How do I get government health insurance? This question is on the minds of many Americans, especially those struggling to afford private healthcare. Navigating the complexities of government-funded health programs can be daunting, but understanding your eligibility, available options, and enrollment process is crucial. This guide will equip you with the knowledge to confidently access the healthcare you need.

The United States offers a variety of government health insurance programs, each with its own eligibility requirements and benefits. These programs, such as Medicaid, Medicare, and the Children’s Health Insurance Program (CHIP), are designed to provide financial assistance for healthcare costs to individuals and families who meet certain criteria. By understanding the different programs, you can determine which one best suits your individual needs and financial situation.

Eligibility for Government Health Insurance

In the United States, government health insurance programs provide financial assistance to individuals and families who meet certain eligibility criteria. These programs aim to ensure access to healthcare for those who might otherwise struggle to afford it.

Eligibility Criteria for Government Health Insurance Programs

The eligibility criteria for government health insurance programs vary depending on the specific program. Some of the most common programs include Medicaid, Medicare, and the Children’s Health Insurance Program (CHIP).

Medicaid Eligibility

Medicaid is a government-funded health insurance program that provides coverage to low-income individuals and families.

Income and Asset Requirements

To qualify for Medicaid, individuals and families must meet specific income and asset requirements. These requirements vary from state to state.

- Income: Generally, individuals and families must have an income below a certain percentage of the federal poverty level (FPL). For instance, in 2023, a single person in California needs to have an income of less than 138% of the FPL to qualify for Medicaid.

- Assets: Medicaid programs may also have asset limits. These limits vary by state. For example, in some states, the maximum allowable asset value for a single person might be $2,000.

Other Factors Affecting Medicaid Eligibility

Besides income and assets, other factors can influence Medicaid eligibility. These include:

- Age: Some states have expanded Medicaid eligibility to include adults without children.

- Disability: Individuals with disabilities may qualify for Medicaid, even if they exceed the income limits.

- Pregnancy: Pregnant women may qualify for Medicaid even if they don’t meet the standard income requirements.

- Citizenship: U.S. citizens and lawful permanent residents are generally eligible for Medicaid.

Medicare Eligibility

Medicare is a federal health insurance program that provides coverage to individuals aged 65 and older, as well as certain individuals with disabilities.

Age-Based Eligibility

The most common eligibility requirement for Medicare is age. Individuals who are 65 years or older are automatically eligible for Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

Disability-Based Eligibility

Individuals with certain disabilities may qualify for Medicare, even if they are under 65. To qualify for Medicare based on disability, individuals must have received Social Security Disability Insurance (SSDI) benefits for at least 24 months.

Children’s Health Insurance Program (CHIP), How do i get government health insurance

CHIP is a government-funded health insurance program that provides coverage to children in families who don’t qualify for Medicaid but still have limited income.

Income Requirements

CHIP eligibility is based on income and family size. The income limits for CHIP are generally higher than those for Medicaid. For example, in 2023, a family of four in California can earn up to 200% of the FPL and still qualify for CHIP.

Other Factors Affecting CHIP Eligibility

Besides income, other factors can influence CHIP eligibility. These include:

- Age: CHIP coverage is typically available to children up to age 19.

- Citizenship: U.S. citizens and lawful permanent residents are generally eligible for CHIP.

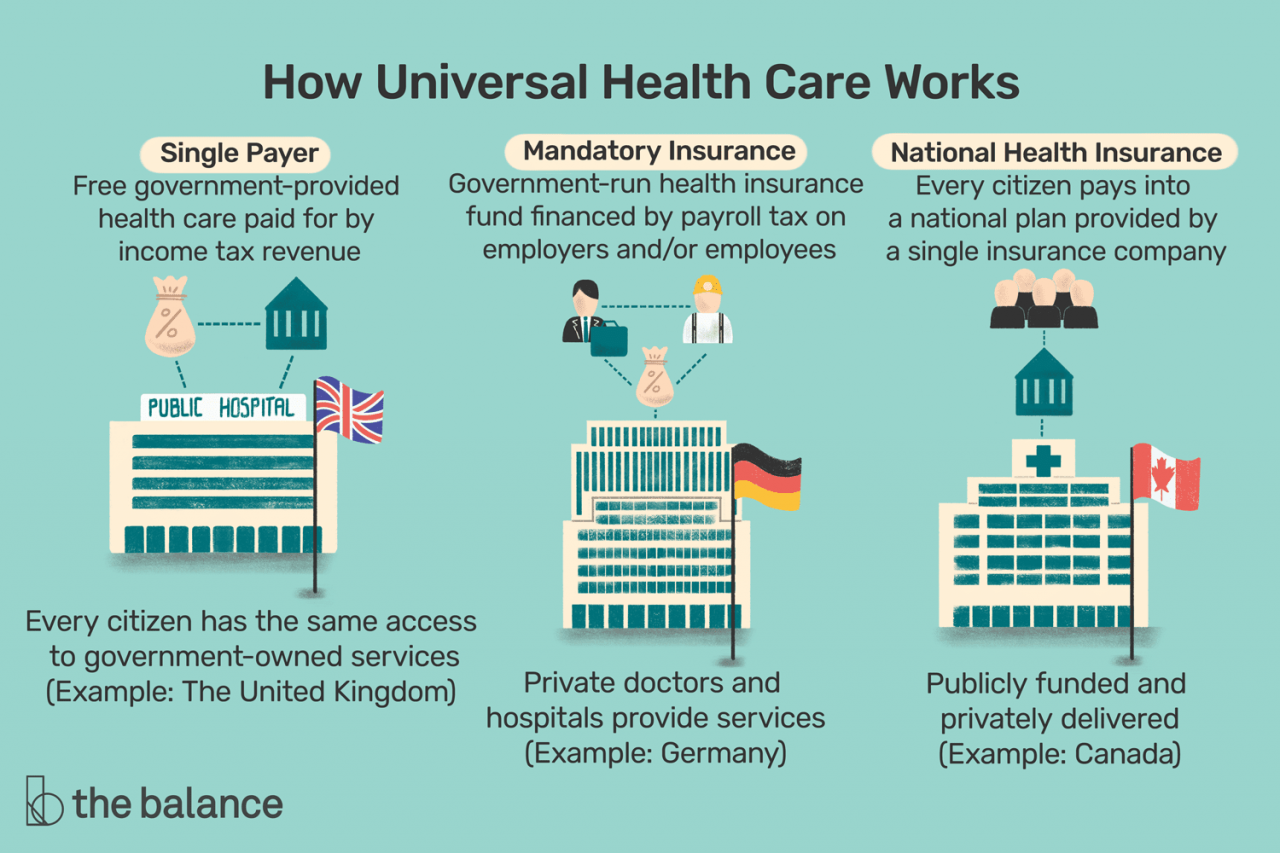

Types of Government Health Insurance

The United States government offers several health insurance programs to assist individuals and families in accessing healthcare. These programs vary in eligibility requirements, benefits, and coverage.

Medicaid

Medicaid is a government-funded health insurance program for low-income individuals and families. It is jointly administered by the federal and state governments, with each state setting its own eligibility guidelines. Medicaid provides comprehensive health coverage, including:

- Hospital and doctor visits

- Prescription drugs

- Dental and vision care

- Mental health services

- Long-term care

Eligibility for Medicaid is based on income and family size. In general, individuals and families with incomes below a certain threshold qualify. To enroll in Medicaid, you must apply through your state’s Medicaid agency.

Medicare

Medicare is a federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities. It is divided into four parts:

- Part A: Covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health services.

- Part B: Covers outpatient medical services, such as doctor visits, preventive services, and medical equipment.

- Part C: Offers private health insurance plans that provide Medicare benefits through a network of providers. It is also known as Medicare Advantage.

- Part D: Covers prescription drugs.

Medicare beneficiaries pay monthly premiums for Parts B and D, and may also have deductibles and copayments for services.

Children’s Health Insurance Program (CHIP), How do i get government health insurance

CHIP is a government-funded health insurance program for children from low-income families who do not qualify for Medicaid. It is also administered jointly by the federal and state governments. CHIP provides comprehensive health coverage for children, including:

- Doctor visits

- Hospital care

- Prescription drugs

- Dental and vision care

- Mental health services

Eligibility for CHIP is based on income and family size, with income limits generally higher than those for Medicaid. To enroll in CHIP, you must apply through your state’s CHIP agency.

Enrollment and Application Process

Applying for government health insurance involves several steps, each with its own requirements and deadlines. The process can seem complex, but understanding the steps and resources available can make it more manageable.

Application Forms and Required Documentation

You can usually find the application forms and required documentation online or by contacting your state’s health insurance marketplace.

The specific documents needed will vary depending on the program you’re applying for. However, some common documents include:

- Proof of identity, such as a driver’s license or passport.

- Proof of citizenship or immigration status.

- Proof of income, such as pay stubs or tax returns.

- Proof of residency, such as a utility bill or lease agreement.

Enrollment Periods and Deadlines

Most government health insurance programs have specific enrollment periods throughout the year.

- Open Enrollment Period: This is the main enrollment period, usually lasting for several weeks in the fall. During this time, you can apply for coverage that will begin the following year.

- Special Enrollment Period: You may qualify for a special enrollment period if you experience a life-changing event, such as losing your job, getting married, or having a baby. This allows you to enroll outside of the open enrollment period.

It’s crucial to meet the deadlines for enrollment, as missing them could delay your coverage.

Application Process

The application process for government health insurance typically involves these steps:

- Gather required documentation: Collect all the necessary documents, such as proof of income, identity, and residency.

- Complete the application form: You can apply online, by phone, or by mail. The application form will ask for personal information, income details, and health information.

- Submit your application: Once you’ve completed the application, submit it by the deadline.

- Review and approval: Your application will be reviewed to determine your eligibility and the coverage you qualify for. You’ll receive a notification about the outcome.

- Enroll in your plan: If you’re approved, you’ll need to choose a health insurance plan from the available options. This involves selecting a plan that best meets your needs and budget.

Remember to carefully review your application and all supporting documentation before submitting it. Accuracy is crucial for a smooth and successful enrollment process.

Cost and Payment Options: How Do I Get Government Health Insurance

The cost of government health insurance programs varies depending on the specific program and your individual circumstances. You’ll likely have to pay premiums, co-pays, and deductibles. Fortunately, there are also financial assistance programs and subsidies available to help low-income individuals afford coverage.

Premiums

Premiums are monthly payments you make to maintain your health insurance coverage. The amount you pay will depend on your income, age, location, and the type of plan you choose. Some government programs, such as Medicaid, may have no premium at all.

Co-pays

Co-pays are fixed amounts you pay for specific medical services, such as doctor visits or prescription drugs. These co-pays are typically lower than the full cost of the service. They are designed to help share the cost of care with the insurance company and encourage you to be more mindful of healthcare expenses.

Deductibles

Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. This means that you are responsible for the full cost of medical services until you reach your deductible. Once you have met your deductible, your insurance company will begin to cover a portion of your healthcare costs.

Financial Assistance Programs and Subsidies

The Affordable Care Act (ACA) offers financial assistance programs and subsidies to help eligible individuals and families afford health insurance. These programs are based on income and family size. You can use the Healthcare.gov website to determine if you qualify for financial assistance.

For example, a family of four with an income of $50,000 per year may qualify for a tax credit that reduces their monthly premium by $200.

Other Payment Options

In addition to premiums, co-pays, and deductibles, you may also be responsible for other costs, such as:

- Out-of-pocket expenses for services not covered by your insurance plan

- Co-insurance, which is a percentage of the cost of a service that you pay after you meet your deductible

- Prescription drug co-pays, which are fixed amounts you pay for prescription medications

Resources and Support

Navigating the world of government health insurance can be complex, but you don’t have to go it alone. Numerous resources are available to provide information, guidance, and assistance throughout the process.

Government Agencies

Government agencies play a crucial role in administering and managing health insurance programs. These agencies offer valuable resources, including information about eligibility, enrollment, and program details.

| Agency | Phone Number | Website |

|---|---|---|

| Centers for Medicare & Medicaid Services (CMS) | 1-800-MEDICARE (1-800-633-4227) | https://www.cms.gov/ |

| State Health Insurance Assistance Program (SHIP) | Vary by state | https://www.shiptacenter.org/ |

| Healthcare.gov | 1-800-318-2596 | https://www.healthcare.gov/ |

Advocacy Groups and Organizations

Advocacy groups and organizations are dedicated to supporting individuals and families in accessing affordable healthcare. They offer a range of services, including counseling, education, and advocacy.

- The National Council on Aging (NCOA): Provides information and resources for older adults, including Medicare counseling and assistance.

- The National Health Law Program (NHeLP): Offers legal assistance and advocacy for low-income individuals and families facing healthcare challenges.

- The Kaiser Family Foundation (KFF): Conducts research and provides information on health policy, including health insurance programs.

Common Questions and Concerns

It’s normal to have questions and concerns about government health insurance. Understanding the ins and outs of this system can be a bit complex, and it’s important to get reliable information to make informed decisions. This section addresses some of the most frequently asked questions and common concerns related to government health insurance.

Coverage for Specific Medical Conditions

People often want to know if specific medical conditions are covered by government health insurance. It’s important to note that coverage can vary depending on the specific program and state. However, most government health insurance plans cover a wide range of medical conditions, including:

- Preventive care, such as vaccinations and screenings

- Chronic illnesses, such as diabetes and heart disease

- Mental health conditions, such as anxiety and depression

- Emergency care

- Prescription drugs

It’s essential to review the specific coverage details of the program you’re considering to ensure your medical needs are met. You can usually find this information on the program’s website or by contacting the program directly.

Enrollment and Eligibility

Many people are concerned about the enrollment process and whether they are eligible for government health insurance. It’s understandable to have these concerns, as the eligibility criteria and application process can be complex.

- Eligibility: Eligibility for government health insurance is based on factors such as income, age, and citizenship status. There are different eligibility requirements for each program, so it’s crucial to research the specific program you’re interested in.

- Enrollment Period: There are specific enrollment periods for government health insurance programs. Missing these deadlines can result in a delay in coverage. It’s essential to stay informed about the enrollment periods and plan accordingly.

- Application Process: The application process can be done online, by phone, or in person. The specific process will vary depending on the program and state. It’s important to gather all necessary documents and information before starting the application process to ensure a smooth experience.

Benefits and Costs

Understanding the benefits and costs associated with government health insurance is essential. Many people are concerned about the affordability and the scope of coverage.

- Benefits: Government health insurance plans offer a wide range of benefits, including preventive care, prescription drugs, and hospitalization. However, the specific benefits offered can vary depending on the program and state. It’s crucial to review the program’s benefits and coverage details carefully.

- Costs: The cost of government health insurance can vary depending on the program, state, and individual circumstances. Some programs have monthly premiums, while others may have copayments or deductibles. It’s essential to consider the overall cost of the program, including any potential out-of-pocket expenses.

Accessing Government Health Insurance

Navigating the system and accessing government health insurance can be challenging. Some people may face barriers related to:

- Lack of Information: Understanding the complex eligibility requirements, enrollment periods, and benefits can be overwhelming. Many people lack access to reliable information and resources to navigate the system effectively.

- Language Barriers: Language barriers can make it difficult for individuals to understand the application process and access essential information about government health insurance programs.

- Technology Barriers: The online application process can be challenging for individuals who lack access to computers or internet connectivity. This can be a significant barrier for many, especially in rural areas.

It’s essential to find reliable resources and support to overcome these challenges. Many organizations offer assistance with enrollment, application processes, and navigating the system. These resources can provide valuable guidance and support to ensure individuals can access the healthcare they need.

Ultimate Conclusion

Securing government health insurance can be a significant step toward accessing quality healthcare. Understanding your eligibility, the various programs available, and the enrollment process is essential. By utilizing the resources and support mentioned, you can navigate this journey with confidence. Remember, obtaining healthcare coverage is a vital step in safeguarding your health and well-being.

Question & Answer Hub

What if I have a pre-existing condition?

Government health insurance programs generally cover pre-existing conditions, ensuring access to necessary medical care regardless of your health history.

How often can I enroll in government health insurance?

Enrollment periods for government health insurance programs vary. You can typically enroll during an open enrollment period or if you experience a qualifying life event, such as losing your job or getting married.

What if I’m a student?

Students may be eligible for government health insurance programs based on their income and other factors. Check with your state’s Medicaid or CHIP program for specific eligibility requirements.