How much does COBRA health insurance cost? It’s a question many people ask when they lose their job or experience a change in their employment status. COBRA, or the Consolidated Omnibus Budget Reconciliation Act, provides a temporary extension of health insurance coverage to individuals who have lost their employer-sponsored plan. While this can be a lifeline during a transition, it’s important to understand the financial implications of this coverage. COBRA premiums are often significantly higher than those offered by employer-sponsored plans, and there are several factors that contribute to the cost.

This guide will delve into the intricacies of COBRA health insurance costs, exploring the factors that influence premiums, providing tips for estimating potential expenses, and outlining alternative health insurance options that might be more cost-effective. By understanding the complexities of COBRA, individuals can make informed decisions about their health insurance coverage during a time of change.

Understanding COBRA Health Insurance: How Much Does Cobra Health Insurance Cost

COBRA, or the Consolidated Omnibus Budget Reconciliation Act of 1985, is a federal law that allows certain individuals to continue their health insurance coverage after they lose their job or experience a change in their employment status. It provides a temporary continuation of group health insurance coverage under certain circumstances.

COBRA’s Purpose and How It Works

COBRA’s primary purpose is to ensure that individuals and their families do not lose their health insurance coverage during periods of transition, such as job loss or a change in employment status. It gives individuals the right to continue their employer-sponsored health insurance coverage for a limited time, even if they are no longer employed by the company.

Definition of COBRA Health Insurance

COBRA health insurance refers to the continuation of group health insurance coverage offered by an employer, under the terms of the COBRA law, to individuals who have lost their coverage due to specific events, such as job loss, reduction in work hours, or a change in employment status.

Eligibility Requirements for COBRA Coverage

To be eligible for COBRA coverage, an individual must meet certain criteria:

- The individual must have lost their group health insurance coverage due to a qualifying event, such as job loss, reduction in work hours, or a change in employment status.

- The individual must have been covered under the employer’s group health insurance plan immediately before the qualifying event.

- The employer must have at least 20 employees on the day before the qualifying event.

- The employer must be subject to COBRA regulations.

Situations Where COBRA Might Be Applicable

COBRA coverage can be applied in various situations, including:

- Job Loss: An employee who loses their job due to termination, layoff, or resignation is eligible for COBRA coverage.

- Reduction in Work Hours: If an employee’s work hours are reduced to a level that disqualifies them from group health insurance coverage, they may be eligible for COBRA.

- Change in Employment Status: A change in employment status, such as a transition from full-time to part-time employment or a change in employers, can trigger COBRA eligibility.

- Death of an Employee: In the event of an employee’s death, their surviving spouse and dependents may be eligible for COBRA coverage.

- Divorce or Legal Separation: A spouse who is covered under an employee’s group health insurance plan may be eligible for COBRA coverage after a divorce or legal separation.

Factors Influencing COBRA Costs

COBRA premiums are influenced by several factors, including the former employer’s health plan, the individual’s coverage options, and the current market conditions. Understanding these factors is crucial for individuals considering COBRA coverage as they can significantly impact the overall cost.

The Role of the Former Employer’s Health Plan

The former employer’s health plan plays a significant role in determining COBRA premiums. The plan’s design, including its coverage levels and benefits, directly affects the cost of coverage. Here are some key factors:

- Plan Type: Different health plan types, such as HMOs, PPOs, and HDHPs, have varying costs. HMOs typically have lower premiums but restrict provider choices. PPOs offer more flexibility but often have higher premiums. HDHPs have lower premiums but require higher deductibles and out-of-pocket expenses.

- Coverage Levels: The level of coverage provided by the plan, such as the deductible, copayments, and coinsurance, directly impacts premiums. Plans with lower deductibles and copayments generally have higher premiums.

- Benefits: The specific benefits offered by the plan, such as prescription drug coverage, dental, and vision, also contribute to the cost of coverage. Plans with more comprehensive benefits tend to have higher premiums.

Individual Coverage Options

Individual coverage options, such as family coverage or individual coverage, also affect COBRA premiums.

- Family Coverage: Premiums for family coverage are typically higher than premiums for individual coverage, as they cover multiple individuals.

- Individual Coverage: Premiums for individual coverage are generally lower than family coverage, as they cover only one person.

Comparison with Other Health Insurance Options

COBRA premiums are often significantly higher than other health insurance options, such as individual health insurance plans purchased through the Health Insurance Marketplace or employer-sponsored plans. This is because COBRA premiums are based on the full cost of the former employer’s plan, without any employer contributions.

- Individual Health Insurance Plans: Individual health insurance plans purchased through the Health Insurance Marketplace can offer more affordable options than COBRA, especially for individuals who qualify for subsidies or tax credits.

- Employer-Sponsored Plans: If you have access to an employer-sponsored plan through a new job, the premiums may be significantly lower than COBRA premiums, as the employer typically contributes a portion of the cost.

Estimating COBRA Costs

Estimating the cost of COBRA health insurance can be complex, but understanding the factors involved and following a systematic approach can help you make informed decisions. By understanding the process, you can accurately estimate your potential COBRA premiums and compare them with other health insurance options.

Calculating COBRA Premiums, How much does cobra health insurance cost

To estimate your COBRA premiums, you need to understand the factors that contribute to the cost. These include:

- Your former employer’s health insurance plan. The type of plan you were enrolled in, including its coverage levels and benefits, will directly impact your COBRA premiums.

- The number of dependents covered under your plan. If you have a spouse or children covered under your COBRA plan, your premiums will be higher.

- Your former employer’s premium contribution. In some cases, your former employer may contribute a portion of your COBRA premiums. The amount of this contribution can vary depending on your employer’s policy.

- The duration of your COBRA coverage. The longer you choose to stay on COBRA, the more you will pay in premiums.

Resources for Estimating COBRA Costs

Several resources can help you estimate your COBRA costs.

- Your former employer’s human resources department. Your former employer is the best source of information about your COBRA premiums. They can provide you with an estimate of your monthly premiums and a detailed breakdown of the costs.

- The Department of Labor’s COBRA website. The Department of Labor provides comprehensive information about COBRA, including a detailed explanation of the law and its requirements.

- Online COBRA cost calculators. Several online calculators can help you estimate your COBRA costs. However, it is important to note that these calculators may not be completely accurate, as they may not take into account all of the factors that influence your premiums.

Comparing COBRA Costs with Other Health Insurance Options

Once you have estimated your COBRA costs, it is essential to compare them with other health insurance options. This includes:

- Individual health insurance plans. If you are eligible for individual health insurance plans through the Affordable Care Act (ACA) Marketplace, you may find more affordable options than COBRA.

- Spouse’s health insurance plan. If your spouse has health insurance through their employer, you may be eligible to enroll in their plan.

- Other employer-sponsored plans. If you are starting a new job, you may be eligible for health insurance through your new employer.

Financial Considerations

COBRA premiums can significantly impact your budget, so it’s essential to carefully consider the financial implications before enrolling in COBRA coverage. This section delves into strategies for managing COBRA costs, analyzes the pros and cons of enrolling, and compares the financial implications of different health insurance choices.

Managing COBRA Costs

Managing COBRA costs effectively requires a strategic approach. Here are some strategies:

- Explore alternative health insurance options: Before enrolling in COBRA, research other health insurance options, such as individual health insurance plans, state health insurance marketplaces, or employer-sponsored plans through a spouse’s employer. Comparing premiums and coverage can help you identify a more affordable alternative.

- Negotiate a payment plan: If you’re facing financial difficulties, consider negotiating a payment plan with your former employer or the COBRA administrator. They may be willing to work with you to make payments more manageable.

- Reduce your health care costs: Look for ways to reduce your healthcare costs, such as using generic medications, seeking preventive care, and utilizing telehealth services. These measures can help offset the high COBRA premiums.

- Consider a shorter COBRA coverage period: If you anticipate needing coverage for a limited time, you can choose a shorter COBRA coverage period, potentially reducing your overall costs. However, ensure you have a plan for health insurance once the COBRA period ends.

Pros and Cons of Enrolling in COBRA Coverage

Weighing the pros and cons of COBRA coverage is crucial before making a decision.

- Pros:

- Continuity of coverage: COBRA provides uninterrupted health insurance coverage, ensuring you don’t have a gap in coverage during a critical period.

- Same benefits and providers: You retain the same benefits and access to the same healthcare providers you had under your former employer’s plan.

- No pre-existing condition exclusions: COBRA coverage protects you from pre-existing condition exclusions, which can be a concern when switching to a new health insurance plan.

- Cons:

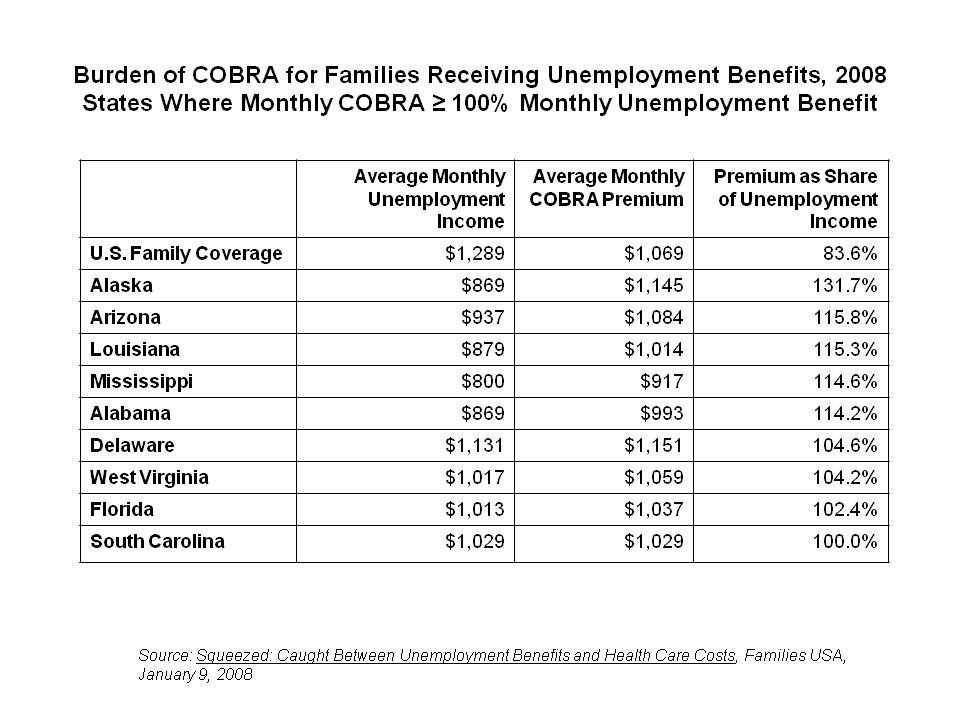

- High premiums: COBRA premiums are typically significantly higher than employer-sponsored plans, as you’re responsible for the full cost of coverage.

- Limited coverage period: COBRA coverage is generally limited to 18 months, with some exceptions extending to 29 months. After this period, you’ll need to find alternative health insurance coverage.

- Financial burden: The high cost of COBRA premiums can place a significant financial strain on individuals and families, especially if they’re already facing financial challenges.

Comparing Financial Implications of Different Health Insurance Choices

When comparing the financial implications of different health insurance choices, consider the following:

- Premium costs: Compare the monthly premiums of COBRA coverage with other health insurance options, such as individual plans, state marketplace plans, or employer-sponsored plans through a spouse’s employer.

- Deductibles and co-pays: Evaluate the deductibles, co-pays, and coinsurance rates of each plan to understand the out-of-pocket costs you’ll incur.

- Coverage limits: Compare the coverage limits and benefits of each plan to ensure it meets your healthcare needs. For example, consider the annual out-of-pocket maximum, which limits your total out-of-pocket expenses for the year.

- Network coverage: Ensure the plan’s network includes your preferred healthcare providers and hospitals. A limited network can lead to higher out-of-pocket costs if you’re forced to use out-of-network providers.

Alternative Health Insurance Options

COBRA is not the only health insurance option available after losing employer-sponsored coverage. Several other plans offer varying levels of coverage and cost, and exploring these alternatives can help you find the best fit for your needs and budget.

Comparing COBRA with Other Health Insurance Options

Here’s a table comparing COBRA with other popular health insurance options:

| Feature | COBRA | Individual Health Insurance Plans | Marketplace Plans (ACA) |

|---|---|---|---|

| Eligibility | Loss of employer-sponsored coverage due to specific qualifying events (e.g., job loss, reduction in hours, death of employee) | Available to anyone, regardless of employment status | Available to individuals and families meeting income and residency requirements |

| Coverage | Same as your previous employer-sponsored plan | Wide range of plans with varying coverage levels and benefits | Wide range of plans with varying coverage levels and benefits, including subsidies for eligible individuals |

| Cost | Usually 102% of the premium your employer paid, plus administrative fees | Premiums vary based on age, location, health status, and plan type | Premiums vary based on age, location, health status, and plan type; subsidies available based on income |

| Open Enrollment | Not applicable; continuation of existing coverage | Typically open enrollment periods throughout the year, but specific dates vary by state | Open enrollment period typically runs from November 1st to January 15th, with special enrollment periods for qualifying events |

| Pre-existing Conditions | Covered if you had them under your previous employer-sponsored plan | May be covered depending on the plan, but pre-existing conditions may affect premiums | Guaranteed coverage for pre-existing conditions, regardless of health status |

Advantages and Disadvantages of Alternative Health Insurance Options

Understanding the advantages and disadvantages of each alternative can help you make an informed decision:

Individual Health Insurance Plans

- Advantages:

- Flexibility in choosing plans based on your specific needs and budget.

- Potential for lower premiums compared to COBRA, depending on your health status and location.

- Disadvantages:

- Premiums can be higher than employer-sponsored plans, especially for individuals with pre-existing conditions.

- Limited network of providers compared to employer-sponsored plans.

- May have higher deductibles and co-pays.

Marketplace Plans (ACA)

- Advantages:

- Guaranteed coverage for pre-existing conditions.

- Potential for subsidies to lower premiums based on income.

- Wide range of plans with varying coverage levels and benefits.

- Disadvantages:

- May have higher deductibles and co-pays compared to employer-sponsored plans.

- Open enrollment periods are limited, with special enrollment periods for qualifying events.

- May be difficult to navigate the website and find the best plan.

Guidance on Selecting the Most Suitable Health Insurance Option

Consider these factors when choosing the best health insurance option for you:

- Your budget: Compare premiums, deductibles, co-pays, and out-of-pocket maximums for each option.

- Your health status: Consider pre-existing conditions and potential health needs.

- Your location: Different plans have varying coverage areas and provider networks.

- Your coverage needs: Choose a plan that meets your specific healthcare needs, such as prescription drug coverage, mental health services, or maternity care.

Conclusion

Navigating the world of health insurance can be challenging, especially when facing job loss or a change in employment. Understanding the costs and implications of COBRA coverage is essential for making informed decisions. By weighing the pros and cons of COBRA against alternative options, individuals can choose the health insurance plan that best fits their needs and financial situation. Whether you opt for COBRA or explore other avenues, remember that access to quality healthcare is crucial, and there are resources available to help you navigate this process.

Q&A

What is the maximum length of time I can have COBRA coverage?

The maximum length of COBRA coverage depends on the qualifying event. For example, if you lose your job, you can typically have coverage for up to 18 months. Other qualifying events, such as divorce or death of the primary covered employee, may have different timeframes.

Can I be denied COBRA coverage?

While you generally qualify for COBRA coverage if you meet the eligibility requirements, there are some exceptions. For example, you may be denied coverage if your employer’s plan is terminated or if you are fired for gross misconduct.

What happens if I don’t pay my COBRA premiums?

If you fail to pay your COBRA premiums on time, your coverage may be terminated. You may be able to reinstate coverage if you pay the past due premiums, but this is not always guaranteed.