- Introduction to Life Insurance in Australia

- How Life Insurance Policies Work in Australia

- Key Considerations for Choosing Life Insurance in Australia: How Life Insurance Works In Australia

- Understanding Life Insurance Claims in Australia

- Regulation and Oversight of Life Insurance in Australia

- Ending Remarks

- FAQ Resource

How life insurance works in Australia is a crucial topic for anyone seeking financial security and peace of mind. Life insurance provides a safety net for your loved ones, ensuring their financial well-being in the event of your passing. This comprehensive guide delves into the intricacies of life insurance in Australia, exploring its different types, key considerations, and the claims process.

Understanding how life insurance operates is essential for making informed decisions about your financial future. This guide aims to demystify the process, equipping you with the knowledge you need to choose the right policy for your individual circumstances.

Introduction to Life Insurance in Australia

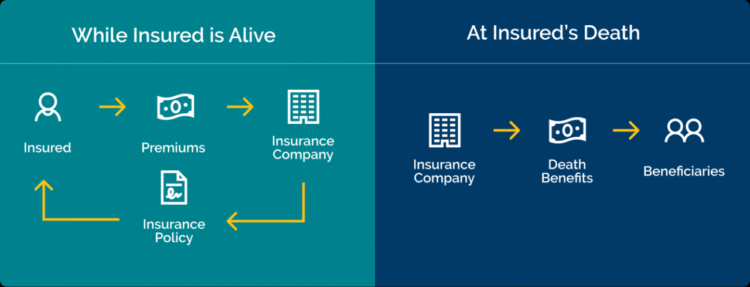

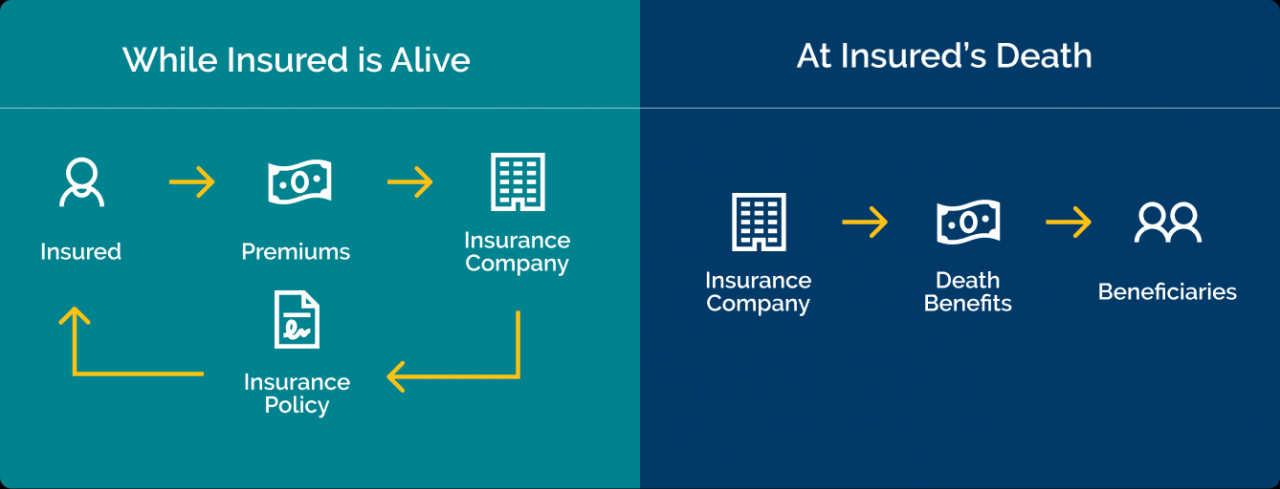

Life insurance is a crucial financial safety net for Australians, providing financial security and peace of mind for families in the event of an unexpected death. It works by providing a lump sum payment, known as a death benefit, to your beneficiaries upon your passing. This payment can help cover various expenses, such as funeral costs, outstanding debts, mortgage repayments, or provide financial support for your loved ones.

Life insurance is a vital part of a comprehensive financial plan, ensuring that your family is protected and financially secure if something unexpected happens to you.

Types of Life Insurance Policies in Australia

Life insurance policies come in different forms, each tailored to specific needs and financial circumstances. Here’s a breakdown of some common types available in Australia:

- Term Life Insurance: This policy provides coverage for a specific period, typically ranging from 10 to 30 years. It’s a cost-effective option if you need coverage for a limited time, such as while you have young children or a mortgage. Term life insurance policies are generally cheaper than permanent life insurance policies because they only provide coverage for a specific period of time.

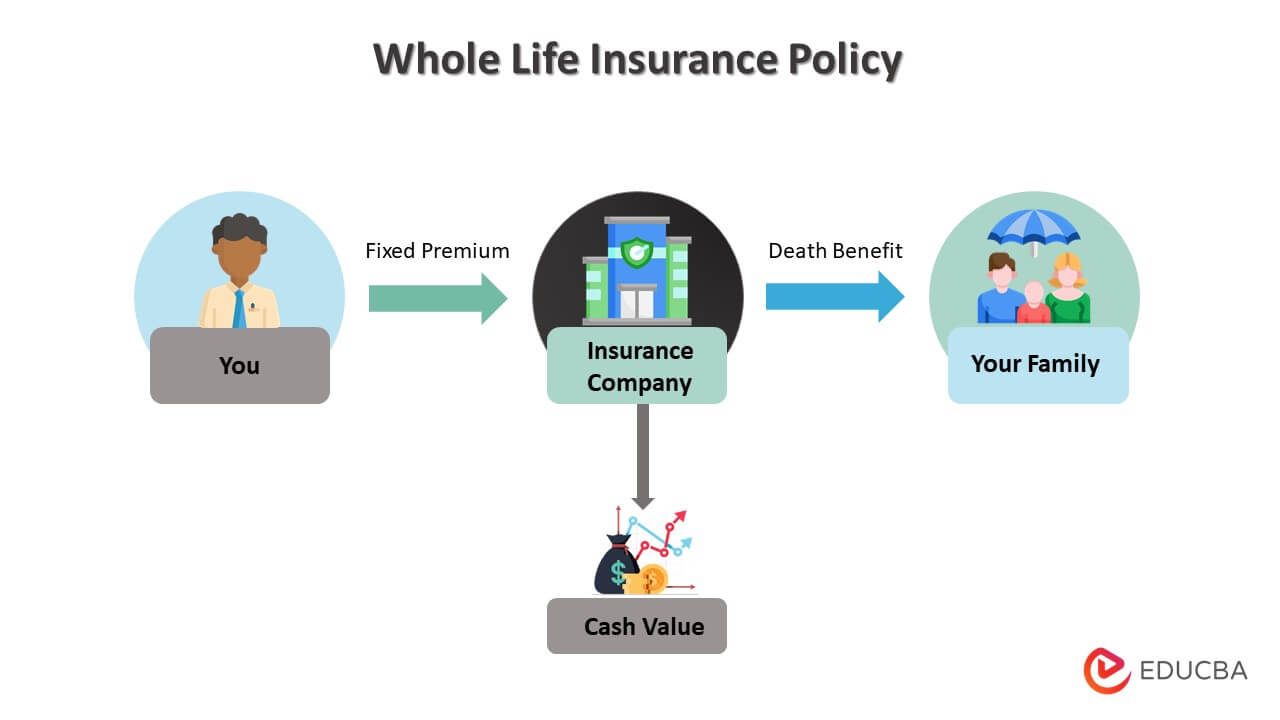

- Whole Life Insurance: Whole life insurance policies provide coverage for your entire life, offering a guaranteed death benefit. These policies are typically more expensive than term life insurance, but they also build cash value over time, which can be borrowed against or withdrawn. Whole life insurance policies are often used as a way to save for retirement or to cover estate taxes.

- Endowment Policies: These policies combine life insurance coverage with savings elements. They offer a death benefit upon your passing and a lump sum payment at the end of a specified term, provided you survive until then. Endowment policies are typically more expensive than term life insurance policies but offer a potential return on investment.

Key Features and Benefits of Life Insurance

Life insurance offers several key features and benefits that make it a valuable financial tool for Australians:

- Financial Security for Loved Ones: Life insurance provides a financial safety net for your family in the event of your death, ensuring they can maintain their lifestyle and meet their financial obligations.

- Debt Coverage: Life insurance can help pay off outstanding debts, such as mortgages, loans, or credit card balances, preventing financial hardship for your family.

- Income Replacement: Life insurance can help replace lost income for your family, ensuring they can continue to meet their living expenses.

- Funeral Expenses: Life insurance can cover funeral costs, relieving your family of this financial burden during a difficult time.

- Peace of Mind: Life insurance provides peace of mind knowing that your family is financially protected in the event of your passing. This can help reduce stress and anxiety for both you and your loved ones.

How Life Insurance Policies Work in Australia

Life insurance policies in Australia offer financial protection to your loved ones in case of your unexpected death. Understanding how these policies work is crucial for making informed decisions about your coverage.

Applying for a Life Insurance Policy, How life insurance works in australia

Applying for life insurance involves a straightforward process. You’ll need to provide personal details and information about your health, lifestyle, and desired coverage.

- Personal Information: Your name, address, date of birth, and contact details are essential.

- Health Information: You’ll need to disclose your medical history, including any pre-existing conditions or medications you’re taking. This helps the insurer assess your risk profile.

- Lifestyle Information: You’ll be asked about your hobbies, habits, and occupation. This helps the insurer understand your risk of premature death.

- Coverage Amount: You’ll need to decide on the amount of coverage you need, which should be sufficient to meet your family’s financial needs in your absence.

- Documentation: You might need to provide supporting documents, such as your driver’s license, passport, or medical records.

Factors Influencing Premium Calculations

Life insurance premiums are calculated based on several factors, including your age, health, lifestyle, and the coverage amount.

- Age: Younger individuals typically pay lower premiums than older individuals, as they have a lower risk of premature death.

- Health: People with pre-existing conditions or poor health generally pay higher premiums, as they pose a higher risk to the insurer.

- Lifestyle: Engaging in risky activities like smoking, excessive drinking, or dangerous hobbies can lead to higher premiums.

- Coverage Amount: The higher the coverage amount you choose, the higher your premium will be.

Payment Options

Life insurance premiums can be paid in various ways, offering flexibility to suit your financial situation.

- Monthly Premiums: The most common payment option, allowing for smaller, regular payments.

- Quarterly Premiums: Payments made every three months, offering a slightly lower premium than monthly payments.

- Annual Premiums: Paying your premium once a year, which can result in a significant discount.

Key Considerations for Choosing Life Insurance in Australia: How Life Insurance Works In Australia

Choosing the right life insurance policy is a significant decision that requires careful consideration. It’s not just about getting the cheapest policy, but about finding one that meets your individual needs and circumstances.

Coverage Amount

The coverage amount, also known as the sum assured, is the amount your beneficiaries will receive if you pass away. It’s crucial to determine the appropriate coverage amount to protect your loved ones financially. This will depend on your financial obligations, such as your mortgage, outstanding debts, and dependents’ living expenses.

- Consider your dependents’ living expenses, including rent or mortgage payments, utilities, groceries, and education costs.

- Factor in any outstanding debts, such as credit card balances, personal loans, and mortgages.

- Estimate the cost of funeral expenses and other final expenses.

Premium Affordability

The premium is the monthly payment you make for your life insurance policy. It’s essential to choose a policy with a premium you can comfortably afford. You can use online calculators or contact insurance providers to get quotes and compare premiums.

- Consider your current income and expenses to determine how much you can afford to pay each month.

- Explore different policy types and coverage levels to find a balance between affordability and adequate coverage.

- Consider options like increasing your premium as your income grows, or choosing a policy with a shorter term.

Policy Features

Life insurance policies come with various features that can impact your coverage and premiums. Understanding these features will help you make an informed decision.

- Waiting periods: Some policies have a waiting period before you are covered for certain conditions. This can range from a few weeks to a few months.

- Exclusions: Certain conditions or activities may not be covered by your policy. For example, some policies may exclude coverage for pre-existing conditions or risky hobbies.

- Guaranteed insurability: This option allows you to increase your coverage amount at certain intervals without having to undergo further medical assessments.

- Accidental death benefit: This provides an additional payout if your death is caused by an accident.

- Terminal illness benefit: This provides a lump sum payment if you are diagnosed with a terminal illness.

Policy Types

There are several types of life insurance policies available in Australia, each with its own benefits and drawbacks.

- Term life insurance: This provides coverage for a specific period, such as 10, 20, or 30 years. It is generally more affordable than permanent life insurance but does not offer any cash value component. It is suitable for those who need temporary coverage, such as during a mortgage term or while raising young children.

- Permanent life insurance: This provides lifelong coverage and includes a cash value component that grows over time. It is typically more expensive than term life insurance but offers flexibility and investment potential. This is suitable for those who need long-term coverage, such as protecting their estate or providing financial security for their family over a lifetime.

- Whole life insurance: This is a type of permanent life insurance with a fixed premium and a guaranteed death benefit. It is a more traditional option and offers stability and predictability. This is suitable for those who want a long-term policy with guaranteed premiums and a fixed death benefit.

- Universal life insurance: This is a type of permanent life insurance with flexible premiums and a death benefit that can be adjusted. It offers more flexibility and control over your policy but can be more complex to understand. This is suitable for those who want more control over their policy and may have changing financial needs.

Seeking Professional Advice

When choosing life insurance, it’s highly recommended to seek professional advice from a financial advisor or insurance broker. They can help you understand your options, compare policies, and make an informed decision that aligns with your specific needs and financial goals.

- They can assess your individual circumstances, such as your income, expenses, dependents, and financial goals.

- They can explain the different types of policies and features available and help you choose the right one.

- They can negotiate with insurance providers on your behalf to secure the best possible terms and premiums.

Understanding Life Insurance Claims in Australia

Making a life insurance claim in Australia can be a complex process, especially during a difficult time. Understanding the process, the different types of claims, and the potential challenges can help you navigate this effectively.

The Life Insurance Claim Process

Filing a life insurance claim involves providing the insurer with all necessary documentation to support your request. This includes the policy documents, death certificate, and other relevant documents. The process generally involves the following steps:

- Contact the insurer: The first step is to contact your insurer as soon as possible after the insured event occurs. You can usually do this by phone, email, or through their online portal.

- Provide required documentation: The insurer will provide you with a claim form and a list of required documents. These may include the policy documents, the death certificate, medical records, and other relevant documents.

- Claim assessment: The insurer will review your claim and the supporting documentation to verify the validity of the claim.

- Claim approval or rejection: The insurer will inform you of their decision regarding your claim. If approved, the insurer will process the payment according to the terms of your policy. If rejected, they will provide you with reasons for the rejection.

Types of Life Insurance Claims

There are different types of life insurance claims, depending on the event that triggered the claim. The most common types are:

- Death benefit claims: These claims are made when the insured person passes away. The insurer will pay the death benefit to the designated beneficiary.

- Terminal illness claims: These claims are made when the insured person is diagnosed with a terminal illness. The insurer may pay a lump sum benefit or a regular income stream to the insured person.

- Total and permanent disability claims: These claims are made when the insured person is unable to work due to a disability. The insurer may pay a lump sum benefit or a regular income stream to the insured person.

Claim Timeframes and Potential Challenges

The timeframe for processing a life insurance claim can vary depending on the insurer and the complexity of the claim. It can take several weeks or even months to process a claim. Potential challenges that may arise during the claim process include:

- Incomplete or missing documentation: If you fail to provide all required documents, the insurer may delay or reject your claim.

- Disputed claims: The insurer may dispute your claim if they believe that the insured event does not meet the terms of the policy.

- Fraudulent claims: If the insurer suspects that your claim is fraudulent, they may investigate the claim and potentially reject it.

Regulation and Oversight of Life Insurance in Australia

The Australian life insurance industry operates within a robust regulatory framework designed to ensure financial stability, consumer protection, and fair market practices. This framework involves a combination of legislation, oversight bodies, and industry codes of conduct.

The Regulatory Framework

The life insurance industry in Australia is primarily governed by the following legislation:

- The Corporations Act 2001: This act establishes the Australian Securities and Investments Commission (ASIC) as the primary regulator for financial markets, including life insurance companies.

- The Life Insurance Act 1995: This act specifically addresses the regulation of life insurance products and the conduct of life insurance companies.

- The Insurance Contracts Act 1984: This act sets out the legal framework for insurance contracts and consumer rights.

The Role of APRA

The Australian Prudential Regulation Authority (APRA) plays a crucial role in overseeing the financial stability and consumer protection of life insurance companies.

- Financial Stability: APRA sets prudential standards for life insurers, including capital adequacy requirements, to ensure they can meet their financial obligations to policyholders.

- Consumer Protection: APRA monitors life insurers’ compliance with consumer protection laws and industry codes of conduct, ensuring fair and ethical treatment of policyholders.

- Market Conduct: APRA conducts regular reviews of the life insurance market to identify and address potential risks to consumers and the financial system.

Consumer Rights and Protections

Australian consumers have a range of rights and protections when it comes to life insurance.

- Right to Information: Consumers have the right to clear and concise information about life insurance products, including their features, benefits, and exclusions.

- Right to Fair Treatment: Life insurers are required to treat consumers fairly and ethically, including providing reasonable assistance with claims and addressing complaints promptly.

- Right to Dispute Resolution: Consumers have access to external dispute resolution schemes if they are unable to resolve a complaint with their insurer directly.

Ending Remarks

Navigating the world of life insurance in Australia can seem daunting, but with careful planning and the right information, you can secure a valuable financial safety net for your family. By understanding the different policy types, key considerations, and the claims process, you can make informed decisions that provide peace of mind and protect your loved ones from financial hardship.

FAQ Resource

What is the difference between term life and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is generally more affordable. Whole life insurance provides lifelong coverage and includes a savings component, making it more expensive.

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your dependents, outstanding debts, and desired lifestyle for your family after your passing. It’s recommended to consult with a financial advisor to determine the appropriate coverage amount.

Can I cancel my life insurance policy?

Yes, you can usually cancel your life insurance policy, but there may be cancellation fees or surrender charges depending on the policy type and your policy’s duration.

What happens if I miss a premium payment?

If you miss a premium payment, your policy may lapse, meaning your coverage will be suspended. You may be able to reinstate your policy by paying the missed premiums plus any applicable penalties. However, if you don’t reinstate your policy, your coverage will be terminated.