Do I need health insurance to travel to France? This is a question that many travelers ask themselves before embarking on a trip to the beautiful country of France. The answer, as you might expect, is not always straightforward. It depends on several factors, including your citizenship, the duration of your trip, and your health status. This article aims to guide you through the complexities of French healthcare and help you determine if travel insurance is necessary for your trip.

France boasts a robust and comprehensive public healthcare system, known for its high quality and affordability for residents. However, the system isn’t always readily accessible to visitors, especially those from countries without reciprocal agreements. Understanding the intricacies of French healthcare and its limitations for travelers is crucial to ensuring a smooth and stress-free journey.

Understanding French Healthcare System

The French healthcare system is known for its universal coverage and emphasis on preventative care. It is a social security system financed through payroll taxes and contributions from both employers and employees.

French Health Insurance Card (Carte Vitale)

The Carte Vitale is a vital part of the French healthcare system. It is a smart card that holds your health insurance information. This card is essential for accessing healthcare services in France, including consultations with doctors, hospitals, and pharmacies.

Reimbursement System for Medical Expenses

The French healthcare system operates on a reimbursement system. This means that you pay for medical expenses upfront and then submit a claim for reimbursement. The amount reimbursed depends on the type of service and the health insurance plan you have.

- The reimbursement rate is usually set by the government and is applied to the majority of medical services.

- You can receive reimbursement from your primary health insurance provider (CPAM), which is the national health insurance fund.

- The reimbursement rate is typically around 70% of the cost of medical services.

- The remaining 30% is your responsibility, but you can often purchase supplementary health insurance (mutuelle) to cover this portion.

Types of Health Insurance for Travelers: Do I Need Health Insurance To Travel To France

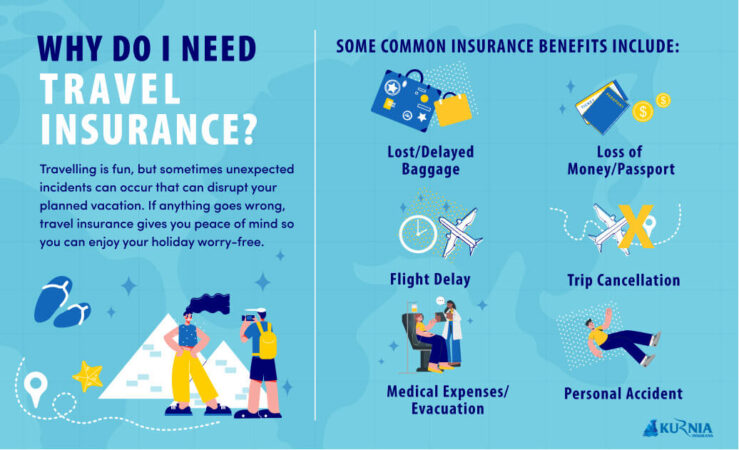

When traveling to France, having health insurance is crucial. It safeguards you from unexpected medical expenses, providing peace of mind during your trip. There are various travel health insurance plans available, each offering different levels of coverage and catering to diverse travel needs. Understanding the types of plans and their benefits is essential for choosing the right one for your trip.

Types of Travel Health Insurance Plans, Do i need health insurance to travel to france

Travel health insurance plans are broadly categorized into three types: basic, comprehensive, and emergency medical evacuation.

- Basic plans: These plans provide essential coverage for medical emergencies, including hospitalization, surgery, and doctor visits. They typically have lower premiums than comprehensive plans but offer limited coverage. Basic plans may not cover pre-existing conditions, dental care, or repatriation costs.

- Comprehensive plans: Comprehensive plans offer extensive coverage for medical emergencies, including hospitalization, surgery, doctor visits, and prescription drugs. They may also include coverage for dental care, lost luggage, and travel delays. These plans usually have higher premiums than basic plans but provide more comprehensive protection.

- Emergency medical evacuation plans: These plans focus on providing medical evacuation services in case of a serious illness or injury. They cover the cost of transporting you to a hospital or medical facility in your home country. These plans are often purchased as an add-on to a basic or comprehensive plan.

Benefits and Limitations of Different Travel Health Insurance Plans

Choosing the right travel health insurance plan depends on your individual needs and travel plans. Consider the following factors:

- Duration of trip: For short trips, a basic plan may suffice. For longer trips, a comprehensive plan offers more comprehensive coverage.

- Destination: If you are traveling to a remote area, an emergency medical evacuation plan is essential.

- Age and health: Older travelers or those with pre-existing conditions may need a comprehensive plan.

- Budget: Basic plans are more affordable than comprehensive plans.

Coverage Offered by Different Travel Health Insurance Plans

The coverage offered by different travel health insurance plans can vary significantly. Here is a table comparing the coverage offered by basic, comprehensive, and emergency medical evacuation plans:

| Coverage | Basic Plan | Comprehensive Plan | Emergency Medical Evacuation Plan |

|---|---|---|---|

| Hospitalization | Yes | Yes | No |

| Surgery | Yes | Yes | No |

| Doctor Visits | Yes | Yes | No |

| Prescription Drugs | Limited | Yes | No |

| Dental Care | No | Yes (Limited) | No |

| Lost Luggage | No | Yes (Limited) | No |

| Travel Delays | No | Yes (Limited) | No |

| Medical Evacuation | No | No | Yes |

Choosing the Right Travel Health Insurance Plan

It is crucial to choose a travel health insurance plan that meets your specific needs and budget. Consider your destination, duration of trip, age, health, and budget when making your decision. Read the policy carefully before purchasing to ensure you understand the coverage and limitations.

Eligibility for French Healthcare

As a tourist, you generally won’t have direct access to the French healthcare system. However, there are some exceptions and options available to you.

Reciprocal Agreements

Reciprocal healthcare agreements exist between some countries, allowing citizens to access healthcare in the other country. This means you might be able to use your existing health insurance card to receive treatment in France.

For example, citizens of European Union countries, Iceland, Liechtenstein, Norway, and Switzerland can typically access healthcare in France using their European Health Insurance Card (EHIC).

However, it’s crucial to note that these agreements often cover only essential healthcare, and you might still have to pay some costs upfront. It’s always best to check with your home country’s healthcare provider or the French embassy in your country to confirm coverage details and any associated fees.

Temporary Health Insurance

If your country doesn’t have a reciprocal agreement with France, or if you need more extensive coverage, you can purchase temporary health insurance for your trip. These policies are specifically designed for travelers and offer varying levels of coverage, including medical expenses, emergency medical evacuation, and repatriation.

Some popular providers of temporary health insurance for travelers include World Nomads, SafetyWing, and Allianz Global Assistance.

When choosing a policy, carefully consider the coverage details, the duration of your trip, and the activities you plan to engage in.

Conclusion

Navigating the world of French healthcare can be a bit daunting, but with a clear understanding of your options and a well-informed decision, you can travel with peace of mind. Remember to consider your individual circumstances, weigh the benefits and limitations of different insurance plans, and prioritize your health and financial security. Whether you choose travel insurance or rely on alternative options, be prepared for any potential medical expenses and enjoy your journey to France!

General Inquiries

Do I need travel insurance if I have health insurance in my home country?

While your home country’s health insurance might cover some medical expenses abroad, it’s often limited in scope and may not cover all costs. Travel insurance provides comprehensive coverage for unexpected medical emergencies, evacuations, and other travel-related issues, offering greater peace of mind.

What are some common medical emergencies that travelers might face in France?

Common medical emergencies for travelers in France include accidents, illnesses, and unexpected health conditions. It’s crucial to be prepared for these situations and ensure you have adequate insurance coverage.

How can I find the best travel insurance for my trip to France?

Compare quotes from reputable travel insurance providers, consider your specific needs and travel plans, and choose a plan that offers adequate coverage for medical expenses, emergency evacuation, and other potential risks.

What are the common costs of medical services in France?

Medical service costs in France vary depending on the type of service and the region. Doctor visits, hospital stays, and prescription medications can incur significant expenses, making travel insurance a wise investment.