How much is business insurance in Australia? It’s a question that many entrepreneurs and business owners ask themselves. The cost of business insurance can vary greatly depending on a number of factors, including the type of business, its size, its location, and its risk profile. Understanding these factors and how they influence insurance costs is essential for making informed decisions about your business’s insurance needs.

Business insurance is a crucial investment for any Australian company. It provides financial protection against a wide range of risks, such as property damage, legal liability, and employee injuries. By safeguarding your business from potential financial losses, insurance can help you stay afloat in the face of unexpected challenges.

Introduction

Running a business in Australia comes with its fair share of risks. From unexpected accidents to legal disputes, these unforeseen events can significantly impact your business’s financial stability. This is where business insurance plays a crucial role. It acts as a safety net, providing financial protection against potential risks and helping you mitigate the impact of unexpected events.

Business insurance is an essential investment for Australian businesses of all sizes. It safeguards your assets, protects your finances, and provides peace of mind, allowing you to focus on growing your business.

Types of Business Insurance

Business insurance encompasses a wide range of policies designed to cover different aspects of your business operations. Understanding the various types available is essential to determine the right coverage for your specific needs.

- Public Liability Insurance: This policy protects your business against claims arising from injuries or property damage caused by your business activities to third parties. For instance, if a customer slips and falls on your premises, public liability insurance would cover legal costs and compensation.

- Product Liability Insurance: This policy covers your business against claims arising from defects in your products that cause injury or damage to customers. It’s particularly crucial for businesses manufacturing or selling products.

- Professional Indemnity Insurance: This policy protects your business against claims arising from professional negligence or errors in providing services. It’s essential for professionals like accountants, lawyers, and consultants.

- Workers Compensation Insurance: This policy covers your employees’ medical expenses and lost wages if they suffer an injury or illness at work. It’s mandatory for most businesses in Australia.

- Business Property Insurance: This policy covers your business premises, equipment, and stock against damage or loss caused by fire, theft, natural disasters, or other perils.

- Business Interruption Insurance: This policy provides financial compensation for lost income if your business is forced to close due to an insured event. It helps you cover ongoing expenses and maintain business continuity.

- Cyber Liability Insurance: This policy protects your business against financial losses resulting from cyberattacks, data breaches, or other cyber incidents. It’s becoming increasingly important as businesses rely more heavily on technology.

Factors Influencing Insurance Costs

The cost of business insurance varies depending on several factors. Understanding these factors can help you negotiate the best possible premium.

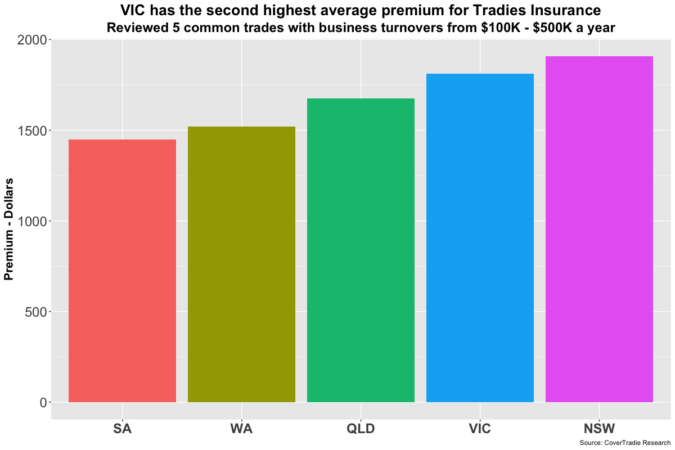

- Industry: Some industries are inherently riskier than others. For example, construction companies face higher risks than retail businesses, which will reflect in their insurance premiums.

- Business Size: Larger businesses with more employees and assets typically pay higher premiums than smaller businesses.

- Location: Businesses in high-risk areas, such as areas prone to natural disasters, may face higher premiums.

- Claims History: Businesses with a history of claims may face higher premiums, as insurers perceive them as higher risk.

- Risk Management Practices: Businesses with strong risk management practices, such as implementing safety procedures and security measures, may qualify for lower premiums.

- Coverage Limits: Higher coverage limits generally result in higher premiums, as insurers are assuming greater financial responsibility.

Key Factors Affecting Business Insurance Costs

The cost of business insurance in Australia is influenced by several key factors. These factors can significantly affect your premium, so understanding them is crucial for getting the right coverage at a reasonable price.

Business Size and Industry

The size and type of your business play a significant role in determining your insurance costs.

- Larger businesses with higher revenues generally face higher premiums due to the increased potential for larger claims. For example, a large construction company will likely have higher insurance premiums than a small retail store.

- Certain industries are considered riskier than others, leading to higher insurance premiums. For instance, businesses in industries like construction, manufacturing, or hospitality may face higher premiums due to the inherent risks associated with their operations.

Risk Assessment and Claims History

Insurance companies assess the risks associated with your business to determine your premium.

- A comprehensive risk assessment helps identify potential hazards and vulnerabilities. This can include factors like the type of equipment used, the work environment, and the number of employees. Based on this assessment, insurers can tailor your coverage and premiums accordingly.

- Your business’s claims history also impacts your premiums. Businesses with a history of frequent or large claims may face higher premiums as they are perceived as higher risk.

Types of Insurance Policies

The type of insurance policy you choose also affects the cost.

- Comprehensive policies that cover a wide range of risks generally cost more than policies with limited coverage. For instance, a comprehensive business insurance policy that covers property damage, liability, and business interruption will be more expensive than a policy that only covers property damage.

- Policies with higher coverage limits, such as higher liability limits, will also result in higher premiums. However, these policies offer greater protection against significant financial losses.

Common Types of Business Insurance in Australia

A variety of business insurance policies are available in Australia to protect businesses from various risks. These policies provide financial protection and peace of mind, helping businesses to manage potential losses and continue operations in the face of unexpected events.

Public Liability Insurance

Public liability insurance is essential for businesses that interact with the public, as it covers legal costs and compensation claims arising from injuries or property damage caused by the business’s negligence. This insurance protects businesses from financial ruin in the event of a lawsuit.

Workers’ Compensation Insurance

Workers’ compensation insurance is mandatory for most businesses in Australia and covers medical expenses, lost wages, and rehabilitation costs for employees who suffer injuries or illnesses at work. This insurance ensures that employees are financially supported during their recovery and protects businesses from liability for work-related injuries.

Property Insurance

Property insurance protects businesses from financial losses caused by damage to their physical assets, such as buildings, equipment, and inventory. This insurance covers risks like fire, theft, natural disasters, and vandalism, ensuring that businesses can rebuild or replace damaged assets.

Business Interruption Insurance

Business interruption insurance covers the loss of income and ongoing expenses that a business incurs when it is forced to shut down due to an insured event, such as a fire or natural disaster. This insurance helps businesses to maintain cash flow and stay afloat during a period of disruption.

Cyber Liability Insurance

Cyber liability insurance protects businesses from financial losses caused by cyberattacks, such as data breaches, ransomware attacks, and system failures. This insurance covers costs related to data recovery, legal expenses, and regulatory fines.

Professional Indemnity Insurance

Professional indemnity insurance protects businesses that provide professional services, such as accountants, lawyers, and consultants, from claims arising from negligence or errors in their work. This insurance covers legal costs and compensation claims made by clients who have suffered financial losses due to professional misconduct.

Product Liability Insurance, How much is business insurance in australia

Product liability insurance protects businesses that manufacture or sell products from claims arising from injuries or damages caused by defective products. This insurance covers legal costs and compensation claims made by consumers who have been harmed by a product.

Motor Vehicle Insurance

Motor vehicle insurance protects businesses from financial losses caused by accidents involving company vehicles. This insurance covers damages to the vehicle, injuries to drivers and passengers, and liability claims made by third parties.

Other Types of Business Insurance

There are several other types of business insurance available in Australia, depending on the specific risks faced by a business. These include:

- Management Liability Insurance: Protects businesses from claims made against directors and officers for negligence or misconduct.

- Crime Insurance: Covers losses caused by theft, fraud, or embezzlement.

- Marine Insurance: Protects businesses involved in shipping or transportation of goods.

- Travel Insurance: Protects employees who travel for business purposes.

Obtaining Business Insurance Quotes

Getting quotes for business insurance is crucial for securing the right coverage at a competitive price. By understanding the process and making informed decisions, you can ensure you have the necessary protection for your business.

Finding Reliable Insurance Brokers and Providers

Finding reliable insurance brokers and providers is an important first step in obtaining quotes. Brokers act as intermediaries, helping you find the best insurance options based on your specific needs. They can access a wide range of insurance providers and negotiate on your behalf.

- Seek recommendations: Ask fellow business owners, industry associations, or professional networks for recommendations on trusted brokers or providers.

- Check online reviews and ratings: Websites like Google My Business, Trustpilot, and Canstar provide reviews and ratings from previous customers, offering insights into the reputation and reliability of brokers and providers.

- Verify licenses and accreditations: Ensure that the broker or provider is licensed and accredited by the relevant regulatory bodies, such as the Australian Securities and Investments Commission (ASIC) for financial services.

- Look for specialized expertise: Consider brokers or providers specializing in your industry, as they have a deeper understanding of your specific risks and insurance requirements.

Obtaining Quotes from Different Insurers

Once you’ve identified potential brokers or providers, it’s time to start gathering quotes. To get accurate quotes, be prepared to provide detailed information about your business, including:

- Business type and industry: This helps insurers assess the level of risk associated with your business.

- Location and size: The location and size of your business can influence the cost of insurance.

- Revenue and employees: This information helps insurers determine the potential financial impact of a claim.

- Existing insurance policies: Providing details of your current insurance policies can help insurers understand your coverage needs and identify potential gaps.

Comparing Quotes and Understanding Policy Terms

After receiving quotes from different insurers, it’s essential to compare them carefully and understand the policy terms.

- Compare premiums: Look at the annual premiums for each policy and consider the coverage offered. The lowest premium may not always be the best option if the coverage is inadequate.

- Review coverage limits and deductibles: Understand the maximum amount of coverage provided by each policy and the amount you’ll need to pay out of pocket before the insurance kicks in.

- Read the policy documents: Carefully read the policy documents to understand the specific terms and conditions, including exclusions, limitations, and claim procedures.

- Ask questions: Don’t hesitate to ask the broker or provider any questions you have about the policy terms or coverage.

Remember, the cheapest policy isn’t always the best option. It’s crucial to choose a policy that provides adequate coverage at a price you can afford.

Tips for Reducing Business Insurance Costs

While business insurance is essential for protecting your company, it’s natural to want to keep premiums as low as possible. By implementing strategic measures, you can significantly reduce your insurance costs without compromising coverage.

Risk Management Practices

Proactive risk management is the cornerstone of reducing insurance premiums. By identifying and mitigating potential risks, you demonstrate to insurers that your business is well-managed and less likely to experience claims.

- Conduct regular risk assessments: Identify potential hazards and vulnerabilities within your operations, workplace, and products or services.

- Implement safety protocols: Develop and enforce comprehensive safety procedures to minimize accidents, injuries, and property damage. This could include safety training for employees, regular equipment maintenance, and adherence to industry standards.

- Improve security measures: Invest in security systems, surveillance, and access control to deter theft, vandalism, and other security breaches. This can include alarms, CCTV systems, and secure storage facilities.

- Maintain accurate records: Keep detailed records of all incidents, accidents, and near misses. This helps you track trends, identify potential issues, and demonstrate your commitment to safety and risk management.

Negotiating Insurance Terms and Conditions

Understanding the intricacies of your insurance policy and effectively negotiating with insurers can lead to substantial savings.

- Shop around for quotes: Obtain quotes from multiple insurers to compare coverage, premiums, and policy terms.

- Negotiate deductibles: Higher deductibles generally result in lower premiums. Consider your risk tolerance and financial capacity when determining the appropriate deductible level.

- Bundle policies: Combining multiple insurance policies, such as business property and liability insurance, with the same insurer can often result in discounts.

- Review your policy regularly: Ensure that your coverage remains adequate and that you are not paying for unnecessary or outdated coverage.

Other Cost-Saving Strategies

Beyond risk management and negotiation, there are additional strategies you can employ to reduce business insurance costs.

- Improve your credit score: Insurers often consider your credit score when determining premiums. Maintaining a good credit history can lead to lower rates.

- Invest in employee training: Well-trained employees are less likely to make mistakes that could lead to accidents or claims.

- Consider alternative risk transfer mechanisms: Explore options like captive insurance companies or self-insurance to potentially reduce costs, but only after careful consideration and consultation with an insurance professional.

Final Summary

Ultimately, the cost of business insurance in Australia is a reflection of the unique risks your business faces. By understanding these risks and taking steps to mitigate them, you can potentially reduce your insurance premiums. Working with a reputable insurance broker or provider can help you navigate the complexities of business insurance and find the right coverage for your specific needs.

Question Bank: How Much Is Business Insurance In Australia

What are the main types of business insurance in Australia?

Common types include public liability, workers’ compensation, property insurance, professional indemnity, and cyber liability insurance. The specific types you need will depend on your industry and the risks your business faces.

How can I get a quote for business insurance?

Contact multiple insurance brokers or providers directly. Be sure to provide them with accurate information about your business, including its size, industry, and location. You can also use online comparison websites to get quotes from various insurers.

What are some tips for reducing my business insurance costs?

Implement strong risk management practices, maintain a good claims history, consider increasing your deductible, and shop around for the best rates.