- Understanding Income Protection Insurance in Australia

- Factors Influencing Income Protection Insurance Costs

- Estimating Income Protection Insurance Costs

- Considerations When Choosing Income Protection Insurance

- Resources for Further Information: How Much Does Income Protection Insurance Cost In Australia

- Final Review

- FAQ Compilation

How much does income protection insurance cost in Australia? It’s a question many Australians ask themselves, especially as they navigate the complexities of life and the potential risks associated with unexpected events. Income protection insurance acts as a safety net, providing financial security in the event of illness or injury that prevents you from working. This insurance policy aims to replace a portion of your lost income, helping you maintain your financial stability during challenging times.

Understanding the cost of income protection insurance is crucial, as it varies significantly depending on individual circumstances and policy details. Factors such as your age, occupation, health, and desired level of coverage all play a role in determining your premiums. By carefully considering these factors and comparing quotes from different providers, you can find an income protection policy that fits your budget and needs.

Understanding Income Protection Insurance in Australia

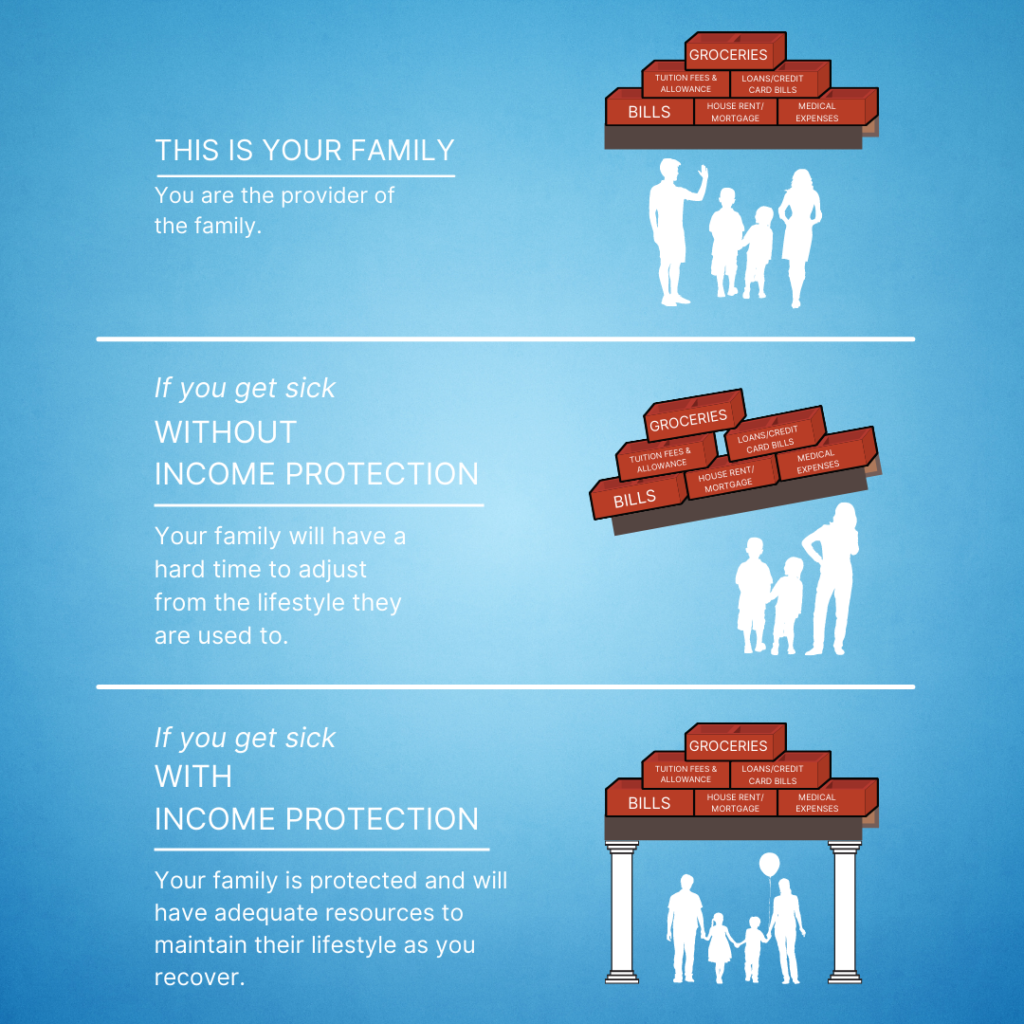

Income protection insurance, also known as salary continuance insurance, is a vital financial safety net designed to protect your income if you’re unable to work due to illness or injury. It provides a regular income stream during your recovery period, ensuring you can meet your financial obligations and maintain your lifestyle.

Benefits of Income Protection Insurance

Income protection insurance offers numerous benefits, providing peace of mind and financial security during challenging times.

- Financial Stability: It provides a regular income replacement, enabling you to pay your bills, mortgage, and other expenses without financial strain. This reduces stress and allows you to focus on your recovery.

- Lifestyle Protection: It helps maintain your current lifestyle, allowing you to continue enjoying the things that are important to you, even when you’re unable to work. This could include hobbies, travel, or simply providing for your family’s needs.

- Peace of Mind: Knowing you have income protection insurance in place provides peace of mind, knowing that you’re financially protected if something unexpected happens. This can be particularly important for those with dependents or significant financial commitments.

How Income Protection Insurance Works

Income protection insurance operates on a straightforward principle: you pay regular premiums to an insurance provider, and in return, they provide you with a monthly income payment if you’re unable to work due to illness or injury.

- Waiting Period: Most income protection policies have a waiting period, which is the period you need to be unable to work before payments begin. This waiting period can range from 2 weeks to 6 months, depending on the policy.

- Benefit Period: The benefit period is the maximum length of time you can receive income protection payments. This can range from 2 years to your retirement age, depending on the policy.

- Benefit Amount: The benefit amount is the monthly payment you receive while you’re unable to work. This is usually a percentage of your pre-disability income, typically between 50% and 75%.

Factors Influencing Income Protection Insurance Costs

The cost of income protection insurance in Australia is determined by a range of factors, which are carefully assessed by insurers to determine the level of risk they are taking on. These factors are used to calculate premiums, which are the monthly payments you make for your insurance coverage.

Types of Income Protection Policies, How much does income protection insurance cost in australia

Income protection policies in Australia can be broadly categorized into two main types:

- Own Occupation: This type of policy provides benefits if you are unable to perform the duties of your current occupation. It offers the highest level of protection, as it considers the specific requirements of your job.

- Any Occupation: This policy provides benefits if you are unable to perform any occupation for which you are reasonably suited, considering your education, skills, and experience. It is generally less expensive than an own occupation policy, but offers a lower level of protection.

Age

Your age is a significant factor in determining your premium. Generally, younger people are considered to be at a lower risk of becoming disabled, so they pay lower premiums. As you age, the risk of disability increases, leading to higher premiums.

Occupation

The type of work you do plays a major role in your premium. Some occupations are considered to be more hazardous than others, leading to higher premiums. For example, construction workers or miners may face higher premiums compared to office workers.

Health

Your health status is a crucial factor in assessing your risk. If you have pre-existing health conditions, you may be required to pay higher premiums or even be declined coverage. Insurers may ask for medical records or require you to undergo a medical assessment to determine your risk.

Income Level

Your income level is directly related to the amount of cover you need and the premium you pay. Higher earners typically need more cover and will pay higher premiums.

Estimating Income Protection Insurance Costs

The cost of income protection insurance in Australia varies depending on several factors, including your age, health, occupation, and the level of cover you choose. While it’s impossible to provide an exact cost without knowing your specific circumstances, it’s helpful to understand the general range of premiums and how they can vary.

Average Income Protection Insurance Premiums

The following table provides a general overview of average monthly and annual premiums for different income protection insurance policy types and coverage levels. Keep in mind that these are just estimates, and your actual premium may be higher or lower depending on your individual circumstances.

| Policy Type | Coverage Level | Average Monthly Premium | Average Annual Premium |

|---|---|---|---|

| Basic | 50% of income | $50 – $100 | $600 – $1,200 |

| Standard | 75% of income | $75 – $150 | $900 – $1,800 |

| Comprehensive | 100% of income | $100 – $200 | $1,200 – $2,400 |

Obtaining a Personalized Quote

To get a personalized quote for income protection insurance, you can contact an insurance broker or directly with an insurance provider. They will ask you about your individual circumstances, including your age, health, occupation, income, and desired level of cover. They will then use this information to calculate your premium.

Here are some tips for getting the best possible quote:

- Compare quotes from multiple providers: Don’t settle for the first quote you receive. Shop around and compare quotes from different insurers to find the best value for your needs.

- Consider your needs: Carefully consider your income, expenses, and the level of cover you need. Choose a policy that provides adequate protection without being too expensive.

- Ask about discounts: Many insurers offer discounts for things like healthy lifestyle choices, group discounts, or bundling multiple policies.

- Read the policy documents carefully: Before you sign up for a policy, make sure you understand the terms and conditions, including any exclusions or limitations.

Considerations When Choosing Income Protection Insurance

Choosing the right income protection insurance policy is crucial, as it can significantly impact your financial security during unexpected illness or injury. It’s important to carefully consider your individual needs and circumstances to ensure the policy you select provides adequate coverage and aligns with your financial goals.

Key Features to Consider

When comparing income protection insurance policies, several key features should be considered. These features can significantly impact the level of protection you receive and the overall cost of the policy.

- Waiting Periods: This refers to the period after you become ill or injured before your income protection insurance payments begin. Shorter waiting periods generally result in higher premiums, while longer waiting periods can lead to lower premiums. You should consider your financial situation and how long you could manage without income before choosing a waiting period.

- Benefit Periods: This refers to the maximum duration for which you can receive income protection insurance payments. It’s important to choose a benefit period that aligns with your anticipated recovery time or the duration you may need income support. Longer benefit periods typically result in higher premiums.

- Exclusions: Income protection insurance policies often have exclusions, which are conditions or situations that are not covered by the policy. These exclusions can vary significantly between insurers, so it’s essential to carefully review the policy documents to understand what is and isn’t covered. Common exclusions may include pre-existing conditions, self-inflicted injuries, or certain types of occupations.

Comparing Quotes from Different Insurance Providers

To find the most suitable income protection insurance policy, it’s essential to compare quotes from multiple insurance providers. This allows you to assess different coverage options, premiums, and features. Here are some tips for comparing quotes:

- Use a comparison website: Online comparison websites can help you quickly and easily compare quotes from multiple insurers. These websites typically allow you to enter your personal details and coverage requirements, and they then generate a list of relevant policies and their associated premiums.

- Consider the insurer’s financial stability: Before committing to a policy, it’s crucial to research the insurer’s financial stability. You can check the insurer’s credit rating and read reviews from other customers to gauge their reputation. This helps ensure that the insurer will be able to pay out your claims when you need them.

- Read the policy documents carefully: Don’t just focus on the premium; ensure you thoroughly read the policy documents before making a decision. Pay close attention to the exclusions, waiting periods, benefit periods, and other terms and conditions. If you have any questions, don’t hesitate to contact the insurer for clarification.

- Seek advice from a financial advisor: If you’re unsure about which income protection insurance policy is right for you, consider seeking advice from a qualified financial advisor. They can help you understand your individual needs and recommend policies that align with your financial goals.

Resources for Further Information: How Much Does Income Protection Insurance Cost In Australia

This section provides resources for further information on income protection insurance in Australia. This information can help you make informed decisions about your insurance needs.

Reputable Insurance Providers in Australia

Finding the right insurance provider is crucial for securing adequate income protection. There are many reputable insurance providers in Australia, offering a range of plans and features.

- AIA Australia: Known for its comprehensive range of insurance products, including income protection.

- AMP: A leading financial services provider offering various insurance products, including income protection.

- Australian Unity: A mutual insurer known for its focus on community and member benefits, including income protection.

- BUPA: A well-established health insurance provider also offering income protection plans.

- CommInsure: A subsidiary of Commonwealth Bank, offering a wide range of insurance products, including income protection.

- HCF: A health fund that also provides income protection insurance.

- Medibank: A major health insurer offering income protection plans.

- NIB: A private health insurer that also offers income protection insurance.

- TAL: A leading life insurance provider also offering income protection plans.

- Zurich: A global insurer offering various insurance products, including income protection in Australia.

Government Websites and Consumer Advocacy Groups

Government websites and consumer advocacy groups offer valuable resources and information about income protection insurance.

- Australian Securities and Investments Commission (ASIC): ASIC provides information on financial products, including income protection insurance, and consumer rights. Their website offers guides, resources, and tools to help consumers make informed decisions.

- Australian Competition and Consumer Commission (ACCC): The ACCC promotes fair trading and consumer protection in Australia. Their website provides information on consumer rights and how to resolve disputes with insurance providers.

- Financial Ombudsman Service (FOS): FOS is an independent body that helps resolve disputes between consumers and financial service providers, including insurance companies. Their website provides information on the dispute resolution process and how to lodge a complaint.

- Consumer Action Law Centre (CALC): CALC is a non-profit organization that provides free legal advice and support to consumers on a range of issues, including insurance disputes.

Seeking Advice from a Financial Advisor

A financial advisor can provide personalized advice and guidance on income protection insurance. They can help you understand your insurance needs, compare different plans, and choose the best option for your circumstances.

- Find a qualified financial advisor: Look for an advisor who is licensed and experienced in providing advice on insurance products. You can use online directories or seek referrals from trusted sources.

- Discuss your financial goals and circumstances: Be transparent with your advisor about your income, expenses, and financial goals. This will help them tailor their advice to your specific needs.

- Compare different options: Ask your advisor to compare different income protection plans from various providers. They can help you understand the benefits, exclusions, and costs of each plan.

- Consider the long-term implications: Discuss the long-term implications of your insurance decisions with your advisor. This will help you make a choice that aligns with your financial goals and protects your future.

Final Review

Ultimately, deciding whether income protection insurance is right for you requires a thorough assessment of your individual circumstances and risk tolerance. While the cost may seem significant, the potential benefits of having financial protection during a time of illness or injury can be invaluable. By researching different policies, understanding the factors influencing costs, and seeking advice from a financial advisor, you can make an informed decision that provides you with peace of mind and financial security.

FAQ Compilation

What are the common exclusions in income protection policies?

Exclusions vary between providers but often include pre-existing conditions, self-inflicted injuries, and certain types of occupations. It’s essential to carefully review the policy document to understand the specific exclusions that apply.

How long does it take to receive a payout from an income protection policy?

The waiting period before receiving benefits varies depending on the policy. Some policies have a waiting period of 14 days, while others may have a waiting period of several weeks or months. It’s crucial to understand the waiting period before making a decision.

What are the tax implications of income protection insurance?

Income protection insurance benefits are generally considered taxable income. It’s essential to discuss the tax implications with a financial advisor to understand how your benefits will be treated for tax purposes.