Do I need travel insurance for a cruise in Australia? The answer is a resounding yes, and here’s why. Cruising through the breathtaking waters of Australia promises an unforgettable adventure, but unexpected events can happen. From medical emergencies to lost luggage, having travel insurance provides a safety net, allowing you to relax and enjoy your journey without the worry of financial burdens.

Australia’s diverse cruise itineraries offer something for everyone, whether you’re seeking a luxurious escape, a family-friendly adventure, or a thrilling exploration of the Great Barrier Reef. While these cruises are designed for enjoyment, unforeseen circumstances can arise, making travel insurance a wise investment.

Cruises in Australia

Cruises in Australia offer a unique and exciting way to explore the diverse landscapes and vibrant culture of this vast continent. From the sun-drenched beaches of the Gold Coast to the rugged beauty of Tasmania, there’s a cruise itinerary for every taste and budget.

Cruise Itineraries in Australia

Australia’s cruise itineraries are as diverse as the country itself. You can choose from short weekend getaways to extended voyages that explore the entire coastline. Popular itineraries include:

- The Great Barrier Reef: Explore the world’s largest coral reef system with its vibrant marine life, pristine beaches, and secluded islands.

- The South Pacific: Embark on a journey to exotic destinations like Fiji, New Caledonia, and Vanuatu, known for their stunning beaches, crystal-clear waters, and rich cultural heritage.

- Western Australia: Discover the rugged beauty of Western Australia’s coastline, including the Kimberley region, with its towering gorges, ancient rock art, and diverse wildlife.

- Tasmania: Explore the island state of Tasmania, renowned for its dramatic landscapes, historic towns, and unique wildlife, including the Tasmanian devil.

- The Australian Coast: Enjoy a scenic cruise along the Australian coastline, visiting iconic cities like Sydney, Melbourne, and Brisbane, and experiencing the country’s diverse culture and natural beauty.

Popular Destinations and Ports of Call

Australia’s cruise destinations offer a blend of natural beauty, cultural experiences, and historical significance. Some of the most popular ports of call include:

- Sydney: Australia’s iconic city, renowned for its Harbour Bridge, Opera House, and vibrant nightlife.

- Melbourne: A cosmopolitan city known for its art, culture, and culinary scene.

- Brisbane: A vibrant city with a subtropical climate, offering a mix of urban attractions and natural beauty.

- Cairns: The gateway to the Great Barrier Reef, offering access to stunning coral reefs, tropical rainforests, and unique wildlife.

- Fremantle: A historic port city in Western Australia, known for its maritime heritage, art galleries, and vibrant markets.

- Hobart: The capital of Tasmania, offering a blend of history, culture, and natural beauty.

Types of Cruises in Australia

Australia offers a wide range of cruise experiences to cater to different interests and budgets.

- Luxury Cruises: Indulge in unparalleled comfort and service aboard luxury cruise lines, with elegant dining, spacious accommodations, and a wide range of amenities.

- Family Cruises: Enjoy family-friendly activities and entertainment, including kids’ clubs, water parks, and interactive experiences.

- Adventure Cruises: Explore remote destinations and participate in thrilling activities like snorkeling, scuba diving, kayaking, and hiking.

- Themed Cruises: Celebrate special occasions or interests with themed cruises, such as wine cruises, music festivals, or culinary journeys.

The Importance of Travel Insurance

While cruising in Australia promises breathtaking scenery and exciting experiences, it’s essential to consider the potential risks that could arise during your journey. Unexpected events can disrupt your plans and lead to significant financial burdens. Travel insurance acts as a safety net, providing peace of mind and financial protection against unforeseen circumstances.

The Importance of Travel Insurance

Travel insurance offers crucial protection against a wide range of potential risks, ensuring you’re financially covered in case of unforeseen events. It can be a lifesaver in various situations, from medical emergencies to flight cancellations.

Scenarios Where Travel Insurance Can Be Crucial

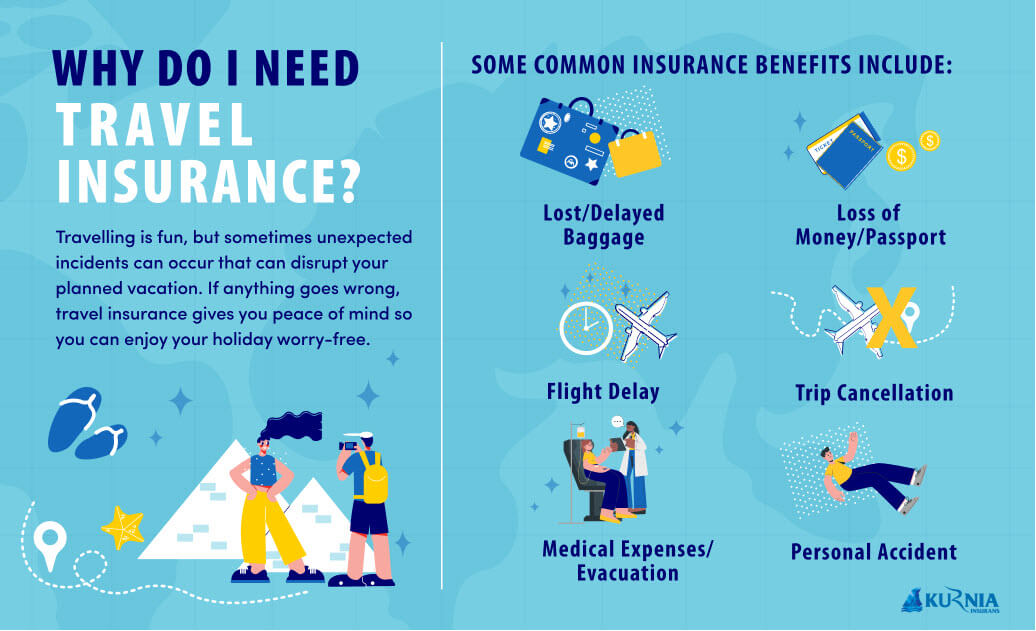

Travel insurance proves invaluable in various scenarios, offering financial protection and peace of mind. Here are some examples:

- Medical Emergencies: Cruising in Australia can involve activities like snorkeling, diving, or hiking, increasing the risk of accidents or illnesses. Travel insurance covers medical expenses, including hospitalization, evacuation, and repatriation, ensuring you receive necessary care without financial strain.

- Trip Cancellation or Interruption: Unforeseen circumstances like severe weather, natural disasters, or personal emergencies can force you to cancel or interrupt your cruise. Travel insurance provides reimbursement for non-refundable expenses, such as cruise fares, flights, and accommodation.

- Lost or Stolen Baggage: Accidents happen, and your luggage could be lost or stolen during your cruise. Travel insurance covers the cost of replacing essential items, alleviating the stress of unexpected expenses.

- Personal Liability: If you accidentally cause damage to property or injure someone during your cruise, travel insurance offers protection against legal liabilities, ensuring you’re not held responsible for significant financial losses.

Benefits of Travel Insurance

Travel insurance offers a comprehensive suite of benefits designed to protect you during your cruise:

- Medical Coverage: Covers medical expenses, including hospitalization, surgery, and emergency medical evacuation, ensuring you receive the necessary care without financial strain.

- Baggage Protection: Provides reimbursement for lost, stolen, or damaged luggage, ensuring you can replace essential items without incurring significant costs.

- Trip Cancellation and Interruption: Reimburses non-refundable expenses, such as cruise fares, flights, and accommodation, in case of unforeseen circumstances that force you to cancel or interrupt your trip.

- Personal Liability: Covers legal liabilities if you accidentally cause damage to property or injure someone during your cruise, protecting you from potential financial losses.

- Emergency Assistance: Provides 24/7 access to emergency assistance services, including medical referrals, legal advice, and translation services, offering support in challenging situations.

Specific Travel Insurance Needs for Australian Cruises

While general travel insurance covers the basics, Australian cruises have unique needs that require specialized coverage. Cruises often involve remote destinations, potentially leading to increased medical expenses or challenging evacuations. Additionally, the value of your belongings and the possibility of theft or damage are considerations that should not be overlooked.

Medical Coverage

Medical emergencies can arise unexpectedly, especially when traveling to new destinations. Australian cruises often visit remote areas, which can complicate medical treatment. It is essential to have travel insurance that provides adequate medical coverage, including:

- Emergency medical expenses: Covering the costs of doctor visits, hospital stays, and necessary medical procedures.

- Medical evacuation: Providing transportation to a suitable medical facility, should the need arise.

- Repatriation: Covering the cost of returning you to your home country if you become seriously ill or injured while on the cruise.

It is crucial to ensure your travel insurance policy has sufficient limits for medical expenses and includes coverage for pre-existing conditions.

Emergency Evacuation Coverage

The remote locations visited by Australian cruises can pose challenges in case of an emergency. Having adequate emergency evacuation coverage is vital. This coverage ensures you can be transported to a medical facility or returned home safely in the event of a medical emergency or natural disaster.

- Air ambulance: Covering the cost of transportation by air ambulance if needed.

- Medical evacuation by sea: Providing for transportation by ship if air travel is not feasible.

- Search and rescue: Covering the cost of locating and rescuing you if you are lost or injured in a remote area.

Cruises in Australia often visit remote areas, so having this coverage can provide peace of mind and ensure you receive timely and appropriate medical attention.

Baggage and Personal Belongings Insurance

While on a cruise, your personal belongings are susceptible to theft, damage, or loss. Travel insurance that includes baggage and personal belongings coverage can protect you against these risks.

- Theft or damage: Covering the cost of replacing or repairing stolen or damaged items.

- Loss of baggage: Providing compensation for lost luggage or personal belongings.

- Delayed baggage: Reimbursing you for essential items purchased while waiting for your delayed luggage.

This coverage is especially important when traveling with valuable items, such as jewelry, electronics, or expensive clothing. It can also provide financial protection if your luggage is lost or damaged during transit.

Factors Influencing Travel Insurance Decisions

Deciding whether or not to purchase travel insurance for your Australian cruise involves several factors. You need to consider the coverage offered by different insurers, your personal circumstances, and the overall cost of the insurance compared to the potential risks and financial implications of an unexpected event.

Comparing Coverage Offered by Different Providers

Travel insurance policies vary significantly in terms of the coverage they offer. Comparing different providers and their policies is crucial to find one that aligns with your specific needs and budget.

- Medical Expenses: This covers medical costs incurred during your trip, including emergency medical treatment, hospitalization, and evacuation.

- Trip Cancellation and Interruption: This protects you against financial losses if you need to cancel or interrupt your cruise due to unforeseen circumstances such as illness, injury, or family emergencies.

- Baggage Loss or Damage: This covers the cost of replacing lost or damaged luggage.

- Personal Liability: This provides protection against legal claims for damages caused by you to others during your trip.

- Emergency Assistance: This provides support services such as medical assistance, legal advice, and repatriation in case of emergencies.

You should also consider the specific exclusions and limitations of each policy. Some policies may exclude certain activities or pre-existing medical conditions.

Impact of Pre-existing Medical Conditions, Do i need travel insurance for a cruise in australia

Pre-existing medical conditions can significantly impact your travel insurance coverage. Some insurers may refuse to cover you entirely, while others may offer limited coverage or require you to pay a higher premium.

- Disclosure: It’s essential to disclose all pre-existing medical conditions to your insurer. Failing to do so could result in your claim being denied.

- Medical Conditions: Depending on the severity of your pre-existing condition, you may need to obtain a medical certificate from your doctor before purchasing travel insurance.

- Special Policies: Some insurers offer specialized policies for individuals with pre-existing medical conditions. These policies may have higher premiums but provide broader coverage.

Cost of Travel Insurance in Relation to Cruise Expenses

The cost of travel insurance is typically a small fraction of your overall cruise expense. However, it’s crucial to consider the potential financial implications of an unexpected event.

Consider the following factors when evaluating the cost of travel insurance:

- Cost of the Cruise: The more expensive your cruise, the higher the potential financial losses if something goes wrong.

- Coverage Level: Policies with more comprehensive coverage typically have higher premiums.

- Age and Health: Your age and health can also affect the cost of travel insurance.

It’s important to weigh the cost of insurance against the potential benefits. A relatively small investment in travel insurance can provide significant peace of mind and financial protection.

Recommended Travel Insurance Providers for Australian Cruises: Do I Need Travel Insurance For A Cruise In Australia

Choosing the right travel insurance provider is crucial for ensuring peace of mind during your Australian cruise. This section will provide insights into some of the leading travel insurance providers in Australia, helping you make an informed decision based on your specific needs and budget.

Recommended Travel Insurance Providers for Australian Cruises

When selecting travel insurance for an Australian cruise, it’s essential to compare different providers based on their coverage details, cost, and customer reviews. Here’s a table outlining some of the key features and benefits of popular travel insurance providers:

| Provider Name | Coverage Details | Cost | Customer Reviews |

|---|---|---|---|

| [Provider Name 1] | [Coverage details, e.g., medical expenses, cancellation, baggage loss] | [Estimated cost range, e.g., $XX – $XX] | [Summary of customer reviews, e.g., positive, mixed, negative] |

| [Provider Name 2] | [Coverage details, e.g., medical expenses, cancellation, baggage loss] | [Estimated cost range, e.g., $XX – $XX] | [Summary of customer reviews, e.g., positive, mixed, negative] |

| [Provider Name 3] | [Coverage details, e.g., medical expenses, cancellation, baggage loss] | [Estimated cost range, e.g., $XX – $XX] | [Summary of customer reviews, e.g., positive, mixed, negative] |

Remember that these are just examples, and it’s essential to conduct thorough research and compare quotes from multiple providers before making a decision.

- [Provider Name 1]: [Website Link]

- [Provider Name 2]: [Website Link]

- [Provider Name 3]: [Website Link]

Conclusion

Ultimately, deciding whether to purchase travel insurance for a cruise in Australia is a personal choice. However, considering the potential risks, the benefits of coverage, and the peace of mind it provides, it’s a decision worth careful thought. By weighing the pros and cons, you can make an informed choice that aligns with your individual needs and travel plans, ensuring a worry-free and enjoyable cruise experience.

FAQ

What type of medical coverage is essential for a cruise in Australia?

Medical coverage that includes emergency evacuation is highly recommended. Australia’s vast distances and remote locations may require swift and expensive transportation in case of a medical emergency.

What are the potential risks associated with cruising in Australia?

Potential risks include medical emergencies, lost or damaged luggage, flight delays or cancellations, and unexpected weather events. Travel insurance can help mitigate these risks and provide financial protection.

Are there any specific travel insurance providers recommended for Australian cruises?

Research and compare various providers, considering factors like coverage, cost, and customer reviews. Seek recommendations from travel agents or online forums.

What are the common exclusions in travel insurance policies?

Exclusions can vary, but common ones include pre-existing medical conditions, dangerous activities, and travel against medical advice. Carefully review the policy terms and conditions.