- Introduction to Private Medical Insurance in Australia

- Factors Influencing the Cost of Private Health Insurance

- Cost Breakdown of Private Health Insurance: Cost Of Private Medical Insurance In Australia

- Government Incentives and Rebates

- Tips for Reducing Private Health Insurance Costs

- The Future of Private Health Insurance Costs

- Conclusion

- Common Queries

Cost of private medical insurance in australia – Private medical insurance in Australia plays a crucial role in supplementing the public healthcare system, offering a wide range of benefits and coverage options. Navigating the costs associated with private health insurance can be a complex process, with numerous factors influencing premiums and out-of-pocket expenses. Understanding these factors and exploring strategies for minimizing costs is essential for individuals and families seeking comprehensive healthcare coverage.

This comprehensive guide explores the intricacies of private medical insurance costs in Australia, delving into the factors that determine premiums, providing a cost breakdown, and examining government incentives and cost-saving strategies. We will also delve into the future of private health insurance costs, considering potential trends and their impact on affordability.

Introduction to Private Medical Insurance in Australia

Private health insurance plays a vital role in the Australian healthcare system, providing individuals with access to a wider range of medical services and shorter waiting times than the public system. It complements the publicly funded Medicare system, offering Australians an additional layer of coverage and choice.

Benefits of Private Health Insurance

Having private health insurance offers numerous advantages, making it a worthwhile consideration for many Australians.

- Faster Access to Treatment: Private health insurance allows you to access a wider range of medical services and specialists, often with shorter waiting times compared to the public system. This is particularly beneficial for elective surgeries, diagnostic tests, and specialist consultations.

- Choice of Doctors and Hospitals: With private health insurance, you have greater flexibility in choosing your doctor and hospital, allowing you to select those that best suit your needs and preferences. You can opt for private hospitals, which often offer a more personalized and comfortable experience.

- Cover for a Wider Range of Services: Private health insurance covers a broader range of medical services beyond what is covered by Medicare. This includes dental, optical, physiotherapy, and other ancillary services, providing comprehensive healthcare coverage.

- Financial Protection: Private health insurance can help protect you from unexpected medical expenses. It covers a portion of your healthcare costs, reducing the financial burden associated with medical treatment.

- Government Rebates: The Australian government offers rebates to private health insurance policyholders, reducing the overall cost of premiums. These rebates vary depending on your age and income.

Types of Private Health Insurance Policies

Private health insurance policies are categorized into various types, each offering different levels of coverage and benefits. Understanding the different types of policies available is crucial to choosing the one that best aligns with your individual needs and budget.

- Hospital Cover: This type of policy covers the cost of hospital stays, including accommodation, surgery, and other related medical services. It is typically the most expensive type of private health insurance, but offers the most comprehensive hospital coverage.

- Extras Cover: Extras cover policies provide benefits for ancillary services, such as dental, optical, physiotherapy, and other health-related expenses. These policies are generally less expensive than hospital cover and can be tailored to meet your specific needs.

- Combined Hospital and Extras Cover: This type of policy combines the benefits of both hospital and extras cover, offering comprehensive coverage for both hospital stays and ancillary services. It is a popular choice for individuals seeking a comprehensive healthcare package.

Factors Influencing the Cost of Private Health Insurance

The cost of private health insurance in Australia is influenced by a number of factors, including your age, health status, the level of cover you choose, and the insurer you select. These factors are all interconnected and contribute to the final premium you pay.

Age

Your age is one of the most significant factors that influences your private health insurance premiums. This is because older individuals are statistically more likely to require healthcare services, leading to higher claims costs for insurers. As a result, premiums tend to increase with age.

Health Status, Cost of private medical insurance in australia

Your health status also plays a role in determining your premium costs. Individuals with pre-existing medical conditions may be charged higher premiums because they are considered higher risk. Insurers may assess your medical history and current health conditions to determine your risk profile.

Coverage Level

The level of cover you choose significantly impacts your premium costs. Higher levels of cover, such as comprehensive hospital cover, typically involve higher premiums. This is because they provide broader coverage for a wider range of medical expenses. Conversely, basic hospital cover, which provides less extensive coverage, generally comes with lower premiums.

Insurance Provider

Different insurance providers offer a range of policies with varying premiums and benefits. It’s important to compare quotes from multiple insurers to find the most competitive option that meets your specific needs and budget. Factors such as their claims experience, administrative costs, and profit margins can influence their pricing.

Policy Type

The type of policy you choose can also affect your premiums. For example, policies with higher excesses, which are the amount you pay out-of-pocket before your insurance kicks in, generally come with lower premiums. Conversely, policies with lower excesses may have higher premiums.

Cost Breakdown of Private Health Insurance: Cost Of Private Medical Insurance In Australia

The cost of private health insurance in Australia is determined by a variety of factors, including your age, location, coverage level, and health status. This section provides a detailed breakdown of the typical costs associated with private health insurance premiums.

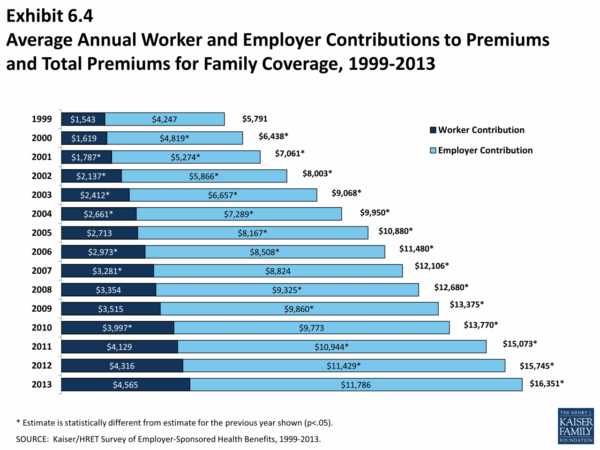

Average Monthly Premiums

The average monthly premiums for private health insurance vary depending on the coverage level and age group. The following table provides a general overview of average monthly premiums for different coverage levels and age groups.

| Coverage Level | Age Group | Average Monthly Premium |

|---|---|---|

| Basic Hospital Cover | 18-29 | $100 – $150 |

| 30-39 | $150 – $200 | |

| 40-49 | $200 – $250 | |

| 50-59 | $250 – $300 | |

| 60+ | $300+ | |

| Hospital and Extras Cover | 18-29 | $150 – $250 |

| 30-39 | $250 – $350 | |

| 40-49 | $350 – $450 | |

| 50-59 | $450 – $550 | |

| 60+ | $550+ |

Additional Costs

In addition to monthly premiums, there are a number of other costs associated with private health insurance. These include:

- Excess Fees: An excess fee is a fixed amount that you are required to pay towards the cost of your treatment before your insurance covers the rest. Excess fees can vary depending on the type of treatment and your insurance policy. For example, you might have to pay a $500 excess for a hospital stay.

- Co-payments: A co-payment is a fixed amount that you are required to pay towards the cost of your treatment, even after your insurance has paid its share. Co-payments are typically used for things like consultations with specialists or physiotherapy sessions. For example, you might have to pay a $50 co-payment for each physiotherapy session.

- Waiting Periods: Some insurance policies have waiting periods before you can claim certain benefits. For example, there may be a waiting period before you can claim for pregnancy or dental treatment.

- Loading Fees: If you have a pre-existing medical condition, your insurance provider may charge you a loading fee. This is an additional amount that you have to pay on top of your regular premium. The amount of the loading fee will depend on the severity of your pre-existing condition.

It’s important to remember that the cost of private health insurance can vary significantly from person to person. The best way to find out how much private health insurance will cost you is to get a quote from a number of different insurance providers.

Government Incentives and Rebates

The Australian government plays a significant role in supporting private health insurance by offering various rebates and subsidies. These incentives aim to make private health insurance more affordable and encourage Australians to take responsibility for their healthcare.

The government’s involvement in private health insurance aims to ensure a balanced healthcare system, where both public and private sectors contribute to the overall well-being of the population. By providing financial support, the government encourages individuals to access private health insurance, thus reducing the burden on the public healthcare system.

Eligibility Criteria for Rebates

To be eligible for the government’s private health insurance rebate, individuals must meet certain criteria. These include:

– Residency: You must be an Australian resident.

– Age: You must be 18 years or older.

– Income: Your income must be within the specified limits.

– Coverage: You must have a qualifying private health insurance policy.

Rebate Amounts

The amount of rebate you receive depends on your age, income, and the type of private health insurance policy you hold. Here’s a table outlining the different rebate amounts:

| Age Group | Income (Single) | Income (Couple) | Rebate Amount |

|---|---|---|---|

| 18-30 | $90,000 | $180,000 | $1,000 |

| 31-40 | $100,000 | $200,000 | $1,200 |

| 41-50 | $110,000 | $220,000 | $1,400 |

| 51-60 | $120,000 | $240,000 | $1,600 |

| 61+ | $130,000 | $260,000 | $1,800 |

Note: These are just examples, and the actual rebate amounts may vary depending on the specific policy and individual circumstances. It’s essential to check with your health insurance provider or the Australian Taxation Office (ATO) for the most up-to-date information.

Tips for Reducing Private Health Insurance Costs

Private health insurance in Australia can be a significant expense, but there are strategies you can employ to minimize your premiums. By understanding your options and making informed choices, you can save money without compromising on the coverage you need.

Choosing the Right Policy and Coverage Level

Selecting the right policy and coverage level is crucial for reducing your insurance costs. Consider your individual needs and health status when making your decision.

- Assess your health needs: Determine the types of healthcare services you are most likely to require. If you are generally healthy and primarily need coverage for hospital expenses, a basic hospital policy might be sufficient. However, if you have pre-existing conditions or anticipate needing more extensive medical care, a comprehensive policy with extras coverage might be more suitable.

- Compare policies and premiums: Use online comparison websites or speak to an insurance broker to compare different policies and their premiums. Look for policies that offer the coverage you need at a competitive price. Consider factors such as the insurer’s reputation, claims process, and customer service.

- Consider a lower level of cover: If you are young and healthy, you may be able to save money by choosing a lower level of cover. For example, you might opt for a policy that covers hospital expenses but excludes extras coverage, such as dental or physiotherapy. However, ensure that the chosen level of cover meets your current and future health needs.

Making a Lump Sum Payment

Paying your premium in a lump sum can sometimes result in a discount. This strategy is particularly beneficial if you have the financial capacity to make a one-time payment.

Many insurers offer discounts for lump sum payments, ranging from a few percentage points to a more substantial amount depending on the policy and insurer.

Choosing a Family Policy

If you have a family, opting for a family policy can often be more cost-effective than purchasing individual policies for each member.

- Family policies offer discounts: Insurers often provide discounts for families, recognizing the increased risk associated with covering multiple individuals.

- Bundled coverage: Family policies typically offer bundled coverage, which can be more convenient and potentially cheaper than individual policies.

The Future of Private Health Insurance Costs

Predicting the future of private health insurance costs is a complex task, influenced by a multitude of factors. Understanding these factors and their potential impact is crucial for individuals and policymakers alike.

Rising Healthcare Costs

Rising healthcare costs are a global phenomenon, driven by factors such as technological advancements, an aging population, and increasing demand for complex treatments. These rising costs inevitably influence private health insurance premiums.

- Technological Advancements: While technology offers significant benefits, it often comes with a high price tag. New treatments, diagnostic tools, and medical devices can be expensive to develop and implement, pushing up healthcare costs. For example, the development and widespread adoption of gene therapy for rare diseases, while offering hope for patients, has contributed to higher healthcare costs.

- Aging Population: As the population ages, the demand for healthcare services increases. Older individuals are more likely to experience chronic conditions, requiring more frequent and complex medical care. This trend places additional pressure on healthcare systems and contributes to rising costs. For instance, the increasing prevalence of conditions like diabetes and heart disease, which are more common in older adults, has led to higher healthcare expenditures.

- Increased Demand for Complex Treatments: Advancements in medical technology have led to the development of more complex and specialized treatments. While these treatments offer improved outcomes, they often come with higher costs. For example, the use of robotic surgery, while potentially more precise and less invasive, can be more expensive than traditional surgery.

Technological Advancements in Private Health Insurance

Technological advancements are not only driving up healthcare costs but also influencing the way private health insurance is delivered. These advancements can both increase and decrease costs, depending on their specific application.

- Telehealth: The rise of telehealth, which allows patients to consult with healthcare professionals remotely, has the potential to reduce costs by lowering the need for in-person visits. However, the implementation of telehealth systems requires significant investment in technology and infrastructure.

- Artificial Intelligence (AI): AI applications are increasingly being used in healthcare, including diagnosis, treatment planning, and risk assessment. These applications can potentially improve efficiency and accuracy, leading to cost savings. However, the development and implementation of AI systems require significant investment in research and development.

- Data Analytics: Data analytics can be used to identify trends in healthcare utilization and predict future needs. This information can help insurers optimize their pricing strategies and manage costs more effectively. However, the collection and analysis of large datasets require significant investments in technology and expertise.

Government Policies and Regulations

Government policies and regulations play a significant role in shaping the private health insurance landscape. Changes to these policies can have a direct impact on the cost of premiums.

- Government Subsidies and Rebates: Government subsidies and rebates help offset the cost of private health insurance for individuals and families. Changes to these subsidies, such as reductions or eligibility criteria, can increase the cost of premiums for individuals.

- Regulation of Premium Increases: Governments can regulate the frequency and magnitude of premium increases to protect consumers. However, strict regulations can limit insurers’ ability to adjust premiums to reflect rising healthcare costs, potentially leading to financial strain for insurers and ultimately impacting premium affordability.

- Competition and Market Structure: Government policies can influence the level of competition in the private health insurance market. Increased competition can lead to lower premiums, but it can also create pressure on insurers to reduce benefits or coverage.

Conclusion

As the healthcare landscape continues to evolve, so too will the costs associated with private medical insurance in Australia. Staying informed about the factors influencing premiums, exploring cost-saving strategies, and understanding government incentives are crucial steps in navigating this complex landscape. By carefully considering your healthcare needs, coverage options, and financial situation, you can make informed decisions that ensure you have access to quality healthcare while managing your out-of-pocket expenses effectively.

Common Queries

How do I compare different private health insurance providers?

You can compare different providers using online comparison websites, contacting insurers directly, or seeking advice from a financial advisor. Consider factors like coverage levels, premiums, and customer service when making your choice.

Can I change my private health insurance policy?

Yes, you can typically change your policy at the end of your membership period. Some insurers may allow you to switch to a different policy within the same company. Check with your insurer for specific terms and conditions.

What happens if I don’t have private health insurance?

Without private health insurance, you will rely solely on the public healthcare system. While this provides essential healthcare services, wait times for non-urgent procedures can be longer. You may also be subject to out-of-pocket expenses for certain services.