Compare car insurance in Australia: a crucial task for every driver. Navigating the complex world of car insurance can feel overwhelming, with numerous providers offering diverse policies and coverage options. From comprehensive to third-party, understanding the different types of insurance available is essential for making an informed decision. This guide will delve into the key factors influencing premiums, compare major providers, and help you choose the policy that best suits your needs and budget.

In Australia, car insurance premiums are influenced by a multitude of factors, including your age, driving history, the type of car you own, and your location. Understanding these factors and how they impact your premiums is crucial for securing the best deal. This guide will explore these factors in detail, offering valuable insights into how to optimize your insurance costs.

Understanding Australian Car Insurance

Car insurance is a crucial aspect of owning a vehicle in Australia. It protects you financially in the event of an accident or other incidents involving your car. There are different types of car insurance available, each offering varying levels of coverage and protection. Understanding the different types of car insurance and the factors that influence premiums is essential for making informed decisions.

Types of Car Insurance in Australia

Car insurance in Australia is categorized into three main types:

- Comprehensive Car Insurance: This provides the most comprehensive coverage, protecting you against damage to your car, regardless of who is at fault. It also covers theft, fire, and other perils. Comprehensive car insurance is the most expensive option but offers the highest level of protection.

- Third Party Fire and Theft: This type of insurance covers damage to other people’s property or vehicles caused by your car, as well as damage to your car due to fire or theft. However, it doesn’t cover damage to your car if you are at fault in an accident. This option is less expensive than comprehensive insurance but offers less protection.

- Third Party Property: This is the most basic type of car insurance and only covers damage to other people’s property or vehicles caused by your car. It doesn’t cover damage to your car or any other perils. This option is the least expensive but offers the least protection.

Factors Influencing Car Insurance Premiums

Several factors determine your car insurance premium. These include:

- Age and Driving History: Younger drivers and those with a history of accidents or traffic violations generally pay higher premiums. This is because they are statistically more likely to be involved in accidents.

- Car Type: The make, model, and value of your car can significantly impact your premium. High-performance or expensive cars are generally more expensive to insure.

- Location: Your location can also influence your premium. Areas with higher accident rates or higher car theft rates may have higher premiums.

- Driving Habits: Your driving habits, such as the number of kilometers you drive annually and the type of roads you drive on, can also affect your premium.

- Claims History: If you have made claims in the past, your premium may be higher. This is because insurance companies view you as a higher risk.

- Excess: The excess is the amount you agree to pay towards the cost of a claim. A higher excess generally means a lower premium.

Common Car Insurance Exclusions and Limitations

Car insurance policies often have exclusions and limitations. These are situations where your insurance may not cover the damage or loss. Some common exclusions and limitations include:

- Driving under the Influence of Alcohol or Drugs: Most insurance policies will not cover damage or loss if you are driving under the influence of alcohol or drugs.

- Driving without a License: If you are driving without a valid driver’s license, your insurance may not cover any damage or loss.

- Driving a Vehicle Not Listed on Your Policy: Your insurance policy typically only covers the vehicle listed on the policy. If you are driving a different vehicle, your insurance may not cover any damage or loss.

- Wear and Tear: Car insurance generally doesn’t cover damage or loss caused by wear and tear.

- Acts of God: While some insurance policies may cover damage caused by natural disasters, such as floods or earthquakes, there are often limitations or exclusions.

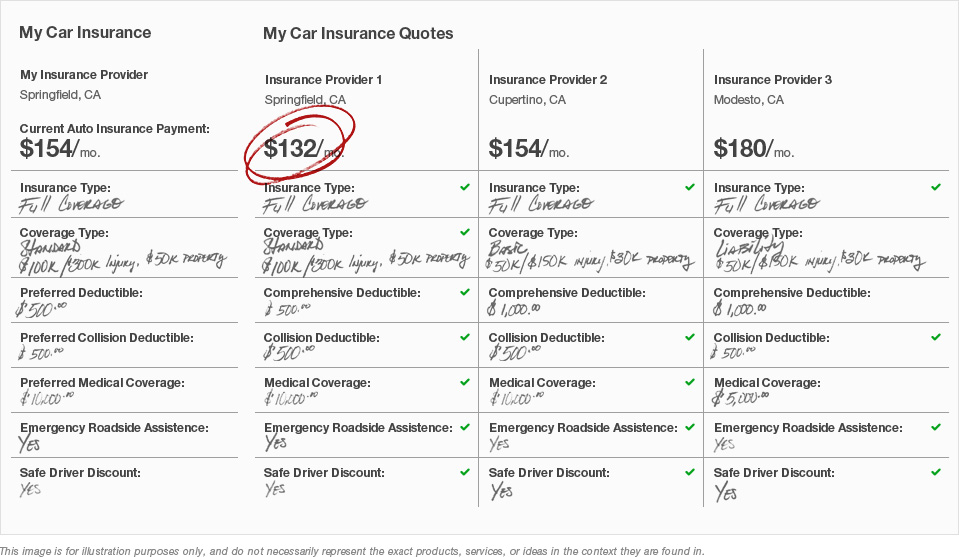

Key Factors to Consider When Comparing

Finding the right car insurance policy can be a bit of a maze, but it doesn’t have to be a stressful experience. The key is to compare different policies based on your specific needs and driving habits. It’s like finding the perfect pair of shoes – you wouldn’t buy the first pair you see, right? You’d consider your foot size, the occasion, and your budget, wouldn’t you? The same applies to car insurance.

Your Individual Needs and Driving Habits

Understanding your individual needs and driving habits is crucial in finding the right car insurance policy. This means considering factors like your age, driving experience, the type of car you drive, and where you live. For example, if you’re a young driver with a new car, you might need a policy with comprehensive coverage and a lower excess. If you’re an experienced driver with an older car, you might be able to save money by opting for a basic policy with a higher excess.

Key Features and Benefits to Prioritize

When comparing quotes, there are some key features and benefits you should prioritize:

Excess

This is the amount you pay out of pocket in the event of a claim. A lower excess generally means higher premiums, while a higher excess usually translates to lower premiums. Consider your risk tolerance and financial situation when choosing an excess.

Coverage Limits

These determine the maximum amount the insurer will pay for a claim. Make sure the coverage limits are sufficient for your needs, especially if you have a high-value car.

Roadside Assistance

This provides assistance in case of a breakdown, flat tire, or other emergencies. It’s a valuable feature, especially if you often drive long distances or in remote areas.

Other Benefits

Some insurers offer additional benefits like new car replacement, windscreen cover, and rental car reimbursement. These benefits can be useful, but they might come at a higher premium.

Questions to Ask Potential Insurers

Once you’ve narrowed down your options, it’s a good idea to ask potential insurers these questions:

- What are the specific terms and conditions of your policy?

- What are the exclusions and limitations of your policy?

- How does your claims process work?

- What is your customer service record like?

- What discounts are available?

Asking these questions will help you make an informed decision and ensure you choose a policy that meets your needs and budget.

Understanding Policy Terms and Conditions: Compare Car Insurance In Australia

It’s essential to understand the terms and conditions of your car insurance policy. This ensures you know what’s covered and what isn’t, and can make informed decisions about your insurance needs.

Common Car Insurance Policy Terms and Conditions

Understanding common car insurance policy terms and conditions can help you make informed decisions about your insurance needs. Here are some key terms and conditions:

- Excess: The amount you pay towards a claim, even if the claim is covered by your insurance.

- Sum insured: The maximum amount your insurer will pay for a covered claim. This is often the market value of your car.

- Comprehensive insurance: Covers a wide range of events, including accidents, theft, fire, and natural disasters. It typically comes with a higher premium than third-party insurance.

- Third-party insurance: Covers damage to other people’s property or injuries to other people in an accident. It does not cover damage to your own vehicle.

- Third-party property damage: Covers damage to other people’s property, but not injuries or damage to your own vehicle.

- Agreed value: You and your insurer agree on a fixed value for your car, which will be paid out if it’s written off. This is often used for classic or high-value vehicles.

- Market value: The current market value of your car is paid out if it’s written off. This is often used for newer or more common vehicles.

- No claim bonus (NCB): A discount on your premium for not making a claim in a certain period. NCBs can accumulate over time, resulting in significant savings.

- Policy period: The length of time your policy is valid for.

- Renewal date: The date your policy is due for renewal.

Examples of Situations Where a Policy Might Not Cover a Claim, Compare car insurance in australia

It’s important to understand that car insurance policies have limitations and exclusions. Here are some examples of situations where a claim might not be covered:

- Driving under the influence of alcohol or drugs: Most car insurance policies will not cover claims if you’re driving under the influence.

- Driving without a valid driver’s license: If you’re driving without a valid license, your insurance policy may not cover any claims.

- Using your car for business purposes: If you use your car for business purposes, you may need to take out a separate commercial insurance policy.

- Driving outside of Australia: Most car insurance policies only cover you within Australia. If you’re driving outside of Australia, you’ll need to get additional insurance.

- Claims for wear and tear: Your car insurance policy typically won’t cover claims for wear and tear. This includes things like flat tires, worn brake pads, and a cracked windshield.

Importance of Reading and Understanding Your Policy Documents

It’s crucial to read and understand your policy documents before you sign them. This will help you avoid any surprises later on. Pay close attention to the following:

- Exclusions: This section Artikels what your policy doesn’t cover.

- Conditions: This section Artikels the terms and conditions you must adhere to in order for your policy to be valid.

- Claims process: This section explains how to make a claim if you need to.

It’s important to note that the terms and conditions of car insurance policies can vary between insurers. It’s always best to read your policy documents carefully to ensure you understand what’s covered and what isn’t.

Epilogue

Ultimately, comparing car insurance in Australia requires a thoughtful approach. By carefully considering your individual needs, driving habits, and budget, you can find a policy that provides adequate coverage at a competitive price. Remember to explore various providers, compare quotes, and ask questions to ensure you’re making an informed decision that protects you and your vehicle on the road.

FAQ Overview

What are the different types of car insurance available in Australia?

The main types of car insurance in Australia are comprehensive, third party fire and theft, and third party property. Comprehensive provides the most extensive coverage, while third party fire and theft offers protection against specific risks. Third party property covers damage caused to another person’s vehicle or property.

How can I find the best car insurance deal?

Start by comparing quotes from multiple insurers using online comparison websites or contacting brokers. Consider your individual needs and driving habits when selecting a policy, and don’t hesitate to ask questions about coverage details and exclusions.

What are some common car insurance exclusions?

Exclusions vary by insurer, but common ones include damage caused by wear and tear, intentional acts, driving under the influence, and driving without a valid license.

What are the benefits of using a broker?

Brokers can save you time by comparing quotes from multiple insurers, and they can provide expert advice tailored to your specific needs. However, they may charge a fee for their services.