- Average Health Insurance Costs in the United States

- Factors Affecting Individual Health Insurance Costs

- Understanding Health Insurance Premiums and Out-of-Pocket Costs

- The Role of Employer-Sponsored Health Insurance

- Government Programs and Health Insurance Costs

- Strategies for Managing Health Insurance Costs

- Wrap-Up

- General Inquiries: How Much Does The Average American Pay In Health Insurance

How much does the average american pay in health insurance – How much does the average American pay for health insurance? It’s a question that weighs heavily on the minds of many, as healthcare costs continue to climb. The answer, however, is not a simple one, as the cost of health insurance can vary significantly depending on a number of factors, including age, location, health status, and the type of plan chosen. This article delves into the complexities of health insurance costs in the United States, exploring the different types of plans available, the factors that influence individual premiums, and strategies for managing these expenses.

From employer-sponsored plans to individual policies and government programs like Medicare and Medicaid, the landscape of health insurance is vast and multifaceted. Understanding the intricacies of this system is crucial for individuals and families seeking to navigate the complexities of healthcare financing. This article aims to provide a comprehensive overview of health insurance costs in the United States, empowering readers with knowledge and insights to make informed decisions about their healthcare coverage.

Average Health Insurance Costs in the United States

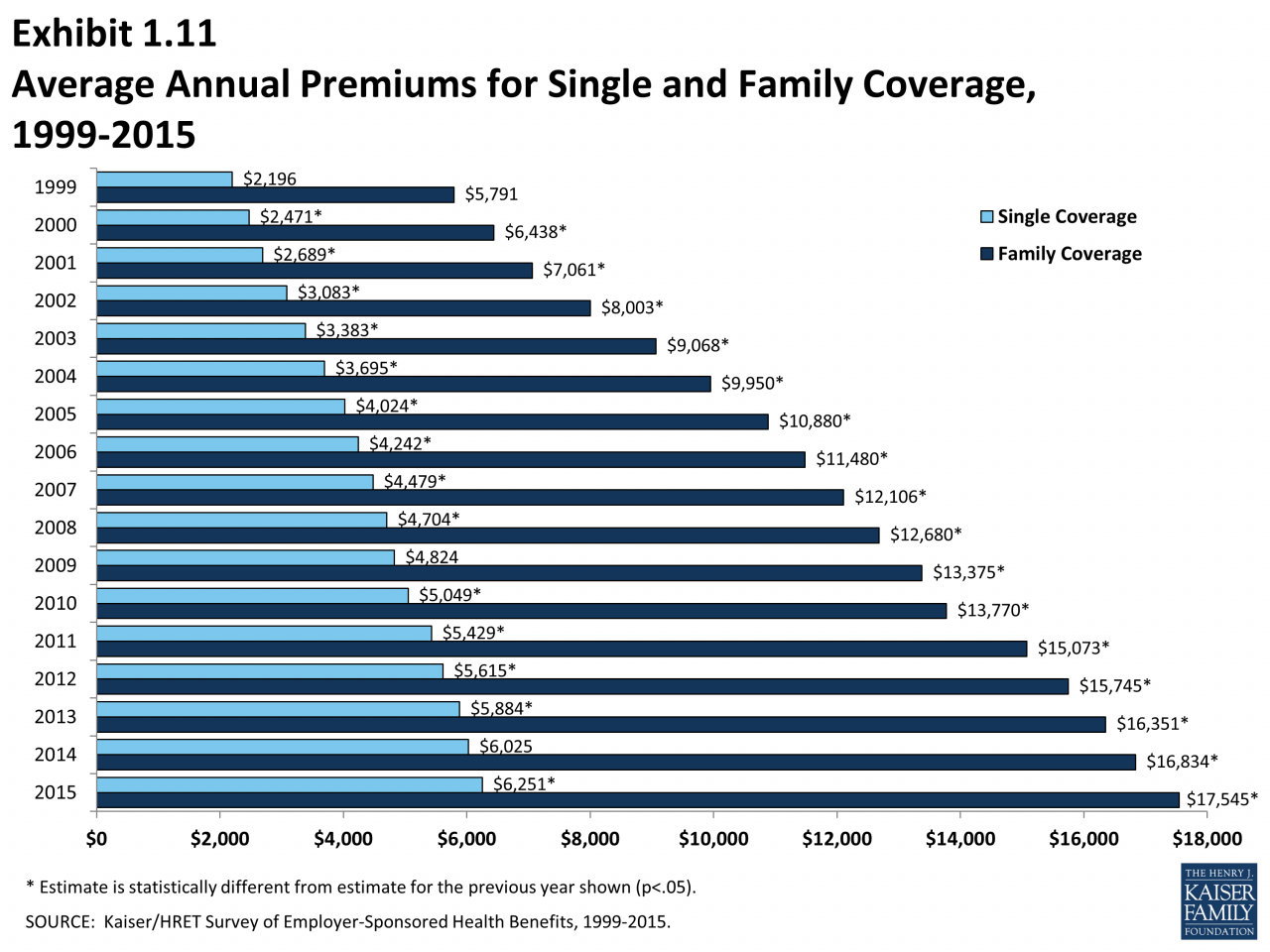

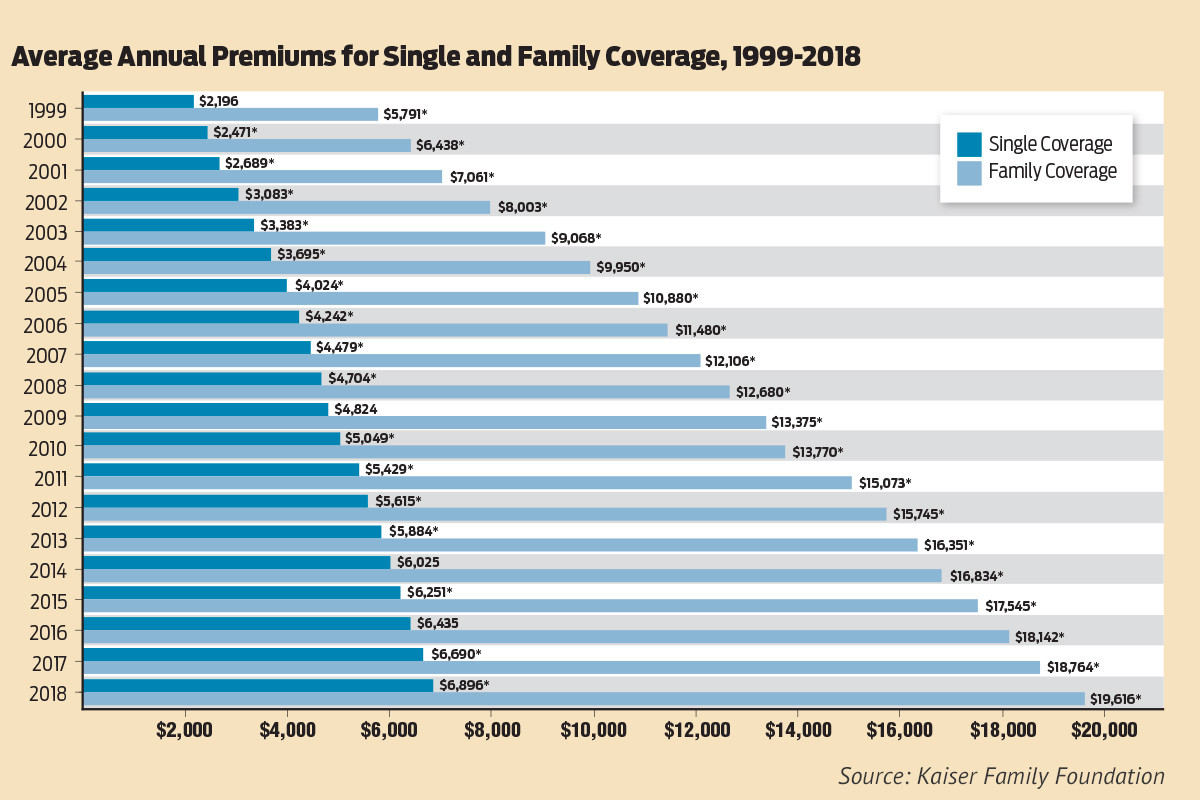

The cost of health insurance in the United States can vary significantly depending on several factors, including the type of plan, location, age, and health status. This section will delve into the factors influencing average health insurance costs in the US, providing a breakdown of average annual health insurance premiums for different types of plans, and discussing the impact of rising healthcare costs on average insurance premiums.

Factors Influencing Average Health Insurance Costs

Several factors influence the average cost of health insurance in the United States. Understanding these factors can help individuals and families make informed decisions about their health insurance coverage.

- Employer-Sponsored Insurance: A significant portion of the US population obtains health insurance through their employers. Employer-sponsored plans often offer lower premiums than individual plans due to economies of scale. However, the cost of employer-sponsored plans can vary based on factors like the size of the employer, the industry, and the plan’s coverage.

- Individual Health Insurance Plans: Individuals who do not obtain health insurance through their employers can purchase individual plans through the Affordable Care Act (ACA) marketplaces or directly from insurance companies. These plans generally have higher premiums than employer-sponsored plans due to the absence of group purchasing power.

- Government Programs: Government programs like Medicare and Medicaid provide health insurance coverage to specific populations. Medicare covers individuals aged 65 and older, while Medicaid provides coverage for low-income individuals and families. The costs of these programs are subsidized by the government, which can impact the overall average cost of health insurance in the US.

Average Annual Health Insurance Premiums

The average annual health insurance premium can vary widely based on the type of plan, location, and other factors. Here’s a breakdown of average annual premiums for different types of plans:

| Plan Type | Average Annual Premium |

|---|---|

| Employer-Sponsored Health Insurance | $7,739 (2022 data) |

| Individual Health Insurance (ACA Marketplace) | $5,427 (2022 data) |

| Medicare Part B (Monthly Premium) | $170.10 (2023 data) |

| Medicaid (varies by state) | No premium for eligible individuals |

Impact of Rising Healthcare Costs

The rising cost of healthcare in the United States is a significant factor driving up average health insurance premiums. As healthcare costs increase, insurance companies pass these costs on to consumers through higher premiums. The rising cost of prescription drugs, hospital services, and medical technology are contributing factors to this trend.

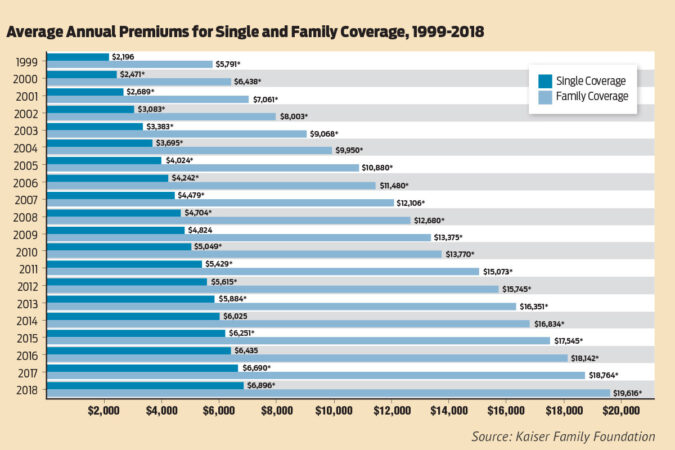

“The average annual premium for employer-sponsored health insurance has increased by over 100% since 2000.” – Kaiser Family Foundation

The rising cost of healthcare is a complex issue with no easy solutions. However, understanding the factors driving up healthcare costs is essential for individuals and policymakers to address the issue effectively.

Factors Affecting Individual Health Insurance Costs

Health insurance premiums are influenced by various factors, including demographics, health status, and lifestyle choices. Understanding these factors can help individuals make informed decisions about their health insurance coverage.

Age

Age is a significant factor in determining health insurance premiums. Older individuals tend to have higher healthcare costs due to a greater likelihood of chronic conditions and increased healthcare utilization. Insurance companies consider age as a risk factor and adjust premiums accordingly. For example, a 60-year-old individual may pay a higher premium compared to a 30-year-old individual with similar health status.

Location

Geographic location also plays a role in health insurance premiums. The cost of living, healthcare provider availability, and the prevalence of certain diseases can vary across different regions. For instance, individuals residing in urban areas with high healthcare costs may face higher premiums compared to those living in rural areas with lower healthcare costs.

Health Status

Health status is a major determinant of health insurance premiums. Individuals with pre-existing conditions, such as diabetes, heart disease, or cancer, are generally considered higher risk and may face higher premiums. This is because they are more likely to require significant healthcare services, resulting in higher insurance costs.

Tobacco Use, How much does the average american pay in health insurance

Tobacco use is another factor that influences health insurance premiums. Smokers are known to have higher healthcare costs due to increased risks of lung cancer, heart disease, and other tobacco-related illnesses. Insurance companies typically charge smokers higher premiums to account for these elevated risks.

Family Size

Family size can impact health insurance premiums. Larger families typically have higher healthcare utilization due to the presence of multiple individuals requiring coverage. Insurance companies may adjust premiums based on the number of dependents covered under a policy.

Pre-existing Conditions

Pre-existing conditions can significantly affect health insurance premiums. Individuals with pre-existing conditions may face higher premiums due to the increased likelihood of requiring expensive healthcare services. The Affordable Care Act (ACA) prohibits insurance companies from denying coverage or charging higher premiums based solely on pre-existing conditions, but they can still consider health status as a factor in determining premiums.

Understanding Health Insurance Premiums and Out-of-Pocket Costs

Health insurance premiums and out-of-pocket costs are essential components of understanding your overall healthcare expenses. Understanding these costs can help you make informed decisions about your health insurance plan and manage your healthcare spending effectively.

Components of Health Insurance Premiums

Premiums are the monthly payments you make to your health insurance company to maintain coverage. These payments cover the insurer’s costs for providing you with health insurance benefits. The premium is typically broken down into several components:

- Monthly Premium: This is the fixed amount you pay each month to maintain your health insurance coverage. The amount can vary based on factors such as age, location, coverage type, and individual health status.

- Deductible: This is the amount you must pay out-of-pocket for healthcare services before your insurance coverage kicks in. For example, if your deductible is $1,000, you would need to pay the first $1,000 of your healthcare costs yourself before your insurance starts covering the remaining expenses.

- Co-pay: This is a fixed amount you pay for specific healthcare services, such as doctor visits or prescription drugs, after you have met your deductible. Co-pays help to keep healthcare costs manageable for both you and your insurance company.

- Co-insurance: This is a percentage of the healthcare cost you pay after you have met your deductible. For example, if your co-insurance is 20%, you would pay 20% of the cost of a hospital stay after meeting your deductible, and your insurance would cover the remaining 80%.

Examples of Premium Components Affecting Healthcare Expenses

- Imagine you have a $1,000 deductible, a $20 co-pay for doctor visits, and a 20% co-insurance for hospital stays. If you need to see a doctor and have a hospital stay, your out-of-pocket costs would be:

- Doctor Visit: $20 co-pay (assuming you’ve met your deductible)

- Hospital Stay: $1,000 deductible + 20% of the remaining hospital costs (after deductible)

Out-of-Pocket Maximums

An out-of-pocket maximum is the highest amount you will have to pay for healthcare costs in a year. Once you reach this limit, your insurance company will cover 100% of your remaining healthcare expenses for the rest of the year. Out-of-pocket maximums can help protect you from significant financial burdens due to unexpected healthcare costs. For example, if your out-of-pocket maximum is $5,000, you will not have to pay more than $5,000 for healthcare costs in a year, even if your medical expenses exceed this amount.

The Role of Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a significant component of the US healthcare system, playing a vital role in providing health coverage to millions of Americans. This type of insurance is offered by employers to their employees, often as part of a benefits package.

Prevalence of Employer-Sponsored Health Insurance

Employer-sponsored health insurance is the most prevalent type of health coverage in the US. According to the Kaiser Family Foundation, in 2022, 55% of non-elderly Americans received health insurance through their employers. This signifies that a majority of working Americans rely on their employers for health coverage.

Advantages and Disadvantages of Employer-Sponsored Health Insurance

Employer-sponsored health insurance offers advantages and disadvantages for both employers and employees.

Advantages for Employers

- Attracting and Retaining Employees: Offering health insurance can be a significant draw for potential employees, particularly those with families or pre-existing health conditions. It can also help retain existing employees, reducing turnover costs.

- Tax Advantages: Employers can deduct the cost of providing health insurance as a business expense, reducing their tax liability.

- Group Rates: Employers can negotiate lower premiums for their employees by purchasing insurance through a group plan.

Disadvantages for Employers

- Cost: Providing health insurance can be a significant expense for employers, particularly as healthcare costs continue to rise.

- Administrative Burden: Managing an employer-sponsored health insurance plan can be time-consuming and complex, requiring administrative staff and resources.

- Employee Health Issues: Employers may face higher healthcare costs if their employees have significant health issues.

Advantages for Employees

- Affordable Premiums: Employer contributions can significantly reduce employee premiums, making health insurance more affordable.

- Wider Coverage: Employer-sponsored plans often offer broader coverage than individual plans, including coverage for dependents.

- Convenience: Premiums are typically deducted directly from employees’ paychecks, making it convenient to pay for health insurance.

Disadvantages for Employees

- Limited Choice: Employees may have limited options for choosing a health insurance plan, as employers typically offer a few specific plans.

- Job Security: Losing a job can result in losing access to employer-sponsored health insurance, leaving employees with limited options for coverage.

- Employer Contributions: Employer contributions to health insurance premiums are not guaranteed and can be reduced or eliminated, leading to higher out-of-pocket costs for employees.

Comparing Employer-Sponsored and Individual Health Insurance Plans

Employer-sponsored health insurance plans typically offer lower premiums than individual plans. This is because employers negotiate group rates with insurance companies, which can result in lower costs per person. Additionally, employers often contribute a portion of the premium, further reducing the cost for employees.

However, it’s important to note that employer-sponsored plans may have higher deductibles and co-pays compared to individual plans.

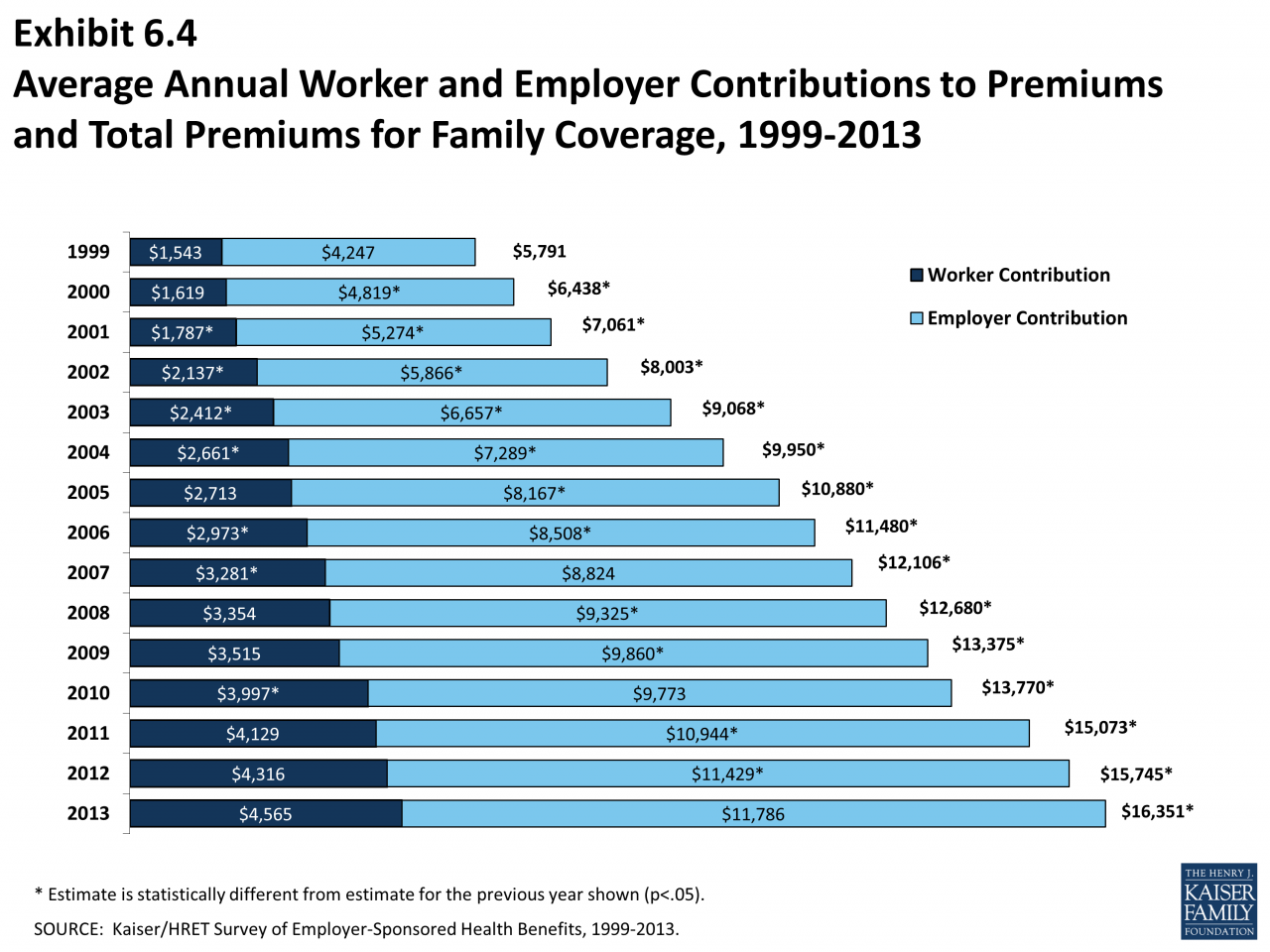

Impact of Employer Contributions on Employee Premiums

Employer contributions play a significant role in determining the affordability of health insurance for employees. When employers contribute a larger portion of the premium, employees pay less, making health insurance more accessible. Conversely, if employer contributions are reduced or eliminated, employees face higher premiums and out-of-pocket costs.

Government Programs and Health Insurance Costs

Government programs play a vital role in the American healthcare system, providing health insurance coverage to millions of citizens and contributing significantly to overall healthcare spending. These programs, particularly Medicare and Medicaid, have a substantial impact on the average cost of health insurance in the United States.

Medicare and Medicaid: Key Government Programs

Medicare and Medicaid are two major government-run health insurance programs that provide coverage to a wide range of individuals.

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as certain younger individuals with disabilities. It is funded through payroll taxes and general revenues.

Medicaid, on the other hand, is a joint federal and state program that provides health coverage to low-income individuals and families, including children, pregnant women, and people with disabilities. Eligibility for Medicaid varies by state, and it is funded through a combination of federal and state funds.

Eligibility Criteria and Benefits

Eligibility for Medicare and Medicaid is based on specific criteria:

- Medicare: Individuals must be 65 or older, have certain disabilities, or have end-stage renal disease (permanent kidney failure requiring dialysis or a transplant).

- Medicaid: Eligibility criteria vary by state, but generally include low income, certain disabilities, and family size. States can expand Medicaid eligibility under the Affordable Care Act.

Both programs offer a range of benefits, including:

- Medicare: Covers hospital stays, doctor visits, preventive care, and prescription drugs.

- Medicaid: Covers a broad range of services, including hospital stays, doctor visits, mental health care, and prescription drugs.

Impact on Healthcare Spending and Insurance Costs

Government programs like Medicare and Medicaid significantly impact overall healthcare spending and average insurance costs. They represent a substantial portion of national healthcare expenditures, contributing to both rising healthcare costs and the overall cost of health insurance.

- Increased Healthcare Spending: Medicare and Medicaid contribute to higher healthcare spending due to their extensive coverage and the volume of beneficiaries they serve.

- Lower Average Insurance Costs: While they contribute to higher overall spending, these programs also help to lower average insurance costs for many individuals by providing subsidized coverage, particularly for those who might otherwise be unable to afford private insurance.

Future Changes and Potential Impact

Future changes to Medicare and Medicaid, such as changes in eligibility criteria, benefits, or funding, could have a significant impact on health insurance costs.

- Reduced Benefits or Eligibility: Changes that reduce benefits or eligibility could lead to higher out-of-pocket costs for beneficiaries, potentially increasing the demand for private insurance and contributing to higher premiums.

- Increased Funding: Increased funding for these programs could help to maintain or expand coverage, potentially leading to lower average insurance costs for those who rely on these programs.

It is crucial to consider the potential implications of policy changes on both healthcare spending and the affordability of health insurance for individuals.

Strategies for Managing Health Insurance Costs

Health insurance is a vital part of life in the United States, but the rising cost of healthcare can put a strain on your budget. Fortunately, there are several strategies you can implement to manage your health insurance costs and make sure you’re getting the best value for your money.

Shopping for the Best Plan

Finding the right health insurance plan can significantly impact your overall healthcare costs. It’s crucial to compare different plans and consider factors like premiums, deductibles, copayments, and coverage.

- Use online comparison tools: Several websites, including Healthcare.gov, allow you to compare health insurance plans from different providers based on your location, income, and health status.

- Consider your needs: Assess your healthcare needs and choose a plan that provides adequate coverage for your specific requirements. For example, if you have a chronic condition, you might want to opt for a plan with lower out-of-pocket costs for related treatments.

- Evaluate the network: Make sure your preferred doctors and hospitals are included in the plan’s network. Out-of-network care can be significantly more expensive.

Negotiating with Insurance Providers

While negotiating directly with insurance providers may not be possible for everyone, it’s worth exploring if you have a high-deductible plan or are facing significant medical expenses.

- Appeal denied claims: If your insurance company denies a claim, understand the reasons and consider appealing the decision.

- Request a lower premium: If you’ve experienced a significant life event, like a job loss or change in family size, you may be eligible for a lower premium.

- Ask for a payment plan: If you’re struggling to pay your premiums, consider requesting a payment plan from your insurance provider.

Utilizing Preventive Care Services

Preventive care services are designed to catch health issues early and prevent more serious problems later. These services are often covered by insurance plans with little or no out-of-pocket costs.

- Annual check-ups: Regular check-ups with your primary care physician can help identify potential health problems early on.

- Vaccinations: Staying up-to-date on vaccinations can protect you from preventable diseases.

- Screenings: Screenings for conditions like cancer, diabetes, and heart disease can detect problems early, when treatment is often more effective and less expensive.

Managing Chronic Conditions Effectively

If you have a chronic condition, it’s essential to manage it effectively to prevent complications and reduce healthcare costs.

- Adhere to your treatment plan: Following your doctor’s instructions for medication, lifestyle changes, and other treatments is crucial for managing your condition.

- Participate in self-management programs: Many insurance plans offer self-management programs for chronic conditions, providing education and support to help you manage your health.

- Monitor your condition: Keep track of your symptoms, medications, and blood sugar levels (if applicable) to identify any potential problems early on.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs can be valuable tools for managing healthcare costs.

- HSAs: HSAs are tax-advantaged savings accounts that can be used for healthcare expenses. The money you contribute to an HSA is pre-tax, and you can withdraw it tax-free for qualified medical expenses.

- FSAs: FSAs are employer-sponsored accounts that allow you to set aside pre-tax money for healthcare expenses. The money in an FSA must be used within a specific timeframe, usually one year.

Understanding Your Health Insurance Plan

Knowing the details of your health insurance plan is essential for maximizing its benefits and avoiding unnecessary expenses.

- Review your plan documents: Take the time to read your plan’s summary of benefits and coverage, which Artikels your deductibles, copayments, and covered services.

- Ask questions: If you have any questions about your plan, don’t hesitate to contact your insurance provider or a healthcare professional.

- Track your healthcare spending: Keep track of your medical expenses and compare them to your plan’s coverage to ensure you’re getting the most out of your benefits.

Wrap-Up

Navigating the world of health insurance can be a daunting task, but understanding the factors that influence costs and exploring strategies for managing expenses can empower individuals to make informed decisions about their healthcare coverage. From exploring different plan options to utilizing preventive care services and maximizing the benefits of health savings accounts, there are numerous ways to mitigate the financial burden of healthcare. Ultimately, being an informed consumer is key to ensuring affordable and accessible healthcare for all Americans.

General Inquiries: How Much Does The Average American Pay In Health Insurance

What are some common health insurance plans?

Common health insurance plans include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and EPOs (Exclusive Provider Organizations). Each plan offers different levels of coverage and flexibility.

How can I compare different health insurance plans?

You can use online comparison tools or consult with an insurance broker to compare different plans based on factors like premium costs, coverage, and provider networks.

What is a deductible?

A deductible is the amount you must pay out-of-pocket before your health insurance coverage kicks in.

What is a co-pay?

A co-pay is a fixed amount you pay for certain medical services, like doctor’s visits or prescriptions.