- Factors Influencing Travel Insurance Costs in Australia

- Types of Travel Insurance Coverage

-

Choosing the Right Travel Insurance Plan: How Much Does Travel Insurance Cost In Australia

- Comparing Travel Insurance Providers

- Essential Factors to Consider When Selecting Travel Insurance

- Step-by-Step Guide to Comparing Travel Insurance Policies, How much does travel insurance cost in australia

- Understanding Policy Terms and Conditions

- Maximizing Value for Money When Purchasing Travel Insurance

- Making a Travel Insurance Claim

- Travel Insurance Tips for Australians

- Final Wrap-Up

- Answers to Common Questions

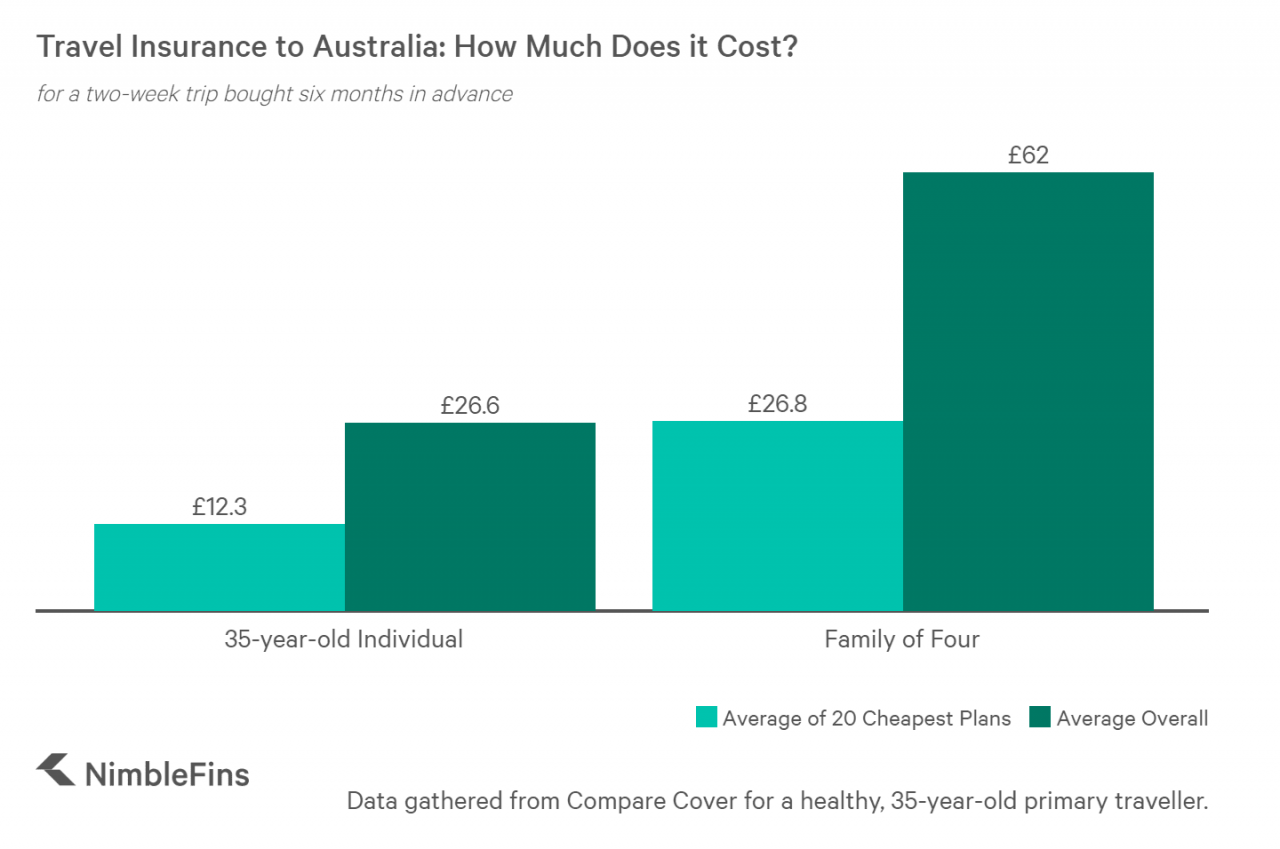

How much does travel insurance cost in Australia? It’s a question many Aussies ask themselves before embarking on their next adventure. The cost of travel insurance can vary greatly depending on a number of factors, including your age, destination, pre-existing medical conditions, trip duration, and the type of travel you’re planning. Understanding these factors is crucial for making an informed decision about your travel insurance needs.

Travel insurance is designed to protect you from financial losses that could arise from unexpected events during your trip, such as medical emergencies, flight cancellations, lost luggage, or even natural disasters. It’s important to choose a plan that provides adequate coverage for your specific needs and travel plans. This article will guide you through the intricacies of travel insurance costs in Australia, helping you make the right choice for your next adventure.

Factors Influencing Travel Insurance Costs in Australia

The cost of travel insurance in Australia is determined by a variety of factors, including your age, destination, pre-existing medical conditions, trip duration, and the type of travel.

Age

Your age is a significant factor in determining your travel insurance premium. Generally, younger travelers pay lower premiums than older travelers. This is because younger people are statistically less likely to experience health problems while traveling. However, there are some exceptions to this rule. For example, if you are a young traveler participating in extreme adventure sports, you may be required to pay a higher premium.

Destination Risk

The risk associated with your destination is another key factor in determining your travel insurance cost. Destinations with a higher risk of natural disasters, political instability, or health risks will generally have higher insurance premiums. For example, a trip to a country with a high risk of malaria or dengue fever will likely cost more to insure than a trip to a country with a lower risk of these diseases.

Pre-Existing Medical Conditions

If you have any pre-existing medical conditions, you may need to pay a higher premium for travel insurance. This is because you are more likely to require medical attention while traveling. The severity of your condition and the likelihood of it requiring treatment while you are away will influence the cost of your insurance. Some insurers may even refuse to cover you if you have certain pre-existing conditions.

Trip Duration

The longer your trip, the higher your travel insurance premium will be. This is because you are more likely to experience an event that requires insurance coverage during a longer trip. For example, a 14-day trip will generally cost more to insure than a 7-day trip.

Type of Travel

The type of travel you are undertaking can also impact the cost of your insurance. For example, adventure travel, such as hiking, skiing, or scuba diving, will generally cost more to insure than a more traditional vacation. This is because adventure travel carries a higher risk of accidents or injuries. Luxury travel, such as cruises or all-inclusive resorts, may also cost more to insure due to the higher value of your belongings and the potential for higher medical expenses.

Types of Travel Insurance Coverage

Travel insurance offers various levels of coverage, ranging from basic protection to comprehensive plans with extensive benefits. Understanding the different types of coverage is crucial to ensure you have adequate protection for your trip.

Basic Travel Insurance Coverage

Basic travel insurance plans provide essential protection against unexpected events. These plans typically include coverage for:

- Medical Expenses: This covers emergency medical expenses incurred while traveling, including hospital stays, doctor’s visits, and medication. It is crucial for unexpected illnesses or injuries that require immediate medical attention.

- Emergency Evacuation: This covers the cost of transporting you back to Australia in case of a medical emergency or other unforeseen circumstances. Medical evacuation can be expensive, and this coverage is essential for travelers visiting remote destinations.

- Personal Liability: This covers you if you are held liable for causing damage to property or injury to another person while traveling. This is important for travelers who engage in activities such as skiing or water sports.

- Lost or Stolen Luggage: This covers the cost of replacing lost or stolen luggage during your trip. It’s important to keep track of your belongings and report any losses immediately to the authorities and your insurance provider.

- Trip Cancellation or Interruption: This covers the cost of canceling or interrupting your trip due to unforeseen circumstances such as illness, injury, or death. It’s important to note that these plans often have specific exclusions and conditions, so it’s crucial to read the policy carefully.

Comprehensive Travel Insurance Coverage

Comprehensive travel insurance plans provide a wider range of coverage than basic plans, offering additional benefits such as:

- Travel Delay: This covers the cost of accommodation and meals if your flight is delayed for an extended period. This is particularly helpful for travelers with tight connections or important events to attend.

- Baggage Delay: This covers the cost of essential items if your luggage is delayed in transit. This can be useful for travelers who need to purchase replacement items such as clothing or toiletries.

- Adventure Activities: This covers you for injuries or accidents while participating in adventurous activities such as skiing, scuba diving, or bungee jumping. This coverage is essential for travelers who engage in these activities.

- Overseas Legal Expenses: This covers legal expenses if you are involved in a legal dispute while traveling overseas. This can be particularly helpful for travelers who are unfamiliar with the local laws and regulations.

- Terrorism and Natural Disasters: This covers you for losses or injuries caused by terrorist attacks or natural disasters. This is important for travelers visiting areas prone to these events.

Single-Trip vs. Multi-Trip Travel Insurance

- Single-trip travel insurance: This is a one-time policy that covers you for a single trip. It is suitable for travelers who take infrequent trips or have a specific trip planned. It’s important to note that the duration of coverage is limited to the dates of your trip.

- Multi-trip travel insurance: This policy provides coverage for multiple trips within a specific period, typically 12 months. It is suitable for frequent travelers who take multiple trips throughout the year. It’s important to consider the total number of trips and the maximum duration of each trip covered by the policy.

Medical Evacuation Coverage

Medical evacuation coverage is a crucial component of travel insurance, particularly for travelers visiting remote destinations or countries with limited healthcare facilities. This coverage provides financial assistance for transporting you back to Australia in case of a medical emergency. It includes:

- Air Ambulance: This covers the cost of transporting you back to Australia by air ambulance, which is often necessary for patients who require specialized medical care.

- Medical Expenses: This covers the cost of medical treatment and care received during the evacuation process.

- Accompanying Family Member: Some policies also cover the cost of accompanying a family member to be with you during the evacuation process.

Cancellation and Interruption Insurance

Cancellation and interruption insurance covers the cost of canceling or interrupting your trip due to unforeseen circumstances. This coverage is essential for protecting your investment in your trip. It can cover:

- Illness or Injury: This covers the cost of canceling or interrupting your trip if you or a family member becomes ill or injured before or during your trip.

- Death: This covers the cost of canceling or interrupting your trip if a family member passes away.

- Job Loss: Some policies may cover the cost of canceling or interrupting your trip if you lose your job before or during your trip.

- Natural Disasters: This covers the cost of canceling or interrupting your trip if a natural disaster occurs at your destination.

Choosing the Right Travel Insurance Plan: How Much Does Travel Insurance Cost In Australia

Choosing the right travel insurance plan can feel overwhelming, but it’s essential for safeguarding your trip and finances. With numerous providers and policies available, finding the best fit for your needs requires careful consideration. This section will guide you through the process of selecting the ideal travel insurance plan for your Australian adventure.

Comparing Travel Insurance Providers

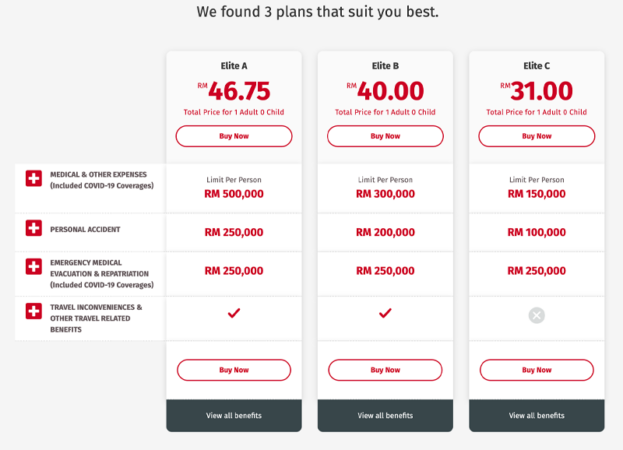

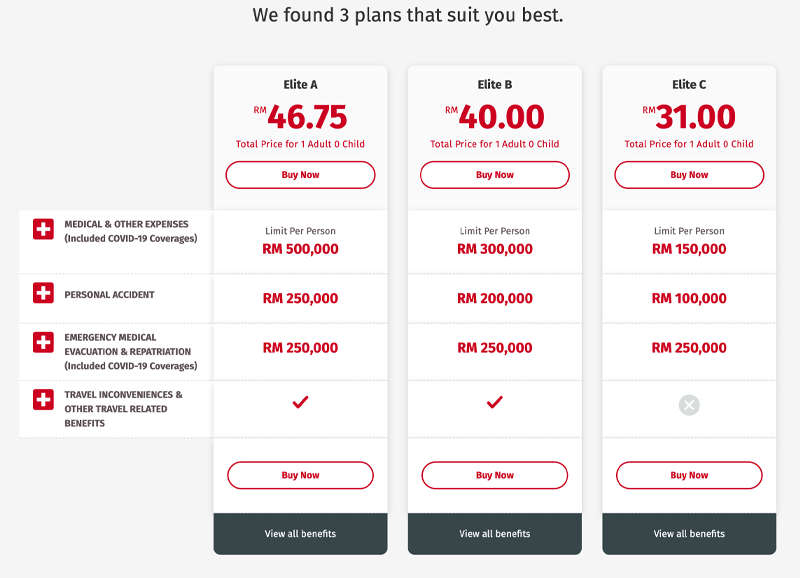

To compare travel insurance providers effectively, you can use a table like this:

| Provider | Coverage | Price | Pros | Cons |

|—|—|—|—|—|

| [Provider 1] | [Coverage details] | [Price range] | [Advantages] | [Disadvantages] |

| [Provider 2] | [Coverage details] | [Price range] | [Advantages] | [Disadvantages] |

| [Provider 3] | [Coverage details] | [Price range] | [Advantages] | [Disadvantages] |

Remember that this is a simplified example, and each provider offers various policies with different coverage options and prices. It’s crucial to compare specific policy details for your desired coverage and budget.

Essential Factors to Consider When Selecting Travel Insurance

Before you start comparing policies, consider these crucial factors to ensure you select the right plan for your needs:

- Trip duration and destination: Travel insurance premiums vary based on the length of your trip and the destination you’re visiting. Some destinations may have higher risks, requiring more comprehensive coverage.

- Your age and health: Your age and pre-existing medical conditions can influence the cost and availability of coverage. Be sure to disclose any relevant health information to ensure adequate protection.

- Your travel activities: If you plan to engage in adventurous activities like skiing, scuba diving, or extreme sports, you’ll need a policy that covers these activities. Standard policies may not offer sufficient protection for high-risk activities.

- Your budget: Travel insurance premiums vary significantly, so it’s essential to set a budget and compare policies accordingly. While it’s tempting to opt for the cheapest option, ensure it offers adequate coverage for your needs.

Step-by-Step Guide to Comparing Travel Insurance Policies, How much does travel insurance cost in australia

Comparing policies is a straightforward process once you’ve identified your needs and budget:

- Gather quotes: Use online comparison websites or contact individual insurance providers to obtain quotes. Ensure you provide accurate information about your trip details and health conditions.

- Compare policy features: Pay close attention to the coverage offered by each policy. Look for features like medical expenses, cancellation coverage, lost luggage, and emergency assistance.

- Review exclusions: Carefully review the policy exclusions, which are situations or events not covered by the policy. Understand what is and isn’t covered to avoid unexpected costs.

- Check the excess: The excess is the amount you pay out of pocket before your insurance kicks in. Compare the excesses of different policies and choose one that fits your budget.

- Read the fine print: Don’t skip reading the policy terms and conditions. Understand the policy’s limitations, cancellation procedures, and claim process.

Understanding Policy Terms and Conditions

Reading and understanding the policy terms and conditions is crucial to avoid any surprises later. Some key aspects to pay attention to include:

- Definition of covered events: Ensure you understand the events and circumstances covered by the policy. Some policies may exclude specific events or activities.

- Claim process: Familiarize yourself with the claim process, including the necessary documentation and deadlines. Knowing this information will help you file a claim promptly and efficiently.

- Cancellation policy: Understand the conditions under which you can cancel your policy and receive a refund. This information is essential, especially if your travel plans change unexpectedly.

Maximizing Value for Money When Purchasing Travel Insurance

Following these tips can help you get the most value for your money when purchasing travel insurance:

- Compare policies carefully: Don’t settle for the first policy you find. Compare multiple policies to find the best coverage at the most competitive price.

- Consider a comprehensive policy: While a basic policy might seem cheaper, a comprehensive policy offers more protection against unexpected events. This could save you significant costs in the long run.

- Take advantage of discounts: Many insurance providers offer discounts for group bookings, early purchases, or membership in certain organizations. Inquire about available discounts to potentially save on your premium.

- Read reviews: Before purchasing a policy, read online reviews from other travelers to gain insights into the provider’s reputation and customer service.

Making a Travel Insurance Claim

Making a travel insurance claim in Australia can be a straightforward process, but it’s important to understand the steps involved and the documentation required. The sooner you report your claim, the quicker you can get the assistance you need.

Common Reasons for Making Travel Insurance Claims

Travel insurance claims can be made for a variety of reasons, including:

- Medical emergencies: This could include unexpected illnesses, injuries, or hospitalizations during your trip.

- Lost or stolen belongings: If your luggage or personal items are lost or stolen, your travel insurance may cover the cost of replacement.

- Trip cancellations or interruptions: If you need to cancel or interrupt your trip due to unforeseen circumstances, such as illness, natural disasters, or family emergencies, your travel insurance may provide coverage.

- Flight delays or cancellations: Travel insurance can help cover expenses related to flight delays or cancellations, such as accommodation and meals.

- Emergency evacuation: If you require medical evacuation from your destination, travel insurance can cover the associated costs.

Documents Required for Travel Insurance Claims

To ensure a smooth and successful claim process, it’s essential to provide the necessary documentation. This typically includes:

- Claim form: You can usually find this on your insurance provider’s website or by contacting them directly.

- Proof of purchase: This includes your travel insurance policy documents and receipts for any expenses incurred.

- Medical reports: If your claim involves medical expenses, you will need to provide medical reports from your doctor or hospital.

- Police reports: If your claim involves lost or stolen belongings, you will need to file a police report and provide a copy to your insurer.

- Flight or accommodation confirmations: If your claim involves trip cancellations or interruptions, you will need to provide proof of your travel arrangements.

Timeframe for Processing Travel Insurance Claims

The time it takes to process a travel insurance claim can vary depending on the complexity of the claim and the insurer’s procedures. However, most insurers aim to process claims within a reasonable timeframe.

It’s important to note that the timeframe may be longer if additional documentation is required or if the claim involves a complex legal issue.

Role of Travel Insurance Brokers in Claim Assistance

Travel insurance brokers can play a crucial role in assisting with your claim process. They can:

- Provide guidance and support: Brokers can help you understand the terms and conditions of your policy and guide you through the claim process.

- Negotiate with insurers: Brokers can act as intermediaries between you and your insurer, advocating for your best interests and ensuring you receive the maximum benefits possible.

- Handle administrative tasks: Brokers can assist with collecting and submitting the necessary documentation to your insurer.

Travel Insurance Tips for Australians

Navigating the world of travel insurance can feel like a maze, but with a few smart strategies, you can ensure you’re well-protected without breaking the bank. Here are some practical tips to help you make the most of your travel insurance policy.

Minimizing Travel Insurance Costs

There are several ways to reduce your travel insurance premiums without compromising on essential coverage.

- Compare Quotes: Before settling on a policy, compare quotes from multiple insurers. Use online comparison websites or contact insurers directly to gather information.

- Consider Your Trip Duration: Shorter trips generally cost less to insure. If you’re planning a long-term adventure, consider purchasing a multi-trip policy that covers multiple trips within a year.

- Travel During Off-Peak Seasons: Travel insurance premiums tend to be higher during peak travel seasons. Consider traveling during shoulder seasons or off-peak periods for potential savings.

- Choose a Basic Policy: If you’re a young and healthy traveler with a straightforward itinerary, a basic policy might suffice. You can always add extra coverage later if needed.

- Consider Exclusions: Understand the exclusions in your policy and adjust your travel plans accordingly. For example, if your policy excludes certain activities, avoid them or find alternative coverage.

- Bundle Your Policies: Some insurers offer discounts when you bundle your travel insurance with other policies, such as home or car insurance.

Avoiding Common Travel Insurance Pitfalls

Understanding common pitfalls can help you avoid costly mistakes and ensure your policy protects you as intended.

- Reading the Fine Print: Don’t just skim the policy document. Read it thoroughly, paying close attention to exclusions, limitations, and waiting periods.

- Not Disclosing Pre-Existing Conditions: Failing to disclose pre-existing medical conditions can invalidate your policy. Be honest and transparent with your insurer.

- Waiting Until the Last Minute: Don’t wait until the last minute to purchase travel insurance. You may face higher premiums or be denied coverage if you buy it too close to your departure date.

- Overlooking the Excess: Understand the excess, or deductible, you’ll need to pay in case of a claim. Consider a policy with a lower excess if you’re concerned about out-of-pocket costs.

- Assuming Your Credit Card Provides Enough Coverage: Credit cards often provide some travel insurance, but it’s usually limited. Check the terms and conditions carefully and consider additional coverage if necessary.

Understanding Travel Insurance Exclusions

Travel insurance policies typically have exclusions that limit coverage. It’s crucial to understand these exclusions to avoid surprises when making a claim.

- Pre-Existing Conditions: Most policies exclude pre-existing medical conditions unless you declare them and pay an additional premium.

- Dangerous Activities: Activities like skydiving, scuba diving, and extreme sports are often excluded unless you purchase specific coverage.

- Natural Disasters: Some policies may exclude coverage for events like earthquakes, volcanic eruptions, or tsunamis, depending on the specific circumstances.

- Acts of Terrorism: Coverage for terrorism-related incidents may be limited or excluded, depending on the insurer and policy.

- Political Unrest: Travel insurance may not cover events like civil unrest, riots, or coups, depending on the specific policy and circumstances.

Ensuring Adequate Travel Insurance Coverage

To ensure you have sufficient travel insurance coverage, consider these factors:

- Destination: The type of coverage you need will vary depending on your destination. Research the specific risks and requirements of your chosen country.

- Trip Duration: Longer trips require more extensive coverage. Consider a policy with a longer duration or a multi-trip policy for frequent travelers.

- Activities: If you plan to engage in risky activities, ensure your policy covers them. You may need to purchase additional coverage for specific activities.

- Medical Expenses: Consider the cost of medical care in your destination. Ensure your policy provides adequate coverage for medical expenses, including repatriation.

- Personal Belongings: Choose a policy with sufficient coverage for your personal belongings, including luggage, electronics, and valuables.

Seeking Professional Travel Insurance Advice

When in doubt, seek professional advice from a travel insurance broker or financial advisor. They can help you understand the complexities of travel insurance and choose a policy that meets your specific needs.

Final Wrap-Up

Choosing the right travel insurance plan in Australia is essential for a worry-free trip. By understanding the factors that influence cost, comparing different providers, and carefully reviewing policy terms and conditions, you can find a plan that offers the coverage you need at a price that fits your budget. Remember to consider your individual needs, travel plans, and potential risks, and don’t hesitate to seek professional advice for personalized recommendations. With the right travel insurance, you can explore the world with peace of mind, knowing you’re protected from the unexpected.

Answers to Common Questions

What is the average cost of travel insurance in Australia?

The average cost of travel insurance in Australia can vary widely depending on factors like your age, destination, and the level of coverage you choose. However, you can generally expect to pay anywhere from $50 to $500 or more for a single-trip policy.

Can I get travel insurance if I have a pre-existing medical condition?

Yes, you can usually get travel insurance with a pre-existing medical condition. However, you may need to disclose your condition and pay a higher premium. Some insurers may even have specific exclusions for certain conditions.

Is travel insurance mandatory for travel to Australia?

While travel insurance is not mandatory for travel to Australia, it is highly recommended. It can protect you from unexpected events and financial losses that could occur during your trip. Some countries may require proof of travel insurance before granting entry.

What happens if I need to make a claim on my travel insurance?

If you need to make a claim on your travel insurance, you’ll need to contact your insurer and provide them with the necessary documentation. The claim process can vary depending on the insurer and the type of claim. It’s important to keep all relevant receipts and documentation for your claim.