- Eligibility for UK Insurance with an Australian Driving Licence

- Impact of an Australian Driving Licence on UK Insurance Premiums

- Obtaining UK Driving Licence and its Effect on Insurance

- Insurance Considerations for Temporary Residents with an Australian Driving Licence

- Insurance Implications for Permanent Residents with an Australian Driving Licence

- Epilogue

- Common Queries: Australian Driving Licence In Uk Insurance

Australian driving licence in uk insurance – Navigating the complexities of UK insurance with an Australian driving licence can be a challenge. Whether you’re a temporary resident or planning to make the UK your permanent home, understanding the rules and regulations surrounding your driving credentials is crucial. This guide delves into the intricacies of using an Australian driving licence for UK insurance purposes, providing valuable insights and practical advice.

From the initial eligibility requirements and potential impact on premiums to the process of obtaining a UK driving licence and its effect on insurance, we’ll explore the key considerations for Australian drivers seeking insurance in the UK. We’ll also address the unique circumstances of temporary and permanent residents, offering guidance on navigating the insurance landscape.

Eligibility for UK Insurance with an Australian Driving Licence

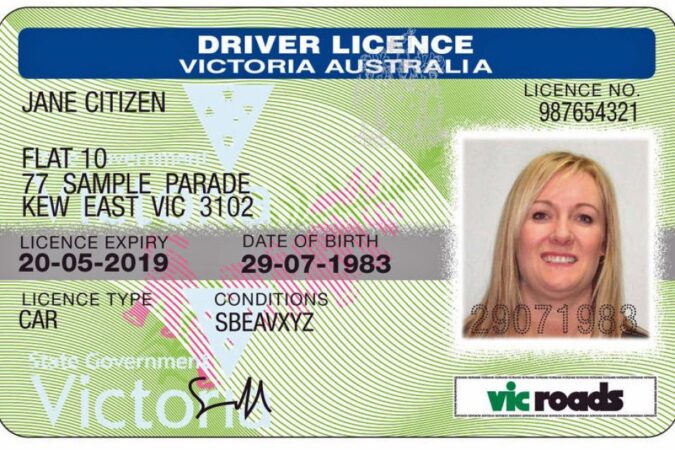

Driving in the UK with an Australian licence can be straightforward, but it’s crucial to understand the rules and regulations. The UK government recognises certain foreign driving licences, including those issued in Australia, for a limited period. This means you can drive legally in the UK using your Australian licence, but you may need to exchange it for a UK licence eventually.

Validity Period of an Australian Driving Licence for UK Insurance Purposes, Australian driving licence in uk insurance

The validity period of your Australian licence for UK insurance purposes is typically the shorter of the following:

- The remaining validity of your Australian licence

- Twelve months from the date you entered the UK

It’s important to note that this validity period applies to driving in the UK, not necessarily to obtaining insurance. Some insurance companies may have their own rules regarding the acceptance of foreign licences. Therefore, it’s essential to check with your chosen insurance provider about their specific requirements.

Requirements for Driving Licence Exchange or Conversion

If you plan to stay in the UK for an extended period, you might need to exchange your Australian licence for a UK licence. This is generally required if you’ve been living in the UK for more than 12 months. The process involves:

- Passing a UK driving test, which includes a theory test and a practical driving test.

- Providing proof of identity and residency in the UK.

- Paying a fee for the licence exchange.

It’s advisable to contact the Driver and Vehicle Licensing Agency (DVLA) for detailed information about the exchange process and requirements.

Scenarios Where an Australian Licence May Not Be Valid for UK Insurance

There are certain situations where your Australian licence may not be valid for UK insurance. These include:

- If your Australian licence has expired.

- If you’ve been disqualified from driving in Australia.

- If you’ve had your Australian licence revoked or suspended.

It’s crucial to be transparent with your insurance provider about your driving history and any relevant information related to your Australian licence. Failure to disclose this information can lead to your insurance being invalidated.

Impact of an Australian Driving Licence on UK Insurance Premiums

It is common for individuals to wonder how their Australian driving licence might affect their UK car insurance premiums. The impact can vary depending on several factors, including your driving history, claims record, and the insurer you choose.

Factors Influencing Insurance Premiums Based on Driving Licence Origin

The origin of your driving licence is one factor that insurance companies consider when calculating your premium. Insurers may have different policies and risk assessments for drivers with licences from different countries. This is because driving laws, road conditions, and driving cultures can vary significantly.

- Driving Experience: Your years of driving experience are a key factor. Insurers may view drivers with extensive experience, even if obtained in Australia, as less risky than those with limited experience.

- Claims History: If you have a history of claims in Australia, this information may be shared with UK insurers and could impact your premium. A clean driving record will generally result in lower premiums.

- Risk Perception: Insurers may have different perceptions of risk associated with drivers from different countries. For example, some insurers might perceive Australian drivers as having a higher risk profile due to factors like different road conditions or driving habits.

Impact of Driving History and Claims Records from Australia

Your driving history and claims record in Australia can have a significant impact on your UK insurance premiums. Insurers often obtain driving history information from international databases, such as the Motor Insurance Anti-Fraud and Theft Register (MIAFTR) in the UK. This information can be used to assess your risk and determine your premium.

- Positive Impact: A clean driving record in Australia can work in your favour, potentially leading to lower premiums in the UK.

- Negative Impact: If you have a history of claims or convictions in Australia, this information could lead to higher premiums or even difficulty obtaining insurance.

Obtaining a Quote with an Australian Driving Licence

When obtaining a car insurance quote in the UK with an Australian driving licence, you’ll need to provide detailed information about your driving history and claims record. This information will be used by the insurer to assess your risk and determine your premium.

- Be Transparent: It is crucial to be honest and transparent about your driving history, including any accidents, convictions, or claims. Providing false information can have serious consequences, including policy cancellation or refusal to pay claims.

- Compare Quotes: It’s recommended to compare quotes from multiple insurers to find the best deal. Different insurers have different policies and risk assessments, so you may find that one insurer offers a more competitive premium than others.

Obtaining UK Driving Licence and its Effect on Insurance

If you’re planning to stay in the UK for an extended period and intend to drive, obtaining a UK driving licence is advisable. This allows you to legally drive in the UK and may also impact your insurance premiums.

Applying for a UK Driving Licence with an Australian Licence

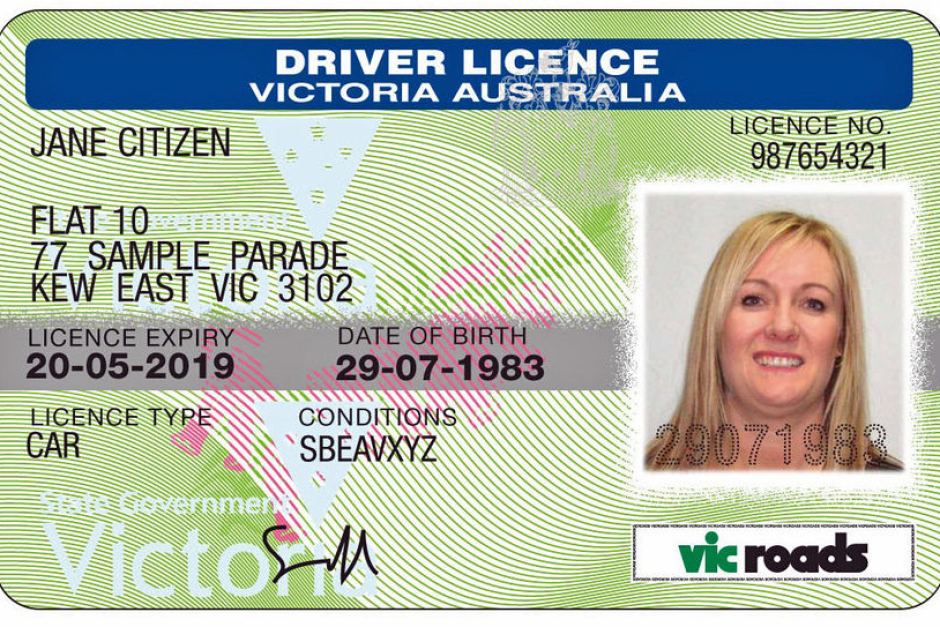

To apply for a UK driving licence with an Australian licence, you’ll need to go through the process of exchanging your existing licence.

The application process involves the following steps:

- Complete an application form: This form can be downloaded from the UK government’s website or obtained from a local Post Office. It requires details about your personal information, driving history, and medical conditions.

- Provide supporting documents: You’ll need to submit your Australian driving licence, passport, proof of address in the UK, and a completed eyesight test form. The eyesight test form can be obtained from a qualified optician or a DVLA-approved testing centre.

- Pay the application fee: The fee for exchanging a driving licence varies depending on your age and the type of licence you’re applying for. You can pay online or at a Post Office.

- Send your application: Once you have completed the application form and gathered all the necessary documents, you need to send them to the Driver and Vehicle Licensing Agency (DVLA) in Swansea, Wales.

Required Documents and Fees

Here’s a table summarizing the required documents and fees for applying for a UK driving licence with an Australian licence:

| Document | Description |

|---|---|

| Australian Driving Licence | Original licence, valid for at least one year |

| Passport | Valid passport with your current address |

| Proof of Address | Utility bill, bank statement, or other official document showing your UK address |

| Eyesight Test Form | Completed form from a qualified optician or DVLA-approved testing centre |

| Application Fee | Varies depending on age and type of licence |

Insurance Implications of a UK Driving Licence

Obtaining a UK driving licence can have a significant impact on your insurance premiums. Here’s a breakdown of the potential effects:

- Lower premiums: In most cases, holding a UK driving licence can lead to lower insurance premiums compared to having an Australian licence. This is because UK insurance companies are more familiar with the UK driving environment and may consider you a lower risk.

- Discounts for no-claims bonus: Your no-claims bonus from your Australian licence may be transferable to your UK licence, potentially earning you discounts on your insurance premiums.

- Potential for higher premiums: However, in some situations, your insurance premiums might be higher with a UK licence. This could happen if you have a poor driving record in Australia or if your Australian licence is not recognised in the UK.

Impact of Driving History and Claims Records

Your driving history and claims records from Australia can influence your UK insurance premiums. Here’s how:

- No-claims bonus: If you have a no-claims bonus from your Australian licence, you might be able to transfer it to your UK licence. This can lead to significant discounts on your insurance premiums.

- Claims history: If you have a history of claims in Australia, UK insurance companies may consider you a higher risk. This could result in higher premiums or even refusal of insurance.

- Driving offences: Any driving offences you have committed in Australia, such as speeding tickets or driving under the influence, can also affect your UK insurance premiums.

Insurance Considerations for Temporary Residents with an Australian Driving Licence

As a temporary resident in the UK, you can drive with your Australian driving licence for up to 12 months. However, you’ll need to obtain temporary insurance coverage to legally drive in the UK.

Obtaining Temporary Insurance with an Australian Driving Licence

Temporary insurance policies are designed specifically for visitors and temporary residents who don’t have a UK driving licence. These policies provide short-term coverage while you’re in the UK.

- Contact UK Insurance Providers: Reach out to reputable UK insurance companies that offer temporary car insurance policies. Many insurers cater to visitors and temporary residents.

- Provide Required Information: Be prepared to provide your Australian driving licence details, personal information, details about the vehicle you’ll be driving, and the duration of your stay in the UK.

- Compare Quotes: Obtain quotes from multiple insurers to compare prices and coverage options. Consider factors like the type of vehicle, your driving history, and the duration of your stay.

Duration of Temporary Insurance Coverage

Temporary insurance policies are typically offered for durations ranging from a few days to several months. The maximum coverage period can vary depending on the insurer.

Requirements and Limitations of Temporary Insurance Policies

Temporary insurance policies often have specific requirements and limitations.

- Age Restrictions: Some insurers may have age restrictions for temporary insurance policies. You might need to be at least 18 years old or older to qualify.

- Driving Experience: Most insurers require a minimum driving experience of at least a year or two in your home country.

- Vehicle Type: Temporary insurance policies might not cover all types of vehicles, such as commercial vehicles or motorcycles. Check with the insurer about the types of vehicles they cover.

- Coverage Limits: Temporary insurance policies may have lower coverage limits compared to standard UK insurance policies. Ensure the policy provides adequate coverage for your needs.

Comparison of Different Insurance Options for Temporary Residents

Here’s a table comparing different insurance options for temporary residents:

| Insurance Option | Duration | Coverage | Requirements |

|---|---|---|---|

| Temporary Insurance | Days to months | Third-party, third-party fire and theft, comprehensive | Australian driving licence, proof of residency, vehicle details |

| Short-term Insurance | Weeks to months | Similar to temporary insurance | UK driving licence, proof of residency, vehicle details |

| Standard UK Insurance | Year or more | Comprehensive, third-party fire and theft | UK driving licence, proof of residency, vehicle details |

Insurance Implications for Permanent Residents with an Australian Driving Licence

Becoming a permanent resident in the UK brings new opportunities, but it also involves navigating the complexities of the local driving regulations and insurance policies. Understanding the insurance implications of your Australian driving licence is crucial as you transition into permanent residency.

Transitioning from a Temporary to a Permanent Driving Licence

Upon becoming a permanent resident, you are no longer subject to the temporary driving licence rules. You can continue driving in the UK with your Australian licence for a specified period, but you will need to obtain a UK driving licence to maintain legal driving status. The process for transitioning to a permanent UK licence involves:

- Applying for a UK driving licence: You can apply for a full UK driving licence if you have held a valid Australian licence for at least one year. You will need to provide your Australian licence, proof of identity, and residency documents.

- Taking a driving test: You may be required to take a driving test in the UK, depending on your driving experience and the type of licence you are applying for. The UK driving test assesses your driving skills and knowledge of UK road rules.

- Obtaining a UK driving licence: Once you have passed the driving test (if required) and your application is approved, you will receive a UK driving licence.

Insurance Implications of Becoming a Permanent Resident

Becoming a permanent resident with an Australian driving licence can impact your insurance premiums. While you can initially continue driving with your Australian licence, insurers often offer more favourable rates to individuals with a UK driving licence. This is because:

- Driving history: UK insurers typically base premiums on your driving history. Having a UK driving licence allows them to access your driving record, including any accidents or convictions. This information helps them assess your risk profile.

- Risk assessment: UK insurers often consider drivers with foreign licences to be higher risk due to unfamiliarity with UK road rules and conditions. Obtaining a UK licence demonstrates your commitment to driving safely in the UK.

- Discounts and benefits: UK insurers often offer discounts for drivers with a UK driving licence, such as no-claims bonuses, which can significantly reduce your premiums over time.

Insurance Policies for Permanent Residents with Foreign Driving Licences

Several insurance companies offer policies specifically tailored for permanent residents with foreign driving licences. These policies typically provide:

- Coverage for driving with your foreign licence: These policies allow you to drive with your Australian licence while you are in the process of obtaining a UK licence. However, you may be subject to higher premiums compared to those with a UK licence.

- Transitional coverage: Some insurers offer transitional coverage that covers you during the period between applying for your UK licence and receiving it. This can provide peace of mind while you are waiting for your new licence.

- Competitive premiums: While premiums for permanent residents with foreign licences may be higher, insurers strive to offer competitive rates based on your individual circumstances and driving history.

Benefits and Drawbacks of Obtaining a UK Driving Licence

Obtaining a UK driving licence as a permanent resident offers several benefits, but it also comes with certain drawbacks.

Benefits:

- Lower insurance premiums: As mentioned earlier, UK insurers often offer more favourable rates to drivers with a UK driving licence, which can save you money in the long run.

- Easier access to insurance: Some insurers may be more willing to provide insurance to permanent residents with a UK licence, as it reflects a greater understanding of UK driving regulations.

- Driving record: A UK driving licence allows you to build a driving record in the UK, which can be beneficial for future insurance premiums and vehicle rentals.

Drawbacks:

- Cost of obtaining a licence: There are costs associated with obtaining a UK driving licence, including application fees, driving test fees, and potentially lessons.

- Driving test: You may need to take a driving test, which can be a challenging and time-consuming process.

- Potential loss of no-claims bonus: You may lose your no-claims bonus from your Australian licence when you obtain a UK licence. However, you can rebuild a no-claims bonus with your new UK licence.

Epilogue

Successfully navigating the UK insurance system with an Australian driving licence requires careful planning and understanding. By familiarizing yourself with the relevant rules, exploring your options, and proactively addressing any potential challenges, you can ensure a smooth transition and secure the insurance coverage you need. Whether you’re a temporary visitor or a permanent resident, this guide has equipped you with the knowledge to make informed decisions and navigate the UK insurance landscape with confidence.

Common Queries: Australian Driving Licence In Uk Insurance

Can I drive in the UK with only an Australian driving licence?

Yes, you can drive in the UK for up to 12 months with a valid Australian driving licence. However, you must be able to prove your identity and residency in the UK.

What if I’m a permanent resident in the UK?

As a permanent resident, you’re required to exchange your Australian driving licence for a UK licence within 12 months of becoming a permanent resident. You can then use this licence for UK insurance purposes.

Is it cheaper to get a UK driving licence?

The cost of obtaining a UK driving licence can vary depending on your age and the method of application. It’s recommended to compare the costs with your current insurance premiums to determine the most cost-effective option for you.

How long does it take to get a UK driving licence?

The processing time for a UK driving licence can vary depending on the application method and the volume of applications. You can check the estimated processing times on the UK government website.