- Understanding Car Insurance in Australia

- Factors Affecting Car Insurance Costs

- Comparing Car Insurance Companies

- Tips for Finding the Cheapest Car Insurance

- Importance of Comprehensive Coverage: Cheapest Car Insurance Company In Australia

- Common Exclusions and Limitations

- Making Informed Decisions

- Conclusion

- Question & Answer Hub

Finding the cheapest car insurance company in Australia is a common goal for many drivers, and for good reason. Car insurance premiums can vary significantly, and even a small difference in price can add up over time. There are a number of factors that influence the cost of car insurance, including your driving history, the type of car you drive, and your location. By understanding these factors and using the right strategies, you can find the most affordable car insurance policy for your needs.

This guide will explore the different types of car insurance available in Australia, the factors that affect insurance costs, and tips for finding the cheapest options. We’ll also discuss the importance of comprehensive coverage and the common exclusions and limitations that you should be aware of. By the end of this guide, you’ll have a better understanding of how to choose the right car insurance policy for you and save money in the process.

Understanding Car Insurance in Australia

Car insurance is a crucial aspect of responsible vehicle ownership in Australia. It provides financial protection against potential risks and liabilities associated with driving. Understanding the different types of car insurance available and the factors influencing premiums is essential for making informed decisions.

Types of Car Insurance in Australia

Car insurance policies in Australia are broadly categorized into four main types, each offering different levels of coverage:

- Comprehensive Car Insurance: This is the most comprehensive type of car insurance, providing coverage for a wide range of incidents, including accidents, theft, fire, and natural disasters. It also covers damage to your own vehicle, regardless of fault.

- Third-Party Property Damage: This type of insurance covers damage to other people’s property if you are at fault in an accident. It does not cover damage to your own vehicle.

- Third-Party Fire and Theft: This policy covers damage to other people’s property and theft of your vehicle, but not damage to your own vehicle.

- Third-Party Only: This is the most basic type of car insurance, providing only the minimum legal requirements. It covers damage to other people’s property but not damage to your own vehicle or theft.

Factors Influencing Car Insurance Premiums

Several factors influence car insurance premiums in Australia, including:

- Vehicle Type and Value: The type and value of your vehicle are major determinants of your premium. Luxury or high-performance vehicles typically have higher premiums due to their higher repair costs and risk of theft.

- Driving History: Your driving history, including accidents, traffic violations, and claims, plays a significant role in premium calculation. A clean driving record generally results in lower premiums.

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents. As a result, they often face higher premiums.

- Location: Your location can impact your premium, as insurance companies consider the risk of theft, accidents, and natural disasters in different areas.

- Usage and Mileage: The frequency and distance you drive your vehicle also affect your premium. Individuals who drive more frequently or for longer distances generally pay higher premiums.

- Insurance Provider: Different insurance providers have varying pricing strategies and risk assessments, leading to variations in premiums. It’s essential to compare quotes from multiple providers.

Key Differences Between Car Insurance Policies

Car insurance policies from different providers may vary in their coverage, terms, and conditions. It’s crucial to compare policies carefully to ensure you choose one that meets your specific needs and budget. Some key differences to consider include:

- Excess: This is the amount you pay out of pocket before your insurance covers the remaining costs of a claim.

- Deductible: Similar to excess, the deductible is the amount you pay before your insurance kicks in.

- Cover Limits: Each policy has limits on the amount of coverage provided for specific events, such as accidents, theft, or fire.

- Exclusions: Certain events or situations may be excluded from coverage, such as driving under the influence of alcohol or drugs.

- Add-ons: Some insurance providers offer additional coverage options, such as roadside assistance, windscreen repair, or rental car coverage.

Factors Affecting Car Insurance Costs

Your driving history, the type of car you drive, and your personal characteristics can all influence your car insurance premiums. These factors are considered by insurance companies to assess your risk profile and determine the cost of your insurance policy.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will typically result in lower premiums. Conversely, if you have a history of accidents, speeding tickets, or other driving offenses, your insurance costs will likely be higher.

Insurance companies consider your driving history a strong indicator of your future driving behavior.

Car Features

The type of car you drive can also affect your insurance costs. Factors like the make, model, age, and safety features of your vehicle are all taken into account.

Make and Model

Some car models are considered more expensive to repair or replace than others. These vehicles are typically associated with higher insurance premiums.

Age

Older cars tend to have lower insurance premiums than newer cars, as they are generally worth less. However, older cars may not have the same safety features as newer models, which could lead to higher insurance costs.

Safety Features

Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, are typically associated with lower insurance premiums. These features can reduce the risk of accidents and injuries, which in turn lowers the cost of insurance.

Driver Profiles

Your personal characteristics, such as age, gender, occupation, and location, can also influence your car insurance costs.

Age

Young drivers, particularly those under 25, are generally considered higher risk and therefore pay higher insurance premiums. This is due to their lack of experience and higher likelihood of accidents. As drivers age, their insurance premiums typically decrease.

Gender

Historically, men have been statistically more likely to be involved in accidents than women. However, this gap has been narrowing in recent years. Some insurance companies still use gender as a factor in determining premiums, while others do not.

Occupation

Your occupation can also influence your insurance costs. Some occupations, such as those that involve long commutes or driving for work, may be associated with higher premiums.

Location

Your location can also impact your insurance premiums. Insurance companies consider factors such as the density of traffic, the crime rate, and the frequency of accidents in your area. Areas with higher rates of accidents or crime typically have higher insurance premiums.

Comparing Car Insurance Companies

Choosing the right car insurance company can be a daunting task, especially with so many options available. Each insurer offers a unique combination of coverage, benefits, and pricing, making it essential to compare and contrast different providers to find the best fit for your needs and budget.

Comparing Car Insurance Companies

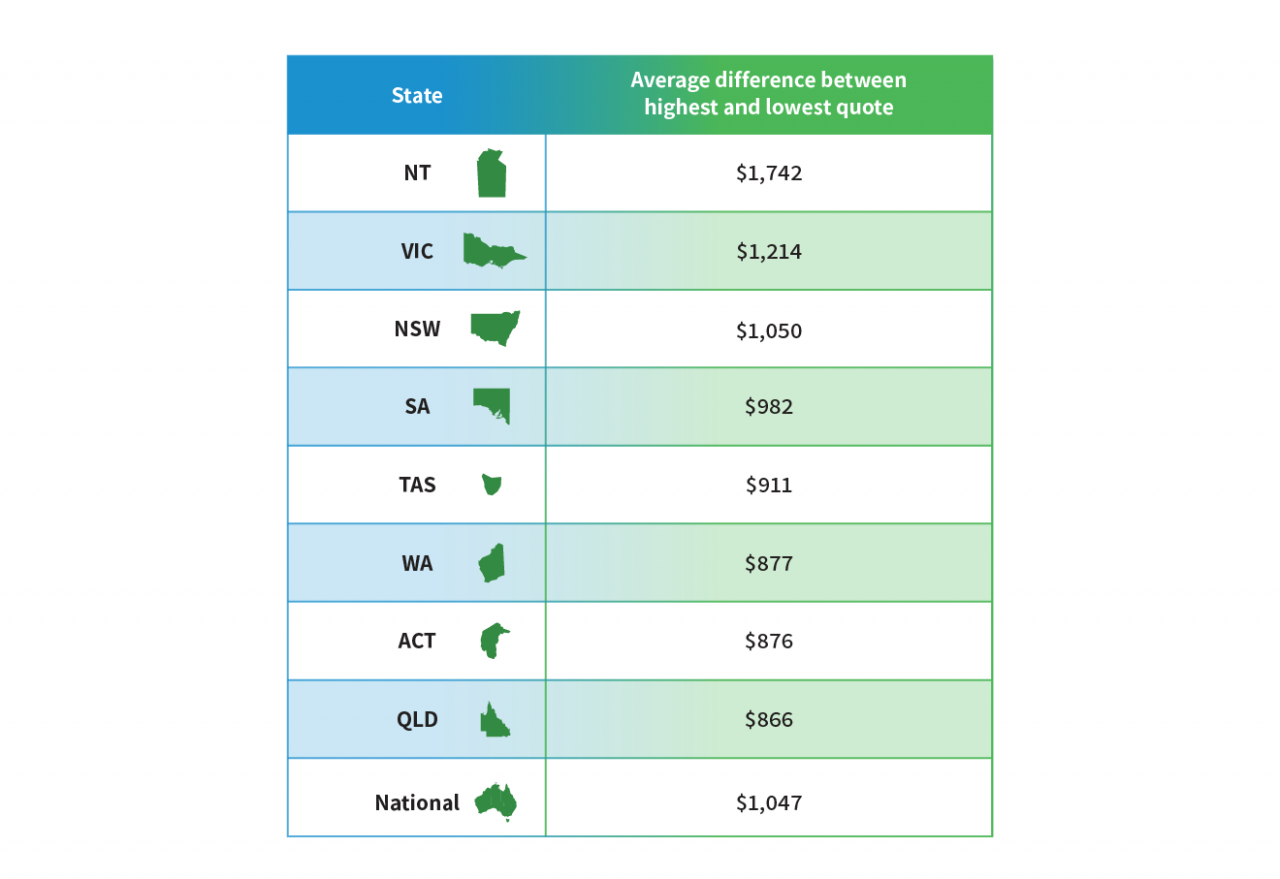

The table below compares key features, benefits, and pricing of some of Australia’s major car insurance providers. It also includes customer service ratings and online reviews to give you a comprehensive overview of each company’s strengths and weaknesses.

| Provider | Key Features | Benefits | Pricing (Estimated) | Customer Service Rating | Online Reviews |

|---|---|---|---|---|---|

| AAMI | Comprehensive, Third Party Property Damage, Third Party Fire & Theft, CTP | 24/7 roadside assistance, new for old replacement, flexible payment options | $500 – $1,500 per year | 4.5/5 | Positive reviews for claims handling and customer service. |

| NRMA | Comprehensive, Third Party Property Damage, Third Party Fire & Theft, CTP | 24/7 roadside assistance, new for old replacement, discounts for safe driving | $450 – $1,400 per year | 4/5 | Mixed reviews, with some praising their roadside assistance and others criticizing their claims process. |

| RACQ | Comprehensive, Third Party Property Damage, Third Party Fire & Theft, CTP | 24/7 roadside assistance, new for old replacement, discounts for members | $400 – $1,300 per year | 4.2/5 | Generally positive reviews, with praise for their competitive pricing and member benefits. |

| Suncorp | Comprehensive, Third Party Property Damage, Third Party Fire & Theft, CTP | 24/7 roadside assistance, new for old replacement, flexible payment options | $480 – $1,450 per year | 3.8/5 | Mixed reviews, with some praising their online experience and others criticizing their claims handling. |

| Allianz | Comprehensive, Third Party Property Damage, Third Party Fire & Theft, CTP | 24/7 roadside assistance, new for old replacement, discounts for safe driving | $520 – $1,550 per year | 4.1/5 | Positive reviews for their comprehensive coverage options and customer service. |

Tips for Finding the Cheapest Car Insurance

Finding the cheapest car insurance in Australia can be a daunting task, but it doesn’t have to be. With a little research and a strategic approach, you can significantly reduce your premiums and find the best value for your money.

Comparing Insurance Quotes

It’s essential to compare quotes from multiple insurance companies before settling on a policy. This allows you to see the range of premiums available and identify the most competitive offers. You can compare quotes online, over the phone, or through a broker.

- Use comparison websites: Websites like Compare the Market, iSelect, and Canstar allow you to enter your details once and receive quotes from multiple insurers simultaneously. This saves you time and effort.

- Contact insurers directly: Don’t rely solely on comparison websites. Some insurers may offer better deals if you contact them directly.

- Be transparent with your details: When filling out quote forms, be truthful and accurate with your information, including your driving history, vehicle details, and any claims you’ve made. Providing inaccurate information can lead to higher premiums or even policy cancellation.

Negotiating with Insurers

Once you’ve identified a few competitive quotes, don’t hesitate to negotiate with the insurers. Many insurers are willing to lower their premiums to secure your business.

- Highlight your good driving record: If you have a clean driving history with no accidents or traffic violations, emphasize this to the insurer. It demonstrates your responsible driving habits and can lead to lower premiums.

- Ask about discounts: Many insurers offer discounts for various factors, such as being a member of certain organizations, having multiple insurance policies with them, or installing safety features in your car. Don’t be afraid to ask about these discounts and see if you qualify.

- Consider paying annually: Paying your premium annually rather than monthly can sometimes lead to a lower overall cost. However, make sure you can afford the upfront payment.

Bundling Insurance Policies

Bundling your car insurance with other insurance products, such as home or health insurance, can often lead to significant savings. Insurers often offer discounts for multiple policies, making it a worthwhile option to consider.

- Explore bundled packages: Many insurers offer packages that combine car, home, and contents insurance. These packages often come with discounts, making them a more affordable option than purchasing individual policies.

- Compare bundle deals: Remember to compare bundle deals from different insurers to ensure you’re getting the best value for your money. Not all insurers offer the same discounts or coverage levels.

Importance of Comprehensive Coverage: Cheapest Car Insurance Company In Australia

Comprehensive car insurance provides extensive protection for your vehicle and financial security in case of unforeseen events. While it might seem like an additional expense, it offers significant advantages that outweigh the cost, particularly in situations where you are responsible for an accident or your car is damaged by factors beyond your control.

Financial Risks of Less Comprehensive Policies

Choosing a less comprehensive policy can lead to substantial financial risks, leaving you responsible for a significant portion of repair costs or even the total replacement value of your vehicle. For instance, a third-party property damage policy only covers damages you cause to another person’s vehicle or property. It doesn’t cover your own car, leaving you liable for the repair costs.

If your car is stolen or damaged in a natural disaster, you will be responsible for the entire repair or replacement cost.

Real-Life Scenarios Where Comprehensive Coverage Proves Valuable

Comprehensive car insurance offers crucial protection in various situations, safeguarding you from significant financial burdens. Here are some real-life scenarios where comprehensive coverage proves invaluable:

- Collision with an Uninsured Driver: If you are involved in an accident with an uninsured driver, your comprehensive coverage will cover the repairs to your vehicle, ensuring you are not left with the entire cost.

- Natural Disasters: Comprehensive coverage provides protection against damage caused by natural disasters such as floods, hailstorms, or earthquakes, ensuring you can get your vehicle repaired or replaced without facing a huge financial burden.

- Theft or Vandalism: Comprehensive coverage covers damage or loss due to theft or vandalism, giving you peace of mind knowing that you are not responsible for the entire cost of replacing your stolen or damaged vehicle.

- Fire Damage: In the unfortunate event of your car catching fire, comprehensive coverage will cover the cost of repairs or replacement, relieving you of a substantial financial burden.

Common Exclusions and Limitations

It’s crucial to understand that car insurance policies don’t cover everything. There are specific situations and circumstances where your claim might be denied. Let’s explore some common exclusions and limitations you might encounter.

Exclusions Related to the Vehicle

Insurance policies often exclude coverage for certain types of vehicles or modifications. For instance, you might find that your policy doesn’t cover:

- Vehicles used for commercial purposes, such as taxis or delivery trucks.

- Vehicles that are older than a specific age limit.

- Vehicles that have been significantly modified, especially if the modifications affect safety or performance.

It’s essential to review your policy carefully to ensure that your vehicle is covered.

Exclusions Related to the Driver

Insurance policies can also exclude coverage for certain types of drivers. For example, your policy might not cover:

- Drivers who are under the influence of alcohol or drugs.

- Drivers who do not have a valid driver’s license or are driving without proper authorization.

- Drivers who are involved in illegal activities, such as racing or street racing.

Exclusions Related to the Incident

Some incidents are specifically excluded from car insurance coverage. These might include:

- Damage caused by wear and tear, such as a flat tire or a broken windshield due to age.

- Damage caused by natural disasters, such as floods or earthquakes, unless you have specific coverage for these events.

- Damage caused by intentional acts, such as vandalism or arson.

Limitations on Coverage, Cheapest car insurance company in australia

In addition to exclusions, car insurance policies often have limitations on the amount of coverage you receive. These limitations might include:

- Excess or deductible: This is the amount you pay out of pocket before your insurance kicks in. The higher your excess, the lower your premium will be.

- Maximum payout: This is the maximum amount your insurance company will pay for a claim. It’s essential to ensure that this limit is sufficient to cover your potential losses.

- Coverage period: Your policy will specify the period for which you are covered. It’s crucial to understand the duration of your coverage and ensure it aligns with your needs.

Examples of Denied Claims

Here are some real-life examples of situations where insurance claims might be denied:

- A driver using their car for ride-sharing services without informing their insurance company, resulting in a denied claim for an accident.

- A driver who was speeding and lost control of their vehicle, causing an accident. The insurance company may deny the claim if they determine that the driver was exceeding the speed limit.

- A driver who had their car stolen and failed to take reasonable precautions to protect their vehicle, such as leaving the keys in the ignition.

The Importance of Reviewing Policy Terms and Conditions

It’s crucial to thoroughly read and understand the terms and conditions of your car insurance policy. This includes carefully reviewing the exclusions and limitations. It’s advisable to ask your insurance company for clarification if you have any doubts about specific aspects of your policy. By understanding the fine print, you can avoid surprises and ensure you have adequate coverage.

Making Informed Decisions

Finding the cheapest car insurance in Australia is only half the battle. The real key is choosing a policy that offers the right coverage at the right price for your individual needs and circumstances.

Evaluating Insurance Quotes

It’s crucial to compare apples to apples when evaluating insurance quotes. Don’t just focus on the cheapest price tag. Consider the following:

- Coverage: Ensure the policy provides the necessary protection for your car, including comprehensive and third-party property damage. Consider additional options like fire and theft cover, or windscreen cover.

- Excess: This is the amount you’ll pay out of pocket before your insurance kicks in. A higher excess usually translates to lower premiums. Choose an excess you can comfortably afford.

- Discounts: Many insurers offer discounts for safe driving, no-claims bonuses, and other factors. Make sure you’re taking advantage of all eligible discounts.

- Customer service: Check the insurer’s reputation for prompt and helpful customer service. You’ll want a company that’s easy to deal with in case you need to make a claim.

Selecting the Best Policy

Once you’ve carefully compared quotes, you can start narrowing down your options.

- Consider your risk tolerance: If you’re a cautious driver with a clean record, you might be comfortable with a higher excess and lower premium. But if you’re a risk-taker or have a history of accidents, you may want more comprehensive coverage with a lower excess, even if it means a higher premium.

- Think about your budget: Car insurance premiums can vary significantly. Choose a policy that fits comfortably within your budget while still providing adequate coverage.

- Read the fine print: Don’t just skim the policy documents. Take the time to read the terms and conditions carefully, especially the exclusions and limitations.

Seeking Professional Advice

If you’re unsure about which policy is right for you, consider seeking professional advice from an insurance broker or financial advisor. They can help you understand your options, compare quotes, and choose a policy that meets your specific needs.

Conclusion

Finding the cheapest car insurance in Australia is a balancing act between affordability and coverage. While it’s tempting to go for the lowest price, it’s essential to consider your individual needs and circumstances. By understanding the different types of car insurance, the factors that affect costs, and the tips for finding the best deals, you can make an informed decision that protects you and your finances.

Question & Answer Hub

What is the difference between comprehensive and third-party car insurance?

Comprehensive car insurance covers damage to your own vehicle, regardless of who is at fault. Third-party car insurance only covers damage to other people’s vehicles or property, and does not cover damage to your own car. It is important to note that third-party car insurance is often required by law.

How can I get a discount on my car insurance?

There are a number of ways to get a discount on your car insurance. Some common discounts include: good driver discounts, multi-policy discounts, and safety feature discounts. You can also try to negotiate a lower price with your insurance company.

What is a no-claims bonus?

A no-claims bonus is a discount that you receive on your car insurance premiums if you have not made a claim in a certain period of time. The longer you go without making a claim, the higher your no-claims bonus will be. It is important to note that if you do make a claim, you may lose your no-claims bonus.