- Understanding Employer-Sponsored Health Insurance

- Factors Influencing Employee Costs

- Employee Cost Sharing Models

- Trends in Employee Health Insurance Costs

- Employee Perspectives on Health Insurance Costs

- Resources for Employees

- Epilogue: How Much Do Employees Pay For Health Insurance

- Question & Answer Hub

How much do employees pay for health insurance – Navigating the world of employer-sponsored health insurance can feel like a labyrinth, especially when it comes to understanding how much employees contribute to their coverage. From deductibles and copayments to premiums and cost-sharing models, the financial landscape can be overwhelming. This article delves into the intricacies of employee health insurance costs, exploring the factors that influence them and providing insights into the challenges and opportunities associated with this essential benefit.

Understanding the intricacies of employee contributions to health insurance is crucial for both employees and employers. Employees need to know how much they can expect to pay out of pocket for their health care, while employers need to understand the financial implications of providing health insurance benefits. This article provides a comprehensive overview of this complex topic, covering everything from the different types of health insurance plans to the trends shaping the future of employee health insurance costs.

Understanding Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a common benefit offered by many companies to their employees. It provides employees with access to affordable health coverage, helping them manage healthcare costs and protect themselves financially in case of unexpected medical expenses. This type of insurance is a valuable benefit for employees and their families, offering a wide range of coverage options and financial support.

Types of Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans come in different types, each with its own unique features and benefits. Understanding the different types of plans available can help employees choose the option that best suits their needs and budget.

- Health Maintenance Organization (HMO): HMO plans typically have a lower monthly premium compared to other plans. They require you to choose a primary care physician (PCP) within the network. You must get a referral from your PCP to see specialists or receive certain medical services. HMO plans often have lower out-of-pocket costs, but you have limited choices for providers and may need to pay more if you go outside the network.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility than HMOs, allowing you to choose any doctor or hospital within or outside the network. However, you’ll typically pay a higher premium for this flexibility. You’ll also pay a higher copayment or coinsurance for out-of-network care.

- Health Savings Account (HSA): HSAs are available with high-deductible health plans (HDHPs). They allow you to set aside pre-tax money to pay for medical expenses. The funds in your HSA can roll over from year to year and are not subject to taxes when used for qualified medical expenses.

Common Features of Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans typically share common features, such as coverage, deductibles, and copayments. Understanding these features can help you compare different plans and choose the one that best aligns with your healthcare needs and budget.

- Coverage: Employer-sponsored health insurance plans cover a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care. However, the specific coverage may vary depending on the plan and the insurer.

- Deductible: The deductible is the amount you must pay out-of-pocket before your insurance plan starts covering medical expenses. Deductibles can vary significantly between plans.

- Copayment: A copayment is a fixed amount you pay for each medical service, such as a doctor’s visit or a prescription.

- Coinsurance: Coinsurance is a percentage of the cost of medical services that you are responsible for paying after you’ve met your deductible.

Employee Contributions to Health Insurance Premiums

Employees typically contribute a portion of their monthly health insurance premiums. The amount they contribute can vary depending on the plan, the employee’s salary, and the company’s contribution policy.

For example, an employee may contribute $100 per month towards their health insurance premium, while their employer contributes the remaining amount.

Factors Influencing Employee Costs

The amount employees pay for health insurance is influenced by various factors. Understanding these factors can help employees make informed decisions about their health insurance coverage and employers understand the complexities involved in offering competitive benefits packages.

Company Size, Industry, and Location

Company size, industry, and location play a significant role in determining employee contributions to health insurance.

- Company Size: Larger companies often have more bargaining power with insurance providers, resulting in lower premiums for their employees. Smaller companies may face higher premiums due to limited negotiating leverage.

- Industry: Some industries, such as healthcare or manufacturing, have higher healthcare costs than others, leading to higher employee contributions. For example, healthcare workers may have higher premiums due to potential exposure to infectious diseases.

- Location: Geographic location can impact health insurance costs due to variations in the cost of living, healthcare provider availability, and state regulations. For instance, urban areas may have higher premiums than rural areas.

Employee Demographics

Employee demographics, including age, family size, and health status, can also influence health insurance costs.

- Age: Older employees generally have higher healthcare costs due to increased likelihood of chronic conditions. Insurance premiums often reflect this higher risk.

- Family Size: Employees with families typically pay higher premiums than those with individual coverage. The cost of covering dependents increases the overall premium.

- Health Status: Employees with pre-existing conditions may face higher premiums due to the potential for higher healthcare utilization. However, the Affordable Care Act (ACA) prohibits insurers from denying coverage or charging higher premiums based solely on pre-existing conditions.

Individual vs. Family Coverage

The cost difference between individual and family coverage is significant. Family coverage typically costs more than individual coverage due to the inclusion of dependents.

- Individual Coverage: This covers only the employee and is generally the most affordable option. It may be suitable for single employees or those without dependents.

- Family Coverage: This covers the employee and their dependents, such as spouse and children. The cost of family coverage increases with the number of dependents and their ages.

Employee Cost Sharing Models

Employee cost-sharing models represent the financial responsibility employees assume for their health insurance coverage. These models determine how much employees contribute towards their healthcare costs, directly impacting their out-of-pocket expenses. Understanding these models is crucial for employees to make informed decisions about their health insurance plans and manage their healthcare budget effectively.

Types of Employee Cost Sharing Models

There are several common employee cost-sharing models used by employers to distribute healthcare costs. Each model has its own advantages and disadvantages, influencing employee out-of-pocket expenses and healthcare utilization patterns.

- Flat Monthly Premiums

- Percentage-Based Contributions

- Tiered Contribution Systems

Flat Monthly Premiums

In this model, employees pay a fixed monthly amount regardless of their salary or family size. This model offers predictability and simplicity for employees, as their monthly contribution remains constant.

- Advantages:

- Predictable monthly costs.

- Easy to budget for.

- Simple administration for employers.

- Disadvantages:

- May not be equitable for employees with different incomes or family sizes.

- Can be expensive for employees with lower incomes.

- May not incentivize employees to choose lower-cost plans.

Percentage-Based Contributions

Under this model, employees contribute a percentage of their salary towards their health insurance premiums. This model can be more equitable than flat monthly premiums, as employees with higher salaries contribute proportionally more.

- Advantages:

- More equitable than flat monthly premiums.

- Can encourage employees to choose lower-cost plans.

- May incentivize employees to increase their income to reduce their relative contribution.

- Disadvantages:

- Can be difficult to budget for, as contributions fluctuate with salary changes.

- May not be fair to employees with lower incomes.

- Can lead to higher costs for employees with higher salaries.

Tiered Contribution Systems

This model combines elements of flat monthly premiums and percentage-based contributions. Employees are categorized into tiers based on factors such as income, family size, or plan choice. Each tier has a different monthly premium, which can be a flat amount or a percentage of salary.

- Advantages:

- Can be more equitable than flat monthly premiums or percentage-based contributions.

- Can incentivize employees to choose lower-cost plans.

- Can offer more flexibility in designing the cost-sharing structure.

- Disadvantages:

- Can be complex to administer.

- May not be transparent to employees.

- Can lead to confusion and frustration for employees.

Examples of Cost-Sharing Models and Out-of-Pocket Expenses

- Flat Monthly Premium: An employee pays $100 per month for their health insurance, regardless of their salary or family size.

- Percentage-Based Contribution: An employee earning $50,000 per year contributes 5% of their salary, or $2,500 annually, towards their health insurance premiums.

- Tiered Contribution System: An employee in the “low-income” tier pays a flat monthly premium of $50, while an employee in the “high-income” tier pays 10% of their salary towards their health insurance premiums.

Trends in Employee Health Insurance Costs

Employee contributions to health insurance premiums have been steadily increasing over the past several decades. This trend is driven by a complex interplay of factors, including rising healthcare costs, changes in insurance market dynamics, and evolving employer strategies.

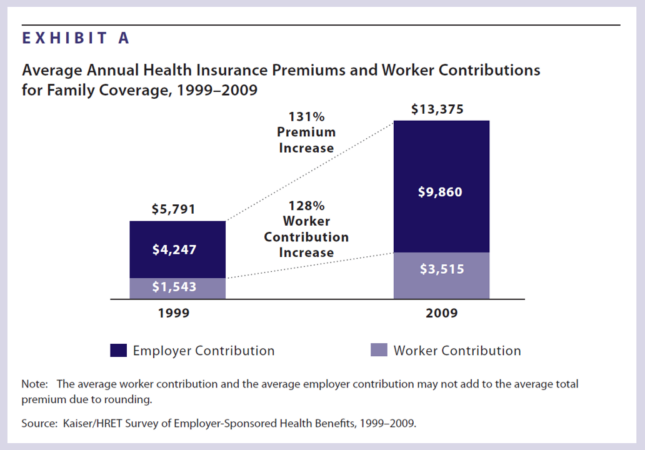

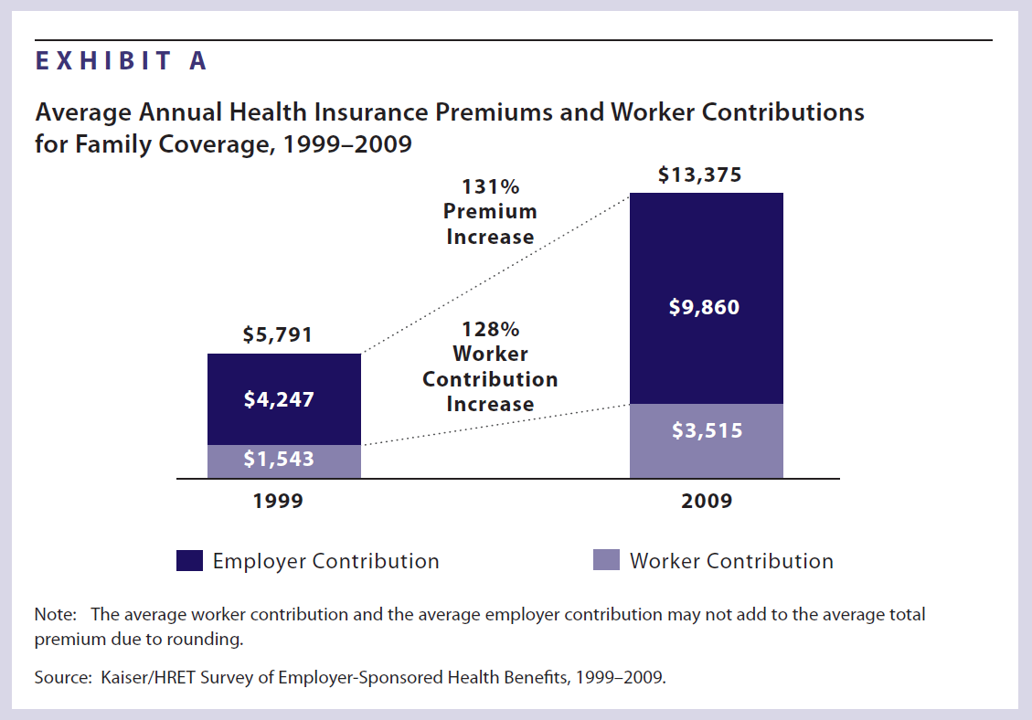

Historical Trends in Employee Contributions

The historical trends in employee contributions to health insurance premiums reveal a consistent upward trajectory. According to the Kaiser Family Foundation, the average annual premium for employer-sponsored health insurance has increased significantly since the 1980s.

- In 1988, the average annual premium for family coverage was $2,174. By 2022, this figure had risen to $22,221.

- The average employee contribution towards family coverage also increased from $518 in 1988 to $6,017 in 2022.

This increase in employee contributions reflects the rising cost of healthcare and the changing dynamics of the insurance market.

Factors Driving Rising Health Insurance Costs

Several factors contribute to the escalating cost of health insurance, leading to higher employee contributions.

- Inflation: The general rise in prices, including healthcare services, contributes to higher insurance premiums. As healthcare costs inflate, insurance companies need to charge higher premiums to cover their expenses.

- Technological Advancements: While technological advancements in medicine have led to improved treatments and diagnostic tools, they also come with a higher price tag. The cost of developing and implementing new technologies is often passed on to consumers through higher insurance premiums.

- Increased Healthcare Utilization: As the population ages and faces more chronic health conditions, healthcare utilization increases. This higher demand for services puts upward pressure on healthcare costs, ultimately impacting insurance premiums.

- Administrative Costs: The complex administrative processes involved in managing health insurance plans contribute to rising costs. Insurance companies, healthcare providers, and employers all incur administrative expenses, which are often passed on to consumers.

- Drug Costs: The cost of prescription drugs has been a significant driver of healthcare inflation. The development and marketing of new drugs, along with the growing use of expensive specialty drugs, contribute to rising insurance premiums.

Strategies for Employers to Mitigate Rising Health Insurance Costs

Employers are actively seeking strategies to mitigate the impact of rising health insurance costs on their employees and their own budgets.

- Wellness Programs: Encouraging healthy lifestyles through wellness programs can help reduce healthcare utilization and lower insurance costs. These programs may include health screenings, fitness initiatives, and smoking cessation programs.

- High-Deductible Health Plans (HDHPs): Offering HDHPs with Health Savings Accounts (HSAs) can incentivize employees to be more cost-conscious in their healthcare spending. These plans typically have lower premiums but require employees to pay a higher deductible before insurance coverage kicks in.

- Tiered Networks: By partnering with specific healthcare providers in tiered networks, employers can negotiate lower rates for services. Employees may have access to a wider network of providers, but they may face higher copayments or deductibles for providers outside the preferred network.

- Telemedicine and Virtual Care: Utilizing telemedicine and virtual care options can help reduce the need for expensive in-person visits. These technologies allow patients to consult with healthcare providers remotely, potentially lowering costs and improving access to care.

- Prescription Drug Management: Implementing strategies to manage prescription drug costs, such as using generic medications when available and negotiating discounts with pharmaceutical companies, can help control rising insurance premiums.

- Employee Education and Engagement: Educating employees about their health insurance options, benefits, and cost-saving strategies can empower them to make informed decisions and reduce unnecessary healthcare spending.

Employee Perspectives on Health Insurance Costs

Employees are increasingly concerned about the rising cost of health insurance, which can significantly impact their financial well-being and overall satisfaction with their jobs. Understanding employee perspectives on health insurance costs is crucial for employers to effectively manage their benefits programs and maintain a positive work environment.

Employee Satisfaction and Affordability

Employee surveys consistently reveal a strong correlation between health insurance affordability and employee satisfaction. Employees who perceive their health insurance as affordable are more likely to be satisfied with their benefits package and feel valued by their employer. Conversely, high health insurance costs can lead to dissatisfaction and even contribute to employee turnover.

- A 2023 survey by the Kaiser Family Foundation found that 61% of employees are satisfied with their health insurance, but this satisfaction level is significantly lower among those who pay a higher share of their premiums.

- Employees with high deductibles or copayments often find themselves hesitant to seek necessary medical care due to financial concerns, which can negatively impact their health and well-being.

Impact on Employee Morale and Productivity

High health insurance costs can significantly impact employee morale and productivity. Employees who are struggling to afford their health insurance may experience increased stress, anxiety, and reduced job satisfaction. This can lead to decreased productivity, absenteeism, and even presenteeism, where employees come to work but are not fully engaged due to financial worries.

- A study by the American Psychological Association found that financial stress is a major contributor to workplace stress, which can negatively impact employee well-being and performance.

- Employers who fail to address employee concerns regarding health insurance affordability may experience higher turnover rates, increased healthcare costs due to delayed or avoided care, and a less productive workforce.

Addressing Employee Concerns

Employers can take several steps to address employee concerns regarding health insurance affordability. These solutions include:

- Offering a wider range of plan options: Employers can provide employees with a variety of health insurance plans, including high-deductible health plans (HDHPs) with health savings accounts (HSAs), which can help employees save money on premiums and healthcare expenses.

- Negotiating lower premiums with insurers: Employers can leverage their bargaining power to negotiate lower premiums with insurance providers, which can benefit both the employer and employees.

- Implementing wellness programs: By encouraging healthy lifestyle choices through wellness programs, employers can reduce healthcare costs and improve employee health. These programs can include health screenings, fitness classes, and smoking cessation support.

- Providing financial assistance: Some employers offer financial assistance to help employees pay for their health insurance premiums or out-of-pocket expenses. This can be particularly beneficial for employees with lower incomes or those who have experienced unexpected medical expenses.

Resources for Employees

Navigating the complexities of employer-sponsored health insurance can be daunting. Luckily, employees have access to various resources that can help them understand their coverage, make informed decisions, and find answers to their questions. These resources provide valuable information, support, and guidance throughout the entire health insurance journey.

Key Resources for Employees, How much do employees pay for health insurance

Employees can access a range of resources to understand their health insurance plans and costs. These resources include government websites, insurance company portals, and consumer advocacy groups.

| Resource | Description | Link |

|---|---|---|

| Healthcare.gov | The official website for the Affordable Care Act (ACA), offering information on health insurance plans, subsidies, and enrollment processes. | https://www.healthcare.gov/ |

| Centers for Medicare & Medicaid Services (CMS) | The federal agency responsible for administering Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). CMS provides resources on health insurance options, regulations, and consumer rights. | https://www.cms.gov/ |

| Your Insurance Company’s Website | Most insurance companies offer online portals where employees can access their plan details, benefits, claims history, and contact information. | [Your Insurance Company’s Website] |

| Employee Benefits Security Administration (EBSA) | The EBSA enforces laws protecting employee benefits, including health insurance plans. The agency provides resources for employees regarding their rights and responsibilities. | https://www.dol.gov/agencies/ebsa |

| Consumer Reports | A non-profit organization that provides independent reviews and ratings of consumer products and services, including health insurance plans. | https://www.consumerreports.org/ |

| National Committee for Quality Assurance (NCQA) | An independent, non-profit organization that accredits and certifies health plans based on quality and performance standards. NCQA’s website offers information on health plan quality and consumer resources. | https://www.ncqa.org/ |

Tips for Navigating the Health Insurance System

- Read your plan documents carefully. Understanding your plan’s coverage, deductibles, copayments, and out-of-pocket maximums is crucial for making informed decisions about healthcare.

- Ask questions. Don’t hesitate to contact your employer’s human resources department, your insurance company, or a consumer advocacy group if you have any questions about your health insurance plan.

- Shop around for the best value. If you have multiple health insurance options, compare the benefits, costs, and provider networks to find the plan that best suits your needs and budget.

- Take advantage of available resources. Many resources, including online tools, calculators, and articles, can help you understand your health insurance options and make informed decisions.

- Stay informed. Keep up-to-date on changes to your health insurance plan, including any changes in coverage, costs, or provider networks.

Epilogue: How Much Do Employees Pay For Health Insurance

Ultimately, the cost of employee health insurance is a complex issue with no easy answers. However, by understanding the factors that influence these costs and the various strategies available to both employees and employers, we can work towards a more affordable and accessible healthcare system. From exploring cost-sharing models and negotiating with insurance providers to advocating for policy changes, there are numerous ways to address the challenges of rising healthcare costs. As we continue to navigate the evolving landscape of health insurance, knowledge and collaboration are essential for ensuring that all individuals have access to quality, affordable healthcare.

Question & Answer Hub

What are some common types of employer-sponsored health insurance plans?

Common types include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and HSAs (Health Savings Accounts). Each plan offers different levels of coverage, networks, and cost-sharing arrangements.

How can I find information about my employer’s health insurance plan?

Your employer’s human resources department can provide you with detailed information about your plan, including coverage details, costs, and enrollment procedures.

What are some strategies for saving money on health insurance?

Strategies include choosing a plan with a higher deductible, participating in wellness programs, and taking advantage of preventive care services.

What are some resources available to help me understand my health insurance options?

Government websites like Healthcare.gov and the Centers for Medicare & Medicaid Services (CMS) offer valuable information about health insurance plans and costs.