- Factors Influencing Car Insurance Costs

- Average Costs by State and Territory

- Types of Car Insurance Coverage

-

Tips for Reducing Car Insurance Costs

- Increasing Your Deductible

- Bundling Your Policies

- Maintaining a Clean Driving Record

- Comparing Quotes from Multiple Insurers

- Shop Around for Discounts

- Negotiating with Your Insurer

- Consider a No-Claims Bonus

- Review Your Coverage Regularly

- Consider a Higher Excess

- Choose the Right Car

- Install Anti-theft Devices

- Maintain Your Car

- Avoid Driving During Peak Hours

- Be a Safe Driver

- Understanding Insurance Policies and Exclusions

- Making a Claim and the Claims Process: Average Cost Of Car Insurance In Australia

- Outcome Summary

- Essential Questionnaire

Average cost of car insurance in Australia is a crucial factor for drivers, influencing their budget and financial planning. Understanding the factors that affect premiums and exploring ways to reduce costs is essential for making informed decisions.

This guide provides a comprehensive overview of car insurance in Australia, covering everything from average costs by state and territory to different coverage options and tips for saving money. We’ll delve into the key factors that determine your premiums, including your age, driving history, vehicle type, and location. You’ll also learn about the different types of coverage available, such as comprehensive, third-party property damage, and third-party fire and theft, as well as the benefits and limitations of each option.

Factors Influencing Car Insurance Costs

Car insurance premiums in Australia are determined by a complex interplay of factors, each contributing to the overall cost. Understanding these factors empowers individuals to make informed decisions and potentially reduce their insurance expenses.

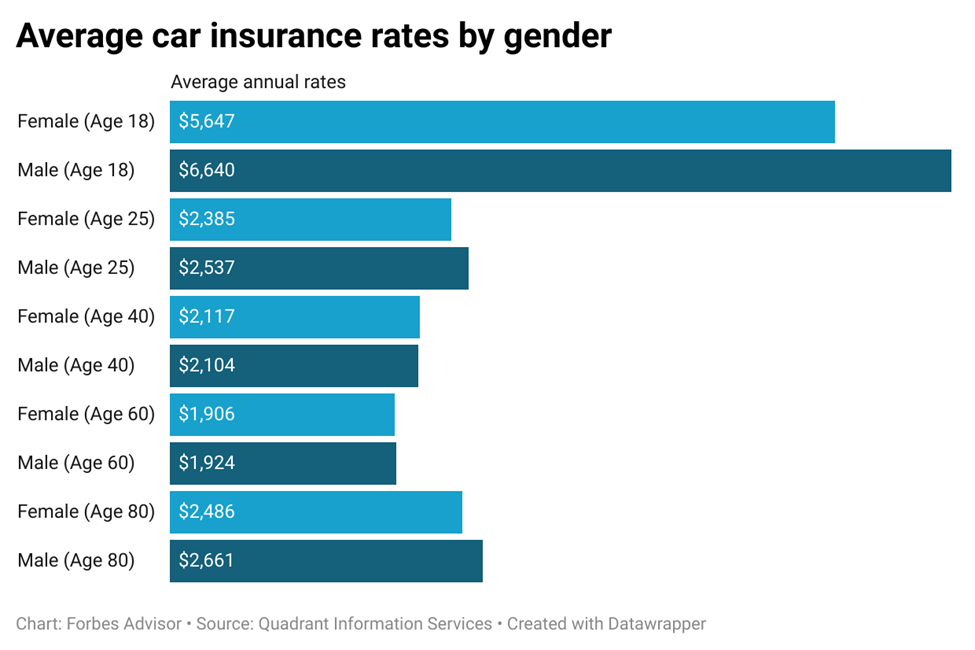

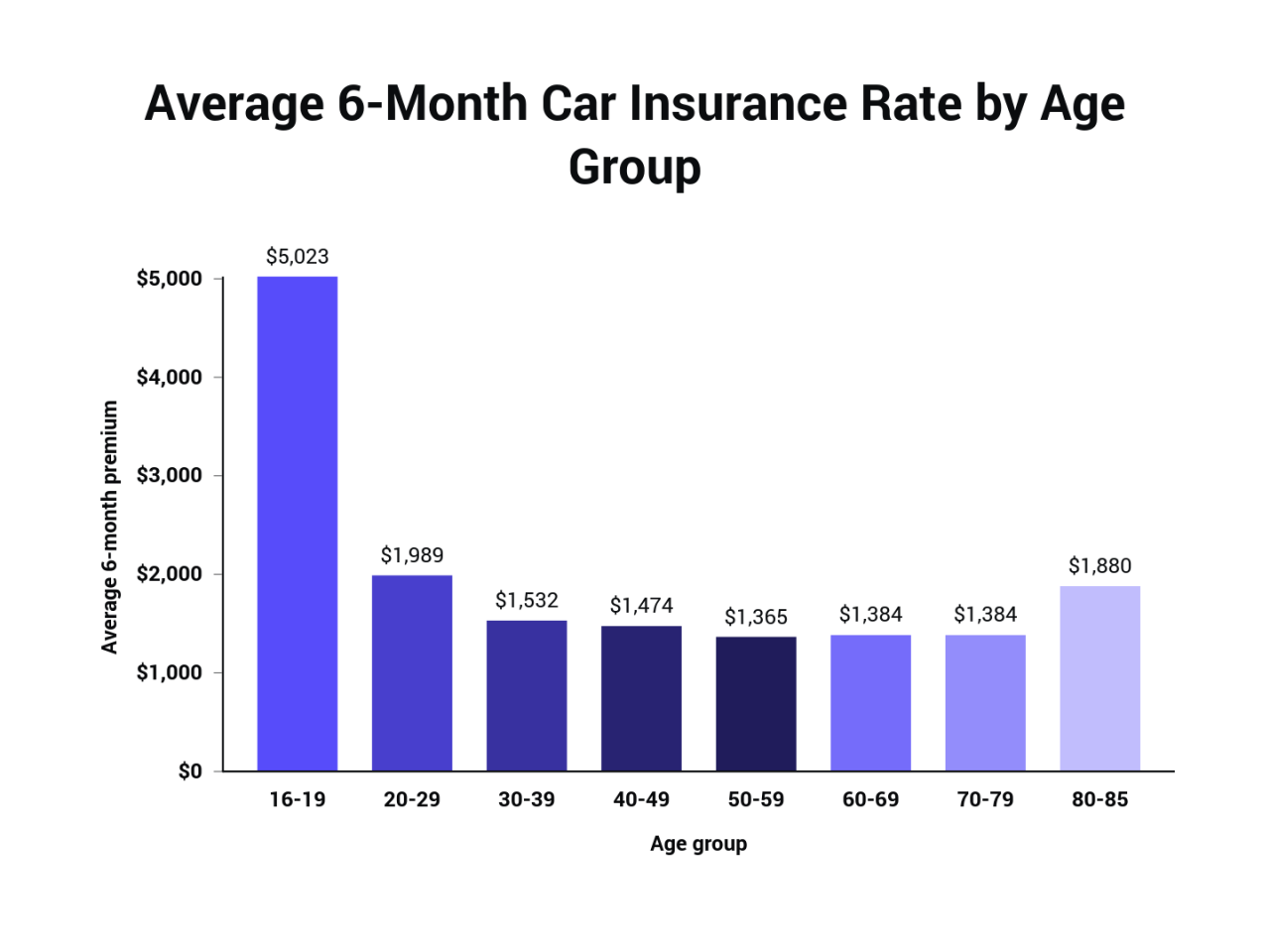

Age

Your age is a significant factor in car insurance pricing. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk profile leads to increased premiums. Conversely, older drivers often benefit from lower premiums due to their accumulated driving experience and statistically lower accident rates.

Driving History, Average cost of car insurance in australia

A clean driving record is crucial for securing affordable car insurance. A history of accidents, speeding tickets, or other traffic violations can significantly increase premiums. Insurance companies assess your driving history to evaluate your risk profile.

Vehicle Type

The type of vehicle you drive plays a substantial role in insurance costs. Luxury cars, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents. Conversely, smaller, less expensive vehicles often attract lower premiums.

Location

The location where you reside can impact your car insurance premiums. Areas with higher crime rates, denser traffic, and more frequent accidents tend to have higher insurance costs.

Coverage Levels

The level of coverage you choose significantly affects your premiums. Comprehensive coverage, which protects against theft, fire, and other non-accident events, is more expensive than basic third-party insurance. Higher coverage levels provide more comprehensive protection but come at a higher cost.

Insurance Providers

Different insurance providers have varying pricing strategies and risk assessments. It’s crucial to compare quotes from multiple providers to find the most competitive rates. Factors such as discounts, loyalty programs, and special offers can influence the final premium.

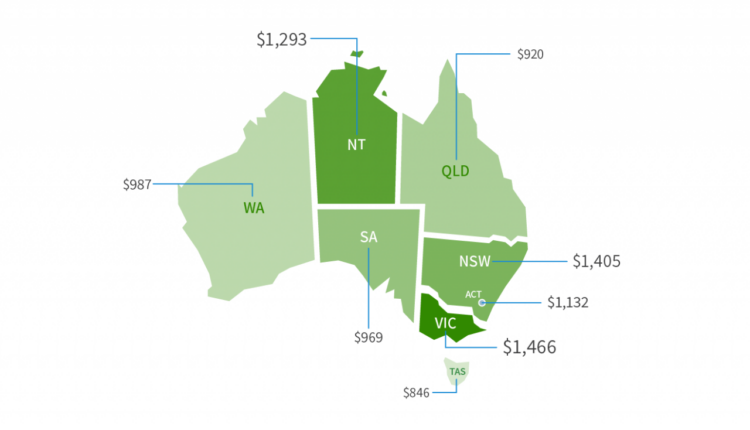

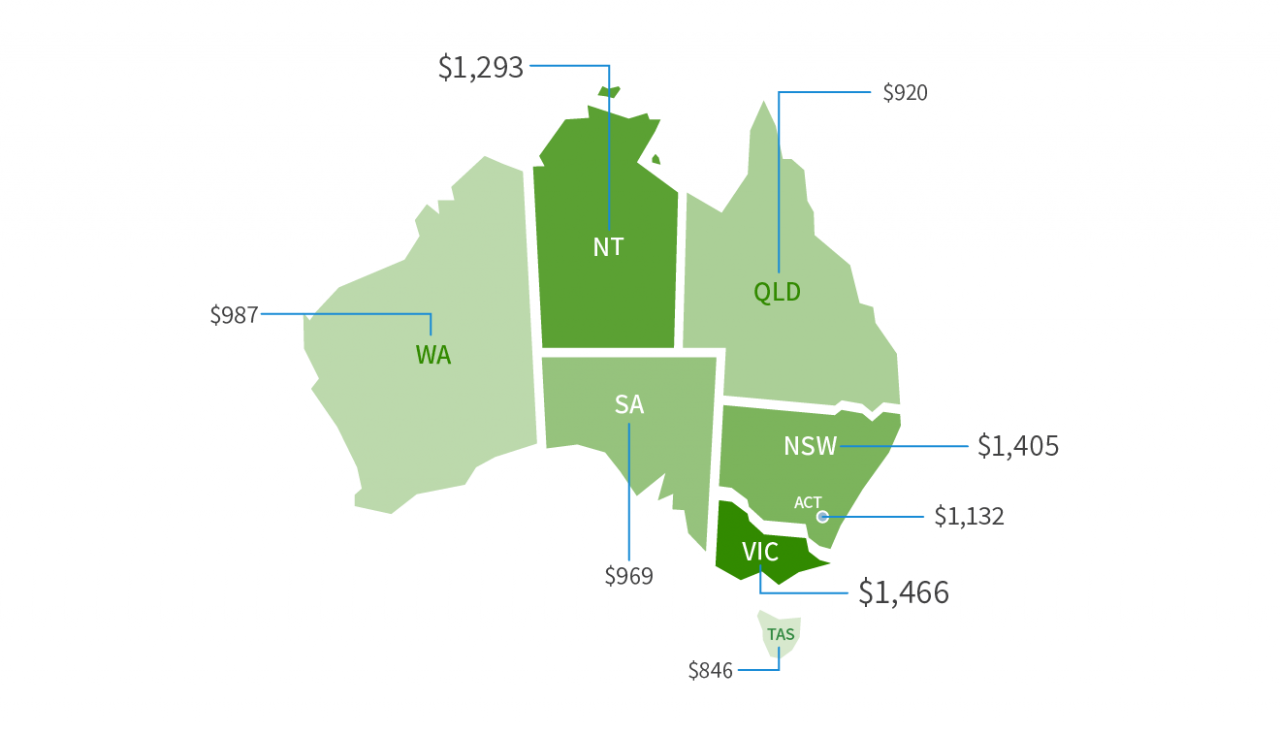

Average Costs by State and Territory

Car insurance premiums can vary significantly across different states and territories in Australia. Factors like population density, traffic congestion, and claims history influence these variations. Understanding these differences can help you find the best deal on your car insurance.

Average Car Insurance Costs by State and Territory

The table below provides a general overview of average annual car insurance premiums across different states and territories in Australia. Keep in mind that these are just estimates, and your actual premium will depend on various factors, including your individual circumstances and the insurer you choose.

| State/Territory | Average Annual Premium | Minimum Premium | Maximum Premium |

|---|---|---|---|

| New South Wales | $1,200 | $800 | $1,600 |

| Victoria | $1,100 | $750 | $1,450 |

| Queensland | $1,300 | $900 | $1,700 |

| Western Australia | $1,000 | $650 | $1,350 |

| South Australia | $1,150 | $780 | $1,520 |

| Tasmania | $950 | $600 | $1,300 |

| Australian Capital Territory | $1,250 | $850 | $1,650 |

| Northern Territory | $1,400 | $950 | $1,850 |

The average cost of car insurance in Australia is generally higher in states and territories with higher population density and traffic congestion, as these areas tend to have more accidents. For example, New South Wales and Victoria have some of the highest car insurance premiums in the country due to their large populations and busy roads. On the other hand, states like Tasmania and Western Australia have lower premiums because they have lower population densities and less traffic congestion.

Types of Car Insurance Coverage

In Australia, you have several options when it comes to car insurance, each offering different levels of protection and financial coverage. Understanding the different types of car insurance is crucial to making an informed decision that aligns with your individual needs and budget.

Comprehensive Car Insurance

Comprehensive car insurance provides the most extensive coverage for your vehicle. It protects you against a wide range of risks, including:

* Accidents: Covers damage to your car caused by a collision, regardless of who is at fault.

* Theft: Covers the cost of replacing your stolen car or reimbursing you for its value.

* Fire: Covers damage to your car caused by fire.

* Natural disasters: Covers damage caused by events like floods, hailstorms, or earthquakes.

* Vandalism: Covers damage caused by vandalism or malicious acts.

Comprehensive insurance is the most expensive type of car insurance, but it offers the highest level of protection for your vehicle.

- Benefits: Comprehensive insurance provides peace of mind, knowing you are covered against most risks. It is essential for new or expensive vehicles.

- Limitations: The high cost of comprehensive insurance can be a significant factor for budget-conscious drivers. There may be exclusions for certain events, such as wear and tear or damage caused by negligence.

Third-Party Property Damage

Third-party property damage insurance covers damage to another person’s property if you are at fault in an accident. This type of insurance is mandatory in all Australian states and territories, except for Western Australia.

- Benefits: This insurance protects you from financial liability for damage caused to another person’s vehicle or property.

- Limitations: Third-party property damage insurance does not cover damage to your own vehicle. It also does not cover injuries to yourself or other people.

Third-Party Fire and Theft

This type of insurance provides coverage for damage or loss to your car due to fire or theft, but only if you are not at fault in an accident. It also covers damage to other people’s property if you are at fault in an accident.

- Benefits: This insurance offers a balance between cost and coverage, providing protection against fire and theft without the comprehensive coverage of comprehensive insurance.

- Limitations: It does not cover damage to your vehicle caused by accidents. It also does not cover injuries to yourself or other people.

CTP (Compulsory Third Party) Insurance

CTP insurance is mandatory in all Australian states and territories. It covers personal injury claims arising from a motor vehicle accident, regardless of who is at fault.

- Benefits: CTP insurance provides essential protection for yourself and others in the event of an accident. It covers medical expenses, lost wages, and other costs associated with injuries.

- Limitations: CTP insurance does not cover damage to your vehicle or other people’s property. It is separate from other types of car insurance.

Tips for Reducing Car Insurance Costs

Car insurance is an essential expense for most Australians, but it can also be a significant drain on your budget. Fortunately, there are several strategies you can implement to lower your premiums and save money.

Increasing Your Deductible

Increasing your deductible means you agree to pay a higher amount out of pocket if you make a claim. In return, your insurer will offer you a lower premium. This strategy is particularly effective for drivers with a clean driving record who are confident they won’t be making claims frequently.

Bundling Your Policies

Many insurers offer discounts when you bundle multiple policies, such as car insurance and home insurance, together. This can be a significant cost-saving measure, as insurers often reward customers for their loyalty and commitment.

Maintaining a Clean Driving Record

A clean driving record is crucial for obtaining lower car insurance premiums. Avoid speeding tickets, accidents, and other traffic violations, as these incidents can significantly increase your insurance costs.

Comparing Quotes from Multiple Insurers

Don’t settle for the first quote you receive. Compare quotes from multiple insurers to find the best deal. Online comparison websites can help you streamline this process.

Shop Around for Discounts

Many insurers offer discounts for various factors, including:

- Good student discounts: If you are a student with good grades, you may be eligible for a discount.

- Safe driver discounts: If you have completed a defensive driving course, you may qualify for a discount.

- Loyalty discounts: Insurers may offer discounts for long-term customers.

- Vehicle safety features discounts: Cars with anti-theft devices, airbags, and other safety features often qualify for discounts.

Negotiating with Your Insurer

Don’t be afraid to negotiate with your insurer. Explain your situation and see if they are willing to offer a lower premium.

Consider a No-Claims Bonus

A no-claims bonus is a reward for drivers who have not made any claims in a certain period. This bonus can significantly reduce your premium.

Review Your Coverage Regularly

Your insurance needs may change over time. Review your coverage periodically to ensure you have the right level of protection and that you are not paying for unnecessary coverage.

Consider a Higher Excess

A higher excess means you pay more out of pocket if you make a claim. In exchange, your insurer will likely offer you a lower premium.

Choose the Right Car

Certain types of cars are considered riskier to insure than others. If you are looking to reduce your insurance costs, consider purchasing a car that is less likely to be stolen or involved in an accident.

Install Anti-theft Devices

Installing anti-theft devices in your car can reduce your insurance premiums. These devices make your car less appealing to thieves, and insurers often reward drivers for taking proactive measures to protect their vehicles.

Maintain Your Car

Regular maintenance, including servicing and repairs, can help prevent accidents and reduce your insurance costs. A well-maintained car is less likely to break down or malfunction, which can lead to accidents.

Avoid Driving During Peak Hours

Traffic congestion can increase the risk of accidents. If possible, avoid driving during peak hours to minimize your exposure to accidents.

Be a Safe Driver

Practicing safe driving habits, such as avoiding distractions, following the speed limit, and driving defensively, can help reduce your risk of accidents and lower your insurance premiums.

Understanding Insurance Policies and Exclusions

Your car insurance policy is a legally binding contract between you and your insurer. It Artikels the terms and conditions of your coverage, including what is covered and what is not. Understanding your policy’s exclusions and limitations is crucial to avoid unexpected costs and ensure you have adequate protection in case of an accident or other covered event.

Common Terms and Conditions

It’s essential to understand the common terms and conditions used in car insurance policies. These terms define the scope of your coverage and help you understand what your insurer will and will not cover.

- Excess: This is the amount you pay out of pocket before your insurer covers the rest of the claim. It is usually a fixed amount specified in your policy.

- Premium: This is the amount you pay your insurer for your coverage. It is usually calculated based on factors such as your age, driving history, car type, and location.

- Sum Insured: This is the maximum amount your insurer will pay for a claim, usually determined by the value of your car.

- Policy Period: This is the duration of your insurance coverage, usually a year.

- No Claim Bonus (NCB): This is a discount offered by your insurer for not making any claims during a specific period.

Understanding Policy Exclusions

Insurance policies have exclusions, which are specific events or situations that are not covered by your policy. These exclusions can be found in the policy document, usually in a section called “Exclusions” or “What We Don’t Cover.” It’s crucial to carefully read this section to understand what is not covered by your policy.

- Driving Under the Influence: Accidents caused by driving under the influence of alcohol or drugs are usually not covered by car insurance policies.

- Unlicensed Driving: If you are driving without a valid driver’s license, your insurer may not cover any damages or injuries caused by an accident.

- Modifications: Modifications to your car, such as performance upgrades, may not be covered by your insurance policy unless specifically declared and approved by your insurer.

- Wear and Tear: Your insurance policy generally does not cover damage due to wear and tear, such as tire punctures or brake pad wear.

- Acts of God: While some insurers may cover damage caused by natural disasters like earthquakes or floods, it’s important to check your policy for specific exclusions related to such events.

Scenarios Where Coverage Might Not Apply

It’s important to understand the potential scenarios where your coverage might not apply. This helps you avoid unexpected costs and ensures you have adequate protection.

- Driving a car not listed in your policy: If you are driving a car that is not listed in your policy, your insurer may not cover any damages or injuries caused by an accident.

- Driving without consent: If you are driving a car without the owner’s consent, your insurer may not cover any damages or injuries caused by an accident.

- Using your car for business purposes: If you use your car for business purposes, your insurer may require you to have a separate business insurance policy.

- Driving in a restricted area: Some insurance policies may exclude coverage for driving in certain areas, such as war zones or areas with high crime rates.

- Driving without the required safety features: Some insurance policies may exclude coverage for driving without the required safety features, such as seat belts or airbags.

Making a Claim and the Claims Process: Average Cost Of Car Insurance In Australia

In the unfortunate event of an accident or theft involving your insured vehicle, understanding the claims process is crucial. Navigating this process efficiently and effectively can help you get the compensation you deserve.

Steps Involved in Filing a Car Insurance Claim

Knowing the steps involved in filing a claim can help you navigate the process smoothly.

- Report the Incident: Immediately contact your insurer to report the accident or theft. This is usually done via phone or online through their website. Provide details such as the date, time, location, and nature of the incident.

- Gather Evidence: Collect as much evidence as possible to support your claim. This may include photographs of the damage, police reports (if applicable), witness statements, and any other relevant documentation.

- File the Claim: Your insurer will provide you with a claim form. Fill it out accurately and completely, providing all the necessary details about the incident.

- Assessment and Investigation: The insurer will assign an assessor to evaluate the damage to your vehicle and determine the extent of the claim. This may involve an inspection of the vehicle and gathering additional information.

- Claim Settlement: Once the assessment is complete, the insurer will determine the amount of compensation you are entitled to. They will then provide you with a settlement offer, which may include repair costs, replacement costs, or other expenses.

Documentation Required

Providing the necessary documentation can help expedite the claims process.

- Policy Details: Your insurance policy number and details.

- Vehicle Information: Make, model, year, and registration details of the vehicle.

- Driver’s License: Your driver’s license details.

- Police Report: If the incident involved an accident or theft, a copy of the police report.

- Photographs: Clear photographs of the damage to your vehicle, the accident scene, and any other relevant details.

- Witness Statements: If there were witnesses to the incident, obtain their contact information and statements.

- Repair Quotes: If you have obtained quotes from repair shops, provide copies of these quotes.

Reporting an Accident or Theft

Reporting an accident or theft to your insurer promptly is crucial.

- Contact Your Insurer: Call your insurer’s 24/7 claims line or report the incident online. Provide the necessary details, including the date, time, location, and nature of the incident.

- Police Report: If the incident involved an accident, contact the police immediately. They will file a report, which you will need to provide to your insurer. If the incident involved theft, report it to the police and obtain a police report.

- Gather Evidence: Take photographs of the accident scene or the stolen vehicle. If there are any witnesses, obtain their contact information and statements.

Role of Insurance Assessors

Insurance assessors play a vital role in the claims process.

- Assessment: Assessors examine the damage to your vehicle and determine the extent of the claim. They will assess the cost of repairs or replacement, taking into account the age, condition, and market value of your vehicle.

- Negotiation: Assessors may negotiate with repair shops or other service providers to obtain the best possible rates for repairs or replacement.

- Dispute Resolution: If you disagree with the assessor’s assessment, you have the right to appeal their decision. Your insurer will have a dispute resolution process in place to address such disagreements.

Disputes During the Claims Process

Disputes can arise during the claims process, but there are avenues for resolution.

- Review the Assessment: Carefully review the assessor’s report and any supporting documentation. If you disagree with their findings, contact your insurer and explain your reasons.

- Internal Dispute Resolution: Your insurer will have an internal dispute resolution process. You can escalate your complaint to a higher level within the insurer’s organization.

- External Dispute Resolution: If you are unable to resolve the dispute internally, you can contact an external dispute resolution body, such as the Australian Financial Complaints Authority (AFCA).

Outcome Summary

Navigating the world of car insurance can be daunting, but with the right knowledge and strategies, you can find the best coverage at an affordable price. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and taking steps to reduce your risk, you can ensure you’re getting the protection you need without breaking the bank. Remember to review your policy regularly and adjust it as needed to reflect changes in your circumstances. Armed with this information, you can confidently navigate the Australian car insurance landscape and make informed decisions that protect your financial well-being.

Essential Questionnaire

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there are significant changes in your circumstances, such as a change in your driving history, vehicle, or address.

What happens if I’m in an accident and don’t have car insurance?

Driving without car insurance in Australia is illegal and can result in hefty fines and penalties. In the event of an accident, you could be held personally liable for any damages or injuries caused, even if you were not at fault.

Can I get a discount on my car insurance if I have a good driving record?

Yes, many insurers offer discounts for drivers with a clean driving record, often referred to as “no claims bonuses.” The amount of the discount can vary depending on the insurer and your specific driving history.