Can you have more than one health insurance policy? It’s a question that often arises, especially when individuals face complex healthcare needs or navigate various life stages. While it may seem unusual, having multiple policies can offer advantages, such as broader coverage, access to specialized care, or protection against unexpected medical expenses. However, it’s essential to understand the intricacies involved, including coordination of benefits, cost implications, and legal regulations.

This guide explores the complexities of having multiple health insurance policies, delving into the reasons behind this decision, the benefits and drawbacks, and the critical factors to consider. We’ll examine the coordination of benefits, analyze the cost implications, and shed light on the legal and regulatory aspects. By understanding these factors, individuals can make informed decisions about their healthcare coverage and ensure they have the right protection for their unique needs.

Types of Health Insurance

Navigating the world of health insurance can be overwhelming, especially with the various options available. Understanding the different types of health insurance is crucial to finding the best coverage for your needs and budget.

Individual Health Insurance

Individual health insurance plans are purchased directly by individuals, independent of an employer. They offer flexibility in choosing coverage options and providers, making them suitable for self-employed individuals, freelancers, or those who prefer to manage their health insurance independently.

- Key Features:

- Flexibility in choosing plans and providers

- Customizable coverage options

- Open enrollment periods for plan changes

- Benefits:

- Greater control over your healthcare

- Ability to tailor coverage to your specific needs

- Bronze: Lowest premiums, highest out-of-pocket costs

- Silver: Moderate premiums and out-of-pocket costs

- Gold: Higher premiums, lower out-of-pocket costs

- Platinum: Highest premiums, lowest out-of-pocket costs

- Vary based on age, location, health status, and chosen plan

- Can be purchased through the Health Insurance Marketplace or directly from insurance companies

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a common type of coverage provided by employers to their employees. It is typically offered as a benefit package, often with a range of options and contributions from both the employer and employee.

- Key Features:

- Offered through an employer

- Often includes employer contributions to premiums

- Access to a network of providers

- Benefits:

- Group rates often result in lower premiums compared to individual plans

- Employer contributions can significantly reduce employee costs

- Access to a broader network of providers

- Coverage Options:

- Health Maintenance Organization (HMO): Restricts coverage to providers within a network, usually requires a primary care physician referral for specialists.

- Preferred Provider Organization (PPO): Offers greater flexibility to see out-of-network providers, but at a higher cost.

- Point-of-Service (POS): Combines features of HMO and PPO, offering a network of providers with the option to see out-of-network providers at a higher cost.

- Premiums:

- Typically deducted from employee paychecks

- Vary based on plan type, employee contributions, and employer contributions

Medicare

Medicare is a federal health insurance program designed for individuals aged 65 and older, as well as certain individuals with disabilities. It provides comprehensive health coverage, including hospitalization, medical care, and prescription drugs.

- Key Features:

- Government-funded program

- Available to individuals aged 65 and older, and certain individuals with disabilities

- Provides comprehensive health coverage

- Benefits:

- Covers a wide range of healthcare services

- Provides financial protection against high healthcare costs

- Coverage Options:

- Part A: Covers inpatient hospital care, skilled nursing facility care, hospice care, and home health services

- Part B: Covers doctor visits, outpatient care, and preventive services

- Part C: Also known as Medicare Advantage, offers private health insurance plans that provide additional benefits and coverage

- Part D: Covers prescription drugs

- Premiums:

- Premiums vary based on income and coverage options chosen

- Individuals can enroll in Medicare during their initial enrollment period or during open enrollment periods

Medicaid

Medicaid is a government-funded health insurance program for low-income individuals and families. It provides comprehensive health coverage, including hospitalization, medical care, and prescription drugs.

- Key Features:

- State-administered program, funded by federal and state governments

- Available to low-income individuals and families

- Provides comprehensive health coverage

- Benefits:

- Covers a wide range of healthcare services

- Provides financial protection against high healthcare costs

- Coverage Options:

- Varies based on state eligibility requirements and program offerings

- Typically includes hospitalization, medical care, and prescription drugs

- Premiums:

- Usually no premiums for eligible individuals

- May have small copayments for certain services

Reasons for Multiple Health Insurance Policies: Can You Have More Than One Health Insurance

Having multiple health insurance policies might seem unusual, but it can be a smart strategy for certain individuals. It allows for greater coverage, especially when facing unique circumstances or specific healthcare needs.

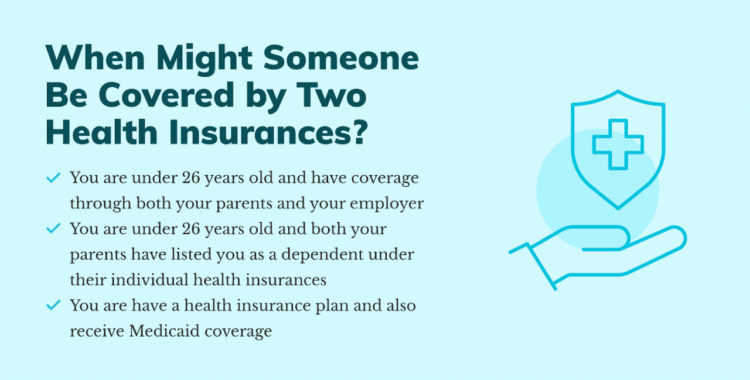

Situations Requiring Multiple Policies

Multiple health insurance policies can be beneficial in situations where individuals have complex healthcare needs or require coverage beyond their primary policy. Some common scenarios include:

- High-Risk Individuals: People with pre-existing conditions or a history of serious illnesses may find it difficult to obtain comprehensive coverage from a single insurer. Having multiple policies can provide wider coverage and financial protection. For example, someone with a chronic condition might have a primary policy for general healthcare and a supplemental policy specifically for their condition.

- Expatriates: Individuals living abroad might need multiple policies to ensure coverage in different countries. A primary policy may cover healthcare in their home country, while a secondary policy can provide coverage for medical emergencies or ongoing treatment in their host country.

- High-Net-Worth Individuals: Individuals with substantial wealth may choose to have multiple policies to access specialized medical care or cover potential high medical expenses. This could include policies for specific types of treatment, such as cancer care or organ transplants.

- Self-Employed Individuals: Self-employed individuals may need to purchase their own health insurance. They can opt for multiple policies to ensure comprehensive coverage for themselves and their families, potentially including policies with different benefits and deductibles.

Benefits of Multiple Policies

Having multiple health insurance policies can offer several advantages:

- Increased Coverage: Multiple policies can provide broader coverage, including different types of medical services, treatments, and benefits. This can be particularly beneficial for individuals with complex healthcare needs.

- Financial Protection: Multiple policies can provide financial protection against high medical expenses. This can be crucial for individuals with pre-existing conditions or who are at risk of facing substantial medical bills.

- Access to Specialized Care: Multiple policies can provide access to specialized medical care, such as treatment from specific doctors or hospitals. This can be important for individuals with rare conditions or who require advanced medical interventions.

- Flexibility: Multiple policies can offer flexibility in coverage options. Individuals can choose policies with different deductibles, co-pays, and benefits to best suit their needs and financial situation.

Drawbacks of Multiple Policies

While multiple policies offer advantages, there are also potential drawbacks to consider:

- Increased Costs: Having multiple policies can significantly increase insurance premiums. This can be a major consideration for individuals with limited budgets.

- Complexity: Managing multiple policies can be complex and time-consuming. It requires keeping track of different policies, deductibles, co-pays, and benefits, which can be challenging.

- Coordination of Benefits: Coordinating benefits between multiple policies can be complicated, especially when multiple insurers are involved. This can lead to delays in claims processing and potential disputes.

Factors Influencing the Decision

Several factors influence the decision to have multiple health insurance policies:

- Age: Older individuals may be more likely to need multiple policies due to an increased risk of health issues and higher medical expenses.

- Health Conditions: Individuals with pre-existing conditions or a history of serious illnesses may benefit from multiple policies to ensure comprehensive coverage.

- Employment: Self-employed individuals or those with limited employer-sponsored health insurance may need to purchase multiple policies to obtain adequate coverage.

- Financial Situation: Individuals with substantial wealth or those who can afford higher premiums may choose to have multiple policies for greater coverage and financial protection.

Coordination of Benefits

Coordination of Benefits (COB) is a crucial aspect of having multiple health insurance policies. It determines how different insurance plans interact to cover healthcare costs when an individual is covered by more than one plan. This mechanism ensures that individuals don’t receive duplicate payments for the same medical expenses.

Explanation of Coordination of Benefits

COB establishes a hierarchy among insurance plans to determine which policy is primary and which is secondary. The primary insurer is responsible for paying the majority of the costs, while the secondary insurer covers the remaining expenses, up to its coverage limits. This process helps prevent individuals from receiving more than 100% of their medical costs, ensuring a fair and efficient allocation of insurance benefits.

Rules and Regulations Governing COB

The rules and regulations governing COB vary depending on the specific insurance plans involved. However, some general principles apply:

* Order of Payment: The order of payment is determined by the “birthday rule” or other criteria specified by the insurance plans. The “birthday rule” designates the policy of the parent whose birthday falls earlier in the year as the primary plan for dependent children. Other factors that may determine the primary plan include the date of marriage, employment, or the order in which policies were acquired.

* Coordination of Benefits Clauses: Each insurance policy contains a COB clause that Artikels the specific rules for coordination of benefits. These clauses can be complex and may vary significantly between plans. It’s essential to carefully review these clauses to understand how your policies will interact in the event of a claim.

Examples of How COB Might Affect Individuals

Here are a few scenarios where COB could impact individuals with multiple policies:

* Dependent Children: If a child is covered by both parents’ health insurance plans, the “birthday rule” will determine which plan is primary. The primary plan will pay first, and the secondary plan will cover any remaining expenses.

* Spouses: If both spouses have individual health insurance policies, the plan of the spouse whose birthday occurs earlier in the year is usually considered the primary plan.

* Medicare and Other Coverage: If an individual has both Medicare and a private health insurance policy, Medicare is typically the primary payer. The private insurance plan will act as a secondary payer, covering any remaining expenses.

It is essential to understand the COB rules governing your insurance plans to ensure that you receive the appropriate coverage for your healthcare needs. Consult with your insurance providers or a healthcare professional if you have questions about how COB applies to your specific situation.

Cost Considerations

Having multiple health insurance policies can be financially beneficial, but it’s essential to weigh the costs and potential savings carefully. The primary concern is the potential for overlapping premiums and the impact on out-of-pocket expenses.

Premium Overlap

It’s crucial to avoid duplicate coverage, as this can lead to unnecessary expenses. You should carefully review the coverage of each policy to ensure there’s no overlap in benefits. For example, if both policies cover hospitalization, you might be paying for the same benefit twice.

Out-of-Pocket Expenses

While multiple policies can provide more comprehensive coverage, they can also increase your out-of-pocket expenses. This is because you’ll likely have to pay deductibles and co-pays for each policy. You need to calculate your potential out-of-pocket costs for each policy and compare them to the benefits you’ll receive.

Strategies for Minimizing Costs

There are several strategies you can employ to minimize the cost of multiple health insurance policies:

- Negotiate with your insurance providers: You can try to negotiate lower premiums by bundling your policies or by demonstrating that you have a good claims history.

- Shop around for better deals: Comparing different insurance providers can help you find more affordable policies.

- Maximize your coverage: You can choose policies that offer comprehensive coverage and reduce the need for multiple policies.

- Consider a high-deductible health plan (HDHP): HDHPs offer lower premiums but have higher deductibles. This option can be beneficial if you’re generally healthy and have low healthcare costs.

Legal and Regulatory Aspects

While the idea of having multiple health insurance policies might seem appealing, it’s crucial to understand the legal and regulatory landscape surrounding this practice. Many jurisdictions have rules and regulations governing health insurance, and these regulations can significantly impact your ability to hold multiple policies.

Restrictions on Multiple Policies

It is essential to understand the legal framework surrounding multiple health insurance policies. Most countries and states have regulations that govern the issuance and use of health insurance. These regulations may place limitations on holding multiple policies, particularly if they involve overlapping coverage.

- Anti-duplication Clauses: Many health insurance policies contain clauses that prevent policyholders from receiving duplicate benefits from multiple policies for the same medical expenses. This means that if you have two policies that cover the same medical event, the insurer may only pay a portion of the costs, ensuring you don’t receive a double payout.

- State Laws: Some states have specific laws regarding the ownership of multiple health insurance policies. These laws might address issues such as coverage limitations, coordination of benefits, and potential penalties for exceeding certain coverage limits.

- Federal Regulations: In some countries, federal regulations might also apply to multiple health insurance policies, especially if they involve employer-sponsored plans or government-funded programs. These regulations may dictate how benefits are coordinated and may impose limitations on the types of policies you can hold concurrently.

Consequences of Violating Regulations

Violating regulations related to multiple health insurance policies can lead to various consequences, including:

- Denial of Claims: If you violate regulations, your insurer may deny your claims, leaving you responsible for all medical expenses.

- Penalties: Some jurisdictions may impose penalties, such as fines or even imprisonment, for deliberately violating health insurance regulations.

- Policy Cancellation: Your insurer may cancel your policies if they discover you are holding multiple policies in violation of their terms or applicable regulations.

Key Regulations and Implications

Here’s a table outlining key regulations and their implications:

| Regulation | Implication |

|---|---|

| Anti-duplication Clauses | Limits the amount of benefits you can receive from multiple policies for the same medical event. |

| State Laws on Multiple Policies | May restrict the types of policies you can hold or impose limits on coverage. |

| Federal Regulations on Employer-Sponsored or Government-Funded Plans | May dictate how benefits are coordinated and impose limitations on concurrent policies. |

Practical Considerations

Navigating the world of multiple health insurance policies can feel overwhelming, but understanding the practical aspects can make the process smoother. This section explores the steps involved in obtaining multiple policies, offers tips for managing them effectively, and Artikels key factors to consider when deciding if this approach is right for you.

Obtaining Multiple Health Insurance Policies

A clear understanding of the steps involved in acquiring multiple health insurance policies is crucial. The following flowchart Artikels the key stages:

- Assess Your Needs: Begin by determining your healthcare needs and the coverage gaps you wish to address. Consider factors like pre-existing conditions, anticipated medical expenses, and preferred healthcare providers.

- Research Insurance Options: Explore different health insurance providers and their offerings. Compare plans, coverage details, premiums, deductibles, and co-pays. Consider both individual and group plans.

- Contact Insurance Providers: Reach out to shortlisted insurance providers to discuss your specific requirements. Inquire about eligibility criteria, coverage limitations, and potential cost implications.

- Apply for Policies: Complete the necessary application forms and provide supporting documentation. Ensure accuracy and completeness to avoid delays or complications.

- Review and Accept Policies: Carefully review the policy documents, including coverage details, exclusions, and terms and conditions. Once satisfied, accept the policies and pay the initial premium.

- Coordinate Benefits: Understand the coordination of benefits (COB) rules governing your multiple policies. Determine the primary and secondary policies to ensure smooth claim processing.

Managing Multiple Health Insurance Policies

Effectively managing multiple health insurance policies is essential to maximize their benefits. Here are some practical tips:

- Maintain Organized Records: Keep all policy documents, including contracts, premium receipts, and claim forms, in a readily accessible location. Consider using a digital file system or a dedicated binder for easy reference.

- Set Reminders for Premiums: Set up calendar alerts or reminders to ensure timely payment of premiums for each policy. Late payments can result in penalties or coverage lapse.

- Track Coverage Details: Keep a record of each policy’s coverage details, including deductibles, co-pays, out-of-pocket maximums, and covered services. This will help you make informed decisions regarding healthcare expenses.

- Communicate with Providers: Inform your healthcare providers about all your health insurance policies. This ensures accurate billing and claim processing.

- Review Policies Regularly: Periodically review your policies for any changes in coverage, premiums, or terms and conditions. This allows you to adjust your plans as needed and maintain optimal coverage.

Key Factors to Consider, Can you have more than one health insurance

Deciding whether to have multiple health insurance policies requires careful consideration of various factors. The following table summarizes key aspects to weigh:

| Factor | Considerations |

|---|---|

| Healthcare Needs | Pre-existing conditions, anticipated medical expenses, specific healthcare providers, coverage gaps |

| Financial Situation | Premiums, deductibles, co-pays, out-of-pocket maximums, affordability |

| Coverage Details | Benefits, exclusions, limitations, network providers, coordination of benefits |

| Administrative Burden | Managing multiple policies, keeping track of coverage details, coordinating claims |

Last Point

Navigating the world of multiple health insurance policies requires careful consideration of various factors, including the types of coverage, coordination of benefits, cost implications, and legal regulations. While having multiple policies can offer advantages, it’s crucial to weigh the benefits against the potential drawbacks and make informed decisions based on individual circumstances. By understanding the intricacies involved and seeking professional advice when necessary, individuals can maximize their healthcare coverage and ensure they have the right protection for their health and well-being.

FAQ Section

Can I use both health insurance policies simultaneously?

It depends on the specific policies and the healthcare provider. Some policies may have clauses that limit coverage if you have multiple policies. It’s crucial to review the terms of your policies and consult with your insurance providers to understand how they coordinate benefits.

Will my premiums be higher if I have multiple health insurance policies?

Yes, having multiple policies will likely result in higher premiums. However, the cost increase may be offset by the additional coverage and benefits you receive. It’s important to compare the costs and benefits of different policies to determine if the added protection is worth the extra expense.

What happens if I have a health condition that is covered by both policies?

The coordination of benefits rules will determine which policy pays first. Typically, the primary policy will cover the majority of the expenses, while the secondary policy will cover the remaining costs. It’s essential to understand the specific COB rules governing your policies.