruise line.

Australian Cruise-Specific Risks

Cruises in Australia offer breathtaking scenery and unique experiences. However, they also present certain risks that are specific to the region, ranging from weather conditions to wildlife encounters. Understanding these risks is crucial for making informed decisions about your travel insurance.

Weather Conditions

Australia’s diverse climate can pose challenges for cruise itineraries. While some areas experience mild temperatures year-round, others are prone to extreme weather events like cyclones, storms, and heatwaves. These conditions can disrupt itineraries, delay departures, or even force cancellations.

Wildlife Encounters

Australia is renowned for its diverse wildlife, but encounters with marine life can pose risks to cruise passengers. For instance, jellyfish stings, shark attacks, or encounters with venomous creatures like blue-ringed octopus can cause serious injury or even death.

Coverage Comparison

| Insurance Option | Weather-Related Risks | Wildlife Encounters |

|---|---|---|

| Basic Cruise Insurance | Limited coverage for delays or cancellations due to weather events. | May offer limited medical coverage for wildlife-related injuries. |

| Comprehensive Cruise Insurance | Wider coverage for weather-related disruptions, including cancellations, delays, and medical expenses. | Provides more extensive medical coverage for wildlife-related injuries, including evacuation costs. |

| Specialized Australian Cruise Insurance | Specific coverage for cyclone-related disruptions, including cancellations, delays, and medical expenses. | Comprehensive medical coverage for wildlife-related injuries, including evacuation costs and specialized treatment. |

Medical Coverage Considerations

Cruises offer a chance to escape and explore, but unexpected medical emergencies can quickly turn a dream vacation into a nightmare. This is where travel insurance, particularly medical coverage, plays a crucial role.

Medical Coverage Levels

Cruise insurance providers offer various levels of medical coverage, each catering to different needs and budgets. Understanding these levels is essential for choosing the right plan.

- Basic Coverage: This typically covers emergency medical expenses, including ambulance transportation, hospitalization, and doctor’s fees. It may also cover evacuation costs in case of a medical emergency that requires you to be flown back home.

- Comprehensive Coverage: This offers more extensive protection, including coverage for pre-existing conditions, dental emergencies, and even lost or stolen luggage. It may also include higher limits for medical expenses and evacuation costs.

- Luxury Coverage: This is the highest level of coverage, often including benefits like private room accommodations in hospitals, repatriation to your home country, and coverage for lost or damaged personal belongings.

Choosing the Right Medical Coverage

Choosing the right medical coverage depends on several factors, including your age, health, and travel plans. Here are some tips:

- Consider your health: If you have pre-existing medical conditions, you’ll need a plan that covers them. Some insurers may require you to disclose your medical history, which could affect your premium.

- Evaluate your travel plans: The length of your cruise and the destinations you’ll be visiting can influence your medical coverage needs. If you’re planning a longer cruise or visiting remote areas, you may need more comprehensive coverage.

- Compare different plans: Don’t just focus on the price; compare the benefits and coverage limits of different plans. Make sure you understand what’s covered and what’s not.

- Read the fine print: Carefully review the policy documents to ensure you understand the terms and conditions. Pay attention to exclusions, limitations, and any specific requirements.

Cancellation and Interruption Coverage

Cancellation and interruption coverage is a crucial aspect of travel insurance, especially for cruises in Australia. This coverage protects you financially if you have to cancel your cruise or if your trip is interrupted due to unforeseen circumstances. It provides reimbursement for non-refundable cruise fares, pre-paid shore excursions, and other related expenses.

Circumstances Requiring Coverage

Cancellation and interruption coverage can be a lifesaver in various situations. Some common scenarios where this coverage might be necessary include:

- Medical emergencies: If you or a family member falls ill or suffers an injury before or during the cruise, requiring immediate medical attention and cancellation of the trip.

- Unexpected job loss or family emergencies: These events can disrupt travel plans, forcing you to cancel your cruise.

- Natural disasters: Severe weather events, such as cyclones or bushfires, can lead to cruise cancellations or interruptions.

- Terrorist attacks or political unrest: These events can disrupt travel plans and necessitate trip cancellations.

- Cruise ship mechanical issues: If the cruise ship encounters mechanical problems, it may be forced to cancel or interrupt the voyage, requiring you to return home.

Filing a Claim

Filing a claim for cancellation or interruption coverage typically involves the following steps:

Flowchart:

[Insert flowchart here]

- Notify your insurance provider: As soon as you become aware of a covered event, contact your insurer to inform them about the situation.

- Provide documentation: You will need to provide supporting documentation, such as medical records, police reports, or official notices of cancellation, to support your claim.

- Complete claim forms: Your insurer will provide claim forms that you need to complete and submit.

- Review and process: The insurer will review your claim and process it according to their policy terms and conditions.

- Payment: If your claim is approved, you will receive reimbursement for covered expenses.

Luggage and Personal Belongings Coverage: Do You Need Travel Insurance For A Cruise In Australia

Cruises are known for their luxurious amenities and opportunities for relaxation, but it’s important to remember that even on a relaxing vacation, your belongings are still vulnerable to theft, damage, or loss. While you’re enjoying the sun, sea, and sand, your luggage and personal belongings might be exposed to unexpected events. This is where travel insurance comes in, providing a safety net to protect your valuable possessions.

Luggage and personal belongings coverage is an essential component of travel insurance, particularly for cruises. This coverage can help you recover the cost of replacing or repairing lost, stolen, or damaged items. The policy typically covers items such as clothing, electronics, jewelry, and other personal belongings.

Types of Luggage and Personal Belongings Coverage

Cruise insurance policies typically offer various levels of coverage for luggage and personal belongings. Understanding the different types of coverage is crucial for choosing the right policy for your needs.

- Basic Coverage: This is the most common type of coverage, providing limited protection for lost, stolen, or damaged luggage and personal belongings. It usually has a maximum coverage limit, and there may be deductibles you need to pay.

- Comprehensive Coverage: This offers more extensive protection, with higher coverage limits and potentially lower deductibles. It may also cover items that are not typically included in basic coverage, such as expensive jewelry or electronics.

- Specific Item Coverage: This allows you to purchase additional coverage for specific high-value items, such as a laptop or a camera. This can be a valuable option if you’re carrying expensive items on your cruise.

Additional Coverage Options

While standard travel insurance often covers the basics, additional coverage options can provide crucial protection for specific risks associated with Australian cruises. These options can help you navigate unexpected situations and ensure peace of mind during your trip.

Emergency Medical Evacuation, Do you need travel insurance for a cruise in australia

Emergency medical evacuation coverage is essential for cruises in Australia, especially if you’re venturing to remote destinations. This coverage can be crucial if you experience a serious medical emergency while on board or ashore.

- Coverage Details: Emergency medical evacuation coverage typically covers the costs of transporting you to a hospital or medical facility with the necessary expertise, regardless of location. It can include air ambulance services, medical escorts, and other related expenses.

- Value: In remote areas, medical facilities may be limited, and accessing specialized care can be challenging. Emergency medical evacuation coverage ensures you receive the appropriate medical attention, regardless of your location.

- Australian Relevance: Australia’s vast and diverse landscape includes remote islands and coastal regions where medical facilities may be limited. This coverage can be invaluable in such situations, providing peace of mind and ensuring you receive the necessary medical care.

Flight Delay Coverage

Flight delays are a common occurrence, especially when traveling to and from remote destinations in Australia. Flight delay coverage can help mitigate the financial impact of such delays.

- Coverage Details: Flight delay coverage typically reimburses you for expenses incurred due to flight delays, such as meals, accommodation, and transportation. This coverage often has a specific time limit, such as a delay of 6 hours or more.

- Value: Flight delays can disrupt your travel plans and lead to unexpected expenses. Flight delay coverage helps offset these costs, providing financial relief during a stressful situation.

- Australian Relevance: Australian airports often experience flight delays due to weather conditions, air traffic congestion, and other factors. Flight delay coverage can be valuable for mitigating these risks, especially when traveling to remote destinations where alternative travel options may be limited.

Choosing the Right Insurance Provider

Choosing the right travel insurance provider for your Australian cruise can be a daunting task, given the plethora of options available. It’s crucial to find a provider that offers comprehensive coverage tailored to your specific needs and budget.

Comparing Cruise Insurance Providers

It’s essential to compare different cruise insurance providers in Australia to find the best fit for your needs. Consider factors such as coverage, benefits, pricing, and customer service when making your decision.

- Coverage: Compare the types of coverage offered by different providers, including medical expenses, cancellation and interruption, luggage and personal belongings, and emergency medical evacuation. Look for policies that offer specific coverage for cruise-related risks, such as seasickness, shipboard accidents, and shore excursions.

- Benefits: Examine the benefits offered by each provider, such as 24/7 emergency assistance, travel assistance services, and reimbursement for medical expenses. Some providers may also offer additional benefits, such as travel delay coverage, lost passport reimbursement, and rental car insurance.

- Pricing: Compare the premiums offered by different providers, taking into account the coverage offered and the length of your cruise. Consider the value proposition of each policy, comparing the price with the level of coverage and benefits provided.

- Customer Service: Check the reputation of the provider and look for customer reviews and testimonials. A reputable provider will have a strong track record of providing excellent customer service and resolving claims promptly.

Tips for Selecting a Reputable Provider

- Read Reviews: Look for online reviews and testimonials from other customers to gauge the reputation of the provider and their track record in handling claims.

- Check Financial Stability: Ensure the provider is financially stable and has a good track record of paying claims. You can check their financial rating with independent agencies like AM Best or Standard & Poor’s.

- Compare Policy Documents: Carefully read the policy documents and understand the terms and conditions, including exclusions and limitations. Make sure you are comfortable with the coverage and the provider’s claims process.

- Seek Professional Advice: If you are unsure about which provider to choose, consider seeking advice from a travel insurance broker or financial advisor. They can help you understand your needs and find a policy that best suits your circumstances.

Provider Comparison Table

| Provider | Coverage | Benefits | Pricing (Approximate) |

|---|---|---|---|

| [Provider 1 Name] | [Coverage details] | [Benefits details] | [Price range] |

| [Provider 2 Name] | [Coverage details] | [Benefits details] | [Price range] |

| [Provider 3 Name] | [Coverage details] | [Benefits details] | [Price range] |

Final Summary

Cruising in Australia offers a unique and unforgettable experience, but it’s essential to be prepared for any unforeseen circumstances. Travel insurance provides a safety net, protecting you from financial losses and ensuring you can enjoy your journey without worry. By understanding the benefits, choosing the right coverage, and taking the necessary steps to obtain insurance, you can cruise with confidence and make the most of your Australian adventure.

FAQ Compilation

What are the most common risks associated with cruises in Australia?

Cruises in Australia can present unique risks such as unpredictable weather conditions, potential wildlife encounters, and the possibility of medical emergencies.

Do I need travel insurance if I’m already covered by my health insurance?

While your health insurance may provide some coverage, travel insurance offers additional benefits specifically tailored for trips abroad, including medical expenses, evacuation, and cancellation coverage.

What should I look for when choosing a cruise insurance provider?

Consider factors such as coverage options, reputation, customer service, and pricing. It’s essential to choose a provider with a strong track record and comprehensive coverage.