- Understanding Whole Life Insurance in Australia

- Eligibility and Requirements for Whole Life Insurance in Australia

- Factors Influencing Whole Life Insurance Premiums in Australia

- Benefits and Drawbacks of Whole Life Insurance in Australia

- Choosing the Right Whole Life Insurance Policy in Australia

- Tips for Obtaining Whole Life Insurance in Australia: Can I Get Whole Life Insurance In Australia

- Closure

- FAQ Guide

Can I get whole life insurance in Australia? This question often arises when individuals seek long-term financial security and a guaranteed death benefit for their loved ones. Whole life insurance, unlike term life insurance, provides lifelong coverage with a cash value component that grows over time. This unique combination makes it an attractive option for many Australians, but it’s crucial to understand the intricacies and considerations before making a decision.

This comprehensive guide delves into the world of whole life insurance in Australia, covering its features, eligibility requirements, premium factors, benefits, drawbacks, and essential tips for choosing the right policy. By understanding these aspects, you can determine if whole life insurance aligns with your financial goals and needs.

Understanding Whole Life Insurance in Australia

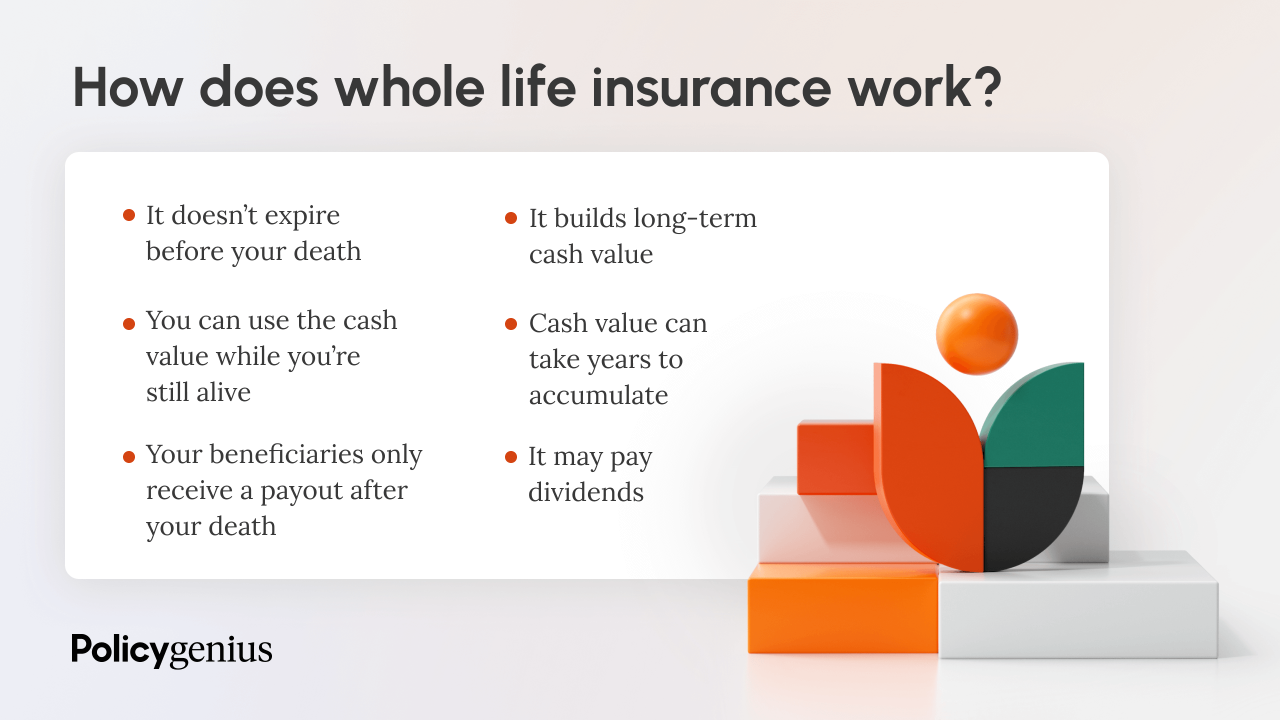

Whole life insurance is a type of permanent life insurance policy that provides coverage for your entire life, as long as you continue to pay your premiums. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection.

Key Features of Whole Life Insurance

Whole life insurance policies in Australia offer several key features, including:

- Death Benefit: This is the sum of money paid to your beneficiaries upon your death. The death benefit is guaranteed, regardless of when you pass away, as long as you keep paying your premiums.

- Cash Value: A portion of your premium payments accumulates as cash value, which you can borrow against or withdraw from the policy. The cash value grows over time, earning interest, and can be a source of funds for emergencies, retirement, or other financial needs.

- Premium Structure: Premiums for whole life insurance are typically fixed, meaning they remain the same throughout the life of the policy. This predictability makes it easier to budget for your insurance costs.

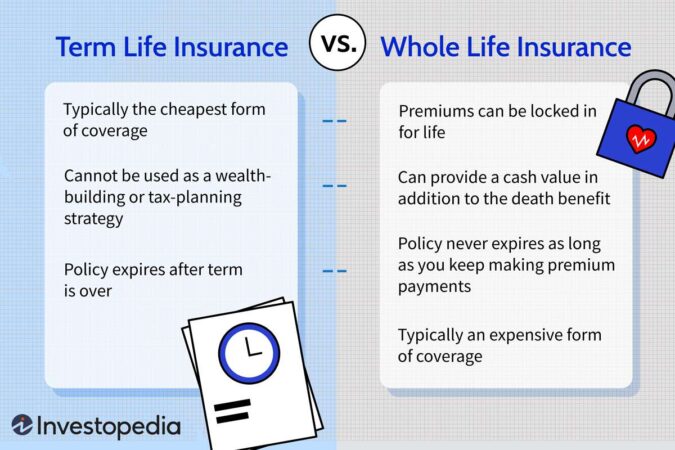

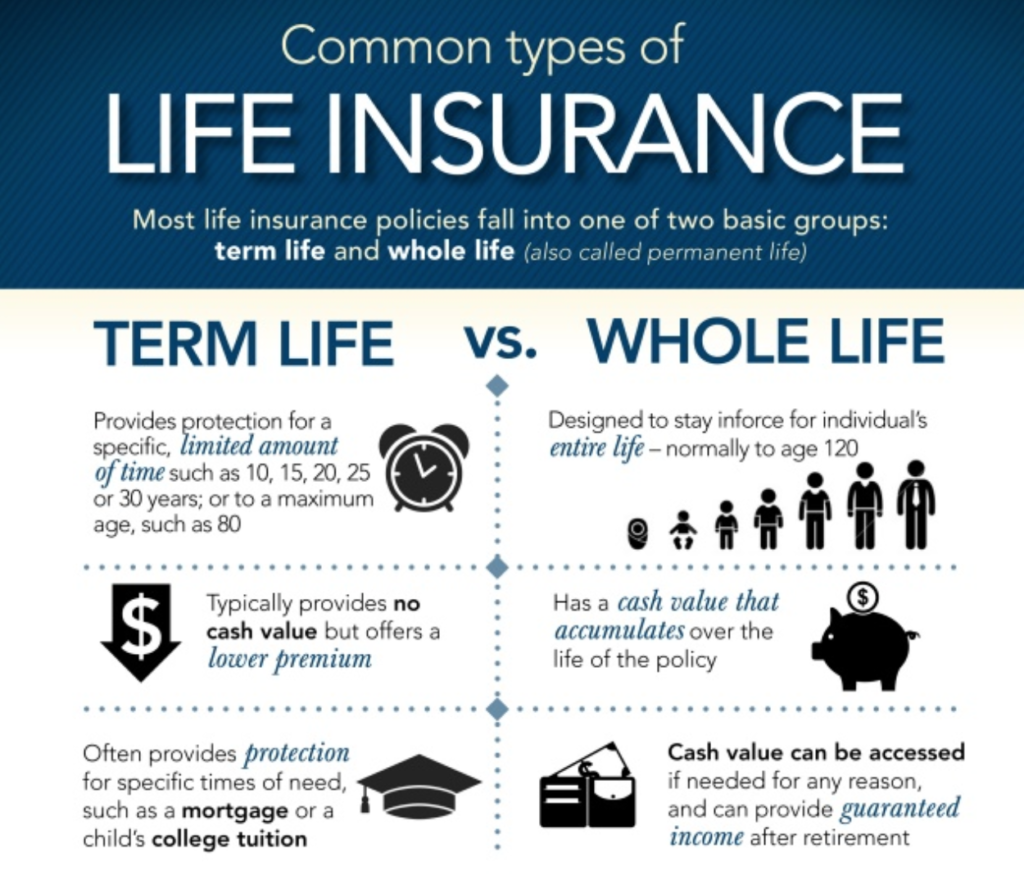

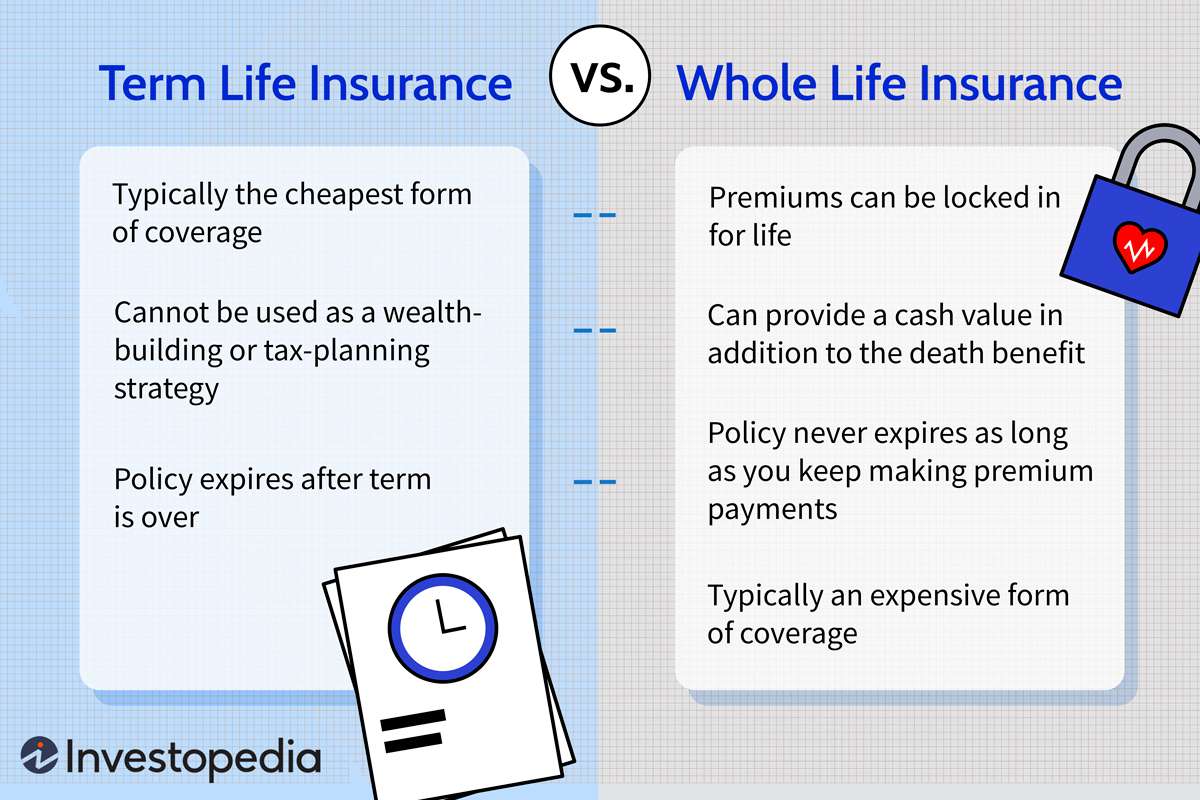

Comparison with Term Life Insurance

Whole life insurance differs significantly from term life insurance in several ways:

- Coverage Period: Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. Whole life insurance, on the other hand, provides coverage for your entire life.

- Premium Structure: Premiums for term life insurance are generally lower than those for whole life insurance, as they only cover the risk of death during the specified term. Whole life insurance premiums are higher because they include the cost of the cash value component.

- Cash Value: Term life insurance policies do not typically accumulate cash value. Whole life insurance policies build cash value over time, which can be accessed for various purposes.

Eligibility and Requirements for Whole Life Insurance in Australia

Obtaining whole life insurance in Australia requires meeting certain eligibility criteria, which primarily revolve around your age, health status, and financial situation. The application process involves submitting relevant documentation and information, followed by an underwriting assessment that determines your policy premium and coverage.

Age Requirements, Can i get whole life insurance in australia

The minimum age to apply for whole life insurance in Australia is typically 18 years old. However, some insurers may have a higher age limit for new applications, depending on their specific policies. For example, an insurer might not accept applications from individuals over 65 years old. It’s important to note that age limits may vary depending on the insurer, the type of policy, and the specific coverage amount.

Health Status

Whole life insurance providers assess your health status to determine your risk profile and assess the likelihood of you needing to claim on your policy. This typically involves a medical examination, which may include:

- A review of your medical history, including any pre-existing conditions.

- A physical examination, including blood pressure, height, and weight measurements.

- Blood and urine tests to assess your overall health.

Based on the results of the medical examination, insurers may classify you into different risk categories. Individuals with pre-existing health conditions or a history of certain illnesses may be considered higher risk and may be required to pay higher premiums.

Financial Situation

Insurers may also assess your financial situation to ensure you can afford the premiums for your whole life insurance policy. This may involve reviewing your income, expenses, and assets. Some insurers may require you to provide proof of income or financial statements. The assessment of your financial situation is crucial for ensuring you can maintain the policy over the long term.

Application Process

To apply for whole life insurance, you will typically need to provide the following information and documentation:

- Your personal details, including your name, address, date of birth, and contact information.

- Details about your health status, including any pre-existing conditions or medical history.

- Your financial situation, including your income, expenses, and assets.

- The desired coverage amount and the policy term.

You may also need to provide supporting documentation, such as:

- Proof of identity, such as a driver’s license or passport.

- Proof of income, such as pay slips or tax returns.

- Medical records, if applicable.

Underwriting Process

After you submit your application, it will be reviewed by an underwriter. The underwriter will assess your risk profile based on the information you have provided. This process involves reviewing your medical history, lifestyle, and financial situation.

The underwriting process is crucial for determining your premium and coverage.

If you are deemed a higher risk, you may be required to pay higher premiums or may be offered a policy with lower coverage. On the other hand, if you are considered a lower risk, you may be eligible for lower premiums or higher coverage.

Factors Influencing Whole Life Insurance Premiums in Australia

The cost of whole life insurance in Australia is determined by a number of factors, including your age, health, lifestyle, and the amount of coverage you need. Understanding these factors can help you make informed decisions about your insurance needs and find the best policy for you.

Age

Your age is one of the most significant factors that will influence your whole life insurance premiums. Younger individuals generally pay lower premiums compared to older individuals. This is because younger people are statistically less likely to pass away in the near future.

Health

Your health status is another critical factor in determining your premium. If you have a pre-existing medical condition, such as diabetes, heart disease, or cancer, you may be charged higher premiums. This is because you are considered a higher risk to insurers. For instance, a person with a history of heart disease might be charged a higher premium than someone with a clean bill of health.

Lifestyle

Your lifestyle choices can also affect your premium. For example, smokers typically pay higher premiums than non-smokers. This is because smoking increases the risk of developing various health problems, including cancer and heart disease. Similarly, individuals who engage in high-risk activities, such as skydiving or motorcycling, may also face higher premiums.

Coverage Amount

The amount of coverage you choose will also impact your premium. The higher the coverage amount, the higher the premium. This is because you are essentially paying for more financial protection in case of your death.

Other Factors

Other factors that can influence your whole life insurance premium include your occupation, family history, and even your driving record. Some occupations, such as those involving hazardous work environments, may lead to higher premiums. A family history of certain diseases can also increase your risk profile, resulting in higher premiums.

Benefits and Drawbacks of Whole Life Insurance in Australia

Whole life insurance offers a unique blend of financial protection and investment potential. Understanding both its advantages and disadvantages is crucial before making a decision.

Benefits of Whole Life Insurance

The benefits of whole life insurance are multifaceted, offering financial security and potential wealth accumulation.

- Guaranteed Death Benefit: Whole life insurance provides a guaranteed death benefit, ensuring your loved ones receive a predetermined sum upon your passing, regardless of market fluctuations. This financial safety net can be crucial for covering funeral expenses, outstanding debts, or supporting dependents.

- Cash Value Accumulation: A portion of your premium contributes to a cash value account, which grows over time, earning interest. You can access this cash value through withdrawals, loans, or even surrender the policy for its accumulated value. This feature adds an investment element to your insurance.

- Potential Tax Advantages: In Australia, the death benefit from whole life insurance is generally tax-free. The cash value accumulation can also be withdrawn tax-free in some cases, though specific tax rules apply. Consulting with a financial advisor is essential to understand the tax implications of your specific situation.

Drawbacks of Whole Life Insurance

While whole life insurance offers advantages, it also comes with drawbacks that are important to consider.

- Higher Premiums: Whole life insurance premiums are typically higher than term life insurance premiums due to the inclusion of the cash value component. This higher cost can be a significant financial burden for some individuals.

- Limited Flexibility: The fixed nature of whole life insurance can limit flexibility. Changing your coverage or accessing the cash value can be subject to certain restrictions and penalties. This can be problematic if your financial needs or circumstances change over time.

Choosing the Right Whole Life Insurance Policy in Australia

Choosing the right whole life insurance policy is crucial, as it’s a long-term commitment. This guide will help you navigate the process and select a policy that aligns with your individual needs and financial circumstances.

Factors to Consider When Choosing a Whole Life Insurance Policy

To make an informed decision, consider these key factors:

- Coverage Amount: Determine the appropriate coverage amount to protect your loved ones financially in the event of your passing. Consider your dependents’ financial needs, outstanding debts, and desired lifestyle.

- Premium Affordability: Choose a policy with premiums you can comfortably afford throughout your life. Consider your income, expenses, and future financial projections.

- Policy Features: Compare different policies to understand their features, such as cash value accumulation, investment options, and riders. Evaluate which features align with your financial goals.

- Insurer Reputation: Select a reputable insurer with a strong financial standing and a history of reliable claims processing. Research their financial stability and customer satisfaction ratings.

- Flexibility and Options: Look for policies that offer flexibility in terms of premium payments, policy adjustments, and potential withdrawal options.

- Transparency and Disclosure: Ensure the policy documents are clear and transparent, outlining all terms, conditions, and fees.

Comparing Whole Life Insurance Policies

Here’s a comparison table highlighting key features, premiums, and benefits of different whole life insurance policies offered by major insurers in Australia:

| Insurer | Policy Name | Coverage Amount | Premium | Cash Value Accumulation | Other Features |

|---|---|---|---|---|---|

| Insurer A | Whole Life Plus | $1 million | $100 per month | Guaranteed interest rate of 3% | Waiver of premium, accidental death benefit |

| Insurer B | LifeSecure | $500,000 | $75 per month | Variable interest rate based on market performance | Investment options, policy loan facility |

| Insurer C | Lifetime Protection | $250,000 | $50 per month | Fixed interest rate of 2.5% | Guaranteed insurability option, premium discounts |

Note: This table is for illustrative purposes only. Actual premiums and benefits may vary depending on individual factors such as age, health, and policy terms.

Tips for Obtaining Whole Life Insurance in Australia: Can I Get Whole Life Insurance In Australia

Securing whole life insurance in Australia involves careful planning and research to ensure you choose a policy that meets your needs and budget. Here’s a guide to help you navigate the process:

Finding a Reputable Insurance Provider

Finding a reputable insurance provider is crucial to ensure you’re dealing with a reliable and trustworthy company. Here are some tips:

- Check financial ratings: Look for providers with strong financial ratings from reputable agencies like Standard & Poor’s or Moody’s. This indicates their financial stability and ability to meet their obligations.

- Read reviews and testimonials: Explore online reviews and testimonials from existing customers to gain insights into the provider’s customer service, claim handling processes, and overall satisfaction levels.

- Seek recommendations: Ask family, friends, or financial advisors for recommendations based on their experiences with different insurance providers.

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Compare quotes from several reputable insurers to find the most competitive rates and coverage options.

Seeking Advice from a Financial Advisor

Consulting a financial advisor can be beneficial in determining if whole life insurance is a suitable investment for your specific circumstances. They can:

- Assess your financial situation: A financial advisor can analyze your income, expenses, assets, and debts to determine if whole life insurance aligns with your financial goals.

- Evaluate your risk tolerance: They can help you understand the risks and potential returns associated with whole life insurance and ensure it matches your risk appetite.

- Compare different policy options: Financial advisors have access to a wide range of insurance products and can help you compare different policy features, premiums, and benefits.

- Provide unbiased advice: Financial advisors are obligated to provide impartial advice, ensuring you receive recommendations based on your needs, not their commissions.

Applying for Whole Life Insurance

Applying for whole life insurance is a straightforward process. Here’s a step-by-step guide:

- Gather required information: Prepare your personal details, medical history, and any other relevant documents requested by the insurer.

- Complete the application form: Fill out the application form accurately and honestly, providing all necessary information.

- Undergo a medical examination: Depending on the coverage amount and your age, you may need to undergo a medical examination conducted by the insurer’s medical professional.

- Receive a decision: The insurer will review your application and medical information to determine your eligibility and premium rates.

- Sign the policy documents: Once approved, you’ll receive the policy documents to review and sign, formally accepting the terms and conditions.

Closure

Ultimately, the decision of whether or not to get whole life insurance is a personal one. Carefully weigh the benefits and drawbacks, considering your financial situation, risk tolerance, and long-term objectives. Remember, consulting with a financial advisor can provide valuable insights and help you make an informed choice that aligns with your unique circumstances.

FAQ Guide

What are the tax implications of whole life insurance in Australia?

The tax implications of whole life insurance in Australia can vary depending on the specific policy and your individual circumstances. It’s best to consult with a financial advisor or tax professional for personalized guidance.

How do I find a reputable insurance provider in Australia?

You can start by researching reputable insurance providers in Australia, comparing their policies, premiums, and customer reviews. Consider seeking recommendations from friends, family, or financial advisors.

What is the difference between whole life insurance and term life insurance?

Whole life insurance provides lifelong coverage with a cash value component, while term life insurance offers coverage for a specific period, typically 10 to 30 years. Whole life insurance premiums are generally higher but offer a potential for cash value growth, while term life insurance premiums are lower but do not accumulate cash value.