- Eligibility Requirements for Adding a Parent to Your Health Insurance

- Types of Health Insurance Plans and Parent Coverage

- Cost Considerations for Adding a Parent

- Enrollment and Application Process

- Impact on Your Coverage and Premiums: Can I Add My Mom To My Health Insurance

- Alternative Coverage Options for Parents

- Legal and Ethical Considerations

- Last Word

- Frequently Asked Questions

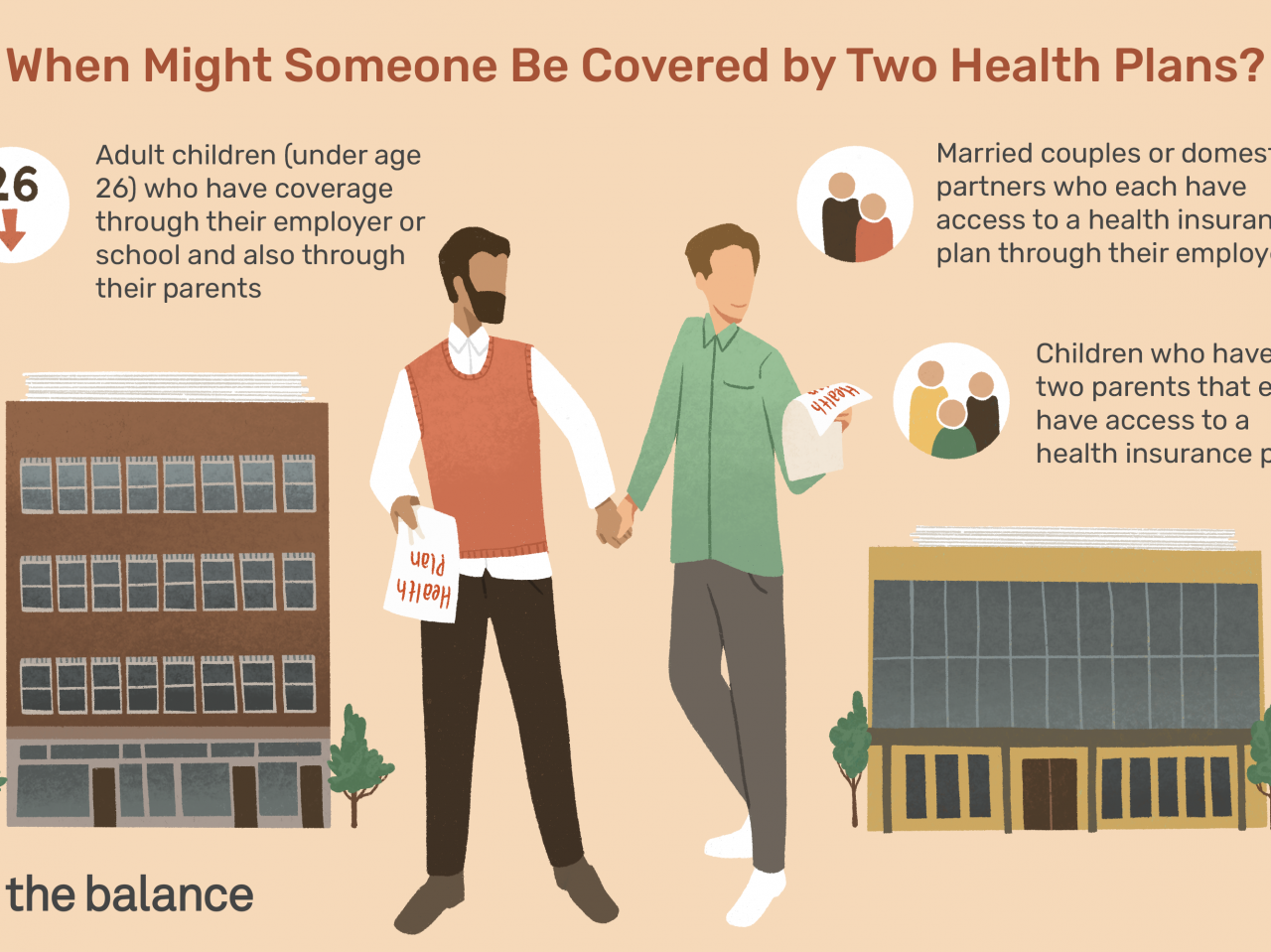

Can I add my mom to my health insurance? It’s a common question for many individuals, especially as parents age and their healthcare needs change. Adding a parent to your health insurance plan can provide them with valuable coverage, but it’s crucial to understand the eligibility requirements, cost considerations, and potential impact on your own plan.

This guide will explore the intricacies of adding a parent to your health insurance, delving into eligibility criteria, different plan types, cost implications, and alternative coverage options. We’ll also touch upon legal and ethical considerations, ensuring you have a comprehensive understanding of the process and its potential implications.

Eligibility Requirements for Adding a Parent to Your Health Insurance

Adding your parent to your health insurance plan can provide them with crucial coverage, but certain eligibility requirements must be met. These requirements can vary depending on your insurance provider and the specific plan you have.

Age Requirements

The age requirement for adding a parent to your health insurance plan is typically based on the parent’s age and their dependency status. In most cases, parents must be at least 55 years old to be eligible for coverage under a child’s plan. However, some insurance providers may have different age requirements, so it’s essential to check with your specific insurer.

Residency Requirements

Most health insurance plans require that your parent reside in the same state as you to be eligible for coverage. This requirement ensures that your parent can access the same healthcare providers and facilities as you. If your parent lives in a different state, you may need to explore other options, such as purchasing a separate health insurance plan for them.

Dependency Status Requirements

In most cases, your parent must be financially dependent on you to be eligible for coverage under your health insurance plan. This means that you must provide a significant portion of their financial support, including their housing, food, and medical expenses. To prove dependency, you may need to provide documentation such as tax returns or bank statements.

Income Limitations

Some health insurance plans may have income limitations for adding a parent. This means that your parent’s income must be below a certain threshold to qualify for coverage. These income limitations can vary depending on the specific plan and your insurance provider.

Types of Health Insurance Plans and Parent Coverage

Understanding the different types of health insurance plans available is crucial when considering adding a parent to your coverage. Each plan type has unique features and rules regarding parent coverage, which can impact your options and costs.

Individual Health Insurance Plans

Individual health insurance plans are purchased by individuals, not through an employer. They offer a range of coverage options and can be tailored to meet specific needs. While individual plans generally allow adding dependents, including parents, they may have limitations.

- Eligibility: Most individual plans require parents to meet specific eligibility criteria, such as age, residency, and income. These requirements vary depending on the insurance provider and state regulations.

- Cost: Adding a parent to an individual plan can significantly increase premiums, especially if they have pre-existing health conditions.

- Coverage: The level of coverage for parents may differ from the individual’s coverage. Some plans may have lower coverage limits or exclude certain benefits for dependents.

Family Health Insurance Plans

Family health insurance plans are designed to cover multiple family members, including parents, spouses, and children. These plans typically offer comprehensive coverage and can be a cost-effective option for families.

- Eligibility: Family plans typically have broader eligibility criteria than individual plans, making it easier to add parents. However, age limits and other requirements may apply.

- Cost: While adding a parent to a family plan will increase premiums, the cost may be lower than purchasing separate individual plans.

- Coverage: Family plans usually provide similar coverage for all family members, including parents. However, certain limitations may exist, such as age-based restrictions on coverage for certain services.

Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans are offered by employers to their employees and their dependents. These plans often provide extensive coverage and may be more affordable than individual or family plans.

- Eligibility: Eligibility for parent coverage under employer-sponsored plans typically depends on the employer’s plan rules and the employee’s relationship to the parent. Some employers may allow employees to add parents as dependents, while others may have restrictions.

- Cost: The cost of adding a parent to an employer-sponsored plan is usually determined by the employer’s plan structure and the parent’s health status.

- Coverage: The coverage provided to parents under employer-sponsored plans can vary depending on the employer’s plan and the employee’s benefits package. Some plans may offer full coverage, while others may have limitations.

Cost Considerations for Adding a Parent

Adding a parent to your health insurance plan can significantly impact your monthly premiums. The cost will depend on several factors, including your parent’s age, health status, and the type of health insurance plan you choose.

Factors Influencing Cost

- Age: Older individuals generally have higher healthcare costs due to increased risk of health issues. As a result, insurance companies may charge higher premiums for older adults.

- Health Status: If your parent has pre-existing medical conditions, they may require more frequent medical care, leading to higher insurance premiums. Insurance companies consider pre-existing conditions when determining premiums.

- Plan Type: The type of health insurance plan you choose can also influence the cost. For example, a comprehensive plan with extensive coverage may be more expensive than a basic plan with limited coverage.

Cost-Saving Strategies

- Compare Different Plans: Before adding your parent to your plan, it’s essential to compare different plans from various insurance providers. This will allow you to identify the most affordable option that meets your parent’s needs.

- Explore Subsidies: The Affordable Care Act (ACA) offers subsidies to individuals and families who meet certain income requirements. These subsidies can help offset the cost of health insurance premiums.

Enrollment and Application Process

Adding your parent to your health insurance plan usually involves contacting your insurance provider and providing them with the necessary information and documentation. The specific steps and requirements may vary depending on your insurance company and plan.

Steps to Enroll a Parent, Can i add my mom to my health insurance

The process of adding a parent to your health insurance plan typically involves these steps:

- Contact your insurance provider: Reach out to your insurance company’s customer service department or visit their website to initiate the enrollment process.

- Provide information about your parent: You’ll need to furnish details like your parent’s name, date of birth, Social Security number, address, and any other required information.

- Complete the application: Your insurance provider will likely provide an application form for you to complete, which will gather information about your parent’s health history and coverage needs.

- Submit required documentation: Depending on your insurance plan and state regulations, you might need to provide proof of your parent’s residency, income, or other supporting documents.

- Pay the premium: Once your parent is enrolled, you’ll need to pay any applicable premium adjustments or additional costs.

Required Documentation

To successfully add your parent to your health insurance plan, you will need to provide the following documentation:

- Proof of relationship: This could be a birth certificate, adoption papers, or other legal documentation confirming your relationship with your parent.

- Proof of residency: Your parent will need to provide proof of their current address, such as a utility bill, lease agreement, or driver’s license.

- Income verification: Depending on your insurance plan, your parent may need to provide documentation about their income, such as tax returns or pay stubs.

- Health information: Your parent may be required to provide information about their health history, including any pre-existing conditions, medications, or recent medical treatments.

Enrollment Periods and Deadlines

Adding a parent to your health insurance plan may be subject to specific enrollment periods and deadlines.

- Open enrollment: This is a specific period during the year when you can make changes to your health insurance plan, including adding dependents.

- Special enrollment periods: In some cases, you may be eligible for a special enrollment period if you experience a qualifying life event, such as getting married, having a child, or losing other health coverage.

- Deadlines: Be aware of any deadlines associated with enrollment periods. Missing a deadline could delay your parent’s coverage.

Impact on Your Coverage and Premiums: Can I Add My Mom To My Health Insurance

Adding a parent to your health insurance plan can significantly impact your coverage and premiums. The changes depend on factors such as your plan type, the parent’s health status, and the insurer’s policies.

Potential Changes in Coverage

Adding a parent to your health insurance plan may affect your existing coverage. For instance, you might experience changes in deductibles, copayments, or out-of-pocket expenses.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Adding a parent might increase your deductible as insurers may adjust it based on the overall risk of covering multiple individuals.

- Copayments: Copayments are fixed amounts you pay for specific services, such as doctor’s visits or prescription drugs. Adding a parent might increase your copayments, especially if they have pre-existing conditions or require frequent medical care.

- Out-of-Pocket Expenses: Out-of-pocket expenses are the total amount you pay for healthcare costs before your insurance coverage kicks in. This includes deductibles, copayments, and coinsurance. Adding a parent might increase your out-of-pocket expenses, as you may need to pay more for their medical services.

Impact on Premiums

Adding a parent to your health insurance plan will likely increase your premiums. The extent of the increase depends on several factors, including the parent’s age, health status, and the type of plan.

- Age: Older individuals generally have higher healthcare costs due to increased health risks. Adding a parent to your plan, especially if they are older, will likely result in higher premiums.

- Health Status: Individuals with pre-existing conditions or who require frequent medical care typically have higher healthcare costs. If your parent has health issues, adding them to your plan will likely lead to a more significant premium increase.

- Plan Type: Different health insurance plans have varying premium structures. For example, plans with lower deductibles and copayments often have higher premiums. Adding a parent to a plan with lower out-of-pocket costs may result in a more substantial premium increase.

Alternative Coverage Options for Parents

If your parents are not eligible to be added to your health insurance plan, there are other coverage options available to them. These options vary depending on your parents’ age, income, and health status.

Government-Sponsored Health Insurance Programs

Government-sponsored health insurance programs provide coverage to individuals who meet specific eligibility requirements.

Medicare

Medicare is a federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities.

- Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care.

- Medicare Part B covers doctor’s visits, outpatient care, preventive services, and some medical equipment.

- Medicare Part C (Medicare Advantage) offers private health insurance plans that cover the benefits of Medicare Parts A and B, and sometimes additional benefits.

- Medicare Part D covers prescription drugs.

Medicaid

Medicaid is a state-funded program that provides health coverage to low-income individuals and families. Eligibility requirements vary by state.

- Medicaid covers a wide range of health services, including doctor’s visits, hospital stays, prescription drugs, and mental health services.

- Individuals can apply for Medicaid through their state’s Department of Health and Human Services.

Private Health Insurance Plans

Private health insurance plans are available for individuals who do not qualify for government-sponsored programs.

Plans for Seniors

Seniors who are not eligible for Medicare or have high medical expenses may consider private health insurance plans specifically designed for seniors.

- These plans typically offer comprehensive coverage, including hospital stays, doctor’s visits, prescription drugs, and preventive care.

- Seniors can compare plans from different insurers to find the best coverage and price for their needs.

Plans for Individuals with Pre-Existing Conditions

Individuals with pre-existing conditions may find it challenging to obtain health insurance through the individual market.

- The Affordable Care Act (ACA) prohibits insurers from denying coverage or charging higher premiums based on pre-existing conditions.

- Individuals with pre-existing conditions can access coverage through the ACA’s health insurance marketplaces.

Legal and Ethical Considerations

Adding a parent to your health insurance plan involves navigating legal and ethical considerations, ensuring transparency, and respecting privacy. It’s essential to understand the implications of such a decision and to make informed choices.

Potential Conflicts of Interest

It’s important to understand potential conflicts of interest when adding a parent to your health insurance plan. While it’s a gesture of support, there are situations where it could be perceived as benefiting you more than your parent. For example, if your parent has a pre-existing condition that requires expensive treatments, adding them to your plan could increase your premiums. It’s crucial to have open and honest conversations with your parent about the financial implications and potential burdens involved.

Privacy Concerns

Adding a parent to your health insurance plan might raise privacy concerns. Your parent’s medical information will be shared with your insurer, and you may have access to this information. It’s essential to respect your parent’s privacy and ensure they are comfortable with this arrangement. You should discuss the implications of sharing their medical information with your insurer and ensure they understand the potential risks involved.

Last Word

Ultimately, deciding whether to add your mom to your health insurance is a personal decision based on your individual circumstances. By carefully considering the factors discussed in this guide, you can make an informed choice that best meets your needs and those of your loved ones. Remember, seeking professional advice from your insurance provider or a financial advisor can provide further clarity and support in navigating this complex process.

Frequently Asked Questions

Can I add my parent if they are retired?

Yes, you may be able to add a retired parent to your health insurance plan, but they must meet the eligibility requirements. This typically includes being a dependent and meeting age and residency criteria.

What if my parent has pre-existing conditions?

Pre-existing conditions can impact eligibility and premiums. Some plans may have limitations or exclusions for certain conditions. It’s crucial to review the plan details and consult with your insurance provider.

Are there any tax implications for adding a parent to my health insurance?

Adding a dependent to your health insurance plan may affect your tax deductions or credits. Consult a tax professional for specific advice on your situation.