Average price of health insurance in australia – Navigating the Australian healthcare system can be complex, especially when it comes to understanding the average price of health insurance. This guide delves into the intricate world of private health insurance, exploring the factors that influence premiums, the average costs across different policies, and the latest trends in the industry. Understanding these aspects is crucial for individuals seeking to make informed decisions about their health coverage.

From the fundamental differences between Medicare and private health insurance to the impact of age, health status, and location on premiums, this comprehensive analysis provides a clear picture of the Australian health insurance landscape. We will also discuss strategies for saving on premiums, including comparing quotes and choosing the right policy options.

Understanding Australian Health Insurance

Australia has a unique healthcare system that combines universal public healthcare with private health insurance options. Understanding the intricacies of this system is crucial for navigating healthcare choices and managing costs.

Medicare and Private Health Insurance

Medicare is Australia’s universal public healthcare system, providing essential medical services to all Australian citizens and permanent residents. However, Medicare coverage is limited, and it doesn’t cover all healthcare expenses. This is where private health insurance comes in, offering supplementary coverage for services not covered by Medicare.

Types of Private Health Insurance

Private health insurance in Australia is categorized into different types based on the services covered. The most common types include:

- Hospital cover: This covers the cost of hospital accommodation, surgeries, and other hospital-related services. It can be further categorized into different levels of coverage, from basic to comprehensive.

- Extras cover: This covers a range of services not covered by Medicare, such as dental, optical, physiotherapy, and alternative therapies. Extras cover is typically offered in addition to hospital cover.

- Combined cover: This combines both hospital and extras cover, providing comprehensive health insurance coverage.

Factors Influencing Private Health Insurance Costs

Several factors influence the cost of private health insurance in Australia. These include:

- Age: Younger individuals generally pay lower premiums than older individuals.

- Health status: Individuals with pre-existing medical conditions may face higher premiums.

- Level of cover: The level of cover chosen, including hospital and extras cover, impacts the premium cost.

- Location: Premiums may vary based on the location of residence.

- Lifestyle factors: Factors such as smoking habits and occupation can also influence premium costs.

Benefits of Private Health Insurance

Private health insurance offers several benefits, including:

- Access to wider range of services: Private health insurance covers services not covered by Medicare, such as private hospital rooms, cosmetic surgery, and certain types of dental and optical care.

- Shorter waiting times: Private health insurance can provide access to faster treatment and shorter waiting times for elective surgeries.

- Choice of healthcare providers: Private health insurance allows individuals to choose their healthcare providers, including specialists and private hospitals.

- Tax benefits: Individuals who hold private health insurance may be eligible for tax rebates.

Factors Influencing Health Insurance Costs: Average Price Of Health Insurance In Australia

The cost of health insurance in Australia is influenced by a variety of factors, including personal circumstances, government policies, and the overall health insurance market. Understanding these factors can help individuals make informed decisions about their health insurance needs and find the most suitable and affordable plan.

Age

Age is a significant factor in determining health insurance premiums. As people age, they are more likely to require medical attention and therefore have higher healthcare costs. This increased risk is reflected in higher premiums for older individuals.

Health Status

Individuals with pre-existing health conditions or a history of medical issues may face higher premiums. Health insurers assess risk profiles to determine the likelihood of claims and adjust premiums accordingly.

Location

The location where an individual resides can also influence health insurance costs. Areas with higher population density or a greater concentration of private hospitals may have higher premiums due to increased demand for healthcare services.

Government Subsidies and Rebates

The Australian government provides subsidies and rebates to help individuals afford health insurance. These subsidies are based on income and age, and they can significantly reduce the cost of premiums.

The government’s Private Health Insurance Rebate is a significant contribution to the cost of health insurance, providing a percentage of the premium back to the policyholder.

The government’s role in subsidizing health insurance aims to encourage Australians to take out private health insurance, thereby reducing the burden on the public healthcare system.

Average Health Insurance Premiums

Understanding the average cost of private health insurance in Australia is crucial for individuals and families making informed decisions about their healthcare coverage. Premiums can vary significantly depending on factors such as age, location, coverage level, and health status. This section provides an overview of average premiums for different types of health insurance policies and explores how costs vary across different demographic groups.

Average Premiums for Different Policy Types

The average cost of private health insurance in Australia varies depending on the type of policy chosen. Here’s a breakdown of average premiums for different policy types, based on data from the Australian Prudential Regulation Authority (APRA):

| Policy Type | Average Annual Premium |

|---|---|

| Hospital Only | $1,200 |

| Hospital and Extras | $2,500 |

| Top Hospital and Extras | $4,000 |

It’s important to note that these are just average premiums and actual costs can vary significantly based on individual circumstances.

Average Costs Across Different Age Groups

Age is a major factor influencing health insurance premiums. Younger individuals generally pay lower premiums than older individuals due to their lower risk of needing healthcare services. Here’s a comparison of average premiums across different age groups:

| Age Group | Average Annual Premium |

|---|---|

| 18-29 | $1,500 |

| 30-44 | $2,000 |

| 45-59 | $3,000 |

| 60+ | $4,500 |

Average Costs Across Different Geographic Regions

The cost of health insurance can also vary depending on the geographic location. Premiums tend to be higher in metropolitan areas due to higher healthcare costs and greater demand for services. Here’s a comparison of average premiums across different regions:

| Region | Average Annual Premium |

|---|---|

| Sydney | $2,800 |

| Melbourne | $2,600 |

| Brisbane | $2,200 |

| Perth | $2,000 |

Average Costs Across Different Coverage Levels

The level of coverage chosen also significantly impacts the cost of health insurance. Policies with higher coverage levels, such as those including extensive extras benefits, typically come with higher premiums. Here’s a comparison of average premiums across different coverage levels:

| Coverage Level | Average Annual Premium |

|---|---|

| Basic Hospital | $1,000 |

| Comprehensive Hospital and Extras | $3,500 |

| Top Hospital and Extras with Extensive Benefits | $5,000 |

Trends in Health Insurance Costs

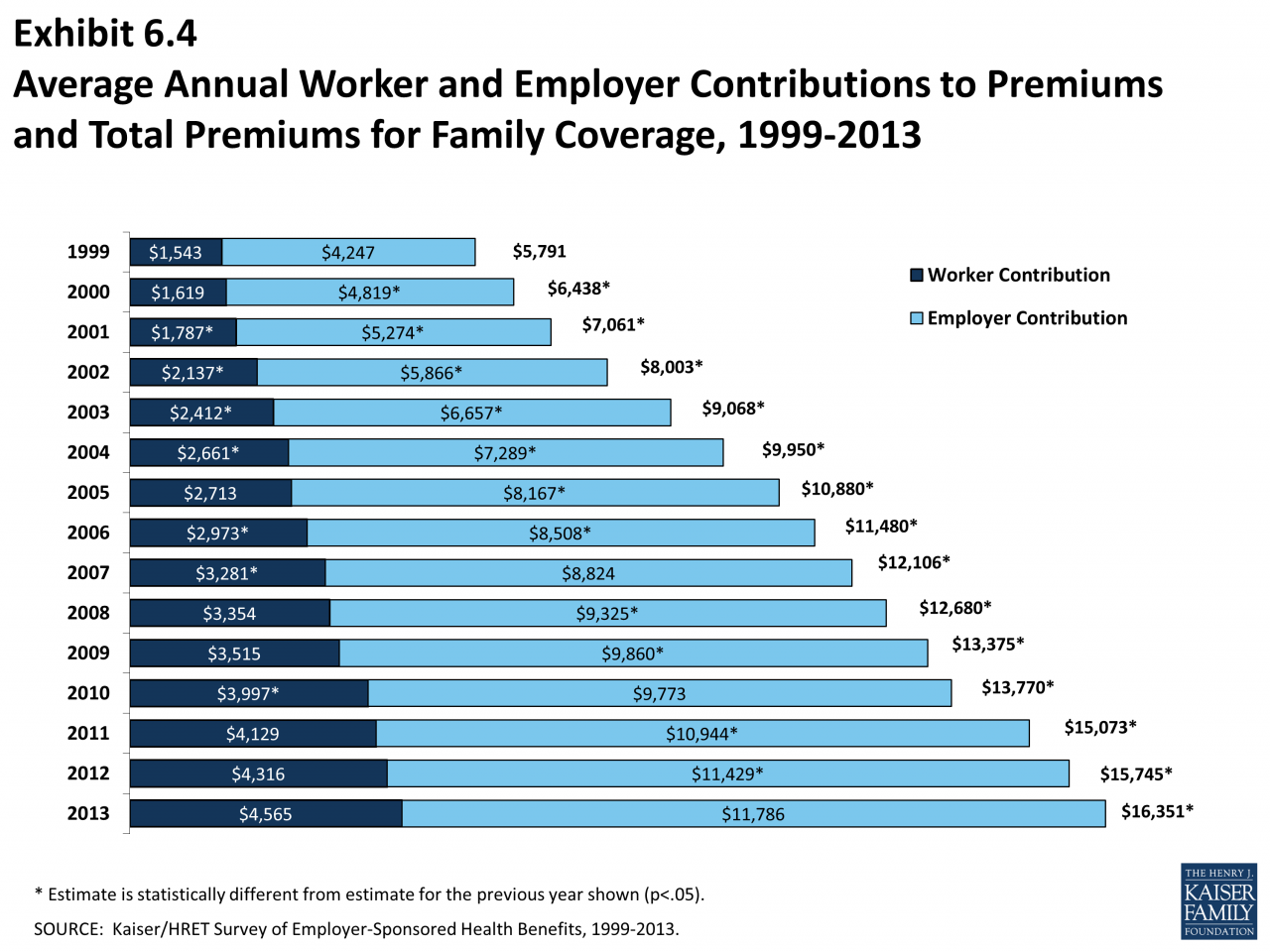

Understanding the historical trends in health insurance premiums provides valuable insights into the factors driving changes in costs and potential future projections.

Historical Trends in Health Insurance Premiums, Average price of health insurance in australia

Over the past decade, health insurance premiums in Australia have experienced a steady upward trend. This increase has been driven by a complex interplay of factors, including rising healthcare costs, technological advancements, and changes in consumer behavior.

Factors Contributing to Rising Health Insurance Costs

Several factors contribute to the increasing cost of health insurance in Australia:

- Rising Healthcare Costs: The cost of healthcare services, including hospital stays, medical procedures, and pharmaceuticals, has been steadily increasing. This rise is attributed to factors such as technological advancements, aging population, and increased demand for specialized treatments.

- Increased Utilization of Services: As Australians age, they tend to require more healthcare services, leading to higher overall utilization rates. This increased demand puts pressure on health insurance providers to cover a greater volume of claims.

- Technological Advancements: The adoption of new medical technologies, such as advanced imaging equipment and minimally invasive surgical procedures, often comes with higher costs. While these technologies offer benefits, they also contribute to rising healthcare expenses.

- Government Policies: Government policies, such as the Medicare Benefits Schedule (MBS) and the Pharmaceutical Benefits Scheme (PBS), can influence the cost of health insurance. Changes to these schemes, including increases in rebates or the introduction of new medications, can affect premiums.

- Administrative Costs: Health insurance providers incur costs associated with administration, marketing, and claims processing. These costs are passed on to policyholders in the form of higher premiums.

Potential Future Trends and Projections

Predicting future trends in health insurance costs is challenging, but several factors suggest continued upward pressure:

- Aging Population: As Australia’s population ages, the demand for healthcare services is expected to increase, further driving up costs.

- Technological Advancements: Advancements in medical technology will continue to offer benefits but also come with higher costs. For example, the development of personalized medicine and gene therapy has the potential to significantly impact healthcare expenses.

- Chronic Disease Management: The prevalence of chronic diseases, such as diabetes and heart disease, is on the rise. Managing these conditions often requires ongoing healthcare services, contributing to higher insurance costs.

- Inflation: General inflation can affect the cost of healthcare services and insurance premiums. As prices rise, health insurance providers may need to adjust premiums to maintain profitability.

Tips for Saving on Health Insurance

Navigating the world of health insurance in Australia can be a bit overwhelming, especially when it comes to finding ways to save on your premiums. Fortunately, there are several strategies you can employ to minimize your costs without compromising on essential coverage.

Comparing Quotes

It’s crucial to compare quotes from different insurers before settling on a policy. This allows you to identify the most competitive rates and features that best suit your individual needs. You can use online comparison websites or contact insurers directly to request quotes.

Choosing Policy Options

Understanding the various policy options and coverage levels offered by insurers is essential for finding a balance between affordability and comprehensive coverage. Consider the following:

- Excess: A higher excess generally translates to lower premiums. This is the amount you pay upfront before your insurance kicks in. It’s a good strategy if you’re generally healthy and have a good financial buffer.

- Coverage Levels: Opting for a lower level of coverage, such as a basic hospital policy, can be more cost-effective if you’re comfortable with a limited scope of benefits.

- Waiting Periods: Some policies have waiting periods for certain procedures or treatments. While this may seem like a drawback, it can also lead to lower premiums.

Reviewing Your Policy Regularly

Your health insurance needs may change over time. It’s essential to review your policy annually to ensure it still aligns with your current circumstances. You may find that your premiums can be reduced by adjusting your coverage or choosing a different insurer.

Epilogue

Ultimately, choosing the right health insurance policy in Australia requires careful consideration of individual needs and financial circumstances. By understanding the factors that influence premiums, comparing quotes from different insurers, and exploring the available policy options, individuals can find a plan that provides adequate coverage at a reasonable price. As the health insurance landscape continues to evolve, staying informed about the latest trends and regulations is essential for making informed decisions about your health and well-being.

Essential FAQs

What is the difference between Medicare and private health insurance?

Medicare is Australia’s universal public health insurance system, providing essential healthcare services. Private health insurance offers additional coverage for services not covered by Medicare, such as private hospital rooms, dental, and optical care.

How can I compare health insurance quotes?

Many online comparison websites and insurance brokers allow you to compare quotes from different insurers. This helps you find the most competitive premiums for the coverage you need.

Are there government subsidies available for health insurance?

Yes, the Australian government offers subsidies and rebates to help reduce the cost of private health insurance for eligible individuals and families.

What are the benefits of choosing a higher level of health insurance coverage?

Higher coverage levels often provide access to wider choices of hospitals, doctors, and treatments, as well as additional benefits like extras cover for dental and optical care.