- Understanding Life Insurance Costs in Australia: How Much Does Life Insurance Cost In Australia

- Factors Affecting Life Insurance Premiums

- Getting Quotes and Comparing Life Insurance Policies

- Understanding Life Insurance Policies and Coverage

- Choosing the Right Life Insurance Policy

- Final Review

- Expert Answers

How much does life insurance cost in Australia? The answer, like many things in life, depends on a variety of factors. From your age and health to the type of coverage you choose, the price of life insurance can vary significantly. Understanding these factors is crucial to finding a policy that provides the right level of protection at a price you can afford.

This guide will delve into the world of life insurance costs in Australia, exploring the key elements that determine premiums and helping you navigate the process of securing the coverage you need. We’ll examine the different types of policies available, the factors that influence pricing, and the steps involved in obtaining quotes and comparing options. By the end, you’ll have a comprehensive understanding of life insurance costs and be equipped to make informed decisions about your financial future.

Understanding Life Insurance Costs in Australia: How Much Does Life Insurance Cost In Australia

Life insurance premiums in Australia can vary significantly depending on several factors. Understanding these factors is crucial for making informed decisions about your life insurance needs and budget.

Factors Influencing Life Insurance Premiums

The cost of life insurance in Australia is influenced by a variety of factors, including your age, health, lifestyle, and the type of policy you choose.

- Age: As you get older, your risk of death increases, which leads to higher premiums. Younger individuals generally pay lower premiums than older individuals.

- Health: Your health status is a significant factor in determining your premium. Individuals with pre-existing health conditions may face higher premiums due to an increased risk of claiming.

- Lifestyle: Certain lifestyle choices, such as smoking or engaging in risky activities, can increase your risk of death and therefore result in higher premiums.

- Policy Type: The type of life insurance policy you choose will also impact your premiums. Term life insurance, which provides coverage for a specific period, is typically cheaper than whole life insurance, which offers lifetime coverage.

- Sum Assured: The amount of coverage you choose, also known as the sum assured, will directly influence your premium. A higher sum assured will generally result in higher premiums.

- Insurer: Different insurance companies have varying pricing structures. It’s essential to compare quotes from multiple insurers to find the best value for your needs.

Types of Life Insurance Policies

Life insurance policies can be broadly categorized into two main types: term life insurance and whole life insurance.

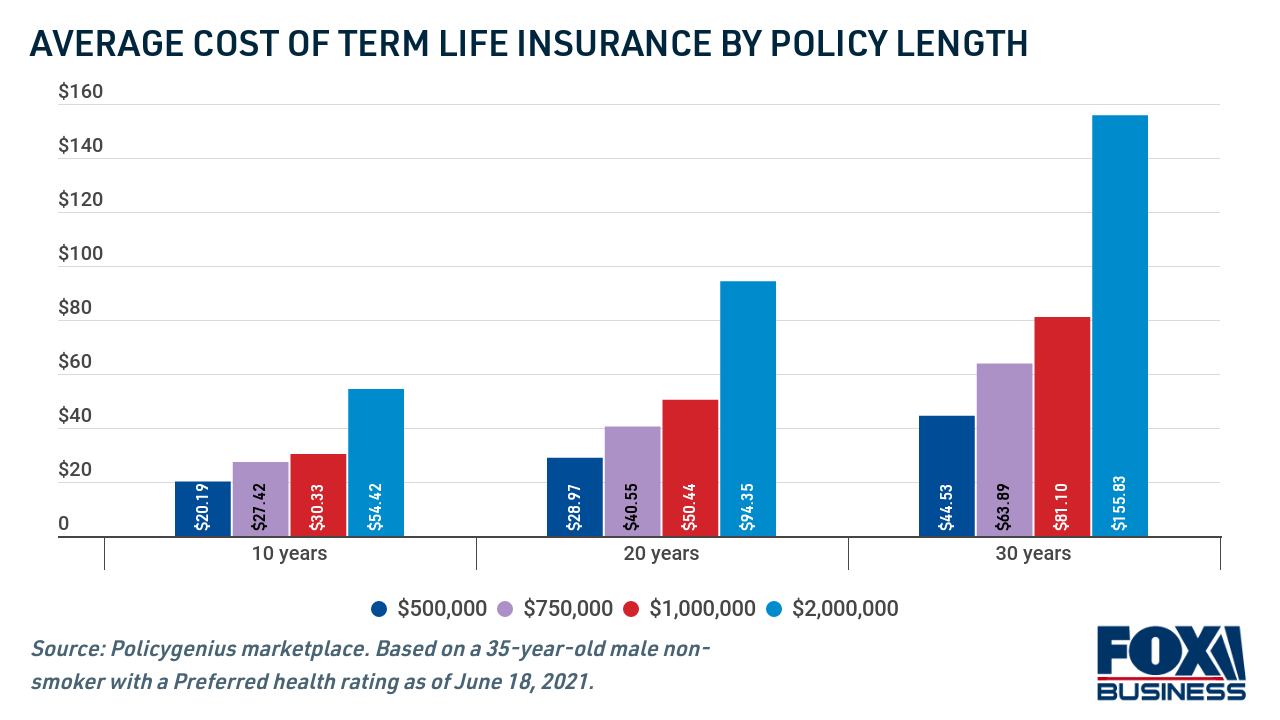

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable than whole life insurance and is often used to cover short-term financial obligations, such as a mortgage or dependents’ income.

- Whole Life Insurance: Whole life insurance provides lifetime coverage, meaning it remains in effect as long as you pay the premiums. It’s typically more expensive than term life insurance and includes a cash value component that grows over time.

Comparing Term Life Insurance and Whole Life Insurance Costs

Term life insurance is generally significantly cheaper than whole life insurance due to its shorter coverage period and lack of a cash value component.

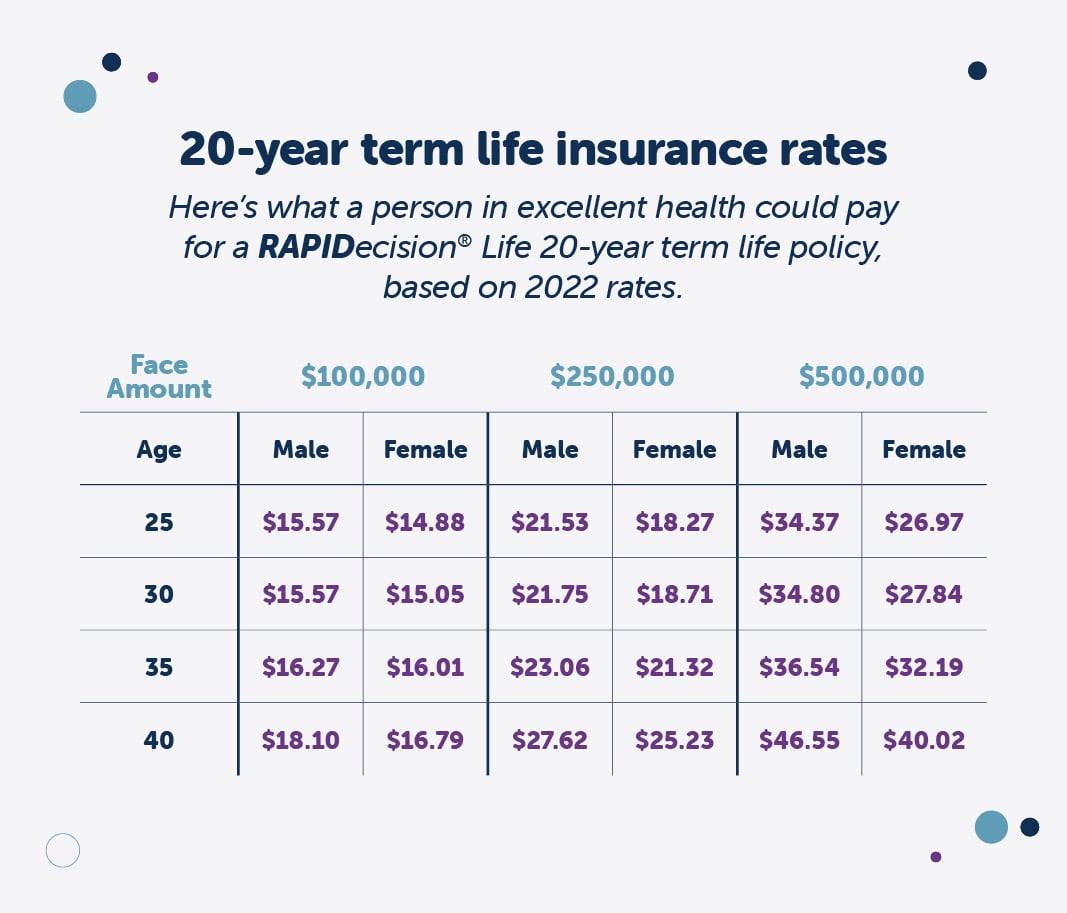

- Term Life Insurance Costs: Term life insurance premiums are typically lower because they only cover the risk of death during the specified term. The premiums are calculated based on the age, health, and lifestyle of the insured individual.

For example, a 30-year-old healthy male with a 20-year term life insurance policy with a sum assured of $500,000 could pay around $50-$100 per month in premiums.

- Whole Life Insurance Costs: Whole life insurance premiums are typically higher because they provide lifetime coverage and include a cash value component. The premiums are also influenced by the age, health, and lifestyle of the insured individual, but they are generally higher than term life insurance premiums.

For example, a 30-year-old healthy male with a whole life insurance policy with a sum assured of $500,000 could pay around $200-$300 per month in premiums.

Factors Affecting Life Insurance Premiums

Life insurance premiums are calculated based on several factors, assessing the likelihood of the insured individual passing away during the policy term. The higher the risk, the higher the premium. Understanding these factors can help you make informed decisions about your life insurance needs and budget.

Age

Your age is a significant factor influencing your life insurance premiums. Younger individuals generally have lower premiums compared to older individuals. This is because statistically, younger people have a lower risk of death.

As you age, your life expectancy decreases, making you a higher risk for insurance companies.

For example, a 25-year-old individual might pay a significantly lower premium for a similar life insurance policy compared to a 55-year-old.

Health

Your health status is another crucial factor determining your premiums. Individuals with pre-existing medical conditions or unhealthy lifestyles may face higher premiums. Insurance companies consider your health history, including conditions like diabetes, heart disease, or cancer, as these factors increase the likelihood of early death.

A healthy lifestyle, including regular exercise and a balanced diet, can help lower your premiums.

For instance, a smoker might pay a higher premium than a non-smoker, as smoking significantly increases the risk of various health issues.

Lifestyle

Your lifestyle choices can also influence your life insurance premiums. Engaging in risky activities like skydiving or extreme sports can increase your premium.

Insurance companies may ask about your hobbies and interests to assess your risk profile.

For example, a professional race car driver might face higher premiums than a librarian due to the inherent risks associated with their occupation.

Coverage Amount

The amount of coverage you choose for your life insurance policy directly impacts your premium. The higher the coverage amount, the higher the premium.

This is because the insurance company is taking on a greater financial obligation if you pass away.

For instance, a $1 million life insurance policy will generally cost more than a $500,000 policy, all other factors being equal.

Occupation

Your occupation can also play a role in determining your life insurance premiums. Certain occupations, such as construction workers or firefighters, are considered higher risk due to the potential for accidents and injuries.

Insurance companies may categorize occupations based on their risk profiles.

For example, a construction worker might pay a higher premium than an office worker, reflecting the higher risk associated with their job.

Smoking Habits

Smoking is a significant risk factor for various health issues, including heart disease, stroke, and lung cancer.

Insurance companies typically charge higher premiums for smokers than non-smokers.

This is because smokers have a higher risk of premature death, increasing the likelihood of a claim.

Pre-existing Medical Conditions

If you have pre-existing medical conditions, such as diabetes, high blood pressure, or cancer, you may face higher life insurance premiums.

Insurance companies may require you to undergo medical tests or provide medical records to assess your health status.

The severity and type of your condition can impact the premium increase.

Getting Quotes and Comparing Life Insurance Policies

Once you have a good understanding of the different types of life insurance and the factors that affect premiums, the next step is to start getting quotes from different providers. This will allow you to compare policies and find the one that best meets your needs and budget.

Obtaining Life Insurance Quotes

You can obtain life insurance quotes from different providers through various methods, including:

- Online quote tools: Many life insurance providers offer online quote tools that allow you to quickly get a preliminary estimate of your premiums. You will typically need to provide some basic information about yourself, such as your age, health, and desired coverage amount.

- Phone calls: You can call life insurance providers directly to request a quote. This allows you to speak to a representative who can answer your questions and provide more personalized advice.

- Financial advisors: If you work with a financial advisor, they can help you obtain quotes from various providers and compare different policies.

It’s important to note that online quotes are often just estimates and may not reflect the final premium you will pay. This is because the provider will need to conduct a more thorough assessment of your health and risk profile before providing a final quote.

Comparing Life Insurance Policies

Once you have received quotes from several providers, it’s essential to compare them carefully. Here’s a table that Artikels some key features to consider:

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Coverage Amount | $500,000 | $1,000,000 | $250,000 |

| Premium | $50 per month | $100 per month | $25 per month |

| Waiting Period | 30 days | 60 days | 14 days |

| Exclusions | Pre-existing conditions | Dangerous hobbies | Suicide |

| Benefits | Death benefit only | Death benefit and terminal illness benefit | Death benefit and critical illness benefit |

Remember that this is just a sample table and the specific features and premiums will vary depending on the provider and your individual circumstances. It’s essential to read the policy documents carefully and understand all the terms and conditions before making a decision.

Reputable Life Insurance Providers in Australia

Here is a list of reputable life insurance providers in Australia:

- AIA Australia: 1300 242 088

- AMP Life: 1300 654 321

- Asteron Life: 1300 654 321

- Australian Unity: 1300 654 321

- BT Financial Group: 1300 654 321

- CommInsure: 1300 654 321

- Guardian Australia: 1300 654 321

- MLC Life: 1300 654 321

- OnePath Life: 1300 654 321

- TAL Life: 1300 654 321

Understanding Life Insurance Policies and Coverage

A life insurance policy is a contract between you and an insurance company that provides financial protection to your loved ones in the event of your death. Understanding the different components of a policy and the coverage options available can help you choose the right policy for your needs.

Key Components of a Life Insurance Policy

A standard life insurance policy typically includes several key components:

- Death Benefit: This is the lump sum payment made to your beneficiaries upon your death. The amount of the death benefit is determined by the policy’s coverage amount and is usually paid out as a tax-free lump sum.

- Premium: This is the regular payment you make to the insurance company to maintain your policy. The premium amount is based on several factors, including your age, health, and the coverage amount you choose.

- Policy Term: This refers to the duration of the policy. It can be a specific number of years (e.g., 10 years, 20 years) or a lifetime policy.

- Beneficiaries: These are the individuals or entities who will receive the death benefit upon your death. You can name one or more beneficiaries and specify how the death benefit will be distributed.

- Waiting Period: This is the period after the policy is issued before certain benefits become payable. For example, there may be a waiting period before a claim for total and permanent disability cover is accepted.

Types of Life Insurance Coverage

Life insurance policies offer a range of coverage options to suit different needs. The most common types include:

- Death Benefit: This is the core coverage provided by most life insurance policies. It provides a lump sum payment to your beneficiaries upon your death, which can be used to cover expenses such as funeral costs, mortgage payments, or income replacement.

- Terminal Illness Cover: This provides a lump sum payment if you are diagnosed with a terminal illness, allowing you to access funds to cover medical expenses, living expenses, or other needs during your final days. The payout is typically made while you are still alive, allowing you to use the money as you see fit.

- Total and Permanent Disability Cover: This provides a regular income stream if you become totally and permanently disabled and are unable to work. The benefit amount is usually a percentage of your pre-disability income, and it can help you cover essential living expenses and maintain your financial stability.

Policy Exclusions and Limitations

It’s important to carefully review the policy documents and understand any exclusions and limitations that may apply. These are situations where the insurer may not pay out a claim, or may pay out a reduced benefit. Some common exclusions include:

- Suicide: Most policies have a suicide exclusion, meaning that if you die by suicide within a certain period (usually one or two years) after taking out the policy, the insurer may not pay out the death benefit. This exclusion is designed to prevent people from taking out life insurance policies with the intention of committing suicide and claiming the benefit.

- Dangerous Activities: Some policies may exclude coverage for death or disability resulting from certain high-risk activities, such as skydiving, scuba diving, or participating in extreme sports. The specific exclusions will vary depending on the insurer and the policy.

- Pre-Existing Conditions: Some policies may have limitations on coverage for death or disability caused by pre-existing medical conditions. This means that if you have a medical condition that existed before you took out the policy, the insurer may not pay out a claim or may pay out a reduced benefit.

Choosing the Right Life Insurance Policy

Choosing the right life insurance policy is a crucial decision that requires careful consideration of your individual needs and circumstances. It involves understanding your financial goals, dependents, risk tolerance, and budget to find a policy that provides adequate coverage while remaining affordable.

Factors to Consider

It is important to consider various factors before making a decision. These factors can significantly influence the type of policy you choose and the premium you pay.

- Financial Goals: Define your financial objectives, such as covering outstanding debts, providing income replacement for your dependents, or funding your children’s education. Your goals will determine the amount of coverage you need.

- Dependents: Consider the number and ages of your dependents, as well as their financial needs. If you have young children or a spouse who relies on your income, you may require higher coverage.

- Risk Tolerance: Assess your willingness to take on financial risk. If you are risk-averse, you might opt for a higher level of coverage, while those comfortable with risk may choose a lower amount.

- Budget: Determine how much you can afford to pay for life insurance premiums. It’s crucial to balance the need for adequate coverage with your financial constraints.

Types of Life Insurance Policies

Life insurance policies come in various forms, each with its own features, benefits, and costs. Understanding these types will help you make an informed decision.

- Term Life Insurance: Provides coverage for a specific period, typically 10, 20, or 30 years. It is generally the most affordable option but does not provide coverage after the term expires.

- Whole Life Insurance: Offers lifetime coverage and builds cash value that you can borrow against or withdraw. It is typically more expensive than term life insurance but provides long-term financial security.

- Universal Life Insurance: Combines the features of term and whole life insurance, offering flexibility in premium payments and death benefits. It allows you to adjust your coverage and cash value accumulation based on your changing needs.

- Index Universal Life Insurance: Similar to universal life insurance, but the cash value is linked to the performance of a specific market index, such as the S&P 500. This option provides potential for higher returns but also carries more risk.

Negotiating Premiums

While life insurance premiums are generally fixed, there are strategies to potentially lower your costs.

- Shop Around: Compare quotes from multiple insurers to find the best rates. Online comparison websites can simplify this process.

- Improve Your Health: Maintaining a healthy lifestyle and avoiding risky habits can lower your premium. Consider factors like smoking, weight, and health conditions.

- Increase Your Deductible: Choosing a higher deductible can result in lower premiums, but it means you’ll pay more out of pocket in case of a claim.

- Bundle Policies: Some insurers offer discounts for bundling multiple insurance policies, such as home, auto, and life insurance.

Reviewing Your Policy Regularly, How much does life insurance cost in australia

Life insurance needs can change over time due to factors such as marriage, children, job changes, or financial goals. It is essential to review your policy periodically to ensure it still meets your current requirements.

- Life Events: Major life events, such as marriage, birth of a child, or job loss, can necessitate adjustments to your coverage.

- Financial Goals: As your financial goals evolve, you may need to increase or decrease your coverage.

- Market Conditions: Changes in interest rates and investment performance can impact the cost and benefits of your policy.

Final Review

Choosing the right life insurance policy is a significant financial decision that should not be taken lightly. By carefully considering your individual needs, researching different options, and understanding the factors that influence premiums, you can find a policy that provides the necessary protection for you and your loved ones without breaking the bank. Remember, life insurance is an investment in peace of mind, ensuring that your family is financially secure in the event of your unexpected passing.

Expert Answers

What are the most common types of life insurance in Australia?

The two most common types are term life insurance and whole life insurance. Term life insurance provides coverage for a specific period, while whole life insurance offers lifetime coverage with a savings component.

How often are life insurance premiums reviewed?

Premiums are typically reviewed annually, and the cost can fluctuate based on factors like your age, health, and the performance of the insurer’s investments.

What happens if I cancel my life insurance policy?

The terms of your policy will dictate the consequences of cancellation. You may receive a refund of unused premiums, but there could also be penalties depending on the policy type and duration.

Is it possible to reduce my life insurance premiums?

Yes, you can potentially reduce your premiums by making lifestyle changes like quitting smoking or improving your health. You can also consider decreasing your coverage amount if it’s no longer necessary.