Navigating the world of car insurance in Australia can feel like a maze, especially when you’re looking for the most affordable option. “Cheapest insurance for car in Australia” is a common search, and it’s understandable. After all, who wants to pay more than they have to? But finding the best deal isn’t just about the lowest price. It’s about finding the right balance between cost and coverage that fits your needs.

Understanding the different types of car insurance available, the factors that influence premiums, and the strategies for comparing quotes are all essential steps in this process. This guide aims to provide you with the information you need to make an informed decision and secure the most affordable car insurance that meets your specific requirements.

Understanding Car Insurance in Australia

Car insurance in Australia is a legal requirement for all vehicle owners. It protects you and your vehicle financially in the event of an accident, theft, or other unforeseen events. Understanding the different types of car insurance available and the factors that influence premiums can help you make informed decisions and find the most suitable coverage for your needs.

Types of Car Insurance in Australia, Cheapest insurance for car in australia

Car insurance in Australia is broadly categorized into three main types:

- Comprehensive Car Insurance: This is the most comprehensive type of car insurance, providing protection against a wide range of risks, including accidents, theft, fire, vandalism, and natural disasters. It covers damage to your own vehicle, as well as liability for damage to other vehicles or property.

- Third-Party Property Damage: This type of insurance covers damage or injury to other people’s property or vehicles caused by you while driving. It does not cover damage to your own vehicle.

- Third-Party Fire and Theft: This type of insurance provides coverage for damage or loss to your vehicle due to fire or theft. It also includes third-party property damage coverage, but does not cover accidents.

Factors Influencing Car Insurance Premiums

Several factors can influence the cost of car insurance in Australia, including:

- Vehicle Type: The type of vehicle you drive significantly affects your premium. High-performance cars, luxury vehicles, and vehicles with a high theft risk tend to have higher premiums.

- Age: Younger drivers typically pay higher premiums due to their lack of experience and higher risk of accidents.

- Driving History: Your driving history, including any accidents, traffic violations, or claims made, plays a crucial role in determining your premium.

- Location: The area where you live can influence your insurance premium. Areas with higher rates of accidents or crime may have higher premiums.

- Coverage Options: The level of coverage you choose can also impact your premium. Comprehensive insurance, with its wider range of protection, generally comes with a higher premium than third-party insurance.

Factors Affecting Car Insurance Costs

Your car insurance premium is influenced by a variety of factors, including the type of vehicle you drive, your driving history, and where you live. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Vehicle Type

The type of vehicle you drive is a significant factor in determining your car insurance premium.

- Sedans are generally considered less risky than SUVs or luxury cars, leading to lower insurance premiums.

- SUVs, with their larger size and potential for greater damage, tend to have higher insurance premiums than sedans.

- Luxury cars are often associated with higher repair costs and are often targeted by thieves, resulting in higher insurance premiums.

Insurance companies consider factors like the vehicle’s value, repair costs, and the likelihood of theft when setting premiums.

Driving History

Your driving history plays a crucial role in determining your car insurance premium.

- Accidents: A history of accidents, particularly at-fault accidents, can significantly increase your premium. Insurance companies view drivers with a history of accidents as higher risk, leading to higher premiums.

- Speeding tickets: Receiving speeding tickets can also result in higher premiums. These tickets indicate a higher risk of accidents and can raise your insurance costs.

- Traffic violations: Other traffic violations, such as running red lights or driving under the influence, can also negatively impact your insurance premium.

A clean driving record can help you secure lower premiums.

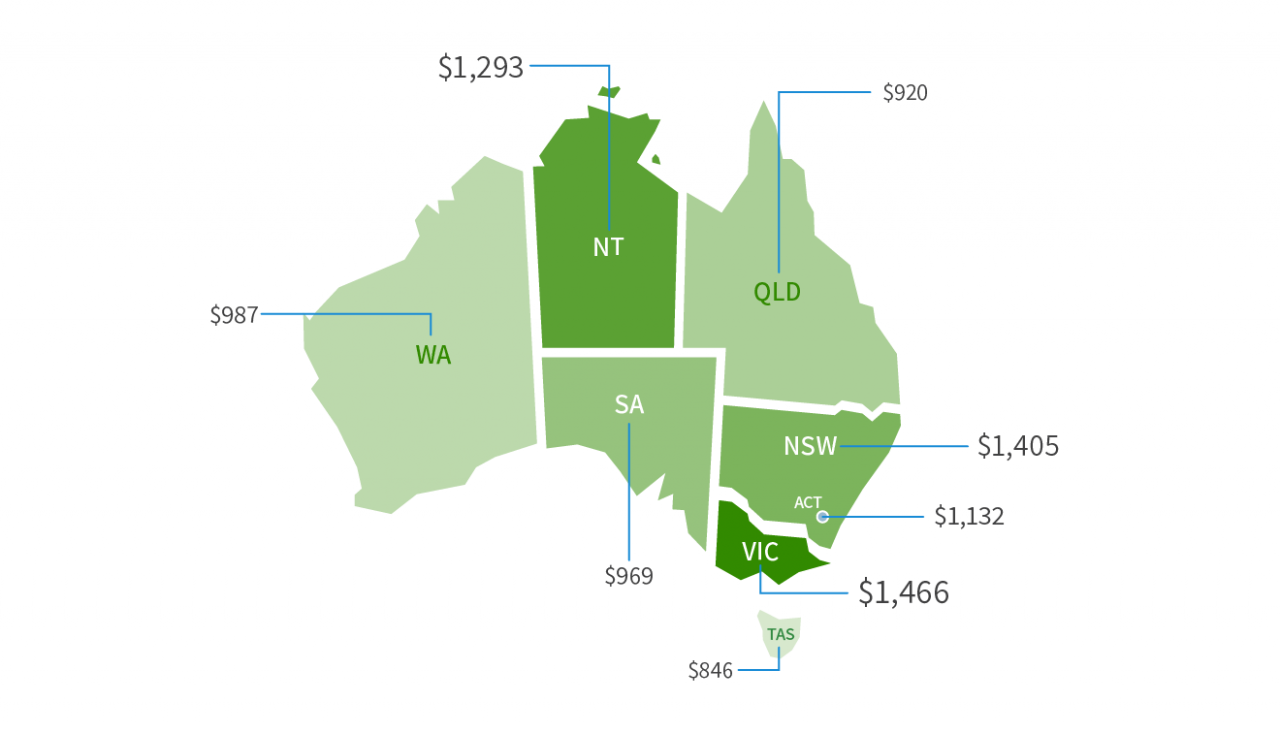

Location

The location where you live can also affect your car insurance premium.

- Urban areas often have higher rates of traffic congestion and theft, which can lead to higher insurance premiums.

- Rural areas, with lower population density and less traffic, tend to have lower insurance premiums.

Insurance companies consider factors like the frequency of accidents, theft rates, and the cost of repairs in specific areas when setting premiums.

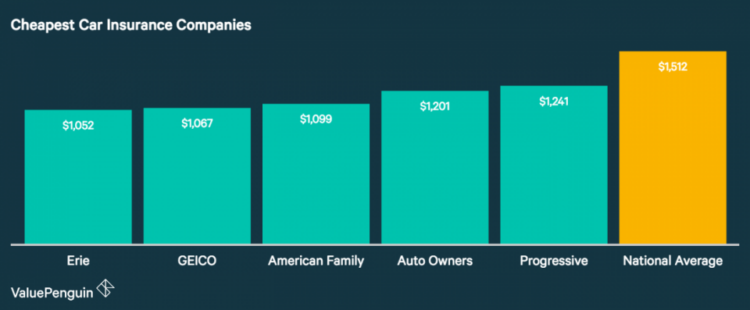

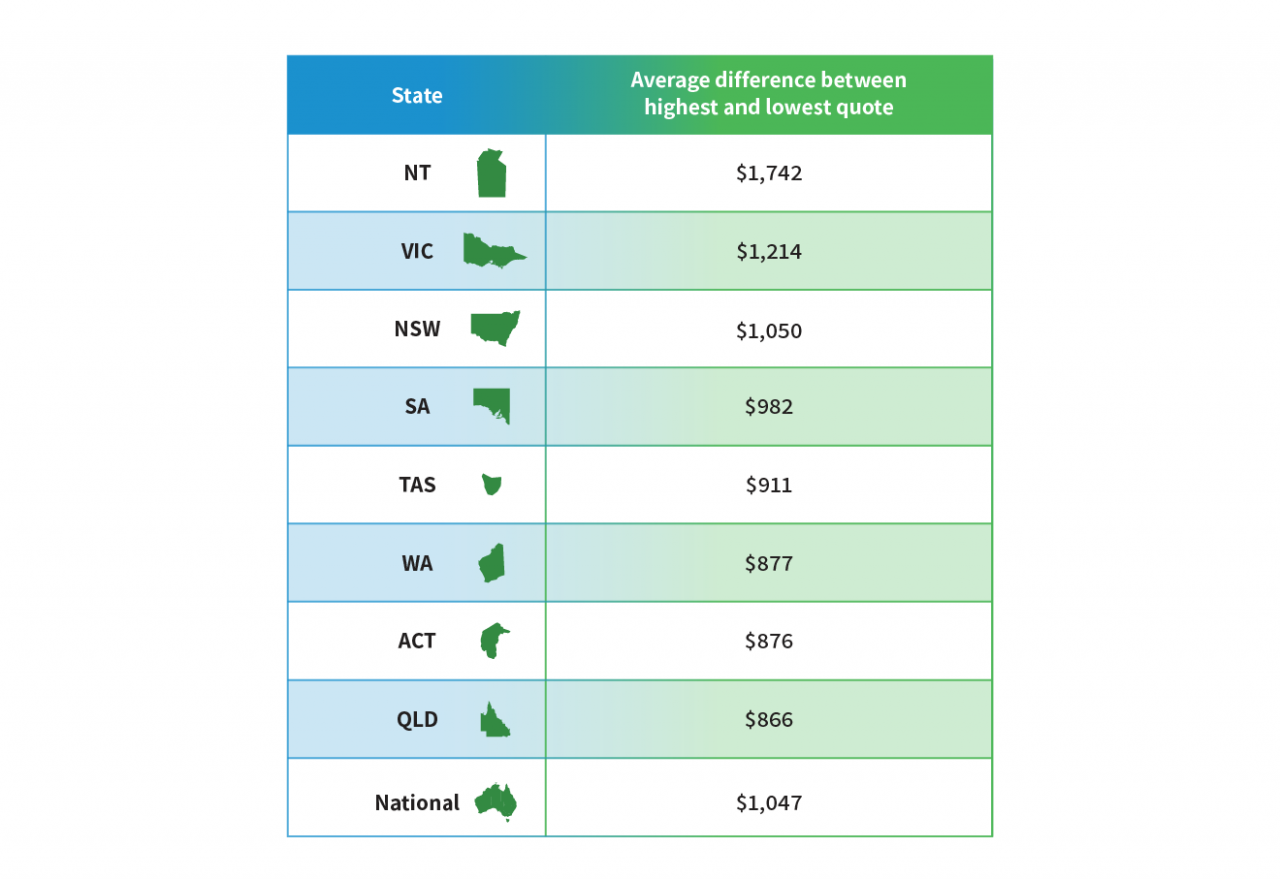

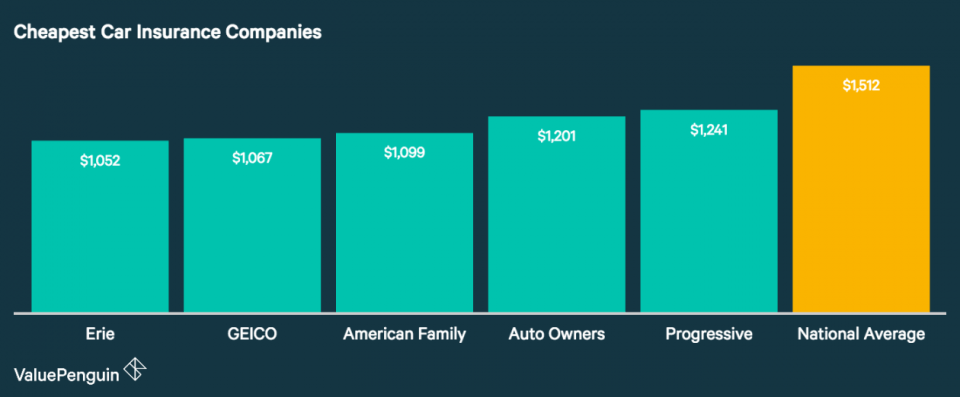

Finding the Cheapest Car Insurance

Finding the cheapest car insurance in Australia requires careful research and comparison. You can save money by understanding the factors that influence insurance premiums and utilizing various strategies for securing the best deal.

Reputable Car Insurance Providers in Australia

Choosing a reputable car insurance provider is crucial for ensuring reliable coverage and peace of mind. Some of the well-known and trusted car insurance providers in Australia include:

- AAMI

- RACV

- NRMA

- Allianz

- GIO

- Suncorp

- QBE

- Budget Direct

- Youi

- Just Car Insurance

Tips for Comparing Car Insurance Quotes

Comparing car insurance quotes from multiple providers is essential for finding the most affordable option. Here are some valuable tips for this process:

- Gather your information: Before starting your comparison, gather all the necessary information, such as your car details, driving history, and desired coverage levels. This will streamline the quoting process.

- Use online comparison websites: Online car insurance comparison websites are a convenient and efficient way to compare quotes from multiple providers simultaneously. They allow you to input your information once and receive quotes from various insurers.

- Consider different coverage options: Different insurers offer various coverage options, including comprehensive, third-party fire and theft, and third-party property damage. Compare the coverage levels and premiums to determine the best fit for your needs and budget.

- Check for discounts: Many insurers offer discounts for factors like safe driving history, multiple policy holders, and vehicle safety features. Inquire about available discounts and ensure you are receiving all applicable benefits.

- Read the policy documents carefully: Before committing to a policy, thoroughly read the policy documents to understand the coverage details, exclusions, and terms and conditions.

Benefits of Using Online Car Insurance Comparison Websites

Online car insurance comparison websites offer numerous advantages for finding the cheapest car insurance.

- Convenience: You can compare quotes from multiple providers without leaving your home, saving time and effort.

- Efficiency: Online platforms streamline the quoting process by allowing you to enter your information once and receive multiple quotes instantly.

- Transparency: Online comparison websites provide clear and concise information about each insurer’s coverage levels and premiums, enabling you to make informed decisions.

- Objectivity: These websites are designed to provide unbiased comparisons, ensuring you receive accurate and reliable information.

Essential Considerations for Car Insurance: Cheapest Insurance For Car In Australia

Choosing the right car insurance policy is crucial for protecting yourself financially in the event of an accident or other unforeseen circumstances. It’s not just about finding the cheapest option; it’s about finding the right level of coverage that meets your individual needs and provides adequate protection.

Understanding Coverage Levels

It’s essential to understand the different levels of car insurance coverage available in Australia. The most common types include:

- Third-party property damage (TPPD): This is the minimum level of coverage required by law in Australia. It covers damage you cause to another person’s property but does not cover damage to your own vehicle or your own injuries.

- Third-party fire and theft (TPFT): This coverage extends TPPD to include damage caused by fire or theft of your vehicle. However, it still doesn’t cover damage to your own vehicle or your own injuries.

- Comprehensive: This is the most comprehensive type of car insurance. It covers damage to your own vehicle, regardless of fault, as well as damage to other vehicles and property, and your own injuries.

Choosing the right level of coverage depends on factors such as your vehicle’s value, your driving habits, and your financial situation. For example, if you drive an older vehicle with a low value, TPPD or TPFT may be sufficient. However, if you drive a new or high-value vehicle, comprehensive insurance is recommended to protect your investment.

Policy Exclusions and Limitations

It’s equally important to carefully read and understand the terms and conditions of your car insurance policy. This includes being aware of any exclusions or limitations. For example, most policies exclude coverage for:

- Damage caused by wear and tear: This includes normal wear and tear on your vehicle, such as tire wear or brake pad wear.

- Damage caused by intentional acts: This includes damage caused by deliberately driving recklessly or causing an accident on purpose.

- Damage caused by certain natural disasters: Some policies may exclude coverage for damage caused by events like earthquakes or volcanic eruptions.

Understanding these exclusions and limitations will help you make informed decisions about your insurance needs and ensure you are not caught off guard in the event of a claim.

Seeking Professional Advice

Navigating the complexities of car insurance can be challenging, and it’s often beneficial to seek professional advice from an insurance broker. Brokers can:

- Provide personalized advice: They will assess your individual needs and recommend the most suitable coverage options.

- Compare quotes from different insurers: They can help you find the most competitive prices and ensure you are getting the best value for your money.

- Assist with claims: They can provide support and guidance throughout the claims process, helping you navigate the complexities and ensure your claim is handled smoothly.

An insurance broker can be a valuable resource when it comes to car insurance. They can help you make informed decisions and ensure you have the right level of coverage to protect yourself financially.

Tips for Saving on Car Insurance

Saving money on car insurance is a priority for many Australians. Fortunately, there are several strategies you can employ to reduce your premiums. By understanding these tips and implementing them, you can significantly lower your insurance costs without compromising on coverage.

Maintaining a Good Driving Record

A clean driving record is a significant factor in determining your car insurance premium. Insurance companies view drivers with a history of accidents, speeding tickets, or other traffic violations as higher risk. Consequently, they charge higher premiums to reflect this increased risk.

- Avoid Traffic Violations: Driving safely and obeying traffic laws is essential to maintain a good driving record. Every violation, even minor ones, can increase your premium.

- Defensive Driving Courses: Consider enrolling in defensive driving courses to enhance your driving skills and knowledge. Completing such courses may earn you discounts on your insurance premiums.

- Avoid Accidents: Accidents are the most significant factor impacting your driving record. Practicing safe driving habits and being vigilant on the road can help you avoid accidents and maintain lower insurance premiums.

Increasing Your Excess

The excess is the amount you pay out of pocket before your insurance covers the rest of the claim. By increasing your excess, you essentially agree to pay more in the event of an accident but receive a lower premium.

- Understand the Trade-off: While increasing your excess can lead to lower premiums, it also means you’ll need to pay more out of pocket if you make a claim. It’s crucial to assess your financial situation and risk tolerance before making this decision.

- Set a Realistic Excess: Don’t choose an excess that’s too high, as it could lead to financial hardship in case of an accident. Ensure the chosen excess is manageable for you.

Bundling Your Car Insurance with Other Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance, home insurance, or health insurance. By combining your policies, you can often secure significant savings.

- Compare Bundled Policies: Contact different insurers and compare their bundled policy options to find the most cost-effective solution.

- Check for Additional Discounts: Some insurers offer further discounts when you bundle policies, so inquire about any additional savings you may be eligible for.

Choosing a Safe Vehicle

The type of vehicle you own also influences your car insurance premium. Vehicles with safety features, such as airbags, anti-lock brakes, and electronic stability control, are generally considered safer and attract lower insurance premiums.

- Research Safety Ratings: Before purchasing a car, research its safety ratings from organizations like ANCAP (Australasian New Car Assessment Program). Vehicles with higher safety ratings tend to have lower insurance costs.

- Consider Safety Features: When comparing vehicles, pay attention to safety features like airbags, anti-lock brakes, and electronic stability control. These features can significantly impact your insurance premiums.

Parking Your Car in a Secure Location

Where you park your car can also influence your insurance premium. Parking in a secure location, such as a garage or a well-lit, monitored parking lot, reduces the risk of theft or damage.

- Garage Parking: If possible, park your car in a garage. This provides the most secure environment and can significantly lower your insurance premiums.

- Monitored Parking Lots: When parking in a public lot, choose one that’s well-lit, monitored by security cameras, and patrolled by security personnel. This reduces the risk of theft or vandalism.

Final Review

In conclusion, securing the cheapest car insurance in Australia involves a careful consideration of your individual needs, driving history, vehicle type, and location. By understanding the factors that influence premiums, utilizing comparison websites, and taking advantage of available discounts, you can find a policy that provides adequate coverage without breaking the bank. Remember, it’s crucial to compare quotes from multiple providers, carefully review policy terms and conditions, and seek professional advice if needed. A little research and effort can go a long way in securing the best car insurance deal for your unique situation.

Clarifying Questions

What are the main types of car insurance in Australia?

The main types are Comprehensive, Third-Party Property Damage, and Third-Party Fire and Theft. Comprehensive offers the most extensive coverage, while the others provide varying levels of protection.

How often should I review my car insurance policy?

It’s recommended to review your policy at least annually, or even more frequently if your circumstances change, such as a change in your driving history, vehicle, or location.

Can I get car insurance if I have a poor driving record?

Yes, but you might face higher premiums. Some insurers specialize in high-risk drivers, so it’s worth exploring your options.

What are some common exclusions in car insurance policies?

Common exclusions include damage caused by wear and tear, intentional acts, and driving under the influence of alcohol or drugs.