Biggest car insurance companies in australia woolworths – Biggest car insurance companies in Australia: Woolworths’ Impact, the supermarket giant has ventured into the world of car insurance, shaking up the market with its competitive offerings. This move has sparked curiosity and raised questions about Woolworths’ potential to become a major player in this industry.

This article delves into the landscape of car insurance in Australia, exploring the key players and comparing their offerings with Woolworths’ unique approach. We’ll analyze customer experiences, financial performance, and the future prospects of Woolworths’ car insurance business. By examining these factors, we can gain a comprehensive understanding of Woolworths’ position in the Australian car insurance market.

Woolworths’ Entry into Car Insurance

Woolworths, a household name in Australia for its supermarket chain, expanded its operations into the car insurance market in 2018. This move marked a significant shift for the company, venturing beyond its traditional retail domain.

Motivation for Entry

Woolworths’ entry into the car insurance market was driven by a strategic decision to leverage its existing customer base and brand recognition. The company aimed to capitalize on its established trust and familiarity with Australian consumers to attract new customers to its insurance products. By offering car insurance, Woolworths sought to diversify its revenue streams and enhance its customer loyalty by providing a comprehensive suite of services.

Benefits and Challenges

Woolworths’ entry into the car insurance market presents both potential benefits and challenges.

Benefits

- Existing Customer Base: Woolworths has a vast and loyal customer base from its supermarket operations. This provides a ready-made market for its car insurance products, allowing for cost-effective customer acquisition.

- Brand Recognition: The Woolworths brand is well-established and trusted in Australia, giving its insurance products a strong starting point in terms of customer confidence.

- Cross-Selling Opportunities: Woolworths can leverage its existing customer relationships to cross-sell car insurance products to its supermarket customers, increasing revenue opportunities.

Challenges

- Competition: The Australian car insurance market is highly competitive, with established players like Suncorp, IAG, and Allianz. Woolworths will need to differentiate its offerings and pricing to attract customers.

- Building Expertise: Woolworths lacks extensive experience in the insurance industry. It will need to invest in building expertise and infrastructure to effectively manage its insurance operations.

- Customer Perception: Woolworths’ entry into the car insurance market may raise concerns among customers about its insurance expertise and ability to provide quality service. The company will need to address these perceptions and build trust in its insurance offerings.

Key Features and Offerings

Woolworths’ car insurance products are designed to be competitive and offer a range of features, including:

- Comprehensive and Third-Party Property Damage Coverage: Woolworths offers both comprehensive and third-party property damage car insurance policies, providing customers with a choice based on their needs and budget.

- Optional Extras: Customers can choose from a range of optional extras, such as new for old replacement, windscreen cover, and roadside assistance, to customize their policy and enhance their coverage.

- Digital Convenience: Woolworths provides online and mobile platforms for customers to manage their insurance policies, including obtaining quotes, making payments, and lodging claims.

- Rewards Programs: Woolworths car insurance customers can earn rewards points through their Woolworths Everyday Rewards program, offering additional benefits and value.

Major Car Insurance Companies in Australia: Biggest Car Insurance Companies In Australia Woolworths

The Australian car insurance market is highly competitive, with numerous companies vying for customers. Understanding the key players and their offerings is essential for consumers to make informed decisions. This section explores the major car insurance companies in Australia, comparing their features and offerings to Woolworths’ entry into the market.

Top Car Insurance Companies in Australia

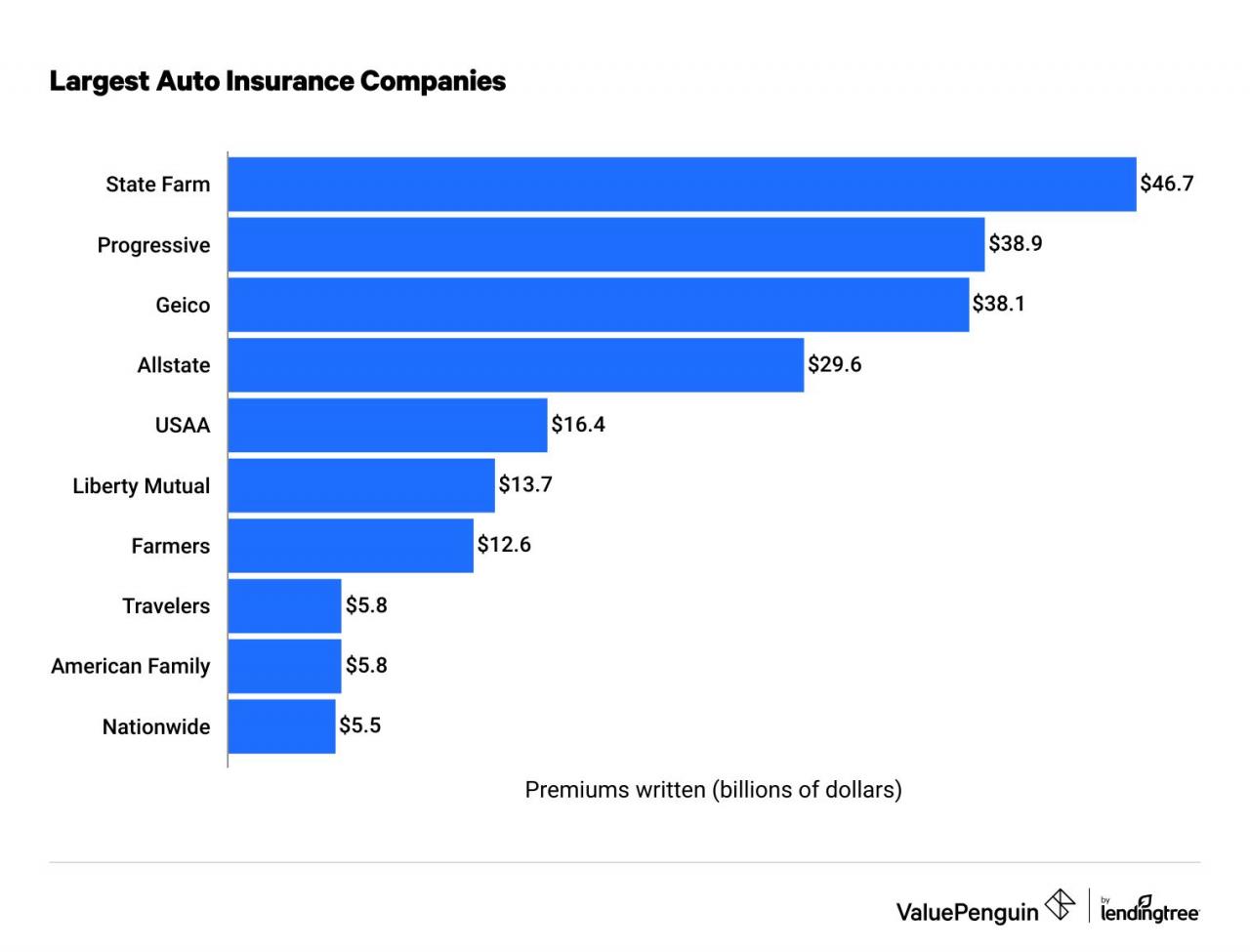

The top five car insurance companies in Australia, based on market share or premium volume, are:

- Suncorp Group: Suncorp is a major financial services group that owns several car insurance brands, including AAMI, GIO, and Bingle. These brands offer a range of products and services, catering to different customer needs and risk profiles.

- IAG: IAG is another large financial services group that owns a variety of insurance brands, including NRMA Insurance, CGU, and SGIC. Like Suncorp, IAG provides a comprehensive range of car insurance options.

- RACV: RACV is a member-based organization that provides car insurance, roadside assistance, and other services to its members in Victoria. RACV’s car insurance offerings are competitive and tailored to the needs of its members.

- Allianz: Allianz is a global insurance company with a strong presence in Australia. It offers a wide range of car insurance products, including comprehensive, third-party property damage, and third-party fire and theft coverage.

- QBE: QBE is an international insurance company with a significant presence in Australia. It provides a range of car insurance products, including commercial and personal lines.

Comparison of Key Features and Offerings

The major car insurance companies in Australia offer a variety of features and benefits to attract customers. These include:

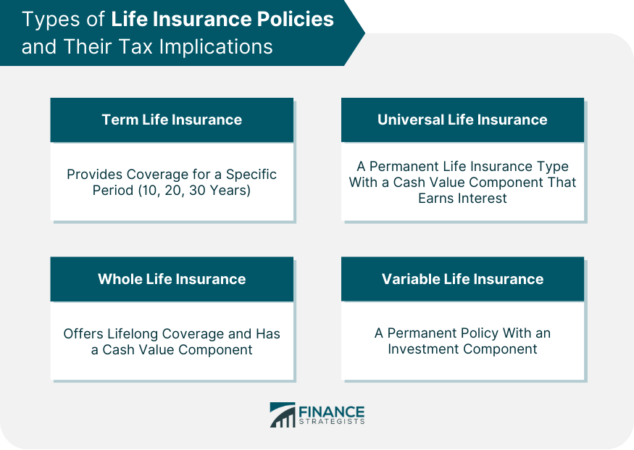

- Comprehensive Coverage: Most major companies offer comprehensive car insurance that covers damage to your vehicle, as well as third-party liability. This is the most comprehensive type of car insurance and provides the most protection.

- Third-Party Property Damage: This type of insurance covers damage you cause to other people’s vehicles or property. It is a legal requirement in Australia.

- Third-Party Fire and Theft: This type of insurance covers damage to your vehicle caused by fire or theft. It is a less comprehensive option than comprehensive insurance.

- Optional Extras: Many companies offer optional extras, such as roadside assistance, new car replacement, and excess reduction. These extras can provide additional peace of mind and protection.

- Discounts: Most companies offer discounts for various factors, such as safe driving history, no claims bonus, and multi-policy discounts.

Woolworths’ Entry into the Car Insurance Market

Woolworths entered the car insurance market in 2019, partnering with Allianz to offer a range of car insurance products. Woolworths’ car insurance offerings are designed to be simple and transparent, with a focus on value for money. They offer a range of coverage options, including comprehensive, third-party property damage, and third-party fire and theft. Woolworths also provides discounts for safe drivers, multi-policy holders, and customers who pay their premiums annually.

Competitive Landscape for Car Insurance in Australia

The car insurance market in Australia is highly competitive, with a wide range of companies vying for customers. Woolworths’ entry into the market has added another layer of competition, with its focus on value for money and simplicity. The major companies are responding to Woolworths’ entry by increasing their focus on customer experience, digitalization, and value-added services. The overall effect is a more competitive market, which benefits consumers with greater choice and lower prices.

Woolworths’ Position in the Competitive Landscape

Woolworths is a well-known and trusted brand in Australia, with a strong customer base. Its entry into the car insurance market has been met with mixed reactions. Some consumers are attracted to Woolworths’ brand reputation and its focus on value for money. However, others are hesitant to switch from their existing insurers, particularly if they have a long-standing relationship with their current provider. Woolworths’ success in the car insurance market will depend on its ability to attract new customers and retain existing ones.

Customer Experience and Reviews

Customer reviews play a crucial role in shaping the perception of any brand, and Woolworths’ foray into car insurance is no exception. Understanding customer sentiment towards Woolworths car insurance is essential for assessing its market competitiveness and future prospects.

Customer Reviews and Ratings Analysis

To gain insights into customer experiences, we can analyze reviews and ratings available on various platforms. These platforms provide a valuable resource for understanding customer perceptions regarding key aspects of the car insurance offering. Here’s a breakdown of common themes found in customer reviews:

- Pricing: Customers often express opinions about the competitiveness of Woolworths’ insurance premiums compared to other providers. Reviews may highlight instances where Woolworths offered competitive rates or, conversely, where premiums were perceived as higher than expected.

- Claims Process: A crucial aspect of car insurance is the claims process. Reviews often focus on the ease, speed, and transparency of the claims process. Customers may share positive experiences about efficient claim handling or negative experiences involving delays or difficulties in resolving claims.

- Customer Service: Customer service is a critical factor in customer satisfaction. Reviews may highlight positive interactions with Woolworths’ customer service representatives, such as prompt responses, helpfulness, and resolution of issues. Conversely, negative reviews might describe slow response times, unhelpful interactions, or difficulties in resolving problems.

Comparison with Other Major Car Insurance Companies

Comparing Woolworths’ customer satisfaction levels with other major car insurance companies in Australia provides valuable insights into its relative performance. This comparison can be conducted using customer review data from reputable platforms. It is essential to consider the volume of reviews and the overall rating trends for each company.

- Industry Benchmarks: Woolworths can benchmark its customer satisfaction against industry averages and the performance of established players. This comparison helps identify areas where Woolworths excels or lags behind competitors.

- Customer Feedback: By analyzing customer feedback across different platforms, Woolworths can gain insights into specific areas where it outperforms or falls short compared to its competitors. This information can guide improvements in its offerings and customer service strategies.

Impact of Customer Reviews on Market Position

Customer reviews have a significant impact on Woolworths’ market position. Positive reviews can attract new customers and enhance brand reputation, while negative reviews can deter potential customers and damage brand image.

- Online Reputation: Customer reviews significantly influence online reputation. Positive reviews can contribute to higher search engine rankings and increased visibility, while negative reviews can lower rankings and visibility.

- Customer Acquisition: Positive reviews can influence customer acquisition. Potential customers are more likely to choose Woolworths if they see positive reviews from other customers. Conversely, negative reviews can discourage potential customers from choosing Woolworths.

- Brand Loyalty: Positive customer experiences and reviews can foster brand loyalty. Customers who have positive experiences with Woolworths car insurance are more likely to remain loyal to the brand. Negative reviews can erode customer loyalty and lead to churn.

Financial Performance and Market Share

Woolworths’ entry into the car insurance market is relatively recent, and assessing its financial performance requires considering its strategic goals and long-term vision. While the company has not yet achieved significant market share, its financial performance and growth potential warrant analysis.

Woolworths’ Financial Performance in the Car Insurance Sector

- Woolworths’ car insurance business is part of its broader financial services division, which includes credit cards, home loans, and insurance products. The company does not disclose specific financial data for its car insurance operations, making it difficult to assess its performance independently.

- However, based on available data, Woolworths has seen consistent growth in its insurance premiums, indicating an increasing customer base and market penetration. This growth is likely fueled by its strong brand recognition, existing customer base, and leveraging its extensive retail network for cross-selling opportunities.

- Woolworths’ profitability in the car insurance sector is expected to be influenced by factors such as claims experience, operational efficiency, and pricing strategies. While profitability data is not publicly available, it is likely that the company’s focus on operational efficiency and cost management, coupled with its scale, could contribute to positive margins.

Comparison with Other Major Car Insurance Companies in Australia

- Woolworths’ car insurance market share is currently relatively small compared to established players like Suncorp, IAG, and Allianz. These companies have long-standing reputations, extensive distribution networks, and significant brand recognition in the Australian market.

- However, Woolworths’ entry into the car insurance market has created competition and forced existing players to adapt their strategies. The company’s focus on customer experience, competitive pricing, and leveraging its existing customer base presents a significant challenge to established players.

- Woolworths’ potential to become a major player in the Australian car insurance market depends on its ability to maintain its growth trajectory, attract new customers, and differentiate itself from existing competitors. The company’s focus on digital innovation, customer service, and leveraging its retail network could be key to achieving this goal.

Woolworths’ Potential to Become a Significant Player

- Woolworths has the potential to become a significant player in the Australian car insurance market by leveraging its existing strengths, including its strong brand recognition, extensive customer base, and retail network. By focusing on customer experience, digital innovation, and competitive pricing, Woolworths can attract new customers and grow its market share.

- However, achieving significant market share will require significant investment, marketing efforts, and a robust claims handling process. Woolworths’ ability to navigate the complexities of the insurance market, build trust with customers, and manage claims effectively will be crucial to its success.

- While Woolworths faces challenges from established players, its entry into the car insurance market has injected competition and forced existing players to adapt. The company’s potential for growth and its ability to disrupt the market should not be underestimated.

Future Prospects and Trends

The Australian car insurance market is poised for continued growth, driven by factors such as increasing vehicle ownership, rising vehicle values, and a growing awareness of the importance of insurance. This presents significant opportunities for Woolworths to expand its market share and solidify its position as a major player in the industry. However, navigating the evolving landscape will require a keen understanding of key trends that will shape the future of car insurance.

Technological Advancements

Technological advancements are rapidly transforming the car insurance industry, presenting both opportunities and challenges for Woolworths. The rise of telematics, which involves using data collected from vehicle sensors to assess risk and personalize insurance premiums, is one of the most notable trends. By leveraging telematics, Woolworths can offer more competitive and tailored insurance products, leading to increased customer satisfaction and loyalty.

- Usage-Based Insurance (UBI): UBI programs use telematics devices to track driving behavior and offer discounts to safe drivers. Woolworths can capitalize on UBI by integrating it into its insurance offerings, providing customers with personalized pricing based on their driving habits. This can attract price-sensitive customers and improve risk assessment accuracy.

- Artificial Intelligence (AI): AI-powered chatbots and virtual assistants can automate customer service processes, reducing wait times and improving efficiency. Woolworths can invest in AI technologies to enhance customer support, personalize insurance recommendations, and streamline claims processing. This can lead to a more efficient and cost-effective customer experience.

- Blockchain Technology: Blockchain can improve transparency and security in insurance transactions, potentially reducing fraud and streamlining claims processing. Woolworths can explore blockchain solutions to enhance its operational efficiency and build trust with customers.

Regulatory Changes, Biggest car insurance companies in australia woolworths

The Australian car insurance market is subject to ongoing regulatory changes, which can significantly impact the industry’s dynamics. Woolworths must stay abreast of these changes and adapt its strategies to remain compliant and competitive.

- Increased Scrutiny of Pricing Practices: Regulators are increasingly scrutinizing insurance pricing practices to ensure fairness and transparency. Woolworths must ensure its pricing models are transparent and justifiable, avoiding practices that could attract regulatory scrutiny.

- Data Privacy and Security Regulations: The Australian government is implementing stricter data privacy and security regulations. Woolworths must comply with these regulations and invest in robust data security measures to protect customer information.

- Changes to Compulsory Third Party (CTP) Insurance: Changes to CTP insurance schemes, such as the introduction of no-fault insurance, can impact the car insurance market. Woolworths needs to adapt its product offerings and pricing strategies to align with any changes to CTP regulations.

Consumer Behavior

Consumer behavior is constantly evolving, driven by factors such as changing demographics, increasing digital adoption, and a growing emphasis on value and convenience. Woolworths must understand these shifts and tailor its offerings to meet the evolving needs of its customers.

- Growing Demand for Digital Channels: Customers are increasingly expecting seamless digital experiences, from online quotes to claims processing. Woolworths needs to invest in a robust digital platform that provides a user-friendly and efficient experience across all touchpoints.

- Preference for Personalized Experiences: Consumers value personalized experiences and expect insurance products tailored to their individual needs. Woolworths can leverage data analytics and AI to offer customized insurance packages that cater to specific customer profiles.

- Emphasis on Value and Convenience: Consumers are looking for value-for-money insurance products and convenient service options. Woolworths can attract customers by offering competitive premiums, transparent pricing, and streamlined claims processes.

Leveraging Trends for Competitive Advantage

Woolworths can leverage these trends to enhance its market position and gain a competitive edge in the Australian car insurance market.

- Embrace Technological Innovation: By embracing technological advancements such as telematics, AI, and blockchain, Woolworths can offer more personalized, efficient, and secure insurance products, attracting a wider range of customers.

- Proactively Adapt to Regulatory Changes: Staying informed about regulatory changes and adapting its business practices accordingly will ensure Woolworths remains compliant and competitive in the long term.

- Focus on Customer Experience: By prioritizing customer experience, Woolworths can build brand loyalty and attract new customers. This involves providing seamless digital experiences, personalized offerings, and convenient service options.

Conclusion

Woolworths’ entry into the Australian car insurance market is a significant development, bringing new competition and potentially shaking up the industry. While it’s too early to definitively predict its long-term success, Woolworths’ strong brand recognition, customer base, and competitive offerings suggest it has the potential to become a major player. As the market continues to evolve, it will be interesting to see how Woolworths navigates the challenges and opportunities ahead, and how its presence shapes the future of car insurance in Australia.

FAQ Insights

What are the benefits of choosing Woolworths car insurance?

Woolworths car insurance offers potential benefits like competitive pricing, convenience through online platforms, and potentially bundled discounts with other Woolworths services.

How does Woolworths car insurance compare to other major insurers?

Woolworths’ car insurance offerings should be compared based on specific needs and preferences, taking into account factors like coverage, pricing, customer service, and claims process.

Is Woolworths car insurance reliable?

Woolworths’ reliability as an insurer is a factor to consider, evaluating its track record in handling claims, customer feedback, and financial stability.