Compare travel insurance in Australia, a crucial step for any traveler, is more than just finding the cheapest option. It’s about understanding the risks you face and securing the right coverage to protect yourself in case of unexpected events. From medical emergencies to lost luggage, travel insurance provides peace of mind and financial security during your adventures.

Australia’s diverse landscape and activities offer incredible experiences, but they also come with potential hazards. Whether you’re hiking in the Outback, diving on the Great Barrier Reef, or exploring bustling cities, travel insurance can act as a safety net, helping you navigate unexpected challenges with confidence.

Introduction

Travel insurance is an essential investment for any traveler visiting Australia. While Australia is known for its breathtaking landscapes, diverse wildlife, and vibrant cities, it’s also important to be prepared for potential risks and unexpected events that could arise during your trip.

Travel insurance provides a safety net, offering financial protection against a wide range of unforeseen circumstances, ensuring peace of mind and allowing you to focus on enjoying your Australian adventure.

Potential Travel Risks in Australia

Travel insurance is particularly important in Australia due to the diverse range of potential risks travelers may encounter. From unexpected medical emergencies to flight delays and cancellations, the right travel insurance policy can help you navigate these challenges and minimize the financial impact.

- Medical Emergencies: Australia’s healthcare system is renowned for its high quality, but medical expenses can be substantial, especially in cases of serious illness or injury. Travel insurance can cover medical costs, including hospitalization, emergency treatment, and medical evacuation, providing financial security in the event of an unexpected health crisis.

- Flight Delays and Cancellations: Flight disruptions are a common occurrence, especially during peak travel seasons. Travel insurance can provide compensation for lost travel time, accommodation costs, and other expenses incurred due to flight delays or cancellations.

- Lost or Stolen Luggage: The inconvenience of lost or stolen luggage can be significant, especially if it contains essential items. Travel insurance can reimburse you for the cost of replacing lost or stolen belongings, helping you get back on track quickly.

- Natural Disasters: Australia is prone to natural disasters, including bushfires, floods, and cyclones. Travel insurance can provide coverage for disruptions caused by these events, including accommodation, transportation, and medical expenses.

- Personal Accidents: Accidents can happen anywhere, and travel insurance can offer financial protection for injuries sustained during your trip, including medical expenses, disability coverage, and even death benefits.

Examples of Travel Emergencies and Insurance Coverage

- Medical Emergency: Imagine you’re hiking in the Outback and suffer a serious ankle injury. Travel insurance can cover the cost of medical evacuation to a hospital, emergency treatment, and ongoing medical care.

- Flight Cancellation: Your flight to Sydney is cancelled due to bad weather. Travel insurance can reimburse you for accommodation costs, alternative flights, and other expenses incurred due to the cancellation.

- Lost Luggage: Your luggage is lost in transit during your flight to Melbourne. Travel insurance can cover the cost of replacing essential items, including clothing, toiletries, and medication.

- Natural Disaster: A bushfire breaks out near your accommodation in Tasmania, forcing you to evacuate. Travel insurance can provide financial assistance for alternative accommodation, transportation, and other emergency expenses.

Types of Travel Insurance

Choosing the right travel insurance is crucial for ensuring peace of mind while traveling. In Australia, you’ll find various types of travel insurance policies tailored to different needs and travel styles. This section explores the common types of travel insurance available in Australia, highlighting their key features and benefits.

Single Trip Travel Insurance

Single trip travel insurance is designed for individual trips, offering coverage for a specific duration. This type of insurance is ideal for short vacations, business trips, or any trip with a defined start and end date.

Here are some key features of single trip travel insurance:

* Coverage Duration: Covers you for the specific duration of your trip, from the date you leave to the date you return.

* Flexibility: You can customize your coverage to match your specific needs and budget, choosing from various options like medical expenses, baggage loss, and cancellation cover.

* Cost-Effective: Generally, single trip insurance is more cost-effective than multi-trip insurance for short trips.

- Example: If you’re planning a two-week vacation to Bali, a single trip travel insurance policy would be suitable to cover you during your trip.

Multi-Trip Travel Insurance

Multi-trip travel insurance is a comprehensive policy that covers multiple trips within a specific period, typically a year. This type of insurance is ideal for frequent travelers, backpackers, or those who take multiple trips throughout the year.

Here are some key features of multi-trip travel insurance:

* Multiple Trip Coverage: Provides coverage for several trips within a defined period, often a year.

* Convenience: You only need to purchase one policy for all your trips within the coverage period, simplifying the insurance process.

* Cost Savings: For frequent travelers, multi-trip insurance can be more cost-effective than purchasing separate single trip policies for each trip.

- Example: If you’re a frequent traveler who takes several short trips throughout the year, a multi-trip travel insurance policy would be more suitable than purchasing separate single trip policies for each trip.

Backpacker Travel Insurance

Backpacker travel insurance is specifically designed for backpackers and young travelers who are often on extended trips and may engage in adventure activities. This type of insurance provides comprehensive coverage tailored to the unique needs of backpackers.

Here are some key features of backpacker travel insurance:

* Extended Trip Coverage: Offers coverage for longer trips, typically lasting several months or even a year.

* Adventure Activity Coverage: Includes coverage for a wide range of adventure activities, such as hiking, skiing, and scuba diving.

* Global Coverage: Provides coverage in multiple countries, allowing backpackers to explore various destinations.

- Example: If you’re planning a gap year trip to Southeast Asia, a backpacker travel insurance policy would be suitable to cover you for the duration of your trip and provide coverage for adventure activities you might engage in.

Family Travel Insurance

Family travel insurance is designed to cover the entire family, providing comprehensive protection for parents and children. This type of insurance offers various benefits tailored to the specific needs of families traveling together.

Here are some key features of family travel insurance:

* Family Coverage: Covers all family members, including parents and children, under one policy.

* Child-Specific Benefits: Includes benefits specific to children, such as coverage for lost or damaged toys, childcare expenses, and medical expenses.

* Family-Friendly Features: Offers features like 24/7 emergency assistance, travel disruption coverage, and cancellation cover, making travel planning and execution smoother for families.

- Example: If you’re planning a family vacation to Disneyland with your spouse and two children, a family travel insurance policy would be suitable to cover the entire family and provide peace of mind during your trip.

Essential Coverage

When comparing travel insurance policies in Australia, understanding the essential coverage components is crucial. These components provide protection against unforeseen circumstances during your trip and can significantly impact the overall cost of your policy.

Medical Expenses

Medical expenses coverage is essential, especially when traveling overseas. This coverage reimburses you for medical costs incurred due to illness or injury during your trip. It includes hospitalisation, doctor’s consultations, ambulance fees, and medication.

The coverage amount can vary depending on the policy, with some offering a fixed sum, while others cover up to a certain limit.

It’s crucial to ensure your policy covers the estimated medical expenses for your destination. For instance, medical costs in countries like the United States can be exorbitant.

Emergency Evacuation

Emergency evacuation coverage is vital, especially for adventurous travellers or those visiting remote locations. This coverage covers the cost of transporting you back to your home country in case of a medical emergency or natural disaster.

It may include air ambulance, medical escort, and other related expenses.

This coverage is particularly crucial when travelling to areas with limited medical facilities or during unforeseen events like volcanic eruptions or political unrest.

Lost Luggage

Lost luggage coverage protects you from financial losses if your luggage is lost, stolen, or damaged during your trip. It reimburses you for the cost of replacing essential items like clothing, toiletries, and electronics.

The coverage amount is usually capped, and you might need to provide receipts for your purchases.

It’s recommended to pack valuable items in your carry-on luggage and keep a record of your luggage contents.

Travel Cancellation, Compare travel insurance in australia

Travel cancellation coverage reimburses you for non-refundable trip expenses if you need to cancel your trip due to unforeseen circumstances. These circumstances can include illness, injury, death in the family, or natural disasters.

The coverage amount is usually capped, and specific reasons for cancellation are Artikeld in the policy.

This coverage is particularly helpful for non-refundable bookings like flights, accommodation, and tours.

Additional Coverage Options

While essential coverage components are crucial, additional coverage options can provide extra peace of mind. These options include:

- Adventure Sports: Covers activities like skiing, snowboarding, scuba diving, and rock climbing, which are typically excluded under standard policies.

- Extreme Sports: Offers protection for high-risk activities like bungee jumping, skydiving, and white-water rafting.

- Pre-Existing Medical Conditions: Covers pre-existing medical conditions, which are usually excluded from standard policies. It’s crucial to disclose any pre-existing conditions to your insurer.

Factors to Consider When Comparing Policies

Choosing the right travel insurance policy is crucial for protecting yourself and your finances during your trip. It’s not a one-size-fits-all situation, and the best policy for you will depend on your individual needs and circumstances. To help you make an informed decision, here are some key factors to consider when comparing travel insurance policies.

Policy Limits

Policy limits refer to the maximum amount your insurer will pay for a particular covered event. These limits vary depending on the type of coverage and the insurer. For example, some policies may have a limit on the amount they will pay for medical expenses, while others may have a limit on the amount they will pay for lost or stolen luggage.

It’s essential to carefully consider the policy limits and ensure they meet your needs. For instance, if you plan on engaging in high-risk activities, such as skiing or scuba diving, you may need a policy with higher limits for medical expenses and emergency evacuation.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums, but you’ll have to pay more if you need to make a claim. Conversely, a lower deductible means higher premiums, but you’ll have less out-of-pocket expense if you need to file a claim.

When choosing a deductible, consider your budget and risk tolerance. If you’re on a tight budget, you may opt for a higher deductible to keep your premiums lower. However, if you’re concerned about potentially high out-of-pocket costs, you may choose a lower deductible.

Exclusions

Exclusions are specific events or situations that are not covered by your travel insurance policy. These exclusions can vary widely from insurer to insurer, so it’s crucial to read the policy document carefully and understand what is and is not covered.

Some common exclusions include:

- Pre-existing medical conditions: Many policies will not cover pre-existing medical conditions unless you specifically purchase additional coverage.

- Dangerous activities: Policies may exclude coverage for high-risk activities, such as skydiving, bungee jumping, or mountain climbing.

- Travel to certain countries: Some insurers may not offer coverage for travel to certain countries, especially those considered high-risk.

It’s essential to make sure your policy covers the activities and destinations you plan on visiting. If you’re unsure about any exclusions, contact your insurer directly for clarification.

Coverage Areas

Coverage areas refer to the geographical locations where your travel insurance policy is valid. Some policies provide worldwide coverage, while others may only cover specific regions.

If you plan on traveling to multiple countries, make sure your policy covers all your intended destinations. It’s also important to consider the specific risks associated with each country and choose a policy that provides adequate coverage.

Customer Reviews

Customer reviews can provide valuable insights into the experiences of other travelers with a particular insurer. These reviews can help you assess the insurer’s reliability, responsiveness, and claims process.

Look for reviews from reputable sources, such as consumer websites and travel forums. Pay attention to the overall rating, as well as the specific comments and experiences shared by other travelers.

Insurer Reputation

The reputation of the insurer is an important factor to consider when choosing a travel insurance policy. Look for insurers with a strong track record of providing excellent customer service and handling claims fairly.

You can research the insurer’s reputation by checking their financial stability ratings, reading industry reports, and seeking recommendations from trusted sources.

Claims Process

The claims process is a critical aspect of travel insurance. You want to ensure that the process is straightforward and that you can easily access the support you need in case of an emergency.

When comparing policies, consider the following factors related to the claims process:

- How easy is it to file a claim? (Online, phone, email)

- What documents are required?

- What is the turnaround time for processing claims?

- What is the insurer’s reputation for handling claims fairly and efficiently?

It’s also a good idea to ask about the insurer’s 24/7 emergency assistance services and their availability in your destination country.

Comparing Prices and Value

Once you’ve identified the essential coverage for your travel insurance needs, it’s time to compare prices and value across different providers. This involves evaluating the features, coverage limits, and overall cost of each policy to determine the best value for your money.

Comparing Prices and Features

Price is a significant factor when choosing travel insurance, but it’s crucial to remember that the cheapest policy isn’t always the best. Consider the features, coverage limits, and exclusions of each policy before making a decision.

| Provider | Policy Type | Annual Premium | Coverage Limits | Key Features | Value Proposition |

|---|---|---|---|---|---|

| [Provider 1] | [Policy Type 1] | $[Premium 1] | [Coverage Limits 1] | [Key Features 1] | [Value Proposition 1] |

| [Provider 2] | [Policy Type 2] | $[Premium 2] | [Coverage Limits 2] | [Key Features 2] | [Value Proposition 2] |

| [Provider 3] | [Policy Type 3] | $[Premium 3] | [Coverage Limits 3] | [Key Features 3] | [Value Proposition 3] |

This table presents a simplified comparison of three different travel insurance policies from reputable providers in Australia. The annual premium, coverage limits, and key features are provided for each policy. The “Value Proposition” column analyzes the policy’s features and price to assess its overall value. For example, a policy with a higher premium might offer greater coverage limits and more comprehensive features, making it a better value for individuals with specific travel needs.

Evaluating Value Proposition

The value proposition of a travel insurance policy is determined by its features, coverage limits, and price. A policy with a higher premium might offer greater coverage limits and more comprehensive features, making it a better value for individuals with specific travel needs. Conversely, a cheaper policy might offer limited coverage and exclusions, making it less valuable for travelers with specific concerns.

To evaluate the value proposition of different policies, consider the following factors:

- Coverage Limits: Ensure the coverage limits are sufficient for your travel needs, particularly for medical expenses, lost luggage, and cancellation costs.

- Exclusions: Understand the policy’s exclusions, as these can significantly impact your coverage. For example, some policies may exclude pre-existing medical conditions or certain types of activities.

- Features: Consider the additional features offered by each policy, such as emergency medical evacuation, 24/7 assistance, and travel delay coverage. These features can add significant value to your policy.

- Price: Compare the price of different policies with similar features and coverage limits. Consider the overall value offered by each policy based on its price and benefits.

Tips for Choosing the Right Policy: Compare Travel Insurance In Australia

Finding the perfect travel insurance policy can be a bit of a puzzle, especially with so many options available. But don’t worry, we’ve got you covered! By taking a few key steps, you can ensure you have the right protection for your trip.

Understanding Your Needs

It’s important to understand your individual needs and travel plans before diving into the world of travel insurance. Consider the following factors:

- Destination: Different countries have different risks, so make sure your policy covers you for the specific destination you’re visiting. For example, a policy covering skiing accidents might be essential if you’re heading to the Alps.

- Duration of Trip: Longer trips often require more comprehensive coverage. Check if your policy has limits on the duration of your trip and adjust accordingly.

- Activities: If you plan on engaging in adventurous activities like skiing, scuba diving, or trekking, ensure your policy covers these activities. Some policies might require additional coverage for these activities.

- Age and Health: Pre-existing medical conditions can impact your coverage. If you have any health concerns, it’s crucial to disclose them to the insurer before purchasing a policy.

- Budget: Travel insurance policies vary in price, so set a budget and stick to it. Remember, you don’t need to break the bank to get good coverage.

Reading the Fine Print

Once you have a general idea of your needs, it’s time to get down to the nitty-gritty.

- Exclusions: Pay close attention to what’s not covered by the policy. This can include things like pre-existing conditions, certain activities, or specific destinations. Knowing the exclusions can help you avoid surprises later.

- Excess: This is the amount you’ll need to pay out of pocket before your insurance kicks in. Compare the excess amounts across different policies and choose one that suits your budget.

- Claims Process: Understand how to file a claim and what documentation is required. A straightforward claims process can make all the difference in a stressful situation.

Comparing Policies

Now that you’ve got a good grasp of your needs and the policy details, it’s time to compare!

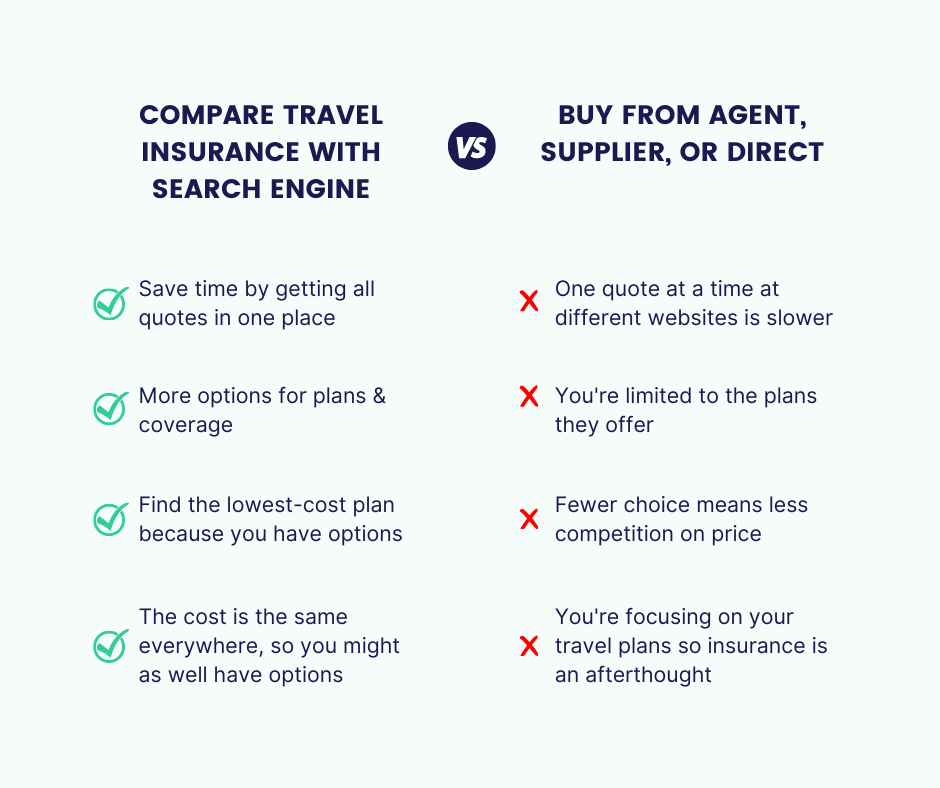

- Use Comparison Websites: Online comparison websites can save you time and effort by allowing you to compare multiple policies side-by-side. These websites often provide detailed information about each policy, including coverage, exclusions, and prices.

- Read Reviews: Check out customer reviews to get an idea of the insurer’s reputation and customer service. Good reviews can be a valuable indicator of the insurer’s reliability and responsiveness.

- Seek Professional Advice: If you’re unsure about which policy is right for you, don’t hesitate to seek advice from a travel insurance broker or financial advisor. They can provide expert guidance and help you make an informed decision.

Ending Remarks

Ultimately, choosing the right travel insurance policy in Australia depends on your individual needs and travel plans. By carefully comparing options, understanding your risks, and considering essential coverage components, you can find a policy that provides the protection you need for a safe and enjoyable journey. Don’t let the unexpected ruin your trip – arm yourself with the right travel insurance and embrace the adventure with confidence.

Questions Often Asked

What is the difference between single trip and multi-trip travel insurance?

Single trip insurance covers you for a single trip, while multi-trip insurance provides coverage for multiple trips within a specified period.

Do I need travel insurance if I’m already covered by my health insurance?

While your health insurance might offer some coverage abroad, travel insurance provides broader protection, including medical expenses, emergency evacuation, and lost luggage.

What are some common exclusions in travel insurance policies?

Exclusions vary, but they often include pre-existing medical conditions, dangerous activities, and travel against government advice.

How do I make a claim with my travel insurance?

Each insurer has its own claims process, but you’ll typically need to provide documentation like medical bills or police reports.