- Understanding Texas Health Insurance Landscape

- Factors Influencing Health Insurance Costs in Texas

- Exploring Affordable Health Insurance Options in Texas

- Navigating the Health Insurance Purchasing Process in Texas

- Resources and Support for Texas Health Insurance Consumers: How Much Is Health Insurance In Texas

- Final Conclusion

- FAQ Corner

How much is health insurance in Texas? It’s a question many Texans ask themselves, especially given the state’s diverse health insurance landscape. From individual plans to employer-sponsored coverage and government programs, there’s a range of options to consider. Understanding the factors that influence costs, such as age, location, health status, and plan features, is crucial in making informed decisions. This guide will delve into the intricacies of Texas health insurance, exploring the various plans, cost determinants, and resources available to help you navigate this complex system.

Navigating the Texas health insurance market can feel overwhelming, but it doesn’t have to be. With a clear understanding of the available options, the factors impacting costs, and the resources at your disposal, you can find the coverage that best meets your needs and budget. This guide aims to empower you with the knowledge you need to make informed decisions about your health insurance in Texas.

Understanding Texas Health Insurance Landscape

Navigating the world of health insurance in Texas can feel overwhelming, but understanding the different plan types, providers, and regulations can help you make informed decisions. This section delves into the key aspects of the Texas health insurance landscape.

Types of Health Insurance Plans in Texas

Texas offers a diverse range of health insurance plans to suit various needs and budgets. Here’s a breakdown of the common plan types:

- Individual Health Insurance: These plans are purchased by individuals directly from insurance companies, offering flexibility in choosing coverage and providers. They are ideal for self-employed individuals or those not covered by employer-sponsored plans.

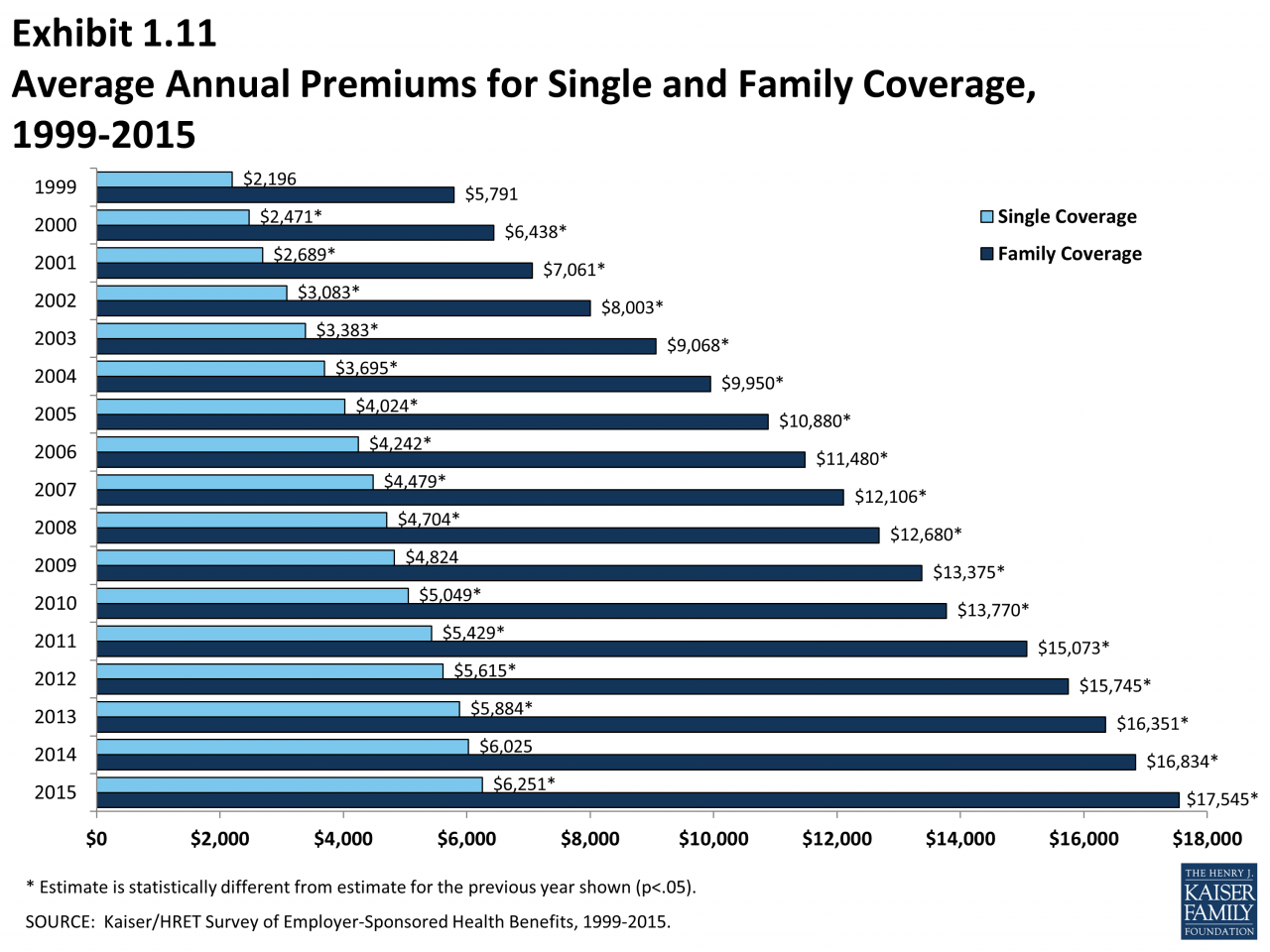

- Family Health Insurance: Similar to individual plans, but designed to cover multiple family members. These plans offer coverage for spouses and dependents, providing comprehensive protection for the entire family.

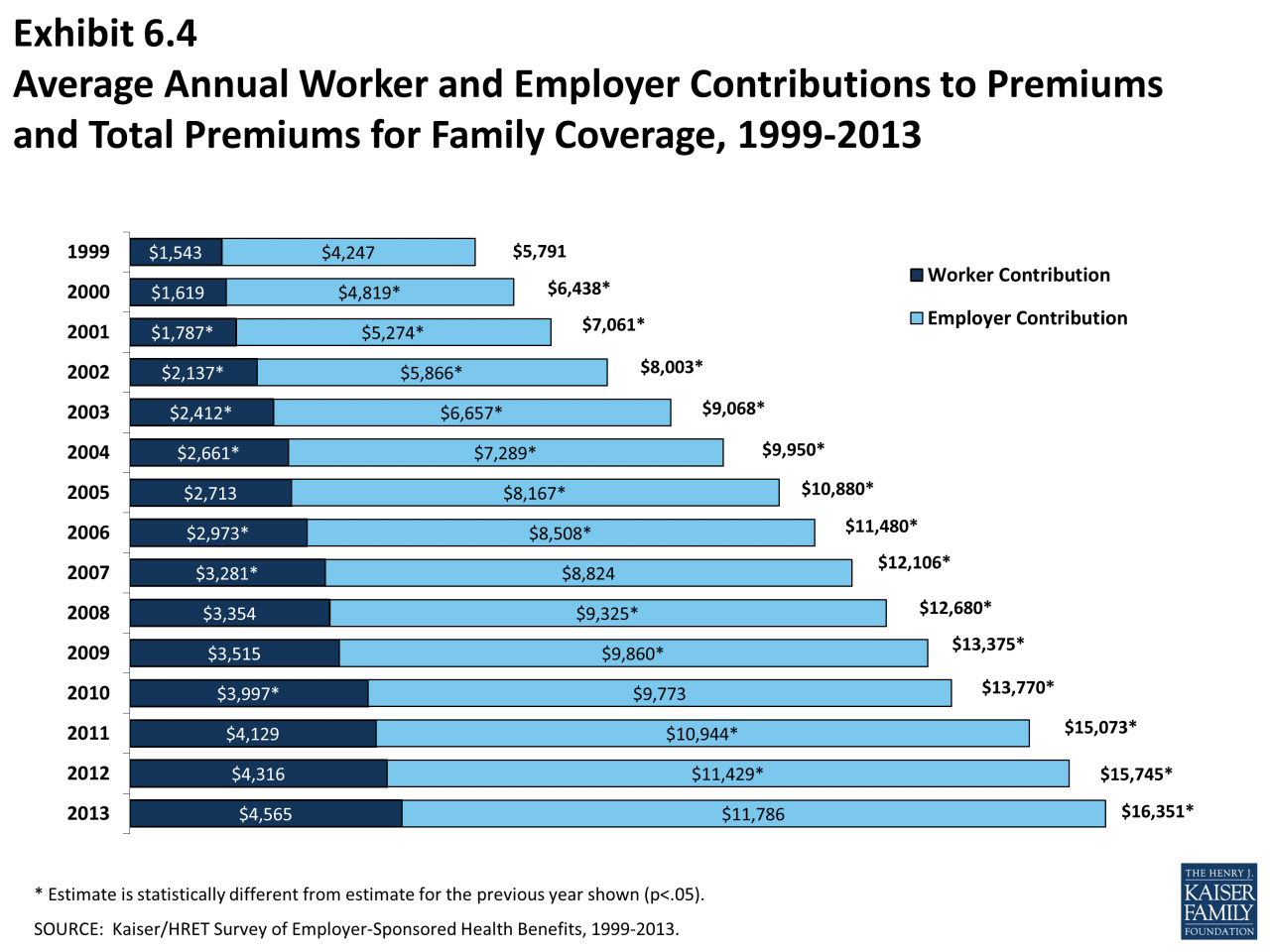

- Employer-Sponsored Health Insurance: Many Texas employers offer health insurance plans as part of their employee benefits package. These plans typically provide group coverage, often with lower premiums and wider networks compared to individual plans.

- Government-Funded Health Insurance: For low-income Texans, the government offers programs like Medicaid and CHIP (Children’s Health Insurance Program). These programs provide subsidized health insurance, ensuring access to essential medical care.

Major Health Insurance Providers in Texas

The Texas health insurance market is dominated by several major providers, each with its own market share and unique features. Here’s a look at some prominent players:

- Blue Cross Blue Shield of Texas: With a substantial market share, Blue Cross Blue Shield of Texas is a leading provider known for its extensive network and diverse plan options.

- UnitedHealthcare: Another major player, UnitedHealthcare offers a wide range of plans, including individual, family, and employer-sponsored options, along with a robust network of providers.

- Cigna: Cigna focuses on providing comprehensive health insurance plans, including dental and vision coverage, with a strong emphasis on preventive care and wellness programs.

- Aetna: Aetna is recognized for its extensive provider network and innovative health management programs, offering a range of plans tailored to individual needs.

- Humana: Humana specializes in Medicare Advantage plans, catering to seniors and individuals eligible for Medicare, offering a variety of plan options and benefits.

Texas Health Insurance Market Regulations

The Texas health insurance market is subject to regulations that govern coverage, costs, and consumer protection. Key aspects include:

- Open Enrollment Period: Texans have a specific period each year to enroll in or change health insurance plans, ensuring they have access to coverage options.

- Essential Health Benefits: The Affordable Care Act mandates that all health insurance plans cover essential health benefits, including preventive care, hospitalization, and prescription drugs.

- Pre-Existing Conditions: Insurers cannot deny coverage or charge higher premiums based on pre-existing conditions, protecting individuals with health concerns.

- Market Stability Program: The Texas Legislature created a market stability program to help stabilize the individual health insurance market and ensure affordable premiums for Texans.

Factors Influencing Health Insurance Costs in Texas

Several factors influence the cost of health insurance in Texas. These factors can be categorized into personal characteristics, plan coverage options, and pre-existing conditions. Understanding these factors can help individuals make informed decisions about their health insurance choices.

Impact of Personal Characteristics on Health Insurance Premiums

Personal characteristics play a significant role in determining health insurance premiums. Factors such as age, location, health status, and family size influence the cost of coverage.

- Age: Generally, older individuals tend to have higher health insurance premiums compared to younger individuals. This is because older individuals are statistically more likely to require healthcare services due to age-related health conditions.

- Location: The cost of health insurance can vary significantly depending on the location in Texas. Areas with higher healthcare costs, such as major cities, typically have higher insurance premiums.

- Health Status: Individuals with pre-existing health conditions often face higher premiums. Insurance companies consider the likelihood of requiring healthcare services based on an individual’s health history.

- Family Size: The number of people covered under a health insurance plan also affects premiums. Larger families typically have higher premiums due to the increased likelihood of healthcare utilization.

Influence of Plan Coverage Options on Premium Costs

Health insurance plans offer various coverage options, which directly impact the cost of premiums. These options include deductibles, copayments, and out-of-pocket maximums.

- Deductibles: A deductible is the amount an individual must pay out-of-pocket before their health insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

- Copayments: Copayments are fixed amounts paid by individuals for specific healthcare services, such as doctor’s visits or prescription drugs. Plans with higher copayments generally have lower premiums.

- Out-of-Pocket Maximums: An out-of-pocket maximum represents the maximum amount an individual must pay for healthcare costs in a given year. Plans with lower out-of-pocket maximums usually have higher premiums.

Role of Pre-existing Conditions and Coverage Limitations

Pre-existing conditions, such as diabetes or heart disease, can significantly influence health insurance costs. Insurance companies may charge higher premiums or impose coverage limitations for individuals with pre-existing conditions.

“The Affordable Care Act (ACA) prohibits insurance companies from denying coverage or charging higher premiums based solely on pre-existing conditions.”

However, some plans may have limitations on coverage for specific pre-existing conditions, which can impact the overall cost of healthcare.

Exploring Affordable Health Insurance Options in Texas

Finding affordable health insurance in Texas can be a challenge, especially for individuals and families with limited income. Fortunately, several government programs and subsidies are available to help Texans access quality healthcare at a reasonable cost. This section explores these resources and provides guidance on navigating the Texas Health Insurance Marketplace.

Government Programs and Subsidies for Low-Income Texans

Texas offers various government programs and subsidies designed to make health insurance more accessible to low-income individuals and families. These programs can help cover the cost of premiums, deductibles, and copayments, making healthcare more affordable.

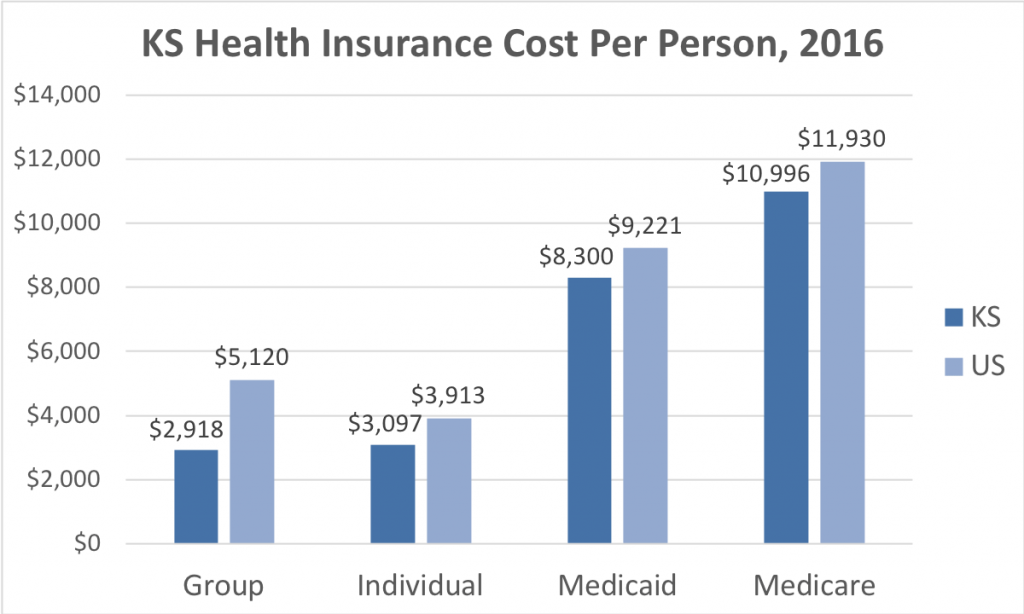

- Medicaid: This federal-state partnership provides health coverage to low-income individuals, families, children, pregnant women, and people with disabilities. Eligibility for Medicaid is based on income and family size. For example, in 2023, a single individual with an income of $18,720 or less qualifies for Medicaid in Texas. To apply for Medicaid, you can visit the Texas Health and Human Services website or contact your local county office.

- Children’s Health Insurance Program (CHIP): CHIP provides health insurance to children from families who earn too much to qualify for Medicaid but cannot afford private health insurance. The income limits for CHIP vary by state. In Texas, a family of four with an income of $50,600 or less may qualify for CHIP. You can apply for CHIP online through the Texas Health and Human Services website or by contacting your local county office.

- Premium Tax Credits: These tax credits are available through the Affordable Care Act (ACA) and can help reduce the cost of health insurance premiums. The amount of the tax credit depends on your income and family size. For instance, a single individual with an income of $51,040 in 2023 may be eligible for a premium tax credit. To access this credit, you must purchase your health insurance through the Texas Health Insurance Marketplace.

- Cost-Sharing Reductions: These subsidies help reduce the cost of deductibles, copayments, and coinsurance for individuals who qualify. The amount of the cost-sharing reduction depends on your income and family size. For instance, a single individual with an income of $30,000 or less may be eligible for cost-sharing reductions. These reductions are available to individuals who purchase their health insurance through the Texas Health Insurance Marketplace.

Finding and Applying for Health Insurance Through the Texas Health Insurance Marketplace

The Texas Health Insurance Marketplace, also known as Healthcare.gov, is a platform where individuals and families can compare and purchase health insurance plans from various insurance companies. This marketplace offers a range of plans, including bronze, silver, gold, and platinum, each with different levels of coverage and premiums.

- Create an Account: The first step is to create an account on Healthcare.gov. You will need to provide basic information, such as your name, address, and Social Security number.

- Provide Income and Family Information: Next, you will need to provide information about your income and family size. This information will be used to determine your eligibility for premium tax credits and cost-sharing reductions.

- Compare Plans: Once you have provided your information, you can use the marketplace’s tools to compare different health insurance plans. The marketplace displays plans from various insurance companies, allowing you to sort them by price, coverage, and other factors.

- Enroll in a Plan: Once you have chosen a plan, you can enroll in it through the marketplace. You can enroll during the open enrollment period, which runs from November 1st to January 15th each year.

Eligibility Criteria and Enrollment Periods for Specific Health Insurance Programs in Texas

Understanding the eligibility criteria and enrollment periods for specific health insurance programs in Texas is crucial for accessing the right coverage.

- Medicaid: Eligibility for Medicaid is based on income and family size. The income limits for Medicaid vary by state. In Texas, a single individual with an income of $18,720 or less qualifies for Medicaid in 2023. Medicaid enrollment is open year-round.

- CHIP: Eligibility for CHIP is based on income and family size. The income limits for CHIP vary by state. In Texas, a family of four with an income of $50,600 or less may qualify for CHIP. CHIP enrollment is open year-round.

- Texas Health Insurance Marketplace: The open enrollment period for the Texas Health Insurance Marketplace runs from November 1st to January 15th each year. During this period, you can enroll in a new health insurance plan or make changes to your existing plan. You may also be able to enroll outside of the open enrollment period if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

Navigating the Health Insurance Purchasing Process in Texas

Purchasing health insurance in Texas can seem daunting, but with a structured approach, it can be a manageable process. This section will guide you through the steps of selecting, comparing, and purchasing health insurance that meets your needs.

Understanding the Key Steps

The process of purchasing health insurance in Texas involves several key steps. These steps will help you find the best coverage at the most affordable price.

- Assess Your Needs: Determine your health insurance requirements based on your medical history, family size, and financial situation. Consider factors like coverage for preventive care, prescription drugs, and hospitalization.

- Explore Available Plans: Utilize online marketplaces like Healthcare.gov or Texas’s own marketplace, YourTexasBenefits.com, to browse available plans. You can also contact insurance brokers or agents for personalized guidance.

- Compare Plans and Costs: Compare different plans based on their premiums, deductibles, co-pays, and coverage details. Consider factors like network size, out-of-pocket maximums, and whether the plan covers your preferred doctors and hospitals.

- Enroll in a Plan: Once you’ve chosen a plan, you’ll need to enroll during the open enrollment period or during a special enrollment period if you qualify. Be sure to provide accurate information and review your application carefully before submitting it.

- Review Your Coverage: After enrolling, review your policy carefully to ensure you understand the terms and conditions. Familiarize yourself with your coverage limits, out-of-pocket expenses, and any exclusions.

Comparing Health Insurance Plans in Texas

Different health insurance plans offer varying levels of coverage and cost. Understanding the key features and benefits of each plan is crucial for making an informed decision. Here’s a table comparing some of the common health insurance plans available in Texas:

| Plan Type | Key Features | Costs | Benefits |

|---|---|---|---|

| Health Maintenance Organization (HMO) |

|

|

|

| Preferred Provider Organization (PPO) |

|

|

|

| Exclusive Provider Organization (EPO) |

|

|

|

| Point of Service (POS) |

|

|

|

Making the Right Choice

Choosing the most suitable health insurance plan requires careful consideration of your individual needs and preferences. Here’s a flowchart illustrating the decision-making process:

[Flowchart Image Description: The flowchart begins with a starting point “Health Insurance Decision-Making Process.” It branches into two paths: “Do you have a preferred doctor or hospital?” and “Are you on a tight budget?” If the answer to the first question is “Yes,” the flowchart leads to “Choose a plan with a network that includes your preferred provider.” If the answer is “No,” the flowchart leads to “Consider plans with a large network.” If the answer to the second question is “Yes,” the flowchart leads to “Explore HMOs or EPOs with lower premiums.” If the answer is “No,” the flowchart leads to “Consider PPOs or POS plans with greater flexibility.” Finally, all paths converge at “Compare plans based on premiums, deductibles, and coverage details.” The flowchart ends with “Choose the plan that best meets your needs and budget.”]

Resources and Support for Texas Health Insurance Consumers: How Much Is Health Insurance In Texas

Navigating the complex world of health insurance can be challenging, especially in a state like Texas with its diverse population and numerous options. Fortunately, Texans have access to a range of resources and support organizations designed to guide them through the process of choosing and enrolling in health insurance. These resources provide valuable information, assistance, and advocacy to ensure consumers make informed decisions that meet their individual needs and budgets.

State Agencies

State agencies play a crucial role in overseeing the health insurance market and providing support to consumers. The Texas Department of Insurance (TDI) is the primary regulatory body for health insurance in Texas.

- TDI offers a wealth of information on health insurance plans, consumer rights, and complaint resolution. You can find helpful resources on their website, including brochures, FAQs, and videos. TDI also provides a toll-free consumer hotline for questions and assistance.

- The Texas Health and Human Services Commission (HHSC) administers the state’s Medicaid and CHIP programs, providing health insurance coverage to low-income Texans. HHSC offers a variety of resources and services to help eligible individuals and families enroll in these programs.

Consumer Advocacy Groups

Consumer advocacy groups work independently to protect the rights of consumers and advocate for policies that promote affordable and accessible healthcare. These organizations offer valuable resources and support, including:

- Information and education on health insurance options and consumer rights.

- Assistance with navigating the enrollment process and resolving insurance-related issues.

- Advocacy for policies that improve access to affordable healthcare.

- The Texas Association of Health Plans (TAHP) is a trade association representing health insurance companies in Texas. While they advocate for the industry, they also offer consumer resources on their website, including information on health insurance plans and enrollment.

- The Texas Appleseed is a non-profit organization that works to ensure access to affordable healthcare for all Texans. They provide resources and advocacy on issues such as Medicaid expansion, access to mental health services, and consumer protection in the healthcare market.

- The Center for Public Policy Priorities (CPPP) is a non-profit research and advocacy organization that focuses on issues related to health, education, and economic opportunity in Texas. They conduct research and publish reports on health insurance affordability and access, providing valuable insights for policymakers and consumers.

Health Insurance Navigators, How much is health insurance in texas

Health insurance navigators are trained professionals who provide free and impartial assistance to consumers seeking health insurance. They help individuals understand their options, compare plans, and complete the enrollment process. Navigators are funded by the federal government and are available through various community organizations and health centers across Texas.

Healthcare Providers

Many healthcare providers, such as hospitals, clinics, and doctors’ offices, offer assistance with health insurance selection and enrollment. They may have staff dedicated to helping patients understand their insurance options and navigate the enrollment process. Some providers also offer financial assistance programs to help patients afford healthcare.

Insurance Brokers

Insurance brokers are licensed professionals who represent consumers in the health insurance market. They can help individuals compare plans from different insurance companies and find the best option for their needs and budget. Brokers are compensated by the insurance companies they represent, but they are legally obligated to act in the best interests of their clients.

Final Conclusion

Choosing the right health insurance plan in Texas is a significant decision that impacts your financial well-being and access to healthcare. By carefully considering the factors discussed in this guide, you can make an informed choice that aligns with your individual circumstances. Remember to leverage the resources available to you, including government programs, online marketplaces, and trusted advisors, to navigate the complexities of the Texas health insurance system. Ultimately, having the right coverage provides peace of mind and ensures you have access to the healthcare you need when you need it.

FAQ Corner

What are the most common types of health insurance plans in Texas?

The most common types of health insurance plans in Texas include individual plans, family plans, employer-sponsored plans, and government-funded plans like Medicaid and Medicare.

What are the eligibility requirements for Medicaid in Texas?

Eligibility for Medicaid in Texas is based on income, family size, and other factors. You can find detailed information and apply online through the Texas Health and Human Services website.

Can I compare health insurance plans online in Texas?

Yes, you can compare health insurance plans online through the Texas Health Insurance Marketplace, which allows you to browse various plans and compare their features and costs.

How often can I change my health insurance plan in Texas?

You can typically change your health insurance plan during the annual open enrollment period, which runs from November 1st to January 15th. You may also be eligible for a special enrollment period if you experience a qualifying life event, such as losing your job or getting married.