- Rental Insurance in Hawaii

- Types of Rental Insurance in Hawaii: Australian Rental Insurance In Hawaii

- Factors Influencing Rental Insurance Costs in Hawaii

- Finding the Right Rental Insurance in Hawaii

- Common Claims Under Rental Insurance in Hawaii

- Tips for Preventing Rental Insurance Claims in Hawaii

- Final Summary

- FAQ Overview

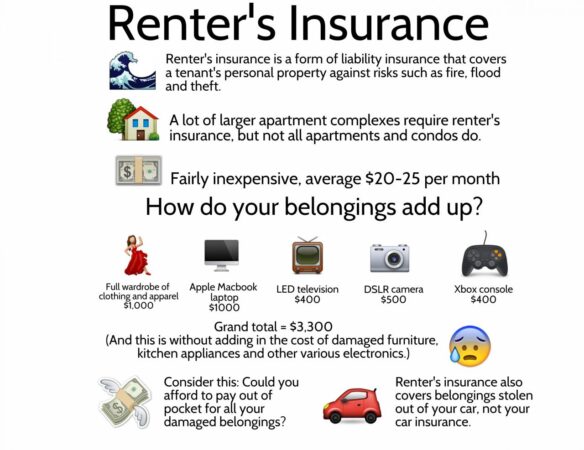

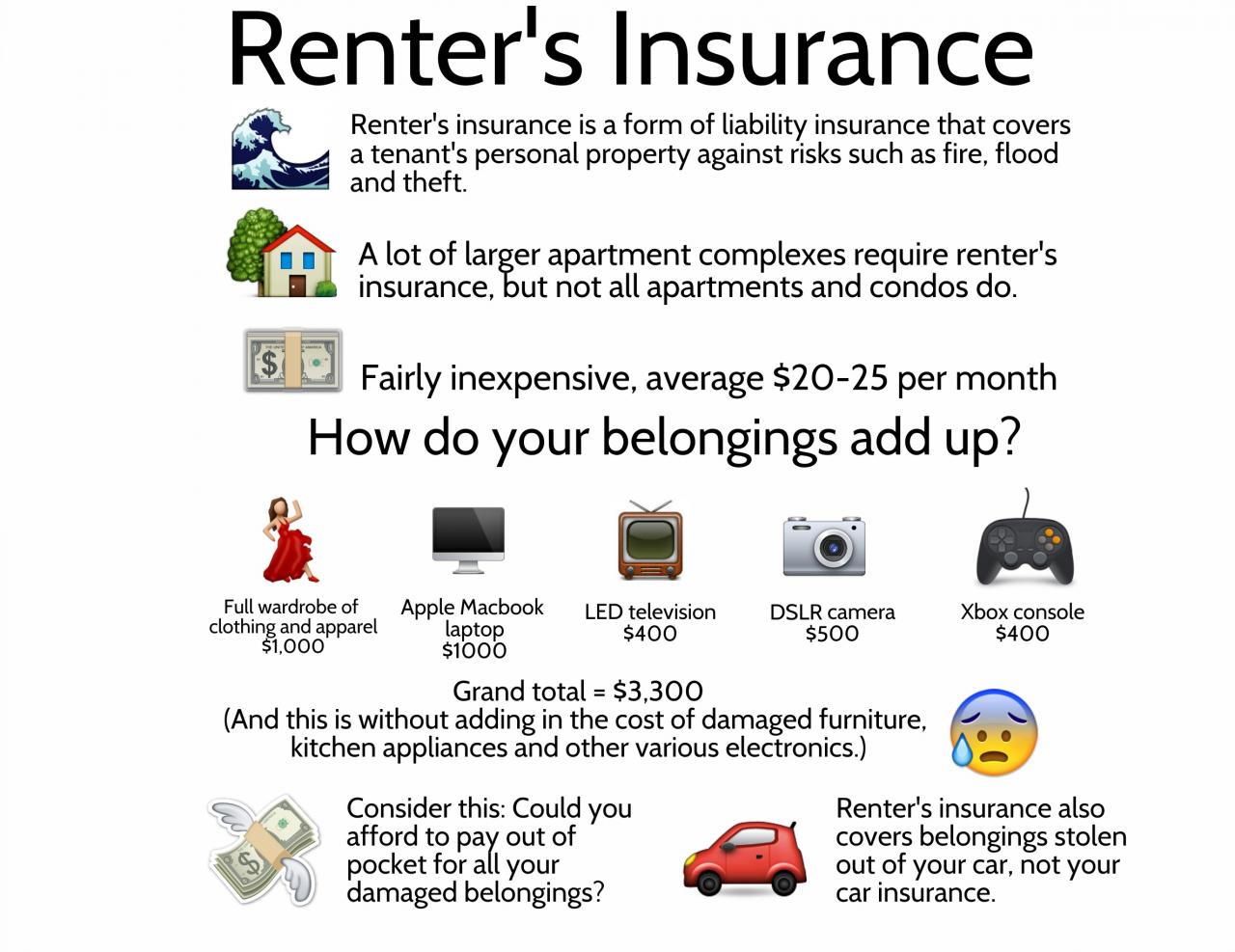

Australian rental insurance in Hawaii is a crucial aspect of protecting your belongings and financial well-being while renting in the Aloha State. The unique environment and lifestyle of Hawaii present specific risks that standard rental insurance policies might not fully cover. This guide delves into the intricacies of Australian rental insurance in Hawaii, providing insights into the types of coverage available, factors influencing costs, and tips for finding the right policy for your needs.

Understanding the nuances of Australian rental insurance in Hawaii is essential for tenants seeking comprehensive protection. From natural disasters like volcanic eruptions and tsunamis to everyday risks like theft and damage, securing the right insurance policy can provide peace of mind and financial security. This guide will equip you with the knowledge to make informed decisions about your rental insurance in Hawaii.

Rental Insurance in Hawaii

Hawaii, a paradise known for its breathtaking beauty and unique culture, also presents specific challenges for renters. The state’s high cost of living, natural disaster risks, and unique legal landscape make securing rental insurance a wise decision for tenants.

Benefits of Rental Insurance in Hawaii

Rental insurance provides a crucial safety net for tenants in Hawaii, offering protection against various risks that could disrupt their lives and finances.

- Protection Against Property Damage: Hawaii is prone to natural disasters like earthquakes, volcanic eruptions, and hurricanes. Rental insurance safeguards your belongings against damage or loss caused by these events, ensuring you can rebuild your life after a disaster.

- Liability Coverage: If you accidentally cause damage to your rental property or injure someone on the premises, rental insurance provides liability coverage, protecting you from costly legal claims and lawsuits.

- Personal Liability Coverage: Rental insurance also covers personal liability, protecting you from claims arising from accidents or injuries you cause outside your rental property, such as a car accident.

- Loss of Use Coverage: If your rental property becomes uninhabitable due to a covered event, rental insurance provides loss of use coverage, allowing you to pay for temporary housing while your home is repaired or rebuilt.

- Additional Living Expenses: This coverage helps you cover additional living expenses like meals, transportation, and temporary housing if you are displaced from your rental property due to a covered event.

Coverage Offered by Rental Insurance in Hawaii

Rental insurance policies in Hawaii typically provide comprehensive coverage for various risks, including:

- Fire and Smoke Damage: This coverage protects your belongings from damage or loss caused by fire or smoke, regardless of the cause.

- Water Damage: This coverage protects against damage caused by water leaks, floods, and burst pipes, providing financial support for repairs or replacements.

- Theft: Rental insurance provides coverage for stolen or damaged belongings, offering peace of mind and financial protection against theft.

- Vandalism: If your belongings are damaged by vandalism, rental insurance provides coverage for repairs or replacements, ensuring you are not left financially burdened.

- Natural Disasters: As mentioned earlier, Hawaii is prone to natural disasters. Rental insurance provides coverage for damage or loss caused by earthquakes, volcanic eruptions, hurricanes, and other natural events.

Types of Rental Insurance in Hawaii: Australian Rental Insurance In Hawaii

Rental insurance in Hawaii offers various coverage options to safeguard your belongings and financial well-being during your stay. Understanding the different types of rental insurance is crucial to choosing the policy that best meets your needs and budget.

Types of Rental Insurance in Hawaii

Rental insurance in Hawaii is categorized into two main types:

- Personal Property Coverage: This type of insurance primarily covers your personal belongings against damage or loss due to various perils, such as theft, fire, or natural disasters. This coverage is often included as part of a comprehensive homeowner’s or renter’s insurance policy, but it can also be purchased as a standalone policy.

- Liability Coverage: This type of insurance protects you from financial liability arising from accidents or injuries that occur on the rental property. It can cover legal fees, medical expenses, and other related costs if you are found responsible for causing damage to the property or injury to another person.

Features and Differences, Australian rental insurance in hawaii

Each type of rental insurance in Hawaii has unique features and coverage specifics, influencing the overall cost and benefits.

Personal Property Coverage

- Coverage Limits: This coverage typically has a limit on the total amount of compensation you can receive for lost or damaged property. The limit can vary depending on the insurer and the value of your belongings.

- Deductibles: Most personal property insurance policies require you to pay a deductible before the insurer covers the remaining costs. The deductible is a fixed amount you are responsible for paying out of pocket.

- Covered Perils: Personal property insurance typically covers a range of perils, including theft, fire, vandalism, natural disasters, and sometimes even accidental damage. However, certain perils may be excluded from coverage, such as wear and tear or intentional acts.

Liability Coverage

- Coverage Limits: Liability coverage also has a limit on the total amount of compensation the insurer will provide. This limit can vary depending on the insurer and the specific policy.

- Covered Events: Liability coverage typically covers events that result in bodily injury or property damage to others, such as accidents involving guests, pets, or negligence on your part.

- Legal Defense Costs: Liability insurance can cover legal defense costs if you are sued as a result of an accident or injury that occurs on the rental property.

Advantages and Disadvantages

Both types of rental insurance in Hawaii offer valuable protection, but it is essential to weigh the advantages and disadvantages before making a decision.

Personal Property Coverage

- Advantage: Provides financial protection against the loss or damage of your personal belongings, ensuring you can replace them if they are destroyed or stolen.

- Disadvantage: Coverage limits and deductibles may limit the amount of compensation you receive, and certain perils may be excluded from coverage.

Liability Coverage

- Advantage: Protects you from significant financial liability if you are found responsible for causing damage or injury to others, safeguarding your financial well-being.

- Disadvantage: The coverage limits may not be sufficient to cover all potential costs, and the policy may not cover certain types of accidents or injuries.

Factors Influencing Rental Insurance Costs in Hawaii

Rental insurance premiums in Hawaii, like anywhere else, are influenced by several factors. Understanding these factors can help tenants make informed decisions and potentially reduce their insurance costs.

Factors Determining Rental Insurance Costs

Several factors contribute to the cost of rental insurance in Hawaii. These factors are considered by insurance companies when calculating premiums:

- Location: The location of the rental property is a significant factor. Areas with a higher risk of natural disasters, such as earthquakes, tsunamis, or hurricanes, will generally have higher insurance premiums. For example, properties in coastal areas of Hawaii may face higher premiums due to the risk of hurricanes and tsunamis.

- Coverage Amount: The amount of coverage you choose will directly impact your premium. Higher coverage limits, which protect you against greater financial losses, will naturally result in higher premiums. For example, if you choose a higher coverage limit for personal belongings, you’ll pay a higher premium compared to someone with a lower coverage limit.

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible will typically result in a lower premium, while a lower deductible will lead to a higher premium. For example, if you choose a $500 deductible, you’ll pay a lower premium than someone with a $100 deductible.

- Credit Score: Similar to other types of insurance, your credit score can influence your rental insurance premium. Individuals with higher credit scores often qualify for lower premiums, while those with lower credit scores may face higher premiums. This is because a higher credit score suggests a lower risk to the insurance company.

- Property Type: The type of rental property can also affect the premium. For example, a single-family home may have a different premium compared to a multi-family apartment building, due to factors like building materials and structural differences.

- Claims History: Your past claims history, including any claims filed for previous rental properties, can impact your premium. A history of frequent claims may lead to higher premiums, while a clean claims history can often result in lower premiums.

Strategies to Reduce Rental Insurance Costs

While some factors influencing premiums are beyond your control, there are strategies tenants can implement to potentially reduce their rental insurance costs:

- Compare Quotes: Getting quotes from multiple insurance companies can help you find the best rates. This allows you to compare coverage options and premiums side-by-side.

- Increase Deductible: Consider increasing your deductible. While this means you’ll pay more out of pocket in the event of a claim, it can significantly reduce your premium. For example, increasing your deductible from $100 to $500 could result in a substantial premium reduction.

- Improve Credit Score: Maintaining a good credit score can help you qualify for lower premiums. This involves paying bills on time, keeping credit utilization low, and avoiding unnecessary credit applications.

- Bundle Policies: If you have other insurance policies, such as auto or homeowners insurance, bundling them with your rental insurance can often lead to discounts.

- Ask About Discounts: Many insurance companies offer discounts for various factors, such as being a safe driver, having security systems installed, or being a long-time customer. Be sure to ask about any potential discounts you may qualify for.

Average Rental Insurance Costs in Hawaii

| Factor | Average Monthly Premium |

|—|—|

| Location: | |

| Honolulu | $20 – $40 |

| Hilo | $15 – $30 |

| Kahului | $18 – $35 |

| Coverage Amount: | |

| $10,000 | $15 – $25 |

| $20,000 | $20 – $35 |

| $30,000 | $25 – $45 |

| Deductible: | |

| $100 | $25 – $40 |

| $500 | $20 – $30 |

| $1,000 | $15 – $25 |

| Credit Score: | |

| Excellent (750+) | $15 – $25 |

| Good (670-749) | $20 – $35 |

| Fair (580-669) | $25 – $40 |

Note: These are just estimates and actual premiums may vary depending on individual circumstances. It’s essential to contact multiple insurance companies to get personalized quotes.

Finding the Right Rental Insurance in Hawaii

Finding the right rental insurance policy in Hawaii involves careful consideration of your specific needs and a thorough comparison of available options. By following a systematic approach, you can ensure you secure a policy that provides adequate protection at a reasonable price.

Comparing Quotes from Different Insurance Providers

Comparing quotes from different insurance providers is crucial for finding the most competitive rental insurance policy in Hawaii. This involves contacting multiple insurers, providing them with your specific requirements, and requesting quotes. By comparing quotes, you can identify the best value for money and choose the policy that offers the most comprehensive coverage at the most affordable price.

- Start by contacting multiple insurance providers. It’s recommended to get quotes from at least three different insurers to ensure you have a wide range of options to compare.

- Provide each insurer with your specific needs and requirements, including the type of rental property, the length of your lease, and the amount of coverage you desire. This will ensure that you receive accurate and relevant quotes.

- Request detailed quotes that Artikel the coverage, deductibles, and premiums associated with each policy. Pay close attention to the terms and conditions of each policy, as these can vary significantly from one insurer to another.

- Compare the quotes carefully, paying attention to the coverage provided, the deductibles, and the premiums. Consider your budget and the level of protection you require when making your decision.

- Don’t hesitate to ask questions and clarify any uncertainties you may have regarding the policies. This will help you make an informed decision and ensure that you understand the terms and conditions of the chosen policy.

Understanding Policy Terms and Conditions

Before making a decision, it is essential to carefully review the terms and conditions of each rental insurance policy. This involves understanding the coverage provided, the exclusions, and the limitations of the policy. This will help you make an informed decision and avoid any surprises or unexpected costs in the future.

- Pay close attention to the coverage provided by the policy. Ensure that it covers the risks you are most concerned about, such as damage to the rental property, personal belongings, and liability.

- Review the exclusions of the policy, which are situations or events that are not covered. These may include specific types of damage, such as those caused by natural disasters or acts of war. It’s important to be aware of these exclusions to avoid any unexpected financial burdens.

- Understand the limitations of the policy, such as the maximum coverage amount and the deductible. This will help you determine if the policy provides sufficient protection for your needs.

- Read the policy carefully and don’t hesitate to ask questions if you have any doubts. It’s better to clarify any uncertainties before making a decision to avoid any surprises later.

Common Claims Under Rental Insurance in Hawaii

Rental insurance in Hawaii, like any other insurance, is designed to protect you from financial losses due to unforeseen events. Understanding the most common claims helps you assess the importance of this insurance and determine if it’s a worthwhile investment for you.

Common Rental Insurance Claims in Hawaii

Common claims made under rental insurance policies in Hawaii typically fall into a few key categories:

- Damage to the Rental Property: This is the most frequent type of claim. It covers damage caused by accidents, negligence, or even natural disasters. For example, if you accidentally break a window while playing catch with a friend, or a hurricane damages the roof of your rental property, rental insurance can help cover the costs of repair or replacement.

- Theft or Vandalism: Rental insurance can protect you against the loss of your belongings due to theft or vandalism. This can be particularly important in areas where crime rates are higher or if you’re staying in a rental property that’s not well-secured. For example, if your laptop is stolen from your rental car, rental insurance can help cover the cost of replacement.

- Personal Liability: Rental insurance often includes liability coverage, which protects you against lawsuits if someone is injured on your rental property. This can be crucial if you’re hosting a party and a guest gets injured, or if someone trips and falls on your rental property.

- Natural Disasters: Hawaii is known for its volcanic activity and hurricanes. Rental insurance can provide coverage for damages caused by these natural disasters, including flooding, earthquakes, and volcanic eruptions.

Examples of Common Scenarios Where Rental Insurance Can Be Crucial

Here are some real-life examples of how rental insurance can be crucial:

- Accidental Damage: You’re having a BBQ at your rental house and accidentally knock over a glass table, causing significant damage to the furniture. Rental insurance can help cover the cost of repairs or replacement.

- Theft: While you’re out exploring the island, someone breaks into your rental car and steals your expensive camera equipment. Rental insurance can help replace your stolen items.

- Liability: You’re hosting a party at your rental condo, and a guest trips on a loose floorboard and suffers a serious injury. Rental insurance can help cover the costs of legal defense and any settlements or judgments that might arise.

- Natural Disaster: A hurricane hits the island, causing damage to the roof of your rental house. Rental insurance can help cover the costs of repairs, allowing you to continue your vacation or return home without facing a significant financial burden.

Claims Covered by Different Rental Insurance Policies

| Type of Claim | Basic Rental Insurance | Comprehensive Rental Insurance |

|—|—|—|

| Damage to the Rental Property | Yes | Yes |

| Theft or Vandalism | Yes | Yes |

| Personal Liability | Limited | Comprehensive |

| Natural Disasters | Limited or Not Covered | Comprehensive |

Tips for Preventing Rental Insurance Claims in Hawaii

Rental insurance is a valuable investment for renters in Hawaii, but taking preventive measures to minimize the risk of claims is equally important. By proactively protecting your belongings and adopting safety practices, you can reduce the likelihood of needing to file a claim and ensure peace of mind.

Protecting Your Belongings

Taking proactive steps to safeguard your belongings is crucial in preventing rental insurance claims. Here are some practical measures you can take:

- Inventory and Document Your Possessions: Create a detailed inventory of your belongings, including descriptions, purchase dates, and receipts. This documentation will be essential in proving ownership and value if a claim is necessary. Consider taking photos or videos of your possessions as well.

- Secure Valuables: Store valuable items, such as jewelry, electronics, and important documents, in a safe deposit box or a secure location within your rental unit.

- Regular Maintenance: Regularly inspect and maintain appliances and equipment to prevent malfunctions or breakdowns. Address any issues promptly to avoid potential damage.

- Prevent Water Damage: Check for leaks in plumbing fixtures and pipes, and promptly address any signs of moisture. Consider installing water sensors to detect leaks early.

Essential Safety Tips for Renters in Hawaii

Hawaii’s unique environment presents specific risks that renters should be aware of. Here are some essential safety tips:

- Hurricane Preparedness: Hawaii is prone to hurricanes, so it’s crucial to have a hurricane preparedness plan in place. This includes securing loose objects, stocking up on emergency supplies, and knowing evacuation routes.

- Volcanic Activity: If you live near active volcanoes, be aware of potential volcanic hazards and follow official guidelines.

- Tsunami Awareness: Hawaii is at risk of tsunamis, so it’s essential to be aware of warning signs and evacuation procedures.

- Fire Safety: Ensure your rental unit has working smoke detectors and fire extinguishers. Be mindful of fire hazards, such as unattended cooking and overloaded electrical outlets.

- Earthquake Safety: While less frequent, earthquakes can occur in Hawaii. Secure heavy objects and be prepared for potential aftershocks.

Final Summary

Navigating the complexities of Australian rental insurance in Hawaii can seem daunting, but with the right information and guidance, you can find the coverage that best suits your needs and budget. By understanding the different types of insurance, factors influencing costs, and tips for preventing claims, you can make informed decisions and protect yourself from unexpected events. Remember, rental insurance in Hawaii is an investment in your peace of mind and financial security.

FAQ Overview

What is the difference between Australian rental insurance and standard rental insurance in Hawaii?

Australian rental insurance often includes specific coverage tailored to the unique risks and circumstances faced by Australian residents living in Hawaii. This may include provisions for natural disasters, cultural differences, and legal considerations related to Australian citizenship.

How do I find an Australian rental insurance provider in Hawaii?

You can contact Australian insurance companies that operate in Hawaii or search online for specialized providers catering to Australian residents. Look for companies with a strong reputation and experience handling claims in Hawaii.

What are the common exclusions in Australian rental insurance policies in Hawaii?

Exclusions can vary, but common ones include pre-existing damage, intentional acts, and certain types of natural disasters. It’s essential to carefully review the policy terms and conditions to understand what is and isn’t covered.

Is it mandatory to have Australian rental insurance in Hawaii?

While not legally mandatory, it’s highly recommended to have rental insurance as it provides essential protection for your belongings and financial security. Your landlord may also require you to have insurance as a condition of your lease agreement.