- Understanding Health Insurance Basics

- Eligibility and Enrollment

- Cost and Affordability

- Coverage and Benefits

- Health Insurance Marketplaces and Providers

- Choosing the Right Health Insurance Plan: Can I Get Health Insurance

- Understanding Your Policy and Coverage

- Managing Your Health Insurance

- Health Insurance Changes and Updates

- Conclusive Thoughts

- Top FAQs

Can I get health insurance? It’s a question many people ask, especially as healthcare costs continue to rise. The answer is often yes, but navigating the world of health insurance can be confusing. This guide aims to demystify the process, explaining different types of plans, eligibility requirements, and how to find the best coverage for your needs.

Understanding your options and the factors that influence cost is crucial for making informed decisions about your health insurance. Whether you’re an individual seeking coverage or part of a group, this guide will provide valuable insights into the world of health insurance.

Understanding Health Insurance Basics

Health insurance is a crucial aspect of financial planning, providing protection against unexpected medical expenses. It acts as a safety net, ensuring access to necessary healthcare services without financial strain. Understanding the different types of health insurance plans available and their key features is essential for making informed decisions about your coverage.

Types of Health Insurance Plans

Health insurance plans can be broadly categorized into different types, each with unique characteristics and benefits. Here are some of the most common types:

- Health Maintenance Organization (HMO): HMOs offer comprehensive health coverage through a network of providers. Members typically choose a primary care physician (PCP) who acts as a gatekeeper to specialist care. HMOs generally have lower premiums than other plans but may have more restrictive coverage.

- Preferred Provider Organization (PPO): PPOs provide greater flexibility than HMOs, allowing members to choose healthcare providers both within and outside the network. However, out-of-network care usually comes with higher costs. PPOs generally have higher premiums than HMOs.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs in that they require members to use providers within their network. However, unlike HMOs, EPOs do not typically require a PCP referral for specialist care. EPOs often have lower premiums than PPOs but offer limited out-of-network coverage.

Individual vs. Employer-Sponsored Health Insurance

The source of your health insurance can significantly impact your coverage and costs. Here’s a breakdown of the key differences:

- Individual Health Insurance: Purchased directly from an insurance company, individual health insurance offers flexibility in choosing plans and providers. However, premiums can be higher than employer-sponsored plans, and coverage may be limited.

- Employer-Sponsored Health Insurance: Offered by employers as part of employee benefits, employer-sponsored health insurance typically provides broader coverage and lower premiums compared to individual plans. However, plan options and coverage may be limited by the employer.

Eligibility and Enrollment

To access health insurance, you need to meet certain eligibility requirements and understand the enrollment periods. Let’s explore the details.

Eligibility Requirements

Eligibility for health insurance is based on factors like your age, residency, employment status, and income. Here’s a breakdown:

- Age: Most health insurance plans are available to individuals of all ages, although some plans might have specific age restrictions.

- Residency: You typically need to be a resident of the state or country where you’re applying for health insurance.

- Employment Status: Some health insurance plans are tied to your employment. If you’re employed, your employer might offer group health insurance plans, or you might be eligible for plans through a professional organization.

- Income: Your income might influence your eligibility for certain government-sponsored health insurance programs, like Medicaid or the Children’s Health Insurance Program (CHIP). These programs have income limits and other eligibility criteria.

Enrollment Periods

Health insurance enrollment periods vary depending on the type of plan and your situation. Understanding these periods is crucial for getting the coverage you need:

- Open Enrollment: This is the annual period when you can enroll in or change health insurance plans without a qualifying life event. The open enrollment period typically occurs from November 1st to January 15th of each year. Changes made during open enrollment take effect the following year.

- Special Enrollment Period: You can enroll in or change health insurance plans outside of open enrollment if you experience a qualifying life event. These events include getting married, having a baby, losing job-based health insurance, or moving to a new state. You have a limited time to enroll after the event occurs.

Applying for and Enrolling in a Health Insurance Plan

The process of applying for and enrolling in a health insurance plan typically involves these steps:

- Determine your eligibility: Check your eligibility based on your age, residency, employment status, and income.

- Research health insurance plans: Explore different plans offered in your area, considering factors like coverage, premiums, deductibles, and copayments.

- Compare plans: Use online comparison tools or consult with an insurance broker to compare different plans and find the best fit for your needs and budget.

- Complete an application: Fill out an application online, over the phone, or in person. You’ll typically need to provide personal information, including your Social Security number, income, and health history.

- Review and submit your application: Carefully review your application before submitting it. Ensure all information is accurate and complete.

- Pay your premium: Once your application is approved, you’ll need to pay your first premium to activate your health insurance coverage.

Cost and Affordability

The cost of health insurance is a significant factor for many people when choosing a plan. Understanding how premiums are calculated and the various factors that influence cost is crucial for making informed decisions.

Factors Influencing Premium Costs

Several factors influence the cost of health insurance premiums. Understanding these factors can help you estimate the cost of your plan and make informed decisions about your coverage.

- Age: Older individuals generally have higher health care costs, leading to higher premiums. As people age, their risk of developing health issues increases, making them more likely to require medical care.

- Location: The cost of living, including healthcare costs, varies by location. Areas with higher healthcare costs tend to have higher premiums.

- Tobacco Use: Smokers are considered a higher risk than non-smokers, leading to higher premiums. Smoking increases the risk of developing various health issues, requiring more medical care.

- Plan Type: Different health insurance plans have varying levels of coverage and costs. Plans with lower deductibles and copayments generally have higher premiums than those with higher deductibles and copayments.

- Family Size: Premiums for family plans are higher than individual plans. This is because the plan covers more people, increasing the potential for healthcare costs.

- Health Status: Individuals with pre-existing conditions may have higher premiums. Insurance companies assess the risk of covering individuals based on their health history, and pre-existing conditions can increase the likelihood of needing medical care.

Comparing Costs of Different Health Insurance Plans

Different health insurance plans offer varying levels of coverage and costs. It’s important to compare plans carefully to find the best fit for your needs and budget.

- Bronze Plans: Bronze plans have the lowest premiums but the highest out-of-pocket costs. They typically cover 60% of medical costs, leaving you responsible for 40%. Bronze plans are a good option for healthy individuals who expect minimal healthcare use.

- Silver Plans: Silver plans offer a balance between premiums and out-of-pocket costs. They typically cover 70% of medical costs, leaving you responsible for 30%. Silver plans are a popular choice for individuals who want some coverage without high premiums.

- Gold Plans: Gold plans have higher premiums than bronze or silver plans but lower out-of-pocket costs. They typically cover 80% of medical costs, leaving you responsible for 20%. Gold plans are a good option for individuals who expect higher healthcare use or want more protection from high medical bills.

- Platinum Plans: Platinum plans have the highest premiums but the lowest out-of-pocket costs. They typically cover 90% of medical costs, leaving you responsible for 10%. Platinum plans are a good option for individuals with high healthcare needs who want the most comprehensive coverage.

Government Programs and Subsidies

Several government programs and subsidies are available to make health insurance more affordable.

- Marketplace Subsidies: The Affordable Care Act (ACA) provides subsidies to individuals and families who meet certain income requirements. These subsidies can help reduce the cost of premiums and out-of-pocket costs.

- Medicaid: Medicaid is a government-funded health insurance program for low-income individuals and families. Eligibility for Medicaid varies by state.

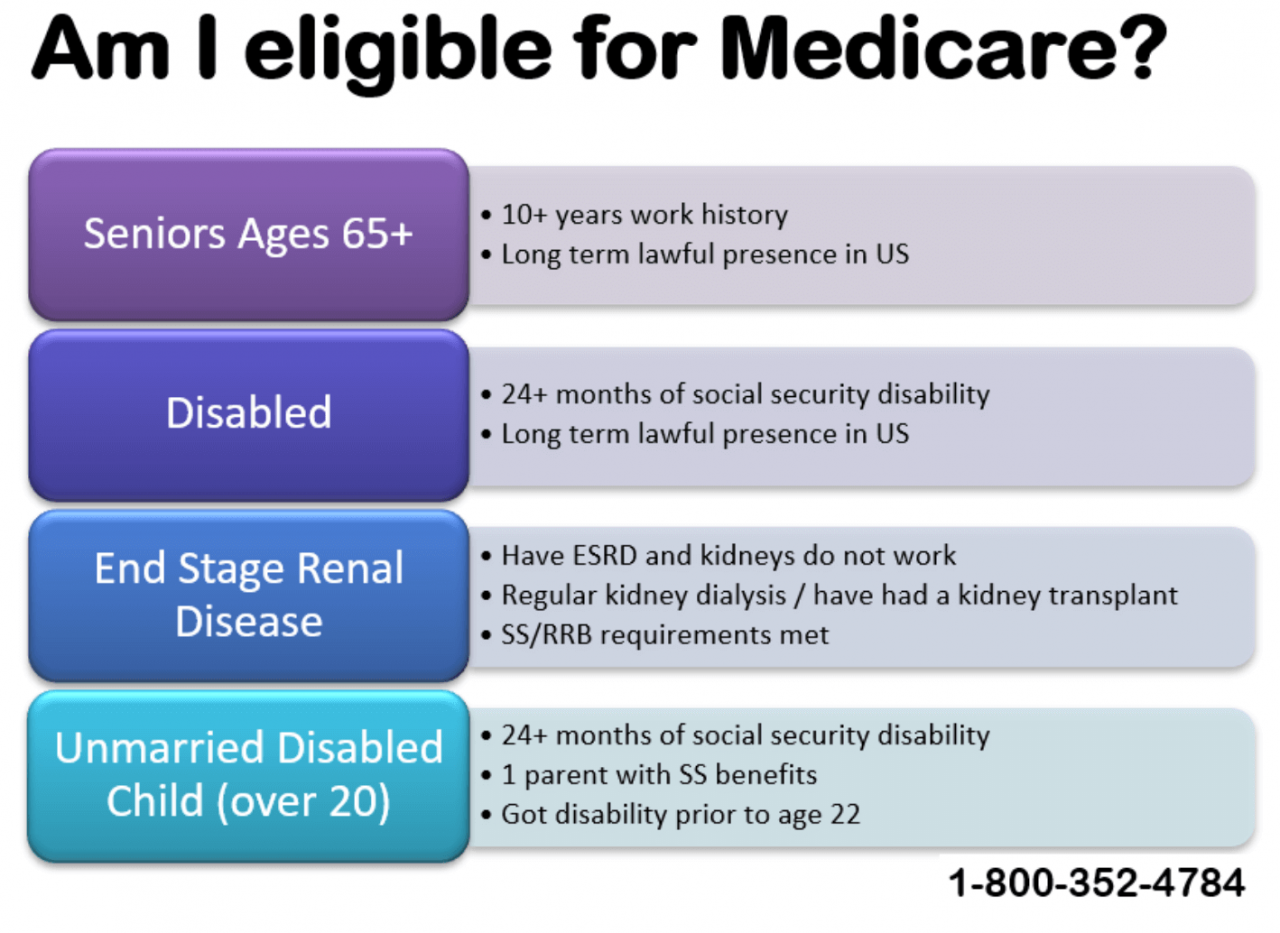

- Medicare: Medicare is a federal health insurance program for individuals aged 65 and older, as well as those with certain disabilities. Medicare offers various coverage options, including Original Medicare and Medicare Advantage.

Coverage and Benefits

Health insurance plans are designed to cover a wide range of medical expenses, providing financial protection against unexpected healthcare costs. Understanding the coverage and benefits included in your plan is crucial to making informed healthcare decisions and maximizing the value of your insurance.

Types of Medical Services Covered

Health insurance plans typically cover a variety of medical services, including:

- Doctor Visits: This includes visits to primary care physicians, specialists, and other healthcare providers for routine checkups, preventive care, and treatment of illnesses or injuries.

- Hospital Stays: Coverage for inpatient hospital care, including room and board, nursing care, and medical services provided during hospitalization.

- Prescription Drugs: Many plans cover prescription medications, although there may be limitations on the types of drugs covered and the amount you pay for them.

- Mental Health Services: Coverage for mental health treatment, including therapy, counseling, and medication.

- Preventive Care: Many plans cover preventive services such as vaccinations, screenings, and wellness programs.

- Emergency Care: Coverage for emergency medical services, including ambulance transportation and treatment in emergency rooms.

Exclusions and Limitations

While health insurance plans provide comprehensive coverage, they also have exclusions and limitations. These are specific services or conditions that are not covered or are subject to certain restrictions.

- Pre-existing Conditions: Some plans may have limitations on coverage for pre-existing medical conditions, which are health issues you had before enrolling in the plan. However, the Affordable Care Act prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions.

- Cosmetic Procedures: Most health insurance plans do not cover elective cosmetic procedures, such as plastic surgery for purely aesthetic reasons.

- Experimental Treatments: Coverage for experimental or investigational treatments may be limited or excluded, as their effectiveness and safety are not fully established.

- Out-of-Network Care: Plans often have higher out-of-pocket costs for care received from providers outside of their network. You may need to pay a higher co-pay, coinsurance, or deductible for out-of-network services.

Understanding Deductibles, Co-pays, and Coinsurance

It is important to understand the different cost-sharing mechanisms in health insurance plans, such as deductibles, co-pays, and coinsurance.

- Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in. Once you meet your deductible, your insurance will start covering a portion of your healthcare costs.

- Co-pay: A fixed amount you pay for certain medical services, such as doctor visits or prescription drugs.

- Coinsurance: A percentage of the cost of a medical service that you are responsible for paying, after your deductible is met. For example, if your coinsurance is 20%, you would pay 20% of the cost of a medical service, and your insurance would cover the remaining 80%.

Health Insurance Marketplaces and Providers

Navigating the world of health insurance can feel overwhelming, especially when trying to understand the different marketplaces and providers available. This section will provide a comprehensive overview of reputable health insurance marketplaces and providers, highlighting their key features and services to help you make an informed decision.

Reputable Health Insurance Marketplaces and Providers

- Health Insurance Marketplaces (State-based and Federal): These marketplaces, also known as exchanges, are designed to simplify the process of finding and purchasing health insurance. They offer a range of plans from different insurance companies, allowing you to compare coverage, costs, and benefits side-by-side.

- Healthcare.gov: The federal marketplace, available in most states, offers plans from multiple insurance companies. You can apply for financial assistance (tax credits) to help offset the cost of premiums.

- State-based Marketplaces: Many states operate their own marketplaces, offering similar features to Healthcare.gov but with potentially different plan options and enrollment periods.

- Direct-to-Consumer Insurance Companies: These companies offer health insurance plans directly to consumers, often through their websites or phone. They typically have a wider range of plans than marketplaces, but may not offer financial assistance.

- UnitedHealthcare: One of the largest health insurance companies in the United States, offering a variety of plans, including individual, family, and employer-sponsored plans.

- Anthem: Another major health insurance provider, offering plans through both marketplaces and directly to consumers.

- Cigna: A global health insurance company offering a range of health insurance plans, including individual, family, and employer-sponsored plans.

- Insurance Brokers: These professionals work with you to find the best health insurance plan based on your needs and budget. They can help you compare plans from different companies and navigate the enrollment process.

Comparison of Services and Features

- Plan Options: Marketplaces generally offer a wider range of plans, including bronze, silver, gold, and platinum plans, with varying levels of coverage and costs. Direct-to-consumer insurance companies may have a more limited selection of plans, but could offer specialized plans tailored to specific needs.

- Financial Assistance: Marketplaces offer subsidies and tax credits to help offset the cost of premiums for eligible individuals and families. Direct-to-consumer insurance companies may offer discounts or payment plans, but typically do not provide government subsidies.

- Customer Support: Marketplaces and direct-to-consumer insurance companies typically provide customer support through phone, email, and online chat. Some marketplaces may offer in-person assistance at enrollment centers.

- Network Coverage: The network of doctors, hospitals, and other healthcare providers covered by a health insurance plan can vary significantly between marketplaces and providers. It’s important to ensure that your preferred healthcare providers are in the plan’s network.

Marketplace Information Table

| Marketplace | Coverage Area | Plan Options | Customer Support |

|---|---|---|---|

| Healthcare.gov | Most states | Bronze, Silver, Gold, Platinum | Phone, email, online chat |

| State-based Marketplaces | Specific states | Varies by state | Phone, email, online chat, enrollment centers |

Choosing the Right Health Insurance Plan: Can I Get Health Insurance

Choosing the right health insurance plan can feel overwhelming, but it’s crucial for securing the coverage you need at a price you can afford. It’s about finding the right balance between cost, coverage, and your individual health needs.

Factors to Consider When Choosing a Health Insurance Plan, Can i get health insurance

Before you start comparing plans, consider your individual circumstances and priorities. This will help you narrow down your options and find the plan that best suits your needs.

- Your health status: If you have pre-existing conditions or anticipate needing frequent medical care, a plan with comprehensive coverage might be more beneficial.

- Your budget: Consider your monthly premium and out-of-pocket costs, such as deductibles and copayments.

- Your medical needs: Think about the types of medical services you anticipate using, such as doctor’s visits, prescription drugs, or hospital stays.

- Your location: The availability of providers and hospitals in your area can influence your plan choice.

- Your age: Younger and healthier individuals may find cheaper plans with lower premiums.

Evaluating Different Plan Options

Once you understand your needs, you can start evaluating different plan options.

- Compare premiums: Premiums are the monthly costs you pay for your health insurance. Look for plans with premiums that fit your budget.

- Analyze deductibles: Deductibles are the amount you pay out-of-pocket before your insurance starts covering costs. Lower deductibles mean you pay less upfront, but higher premiums.

- Evaluate copayments: Copayments are fixed fees you pay for specific services, such as doctor’s visits or prescriptions.

- Check coverage details: Understand the specific services covered by each plan, such as preventive care, hospitalization, and prescription drugs.

- Research provider networks: Ensure your preferred doctors and hospitals are included in the plan’s network.

- Read plan documents carefully: Review the plan’s policy documents to fully understand its terms and conditions.

Tips for Finding the Best Health Insurance Plan

- Use online comparison tools: Many websites offer free health insurance comparison tools that allow you to compare plans side-by-side.

- Consult with a broker: An insurance broker can help you navigate the complex world of health insurance and find the right plan for your needs.

- Don’t be afraid to ask questions: Contact insurance companies or brokers directly to clarify any questions or concerns you may have.

- Consider open enrollment periods: Open enrollment periods are specific times of year when you can enroll in or change your health insurance plan.

Understanding Your Policy and Coverage

Your health insurance policy is a vital document that Artikels your coverage and rights. Understanding its contents is crucial for making informed decisions about your healthcare and maximizing the benefits you’re entitled to.

Navigating Your Policy Document

Navigating your policy document can seem daunting, but with a systematic approach, you can quickly locate key information.

- Policy Summary: This section provides a concise overview of your coverage, including the types of benefits, deductibles, copayments, and other essential details.

- Table of Contents: Use the table of contents to easily find specific sections, such as coverage details, exclusions, and claim procedures.

- Glossary of Terms: Familiarize yourself with common health insurance terminology to understand the policy language.

- Benefit Descriptions: These sections explain the specifics of your coverage, including covered services, limits, and any pre-authorization requirements.

- Exclusions and Limitations: Carefully review the exclusions and limitations to understand what services are not covered or have specific restrictions.

- Claims Procedures: This section Artikels the steps involved in filing a claim, including necessary documentation and deadlines.

Common Terms and Definitions

Health insurance policies use specific terminology that can be confusing. Here are some common terms and their definitions:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in.

- Copayment: A fixed amount you pay for covered services, such as doctor visits or prescriptions.

- Coinsurance: A percentage of the cost of covered services that you share with your insurer.

- Premium: The monthly or annual fee you pay for your health insurance plan.

- Out-of-Pocket Maximum: The maximum amount you’ll pay for covered services in a year, after which your insurance covers the rest.

- Network: A group of healthcare providers, such as doctors, hospitals, and pharmacies, that have contracted with your insurance company.

- Formulary: A list of prescription drugs covered by your insurance plan.

Managing Your Health Insurance

Once you have health insurance, it’s essential to understand how to manage it effectively. This involves knowing how to file claims, access benefits, and minimize out-of-pocket costs.

Understanding Your Policy and Coverage

Your health insurance policy is a contract that Artikels the terms and conditions of your coverage. It’s crucial to understand your policy thoroughly to ensure you’re getting the most out of your insurance.

- Know your coverage details: Carefully review your policy to understand what services are covered, what your deductible and co-pay amounts are, and any limitations or exclusions.

- Check your coverage limits: Some policies have annual or lifetime limits on specific services. This information is crucial for planning your healthcare needs.

- Understand your network: Your health insurance policy will have a network of providers, hospitals, and pharmacies. It’s essential to choose providers within your network to ensure you receive coverage for your services.

- Review your policy regularly: Your insurance plan might change, or you might have changes in your health needs. Reviewing your policy regularly ensures you’re up-to-date with any changes and can adjust your plan accordingly.

Filing Claims and Accessing Benefits

When you receive medical services, you’ll need to file a claim to receive reimbursement from your insurance company.

- Gather necessary information: This includes your insurance card, provider’s billing information, and a copy of your medical bills.

- Submit your claim: You can submit your claim online, by mail, or through your provider’s office.

- Track your claim status: Most insurance companies have online portals where you can track the progress of your claim.

- Appeal denied claims: If your claim is denied, you have the right to appeal the decision. You should understand the process for appealing claims and gather any necessary documentation to support your appeal.

Minimizing Out-of-Pocket Costs

Out-of-pocket costs include deductibles, co-pays, and coinsurance. There are several strategies you can use to minimize these costs.

- Choose a plan with a lower deductible: A lower deductible means you’ll pay less upfront, but your monthly premiums might be higher.

- Utilize preventive services: Many health insurance plans cover preventive services like screenings and immunizations at no cost. Taking advantage of these services can help you stay healthy and avoid more expensive treatments later.

- Negotiate medical bills: You can often negotiate lower prices with providers or hospitals, especially if you’re paying out of pocket.

- Consider a Health Savings Account (HSA): If you have a high-deductible health plan, an HSA can help you save money on healthcare costs. HSAs allow you to contribute pre-tax dollars to an account that can be used for qualified medical expenses.

Health Insurance Changes and Updates

The healthcare landscape is constantly evolving, and with it, health insurance regulations and policies are subject to change. Staying informed about these updates is crucial for individuals and families to make informed decisions about their health insurance coverage.

Understanding the Dynamics of Change

The health insurance landscape is dynamic, driven by various factors like legislation, market trends, and technological advancements.

- Legislative Changes: Federal and state governments regularly enact new laws and regulations that impact health insurance. For instance, the Affordable Care Act (ACA) significantly reshaped the health insurance market, expanding coverage and introducing new regulations.

- Market Trends: Changes in the healthcare market, such as the emergence of new technologies, shifts in consumer preferences, and the rise of telehealth, can also influence health insurance policies.

- Economic Factors: Economic fluctuations, such as recessions or inflation, can impact health insurance costs and affordability.

Staying Informed about Updates

Staying informed about health insurance changes is crucial to ensure you have the best possible coverage. Here are some ways to stay up-to-date:

- Government Websites: Visit the websites of the Centers for Medicare & Medicaid Services (CMS) and your state’s insurance department for official updates and announcements.

- Insurance Provider Websites: Check the websites of your health insurance provider for any changes to your plan or new policy options.

- News and Media: Stay informed by reading reputable news sources that cover health insurance and healthcare policy.

- Consumer Advocacy Groups: Organizations like the Kaiser Family Foundation (KFF) and the National Committee for Quality Assurance (NCQA) provide valuable insights and analysis of health insurance trends.

Impact of New Legislation and Market Trends

New legislation and market trends can have a significant impact on health insurance, affecting factors like:

- Coverage: New laws may expand or restrict coverage for certain services or conditions.

- Cost: Changes in regulations or market dynamics can influence premiums, deductibles, and out-of-pocket costs.

- Eligibility: Eligibility requirements for certain health insurance programs may change.

- Plan Options: New health insurance plans may become available, or existing plans may be modified.

Conclusive Thoughts

Securing health insurance is a significant step towards protecting your well-being and financial stability. By understanding the basics, exploring your options, and choosing a plan that aligns with your needs, you can navigate the health insurance landscape with confidence. Remember, your health is your greatest asset, and having the right insurance coverage can make a world of difference.

Top FAQs

How do I know if I’m eligible for health insurance?

Eligibility for health insurance depends on factors like your age, income, employment status, and residency. You can check your eligibility through the Health Insurance Marketplace or by contacting insurance providers directly.

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician within their network. You’ll need a referral to see specialists. A PPO (Preferred Provider Organization) offers more flexibility, allowing you to see providers outside their network, although it may cost more.

What are some tips for lowering my health insurance costs?

You can potentially lower your premiums by choosing a plan with a higher deductible, enrolling in a health savings account (HSA), or comparing rates from different insurers.

How do I file a claim with my health insurance provider?

The process for filing a claim varies by provider. Typically, you’ll need to submit a claim form with details about your medical services and costs. Your provider will review the claim and process payment.