- High Premiums and Out-of-Pocket Costs

- Limited Coverage and Exclusions

- Waiting Periods and Restrictions

- Lack of Flexibility and Choice

- Administrative Burdens and Complexity

- Impact on Public Healthcare System

- Closing Notes

- Commonly Asked Questions: Disadvantages Of Private Health Insurance In Australia

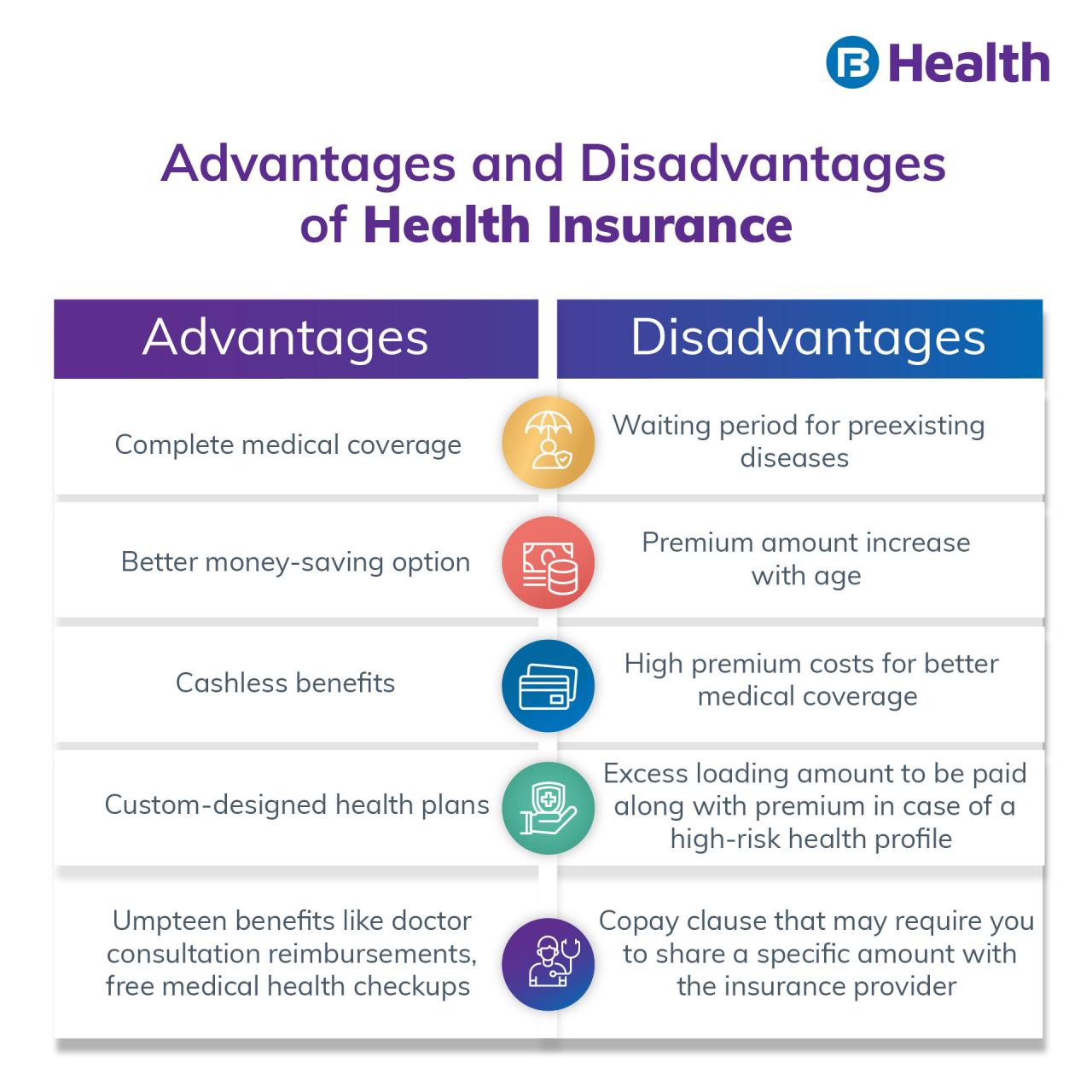

Disadvantages of private health insurance in australia – Private health insurance in Australia, while offering potential benefits, comes with its own set of drawbacks. This article delves into the disadvantages of private health insurance, exploring the factors that contribute to its costs, limitations, and potential impact on the healthcare system.

From high premiums and out-of-pocket expenses to limited coverage and administrative burdens, private health insurance can present challenges for individuals seeking comprehensive healthcare. The article examines the complexities of waiting periods, restricted choices, and the potential for a two-tier healthcare system, offering insights into the trade-offs associated with private health insurance.

High Premiums and Out-of-Pocket Costs

Private health insurance in Australia can be expensive, with premiums and out-of-pocket costs adding up significantly. This section explores the average costs associated with private health insurance and the factors that influence these expenses.

Average Premiums

The average cost of private health insurance premiums in Australia varies depending on factors such as age, health status, and coverage level. According to the Australian Prudential Regulation Authority (APRA), the average annual premium for hospital cover in 2023 was approximately $2,000. This figure can vary significantly depending on the specific policy and the individual’s circumstances.

Factors Influencing Premium Increases

- Age: Premiums generally increase with age, as older individuals are statistically more likely to require medical care.

- Health Status: Individuals with pre-existing medical conditions may face higher premiums, as insurers assess the potential risk associated with their health.

- Coverage Level: The level of coverage chosen also impacts premiums. Comprehensive policies with extensive benefits will typically be more expensive than basic policies.

- Location: Premiums can vary depending on the location, as the cost of healthcare services can differ across regions.

Out-of-Pocket Expenses

In addition to premiums, private health insurance policyholders may also incur out-of-pocket expenses. These costs can include:

- Co-payments: A fixed amount that policyholders pay for each medical service, such as a doctor’s consultation or a hospital stay.

- Excess Fees: An upfront payment that policyholders make for certain services, such as surgery or hospital admission.

- Gap Payments: The difference between the amount charged by the healthcare provider and the amount covered by the insurance policy. This can occur when the provider charges more than the insurer’s scheduled fee.

Limited Coverage and Exclusions

Private health insurance in Australia can offer valuable protection against unexpected medical costs, but it’s crucial to understand the limitations and exclusions that may apply. While policies aim to provide comprehensive coverage, certain medical conditions, treatments, and procedures may not be included, leaving individuals responsible for the costs.

Common Exclusions in Private Health Insurance Policies

- Pre-existing conditions: Most private health insurance policies exclude coverage for medical conditions that existed before the policy’s commencement date. This means that if you have a pre-existing condition, such as diabetes, heart disease, or cancer, your insurance may not cover treatment costs. This exclusion is designed to protect insurers from financial risks associated with pre-existing conditions, which can be expensive to treat.

- Cosmetic procedures: Private health insurance typically does not cover cosmetic procedures, which are primarily intended to enhance appearance rather than address medical conditions. These procedures may include things like breast augmentation, liposuction, and facial fillers. While there may be some exceptions, such as reconstructive surgery following an accident or injury, most cosmetic procedures are considered elective and therefore not covered by private health insurance.

- Certain treatments: Private health insurance policies may exclude coverage for certain treatments, such as alternative therapies, experimental treatments, and some forms of mental health care. This can vary depending on the specific policy and insurer. It’s essential to carefully review the policy document to understand which treatments are covered and which are excluded.

Waiting Periods and Restrictions

Waiting periods and restrictions are another aspect of private health insurance that can be a source of frustration for policyholders. These clauses are designed to prevent individuals from immediately accessing benefits after signing up for a policy, or from accessing certain services or providers.

Waiting Periods for Specific Procedures or Treatments

Waiting periods are a common feature of private health insurance policies. They are typically imposed on new policyholders for specific procedures or treatments, such as dental, optical, or maternity care. This means that you may need to wait a certain period, usually 12 months, before you can access these benefits.

For example, if you sign up for private health insurance and require an elective surgery, you may need to wait 12 months before your policy covers the procedure.

Impact of Waiting Periods on Individuals Requiring Urgent or Elective Medical Care

Waiting periods can pose a significant challenge for individuals who require urgent or elective medical care.

- If you are diagnosed with a serious medical condition shortly after joining a private health insurance plan, you may be forced to wait for coverage, potentially delaying necessary treatment.

- Waiting periods can also affect individuals who need elective procedures, such as cosmetic surgery or hip replacements. If you are unable to access the benefits immediately, you may have to wait for a longer period, which can impact your health and quality of life.

Restrictions on Accessing Certain Services or Providers, Disadvantages of private health insurance in australia

Private health insurance policies may also impose restrictions on the services or providers you can access. This can include:

- Limited Choice of Providers: Your policy may only cover treatment from a specific network of providers, which can limit your choice of doctors, hospitals, or specialists. This can be particularly challenging if you have a pre-existing relationship with a provider who is not part of the network.

- Exclusions: Policies often have exclusions for certain services or treatments, such as pre-existing conditions, experimental procedures, or specific types of medications. This means that you may not be able to access these services even if you have a private health insurance policy.

Lack of Flexibility and Choice

While private health insurance offers coverage for medical expenses, it often lacks the flexibility and choice found in other areas of life. Unlike public healthcare, where everyone has access to essential services, private health insurance can feel restrictive and unsuited to individual needs.

Limited Customization Options

Private health insurance policies are often designed as standardized packages, offering limited options for customization. This means that individuals may have to pay for coverage they don’t need or find themselves without the specific services they require. For example, a policy might include dental coverage that’s unnecessary for someone with excellent dental hygiene, or it might exclude a particular type of therapy needed by someone with a specific condition. This lack of customization can lead to higher premiums and a sense of being locked into an inflexible plan.

Administrative Burdens and Complexity

Private health insurance in Australia can involve significant administrative burdens and complexities, adding to the overall cost and hassle of accessing healthcare. These complexities can arise from the paperwork involved in claiming benefits, navigating complex policy terms and conditions, and dealing with the administrative processes of private insurers.

Paperwork and Administrative Processes

The administrative processes involved in claiming benefits from private health insurance can be time-consuming and require careful attention to detail. This often involves completing claim forms, providing supporting documentation, and following up with the insurer to ensure timely processing.

- Claim Forms: Private health insurance providers require detailed claim forms to be filled out for each medical expense. These forms often request information such as the date of service, the type of service, the provider’s details, and the cost of the service.

- Supporting Documentation: In addition to the claim form, insurers may require supporting documentation, such as receipts, invoices, or medical reports, to validate the claim. This can involve gathering and submitting multiple documents, which can be time-consuming and inconvenient.

- Processing Times: The processing time for claims can vary depending on the insurer and the complexity of the claim. Some claims may be processed within a few days, while others may take several weeks or even months.

Navigating Policy Terms and Conditions

Private health insurance policies can be complex and difficult to understand. This can lead to confusion and frustration when trying to determine what benefits are covered, what exclusions apply, and what procedures need to be followed to claim benefits.

- Exclusions and Limitations: Private health insurance policies often have exclusions and limitations that restrict coverage for certain conditions, treatments, or services. Understanding these exclusions is crucial to avoid unexpected out-of-pocket costs.

- Policy Renewals and Changes: Private health insurance policies are typically renewed annually, and insurers may make changes to their policies during this time. Staying informed about these changes and understanding how they impact your coverage is essential.

Comparison with Medicare

Medicare, Australia’s universal healthcare system, offers a simpler and more streamlined administrative process compared to private health insurance.

- Easy Access: Medicare provides access to essential healthcare services with minimal administrative hurdles. Patients typically only need to provide their Medicare card to access services.

- Simplified Claims: Claims for Medicare-covered services are usually processed automatically, with minimal paperwork required.

- Transparency: Medicare has a transparent system, with clear information available about covered services and costs.

Impact on Public Healthcare System

The presence of private health insurance in Australia can have a complex and multifaceted impact on the public healthcare system, often leading to both positive and negative consequences. While it can provide a degree of financial protection for individuals and contribute to a diverse healthcare landscape, it also raises concerns about potential strain on public resources and the potential for a two-tier system.

Increased Demand for Public Services

The existence of private health insurance can lead to an increased demand for public healthcare services. This occurs because individuals with private insurance may be more likely to seek treatment for conditions that they might otherwise have managed themselves, or for which they might have chosen not to seek treatment at all. For example, individuals with private health insurance may be more inclined to visit a specialist or undergo a diagnostic test, even if the condition is not serious or life-threatening. This increased demand can put pressure on public hospitals and clinics, leading to longer waiting times for non-urgent procedures and services.

Closing Notes

While private health insurance can provide some advantages, its drawbacks warrant careful consideration. The high costs, limited coverage, administrative complexities, and potential impact on the public healthcare system raise important questions about the value and accessibility of private health insurance in Australia. Individuals seeking healthcare should weigh these disadvantages against the potential benefits before making an informed decision.

Commonly Asked Questions: Disadvantages Of Private Health Insurance In Australia

Is private health insurance mandatory in Australia?

No, private health insurance is not mandatory in Australia. However, there are financial incentives for individuals to take out private health insurance, such as the Medicare Levy Surcharge.

How can I compare private health insurance policies?

You can compare private health insurance policies through online comparison websites, independent health insurance brokers, or by contacting insurance providers directly.

What are the benefits of private health insurance?

Private health insurance can provide benefits such as access to private hospitals, shorter waiting times for elective surgery, and coverage for extras such as dental and physiotherapy.