How much is dental insurance in Australia? This is a question many Australians ask themselves, especially when faced with the prospect of unexpected dental bills. Dental insurance can provide a safety net, helping you manage costs and access essential dental care. Understanding the different types of plans, factors influencing costs, and the coverage provided is key to making an informed decision.

This guide will delve into the intricacies of dental insurance in Australia, offering insights into the various plan options, cost considerations, and benefits. We’ll explore the essential steps for finding a suitable plan, demystify coverage and exclusions, and highlight the advantages of having dental insurance. By the end, you’ll be equipped with the knowledge to navigate the world of dental insurance and make informed choices for your oral health.

Dental Insurance Basics in Australia

Dental insurance in Australia can be a valuable investment, offering financial protection against the often-high costs of dental care. It can help cover a wide range of procedures, from routine checkups and cleanings to more complex treatments like crowns, bridges, and implants. However, the coverage and benefits offered vary depending on the type of plan you choose.

Types of Dental Insurance Plans in Australia

Dental insurance plans in Australia are broadly categorized into two main types:

- Hospital and Extras Cover: These comprehensive plans, offered by private health insurers, typically include hospital cover and extras benefits. Extras benefits can include dental coverage, with varying levels of coverage depending on the specific plan.

- Standalone Dental Insurance: These plans, offered by dedicated dental insurers, focus solely on dental coverage. They often provide more tailored dental benefits and may be more cost-effective for individuals who prioritize dental care.

Key Features and Benefits of Dental Insurance Plans

Dental insurance plans can provide various benefits, including:

- Coverage for Routine Checkups and Cleanings: Most dental insurance plans cover routine dental checkups and cleanings, helping you maintain good oral health and prevent more serious dental problems.

- Coverage for Basic Dental Procedures: Many plans cover basic procedures like fillings, extractions, and root canals, reducing the out-of-pocket costs for these essential treatments.

- Coverage for Major Dental Procedures: Some plans offer coverage for major dental procedures like crowns, bridges, and implants, although the level of coverage can vary significantly.

- Discounts on Dental Services: Dental insurance plans may offer discounts on dental services, allowing you to access affordable dental care from participating dentists.

- Access to a Network of Dentists: Dental insurance plans often have a network of participating dentists who offer discounted rates to policyholders.

Common Dental Insurance Terms and Definitions

| Term | Definition | Example | Notes |

|---|---|---|---|

| Annual Limit | The maximum amount your insurer will pay towards your dental expenses in a year. | $1,000 annual limit | This limit applies to all dental services covered by the plan. |

| Waiting Period | The time you must wait before your dental insurance coverage begins. | 12-month waiting period for major dental procedures | Waiting periods vary depending on the type of dental procedure and the insurer. |

| Excess | The amount you pay out-of-pocket before your insurance coverage kicks in. | $100 excess per dental claim | Excess amounts can vary depending on the plan and the type of dental procedure. |

| Benefit Limits | The maximum amount your insurer will pay for a specific dental procedure. | $500 benefit limit for crowns | Benefit limits may vary depending on the plan and the type of dental procedure. |

Factors Influencing Dental Insurance Costs

The cost of dental insurance premiums in Australia can vary significantly depending on a number of factors. Understanding these factors can help you choose a plan that meets your needs and budget.

Age

Your age is a significant factor in determining your dental insurance premium. Generally, younger individuals tend to have lower premiums compared to older individuals. This is because younger people are statistically less likely to require extensive dental treatments. As you age, the risk of needing more dental care increases, which in turn reflects in higher premiums.

Location

The cost of dental insurance can also vary depending on your location. Premiums tend to be higher in metropolitan areas compared to regional areas. This is because the cost of living, including healthcare costs, is typically higher in cities.

Dental History

Your dental history plays a significant role in determining your premium. If you have a history of dental problems, you may be considered a higher risk and therefore pay higher premiums. Conversely, if you have a good dental history with minimal or no past issues, you may be eligible for lower premiums.

Coverage Level

The level of coverage you choose also influences your premium. Higher coverage levels, offering more comprehensive dental benefits, will generally result in higher premiums. Conversely, basic plans with limited coverage will have lower premiums.

Table: Average Dental Insurance Costs

| Age Group | Coverage Level | Average Premium | Notes |

|---|---|---|---|

| 18-30 | Basic | $20 – $40 per month | May cover routine checkups and cleanings. |

| 18-30 | Comprehensive | $50 – $80 per month | May cover a wider range of services, including major dental work. |

| 31-50 | Basic | $30 – $50 per month | May cover routine checkups and cleanings. |

| 31-50 | Comprehensive | $70 – $100 per month | May cover a wider range of services, including major dental work. |

| 51+ | Basic | $40 – $60 per month | May cover routine checkups and cleanings. |

| 51+ | Comprehensive | $90 – $120 per month | May cover a wider range of services, including major dental work. |

Finding the Right Dental Insurance Plan

Finding the right dental insurance plan can feel overwhelming, but it doesn’t have to be. By taking a strategic approach, you can ensure you select a plan that meets your individual needs and budget.

Steps to Finding a Suitable Dental Insurance Plan

To find a suitable dental insurance plan, follow these essential steps:

- Assess your dental needs: Consider your current dental health, any potential future treatments you might require, and your typical dental care expenses.

- Determine your budget: Decide how much you’re comfortable spending on dental insurance premiums and out-of-pocket costs.

- Research different insurance providers: Compare plans from various reputable providers, including Medibank, Bupa, and NIB.

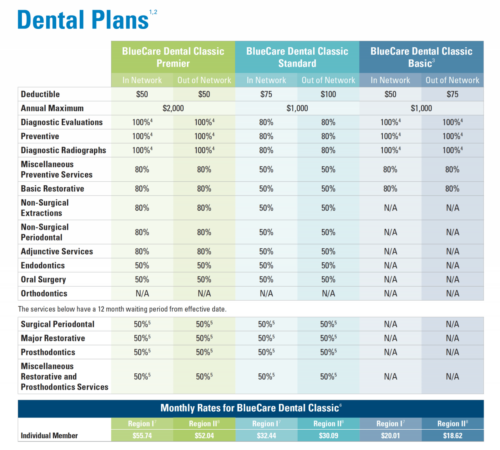

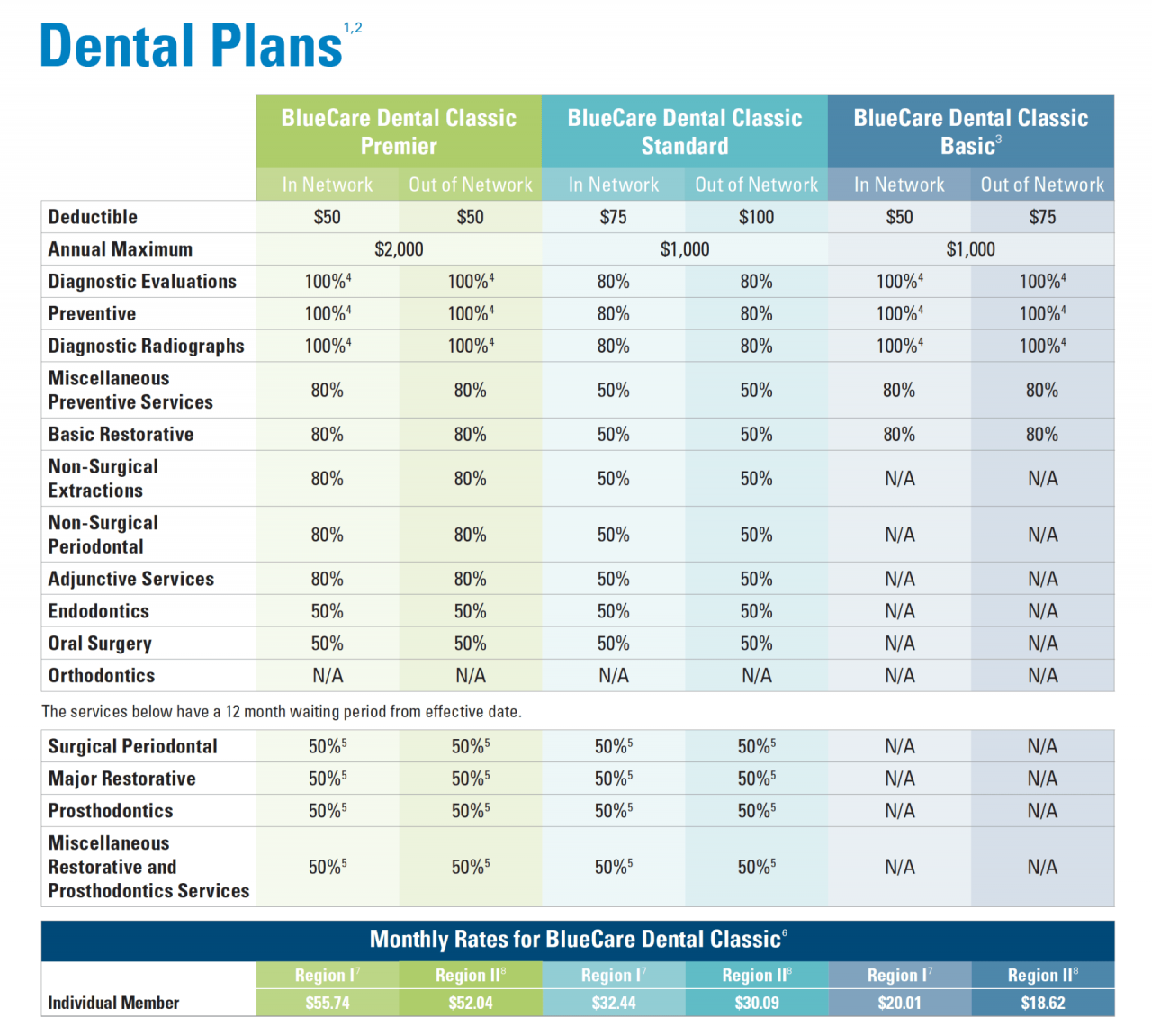

- Compare coverage and benefits: Carefully examine the coverage details of each plan, including annual limits, waiting periods, and the types of dental treatments covered.

- Check provider networks: Ensure your preferred dentists are part of the provider network for the plan you choose.

- Read the fine print: Pay close attention to the terms and conditions of each policy, including exclusions and limitations.

- Seek professional advice: Consult with a financial advisor or insurance broker to get personalized guidance and recommendations.

Comparing Dental Insurance Plans

Once you have a list of potential plans, use the following criteria to compare them:

- Coverage: Evaluate the types of dental treatments covered, including checkups, cleanings, fillings, crowns, and dentures.

- Annual limits: Determine the maximum amount the plan will cover for dental expenses each year.

- Waiting periods: Understand how long you need to wait before certain treatments are covered.

- Out-of-pocket costs: Calculate your expected out-of-pocket expenses, including premiums, co-payments, and excess fees.

- Provider reputation: Research the reputation of the insurance provider, considering factors like customer satisfaction and claim processing efficiency.

Decision-Making Flowchart

The following flowchart illustrates a step-by-step process for selecting a dental insurance plan:

[Flowchart Illustration]

* Start: Assess your dental needs and budget.

* Research: Identify potential insurance providers and compare their plans.

* Compare: Evaluate coverage, annual limits, waiting periods, out-of-pocket costs, and provider reputation.

* Choose: Select the plan that best meets your needs and budget.

* Enroll: Complete the enrollment process and ensure you understand the policy terms.

* Review: Regularly review your plan to ensure it continues to meet your needs.

* End:

Dental Insurance Coverage and Exclusions

Dental insurance in Australia can cover a wide range of procedures, but it’s important to understand what’s included and what’s not. Coverage varies depending on the specific plan you choose, so it’s crucial to read the policy details carefully.

Commonly Covered Procedures

Dental insurance plans typically cover a range of common dental procedures, including:

- Check-ups and Cleanings: Most plans cover regular check-ups and cleanings, often with no or minimal out-of-pocket costs.

- Fillings: Plans generally cover fillings for cavities, with varying levels of coverage for different types of fillings (e.g., composite, amalgam).

- Extractions: Coverage for tooth extractions is common, but may be limited to certain types of extractions or require pre-authorization.

- Root Canals: Many plans cover root canals, a procedure to repair a damaged tooth, often with a co-payment or waiting period.

- Crowns and Bridges: Some plans offer coverage for crowns and bridges, but this coverage often has limitations, such as a waiting period or a maximum benefit amount.

- Dentures: Coverage for dentures can vary widely. Some plans may cover a portion of the cost, while others may not cover dentures at all.

Typical Exclusions and Limitations

While dental insurance offers valuable protection, it’s essential to be aware of common exclusions and limitations:

- Cosmetic Procedures: Most dental insurance plans do not cover purely cosmetic procedures, such as teeth whitening, veneers, or implants for purely aesthetic reasons.

- Pre-Existing Conditions: Some plans may exclude coverage for pre-existing dental conditions, such as gum disease or severe tooth decay, requiring a waiting period or pre-authorization.

- Waiting Periods: Many plans have waiting periods before certain procedures are covered. For example, there might be a waiting period before you can claim for major procedures like crowns or dentures.

- Benefit Limits: Most plans have annual or lifetime benefit limits, meaning there’s a maximum amount they will pay for certain procedures. This means you may be responsible for some of the costs if the procedure exceeds the limit.

- Excesses and Co-payments: Dental insurance plans often have excesses, which are the amount you pay before the insurance starts covering costs. They also have co-payments, which are a fixed amount you pay for each service. These can vary depending on the plan and the procedure.

- Exclusions for Specific Procedures: Some plans may exclude coverage for specific procedures, such as wisdom tooth extractions, orthodontics (braces), or dental implants. It’s essential to check the policy details to understand what is covered.

Typical Coverage for Different Dental Procedures, How much is dental insurance in australia

| Procedure | Coverage Level | Typical Cost | Notes |

|---|---|---|---|

| Check-up and Cleaning | Generally covered with minimal out-of-pocket costs | $100-$200 | May require co-payment or excess |

| Fillings | Partial or full coverage depending on the type of filling | $150-$500 | May have a waiting period |

| Extractions | Covered with varying levels of coverage depending on the type of extraction | $200-$1000 | May require pre-authorization |

| Root Canals | Partial or full coverage, often with a co-payment or waiting period | $500-$1500 | Coverage may be limited depending on the plan |

| Crowns | Partial or full coverage, with limitations on the number of crowns covered | $1000-$2000 | May have a waiting period and a maximum benefit amount |

| Bridges | Partial or full coverage, with limitations on the number of bridges covered | $1500-$3000 | May have a waiting period and a maximum benefit amount |

| Dentures | Coverage varies widely, some plans may cover a portion of the cost | $2000-$5000 | Coverage may be limited or excluded depending on the plan |

Benefits of Dental Insurance in Australia: How Much Is Dental Insurance In Australia

Dental insurance in Australia offers numerous benefits for individuals and families, providing financial protection and promoting preventative care. It can significantly ease the burden of unexpected dental expenses and encourage regular check-ups, leading to better oral health outcomes.

Financial Protection

Dental insurance acts as a financial safety net, shielding individuals and families from the potentially high costs associated with dental procedures. It helps manage unexpected dental expenses, ensuring that individuals can access necessary treatment without experiencing financial strain.

- Coverage for Major Procedures: Dental insurance often covers a significant portion of the costs for major dental procedures, such as crowns, implants, and root canals. This can significantly reduce the out-of-pocket expenses for individuals, making essential treatments more affordable.

- Preventative Care Benefits: Dental insurance plans typically cover regular check-ups, cleanings, and x-rays. These preventative services are crucial for maintaining good oral health and can help detect potential problems early, reducing the need for more extensive and costly procedures in the future.

- Reduced Out-of-Pocket Expenses: Dental insurance helps individuals manage their out-of-pocket expenses for dental care. This can be particularly beneficial for families with children, as they often require more frequent dental visits.

Promoting Preventative Care

Dental insurance encourages individuals to prioritize preventative care, leading to better oral health and reduced long-term dental costs. By covering regular check-ups and cleanings, insurance plans incentivize individuals to maintain their oral health, reducing the likelihood of developing serious dental problems in the future.

- Early Detection and Prevention: Regular dental check-ups and cleanings covered by insurance allow dentists to detect potential problems early, enabling prompt treatment and preventing the development of more serious and costly issues. This proactive approach to dental care can save individuals significant expenses in the long run.

- Reduced Risk of Complications: Preventative care, such as regular cleanings and check-ups, helps reduce the risk of developing complications like gum disease or tooth decay. This can lead to lower healthcare costs and improved overall well-being.

- Improved Oral Health Outcomes: By encouraging preventative care, dental insurance contributes to better oral health outcomes. Regular dental visits allow dentists to identify and address potential issues before they become more severe, leading to a healthier smile and overall health.

Final Summary

In conclusion, dental insurance in Australia can provide peace of mind and financial protection for your oral health. By carefully considering your needs, comparing plans, and understanding the factors that influence costs, you can find a plan that fits your budget and provides the coverage you require. Remember, investing in dental insurance is an investment in your overall well-being, ensuring access to preventive care and helping you manage unexpected dental expenses.

Helpful Answers

What is the average cost of dental insurance in Australia?

The average cost of dental insurance in Australia varies depending on factors like age, coverage level, and the insurer. You can expect to pay anywhere from $50 to $200 per month.

How do I know if I need dental insurance?

If you are concerned about the cost of dental care, have a history of dental problems, or want to ensure access to regular checkups and preventive treatments, dental insurance can be a valuable investment.

What are some common dental procedures covered by insurance?

Most dental insurance plans cover basic procedures like checkups, cleanings, fillings, and extractions. Some plans may also cover more extensive treatments like crowns, bridges, and dentures, but coverage may vary.

How can I compare different dental insurance plans?

Use online comparison websites, contact insurers directly, or speak to a financial advisor to compare plans based on coverage, cost, and provider reputation.