Navigating the Australian healthcare system can be overwhelming, especially when it comes to finding affordable health insurance. “Best and cheap health insurance in Australia” might sound like an oxymoron, but with careful planning and research, you can find a plan that fits your budget and provides the coverage you need. This guide will explore the factors influencing health insurance costs, highlight key providers, and provide tips for making informed decisions.

Understanding the Australian healthcare system is crucial for making informed decisions about your health insurance. The public system, Medicare, provides basic healthcare services, but private health insurance offers additional benefits like shorter waiting times for elective surgery and access to private hospitals. Private health insurance comes in various forms, from hospital-only coverage to comprehensive plans covering a wide range of services. This variety allows you to tailor your coverage to your individual needs and budget.

Understanding Australian Health Insurance

Australia has a universal healthcare system, meaning everyone has access to essential medical services regardless of their income or employment status. The Australian healthcare system is a complex and multifaceted system that combines both public and private healthcare components.

The Australian Healthcare System, Best and cheap health insurance in australia

The Australian healthcare system is comprised of two main components: Medicare and private health insurance.

- Medicare is a universal public health insurance scheme that provides access to essential healthcare services, including general practitioner consultations, hospital admissions, and some specialist services.

- Private health insurance is a supplementary option that provides access to a wider range of healthcare services, such as private hospital rooms, faster access to specialists, and some treatments not covered by Medicare.

The Role of Private Health Insurance

Private health insurance plays a significant role in the Australian healthcare system by providing additional coverage beyond what is offered by Medicare. It allows individuals to choose their preferred healthcare provider, access a wider range of services, and enjoy faster waiting times for treatment.

Types of Health Insurance

Private health insurance in Australia is broadly categorized into two main types: hospital cover and extras cover.

- Hospital cover provides financial assistance for hospital stays, including surgery, accommodation, and other related expenses.

- Extras cover provides reimbursement for a range of healthcare services, such as dental, optical, physiotherapy, and alternative therapies.

Factors Influencing Cost and Coverage

The cost of health insurance in Australia is influenced by a variety of factors, including the level of coverage you choose, your age, health status, and lifestyle. Understanding these factors can help you make informed decisions about your health insurance policy.

Factors Affecting Premium Costs

The premium you pay for health insurance is determined by a number of factors. These factors can be categorized into two main groups:

- Policy-related factors: These factors are directly related to the features of your policy, such as the level of cover you choose, the number of extras you include, and the insurer you select.

- Personal factors: These factors are related to your individual circumstances, such as your age, health status, and lifestyle.

Level of Coverage

Health insurance policies in Australia are typically categorized into four levels of cover:

- Basic: This level of cover provides the most limited coverage, typically only covering essential hospital procedures and services. It is the most affordable option but may not cover all your healthcare needs.

- Bronze: This level of cover provides more comprehensive coverage than basic, including a wider range of hospital procedures and services. It is a good option for people who want a balance between affordability and coverage.

- Silver: This level of cover offers the most comprehensive coverage, including a wide range of hospital procedures and services, as well as some extras like dental and optical care. It is the most expensive option but provides the most peace of mind.

- Gold: This level of cover is similar to Silver but often includes a wider range of extras, such as physiotherapy and alternative therapies.

Impact of Age, Health Status, and Lifestyle

Your age, health status, and lifestyle can all influence the cost of your health insurance premiums.

- Age: Generally, younger people pay lower premiums than older people, as they are statistically less likely to require healthcare services. However, some insurers offer discounts for young people who are in good health and have a healthy lifestyle.

- Health Status: People with pre-existing medical conditions may be charged higher premiums, as they are more likely to require healthcare services. However, some insurers offer special programs for people with pre-existing conditions, such as chronic diseases, that can help them access affordable health insurance.

- Lifestyle: People who engage in risky behaviors, such as smoking or excessive alcohol consumption, may be charged higher premiums, as they are more likely to experience health problems. Conversely, people who live a healthy lifestyle, such as eating a balanced diet and exercising regularly, may be eligible for discounts on their premiums.

Finding the Best and Cheapest Options

Navigating the Australian health insurance market can feel overwhelming, but finding the best and cheapest option doesn’t have to be a daunting task. This section will provide you with practical tools and tips to help you make informed decisions.

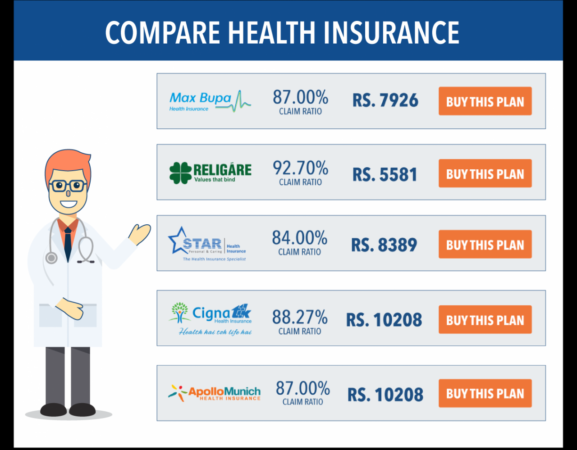

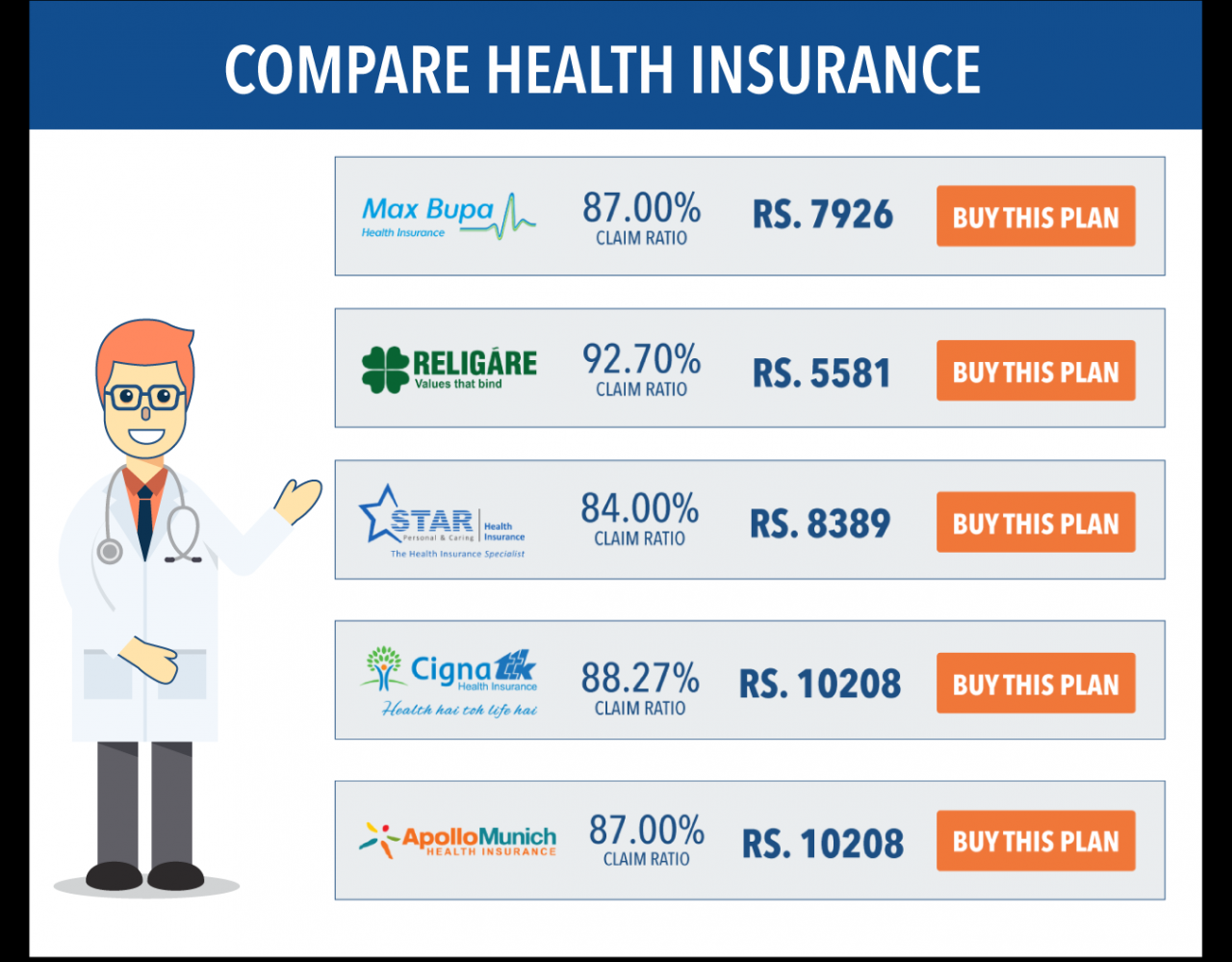

Comparing Health Insurance Providers

Understanding the key features, benefits, and premiums of popular health insurance providers can significantly simplify your search. The following table offers a comparison of some leading insurers in Australia:

| Provider | Key Features | Benefits | Premiums (Approximate Monthly) |

|---|---|---|---|

| Medibank | Wide network of hospitals and specialists, comprehensive cover options, digital health tools | Hospital cover, extras cover, ambulance cover, international cover | $150 – $400+ |

| Bupa | Strong focus on preventative care, wellness programs, international coverage options | Hospital cover, extras cover, ambulance cover, international cover | $140 – $350+ |

| NIB | Wide range of extras cover options, strong customer service, flexible payment plans | Hospital cover, extras cover, ambulance cover, international cover | $130 – $300+ |

| HCF | Not-for-profit organization, strong community focus, competitive premiums | Hospital cover, extras cover, ambulance cover, international cover | $120 – $280+ |

Remember, these are just approximate figures and premiums can vary significantly based on factors like your age, location, chosen cover level, and health status. It’s crucial to obtain personalized quotes from multiple insurers to compare accurately.

Tips for Finding Affordable Health Insurance

Finding affordable health insurance involves a strategic approach. Here are some helpful tips:

- Consider your health needs: Assess your current health status, family history, and lifestyle. Determine what level of cover you truly require. If you are generally healthy with no major health concerns, you might consider a basic hospital cover with a limited extras package.

- Compare quotes: Request quotes from multiple insurers and compare their offerings side-by-side. Don’t hesitate to use online comparison tools or contact insurers directly.

- Look for discounts: Many insurers offer discounts for things like being a member of a particular organization, having a healthy lifestyle, or paying your premium annually.

- Explore extras cover options: Extras cover can help you manage the cost of everyday health expenses like dental, optical, physiotherapy, and chiropractor visits. However, choose extras cover that aligns with your needs and usage.

- Consider a higher excess: Opting for a higher excess can often lead to lower premiums. This means you pay a larger upfront amount in case of a claim, but you’ll save on your monthly payments.

- Review your policy regularly: As your health needs and financial situation change, review your policy to ensure it remains suitable. You might be able to adjust your cover level or switch to a different insurer if needed.

Importance of Comparing Quotes

Comparing quotes from multiple insurers is essential for finding the best and cheapest health insurance option. This practice allows you to:

- Identify the most competitive premiums: You can compare premiums for similar cover levels and choose the most affordable option.

- Discover unique features and benefits: Each insurer offers unique features and benefits, such as wellness programs, discounts, or additional cover options. By comparing quotes, you can find the insurer that best aligns with your needs and preferences.

- Negotiate a better deal: Armed with quotes from multiple insurers, you can leverage this information to negotiate a better deal with your preferred insurer.

Remember, the cheapest option isn’t always the best. Consider your individual needs, budget, and health status to make an informed decision.

Essential Considerations for Choosing Health Insurance

Choosing the right health insurance policy is a crucial decision, as it significantly impacts your financial well-being and access to healthcare. To make an informed choice, it’s essential to consider your individual needs, health requirements, and lifestyle. This involves carefully evaluating the benefits, coverage, and costs associated with different plans.

Understanding Your Individual Needs and Health Requirements

Your health insurance needs are unique and depend on your specific circumstances. Factors like age, health conditions, lifestyle, and family size play a crucial role in determining the type of coverage you require. For instance, if you have pre-existing conditions, you may need a comprehensive plan that covers your specific needs. Similarly, if you’re a young and healthy individual, you might opt for a basic plan with lower premiums.

Benefits of Having Private Health Insurance in Australia

Private health insurance offers several benefits in Australia, including:

- Faster Access to Healthcare: Private health insurance can provide quicker access to specialists, procedures, and hospital care, reducing waiting times compared to the public system.

- Choice of Healthcare Providers: You have the freedom to choose your preferred doctors, hospitals, and specialists within your insurance network.

- Cover for a Wider Range of Services: Private health insurance covers a broader range of services compared to Medicare, such as dental, optical, and physiotherapy.

- Reduced Out-of-Pocket Expenses: Private health insurance helps mitigate out-of-pocket expenses for medical treatments, reducing the financial burden associated with healthcare.

- Tax Benefits: Australians who hold private health insurance may be eligible for tax rebates, depending on their income and the type of policy they hold.

Potential Drawbacks of Cheaper Plans

While cheaper health insurance plans may seem appealing, they often come with limited coverage and benefits.

- Lower Benefits and Coverage: Cheaper plans may have lower limits on benefits, shorter waiting periods, and fewer covered services. This can result in higher out-of-pocket expenses for certain treatments or procedures.

- Limited Choice of Providers: Cheaper plans may have a smaller network of healthcare providers, restricting your options for choosing doctors and hospitals.

- Higher Out-of-Pocket Costs: Despite lower premiums, cheaper plans can lead to higher out-of-pocket costs for certain treatments or services that are not fully covered.

Navigating the Health Insurance Landscape

Choosing the right health insurance plan can be a daunting task, especially with the wide array of options available in Australia. Understanding your needs, comparing plans, and navigating the claims process are key to finding the best fit for you.

Understanding Policy Terms and Conditions

It’s crucial to carefully read and understand the terms and conditions of your health insurance policy. These documents Artikel the coverage, exclusions, and limitations of your plan.

- Excess: This is the amount you pay upfront for each claim. Excess can vary depending on the type of service and your policy. It’s important to understand the excess for each service to budget accordingly.

- Waiting periods: Some policies have waiting periods for certain services, meaning you need to be covered for a specific period before you can claim for them. Waiting periods can vary depending on the service and the insurer.

- Co-payments: These are fixed amounts you pay for certain services, even after meeting your excess. Co-payments can be a significant factor in the overall cost of your healthcare.

- Benefit limits: These are the maximum amounts your insurer will pay for certain services. It’s important to understand these limits to avoid unexpected out-of-pocket costs.

- Exclusions: Policies often have exclusions, which are services not covered. These can include pre-existing conditions, experimental treatments, or cosmetic procedures.

Making Claims and Accessing Benefits

Once you have chosen a health insurance plan, you need to understand how to make claims and access your benefits.

- Claims process: Each insurer has its own claims process. You typically need to submit a claim form, along with supporting documentation, such as medical bills. Some insurers offer online claim submission, which can be more convenient.

- Claim processing time: The time it takes for your claim to be processed can vary depending on the insurer and the complexity of your claim. It’s important to be patient and keep track of your claim’s status.

- Accessing benefits: Once your claim is approved, your insurer will typically pay your healthcare provider directly. You may need to pay the excess and co-payments upfront and claim reimbursement later.

Outcome Summary: Best And Cheap Health Insurance In Australia

Choosing the right health insurance plan in Australia is a personal decision. By understanding the factors influencing costs, comparing quotes, and carefully considering your needs, you can find a plan that provides the best value for your money. Remember, your health is your most valuable asset, and having the right insurance can provide peace of mind and financial security.

Key Questions Answered

What are the main types of health insurance in Australia?

The main types of health insurance in Australia include hospital-only, extras, and combined hospital and extras. Hospital-only covers hospital costs, extras covers services like dental, physiotherapy, and optical, and combined plans cover both.

How do I compare health insurance quotes?

You can compare health insurance quotes online using comparison websites or by contacting individual insurers directly. Be sure to compare plans with similar levels of coverage to get an accurate comparison.

What are the benefits of having private health insurance?

Benefits of private health insurance include shorter waiting times for elective surgery, access to private hospitals, and coverage for a wider range of services. It can also help reduce out-of-pocket expenses for healthcare.

How often should I review my health insurance policy?

It’s recommended to review your health insurance policy annually to ensure it still meets your needs and budget. You may be able to find a better plan or negotiate a lower premium.