How much does Target health insurance cost sets the stage for this exploration, offering insights into the various factors influencing the price of Target health plans. This guide delves into the different plan options, cost-determining factors, and strategies for saving money on your premiums. Whether you’re an employee considering Target’s benefits or simply curious about the costs associated with this popular provider, this article aims to provide you with a clear understanding of the landscape.

Target offers a range of health insurance plans, each designed to cater to different needs and budgets. Factors like age, location, family size, and health status play a crucial role in determining your individual premium. Additionally, understanding cost-sharing components like deductibles, copayments, and coinsurance is essential when comparing plans and making informed decisions.

Target Health Insurance Plans

Target does not offer its own health insurance plans directly. Instead, Target partners with health insurance providers to offer a range of plans to its employees and their families. These plans are available through the Target Benefits Marketplace, which allows employees to choose the plan that best meets their needs and budget.

Target Health Insurance Plans Offered Through the Benefits Marketplace

The specific health insurance plans offered through Target’s Benefits Marketplace vary depending on the employee’s location and employment status. However, the plans generally fall into the following categories:

- Health Maintenance Organization (HMO) Plans: HMO plans typically have lower monthly premiums than other types of plans. They also have a narrow network of doctors and hospitals, meaning that you must see a provider within the network to receive coverage. HMO plans usually require you to choose a primary care physician (PCP) who will act as your main point of contact for healthcare.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility than HMO plans. They have a wider network of providers, and you can see a doctor outside of the network for a higher copay. PPO plans generally have higher monthly premiums than HMO plans.

- Exclusive Provider Organization (EPO) Plans: EPO plans are similar to HMO plans in that they have a limited network of providers. However, EPO plans typically offer more flexibility in terms of choosing specialists without a referral from your PCP.

- High Deductible Health Plans (HDHPs): HDHPs have lower monthly premiums than traditional plans, but they have higher deductibles. This means that you will need to pay more out-of-pocket for healthcare expenses before your insurance kicks in. HDHPs are often paired with a Health Savings Account (HSA), which allows you to save money pre-tax for healthcare expenses.

Key Features and Benefits of Target Health Insurance Plans

Target health insurance plans offer a variety of features and benefits, including:

- Coverage for medical expenses: Target health insurance plans cover a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care.

- Dental and vision coverage: Some Target health insurance plans also include dental and vision coverage.

- Health Savings Accounts (HSAs): Target offers HSAs to employees who enroll in HDHPs. HSAs allow you to save money pre-tax for healthcare expenses.

- Flexible Spending Accounts (FSAs): Target also offers FSAs, which allow you to set aside pre-tax money to pay for eligible healthcare expenses.

- Wellness programs: Target offers a variety of wellness programs to help employees stay healthy and prevent chronic diseases.

Eligibility Criteria and Enrollment Process

To be eligible for Target health insurance, you must be a Target employee or a dependent of a Target employee. The enrollment process typically occurs during an annual open enrollment period, although there may be opportunities to enroll outside of this period.

Important Considerations

When choosing a Target health insurance plan, it is important to consider your individual needs and budget. Factors to consider include:

- Your medical history: If you have a history of chronic illnesses or frequent medical needs, you may want to choose a plan with lower deductibles and copays.

- Your budget: Consider your monthly premium and out-of-pocket expenses when choosing a plan.

- Your healthcare needs: If you need to see specialists frequently or have specific healthcare needs, you may want to choose a plan with a wider network of providers.

Factors Affecting Cost

Several factors influence the cost of Target health insurance premiums. Understanding these factors can help you estimate your potential costs and make informed decisions about your coverage.

Age

Your age is a significant factor in determining your health insurance premiums. Generally, younger individuals tend to have lower premiums than older individuals. This is because younger people are statistically less likely to require extensive medical care. As you age, your risk of developing health conditions increases, leading to higher premiums.

Location

The geographic location where you reside also plays a role in your health insurance costs. Premiums can vary depending on the cost of living, healthcare providers, and the prevalence of certain diseases in the area. For instance, areas with a high concentration of specialists or a higher cost of living may have higher premiums.

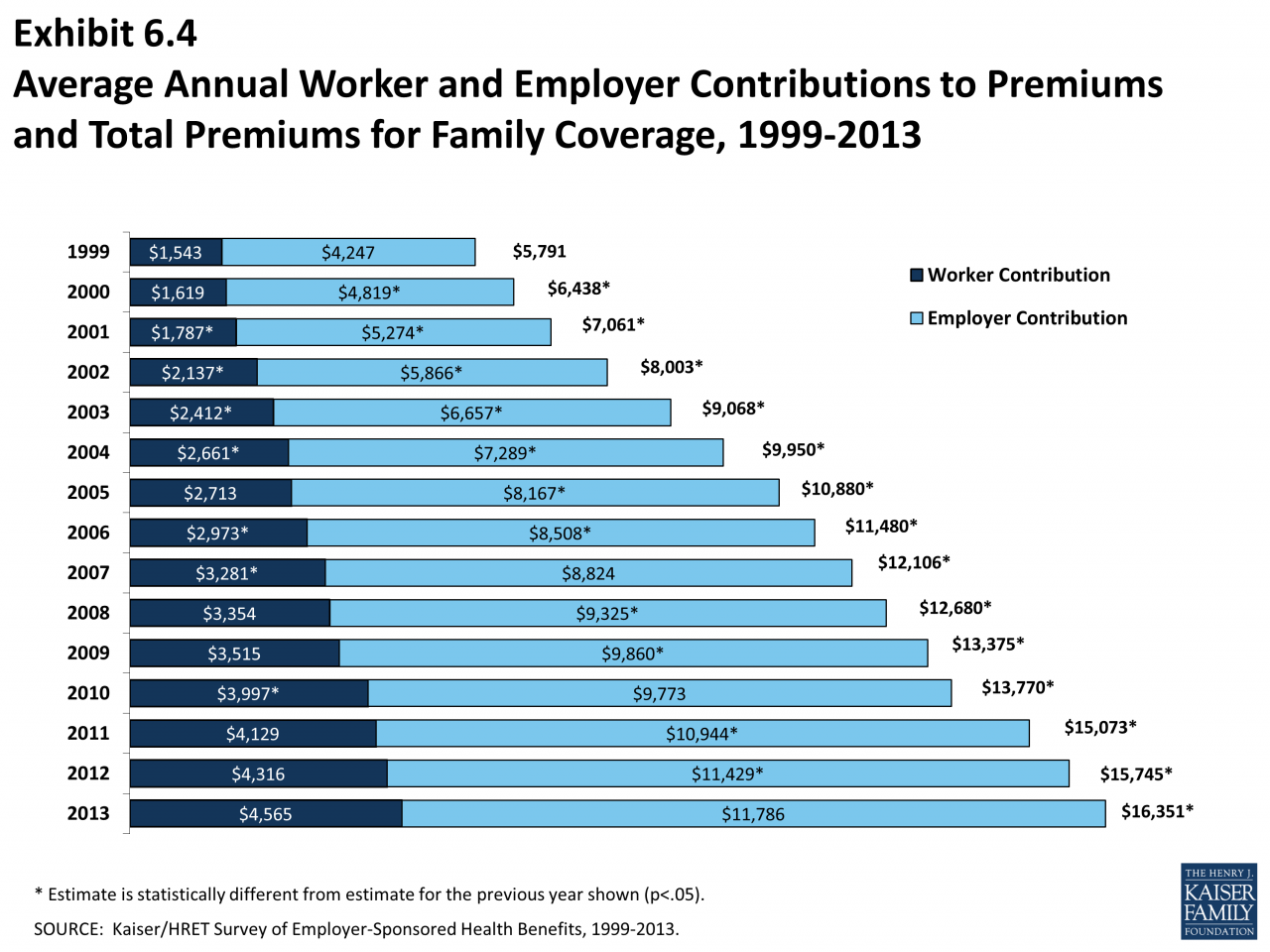

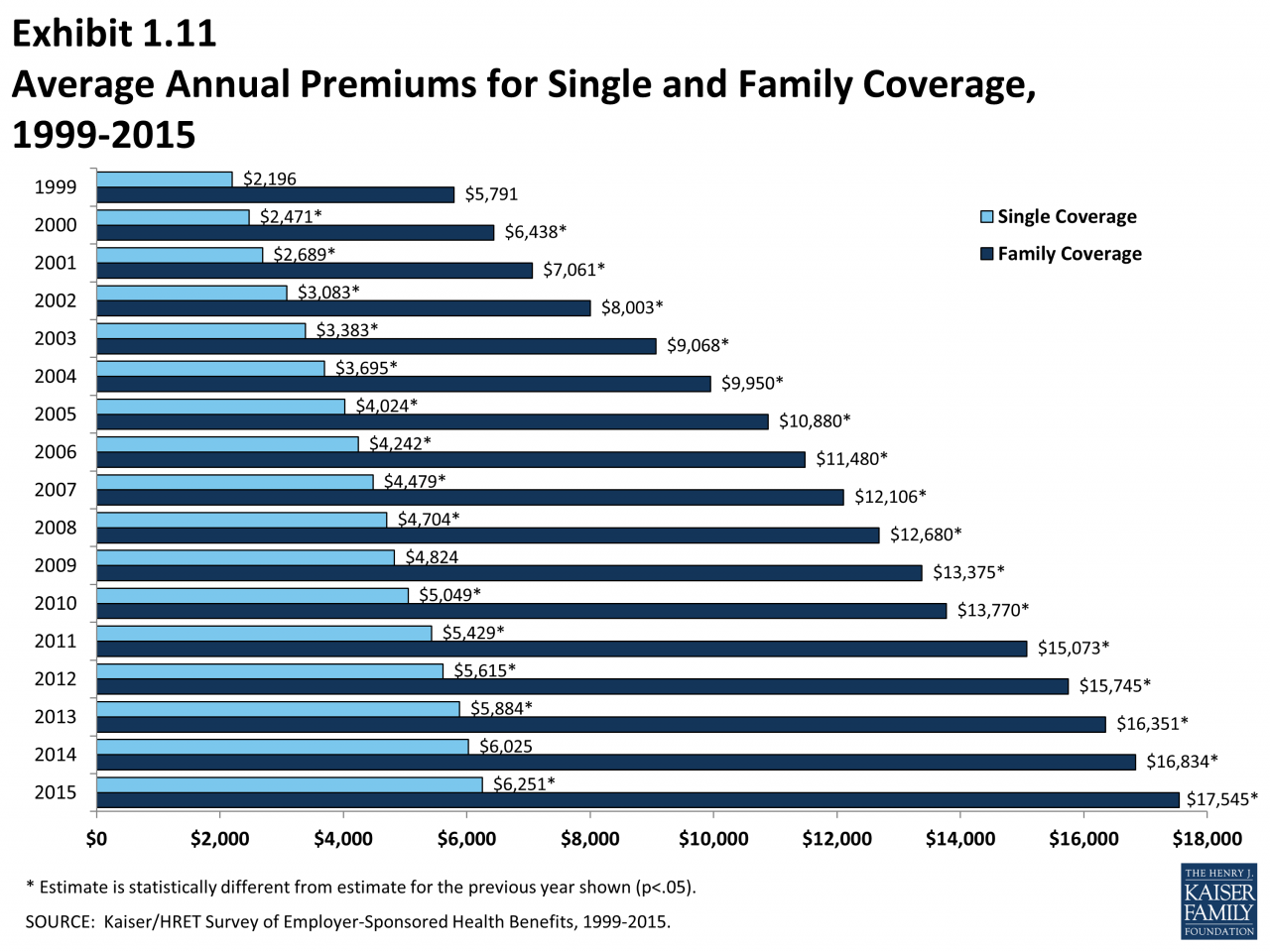

Family Size

The size of your family also influences your health insurance costs. If you have dependents, such as children or a spouse, your premiums will likely be higher than if you are single. This is because you are covering a larger group of people under your plan, increasing the potential for medical expenses.

Health Status

Your health status is a major factor in determining your health insurance premiums. Individuals with pre-existing health conditions or a history of significant medical expenses typically face higher premiums. This is because insurance companies assess the risk associated with covering your healthcare needs.

Cost-Sharing Components

In addition to the base premium, health insurance plans often have cost-sharing components, which are designed to help share the cost of healthcare services. These components include deductibles, copayments, and coinsurance.

Deductibles

A deductible is the amount you must pay out-of-pocket before your health insurance coverage begins. Once you reach your deductible, your insurance company will start covering a portion of your medical expenses.

Copayments

Copayments are fixed amounts you pay for specific healthcare services, such as doctor visits or prescriptions. They are typically a smaller amount than deductibles and are paid at the time of service.

Coinsurance

Coinsurance is a percentage of the cost of covered healthcare services that you pay after meeting your deductible. For example, if your coinsurance is 20%, you would pay 20% of the cost of a covered medical procedure, and your insurance company would cover the remaining 80%.

Cost Comparisons

Comparing Target health insurance costs to other major providers is crucial to understanding its value proposition. By analyzing average monthly premiums and considering the benefits offered, you can determine if Target health insurance aligns with your needs and budget.

Average Monthly Premiums

The following table presents average monthly premiums for different plan types and coverage levels from Target and other major health insurance providers. These figures are estimates and may vary depending on factors such as age, location, and health status.

| Plan Type | Target | Blue Cross Blue Shield | UnitedHealthcare | Cigna |

|---|---|---|---|---|

| Bronze | $350 | $325 | $375 | $340 |

| Silver | $425 | $400 | $450 | $415 |

| Gold | $500 | $475 | $525 | $490 |

| Platinum | $575 | $550 | $600 | $565 |

Value Proposition of Target Health Insurance

Target health insurance may offer a competitive value proposition depending on your individual circumstances. Consider the following factors:

- Cost: Target’s premiums may be more affordable than other providers for certain plan types and coverage levels.

- Benefits: Target’s plans may offer specific benefits, such as access to a wide network of providers or telehealth services, that are important to you.

- Customer Service: Target’s customer service reputation can influence your overall experience with their health insurance plans.

It’s essential to compare Target’s plans against other providers based on your specific needs and priorities. This allows you to make an informed decision about which health insurance plan best suits your situation.

Cost-Saving Strategies

Reducing your health insurance costs can significantly impact your financial well-being. By implementing smart strategies and taking advantage of available resources, you can potentially save money on your premiums and out-of-pocket expenses.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are tax-advantaged accounts that allow you to set aside pre-tax dollars for qualified medical expenses.

- Health Savings Accounts (HSAs) are available to individuals enrolled in high-deductible health plans (HDHPs). These accounts offer triple tax advantages: contributions are tax-deductible, earnings grow tax-deferred, and withdrawals for qualified medical expenses are tax-free. HSAs provide a long-term savings vehicle for healthcare expenses, allowing you to accumulate funds over time.

- Flexible Spending Accounts (FSAs) are offered by employers and allow employees to set aside pre-tax dollars for eligible medical, dental, and vision expenses. FSAs offer a tax advantage by reducing your taxable income, but the funds typically have a “use-it-or-lose-it” provision, meaning any unused funds at the end of the plan year may be forfeited.

Preventive Care and Healthy Lifestyle Choices

Maintaining good health through preventive care and healthy lifestyle choices can help reduce your healthcare costs in the long run.

- Regular Checkups and Screenings: By staying up-to-date with preventive care, such as annual physicals, vaccinations, and screenings for common conditions, you can catch potential health issues early when they are often easier and less expensive to treat.

- Healthy Diet and Exercise: A balanced diet and regular exercise can help prevent chronic diseases, such as heart disease, diabetes, and obesity, which can lead to high healthcare costs.

- Quit Smoking and Limit Alcohol Consumption: Smoking and excessive alcohol consumption increase the risk of various health problems, leading to higher healthcare costs.

Customer Reviews and Experiences: How Much Does Target Health Insurance Cost

Understanding customer perspectives on Target health insurance is crucial to evaluating its overall value proposition. Reviews and testimonials offer valuable insights into the plan’s coverage, customer service, and claims processing efficiency.

Overall Customer Satisfaction, How much does target health insurance cost

Reviews and ratings on platforms like Trustpilot, ConsumerAffairs, and the Better Business Bureau can provide a general overview of customer satisfaction with Target health insurance. These platforms allow customers to share their experiences with the plan, providing valuable feedback on its strengths and weaknesses.

Final Thoughts

Navigating the world of health insurance can feel overwhelming, but understanding the factors that influence cost and exploring cost-saving strategies can empower you to make informed decisions. By considering your individual needs and circumstances, you can find a Target health insurance plan that aligns with your budget and provides the coverage you require. Remember to explore customer reviews and testimonials to gain insights into real-world experiences with Target health insurance plans.

Commonly Asked Questions

What types of health insurance plans does Target offer?

Target offers a variety of health insurance plans, including HMOs, PPOs, and HSA-compatible plans. The specific plans available may vary depending on your location and eligibility.

How can I estimate my monthly premium?

You can use Target’s online quote tool or contact their customer service team to obtain a personalized estimate based on your individual circumstances.

Does Target offer any discounts on health insurance premiums?

Yes, Target may offer discounts for certain groups, such as employees who participate in wellness programs or those who enroll in coverage during open enrollment periods.

What are the common complaints about Target health insurance?

While customer satisfaction with Target health insurance is generally positive, some common complaints include limited provider networks, high deductibles, and occasional difficulties with claims processing.