The cost of public liability insurance in Australia is a crucial consideration for businesses of all sizes. It acts as a safety net, protecting you against financial repercussions if someone is injured or their property is damaged due to your operations. The price of this insurance, however, can vary greatly, influenced by factors like your industry, business size, location, and the level of risk associated with your activities.

Understanding these factors is essential for businesses to obtain adequate coverage at a competitive price. This guide will explore the key considerations for businesses when it comes to public liability insurance, including the factors that influence costs, essential coverage elements, and strategies for minimizing risks and securing the best possible policy.

Factors Influencing Public Liability Insurance Costs

Public liability insurance is essential for businesses and individuals in Australia, offering protection against financial losses arising from claims of negligence or injury. The cost of this insurance can vary significantly, depending on several factors. Understanding these factors can help you obtain the most appropriate and affordable coverage for your specific needs.

Industry and Business Size

The industry in which you operate and the size of your business are major factors influencing public liability insurance costs. Industries with higher inherent risks, such as construction, manufacturing, or healthcare, typically face higher premiums. Larger businesses with more employees and a greater potential for liability exposure often have higher premiums compared to smaller businesses.

- For example, a construction company working on high-rise buildings would likely have higher premiums than a small retail store.

- Similarly, a large manufacturing plant with complex machinery and hazardous materials would face higher premiums than a small office.

Location

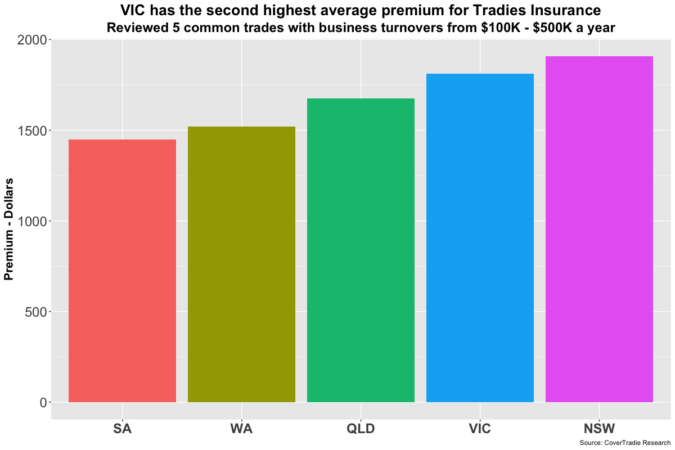

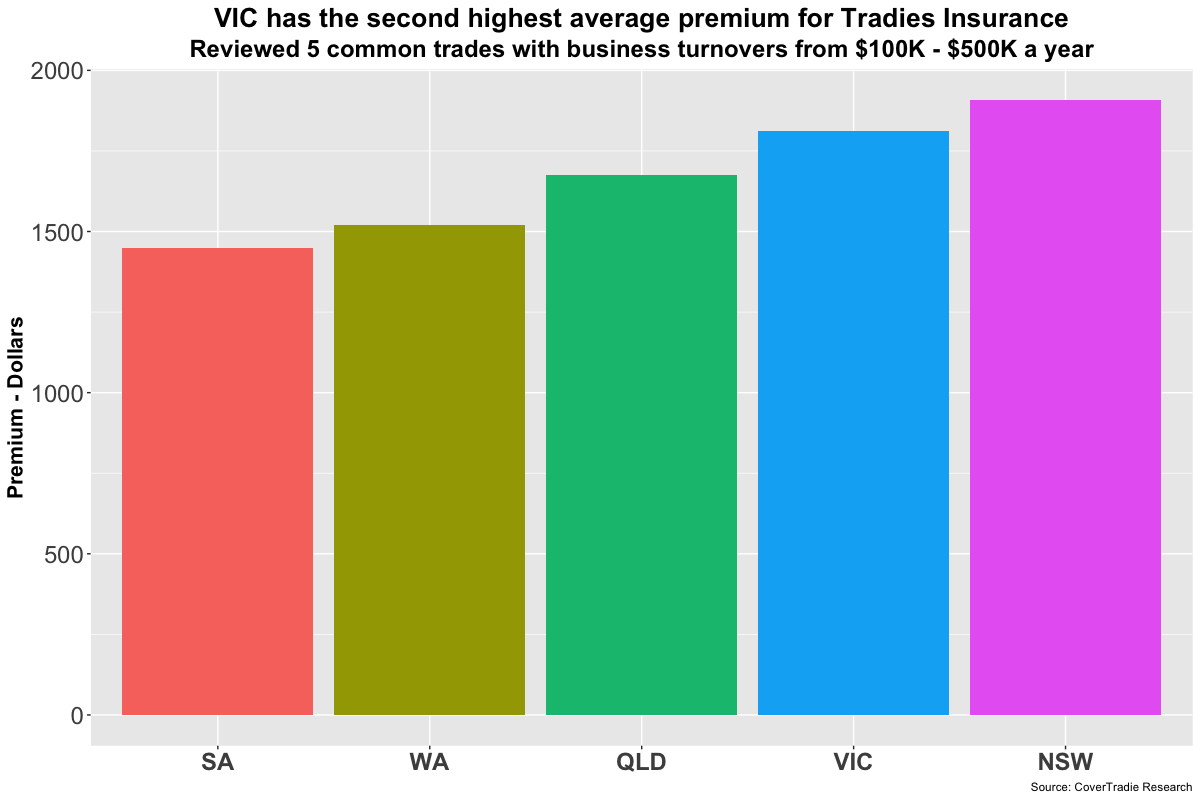

The location of your business can also impact your insurance costs. Areas with higher population density and more traffic congestion may have a higher risk of accidents and incidents, leading to increased premiums.

- For instance, a business located in a busy metropolitan area may face higher premiums compared to a business in a rural area with lower population density.

Risk Profile

Your business’s risk profile plays a crucial role in determining your public liability insurance costs. Factors such as the nature of your work, safety practices, and past claims history are considered. Businesses with a higher risk profile, such as those involved in hazardous activities or with a history of claims, are likely to face higher premiums.

- For example, a business that handles hazardous materials or operates heavy machinery would have a higher risk profile than a business that provides office services.

- A business with a history of frequent claims would also face higher premiums compared to a business with a clean claims history.

Level of Coverage and Policy Limits

The level of coverage and policy limits you choose can significantly impact your insurance premiums. Higher coverage limits and broader coverage options will generally result in higher premiums.

- For instance, a policy with a higher limit of liability for bodily injury claims would typically cost more than a policy with a lower limit.

- Similarly, a policy that covers a wider range of risks, such as property damage or legal defense costs, would likely be more expensive than a policy with narrower coverage.

Examples of High-Risk Industries

Some industries are inherently riskier than others, leading to higher public liability insurance costs. These industries often involve hazardous activities, complex machinery, or potential exposure to dangerous substances.

- Construction: Construction sites pose risks of falls, accidents involving heavy equipment, and exposure to hazardous materials.

- Manufacturing: Manufacturing facilities often involve complex machinery, hazardous materials, and potential for workplace injuries.

- Healthcare: Healthcare providers face risks of medical negligence, patient injuries, and potential lawsuits.

- Transportation: Transportation companies, including trucking and logistics firms, are exposed to risks of accidents, traffic violations, and cargo damage.

- Hospitality: Hotels, restaurants, and other hospitality businesses face risks of slip-and-fall accidents, food poisoning, and potential assaults.

Understanding Public Liability Insurance Coverage

Public liability insurance in Australia is designed to protect businesses and individuals from financial losses arising from claims of bodily injury or property damage caused by their negligence. It provides essential coverage to help navigate potential legal and financial challenges, ensuring peace of mind in various situations.

Essential Elements of Coverage

Public liability insurance policies typically cover three primary elements:

- Bodily Injury: This covers claims arising from injuries sustained by third parties due to your negligence. Examples include slips, trips, falls, or contact with your products or services.

- Property Damage: This covers claims for damage to third-party property caused by your negligence. Examples include damage to buildings, vehicles, or personal belongings.

- Legal Defense Costs: This covers the costs of defending yourself against a claim, including legal fees, court costs, and expert witness fees. This aspect is crucial as legal battles can be expensive and time-consuming.

Common Exclusions and Limitations, Cost of public liability insurance in australia

While public liability insurance provides broad protection, it’s essential to understand its limitations and exclusions. Some common exclusions include:

- Intentional Acts: Coverage generally does not extend to injuries or damage caused intentionally by you or your employees.

- Professional Negligence: Claims arising from professional services, such as medical negligence or legal malpractice, are typically excluded and require separate professional indemnity insurance.

- Environmental Damage: Coverage for environmental damage may be limited or excluded, requiring specific environmental liability insurance.

- Certain Activities: Some activities, such as dangerous sports or hazardous materials handling, may be excluded or require additional coverage.

Importance of Choosing Appropriate Policy Limits

Policy limits, also known as coverage limits, define the maximum amount your insurer will pay for each claim or in total. Choosing appropriate policy limits is crucial for ensuring sufficient protection.

“The policy limit should be high enough to cover potential claims arising from your business activities.”

For instance, if you run a construction company, you might require a higher policy limit than a small retail store. Consulting with an insurance broker can help determine the appropriate policy limits based on your specific circumstances and risk profile.

Key Considerations for Businesses

Protecting your business from potential liabilities is paramount. Public liability insurance is a vital component of this protection, but it’s not a magic bullet. Understanding the risks your business faces and taking proactive steps to mitigate them is equally important.

Risk Assessment and Mitigation Strategies

A comprehensive risk assessment is the foundation of effective public liability management. It involves identifying potential hazards, evaluating their likelihood and severity, and developing strategies to minimize their impact. This process helps businesses understand their specific vulnerabilities and prioritize risk mitigation efforts.

- Identify Potential Hazards: This involves a thorough review of your business operations, premises, and products/services. Consider factors like workplace layout, equipment used, customer interactions, and potential environmental impacts. For example, a cafe might identify potential hazards like slippery floors, hot beverages, and the use of sharp knives.

- Evaluate Likelihood and Severity: Once you’ve identified potential hazards, assess the likelihood of each hazard causing an incident and the severity of the potential consequences. For example, a cafe might determine that the likelihood of a customer tripping on a wet floor is high, and the severity of a resulting injury could be moderate.

- Develop Mitigation Strategies: Based on the risk assessment, implement strategies to reduce the likelihood or severity of potential hazards. This could involve implementing safety procedures, providing training to employees, using protective equipment, and maintaining a safe work environment.

Common Claims Scenarios

Businesses need to be aware of common claims scenarios that could lead to public liability claims. By understanding these scenarios, businesses can proactively address potential risks and minimize their exposure.

- Slips, Trips, and Falls: These are among the most common public liability claims. Ensure adequate lighting, clear walkways, and appropriate signage to prevent these incidents. Regular maintenance of floors and surfaces is crucial.

- Product Liability: If your business manufactures or sells products, you need to ensure they are safe and meet relevant standards. Defective products can lead to injuries and property damage, resulting in claims.

- Negligence: Failure to provide a safe environment or adequate supervision can result in negligence claims. This could include inadequate security measures, lack of proper training for employees, or failure to warn customers of potential hazards.

- Professional Indemnity: If your business provides professional services, errors or omissions in your work could lead to claims. Professional indemnity insurance covers claims arising from negligent advice or services provided.

Managing and Documenting Safety Procedures

Clear and comprehensive safety procedures are essential for reducing the likelihood of accidents. Documenting these procedures ensures consistency and accountability.

- Develop Written Procedures: Create detailed written procedures for all aspects of your business operations, including safety protocols, emergency procedures, and handling of hazardous materials.

- Provide Training: Ensure all employees are properly trained on safety procedures and understand their responsibilities. Regular refresher training is crucial.

- Implement and Monitor: Actively implement and monitor safety procedures. Regular audits and reviews help identify any gaps or areas for improvement.

- Record Keeping: Maintain accurate records of safety training, inspections, incidents, and any corrective actions taken. This documentation can be crucial in defending against potential claims.

Obtaining Quotes and Comparing Policies

Getting the best public liability insurance policy for your needs involves gathering quotes from different insurers and comparing them carefully. This process helps you find the most suitable coverage at a competitive price.

Comparing Policy Features and Premiums

Once you have gathered quotes from several insurers, it’s essential to compare their policy features and premiums. This allows you to identify the best value for your money. Consider the following factors:

- Coverage Limits: Compare the maximum amount of coverage offered for different types of claims, such as bodily injury, property damage, and legal expenses.

- Exclusions: Carefully review the policy exclusions, which are specific situations or activities not covered by the insurance.

- Premium Costs: Consider the annual premium cost and any additional fees or charges. Compare premiums based on similar coverage levels to make a fair assessment.

- Discounts: Check if any discounts are available, such as those for safety programs, risk management practices, or business affiliations.

Understanding Policy Terms and Conditions

Before making a decision, it is crucial to thoroughly understand the policy’s terms and conditions. This ensures you know exactly what is covered and what is not. Pay close attention to:

- Definitions: Understand how the policy defines key terms, such as “accident,” “injury,” and “damage.”

- Conditions: Review the conditions that must be met for a claim to be paid, such as reporting the incident promptly and cooperating with the insurer’s investigation.

- Claims Process: Understand the steps involved in making a claim and the timeframes for processing it.

Negotiating with Insurers

Once you have compared quotes and understand the policies, you can consider negotiating with insurers to secure the best possible coverage at a competitive price. Here are some tips:

- Shop around: Get quotes from multiple insurers to leverage competition and find the best deals.

- Highlight your risk management practices: If you have implemented safety measures or risk management programs, highlight them to insurers as it can potentially lower your premium.

- Be prepared to negotiate: Don’t be afraid to negotiate with insurers on premium rates, coverage limits, and policy terms.

- Consider bundling policies: If you need other types of insurance, such as workers’ compensation or property insurance, ask about bundling discounts.

The Role of Insurance Brokers

Navigating the complex world of public liability insurance can be daunting, especially for businesses seeking the right coverage at a competitive price. This is where insurance brokers play a crucial role, acting as intermediaries between businesses and insurance companies.

Brokers bring a wealth of experience and knowledge to the table, helping businesses find the most suitable public liability insurance policy for their unique needs.

Understanding the Value of Brokers

Brokers provide a valuable service by simplifying the insurance process and ensuring businesses secure the best possible coverage. They act as advocates for their clients, negotiating favorable terms and conditions with insurers.

- Expertise and Market Knowledge: Brokers have a deep understanding of the insurance market, including various policies, insurers, and pricing structures. They stay up-to-date on industry trends and regulations, ensuring their clients have access to the most relevant and competitive options.

- Personalized Advice: Brokers take the time to understand their clients’ specific needs and risk profiles. They conduct thorough assessments, considering factors such as industry, business operations, and potential liabilities, to recommend the most suitable policy.

- Negotiation Power: Brokers leverage their relationships with multiple insurers to negotiate competitive premiums and policy terms on behalf of their clients. They have access to a wider range of options and can secure better deals than businesses might be able to achieve on their own.

- Claims Support: Brokers provide ongoing support throughout the insurance process, including during claims. They guide clients through the claims process, ensuring they understand their rights and responsibilities, and advocate for a smooth and efficient resolution.

Independent Brokers vs. Direct Insurers

While businesses can purchase public liability insurance directly from insurers, working with an independent broker offers several advantages.

- Objectivity: Independent brokers are not tied to any particular insurer, allowing them to provide unbiased advice and recommendations. They can compare policies from multiple insurers, ensuring their clients get the best value for their money.

- Wider Range of Options: Brokers have access to a wider range of insurers and policies than businesses can typically access directly. This allows them to tailor solutions to specific needs, ensuring clients get the right coverage for their unique circumstances.

- Cost-Effectiveness: Brokers often have access to exclusive discounts and deals from insurers, potentially saving businesses money on their premiums. They can also help businesses negotiate favorable terms and conditions, further reducing overall costs.

- Time Savings: Brokers handle the complex administrative tasks associated with insurance, freeing up businesses to focus on their core operations. They handle everything from obtaining quotes to policy documentation, simplifying the process for their clients.

Ultimate Conclusion: Cost Of Public Liability Insurance In Australia

Navigating the world of public liability insurance in Australia can feel daunting, but understanding the key factors, coverage options, and strategies for risk mitigation can empower businesses to make informed decisions. By taking the time to assess their needs, compare quotes, and engage with experienced brokers, businesses can secure the right level of protection at a reasonable price, ensuring peace of mind and safeguarding their financial well-being.

FAQ Compilation

What is public liability insurance and why is it important?

Public liability insurance protects your business from financial losses if someone is injured or their property is damaged due to your activities. It covers legal costs, compensation, and other expenses related to claims arising from negligence or accidents.

How much does public liability insurance cost in Australia?

The cost varies depending on factors like your industry, business size, location, and risk profile. It’s best to obtain quotes from multiple insurers to compare prices and coverage.

What are some common exclusions in public liability insurance policies?

Common exclusions can include intentional acts, pre-existing conditions, or claims arising from activities not covered by the policy. It’s important to carefully review the policy terms and conditions to understand what’s included and excluded.

How can I find the best public liability insurance for my business?

Consult with an independent insurance broker who can assess your needs and provide recommendations for suitable policies. They can also help you negotiate favorable terms and secure the best possible coverage.