- Understanding Travel Health Insurance

- Factors Determining Need for Travel Health Insurance

- Evaluating Existing Health Coverage

- Analyzing Travel Destination and Risks

- Exploring Alternative Options

- Considerations for Budget and Travel Style: Do I Need Travel Health Insurance

- Understanding Policy Coverage and Exclusions

- Claim Procedures and Assistance

- Conclusive Thoughts

- FAQ Section

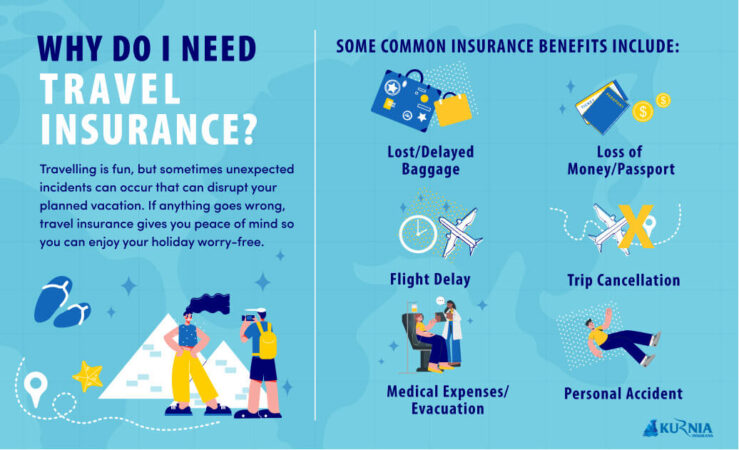

Do I need travel health insurance? It’s a question that pops up for many travelers, especially those venturing beyond their home country. While the allure of exploring new cultures and breathtaking landscapes is undeniable, the reality of unexpected medical expenses abroad can quickly dampen the travel spirit. Travel health insurance acts as a safety net, offering peace of mind and financial protection against potential medical emergencies, unexpected illnesses, and even travel disruptions.

Understanding the purpose and benefits of travel health insurance is crucial for making informed decisions about your travel plans. It’s not just about covering medical costs; it’s about ensuring you have access to quality medical care, navigating foreign healthcare systems, and potentially saving you from significant financial burdens in the event of an unforeseen medical incident.

Understanding Travel Health Insurance

Travel health insurance is a vital safety net for travelers, providing financial protection against unexpected medical emergencies and other unforeseen circumstances while abroad. It acts as a shield against potentially devastating financial burdens, allowing travelers to focus on their health and well-being without the added stress of exorbitant medical bills.

Common Situations Where Travel Health Insurance is Crucial

Travel health insurance is designed to cover a wide range of situations that can arise during your trip, offering peace of mind and financial protection.

Here are some common scenarios where travel health insurance can be invaluable:

- Medical Emergencies: A sudden illness or injury while traveling can lead to expensive medical bills, especially in countries with high healthcare costs. Travel health insurance covers medical expenses, including hospital stays, surgeries, and emergency medical evacuation.

- Evacuation: In case of a serious medical emergency, you may need to be transported back to your home country for specialized care. Travel health insurance covers the cost of medical evacuation, ensuring you receive the necessary treatment.

- Lost or Stolen Luggage: Losing your luggage can be a stressful experience, especially if it contains essential items. Travel health insurance often includes coverage for lost or stolen luggage, providing compensation for your belongings.

- Trip Cancellation or Interruption: Unexpected events such as illness, family emergencies, or natural disasters can disrupt your travel plans. Travel health insurance can reimburse you for non-refundable travel expenses due to trip cancellation or interruption.

- Dental Emergencies: Dental problems can arise at any time, and seeking treatment abroad can be costly. Travel health insurance often covers dental emergencies, providing access to necessary care.

Definition and Key Features of Travel Health Insurance

Travel health insurance is a type of insurance policy designed to cover medical expenses, emergency evacuation, and other travel-related risks while you are traveling outside your home country. It offers financial protection against unforeseen circumstances, allowing you to focus on your health and well-being without worrying about the financial implications of unexpected events.

Key features of travel health insurance typically include:

- Medical Expense Coverage: This covers the cost of medical treatment, including hospital stays, surgeries, doctor’s visits, and medications.

- Emergency Evacuation: This covers the cost of transporting you back to your home country for medical treatment if necessary.

- Repatriation of Remains: In the unfortunate event of death while traveling, this coverage assists with transporting your remains back to your home country.

- Lost or Stolen Luggage: This covers the cost of replacing lost or stolen luggage and its contents.

- Trip Cancellation or Interruption: This reimburses you for non-refundable travel expenses due to trip cancellation or interruption.

- Dental Emergencies: This covers the cost of emergency dental treatment.

- Personal Liability: This protects you against legal claims for damages caused to others.

Factors Determining Need for Travel Health Insurance

Travel health insurance is not a one-size-fits-all solution. Several factors come into play when deciding whether or not you need it. It’s crucial to assess your individual circumstances and potential risks to determine if this type of insurance is right for you.

Destination-Specific Risks, Do i need travel health insurance

The risks you face while traveling vary significantly depending on your destination. Understanding these risks is crucial in deciding if travel health insurance is necessary.

- High-Risk Destinations: Certain countries have higher risks of contracting diseases, experiencing political instability, or encountering natural disasters. If you’re traveling to such regions, travel health insurance becomes particularly important. For example, if you’re planning a trip to a country with a high prevalence of malaria, insurance can cover medical expenses and evacuation costs if you contract the disease.

- Developing Countries: Traveling to developing countries often presents greater health risks due to limited healthcare infrastructure and access to quality medical care. Travel health insurance can provide peace of mind, knowing you’ll have financial support in case of a medical emergency.

- Remote Areas: Traveling to remote or isolated areas can significantly increase the risk of accidents and medical emergencies, as access to healthcare might be limited. Travel health insurance can cover the costs of emergency evacuation or air ambulance services in such situations.

Traveler’s Age, Health Conditions, and Travel Duration

Your age, health conditions, and the duration of your trip can also influence your need for travel health insurance.

- Age: Older travelers are generally at a higher risk of experiencing health complications while traveling. Travel health insurance can help cover the costs of unexpected medical expenses, especially if you have pre-existing conditions.

- Health Conditions: If you have pre-existing medical conditions, travel health insurance is often recommended. It can provide coverage for treatment and medical expenses related to your condition while you’re abroad. This is particularly important in destinations where your usual healthcare providers may not be available.

- Travel Duration: The longer your trip, the greater the risk of experiencing a health issue. Travel health insurance provides coverage for extended periods, offering peace of mind throughout your journey.

Other Key Factors

Beyond destination-specific risks and personal factors, other key factors can influence your need for travel health insurance.

- Pre-existing Conditions: If you have pre-existing medical conditions, travel health insurance is essential. It can help cover the costs of treatment and medication, ensuring you receive the necessary care while abroad. Some policies even offer coverage for pre-existing conditions, but it’s important to review the policy details carefully.

- Adventure Activities: Engaging in adventure activities, such as skiing, scuba diving, or trekking, increases your risk of accidents and injuries. Travel health insurance can provide coverage for medical expenses and emergency evacuation related to these activities.

- Medical Emergencies: Travel health insurance can provide financial protection in case of unexpected medical emergencies. This can include coverage for hospitalization, surgery, and medical evacuation, ensuring you receive the necessary care and support without incurring significant financial burdens.

Evaluating Existing Health Coverage

It’s important to assess your existing health insurance plan before deciding whether you need travel health insurance. Many policies provide some coverage outside your home country, but they often have limitations and exclusions that could leave you with significant medical expenses.

Understanding the scope of your existing health insurance plan is crucial. Most plans provide some coverage for medical emergencies abroad, but the extent of this coverage can vary significantly. Factors like pre-existing conditions, coverage limits, and the specific services included in your plan all play a role.

Comparing Coverage

Comparing the benefits of your existing health insurance with travel health insurance is crucial to identify potential gaps in coverage. Travel health insurance often provides broader protection, including coverage for medical emergencies, evacuation, and repatriation.

| Feature | Existing Health Insurance | Travel Health Insurance |

|---|---|---|

| Coverage Area | Limited to specific countries or regions, often excluding certain areas | Global coverage or coverage for specific regions based on your travel plans |

| Pre-existing Conditions | May not cover pre-existing conditions, or coverage may be limited | Often provides coverage for pre-existing conditions, subject to specific terms and conditions |

| Emergency Evacuation | May not cover emergency evacuation or repatriation | Usually includes coverage for medical evacuation and repatriation to your home country |

| Coverage Limits | May have low coverage limits for medical expenses abroad | Typically offers higher coverage limits for medical expenses |

| Dental and Vision Care | May not cover dental or vision care outside your home country | Often includes coverage for dental and vision care |

| Lost or Stolen Belongings | May not cover lost or stolen belongings while traveling | May offer coverage for lost or stolen belongings, depending on the plan |

| Trip Cancellation or Interruption | May not cover trip cancellation or interruption due to medical reasons | Often includes coverage for trip cancellation or interruption due to medical reasons |

Analyzing Travel Destination and Risks

Your travel destination plays a crucial role in determining the need for travel health insurance. Different regions have varying health risks, ranging from common illnesses to potential medical emergencies. Understanding these risks can help you assess the level of coverage you need.

Health Risks by Destination

The health risks associated with travel destinations vary widely. Common illnesses and potential medical emergencies can differ significantly based on factors such as climate, hygiene standards, and the prevalence of infectious diseases.

Here’s a table highlighting some of the health risks associated with popular travel destinations:

| Destination | Prevalent Diseases | Medical Infrastructure | Emergency Services |

|---|---|---|---|

| Southeast Asia | Dengue Fever, Malaria, Typhoid | Generally good in major cities, but can be limited in rural areas | Available in major cities, but response times can vary in remote areas |

| South America | Zika Virus, Yellow Fever, Chikungunya | Variable, with advanced facilities in major cities and limited access in rural areas | Emergency services available in major cities, but access can be challenging in remote areas |

| Africa | Malaria, Yellow Fever, Ebola | Varying levels, with limited access in many regions | Limited availability and accessibility, especially in rural areas |

| Central America | Dengue Fever, Zika Virus, Chikungunya | Generally good in major cities, but can be limited in rural areas | Emergency services available in major cities, but response times can vary in remote areas |

| Europe | Seasonal Flu, Meningitis, Lyme Disease | Generally excellent throughout the continent | Excellent and readily available throughout the continent |

Health Risks Associated with Travel Activities

Your chosen travel activities can also influence the health risks you face. Certain activities, such as adventure sports, trekking, and diving, can expose you to unique health hazards.

Here’s a breakdown of specific health risks associated with various travel activities:

Adventure Sports

Adventure sports, such as skiing, snowboarding, rock climbing, and bungee jumping, involve inherent risks of injury. These activities often take place in remote areas, which can pose challenges for accessing medical care in case of an accident.

Trekking

Trekking, especially in high-altitude regions, can increase the risk of altitude sickness, dehydration, and exposure to extreme weather conditions. The availability of medical facilities and emergency services can vary depending on the location and remoteness of the trekking route.

Diving

Diving activities carry risks of decompression sickness, ear and sinus barotrauma, and drowning. It’s crucial to have proper training and certification, as well as access to a reputable dive operator who adheres to safety standards.

Exploring Alternative Options

While travel health insurance is a popular choice for covering medical expenses while traveling, alternative options can provide valuable protection. Understanding these alternatives can help you make an informed decision about the best way to safeguard your health and finances abroad.

Travel Assistance Programs

Travel assistance programs offer a range of services designed to help travelers in emergency situations. These programs typically include features like:

- Emergency medical evacuation: This service transports you to a suitable medical facility in your home country or another location with appropriate care.

- Medical advice and referral: Access to 24/7 medical professionals for advice on local medical facilities and referrals to qualified healthcare providers.

- Repatriation of remains: Assistance with transporting your body back to your home country in the event of death.

- Lost luggage assistance: Help with locating and recovering lost or delayed luggage.

- Legal assistance: Support in dealing with legal issues that may arise during your trip.

Travel assistance programs are often offered by credit card companies, travel insurance providers, and travel agencies. They can be a valuable addition to existing travel insurance plans or a standalone solution for those who primarily seek assistance with emergencies.

Emergency Medical Evacuation Services

Emergency medical evacuation services specialize in transporting individuals who require urgent medical attention back to their home country or a suitable medical facility. These services are typically accessed through travel insurance policies or separate contracts.

- Medical stabilization: Ensure the patient is medically stable for transport, often involving on-site medical professionals.

- Air or ground ambulance: Utilize specialized aircraft or ground ambulances equipped for medical transport.

- Medical escorts: Provide qualified medical professionals to accompany the patient during transport.

- Coordination with medical facilities: Arrange for admission and care at the receiving medical facility.

These services can be expensive, but they are crucial for travelers who require complex medical care or are in remote locations with limited medical resources.

Comparison of Alternatives

| Feature | Travel Assistance Program | Emergency Medical Evacuation | Travel Health Insurance |

|---|---|---|---|

| Coverage | Emergency medical evacuation, medical advice, repatriation of remains, lost luggage assistance, legal assistance | Emergency medical evacuation, medical stabilization, air or ground ambulance, medical escorts, coordination with medical facilities | Medical expenses, emergency medical evacuation, trip cancellation, lost luggage, travel delays |

| Cost | Varies depending on provider and coverage level, often included with credit cards or travel insurance plans | High, typically purchased as a standalone service or as part of travel insurance | Varies depending on destination, duration of trip, and coverage level |

| Benefits | Comprehensive assistance for emergencies, often affordable or included with existing plans | Specialized medical transport for critical situations, ensures access to appropriate medical care | Broad coverage for medical expenses, trip disruptions, and other travel-related risks |

| Limitations | Limited medical expense coverage, may not cover all emergencies | Limited coverage for other travel-related risks, can be expensive | May not cover all pre-existing conditions, can be costly for comprehensive coverage |

Considerations for Budget and Travel Style: Do I Need Travel Health Insurance

Travel health insurance costs can vary widely, and your budget will significantly influence your choices. Understanding the relationship between budget and coverage is crucial for making informed decisions. Your travel style, including whether you’re traveling solo, with a family, or for adventure, also plays a role in determining your insurance needs.

Budget Constraints and Travel Health Insurance Choices

Travelers with limited budgets may be tempted to opt for the cheapest insurance plans. However, it’s essential to remember that the cheapest plan might not offer adequate coverage for unexpected medical emergencies. You need to strike a balance between affordability and sufficient protection. For instance, a plan with a low premium may have high deductibles, meaning you’ll need to pay a significant amount out of pocket before the insurance kicks in. Conversely, a plan with a higher premium might offer comprehensive coverage with lower deductibles.

- Consider the coverage limits: Look at the maximum amount the insurance company will pay for medical expenses. A lower limit might not be enough for complex medical treatments in foreign countries.

- Evaluate deductibles: Understand how much you’ll need to pay upfront before the insurance starts covering expenses. Higher deductibles can significantly impact your out-of-pocket costs.

- Explore co-pays and coinsurance: These are percentages you might be required to pay for medical services. Higher co-pays and coinsurance can add up quickly.

- Factor in emergency evacuation costs: If you need to be flown back home due to a medical emergency, the insurance plan should cover these costs. Ensure the plan has adequate coverage for this scenario.

Travel Style and Insurance Needs

Your travel style significantly influences the type of insurance you need. Solo travelers, families, and adventure enthusiasts have different risk profiles and insurance requirements.

- Solo Travelers: Solo travelers might consider plans with higher coverage limits for medical expenses and emergency evacuation, as they’re solely responsible for their well-being. They may also want to look for plans with 24/7 support and assistance services, especially if they’re traveling to remote areas.

- Families: Families with children should prioritize plans that cover pediatric care and have a higher coverage limit for medical expenses. They might also want to consider plans with additional benefits like lost luggage coverage or trip interruption insurance.

- Adventure Enthusiasts: Adventure travelers engaging in high-risk activities like mountain climbing, scuba diving, or extreme sports should seek plans that specifically cover these activities. They may need higher coverage limits and more comprehensive coverage for medical expenses, search and rescue, and evacuation.

Choosing the Right Travel Health Insurance

When choosing travel health insurance, consider your budget, travel style, and destination.

- Compare Quotes: Gather quotes from different insurance companies to compare coverage levels and prices. You can use online comparison websites or contact insurance brokers for assistance.

- Read the Fine Print: Carefully review the policy documents to understand the coverage details, exclusions, and limitations. Look for any hidden fees or charges.

- Consider Your Needs: Prioritize the features that are most important to you based on your travel style and destination. If you’re traveling to a high-risk area, you might want a plan with comprehensive coverage. If you’re on a tight budget, you might focus on finding a plan with adequate coverage at an affordable price.

Understanding Policy Coverage and Exclusions

Thoroughly reviewing your travel health insurance policy is crucial to ensure it aligns with your travel needs and provides the necessary protection. Carefully examining the coverage details, limitations, and exclusions is essential to avoid any surprises or disappointments during your trip.

Common Exclusions in Travel Health Insurance Policies

Travel health insurance policies typically exclude certain events or conditions, which are important to understand before purchasing coverage. These exclusions can vary depending on the insurer and policy type, but some common examples include:

- Pre-existing Conditions: Many policies exclude coverage for medical conditions that existed before the policy’s effective date. This means that if you have a pre-existing condition, such as diabetes or heart disease, your insurance may not cover related medical expenses incurred during your trip.

- High-Risk Activities: Activities considered high-risk, such as extreme sports, adventure travel, or dangerous hobbies, may not be covered by travel health insurance. It’s important to check the policy’s definition of high-risk activities to determine if your planned activities are included.

- Specific Medical Treatments: Certain medical treatments, such as cosmetic surgery or experimental procedures, may be excluded from coverage.

- Mental Health Conditions: Some policies may limit or exclude coverage for mental health conditions, particularly if they pre-exist or require ongoing treatment.

- Dental Care: Basic dental care, such as checkups and cleanings, may be excluded from coverage, although emergency dental procedures may be covered.

- Pregnancy and Childbirth: Coverage for pregnancy and childbirth complications is typically excluded, unless specifically included in the policy.

Key Coverage Details, Exclusions, and Limitations

Here’s a table summarizing key coverage details, exclusions, and limitations commonly found in travel health insurance policies:

| Coverage Detail | Description | Exclusions | Limitations |

|---|---|---|---|

| Medical Expenses | Covers medical expenses incurred due to illness or injury during your trip, including hospital stays, doctor visits, and medication. | Pre-existing conditions, high-risk activities, specific medical treatments, mental health conditions, dental care, pregnancy and childbirth. | Maximum coverage limits, co-payments, deductibles. |

| Emergency Evacuation and Repatriation | Covers the cost of transporting you back home in case of a medical emergency or if you are unable to travel due to illness or injury. | Pre-existing conditions, high-risk activities, specific medical treatments, mental health conditions. | Maximum coverage limits, pre-existing conditions, high-risk activities. |

| Lost or Stolen Luggage | Covers the cost of replacing lost or stolen luggage during your trip. | Items not declared, items of high value, negligence, intentional acts. | Maximum coverage limits, deductibles. |

| Trip Cancellation or Interruption | Covers the cost of canceling or interrupting your trip due to unforeseen circumstances, such as illness, injury, or death of a family member. | Pre-existing conditions, high-risk activities, specific medical treatments, mental health conditions. | Maximum coverage limits, pre-existing conditions, high-risk activities. |

Note: It’s important to carefully review the specific terms and conditions of your chosen policy to understand its coverage, exclusions, and limitations. Contact your insurance provider if you have any questions or require clarification.

Claim Procedures and Assistance

Travel health insurance is designed to provide financial protection and assistance in case of unexpected medical emergencies while traveling abroad. Understanding the claim procedures and the support provided by travel insurance companies is crucial for maximizing the benefits of this coverage.

Filing a Claim

When filing a claim with your travel health insurance provider, you’ll need to follow a specific process to ensure your request is processed smoothly. The following steps provide a general guideline:

- Contact Your Insurance Provider: Immediately notify your insurance provider about the medical emergency, providing details about the incident, location, and your current condition.

- Gather Necessary Documentation: Collect all relevant documentation, including medical bills, receipts for medications, and any other supporting documents.

- Complete Claim Form: Obtain a claim form from your insurer and complete it accurately, providing all required information and attaching supporting documents.

- Submit Claim: Submit the completed claim form, along with all necessary documentation, to your insurer as instructed.

- Follow Up: Follow up with your insurance provider to track the status of your claim and ensure it is being processed promptly.

Assistance with Medical Emergencies

Travel insurance providers play a vital role in assisting travelers during medical emergencies. They can provide various forms of support, including:

- Medical Evacuation: If necessary, your insurer may arrange for medical evacuation to a hospital with appropriate facilities or back to your home country.

- Medical Treatment: Your insurance provider can help coordinate medical treatment, including arranging appointments with doctors and specialists.

- Hospitalization: They can assist with finding and securing a suitable hospital for your needs, covering the cost of hospitalization and related medical expenses.

- Repatriation: In case of death, your insurer can arrange for the repatriation of your remains to your home country.

Important Considerations for Claim Procedures

- Policy Coverage: Carefully review your policy to understand the specific coverage and limitations.

- Time Limits: Be aware of any time limits for filing claims and notifying your insurer about the medical emergency.

- Communication: Maintain clear and frequent communication with your insurance provider throughout the claim process.

Conclusive Thoughts

Ultimately, the decision of whether or not to purchase travel health insurance depends on individual circumstances, travel plans, and risk tolerance. By carefully evaluating your existing health coverage, destination-specific risks, and budget constraints, you can make a well-informed choice that prioritizes your health and well-being while exploring the world.

FAQ Section

What are the common exclusions in travel health insurance policies?

Common exclusions often include pre-existing conditions, high-risk activities like extreme sports, specific medical treatments like cosmetic surgery, and mental health conditions.

How do I file a claim with travel health insurance?

The process typically involves contacting your insurance provider, providing necessary documentation like medical bills and travel itineraries, and following their claim procedures.

Is travel health insurance worth it for short trips?

Even for short trips, unexpected medical expenses can be costly. If your existing health insurance doesn’t cover international medical costs, travel health insurance can offer valuable protection.