How car insurance works in Australia is a crucial aspect of responsible driving, ensuring financial protection in case of accidents or unforeseen events. Navigating the complexities of car insurance can be daunting, but understanding the basics is essential for making informed decisions about your coverage.

This guide provides a comprehensive overview of car insurance in Australia, covering the different types of policies available, key components of insurance plans, factors influencing premiums, and the process of making a claim. We will also explore the role of car insurance in promoting road safety and provide tips for choosing the right policy for your needs.

Introduction to Car Insurance in Australia

Car insurance is a vital aspect of responsible car ownership in Australia, providing financial protection against the risks associated with driving. It safeguards you and your vehicle from potential financial losses arising from accidents, theft, or other unforeseen events.

Legal Requirements for Car Insurance

In Australia, it is mandatory to have at least third-party property damage (TPPD) insurance for all registered vehicles. This legal requirement ensures that drivers are financially responsible for any damage they cause to other people’s property while driving. TPPD insurance covers the cost of repairs or replacement of another person’s vehicle or property if you are at fault in an accident.

Types of Car Insurance

Car insurance in Australia comes in various forms, each offering different levels of coverage. Here’s a brief overview of the common types:

- Third-Party Property Damage (TPPD): This is the minimum level of insurance required by law. It covers damage to other people’s property but does not cover your own vehicle or injuries to yourself or passengers.

- Comprehensive Car Insurance: This type of insurance provides the most extensive coverage, including damage to your own vehicle, injuries to yourself and passengers, and third-party property damage. It also covers theft, fire, and other non-accident related events.

- Third-Party Fire and Theft (TPFT): This type of insurance covers damage to your own vehicle due to fire or theft, along with third-party property damage. However, it does not cover accidental damage to your vehicle.

Types of Car Insurance

In Australia, you have several choices when it comes to car insurance. Each type of insurance offers varying levels of coverage and protection, and the right choice depends on your individual needs and circumstances. Here’s a breakdown of the most common types of car insurance in Australia:

Comprehensive Car Insurance

Comprehensive car insurance provides the most extensive coverage, protecting you against a wide range of risks. This type of insurance covers damage to your car, regardless of who is at fault, including:

- Accidents

- Theft

- Fire

- Natural disasters

- Vandalism

It also covers your liability to other parties involved in an accident, including their injuries and property damage.

Comprehensive insurance is the most expensive option, but it offers peace of mind knowing that you’re fully protected.

Third-Party Property Damage Insurance

This type of insurance covers damage to other people’s property if you’re at fault in an accident. It does not cover damage to your own car.

Third-party property damage insurance is a legal requirement in Australia. It provides basic protection but is significantly cheaper than comprehensive insurance.

Third-Party Fire and Theft Insurance

This type of insurance covers damage to your car caused by fire or theft. It also covers your liability to other parties involved in an accident, similar to comprehensive insurance.

Third-party fire and theft insurance is a middle ground between comprehensive and third-party property damage insurance. It offers more protection than third-party property damage but less than comprehensive.

Factors Affecting Insurance Costs, How car insurance works in australia

The cost of car insurance is influenced by several factors, including:

- Your driving history: Drivers with a clean record and no accidents or traffic violations will generally pay lower premiums.

- Your age and gender: Younger drivers and males tend to have higher premiums due to higher risk profiles.

- The type of car you drive: Expensive, high-performance cars, or cars with a history of theft, are more likely to have higher premiums.

- Your location: Areas with higher crime rates or more traffic congestion may have higher insurance premiums.

- Your insurance history: Having a previous insurance claim or lapse in coverage can increase your premiums.

- Your occupation: Some occupations, such as delivery drivers, may have higher premiums due to increased risk.

- Your driving habits: Factors like the number of kilometers you drive annually and whether you use your car for business purposes can influence your premiums.

Key Components of Car Insurance Policies

Car insurance policies in Australia are designed to protect you financially in case of an accident or other unforeseen events involving your vehicle. They are typically comprehensive documents outlining the coverage provided, terms and conditions, and the responsibilities of both the insurer and the policyholder. Understanding the key components of a car insurance policy is crucial for making informed decisions about your coverage and ensuring you are adequately protected.

Excess

The excess is the amount you agree to pay out of your own pocket in the event of a claim. This is a standard feature of most car insurance policies, and it helps to keep premiums lower.

The higher your excess, the lower your premium will be, and vice versa.

For example, if you have an excess of $500 and you make a claim for $2,000, you will be responsible for paying the first $500, and the insurance company will cover the remaining $1,500.

Premium

The premium is the amount you pay to your insurance company for your car insurance policy. It is usually calculated based on factors such as:

- The make and model of your car

- Your age and driving history

- Your location

- The type of coverage you choose

Deductible

The deductible is the amount you pay out of pocket for repairs or replacement of your vehicle after an accident or other covered event. It is a similar concept to excess, but it typically applies to specific types of claims, such as collision or comprehensive coverage.

Insurance Add-ons and Optional Extras

Car insurance policies often offer a range of add-ons and optional extras that can enhance your coverage. These extras can provide additional protection for specific situations or needs, such as:

- New for Old: This add-on allows you to receive a replacement vehicle of the same age and model as your current vehicle, even if it’s a newer model.

- Windscreen Cover: This add-on covers the cost of replacing your windscreen in the event of damage, regardless of whether it’s due to an accident or other incident.

- Towing and Breakdown Cover: This add-on provides coverage for towing and breakdown assistance if your vehicle breaks down or is involved in an accident.

- Hire Car Cover: This add-on provides coverage for the cost of hiring a replacement vehicle while your car is being repaired after an accident.

- Personal Accident Cover: This add-on provides coverage for medical expenses and other costs in the event of an accident that results in injury.

It is important to note that add-ons and optional extras can increase your premium, so it’s important to carefully consider your needs and budget before deciding whether to purchase them.

Factors Affecting Car Insurance Premiums

Your car insurance premium is the amount you pay for your policy. Several factors influence how much you pay, and understanding these factors can help you make informed decisions about your insurance.

Vehicle Type

The type of car you drive significantly impacts your insurance premium. Insurers assess the risk associated with different vehicles based on factors like:

- Value: More expensive cars generally cost more to repair or replace, resulting in higher premiums.

- Safety Features: Cars with advanced safety features like anti-lock brakes and airbags tend to have lower premiums.

- Performance: High-performance cars are often associated with higher risk and therefore higher premiums.

- Theft Risk: Some car models are more prone to theft, leading to increased premiums.

Age

Your age is a key factor in determining your car insurance premium.

- Young Drivers: Young drivers (typically under 25) are considered statistically higher risk due to lack of experience. This often translates to higher premiums.

- Mature Drivers: Mature drivers (over 65) may face slightly higher premiums due to potential health concerns.

- Middle-Aged Drivers: Drivers in the middle age range (between 25 and 65) generally enjoy lower premiums due to their experience and lower risk profile.

Driving History

Your driving history plays a crucial role in determining your insurance premium.

- Accidents: Having a history of accidents, even minor ones, can significantly increase your premiums.

- Traffic Violations: Traffic violations like speeding tickets or reckless driving can lead to higher premiums.

- Claims History: Frequent claims, even for minor incidents, can impact your premium.

Location

Where you live can affect your car insurance premium.

- Urban Areas: Urban areas with higher population density and traffic congestion tend to have higher premiums due to a greater risk of accidents.

- Rural Areas: Rural areas with lower population density and less traffic often have lower premiums.

- Crime Rates: Areas with high crime rates, particularly car theft, can lead to higher premiums.

Usage

How often you drive your car and for what purpose also influences your premium.

- Commuting Distance: Driving long distances for work or school increases your exposure to potential accidents, resulting in higher premiums.

- Business Use: Using your car for business purposes, such as deliveries or sales calls, generally leads to higher premiums due to increased exposure to risk.

- Personal Use: Using your car primarily for personal use, such as driving to social events or running errands, typically results in lower premiums.

Making a Claim

Making a claim with your car insurance is a process that involves reporting the incident to your insurer and providing them with the necessary information and documentation. The process can vary slightly depending on the type of claim you’re making, but generally involves several key steps.

Reporting an Accident or Theft

When you’re involved in an accident or your car is stolen, it’s important to report the incident to your insurer as soon as possible. This helps ensure your claim is processed quickly and efficiently.

Here’s a step-by-step guide on how to report an accident or theft:

- Contact your insurer: You can usually report an incident by phone, online, or through their mobile app. Make sure to have your policy details readily available.

- Provide details of the incident: This includes the date, time, location, and circumstances of the incident. For accidents, be sure to include details of any other vehicles involved, including their registration numbers and insurance details.

- Take photos or videos: Document the damage to your car and the scene of the accident. This can be helpful in supporting your claim.

- Obtain contact information: If there are other parties involved, exchange contact information with them, including their names, addresses, and phone numbers.

- File a police report: If the incident involves a hit-and-run, theft, or serious damage, it’s essential to file a police report.

Providing Accurate Information and Documentation

Providing accurate information and documentation is crucial to ensuring your claim is processed smoothly.

- Policy details: This includes your policy number, the type of cover you have, and your contact information.

- Vehicle details: This includes your car’s registration number, make, model, and year of manufacture.

- Driver details: This includes your driver’s license number, age, and any other relevant information.

- Incident details: This includes the date, time, location, and circumstances of the incident. For accidents, include details of any other vehicles involved, including their registration numbers and insurance details.

- Supporting documentation: This can include photos or videos of the damage, police reports, witness statements, and any other relevant documentation.

It’s important to be truthful and honest when providing information to your insurer. Any inaccuracies or omissions could delay or even invalidate your claim.

Choosing the Right Car Insurance

Finding the right car insurance policy can feel overwhelming, with numerous providers offering a wide range of coverage options and premiums. This guide will help you navigate the process, ensuring you find the best fit for your individual needs and circumstances.

Comparing Insurance Providers and Their Offerings

Understanding the differences between insurance providers and their offerings is crucial for making an informed decision. It involves examining factors such as coverage options, premium costs, customer service, and claims handling processes.

- Coverage Options: Each insurer offers a range of coverage options, including comprehensive, third-party property damage, and third-party fire and theft. Understanding the scope of each coverage option is essential for determining the best fit for your needs.

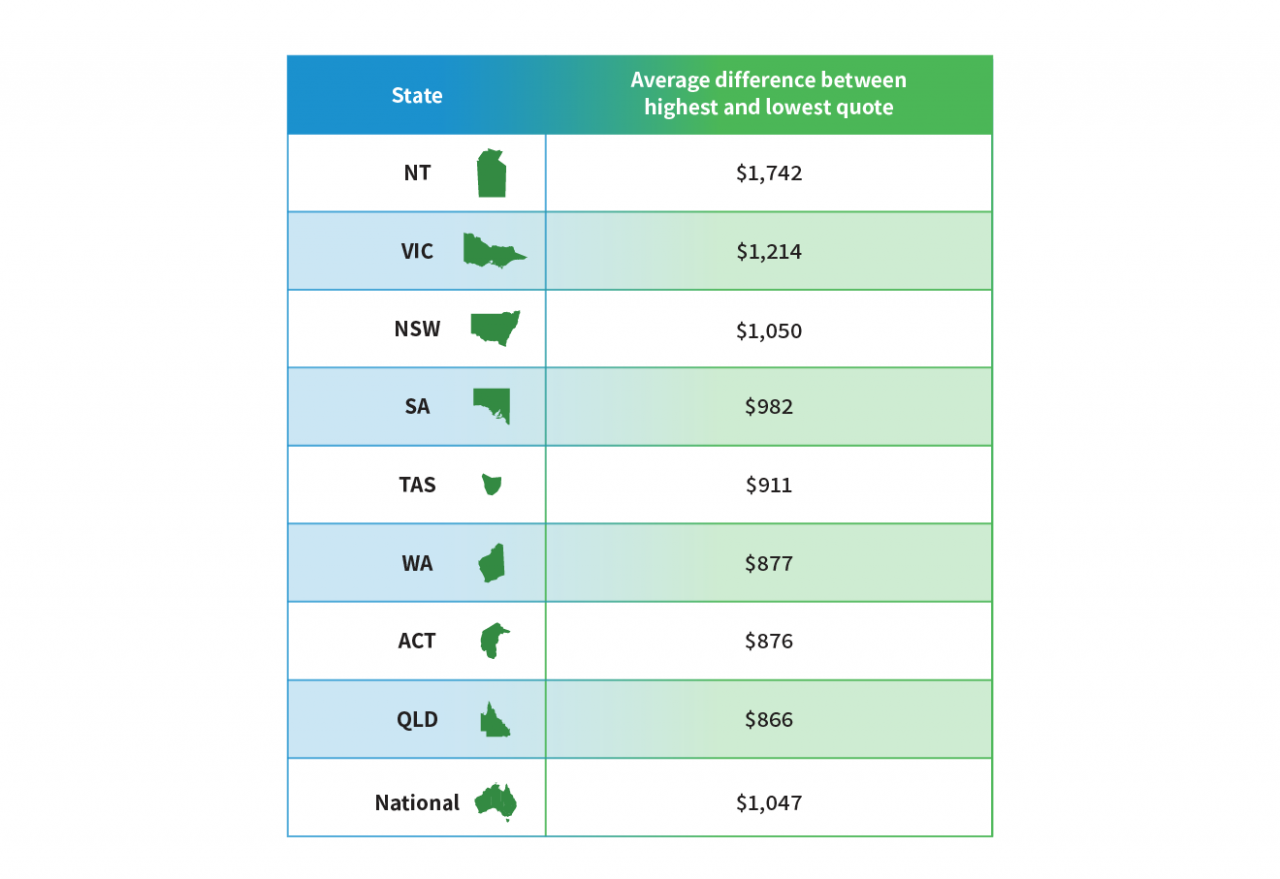

- Premium Costs: Premiums vary significantly between providers, influenced by factors such as your driving history, vehicle type, and location. Comparing quotes from multiple providers is essential to find the most competitive pricing.

- Customer Service: Evaluating an insurer’s customer service reputation is crucial, as it can impact your experience when you need to file a claim or have inquiries. Look for providers with positive customer reviews and readily available support channels.

- Claims Handling Processes: Understanding an insurer’s claims handling process, including their speed and efficiency, is essential. Look for providers with a reputation for smooth and prompt claims resolution.

Tips for Negotiating Car Insurance Premiums

Negotiating car insurance premiums can help you save money. This involves leveraging your driving history, vehicle features, and willingness to explore different coverage options.

- Good Driving History: A clean driving record with no accidents or traffic violations can significantly influence your premium. Highlight your safe driving history to insurers, as it demonstrates a lower risk profile.

- Vehicle Features: Certain vehicle features, such as anti-theft devices or safety systems, can reduce your premium. Mention these features to insurers, as they demonstrate a reduced risk of accidents or theft.

- Coverage Options: Exploring different coverage options can lead to premium savings. Consider opting for a higher excess, which reduces your premium but requires you to pay a larger amount in the event of a claim.

- Loyalty Discounts: Many insurers offer discounts for long-term customers. If you’ve been with your current provider for a significant period, inquire about potential loyalty discounts.

- Comparison Websites: Comparison websites allow you to quickly compare quotes from multiple insurers. This helps you identify the most competitive prices and coverage options.

Car Insurance and Road Safety

Car insurance plays a crucial role in promoting road safety in Australia. It encourages responsible driving behavior and provides financial protection in case of accidents, contributing to a safer driving environment for everyone.

Incentivizing Responsible Driving

Car insurance policies are designed to incentivize responsible driving by rewarding safe drivers with lower premiums and penalizing those who engage in risky behavior. This incentivizes individuals to prioritize safety on the road.

- No-claims bonuses: Drivers who maintain a clean driving record without making claims are rewarded with discounts on their premiums, encouraging them to avoid accidents.

- Risk-based pricing: Insurance companies assess the risk associated with individual drivers based on factors like age, driving history, vehicle type, and location. Higher-risk drivers face higher premiums, motivating them to adopt safer driving practices.

- Telematics devices: Some insurance companies offer telematics devices that track driving behavior, such as speed, braking, and acceleration. Safe driving habits are rewarded with lower premiums, while risky driving behavior results in higher premiums, encouraging drivers to stay within safe limits.

Initiatives and Programs

Australia has various initiatives and programs aimed at reducing road accidents and promoting road safety. These initiatives focus on driver education, awareness campaigns, and infrastructure improvements.

- Driver education programs: These programs, like the Graduated Licensing Scheme, provide new drivers with the knowledge and skills necessary to drive safely. They help to reduce accidents by promoting responsible driving practices and hazard awareness.

- Road safety campaigns: Government agencies and organizations run awareness campaigns to educate the public about road safety issues, promoting safe driving behaviors, and highlighting the dangers of drunk driving, speeding, and distracted driving.

- Infrastructure improvements: Investing in safer roads, such as improved lighting, road markings, and traffic calming measures, can reduce accidents by minimizing risks and enhancing driver visibility.

Closure

By understanding the fundamentals of car insurance in Australia, you can make informed choices that align with your driving needs and financial circumstances. Remember, responsible driving and having adequate insurance are essential for a safe and secure driving experience.

User Queries: How Car Insurance Works In Australia

What is the minimum car insurance required in Australia?

In Australia, the minimum required car insurance is third-party property damage (TPPD) insurance. This covers damage you cause to other people’s vehicles or property, but not damage to your own vehicle.

How often should I review my car insurance policy?

It’s advisable to review your car insurance policy at least annually, or whenever your circumstances change significantly (e.g., new car, change in driving habits, or moving to a new location). This ensures your coverage remains relevant and meets your current needs.

What are the common exclusions in car insurance policies?

Common exclusions in car insurance policies include damage caused by wear and tear, intentional acts, driving under the influence of alcohol or drugs, and certain types of racing or off-road driving.

What are the benefits of having comprehensive car insurance?

Comprehensive car insurance provides broader coverage than TPPD, including damage to your own vehicle caused by accidents, theft, fire, or natural disasters. It also covers additional expenses such as towing and rental car costs.

What are some tips for reducing my car insurance premiums?

To reduce your car insurance premiums, consider factors like choosing a safe vehicle, maintaining a good driving record, increasing your excess, and exploring discounts offered by insurers.