- Introduction to Private Health Insurance in Australia

- Benefits of Buying Private Health Insurance

- Factors to Consider When Choosing Private Health Insurance: Buying Private Health Insurance In Australia

- Understanding Private Health Insurance Policies

- Navigating the Private Health Insurance Market

- Financial Aspects of Private Health Insurance

- Making Informed Decisions

- Concluding Remarks

- Clarifying Questions

Buying private health insurance in Australia sets the stage for a journey into a complex and often misunderstood aspect of the country’s healthcare system. While Australia boasts a strong public healthcare system, many Australians choose to supplement their coverage with private health insurance, seeking additional benefits and choices.

This comprehensive guide explores the various facets of private health insurance in Australia, from the different types of coverage available to the financial implications and factors to consider when making a decision. Whether you’re a newcomer to the country or a seasoned resident seeking to optimize your healthcare options, this guide aims to provide valuable insights and empower you to make informed choices.

Introduction to Private Health Insurance in Australia

Australia has a universal healthcare system, known as Medicare, which provides essential healthcare services to all Australian citizens and permanent residents. Medicare is funded through taxes and provides access to public hospitals, bulk-billed consultations with doctors, and essential medications. However, Medicare does not cover all healthcare needs, such as private hospital rooms, elective surgery, and some specialist consultations. This is where private health insurance comes in.

Private health insurance in Australia is a voluntary system that allows individuals to pay premiums for additional healthcare benefits beyond those provided by Medicare. It provides coverage for a range of services, including:

Types of Private Health Insurance

Private health insurance in Australia can be broadly categorized into two main types:

- Hospital cover: This covers the costs of private hospital treatment, including private rooms, choice of surgeon, and shorter waiting times. It also covers some services like ambulance transport and prosthetics.

- Extras cover: This covers a range of services not covered by Medicare, including dental, optical, physiotherapy, and alternative therapies. It can also cover some services covered by Medicare, such as ambulance transport, but with lower out-of-pocket expenses.

Private health insurance providers offer various levels of cover, with different premiums and benefits. Some providers offer comprehensive cover, including both hospital and extras, while others specialize in specific types of cover.

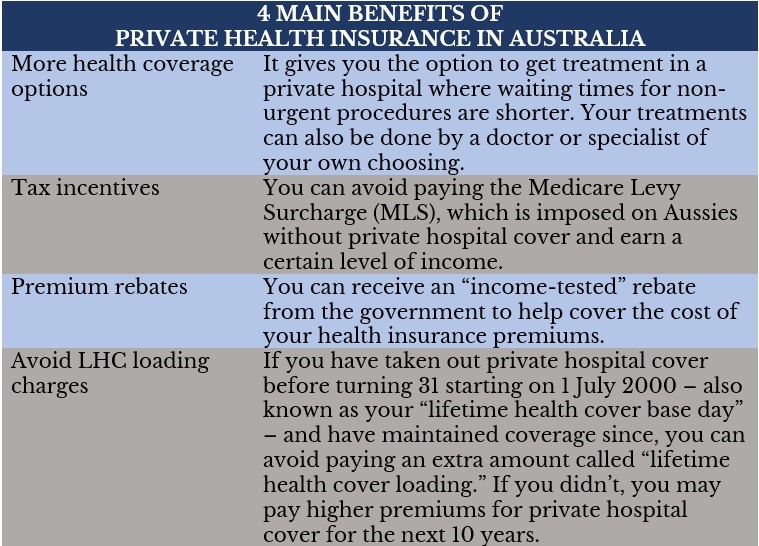

Benefits of Buying Private Health Insurance

Private health insurance in Australia offers numerous benefits that can significantly enhance your healthcare experience. It provides access to a wider range of medical services, potentially faster treatment times, and financial protection against unexpected healthcare costs.

Faster Access to Treatment

Having private health insurance can significantly reduce your waiting time for medical procedures and treatments. This is because private hospitals often have shorter waiting lists compared to public hospitals. For example, a patient with private health insurance might be able to access a hip replacement surgery within a few weeks, while a public patient could wait several months or even years.

Choice of Specialists

Private health insurance allows you to choose your preferred specialist, giving you greater control over your healthcare. This is particularly beneficial for complex medical conditions that require specialized expertise. For instance, if you need a cardiologist, you can choose from a range of specialists within your insurance network, ensuring you receive care from a doctor you trust and feel comfortable with.

Coverage for Specific Procedures

Private health insurance can cover the cost of specific medical procedures, such as surgery, dental work, and physiotherapy. This can be a significant financial benefit, especially for expensive treatments that may not be fully covered by Medicare. For example, if you require a knee replacement, your private health insurance may cover a substantial portion of the surgery and associated costs, reducing your out-of-pocket expenses.

Cost Savings

While private health insurance requires monthly premiums, it can ultimately save you money on healthcare costs. This is because it can help you avoid large out-of-pocket expenses for medical procedures and treatments. For example, if you require a major surgery, your private health insurance can cover a significant portion of the cost, reducing your out-of-pocket expenses and preventing financial strain.

Hospital Cover

Hospital cover is an essential component of private health insurance that provides financial protection for hospital stays. It covers the cost of accommodation, surgery, and other related expenses. Depending on your level of cover, you may also be able to choose a private hospital, giving you more control over your healthcare environment.

Extras Cover

Extras cover provides additional benefits beyond hospital cover, such as dental, optical, and physiotherapy. This can help you manage your healthcare expenses and access a wider range of services. For example, if you require regular dental checkups or need glasses, your extras cover can help reduce the cost of these services.

Factors to Consider When Choosing Private Health Insurance: Buying Private Health Insurance In Australia

Choosing the right private health insurance policy can be a daunting task, as there are numerous factors to consider. It’s essential to weigh your individual needs and financial situation to find a policy that offers the best value for your money.

Premiums

Premiums are the monthly payments you make for your private health insurance. They can vary significantly depending on several factors, including:

- Your age

- Your location

- Your chosen level of cover

- Whether you are a smoker or non-smoker

It’s crucial to compare premiums from different insurers and policies to find the most affordable option that meets your requirements.

Coverage Levels

Private health insurance policies come in various coverage levels, ranging from basic to comprehensive. Basic policies cover essential services like hospital stays, while comprehensive policies offer broader coverage, including extras like dental, optical, and physiotherapy.

- Hospital cover: This covers the costs of private hospital treatment, including surgery, accommodation, and medical care.

- Extras cover: This covers the costs of non-hospital services, such as dental, optical, physiotherapy, and chiropractor services.

Consider your health needs and the services you are most likely to require when deciding on the appropriate coverage level.

Waiting Periods, Buying private health insurance in australia

Waiting periods are the time you need to wait before you can claim certain benefits under your policy. These periods vary depending on the service and insurer. For example, you may need to wait 12 months before claiming benefits for a pre-existing condition.

- Pre-existing conditions: These are medical conditions you had before you took out your health insurance policy.

- New conditions: These are medical conditions that develop after you take out your health insurance policy.

It’s essential to understand the waiting periods associated with your chosen policy, as they can significantly impact your access to benefits.

Exclusions

All private health insurance policies have exclusions, which are services or conditions they do not cover. These exclusions can vary widely between insurers and policies. Some common exclusions include:

- Cosmetic surgery

- Weight loss surgery

- Fertility treatment

- Conditions that are not medically necessary

It’s important to carefully review the policy documents to understand the exclusions and ensure they align with your needs.

Comparing Providers and Policies

It’s essential to compare different insurance providers and policies before making a decision. This can be done by using online comparison websites or contacting insurers directly.

- Online comparison websites: These websites allow you to compare premiums and coverage levels from different insurers in one place.

- Direct contact with insurers: This allows you to discuss your individual needs and get tailored advice from insurers.

When comparing policies, consider factors such as premiums, coverage levels, waiting periods, and exclusions.

Determining the Right Level of Coverage

Determining the right level of coverage is crucial for ensuring you have adequate protection without paying for unnecessary benefits.

- Assess your health needs: Consider your current health status, family history, and lifestyle to determine the services you are most likely to require.

- Consider your budget: Determine how much you can afford to pay in premiums and choose a policy that fits within your financial constraints.

- Seek professional advice: If you are unsure about the right level of coverage, seek advice from a financial advisor or health insurance broker.

It’s essential to find a balance between adequate coverage and affordability.

Understanding Private Health Insurance Policies

Private health insurance policies in Australia are designed to offer various levels of coverage and benefits. To choose the right policy, it’s essential to understand the different types available and the features they offer.

Types of Private Health Insurance Policies

Private health insurance policies in Australia are generally categorized into three main types: hospital cover, extras cover, and combined policies. Each policy type offers distinct coverage and benefits, catering to different needs and preferences.

- Hospital Cover: Hospital cover provides financial assistance for medical expenses incurred during hospitalization. This includes costs related to surgery, accommodation, and other medical services provided in a public or private hospital. Hospital cover is essential for those who want to access private hospitals, avoid long waiting times, and have greater choice in their medical care.

- Extras Cover: Extras cover provides financial assistance for a wide range of healthcare services not covered by Medicare, such as dental, optical, physiotherapy, and alternative therapies. Extras cover is designed to supplement Medicare and cover expenses that may not be covered by the government scheme. It can help individuals manage their healthcare costs and access a broader range of healthcare services.

- Combined Policies: Combined policies offer a comprehensive approach to private health insurance, combining both hospital and extras cover. This type of policy provides the most comprehensive coverage, ensuring financial protection for both hospital and non-hospital healthcare expenses. It’s a popular choice for individuals who want to have peace of mind knowing that their healthcare needs are fully covered.

Coverage and Benefits

Each type of private health insurance policy offers specific coverage and benefits. Understanding these details is crucial for making an informed decision about the right policy for your individual needs.

Hospital Cover

Hospital cover provides financial assistance for various medical expenses incurred during hospitalization. This includes costs related to surgery, accommodation, and other medical services provided in a public or private hospital. The specific benefits offered under hospital cover can vary depending on the policy level and insurer.

- Surgery: Covers the costs associated with surgical procedures performed in a hospital, including fees for the surgeon, anesthesiologist, and other medical professionals involved in the surgery.

- Accommodation: Covers the cost of staying in a private hospital room, including amenities like meals and nursing care. The level of accommodation coverage can vary depending on the policy level.

- Medical Services: Covers the costs of other medical services provided during hospitalization, such as blood tests, X-rays, and other diagnostic tests.

Extras Cover

Extras cover provides financial assistance for a wide range of healthcare services not covered by Medicare. These services can include dental, optical, physiotherapy, and alternative therapies. The specific benefits offered under extras cover can vary depending on the policy level and insurer.

- Dental: Covers a portion of the costs associated with dental services, such as check-ups, cleanings, fillings, and extractions. The level of dental coverage can vary depending on the policy level.

- Optical: Covers a portion of the costs associated with optical services, such as eye exams, glasses, and contact lenses. The level of optical coverage can vary depending on the policy level.

- Physiotherapy: Covers a portion of the costs associated with physiotherapy services, such as treatment for injuries, pain management, and rehabilitation. The level of physiotherapy coverage can vary depending on the policy level.

- Alternative Therapies: Covers a portion of the costs associated with alternative therapies, such as acupuncture, chiropractic, and massage therapy. The level of alternative therapy coverage can vary depending on the policy level.

Comparing Policy Types

| Feature | Hospital Cover | Extras Cover | Combined Policies |

|---|---|---|---|

| Coverage | Hospitalization expenses, surgery, accommodation, medical services | Non-hospital healthcare services, such as dental, optical, physiotherapy, alternative therapies | Both hospital and extras cover |

| Benefits | Access to private hospitals, shorter waiting times, greater choice in medical care | Financial assistance for non-hospital healthcare expenses | Comprehensive coverage for both hospital and non-hospital healthcare expenses |

| Premiums | Higher premiums due to broader coverage | Lower premiums compared to hospital cover | Premiums vary depending on the combination of hospital and extras cover |

| Suitability | Individuals seeking access to private hospitals, shorter waiting times, and greater choice in medical care | Individuals seeking financial assistance for non-hospital healthcare expenses | Individuals seeking comprehensive coverage for both hospital and non-hospital healthcare expenses |

Navigating the Private Health Insurance Market

The Australian private health insurance market is diverse, offering a wide range of policies and providers. Navigating this market can be overwhelming, especially for first-time buyers. This section provides practical tips and strategies for finding the best private health insurance policy for your needs.

Understanding Private Health Insurance Providers

Australia’s private health insurance market is comprised of several major providers, each with unique offerings and features. Understanding these providers and their strengths can help you narrow your search.

- Bupa: One of the largest providers in Australia, Bupa offers a comprehensive range of health insurance products, including hospital and extras cover. They are known for their strong customer service and innovative health management programs.

- Medibank Private: Another leading provider, Medibank Private offers a wide selection of policies, including flexible options for budget-conscious individuals. They are known for their online tools and digital platforms for managing health insurance.

- NIB: NIB is a reputable provider with a focus on value and affordability. They offer a range of policies tailored to different needs and budgets, including specific plans for families and young adults.

- HCF: HCF is a not-for-profit health fund known for its community focus and commitment to affordability. They offer a wide range of policies, including options for seniors and those with pre-existing conditions.

- Australian Unity: Australian Unity is a mutual health fund that prioritizes member benefits and long-term value. They offer a range of policies, including options for specific health needs, such as dental or mental health.

Finding the Best Private Health Insurance Policy

Choosing the right private health insurance policy requires careful consideration of your individual needs, budget, and health priorities. Here are some tips to help you find the best policy:

- Assess your health needs: Consider your current and potential health needs, including any pre-existing conditions. Determine which services are most important to you, such as hospital cover, dental, or optical.

- Set a budget: Establish a clear budget for your monthly premiums. Consider your income, expenses, and financial commitments. Remember that premiums can vary significantly based on factors like age, location, and chosen level of cover.

- Compare policies: Utilize online comparison tools and websites to compare premiums, coverage, and other policy features across different providers. This allows you to see the best value for your money and identify policies that align with your needs.

- Read policy documents carefully: Before making a decision, carefully read the policy documents, including the product disclosure statement (PDS), to fully understand the terms and conditions, exclusions, and waiting periods.

- Seek professional advice: Consider consulting with a financial advisor or health insurance broker who can provide impartial advice and help you navigate the complex market. They can assess your needs and recommend suitable policies based on your specific circumstances.

Comparing Premiums, Coverage, and Other Features

When comparing private health insurance policies, it’s essential to consider various factors beyond just the premium price. Here are some key aspects to compare:

- Premiums: Compare monthly premiums across different providers and policies. Remember that lower premiums may come with limited coverage, so it’s important to weigh the cost against the benefits.

- Hospital cover: Assess the level of hospital cover offered, including the types of hospitals covered, waiting periods, and the extent of coverage for different procedures and treatments.

- Extras cover: Compare the extras benefits offered, such as dental, optical, physiotherapy, and other allied health services. Consider your individual needs and the frequency with which you utilize these services.

- Waiting periods: Check the waiting periods for different services and treatments. These periods specify the time you must wait before claiming benefits for certain services. Shorter waiting periods can be beneficial, but they may come with higher premiums.

- Exclusions and limitations: Carefully review the policy documents to understand any exclusions or limitations on coverage. These can include specific procedures, conditions, or providers that are not covered.

- Customer service: Consider the provider’s reputation for customer service, including their responsiveness, communication, and claim processing efficiency. Read online reviews and testimonials to gauge their overall customer satisfaction.

Utilizing Comparison Websites and Tools

Online comparison websites and tools can be invaluable resources for comparing private health insurance policies. These platforms allow you to enter your details and preferences, then display a range of policies from different providers. This enables you to quickly compare premiums, coverage, and other features side-by-side, making it easier to find the best value for your money.

“Comparison websites are a great starting point for your search, but remember to always read the policy documents carefully before making a decision.”

- Compare the Market: A popular comparison website that allows you to compare quotes from multiple providers across a range of insurance products, including private health insurance.

- iSelect: Another leading comparison website that offers a wide range of insurance products, including private health insurance, with detailed information and user-friendly tools.

- Canstar: Canstar provides independent ratings and reviews of insurance products, including private health insurance, based on factors like value, features, and customer satisfaction.

Financial Aspects of Private Health Insurance

Understanding the financial implications of private health insurance is crucial for making informed decisions. This section delves into the cost of premiums, potential tax benefits, and strategies for managing expenses effectively.

Cost of Private Health Insurance Premiums

The cost of private health insurance premiums varies based on several factors. Understanding these factors helps individuals estimate their potential expenses and choose a plan that aligns with their budget.

- Age: Younger individuals generally pay lower premiums compared to older individuals, as they are statistically less likely to require extensive medical care.

- Location: Premiums can differ depending on the geographic location, reflecting variations in healthcare costs and service availability.

- Health Status: Individuals with pre-existing health conditions might face higher premiums due to a greater likelihood of needing medical services.

- Level of Cover: The comprehensiveness of the health insurance policy significantly influences the premium cost. More comprehensive policies offering wider coverage typically come with higher premiums.

- Family Size: Family policies covering multiple individuals will naturally have higher premiums than individual policies.

- Lifestyle Factors: Certain lifestyle factors, such as smoking, can affect premium costs.

Tax Benefits Associated with Private Health Insurance

The Australian government offers tax benefits for individuals who hold private health insurance. These benefits aim to encourage participation in the private health insurance system and reduce the financial burden.

- Private Health Insurance Rebate: This is a government subsidy that reduces the cost of private health insurance premiums. The rebate percentage varies based on age and income.

- Medicare Levy Surcharge: Individuals without private health insurance, who meet certain income thresholds, are subject to an additional Medicare levy surcharge. This surcharge encourages individuals to consider private health insurance as an alternative.

Managing Private Health Insurance Costs

Managing private health insurance costs involves strategies to optimize value and minimize expenses.

- Compare Policies: Regularly comparing policies from different insurers can help identify potential savings. Use online comparison tools or consult with a financial advisor.

- Consider a Basic Policy: If your health is generally good and you are primarily concerned about hospital cover, a basic policy might be sufficient and more affordable.

- Negotiate Premiums: Some insurers might be open to negotiating premiums, particularly if you have a long-standing relationship or a history of low claims.

- Take Advantage of Discounts: Explore potential discounts offered by insurers, such as group discounts or discounts for healthy lifestyle choices.

- Claim Regularly: If you require medical services, don’t hesitate to claim. This helps to offset the cost of premiums and maximize the value of your policy.

Making Informed Decisions

Choosing the right private health insurance policy is a significant decision, impacting your financial well-being and access to healthcare. To make an informed choice, it’s crucial to consider your individual health needs, financial situation, and available options.

Understanding Your Health Needs

It’s essential to understand your specific health needs and priorities when selecting a private health insurance policy. This involves considering your current health status, family history, and potential future healthcare requirements. For example, if you have a pre-existing condition, you might prioritize a policy that covers specific treatments or therapies.

Assessing Your Financial Situation

Your financial situation plays a crucial role in deciding on the right private health insurance policy. It’s important to consider your income, expenses, and savings when evaluating different policy options. You should also consider the cost of premiums, potential out-of-pocket expenses, and the potential for tax benefits.

Utilizing Available Resources

Several resources can help you make an informed decision about private health insurance. These include:

- Government websites: The Australian Government’s Department of Health website provides comprehensive information on private health insurance, including policy types, benefits, and costs. You can also find information on the Private Health Insurance Ombudsman, which resolves disputes between consumers and private health insurers.

- Independent comparison websites: Websites like Compare the Market, iSelect, and Canstar allow you to compare different private health insurance policies side-by-side, based on your individual needs and budget.

- Financial advisors: Financial advisors can provide personalized advice on private health insurance, considering your overall financial situation and goals. They can help you understand the different policy options and recommend the best fit for your circumstances.

Considering Policy Features

When evaluating different private health insurance policies, it’s crucial to understand the features and benefits offered. Some key aspects to consider include:

- Coverage levels: Policies offer different levels of coverage, ranging from basic hospital cover to comprehensive extras cover. Choosing the right level depends on your individual needs and budget.

- Waiting periods: Some policies have waiting periods before you can access certain benefits. It’s important to understand these waiting periods before making a decision.

- Exclusions and limitations: Policies may have exclusions and limitations on certain treatments or services. Carefully review the policy document to understand any restrictions.

- Premium structure: Premiums can vary depending on your age, health status, and the policy’s coverage level. It’s essential to compare premiums from different insurers and choose a policy that fits your budget.

Seeking Professional Advice

While there are numerous resources available, it’s often beneficial to seek professional advice from a financial advisor or health insurance broker. They can provide personalized guidance based on your specific circumstances and help you navigate the complex world of private health insurance.

Concluding Remarks

Ultimately, the decision to purchase private health insurance in Australia is a personal one, influenced by individual needs, financial circumstances, and priorities. By carefully considering the factors Artikeld in this guide, you can navigate the market, compare options, and find a policy that aligns with your specific requirements. Remember, informed decision-making is key to ensuring you receive the healthcare coverage that best suits your needs and budget.

Clarifying Questions

What are the different types of private health insurance available in Australia?

Private health insurance in Australia generally falls into two categories: hospital cover and extras cover. Hospital cover provides financial assistance for hospital stays and related procedures, while extras cover helps pay for a range of services like dental, optical, physiotherapy, and other allied health services.

How do I know if I need private health insurance?

The need for private health insurance is highly individual. Factors to consider include your health status, risk tolerance, financial capacity, and access to specialist care. If you value faster access to treatment, specific procedures, or the ability to choose your specialist, private health insurance may be beneficial.

What are the tax benefits of private health insurance?

Australia offers tax incentives for private health insurance. Depending on your age and income, you may be eligible for a private health insurance rebate, which reduces the cost of your premiums. There are also tax benefits for certain types of private health insurance, such as those covering hospital stays.