- Types of Compulsory Business Insurance in Australia

- Legal Requirements and Regulations

- Benefits of Compulsory Business Insurance

- Choosing the Right Insurance Policy

- Claiming Insurance Benefits

- Industry-Specific Requirements

- Resources and Support

- Final Thoughts

- Commonly Asked Questions: Compulsory Business Insurance In Australia

Compulsory business insurance in Australia is a vital aspect of running a successful and responsible business. It provides essential financial protection for businesses and their owners against a range of risks, ensuring peace of mind and business continuity in the face of unexpected events.

From workers’ compensation to public liability and professional indemnity, understanding the types of compulsory insurance, their legal requirements, and the benefits they offer is crucial for all Australian businesses. This guide will delve into the intricacies of compulsory business insurance, equipping you with the knowledge and resources to navigate the complexities of this essential aspect of business operations.

Types of Compulsory Business Insurance in Australia

In Australia, several types of business insurance are mandatory for certain industries and activities. These compulsory insurances are designed to protect businesses from financial losses and legal liabilities arising from specific risks associated with their operations. Understanding these mandatory insurances is crucial for businesses to comply with legal requirements and safeguard their financial stability.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory for all businesses in Australia, regardless of size or industry. It covers employees who suffer injuries or illnesses arising from their work. This insurance provides benefits to injured workers, including medical expenses, lost wages, and rehabilitation costs.

Workers’ compensation insurance is crucial for protecting businesses from significant financial liabilities arising from workplace injuries. For example, if an employee suffers a serious injury while working, the business could be liable for substantial medical expenses, lost wages, and legal costs. Workers’ compensation insurance helps to mitigate these risks by providing coverage for these expenses.

Public Liability Insurance

Public liability insurance is a mandatory requirement for many businesses in Australia, particularly those operating in high-risk industries such as construction, hospitality, and retail. This insurance covers businesses against claims of injury or property damage caused to third parties by their activities.

Public liability insurance is essential for businesses to protect themselves from significant financial losses and legal liabilities that could arise from accidents or incidents involving members of the public. For example, if a customer slips and falls in a retail store, the business could be liable for medical expenses, lost wages, and legal costs. Public liability insurance provides coverage for these expenses, protecting the business from financial ruin.

Professional Indemnity Insurance

Professional indemnity insurance is mandatory for certain professionals in Australia, such as lawyers, accountants, and medical practitioners. This insurance covers businesses against claims of negligence or misconduct in the provision of professional services.

Professional indemnity insurance is crucial for protecting professionals from financial losses and legal liabilities that could arise from errors or omissions in their work. For example, if an accountant provides incorrect financial advice that results in a client suffering financial losses, the accountant could be liable for significant damages. Professional indemnity insurance provides coverage for these claims, protecting the professional from financial ruin.

Legal Requirements and Regulations

In Australia, compulsory business insurance is a legal requirement for various industries and activities. The relevant legislation and regulatory bodies play a crucial role in ensuring compliance and protecting the interests of both businesses and the public.

Penalties for Non-Compliance

Non-compliance with compulsory business insurance requirements can result in significant penalties. These penalties may include fines, imprisonment, and the suspension or cancellation of business licenses.

Key Provisions of Relevant Legislation

The Work Health and Safety Act 2011 and the Insurance Contracts Act 1984 are two key pieces of legislation that underpin compulsory business insurance in Australia.

Work Health and Safety Act 2011

This act requires employers to provide a safe and healthy workplace for their employees. This includes ensuring that businesses have adequate insurance coverage to protect their workers from injuries and illnesses arising from their employment.

“An employer must ensure, as far as reasonably practicable, the health and safety of workers who are engaged by the employer.” – Section 19, Work Health and Safety Act 2011

Insurance Contracts Act 1984

This act governs the formation, interpretation, and enforcement of insurance contracts in Australia. It sets out the legal framework for insurance policies, including the rights and obligations of both insurers and policyholders.

“A contract of general insurance is a contract of indemnity by which the insurer undertakes to indemnify the insured against loss or liability in respect of a specified risk.” – Section 9, Insurance Contracts Act 1984

Benefits of Compulsory Business Insurance

Compulsory business insurance in Australia offers numerous advantages for businesses and their owners. It acts as a safety net, providing financial protection and peace of mind in the face of unforeseen circumstances. This insurance plays a crucial role in managing risk and safeguarding the future of your business.

Financial Protection

Compulsory business insurance provides essential financial protection for businesses and their owners. It helps to mitigate the financial impact of unexpected events, such as accidents, injuries, or legal claims.

- Coverage for Accidents and Injuries: Compulsory insurance typically covers the costs associated with accidents and injuries that occur on business premises or during business operations. This includes medical expenses, lost wages, and legal fees. For example, if a customer slips and falls in your store, the insurance will cover the costs of their medical treatment and any legal claims they might make.

- Protection Against Legal Claims: Compulsory insurance provides protection against legal claims arising from accidents, injuries, or other incidents. It covers the costs of legal representation and any settlements or judgments that may be awarded. This can help businesses avoid significant financial losses and protect their assets.

- Business Interruption Coverage: Some compulsory business insurance policies include coverage for business interruption. This provides financial support if your business is forced to close due to an insured event, such as a fire or natural disaster. The coverage helps businesses pay for lost income and other expenses during the downtime.

Risk Management

Compulsory business insurance is an essential component of a comprehensive risk management strategy. It helps businesses identify, assess, and mitigate potential risks.

- Identifying Potential Risks: The process of obtaining compulsory insurance requires businesses to identify and assess potential risks associated with their operations. This helps them develop strategies to minimize these risks.

- Mitigating Risks: By purchasing compulsory insurance, businesses can transfer the financial burden of certain risks to the insurer. This allows them to focus on managing other aspects of their business. For example, by having public liability insurance, businesses can mitigate the risk of financial losses from customer injuries.

- Compliance with Regulations: Compulsory business insurance is often required by law. This ensures that businesses are adequately insured and are meeting their legal obligations. This helps to maintain a safe and compliant working environment.

Reputation Protection

Compulsory business insurance can help protect a business’s reputation by mitigating the impact of negative events.

- Maintaining Public Trust: By having the required insurance, businesses demonstrate their commitment to safety and responsibility. This can help maintain public trust and confidence in the business.

- Minimizing Negative Publicity: In the event of an accident or injury, compulsory insurance can help businesses manage the situation and minimize negative publicity. The insurer will handle claims and communications with affected parties, reducing the burden on the business owner.

- Protecting Brand Image: By protecting the business from financial losses and legal claims, compulsory insurance can help preserve its brand image and reputation. This is particularly important for businesses that rely on their reputation for success.

Choosing the Right Insurance Policy

Navigating the world of compulsory business insurance in Australia can feel overwhelming. With various policies and providers, it’s crucial to make informed decisions to ensure you have the right coverage for your business needs. This section will guide you through the key factors to consider when choosing a policy, helping you make a confident and well-informed decision.

Factors to Consider When Choosing a Policy

Choosing the right compulsory insurance policy involves carefully evaluating several factors, including the coverage limits, premiums, and exclusions. These factors directly impact the level of protection you receive and the financial implications of your policy.

- Coverage Limits: Coverage limits define the maximum amount your insurer will pay for a covered claim. It’s essential to select limits that adequately cover your potential liabilities. For example, if your business has a high-value inventory, you’ll need a policy with a sufficient limit for property damage coverage.

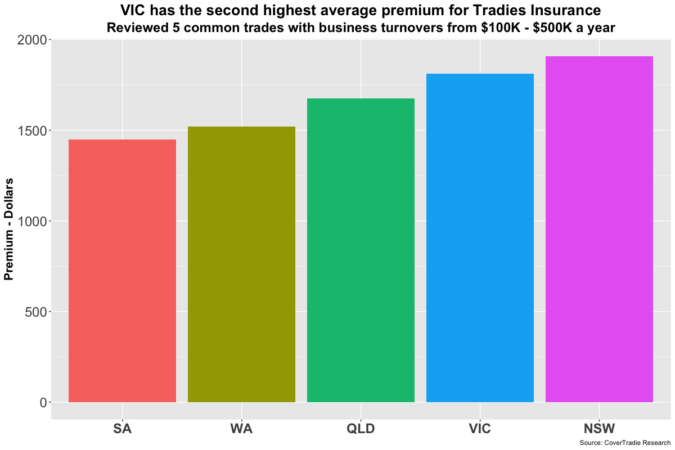

- Premiums: Premiums are the regular payments you make for your insurance coverage. Factors like your business type, size, location, and risk profile influence premium costs.

- Exclusions: Exclusions specify events or circumstances that are not covered by your policy. Carefully review the exclusions to understand what your policy doesn’t cover. For instance, some policies may exclude coverage for certain types of accidents or specific types of property damage.

Comparing Quotes and Understanding Policy Terms, Compulsory business insurance in australia

Once you’ve identified your business’s insurance needs, it’s crucial to compare quotes from different insurers. Each insurer may offer varying coverage options, premiums, and policy terms. This comparison allows you to find the best value for your money and select a policy that aligns with your specific requirements.

- Compare Quotes: Request quotes from multiple insurers to compare coverage options, premiums, and policy terms. Use online comparison tools or contact insurers directly.

- Understand Policy Terms: Carefully review the policy documents to understand the terms and conditions, including coverage details, exclusions, and claims procedures. Seek clarification from the insurer if you have any questions or uncertainties.

Key Considerations for Choosing an Insurance Policy

The table below Artikels key considerations when choosing an insurance policy:

| Key Consideration | Description |

|---|---|

| Coverage | Ensure the policy covers your business’s specific risks and liabilities. Consider coverage limits, exclusions, and the types of claims covered. |

| Cost | Compare premiums from different insurers and consider factors like deductibles and policy terms that may impact the overall cost. |

| Insurer Reputation | Research the insurer’s financial stability, customer service record, and claims handling process. Consider reviews and ratings from independent organizations. |

Claiming Insurance Benefits

Making a claim under compulsory business insurance in Australia is a straightforward process, but it’s crucial to understand the steps involved and the necessary documentation. Timely and accurate reporting is essential for a smooth claim process.

The Claim Process

When you need to make a claim, you should contact your insurer as soon as possible. This is typically done by phone or online through their website. Your insurer will guide you through the process and provide you with the necessary claim forms.

Documentation Required

You will need to provide your insurer with specific documentation to support your claim. This documentation varies depending on the type of claim, but generally includes:

- Details of the incident that led to the claim, including date, time, and location.

- Proof of loss, such as invoices, receipts, or repair estimates.

- Police reports, if applicable.

- Any other relevant documentation that supports your claim.

Common Claim Scenarios

Here are some common claim scenarios and how they are handled:

- Public Liability Claims: If a customer or member of the public is injured on your business premises, you would need to file a public liability claim. This would involve providing details of the incident, the injured party’s details, and any medical reports or treatment records.

- Product Liability Claims: If a customer is injured or suffers harm due to a faulty product you sold, you would need to file a product liability claim. You would need to provide details of the product, the incident, and any evidence of the product’s defect.

- Workers’ Compensation Claims: If an employee is injured at work, you would need to file a workers’ compensation claim. This would involve providing details of the injury, the employee’s medical records, and any lost wages.

Industry-Specific Requirements

Compulsory business insurance in Australia is not a one-size-fits-all solution. The specific requirements and types of insurance mandated by law vary significantly across different industries, reflecting the unique risks and hazards associated with each sector. This section delves into the industry-specific insurance requirements, highlighting the common risks and providing examples of relevant insurance policies.

Construction Industry

The construction industry is inherently risky, involving heavy machinery, hazardous materials, and the potential for workplace accidents. The specific compulsory insurance requirements for this sector are designed to protect workers and mitigate potential liabilities.

Compulsory Insurance Requirements

- Workers’ Compensation Insurance: This insurance covers the medical expenses, lost wages, and rehabilitation costs of employees injured or killed while on the job. It is mandatory for all employers in the construction industry.

- Public Liability Insurance: This policy protects businesses from financial losses arising from claims of injury or damage to third parties. It is essential for construction companies as they operate in public spaces and may cause damage to property or injure individuals.

- Professional Indemnity Insurance: This insurance protects construction professionals, such as architects and engineers, from claims of negligence or errors in their professional services.

Common Risks

- Workplace Accidents: Construction sites are inherently hazardous environments with potential risks of falls, electrocution, and machinery-related accidents.

- Damage to Property: Construction activities can cause damage to surrounding property, including buildings, infrastructure, and utilities.

- Asbestos-Related Liabilities: Construction projects may involve asbestos, which poses serious health risks. This can lead to significant legal liabilities and insurance claims.

Examples of Industry-Specific Insurance Policies

- Construction All Risks Insurance: This policy covers a wide range of risks associated with construction projects, including damage to property, machinery breakdowns, and delays.

- Contractor’s Plant and Equipment Insurance: This insurance protects construction companies from financial losses due to damage or theft of their machinery and equipment.

Healthcare Industry

The healthcare industry faces unique challenges, including the potential for medical negligence, patient safety concerns, and the need for specialized medical equipment. These factors necessitate specific insurance requirements to protect healthcare providers and patients.

Compulsory Insurance Requirements

- Medical Indemnity Insurance: This insurance is mandatory for all medical practitioners and healthcare professionals in Australia. It protects them from financial losses arising from claims of medical negligence or malpractice.

- Public Liability Insurance: This policy protects healthcare providers from claims of injury or damage to third parties, such as patients or visitors to their facilities.

Common Risks

- Medical Negligence: Healthcare professionals face the risk of being sued for medical errors or negligence that result in patient harm.

- Patient Safety: The healthcare industry is constantly striving to improve patient safety and reduce the risk of infections and other complications.

- Cybersecurity: Healthcare providers store sensitive patient data, making them vulnerable to cyberattacks. This can lead to significant financial losses and reputational damage.

Examples of Industry-Specific Insurance Policies

- Cyber Liability Insurance: This policy protects healthcare providers from financial losses due to cyberattacks, including data breaches and ransomware attacks.

- Medical Malpractice Insurance: This insurance provides coverage for claims of medical negligence, including legal defense costs and compensation payments.

Hospitality Industry

The hospitality industry involves a wide range of businesses, from restaurants and cafes to hotels and resorts. These businesses face unique risks, including food poisoning, alcohol-related incidents, and accidents on premises.

Compulsory Insurance Requirements

- Public Liability Insurance: This policy protects hospitality businesses from claims of injury or damage to third parties, such as customers or guests.

- Liquor Liability Insurance: This insurance is required for businesses that serve alcohol and protects them from claims arising from alcohol-related incidents, such as drunk driving accidents or assaults.

Common Risks

- Food Poisoning: Restaurants and cafes face the risk of food poisoning outbreaks, which can lead to significant legal liabilities and reputational damage.

- Alcohol-Related Incidents: Hospitality businesses that serve alcohol face the risk of alcohol-related incidents, such as fights, injuries, and property damage.

- Accidents on Premises: Guests or customers may be injured on the premises of a hospitality business, leading to claims of negligence.

Examples of Industry-Specific Insurance Policies

- Product Liability Insurance: This policy protects hospitality businesses from claims of injury or damage caused by food or beverages they serve.

- Hospitality Workers’ Compensation Insurance: This insurance covers the medical expenses, lost wages, and rehabilitation costs of employees injured or killed while working in a hospitality setting.

Resources and Support

Navigating the world of compulsory business insurance in Australia can be a daunting task. Thankfully, there are numerous resources available to assist you in understanding your obligations and finding the right insurance coverage.

This section will explore the various government agencies, industry associations, and professional support networks that can guide you through the process of securing and managing your compulsory business insurance.

Government Agencies

Government agencies play a crucial role in setting insurance regulations and providing information to businesses. Here are some key agencies you should be aware of:

- Australian Securities and Investments Commission (ASIC): ASIC is responsible for regulating the financial services industry, including insurance. They provide information and guidance on insurance products and consumer protection. You can find resources on their website regarding compulsory business insurance, including information on specific industry requirements and consumer rights.

- Australian Prudential Regulation Authority (APRA): APRA regulates insurance companies and ensures their financial stability. While they don’t directly provide guidance to businesses on insurance choices, they play a critical role in ensuring the insurance market operates fairly and responsibly.

- State and Territory Government Agencies: Each state and territory in Australia has its own government agencies responsible for regulating specific industries and insurance requirements. For example, the Victorian WorkCover Authority oversees workers’ compensation insurance in Victoria. It’s essential to research the relevant agencies in your state or territory to understand your specific obligations.

Industry Associations

Industry associations provide valuable support and resources to businesses within specific sectors. These associations often have expertise in insurance requirements and can offer guidance on navigating the complexities of compulsory business insurance.

- Australian Chamber of Commerce and Industry (ACCI): ACCI represents the interests of businesses across Australia. They provide information on a wide range of business issues, including insurance. You can find resources on their website related to compulsory business insurance and access support services.

- Industry-Specific Associations: Many industries have their own dedicated associations that provide tailored advice and support to their members. For example, the Australian Retailers Association (ARA) offers resources on insurance requirements for retail businesses. It’s essential to identify the relevant association for your industry to access specific information and guidance.

Insurance Brokers

Insurance brokers act as intermediaries between businesses and insurance companies. They can provide expert advice on choosing the right insurance policy, negotiating premiums, and managing claims.

- Independent Advice: Insurance brokers are independent of insurance companies, meaning they can provide unbiased advice based on your specific needs and circumstances.

- Market Knowledge: Brokers have a deep understanding of the insurance market and can help you compare different policies and find the best value for money.

- Claim Support: Brokers can assist you in navigating the claims process and ensuring you receive the appropriate compensation for your losses.

Final Thoughts

Compulsory business insurance in Australia plays a critical role in safeguarding businesses, their owners, and employees. By understanding the types of insurance, legal obligations, and the benefits they provide, businesses can mitigate risk, manage liabilities, and ensure their continued success. It is essential for all Australian businesses to familiarize themselves with the intricacies of compulsory insurance and seek professional guidance to make informed decisions about their insurance needs.

Commonly Asked Questions: Compulsory Business Insurance In Australia

What are the penalties for not having compulsory business insurance?

Penalties for non-compliance vary depending on the specific legislation and the type of insurance involved. They can range from fines to legal action and may also include suspension or cancellation of business licenses.

How do I choose the right insurance policy for my business?

When choosing an insurance policy, consider factors like coverage limits, premiums, exclusions, and the reputation of the insurer. It’s crucial to compare quotes from multiple insurers and carefully read the policy terms and conditions before making a decision.

What happens if I need to make a claim?

The process for making a claim involves notifying your insurer promptly and providing supporting documentation, such as incident reports, medical records, or invoices. Your insurer will guide you through the claim process and provide support throughout.