- Overview of Business Insurance in Australia: Business Insurance Companies In Australia

- Key Considerations for Choosing Business Insurance

- Top Business Insurance Companies in Australia

- Understanding Insurance Policy Terms and Conditions

- Claiming and Managing Insurance Claims

- The Future of Business Insurance in Australia

- Outcome Summary

- FAQ Explained

Business insurance companies in Australia play a vital role in safeguarding businesses from financial losses caused by unforeseen events. From protecting against property damage and liability claims to ensuring business continuity, insurance provides a crucial safety net for entrepreneurs and enterprises of all sizes.

Understanding the different types of business insurance available, choosing the right coverage, and navigating the complexities of policy terms and claims processes are essential for any Australian business owner. This comprehensive guide aims to equip you with the knowledge and insights needed to make informed decisions about your business insurance needs.

Overview of Business Insurance in Australia: Business Insurance Companies In Australia

Business insurance in Australia is crucial for safeguarding your company’s financial stability and protecting you against potential risks. It offers financial protection against unexpected events that can disrupt your operations and lead to significant financial losses. This comprehensive coverage can help you recover from unforeseen circumstances and continue running your business smoothly.

Types of Business Insurance in Australia

The Australian insurance market offers a diverse range of business insurance options, each designed to address specific risks. Understanding the different types of business insurance available is essential for businesses of all sizes.

- Public Liability Insurance: Provides coverage for legal liabilities arising from injuries or property damage caused to third parties by your business activities. This type of insurance is crucial for businesses that interact with the public, such as retailers, restaurants, and service providers.

- Product Liability Insurance: Offers protection against claims arising from defects in your products that cause injury or damage to consumers. This is essential for businesses that manufacture, distribute, or sell products.

- Professional Indemnity Insurance: Protects businesses against claims arising from negligent or wrongful acts or omissions during the provision of professional services. This is vital for professionals such as accountants, lawyers, and consultants.

- Workers Compensation Insurance: Covers the cost of medical expenses, lost wages, and rehabilitation for employees who suffer work-related injuries or illnesses. This is mandatory for all employers in Australia.

- Business Interruption Insurance: Provides financial protection for lost income and ongoing expenses if your business is forced to shut down due to an insured event, such as a fire or natural disaster. This insurance helps ensure your business can recover and resume operations.

- Cyber Liability Insurance: Covers the financial losses and expenses associated with cyberattacks, data breaches, and other cyber threats. This is becoming increasingly important as businesses rely more on technology and store sensitive data online.

- Property Insurance: Protects your business assets, such as buildings, equipment, and inventory, against damage or loss due to fire, theft, vandalism, and other covered events.

- Motor Vehicle Insurance: Covers your business vehicles against damage, theft, and liability claims arising from accidents. This is essential for businesses that rely on vehicles for transportation or delivery.

Legal and Regulatory Landscape

The Australian insurance industry is regulated by the Australian Prudential Regulation Authority (APRA). APRA sets standards for insurers, ensuring their financial stability and solvency. The Australian Securities and Investments Commission (ASIC) regulates the sale and distribution of insurance products, protecting consumers from misleading or deceptive practices.

“It is important for businesses to choose insurance policies that are tailored to their specific needs and risks. This ensures that they have adequate coverage in the event of an insured event.”

Key Considerations for Choosing Business Insurance

Choosing the right business insurance can be a daunting task, but it’s crucial for protecting your business from financial hardship in the event of unexpected events. By carefully considering your needs and options, you can ensure you have the right coverage to safeguard your assets and operations.

Assessing Your Insurance Needs

Before you start shopping for business insurance, it’s essential to assess your specific needs. This involves identifying the potential risks your business faces and the potential financial consequences of those risks. For example, a retail store might face risks such as theft, fire, or natural disasters, while a software company might face risks such as cyberattacks or data breaches. Once you’ve identified your risks, you can start to determine the types of insurance policies you need to mitigate those risks.

Comparing and Contrasting Insurance Policies

Once you’ve identified your insurance needs, you can start comparing and contrasting different insurance policies. There are various types of business insurance available, including:

- Public Liability Insurance: Protects your business from claims arising from injuries or property damage caused by your business activities.

- Product Liability Insurance: Protects your business from claims arising from injuries or damage caused by your products.

- Professional Indemnity Insurance: Protects your business from claims arising from negligent advice or services provided by your business.

- Workers’ Compensation Insurance: Protects your business from claims arising from injuries or illnesses sustained by your employees while at work.

- Property Insurance: Protects your business from losses due to damage or destruction of your property, such as buildings, equipment, or inventory.

- Business Interruption Insurance: Protects your business from lost income and expenses if you are unable to operate due to a covered event, such as a fire or natural disaster.

- Cyber Liability Insurance: Protects your business from losses due to cyberattacks, data breaches, or other cyber incidents.

Each of these policies has different features and benefits, so it’s important to compare them carefully and choose the policies that best meet your needs.

Factors to Consider When Choosing an Insurance Provider

Once you’ve identified the types of insurance policies you need, you can start looking for an insurance provider. Here are some factors to consider:

- Reputation and Financial Stability: Choose a provider with a strong reputation and a solid financial track record. This will ensure that they will be able to pay claims when you need them to.

- Policy Coverage and Exclusions: Carefully review the policy coverage and exclusions to ensure that the policy provides the protection you need. Pay attention to the policy’s limits and deductibles.

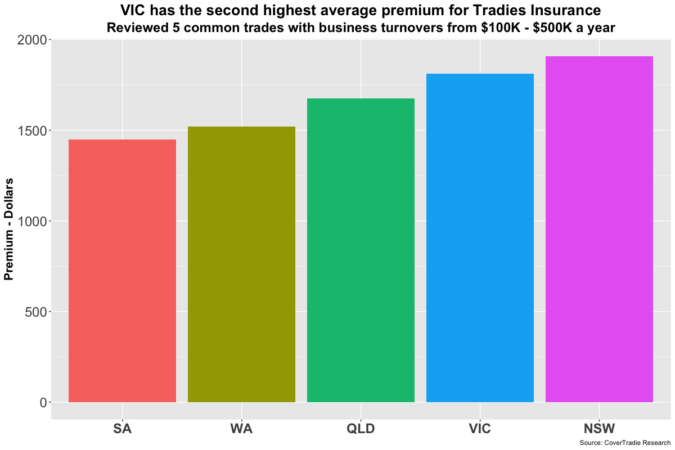

- Premium Costs: Compare premium costs from different providers to find the best value for money. However, don’t just focus on the cheapest option, as it may not offer the coverage you need.

- Customer Service: Choose a provider with a good reputation for customer service. You want to be able to easily contact them and receive prompt and helpful assistance when you need it.

- Claims Process: Understand the provider’s claims process and how long it takes to process claims. A smooth and efficient claims process can save you time and money.

Top Business Insurance Companies in Australia

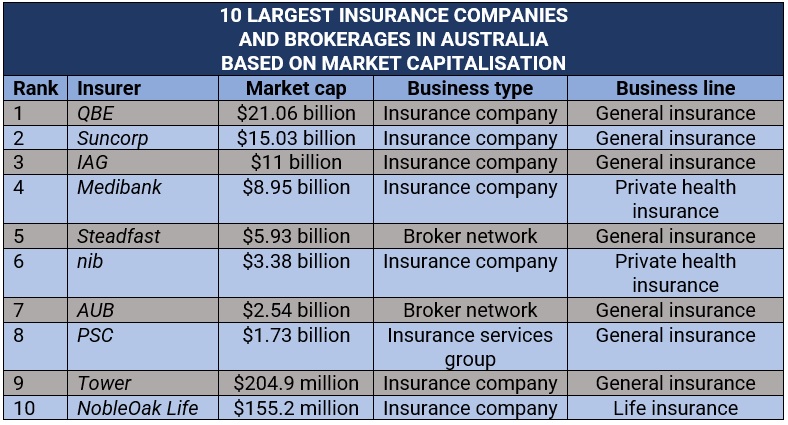

Choosing the right business insurance provider is crucial for protecting your business from financial losses. Australia boasts a competitive market with numerous reputable companies offering a wide range of insurance solutions. This section will delve into the top 10 business insurance companies in Australia, highlighting their key offerings, strengths, and weaknesses.

Top Business Insurance Companies in Australia

This table provides an overview of the top 10 business insurance companies in Australia, outlining their key offerings, strengths, and weaknesses.

| Company Name | Key Offerings | Strengths | Weaknesses |

|---|---|---|---|

| AAMI | Public liability, property, workers’ compensation, motor vehicle | Competitive pricing, comprehensive coverage options, strong customer support | Limited industry-specific insurance options |

| Allianz | Public liability, property, workers’ compensation, professional indemnity, cyber insurance | Global reach, specialized insurance solutions, robust risk management services | Higher premiums compared to some competitors |

| BUPA | Health insurance, workers’ compensation, travel insurance | Strong reputation for health insurance, comprehensive workers’ compensation coverage | Limited business insurance options beyond health and workers’ compensation |

| CGU | Public liability, property, workers’ compensation, motor vehicle, business interruption | Wide range of coverage options, flexible policy customization, strong claims handling | Limited online resources for policy management |

| GIO | Public liability, property, workers’ compensation, motor vehicle, business interruption | Competitive pricing, user-friendly online platform, 24/7 customer support | Limited coverage options for certain industries |

| Insurance Australia Group (IAG) | Public liability, property, workers’ compensation, motor vehicle, business interruption, cyber insurance | Diverse range of insurance products, strong financial stability, extensive network of brokers | Complex policy structures, potentially higher premiums |

| NRMA | Public liability, property, workers’ compensation, motor vehicle, business interruption | Strong reputation for road assistance, competitive pricing for motor vehicle insurance | Limited coverage options for some business types |

| QBE | Public liability, property, workers’ compensation, professional indemnity, cyber insurance | Specialized insurance solutions for various industries, global reach, strong risk management expertise | Higher premiums compared to some competitors |

| Suncorp | Public liability, property, workers’ compensation, motor vehicle, business interruption, cyber insurance | Comprehensive coverage options, user-friendly online platform, competitive pricing | Limited industry-specific insurance solutions |

| Westpac | Public liability, property, workers’ compensation, business interruption, cyber insurance | Strong banking integration, competitive pricing for certain insurance products, online policy management | Limited coverage options for some business types |

Understanding Insurance Policy Terms and Conditions

It’s essential to thoroughly understand the terms and conditions of your business insurance policy to ensure you have adequate coverage and know what to expect in the event of a claim. This section will explain common insurance policy terms and provide tips for navigating the fine print.

Common Insurance Policy Terms

Understanding common insurance policy terms is crucial for making informed decisions about your business insurance. Here are some key terms to be familiar with:

- Coverage Limits: This refers to the maximum amount your insurer will pay for a covered loss. For example, if you have a $1 million liability coverage limit, your insurer will pay up to $1 million for any covered liability claim.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if you have a $5,000 deductible for property damage and suffer a $10,000 loss, you will pay $5,000, and your insurer will cover the remaining $5,000.

- Exclusions: These are specific events or situations that are not covered by your insurance policy. For example, most policies exclude coverage for intentional acts or losses caused by natural disasters like earthquakes.

- Premium: This is the regular payment you make to your insurer for coverage. The premium amount is determined by factors such as the type of insurance, coverage limits, deductible, and your business’s risk profile.

- Policy Period: This is the duration of your insurance coverage, typically a year.

- Renewal: When your policy period ends, you have the option to renew your policy. This typically involves paying a new premium and agreeing to the updated terms and conditions.

Understanding the Fine Print, Business insurance companies in australia

Insurance policies are often written in complex legal language, which can be difficult to understand. Here are some tips for navigating the fine print:

- Read the entire policy: Don’t just skim the document. Take the time to read every section, including the exclusions and limitations.

- Ask questions: If you don’t understand something, don’t hesitate to ask your insurance broker or agent for clarification.

- Compare policies: Before choosing a policy, compare different options from various insurers. This will help you find the best coverage at a competitive price.

- Keep records: Keep all your insurance documents, including your policy, renewal notices, and claim forms, in a safe place.

Negotiating Policy Terms

You may be able to negotiate some policy terms with your insurance provider, especially if you have a good track record or are willing to pay a higher premium. Here are some tips for negotiating:

- Know your options: Research different insurers and compare their policies and rates.

- Be prepared to walk away: If you’re not happy with the terms offered, be prepared to walk away and find another insurer.

- Be polite and respectful: Even when negotiating, it’s important to be polite and respectful to your insurance provider.

- Be clear about your needs: Clearly communicate your insurance needs and the terms you’re looking for.

Claiming and Managing Insurance Claims

Navigating the process of filing and managing an insurance claim can be a complex undertaking. However, understanding the steps involved and the factors that influence claim payouts can significantly streamline the process and enhance your chances of a successful outcome.

Claim Filing Process

The initial step in the claim process is to promptly notify your insurance company about the incident. This notification should be made within the timeframe specified in your policy.

- Contact your insurer: You can typically file a claim online, through their mobile app, or by calling their customer service hotline.

- Provide details: Be prepared to provide detailed information about the incident, including the date, time, location, and nature of the event. You may also need to provide documentation, such as police reports, medical records, or repair estimates.

- Investigate the claim: The insurance company will investigate the claim to determine the validity and extent of the covered losses. This may involve inspecting the damaged property, interviewing witnesses, or reviewing documentation.

- Negotiate the settlement: Once the investigation is complete, the insurance company will assess the claim and determine the amount they will pay. You may have the opportunity to negotiate the settlement if you believe the initial offer is insufficient.

- Receive payment: Once the settlement is finalized, you will receive payment for the covered losses. The payment may be made directly to you or to the repair or service provider, depending on the terms of your policy.

Factors Affecting Claim Payouts

Several factors can influence the amount of compensation you receive from your insurance claim.

- Policy coverage: The specific terms and conditions of your policy will determine the types of events covered and the limits of liability. It is crucial to thoroughly review your policy and understand the scope of your coverage.

- Deductible: Your deductible is the amount you are responsible for paying before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, but you will have to pay more out of pocket in case of a claim.

- Evidence of loss: The strength of the evidence you provide to support your claim will significantly impact the outcome. This includes documentation such as invoices, receipts, repair estimates, and photographs.

- Negligence: If your actions contributed to the incident, your claim payout may be reduced or denied. It is essential to act responsibly and avoid any behavior that could increase the risk of a claim.

- Pre-existing conditions: If the incident occurred due to pre-existing conditions or damage, your claim may be partially or entirely denied.

Tips for Maximizing Claim Success

To improve your chances of a successful claim, consider these tips:

- Maintain accurate records: Keep detailed records of your business operations, including financial statements, inventory lists, and maintenance logs. These records can help you substantiate your claim and demonstrate the extent of your losses.

- Be honest and transparent: Provide accurate and complete information to your insurance company. Avoid making false statements or exaggerating the details of the incident.

- Respond promptly: Respond to all communication from your insurance company in a timely manner. This demonstrates your commitment to resolving the claim and can help avoid delays.

- Consult with a professional: If you have complex or challenging claims, consider consulting with a claims adjuster or insurance lawyer. They can provide guidance and support throughout the process.

- Understand your policy: Take the time to thoroughly review your policy and understand its terms and conditions. This will help you navigate the claim process effectively and avoid potential misunderstandings.

The Future of Business Insurance in Australia

The Australian business insurance landscape is undergoing a significant transformation, driven by technological advancements, evolving risk profiles, and a growing demand for personalized solutions. This evolution is shaping the future of business insurance, with emerging trends poised to revolutionize how businesses protect themselves.

Digital Insurance Platforms

The rise of digital insurance platforms is fundamentally changing the way businesses purchase and manage their insurance. These platforms offer a streamlined and user-friendly experience, enabling businesses to obtain quotes, compare policies, and purchase coverage online. The convenience and accessibility of digital platforms are attracting a growing number of businesses, particularly younger and tech-savvy entrepreneurs.

- Enhanced Customer Experience: Digital platforms provide a seamless and intuitive user experience, allowing businesses to access information, manage policies, and submit claims online, anytime and anywhere.

- Real-time Data and Analytics: These platforms leverage data analytics to personalize insurance offerings, provide tailored risk assessments, and offer competitive pricing based on individual business needs.

- Automated Processes: Digital platforms automate many insurance processes, such as quote generation, policy issuance, and claims processing, resulting in faster turnaround times and reduced administrative burdens.

New Types of Coverage

The evolving business environment necessitates new types of coverage to address emerging risks. Businesses are increasingly exposed to cyberattacks, data breaches, and other digital threats, leading to a surge in demand for cyber insurance.

- Cyber Insurance: This coverage protects businesses against financial losses resulting from cyberattacks, data breaches, and other digital incidents. It typically includes coverage for data recovery, legal expenses, and business interruption.

- Climate Change Insurance: With growing concerns about climate change, businesses are seeking insurance solutions to mitigate the risks associated with extreme weather events and environmental degradation. This coverage can provide financial protection against losses resulting from floods, droughts, and other climate-related disasters.

- Business Interruption Insurance: This type of insurance provides financial support to businesses that suffer income loss due to unforeseen events, such as natural disasters, fires, or power outages. This coverage is becoming increasingly important as businesses rely heavily on technology and face the potential for significant disruptions.

Technological Advancements

Technological advancements are transforming the business insurance industry, impacting everything from risk assessment to claims processing.

- Artificial Intelligence (AI): AI is being used to automate underwriting processes, assess risk profiles, and detect fraud. This technology enables faster and more accurate risk assessments, leading to more efficient insurance pricing and improved fraud prevention.

- Internet of Things (IoT): IoT devices are collecting real-time data on business operations, providing insurers with valuable insights into risk factors. This data can be used to develop more accurate risk assessments, tailor insurance policies, and provide preventative measures to reduce claims.

- Blockchain Technology: Blockchain technology offers secure and transparent data management, which can be used to streamline claims processing, reduce fraud, and enhance policy transparency.

Innovation in Business Insurance

Innovation is driving the future of business insurance, with insurers exploring new ways to meet the evolving needs of businesses.

- Personalized Insurance Solutions: Insurers are developing personalized insurance solutions tailored to the specific needs and risk profiles of individual businesses. This approach allows businesses to obtain coverage that is relevant and cost-effective.

- Insurtech Startups: Insurtech startups are disrupting the traditional insurance industry by offering innovative solutions, such as digital platforms, data-driven pricing, and new types of coverage. These startups are challenging the status quo and pushing the boundaries of innovation in the insurance sector.

- Partnerships and Collaborations: Insurers are increasingly collaborating with technology companies and other stakeholders to develop innovative insurance solutions. These partnerships leverage the expertise of different sectors to create comprehensive and cutting-edge insurance offerings.

Outcome Summary

Navigating the world of business insurance in Australia can seem daunting, but with the right information and guidance, you can confidently secure the protection your business deserves. By understanding your specific needs, carefully comparing insurance options, and engaging with reputable providers, you can build a strong foundation for your business’s financial security and peace of mind.

FAQ Explained

What is the difference between public liability insurance and product liability insurance?

Public liability insurance covers you against claims from third parties for injuries or damage caused by your business operations. Product liability insurance protects you against claims arising from defects in products you manufacture or sell.

How much business insurance do I need?

The amount of insurance you need depends on your specific industry, business size, and risk profile. It’s best to consult with an insurance broker or advisor to determine the appropriate level of coverage for your business.

What are some common exclusions in business insurance policies?

Common exclusions include acts of war, nuclear events, and intentional acts by the insured. It’s crucial to carefully review your policy document to understand any exclusions that may apply to your business.

How can I make a claim on my business insurance policy?

Each insurance company has its own claims process. It’s essential to contact your insurer as soon as possible after an incident occurs and follow their instructions for filing a claim.