Cost of insurance in Australia is a topic that affects every household. Navigating the complex world of insurance can be daunting, with premiums constantly fluctuating and coverage options seemingly endless. This guide aims to provide a comprehensive overview of insurance costs in Australia, covering everything from the average premiums for different types of insurance to strategies for reducing your overall expenses.

Understanding the factors that influence insurance premiums is crucial for making informed decisions. Age, location, occupation, driving history, and health condition all play a role in determining your individual costs. Furthermore, the insurance provider’s pricing strategy, claims history, and risk assessment contribute to the final premium.

Overview of Insurance Costs in Australia: Cost Of Insurance In Australia

Insurance costs in Australia have been steadily increasing over the past few years, impacting individuals and businesses alike. This trend is driven by a complex interplay of factors, including rising claims costs, regulatory changes, and economic conditions. Understanding these factors is crucial for navigating the evolving insurance landscape.

Factors Contributing to Rising Insurance Costs

Rising insurance costs in Australia are a result of several key factors.

- Increased Claims Costs: A significant driver of rising insurance premiums is the increasing frequency and severity of claims. This is particularly evident in areas like motor vehicle insurance, where factors like road congestion and distracted driving have led to more accidents. Natural disasters, such as bushfires and floods, also contribute to higher claims costs.

- Inflation and Cost of Living: General inflation and rising costs of living impact the cost of repairs, replacement, and medical treatment, ultimately leading to higher insurance premiums.

- Regulatory Changes: Government regulations and policies play a crucial role in shaping the insurance market. For example, changes to compensation schemes or the introduction of new safety standards can influence insurance premiums.

- Competition and Market Dynamics: The level of competition within the insurance industry can also influence premiums. A more competitive market may lead to lower premiums, while a concentrated market with fewer players could result in higher premiums.

Role of Government Regulations and Policies

Government regulations and policies play a significant role in influencing insurance costs in Australia. These regulations aim to ensure fair and transparent insurance practices, protect consumers, and promote financial stability within the industry.

- Consumer Protection Laws: Regulations such as the Australian Consumer Law (ACL) aim to protect consumers from unfair or misleading insurance practices. These laws can impact insurance premiums by requiring insurers to be transparent about their pricing and coverage.

- Financial Stability Measures: Regulations designed to maintain financial stability in the insurance industry, such as capital adequacy requirements, can influence insurance costs. These regulations ensure that insurers have sufficient financial resources to meet their obligations to policyholders.

- Taxation Policies: Tax policies, such as the Goods and Services Tax (GST), can indirectly influence insurance costs. Insurers may pass on the cost of GST to policyholders, leading to higher premiums.

- Compensation Schemes: Government-run compensation schemes, such as the National Disability Insurance Scheme (NDIS) and workers’ compensation schemes, can impact insurance premiums. These schemes can influence the cost of claims, potentially leading to higher premiums for insurers.

Breakdown of Insurance Types and Costs

Insurance in Australia covers a wide range of aspects, from protecting your home and car to ensuring financial security for your family and covering unexpected medical expenses. Understanding the different types of insurance available and their associated costs is crucial for making informed decisions about your financial well-being.

Home Insurance, Cost of insurance in australia

Home insurance provides financial protection against damage or loss to your home and its contents due to various events like fire, theft, natural disasters, and vandalism.

- Building insurance covers the structure of your home, including the walls, roof, and foundation.

- Contents insurance protects your personal belongings, such as furniture, appliances, electronics, and clothing.

The cost of home insurance varies significantly based on factors like:

- Location: Homes in areas prone to natural disasters, such as bushfires or floods, generally have higher premiums.

- Value of your home and contents: The higher the value of your property, the more you’ll pay for insurance.

- Level of coverage: Choosing comprehensive coverage with higher limits will result in higher premiums compared to basic coverage.

- Security features: Homes with security systems, such as alarms and security cameras, may qualify for lower premiums.

Car Insurance

Car insurance is essential for protecting yourself financially in the event of an accident, theft, or damage to your vehicle.

- Third-party property damage (TPPD) insurance covers damage to another person’s property if you’re at fault in an accident.

- Third-party fire and theft (TPFT) insurance provides coverage for damage to another person’s property, as well as theft or fire damage to your vehicle.

- Comprehensive car insurance offers the most comprehensive coverage, including damage to your own vehicle, as well as third-party liability.

Car insurance premiums are influenced by:

- Vehicle type: High-performance or expensive cars typically have higher premiums due to their higher repair costs.

- Driving history: Drivers with a history of accidents or traffic violations may face higher premiums.

- Age and gender: Younger drivers and males generally have higher premiums due to higher risk factors.

- Location: Urban areas with higher traffic density and crime rates may have higher premiums.

Health Insurance

Health insurance provides coverage for medical expenses not covered by Medicare, the Australian government’s universal healthcare system.

- Hospital cover covers the costs of private hospital care, including accommodation, surgery, and other treatments.

- Extras cover provides coverage for a range of services not covered by Medicare, such as dental, physiotherapy, and optical.

The cost of health insurance depends on:

- Level of cover: Choosing a higher level of cover with more benefits will result in higher premiums.

- Age: Younger individuals generally have lower premiums than older individuals.

- Health status: Individuals with pre-existing medical conditions may face higher premiums.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death.

- Term life insurance provides coverage for a specific period, typically 10 to 30 years.

- Whole-of-life insurance provides coverage for your entire life, but premiums are generally higher.

Life insurance premiums are influenced by:

- Age and health: Younger and healthier individuals generally have lower premiums.

- Amount of coverage: The higher the amount of coverage, the higher the premium.

- Lifestyle: Individuals engaged in high-risk activities, such as skydiving or extreme sports, may face higher premiums.

Travel Insurance

Travel insurance provides financial protection against unexpected events while traveling overseas or within Australia.

- Medical expenses coverage protects you against the costs of medical treatment abroad.

- Cancellation and interruption coverage provides reimbursement for lost travel expenses if your trip is canceled or interrupted.

- Baggage and personal belongings coverage protects you against loss or damage to your luggage and personal items.

Travel insurance premiums are affected by:

- Destination: Travel to high-risk destinations may have higher premiums.

- Duration of trip: Longer trips generally have higher premiums.

- Level of coverage: Choosing comprehensive coverage with higher limits will result in higher premiums.

Average Insurance Premiums in Major Australian Cities

| Insurance Type | City | Average Premium |

|---|---|---|

| Home Insurance | Sydney | $1,500 – $2,500 per year |

| Melbourne | $1,200 – $2,000 per year | |

| Brisbane | $1,000 – $1,800 per year | |

| Car Insurance | Sydney | $1,000 – $2,000 per year |

| Melbourne | $800 – $1,500 per year | |

| Brisbane | $700 – $1,200 per year | |

| Health Insurance | Sydney | $1,500 – $3,000 per year |

| Melbourne | $1,200 – $2,500 per year | |

| Brisbane | $1,000 – $2,000 per year | |

| Life Insurance | Sydney | $500 – $1,500 per year |

| Melbourne | $400 – $1,200 per year | |

| Brisbane | $300 – $1,000 per year | |

| Travel Insurance | Sydney | $100 – $500 per trip |

| Melbourne | $80 – $400 per trip | |

| Brisbane | $70 – $300 per trip |

Factors Influencing Insurance Premiums

Insurance premiums in Australia are not a one-size-fits-all proposition. A multitude of factors are taken into account when calculating the cost of your insurance, and understanding these factors can help you make informed decisions about your coverage.

Age

Your age plays a significant role in determining your insurance premiums. This is because insurance companies consider age a strong indicator of risk. For example, younger drivers are statistically more likely to be involved in accidents due to factors like inexperience and risk-taking behavior. Conversely, older drivers may face higher premiums due to potential health issues or declining reflexes.

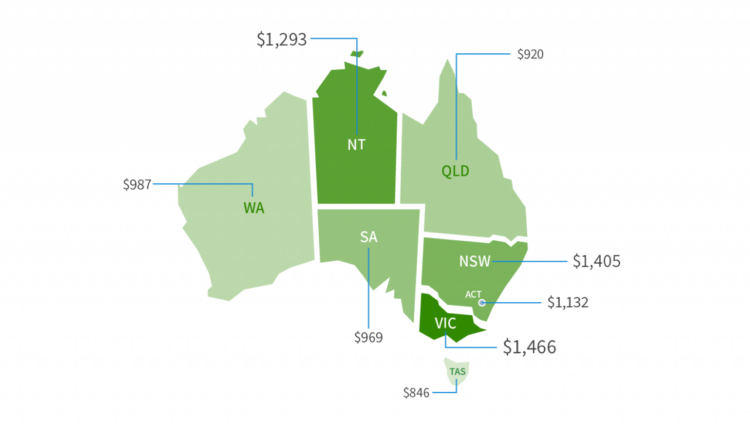

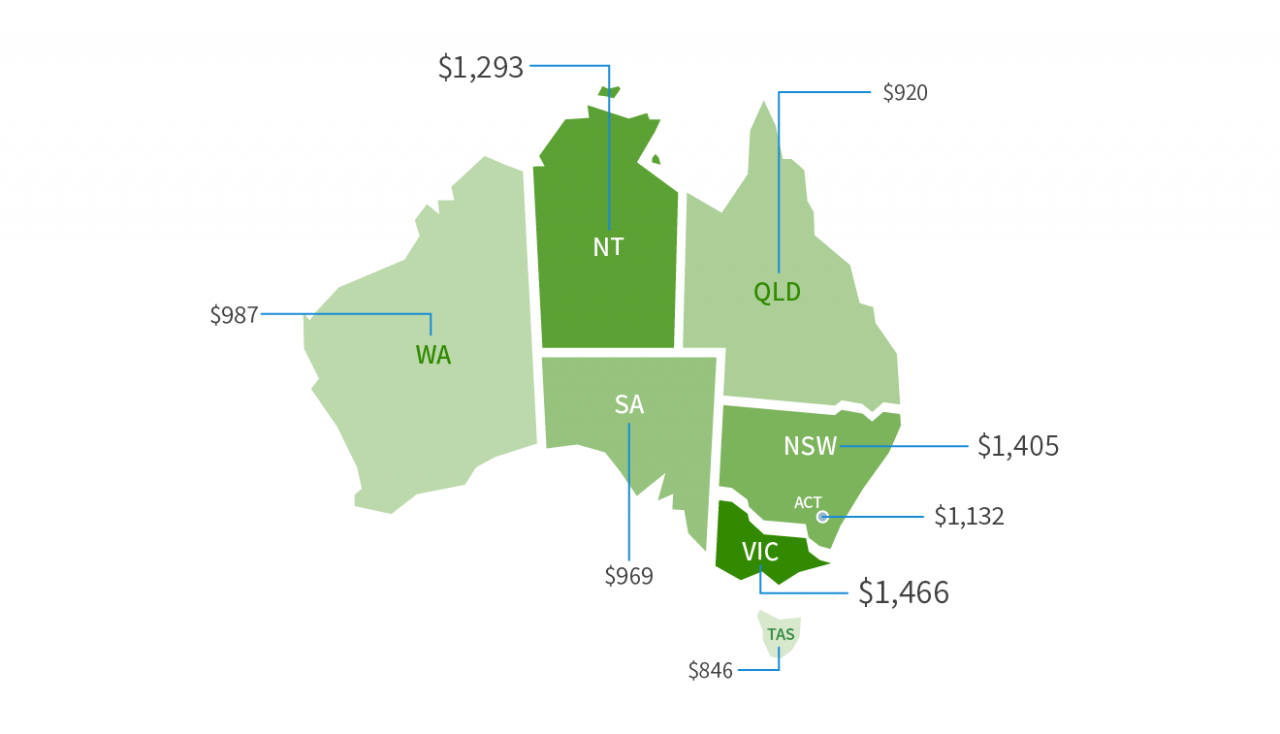

Location

The location where you live can impact your insurance premiums, particularly for home and car insurance. Insurance companies analyze crime rates, the frequency of natural disasters, and the cost of repairs in different areas. For example, a home located in a high-crime area or a flood-prone region may incur higher premiums compared to a home in a safer and less vulnerable location.

Occupation

Your occupation can also influence your insurance premiums. Certain occupations, like those involving hazardous work environments or high-stress levels, may be considered riskier by insurance companies. For example, a construction worker might face higher premiums than an office worker due to the increased risk of accidents or injuries associated with their profession.

Driving History

For car insurance, your driving history is a major factor in determining your premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your insurance costs.

Health Condition

Your health condition is a key factor for health insurance premiums. Insurance companies assess your medical history, current health status, and lifestyle factors to determine your risk profile. For example, individuals with pre-existing health conditions or a family history of certain illnesses may face higher premiums.

Claims History

Your claims history is a significant factor in determining your insurance premiums. If you have filed multiple claims in the past, insurance companies may perceive you as a higher risk and charge you higher premiums. This is because frequent claims indicate a higher likelihood of future claims, increasing the insurer’s financial exposure.

Risk Assessment

Insurance companies use sophisticated risk assessment models to analyze various factors and determine your individual risk profile. These models consider your age, location, occupation, driving history, health condition, and claims history, among other factors. The higher your perceived risk, the higher your insurance premiums will be.

Pricing Strategies

Insurance providers in Australia employ a range of pricing strategies to attract customers and remain competitive. Some companies offer lower premiums for new customers or for those who bundle multiple insurance policies. Others focus on specific customer segments, such as young drivers or those with good driving records, with tailored pricing plans. It’s important to compare quotes from multiple providers to find the best value for your individual needs.

Strategies for Reducing Insurance Costs

In Australia, insurance premiums can be a significant expense. However, there are various strategies that consumers can employ to reduce their insurance costs. By understanding these strategies and implementing them effectively, individuals can potentially save a considerable amount of money on their insurance premiums.

Bundling Insurance Policies

Bundling different types of insurance policies with the same provider can lead to significant cost savings. Insurance companies often offer discounts for customers who bundle their home, car, and contents insurance. This is because insurers can streamline their administrative processes and reduce their risk by insuring multiple aspects of a customer’s life.

Choosing Higher Deductibles

A higher deductible refers to the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower insurance premiums. This is because insurers are less likely to have to pay out claims when customers have a higher deductible.

For example, if you choose a $1,000 deductible for your car insurance, you will be responsible for paying the first $1,000 of any claim. This means that the insurance company will only pay out for any damage exceeding $1,000.

Utilizing Discounts and Promotional Offers

Insurance companies often offer discounts and promotional offers to attract new customers and retain existing ones. These discounts can be based on various factors, such as:

- Safe driving records

- Security systems installed in your home

- Membership in certain organizations

- Being a loyal customer

It is important to inquire about available discounts and promotional offers when obtaining insurance quotes.

The Future of Insurance Costs in Australia

The future of insurance costs in Australia is a complex landscape shaped by various factors, including technological advancements, climate change, and economic trends. Understanding these forces can help individuals and businesses prepare for potential changes in their insurance premiums.

The Influence of Technology

Technological advancements are rapidly changing the insurance industry, impacting pricing and customer experience. The rise of digital insurance platforms, powered by artificial intelligence and big data analytics, is enabling insurers to assess risks more accurately and offer personalized pricing. This means that insurance premiums could become more tailored to individual needs and risk profiles, potentially leading to both higher and lower costs depending on the specific risk assessment.

- Improved Risk Assessment: AI-powered systems can analyze vast amounts of data, including driving records, health information, and property details, to create more accurate risk profiles. This could lead to more precise pricing, with lower premiums for individuals with lower risks and higher premiums for those with higher risks.

- Personalized Pricing: Digital platforms can offer personalized insurance quotes based on individual needs and preferences. This could lead to more competitive pricing, with insurers vying for customers by offering tailored policies and discounts.

- Increased Efficiency: Automation and digital processes can streamline insurance operations, potentially leading to lower administrative costs and, in turn, lower premiums for policyholders.

Wrap-Up

In conclusion, the cost of insurance in Australia is a multifaceted issue influenced by a range of factors. By understanding these factors, consumers can make informed decisions about their insurance needs and explore strategies to reduce their premiums. As technology continues to advance and the insurance landscape evolves, it’s important to stay informed and adapt to the changing dynamics of the market.

FAQ Insights

What are the most common types of insurance in Australia?

The most common types of insurance in Australia include home insurance, car insurance, health insurance, life insurance, and travel insurance.

How can I compare insurance quotes from different providers?

You can compare insurance quotes from different providers using online comparison websites or by contacting insurance brokers.

What is a deductible and how does it affect my insurance premium?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll have to pay more if you need to make a claim.