Cheapest car insurance in South Australia is a hot topic, and for good reason. With so many factors influencing premiums, it can be overwhelming to find the best deal. From understanding the different types of coverage to comparing providers and negotiating rates, this guide will equip you with the knowledge and strategies to secure the most affordable car insurance in South Australia.

Understanding the key factors that affect insurance costs, such as your driving history, car model, and age, is crucial. You’ll also learn about the different types of car insurance available and how to compare quotes from reputable providers. We’ll even provide tips on how to reduce your premiums and secure discounts, ensuring you get the best possible value for your money.

Understanding South Australian Car Insurance

South Australian car insurance is a vital aspect of owning and operating a vehicle in the state. It offers financial protection against various risks, including accidents, theft, and natural disasters. Understanding the factors that influence car insurance costs, the different types of coverage available, and the mandatory requirements is crucial for making informed decisions about your insurance needs.

Factors Influencing Car Insurance Costs

Several factors determine the cost of car insurance in South Australia. These factors are used by insurance companies to assess your individual risk and determine your premium.

- Your Vehicle: The make, model, year, and value of your vehicle significantly influence your insurance premium. Higher-value vehicles, sports cars, and vehicles with a history of theft or accidents tend to have higher premiums. For example, a brand new luxury sedan will likely have a higher premium than a used compact car.

- Your Driving History: Your driving record, including accidents, traffic violations, and driving experience, plays a crucial role in determining your insurance cost. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher premiums.

- Your Location: Your address and the location where your vehicle is parked can influence your insurance cost. Areas with higher crime rates or accident statistics may have higher premiums. For instance, a vehicle parked in a high-crime area may face a higher risk of theft, leading to a higher insurance premium.

- Your Age and Gender: Younger drivers and males typically have higher insurance premiums than older drivers and females. This is due to statistical data showing that younger drivers and males are more likely to be involved in accidents. However, this is not always the case, and individual driving records and experience play a significant role.

- Your Occupation: Some occupations may carry a higher risk of accidents or theft, which can lead to higher insurance premiums. For example, a truck driver may have a higher premium than a teacher due to the higher risk of accidents associated with driving a commercial vehicle.

- Your Insurance History: Your previous insurance claims and payment history can also affect your current premium. A history of frequent claims or late payments may result in higher premiums.

- Your Coverage Choice: The type and amount of coverage you choose will also affect your premium. Comprehensive coverage, which covers damage from various events, will generally be more expensive than third-party property damage only (TPPD) coverage, which only covers damage to other vehicles. For example, comprehensive coverage would cover damage to your vehicle from theft or hailstorms, while TPPD would only cover damage to another vehicle if you were at fault in an accident.

- Your Excess: Your excess is the amount you agree to pay towards a claim. A higher excess will generally result in a lower premium. For instance, if you choose a higher excess of $1,000, your premium may be lower than if you choose a lower excess of $500.

Types of Car Insurance

South Australia offers a variety of car insurance options to suit different needs and budgets.

- Third-Party Property Damage Only (TPPD): This is the minimum level of car insurance required in South Australia. It covers damage to other vehicles or property if you are at fault in an accident. However, it does not cover damage to your own vehicle or personal injuries.

- Third-Party Fire and Theft (TPFT): This type of insurance covers damage to other vehicles or property, as well as damage to your own vehicle caused by fire or theft. It does not cover damage from accidents.

- Comprehensive Car Insurance: This is the most comprehensive type of car insurance. It covers damage to your own vehicle from various events, including accidents, theft, fire, hailstorms, and vandalism. It also includes third-party liability coverage for damage to other vehicles or property.

Mandatory Car Insurance Requirements

South Australia requires all vehicle owners to have at least TPPD insurance. This is a legal requirement and ensures that you are financially protected if you are involved in an accident and cause damage to another vehicle or property. You must have this insurance before driving your vehicle on public roads.

Note: Failure to comply with the mandatory car insurance requirements in South Australia can result in fines and penalties.

Key Factors for Finding the Cheapest Car Insurance: Cheapest Car Insurance In South Australia

Finding the cheapest car insurance in South Australia involves understanding the factors that influence your premiums. Several key elements determine how much you’ll pay for your car insurance, and being aware of them can help you find the best deals.

Car Model and Value

The make, model, and value of your car significantly impact your insurance premiums. Luxury or high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for theft. Conversely, older, less valuable cars typically have lower insurance premiums.

Driving History

Your driving history is a major factor in determining your insurance costs. A clean driving record with no accidents or traffic violations will usually result in lower premiums. Conversely, if you have a history of accidents, speeding tickets, or other offenses, your insurance premiums will likely be higher.

Age and Gender

Age and gender are also considered by insurance companies when calculating premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, which can lead to higher premiums. Gender can also play a role, as statistics show that men tend to have higher accident rates than women.

Location

Where you live in South Australia can also impact your insurance premiums. Areas with higher crime rates or a greater number of accidents tend to have higher insurance costs.

Driving Habits

Your driving habits, such as how often you drive and where you drive, can also affect your insurance premiums. Drivers who frequently drive in high-traffic areas or for long distances may face higher premiums than those who drive less often or in less congested areas.

Other Factors

Other factors that can affect your car insurance premiums include:

- Your Occupation: Some occupations, such as those involving long commutes or driving for work, may increase your premiums.

- Your Credit Score: In some cases, your credit score can be used to assess your risk as an insured driver.

- Your Coverage: The type and amount of coverage you choose will also impact your premiums. Comprehensive and collision coverage typically cost more than liability-only coverage.

- Discounts: Insurance companies offer various discounts to reduce premiums, such as discounts for safe driving, anti-theft devices, and multi-car policies.

Tips for Reducing Car Insurance Premiums

Here are some tips to help you lower your car insurance premiums:

- Shop around: Compare quotes from different insurance companies to find the best rates.

- Consider a higher deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lead to lower premiums.

- Improve your driving record: Avoid accidents and traffic violations to maintain a clean driving history.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for discounts.

- Ask about discounts: Inquire about available discounts, such as those for safe driving, anti-theft devices, and multi-car policies.

Comparing Car Insurance Providers in South Australia

When choosing car insurance in South Australia, comparing providers is crucial to find the best deal. Consider price, coverage, and customer service to make an informed decision.

Comparison of Top Car Insurance Providers

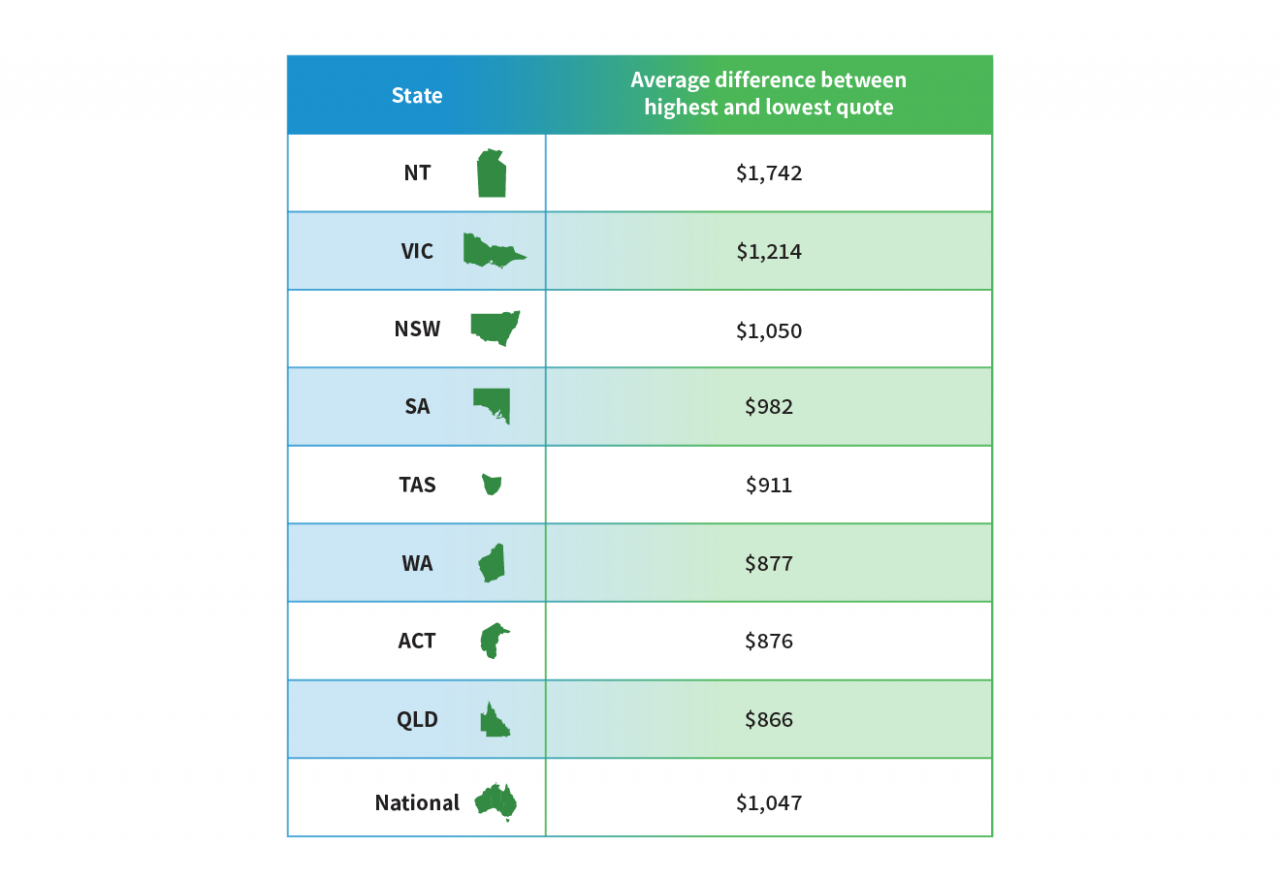

The table below provides a general comparison of top car insurance providers in South Australia. It’s important to note that prices and coverage can vary depending on individual factors like your driving history, car type, and location.

| Provider | Price (Estimated) | Coverage | Customer Service |

|---|---|---|---|

| AAMI | Competitive | Comprehensive, Third Party Property, Third Party Fire and Theft | Good online resources, responsive customer support |

| RACV | Competitive | Comprehensive, Third Party Property, Third Party Fire and Theft | Good online resources, responsive customer support |

| NRMA | Competitive | Comprehensive, Third Party Property, Third Party Fire and Theft | Good online resources, responsive customer support |

| Allianz | Slightly Higher | Comprehensive, Third Party Property, Third Party Fire and Theft | Good online resources, responsive customer support |

| Suncorp | Competitive | Comprehensive, Third Party Property, Third Party Fire and Theft | Good online resources, responsive customer support |

Steps Involved in Comparing Car Insurance Quotes

To compare car insurance quotes effectively, follow these steps:

- Gather your information: This includes your driving history, car details, and any other relevant information.

- Choose your coverage level: Decide what type of coverage you need based on your individual needs and budget.

- Use comparison websites: Several reputable online comparison websites allow you to quickly compare quotes from different providers.

- Contact insurers directly: Once you’ve narrowed down your choices, contact insurers directly to discuss specific details and confirm coverage.

- Compare quotes carefully: Analyze each quote thoroughly, considering price, coverage, and any additional benefits.

- Read the fine print: Ensure you understand the terms and conditions of each policy before making a final decision.

Reputable Online Car Insurance Comparison Websites

Several websites specialize in comparing car insurance quotes in South Australia. These websites can help you save time and effort by providing a comprehensive comparison of available options. Some reputable online comparison websites include:

- Compare the Market: This website compares quotes from various insurance providers and offers a user-friendly interface.

- iSelect: iSelect provides a comprehensive comparison of car insurance policies and allows you to filter options based on your specific needs.

- Canstar: Canstar offers a detailed comparison of car insurance policies and provides ratings based on customer satisfaction and value for money.

- Finder: Finder compares car insurance quotes from various providers and offers insightful articles and guides to help you make an informed decision.

Understanding Car Insurance Policies

In South Australia, car insurance policies are designed to protect you financially in case of an accident or other incident involving your vehicle. Understanding the different types of coverage available and the terms and conditions of your policy is crucial for making informed decisions and ensuring you have the right protection.

Types of Car Insurance Policies

The two main types of car insurance policies in South Australia are comprehensive and third-party insurance.

- Comprehensive car insurance offers the most comprehensive coverage, protecting you against a wide range of risks, including damage to your own vehicle, theft, fire, and natural disasters. It also covers third-party liability, meaning you’re protected if you cause damage to someone else’s property or injure them in an accident.

- Third-party car insurance provides coverage for damage or injury caused to other people or their property, but it doesn’t cover damage to your own vehicle. This type of insurance is generally cheaper than comprehensive insurance, but it offers less protection.

Features and Benefits of Different Car Insurance Policies

The specific features and benefits of car insurance policies can vary depending on the insurer and the chosen policy. However, some common features include:

- Third-party property damage: This coverage protects you if you cause damage to someone else’s property, such as their car, home, or belongings.

- Third-party personal injury: This coverage protects you if you cause injury to someone else in an accident.

- Fire and theft: This coverage protects you if your car is damaged or stolen due to fire or theft.

- Natural disaster cover: This coverage protects you if your car is damaged due to natural disasters such as floods, earthquakes, or storms.

- Accidental damage: This coverage protects you if your car is damaged in an accident, regardless of who is at fault.

- Excess: This is the amount you’re responsible for paying towards the cost of a claim. The excess can vary depending on the policy and the type of claim.

- No-claim bonus: This is a discount you receive on your premium if you don’t make any claims during a certain period. The discount increases with each claim-free year.

- New for old: This benefit ensures you receive the full replacement cost of your car if it’s damaged or stolen within a certain period, even if it’s older than the specified age.

- Towing and roadside assistance: This benefit covers the cost of towing your car to a repair shop or garage in case of a breakdown or accident.

- Windscreen repair or replacement: This benefit covers the cost of repairing or replacing your windscreen if it’s damaged in an accident or by a stone.

Understanding the Terms and Conditions, Cheapest car insurance in south australia

It’s essential to carefully read and understand the terms and conditions of your car insurance policy before you sign up. This includes:

- Exclusions: These are situations or events that are not covered by your policy. For example, your policy might exclude coverage for damage caused by driving under the influence of alcohol or drugs, or for damage caused by wear and tear.

- Limits: These are the maximum amounts your insurer will pay for different types of claims. For example, there might be a limit on the amount you can claim for third-party property damage or personal injury.

- Excess: This is the amount you’re responsible for paying towards the cost of a claim. Make sure you understand how the excess works and how much you’ll need to pay in different situations.

- Claim process: This Artikels the steps you need to take if you need to make a claim. Understanding the process will help you make a claim quickly and efficiently.

- Cancellation: This explains the conditions under which you can cancel your policy and how much notice you need to give. You should also be aware of any penalties for canceling your policy early.

Making an Informed Decision

Choosing the right car insurance in South Australia is crucial to ensure you’re adequately protected while getting the best value for your money. With a plethora of providers and policies available, it can be overwhelming to navigate. This section will provide a step-by-step guide to help you make an informed decision and secure the cheapest car insurance that meets your needs.

Choosing the Cheapest Car Insurance

Before diving into the details, it’s essential to understand that the cheapest car insurance might not always be the best. While saving money is important, it’s equally crucial to have sufficient coverage for your specific needs.

Here’s a step-by-step guide to help you choose the cheapest car insurance in South Australia:

- Assess Your Needs: The first step is to evaluate your individual requirements. Consider factors such as the type of car you drive, your driving history, your age, and the level of coverage you need. For instance, if you have an older car, you might not need comprehensive coverage, which can significantly impact your premium.

- Gather Quotes: Once you’ve assessed your needs, it’s time to gather quotes from multiple insurance providers. You can do this online, over the phone, or by visiting an insurance broker. Ensure you provide accurate information to each provider for a fair comparison.

- Compare Quotes: After receiving quotes, carefully compare them based on factors like the premium, coverage, and any additional benefits offered. Pay close attention to the excess amount, which is the amount you pay out of pocket in case of an accident. A lower excess usually means a higher premium.

- Read Reviews: Before making a final decision, research the reputation of the insurance providers you’re considering. Read customer reviews on websites like ProductReview.com.au to get an understanding of their customer service, claims handling process, and overall satisfaction levels.

- Negotiate: Don’t hesitate to negotiate your premium with the insurance provider. They might be willing to offer a discount if you’re a loyal customer, have a clean driving record, or are willing to increase your excess.

- Final Decision: Once you’ve carefully considered all factors, choose the insurance provider that offers the best combination of price, coverage, and customer service.

Negotiating Car Insurance Premiums

Negotiating your car insurance premium can save you money. Here are some tips:

- Shop Around: Comparing quotes from multiple insurance providers is the first step to finding the best deal.

- Ask About Discounts: Many insurance providers offer discounts for various reasons, such as safe driving records, loyalty, multi-car policies, and safety features in your car.

- Increase Your Excess: Increasing your excess, the amount you pay out of pocket in case of an accident, can significantly reduce your premium. However, ensure you can afford the excess if you need to make a claim.

- Consider Paying Annually: Paying your premium annually instead of monthly can often lead to a discount.

- Be Prepared to Walk Away: If you’re not satisfied with the offered premium, be prepared to walk away and explore other options. This can incentivize the insurance provider to offer a better deal.

Last Point

Finding the cheapest car insurance in South Australia doesn’t have to be a daunting task. By following the tips and strategies Artikeld in this guide, you can confidently navigate the process, compare quotes, and ultimately secure the most affordable coverage that meets your needs. Remember, it’s essential to compare different providers, understand the terms and conditions of each policy, and read customer reviews before making a final decision. With a little research and planning, you can find the best car insurance deal in South Australia and drive with peace of mind.

FAQ

What is the minimum car insurance coverage required in South Australia?

In South Australia, you are required to have at least third-party property damage insurance, which covers damage to other vehicles or property in the event of an accident.

What are some common discounts available for car insurance in South Australia?

Common discounts include good driver discounts, multi-car discounts, and safe driving courses.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually to ensure you’re still getting the best deal and that your coverage meets your current needs.