Can I get a subsidy for health insurance? This is a question many Americans ask themselves as they navigate the complex world of healthcare. The Affordable Care Act (ACA) offers financial assistance in the form of subsidies to help individuals and families afford health insurance. These subsidies are available to those who meet certain income and other eligibility criteria, making health insurance more accessible for a wider range of Americans.

Understanding the different types of subsidies available, how to apply for them, and the factors that influence the amount received can be crucial in securing affordable healthcare coverage. This guide will delve into the intricacies of health insurance subsidies, providing insights into eligibility requirements, application processes, and resources for obtaining further information.

Eligibility for Health Insurance Subsidies

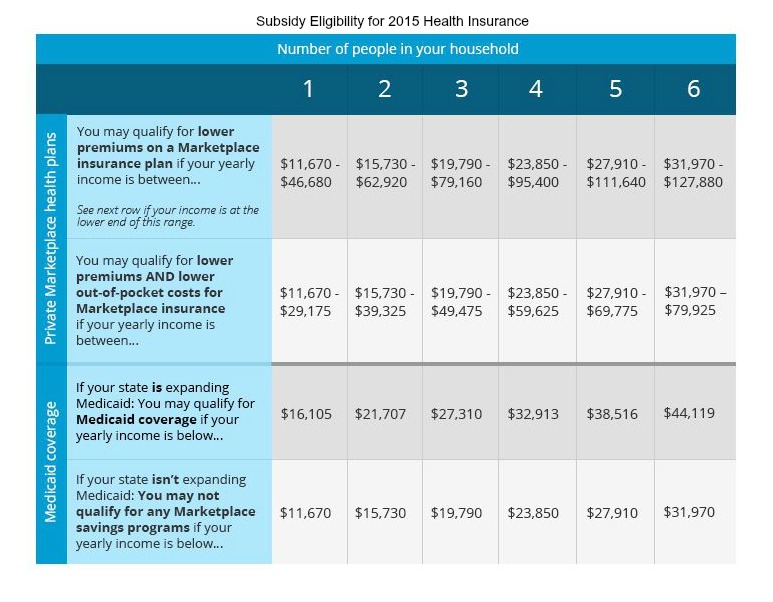

Health insurance subsidies can significantly reduce the cost of health coverage, making it more affordable for many individuals and families. These subsidies are available through various programs, including the Affordable Care Act (ACA) marketplace and state-specific programs. Eligibility for these subsidies is determined based on several factors, including income, family size, and location.

Income Eligibility

The most significant factor determining eligibility for health insurance subsidies is income. Income limits for subsidies vary depending on the program and the individual’s household size. Generally, individuals and families with lower incomes are eligible for larger subsidies.

For example, under the ACA marketplace, the maximum income level for subsidy eligibility in 2023 is 400% of the federal poverty level (FPL). This means that a single individual with an annual income of $51,520 or less is eligible for subsidies, while a family of four with an income of $106,000 or less is eligible. However, these income limits can vary slightly by state, and it is essential to check the specific requirements for your location.

Family Size

The size of an individual’s family also plays a crucial role in determining eligibility for subsidies. Larger families generally have higher income limits for subsidy eligibility. For example, a family of four might have a higher income limit than a single individual.

The following table shows the 2023 income limits for ACA marketplace subsidies based on family size:

| Family Size | Income Limit (400% FPL) |

|---|---|

| 1 | $51,520 |

| 2 | $69,680 |

| 3 | $87,840 |

| 4 | $106,000 |

| 5 | $124,160 |

| 6 | $142,320 |

| 7 | $160,480 |

| 8 | $178,640 |

Other Eligibility Factors

In addition to income and family size, other factors can affect eligibility for health insurance subsidies. These factors may include:

- Citizenship or Immigration Status: Most subsidies are available to U.S. citizens and lawful permanent residents. However, some states offer subsidies to undocumented immigrants.

- Age: Some programs offer subsidies based on age, particularly for individuals over 65 or those with pre-existing conditions.

- Location: State-specific programs may have different eligibility requirements based on the individual’s location.

- Health Status: Some subsidies are available for individuals with pre-existing conditions, such as diabetes or heart disease.

Types of Health Insurance Subsidies

The Affordable Care Act (ACA) provides various financial assistance programs to help individuals and families afford health insurance. These subsidies are designed to make health insurance more accessible and affordable, especially for those with lower incomes. Understanding the different types of subsidies available can help you determine if you qualify for financial assistance and how much you might save on your health insurance premiums.

Premium Tax Credits

Premium tax credits are the most common type of health insurance subsidy. These credits are available to individuals and families who purchase health insurance through the Health Insurance Marketplace. The amount of the tax credit is based on your household income and the cost of health insurance plans in your area.

The premium tax credit is applied directly to your health insurance premium, reducing your monthly cost. It can be claimed either as a reduction in your tax liability during tax season or as an advance payment throughout the year.

The premium tax credit can significantly lower the cost of health insurance, making it more affordable for many individuals and families.

Cost-Sharing Reductions

Cost-sharing reductions are subsidies that help lower the out-of-pocket costs associated with health insurance, such as deductibles, copayments, and coinsurance. These reductions are available to individuals and families who meet certain income requirements and purchase a Silver plan through the Health Insurance Marketplace.

The amount of the cost-sharing reduction varies based on your income level and the specific plan you choose.

Cost-sharing reductions can help to make health insurance more affordable by reducing the amount you have to pay out of pocket for healthcare services.

Out-of-Pocket Maximum Limits

Out-of-pocket maximum limits are another type of subsidy that helps to protect individuals and families from excessive healthcare costs. This limit represents the maximum amount you will have to pay for healthcare expenses in a given year, including deductibles, copayments, and coinsurance. Once you reach this limit, your health insurance plan will cover all remaining healthcare costs for the rest of the year.

The out-of-pocket maximum limit varies depending on your health insurance plan and the type of coverage you have.

Out-of-pocket maximum limits provide peace of mind knowing that you will not be burdened with excessive healthcare costs, even if you face a major health event.

Applying for Health Insurance Subsidies

Once you’ve determined your eligibility for health insurance subsidies, you can proceed with the application process. The process typically involves gathering necessary information, completing an application, and submitting it for review. The time frame for processing applications and receiving subsidy approval can vary depending on the specific program and the time of year.

Applying through the ACA Marketplace

The Affordable Care Act (ACA) Marketplace, also known as HealthCare.gov, is a federal platform where individuals can explore health insurance plans and apply for subsidies. Here’s a step-by-step guide for applying through the ACA Marketplace:

- Create an account: Visit HealthCare.gov and create an account. You’ll need to provide basic information such as your name, address, and Social Security number.

- Provide income and household information: During the application process, you’ll be asked to provide information about your income and household size. This information will be used to determine your eligibility for subsidies.

- Explore available plans: After providing your information, you’ll be presented with a list of health insurance plans available in your area. You can compare plans based on factors like monthly premiums, deductibles, and coverage.

- Enroll in a plan: Once you’ve chosen a plan, you can enroll in it through the Marketplace. Your subsidy will be automatically applied to your monthly premium.

Applying through State-Specific Programs

Some states have their own health insurance marketplaces or programs that offer subsidies in addition to the federal ACA Marketplace. To apply for subsidies through a state-specific program, you’ll need to visit the website of your state’s health insurance exchange or contact your state’s health insurance department for information.

Required Documentation and Information

To apply for health insurance subsidies, you’ll typically need to provide the following documentation and information:

- Proof of income: This can include pay stubs, tax returns, or other documentation that verifies your income. If you’re self-employed, you may need to provide income statements or business tax returns.

- Social Security number: Your Social Security number is required to verify your identity and eligibility for subsidies.

- Proof of citizenship or legal residency: This can include a birth certificate, passport, or green card.

- Information about your household members: You’ll need to provide information about your spouse and any dependents, including their ages, Social Security numbers, and income.

Timeframes for Processing Applications

The time frame for processing applications and receiving subsidy approval can vary depending on the program and the time of year. Generally, it can take several weeks for your application to be processed. If you’re applying during the open enrollment period, you may be able to receive approval more quickly.

Note: If you’re experiencing a life-changing event, such as a job loss or a change in your family size, you may be eligible for a special enrollment period outside of the open enrollment period.

Resources for Subsidy Information

Navigating the world of health insurance subsidies can feel overwhelming. Luckily, there are several reliable resources available to guide you through the process. These resources offer a wealth of information, including eligibility requirements, application procedures, and subsidy amounts.

Government Websites, Can i get a subsidy for health insurance

Government websites are the most authoritative source for information about health insurance subsidies. The government manages these programs and provides detailed guidelines and updates.

- Healthcare.gov: The official website for the Affordable Care Act (ACA) marketplace, where you can find information about subsidies, eligibility requirements, and enrollment periods. This website also offers a subsidy calculator to estimate your potential savings.

- Medicaid.gov: The official website for Medicaid, a government-funded health insurance program for low-income individuals and families. Here, you can find information about Medicaid eligibility, benefits, and how to apply.

- State Health Insurance Marketplaces: Each state has its own marketplace website, which may offer additional information and resources specific to your state. You can find your state’s marketplace website on Healthcare.gov.

Consumer Advocacy Groups

Consumer advocacy groups are dedicated to protecting consumer rights and providing unbiased information. These groups often have resources and expertise on health insurance subsidies.

- The Kaiser Family Foundation: A non-profit organization that provides in-depth research and analysis on health care policy, including subsidies. They offer a wealth of information on their website, including reports, articles, and FAQs.

- The Center on Budget and Policy Priorities: A non-profit research and policy institute that focuses on issues related to poverty and inequality, including access to health care. They offer detailed analysis and resources on health insurance subsidies.

- The National Consumer Law Center: A non-profit organization that advocates for consumer rights and provides legal assistance. They offer information and resources on health insurance subsidies, including legal guidance on consumer protection.

Health Insurance Providers

Health insurance providers can also provide information about subsidies. They may offer resources and tools to help you determine your eligibility and estimate your savings.

- Health Insurance Marketplace Providers: Health insurance providers that participate in the ACA marketplace can provide information about subsidies and enrollment procedures. You can contact them directly or visit their websites.

- Private Health Insurance Providers: Private health insurance providers may also offer subsidies, although these are typically not as extensive as those offered through the ACA marketplace. Contact your insurer directly to inquire about their subsidy programs.

Final Conclusion

Navigating the world of health insurance subsidies can seem daunting, but with a clear understanding of the eligibility requirements, application procedures, and available resources, individuals can make informed decisions about their healthcare coverage. By exploring the different types of subsidies, evaluating their benefits and drawbacks, and staying informed about potential changes, individuals can maximize their chances of obtaining affordable and comprehensive health insurance.

General Inquiries: Can I Get A Subsidy For Health Insurance

How do I know if I qualify for a health insurance subsidy?

You can determine your eligibility for subsidies by visiting the HealthCare.gov website and using their online tool. This tool will ask for your income, family size, and location to calculate your potential subsidy amount.

What happens if my income changes after I receive a subsidy?

If your income changes significantly, you may need to update your information with the marketplace. This could result in a change to your subsidy amount or even a loss of eligibility.

Are there any income limits for receiving a subsidy?

Yes, there are income limits for receiving subsidies. The exact limits vary based on your family size and location. You can find the specific income limits for your state on the HealthCare.gov website.

What if I don’t have access to the internet to apply for a subsidy?

You can apply for subsidies by phone or mail. The HealthCare.gov website provides contact information for both options. You can also seek assistance from local organizations that offer enrollment help.