How much is insurance in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding the cost of insurance in Australia is crucial for individuals and families seeking financial protection and peace of mind. The price of insurance premiums can vary significantly based on a multitude of factors, including your age, location, type of coverage, and personal risk profile.

From health insurance to car insurance, home insurance, and life insurance, the Australian market offers a wide range of options to cater to diverse needs and circumstances. Navigating this landscape requires a comprehensive understanding of the factors that influence insurance costs, the various types of policies available, and the process of obtaining quotes and making claims. This guide aims to provide valuable insights and practical advice to empower you to make informed decisions about your insurance needs.

Factors Influencing Insurance Costs in Australia

Insurance premiums in Australia are determined by a variety of factors, ensuring that individuals pay a fair price for the level of coverage they require. These factors are carefully considered by insurance companies to accurately assess risk and determine the cost of providing insurance.

Age

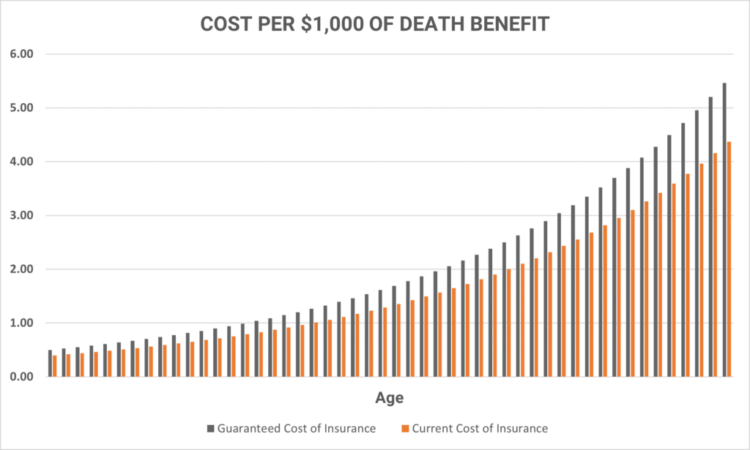

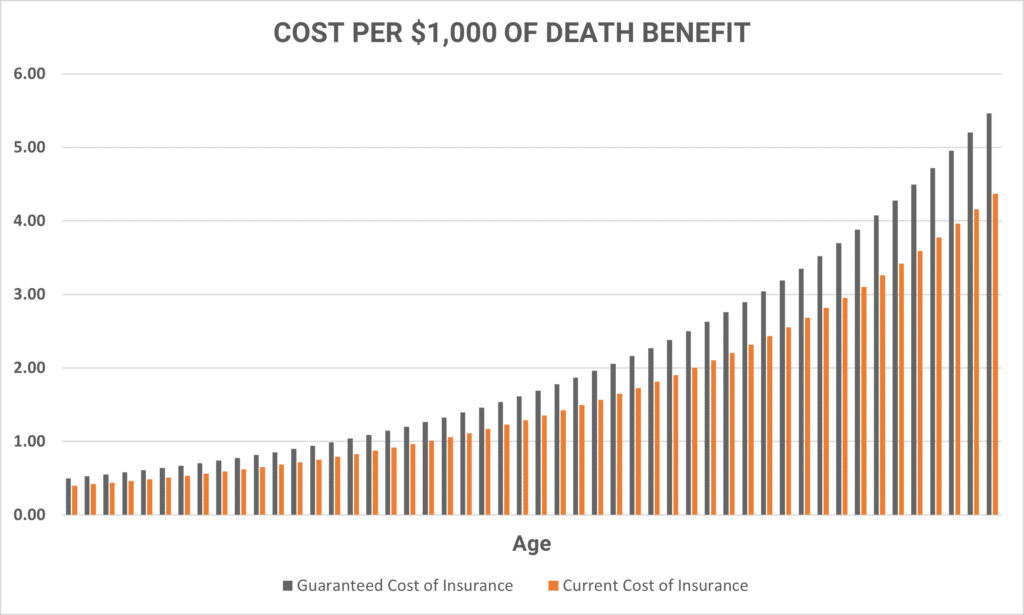

Age plays a significant role in insurance premiums, as it is a strong indicator of risk. Younger individuals tend to have a lower risk profile, as they are statistically less likely to make claims. Conversely, older individuals are often considered higher risk due to factors such as increased likelihood of health issues and potential for accidents. This is reflected in insurance premiums, with younger individuals generally paying lower premiums compared to their older counterparts.

Location

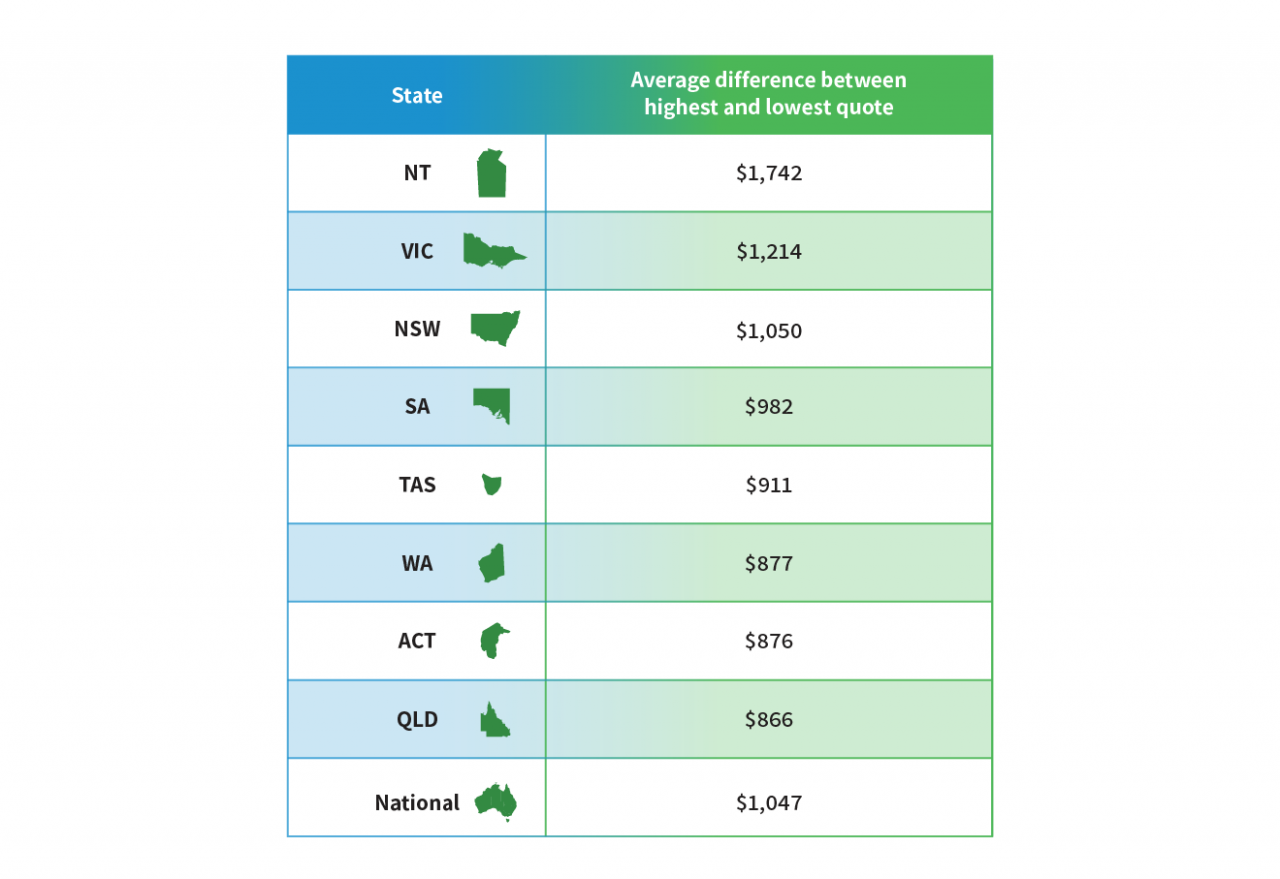

The location where you live can also impact your insurance premiums. Insurance companies consider factors such as crime rates, traffic congestion, and the prevalence of natural disasters in a particular area. For example, individuals living in high-crime areas may pay higher premiums for home and contents insurance due to an increased risk of theft or vandalism. Similarly, those residing in areas prone to bushfires or floods may face higher premiums for property insurance.

Type of Coverage

The type of insurance coverage you choose significantly influences the premium you pay. Different insurance policies offer varying levels of protection and coverage, which directly impact the cost. For example, comprehensive car insurance, which provides broader coverage for accidents, theft, and other damages, will generally be more expensive than third-party property damage insurance, which offers limited coverage.

Risk Profile

Insurance companies assess your individual risk profile to determine your premiums. This involves considering various factors, such as your occupation, hobbies, health history, and driving record. For instance, individuals engaged in high-risk occupations, such as construction workers or firefighters, may pay higher premiums for life insurance due to the inherent risks associated with their professions. Similarly, individuals with a history of health problems may face higher premiums for health insurance.

Claims History

Your claims history plays a significant role in determining your insurance premiums. Individuals with a history of making claims are often considered higher risk and may face higher premiums. This is because insurance companies use past claims data to assess the likelihood of future claims. Conversely, individuals with a clean claims history may be eligible for discounts, as they are seen as lower risk.

Driving Record

For car insurance, your driving record is a crucial factor in determining your premium. Individuals with a history of traffic violations, accidents, or speeding tickets are considered higher risk and may face higher premiums. Conversely, individuals with a clean driving record may be eligible for discounts, as they are seen as lower risk.

Lifestyle Choices

Certain lifestyle choices can also affect your insurance premiums. For example, smokers often face higher premiums for life insurance due to the increased health risks associated with smoking. Similarly, individuals who engage in dangerous hobbies, such as skydiving or motorcycling, may face higher premiums for accident insurance.

Understanding Insurance Policies: How Much Is Insurance In Australia

Insurance policies are legal contracts that Artikel the terms and conditions of coverage between you and your insurer. They are essential for understanding your rights and responsibilities when it comes to insurance.

Key Terms and Conditions

It is crucial to understand the key terms and conditions Artikeld in your insurance policy to make informed decisions about your coverage. These terms define the scope of your insurance and your responsibilities in the event of a claim.

- Deductible: This is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible usually means lower premiums. For example, if you have a $500 deductible for your car insurance and you are in an accident that costs $2,000 to repair, you would pay the first $500 and your insurance company would cover the remaining $1,500.

- Co-payment: This is a fixed amount you pay for specific services, such as doctor visits or prescriptions. It is typically a small amount, but it can add up over time.

- Coverage Limits: This refers to the maximum amount your insurer will pay for a covered event. For instance, if you have a $100,000 coverage limit for your home insurance and your house is damaged in a fire, your insurer will pay up to $100,000 towards the repairs.

- Exclusions: These are specific events or circumstances that are not covered by your insurance policy. For example, most home insurance policies exclude coverage for natural disasters like earthquakes, unless you have purchased additional coverage.

- Waiting Periods: These are periods of time that must pass before certain benefits become available. For instance, there might be a waiting period before you can claim for income protection benefits.

Importance of Reading and Understanding

It is crucial to read and understand your insurance policy documents thoroughly before purchasing coverage.

“A thorough understanding of your insurance policy is essential for making informed decisions and ensuring you have adequate coverage for your needs.”

Tips for Interpreting Insurance Policy Language

Insurance policies can be complex and filled with technical jargon. Here are some tips to help you understand them better:

- Read the entire policy carefully: Don’t just skim through it. Pay attention to every detail, including the fine print.

- Ask questions: If you don’t understand something, don’t hesitate to ask your insurance agent or broker for clarification.

- Use a dictionary: Look up any unfamiliar terms or phrases to ensure you fully grasp the meaning.

- Consider getting professional advice: If you find the policy particularly complex, consider consulting with an independent insurance advisor.

Identifying Potential Pitfalls

While reading your insurance policy, be aware of potential pitfalls that could impact your coverage.

- Hidden exclusions: Look out for any exclusions that may not be immediately obvious. For instance, certain policies might exclude coverage for specific types of damage or events.

- Limited coverage: Ensure the coverage limits are adequate for your needs. Consider your assets and potential risks to determine if the limits are sufficient.

- Unclear language: Be wary of any ambiguous or unclear language in the policy. Seek clarification if you are unsure about the meaning of any terms.

Insurance Regulations and Consumer Protection

The Australian insurance industry operates within a robust regulatory framework designed to protect consumers and ensure fair and transparent practices. The Australian Prudential Regulation Authority (APRA) plays a central role in overseeing the industry, setting standards, and ensuring financial stability.

Consumer Protection Measures

Consumer protection is a priority in the Australian insurance landscape. Several measures are in place to safeguard consumers’ interests and ensure they are treated fairly.

- The Australian Financial Complaints Authority (AFCA): AFCA is an independent body that resolves disputes between consumers and financial service providers, including insurers. Consumers can lodge complaints with AFCA if they feel they have been treated unfairly by their insurer.

- The Insurance Contracts Act 1984: This legislation sets out the minimum standards for insurance contracts, including requirements for disclosure and good faith. It also provides consumers with certain rights, such as the right to cancel their policy within a certain timeframe.

- The Australian Securities and Investments Commission (ASIC): ASIC regulates the financial services industry, including insurance. It ensures that insurance products are marketed fairly and that consumers are provided with accurate information.

- The Australian Competition and Consumer Commission (ACCC): The ACCC enforces the Competition and Consumer Act 2010, which prohibits unfair and misleading conduct by businesses, including insurance companies.

Common Insurance Scams

It’s important to be aware of common insurance scams to protect yourself from fraud. Here are some examples:

- Phishing scams: These scams involve emails or text messages that appear to be from a legitimate insurance company, but are actually designed to steal your personal information. Be cautious about clicking on links in emails or text messages from unknown senders.

- Fake insurance brokers: Some individuals or companies may pose as legitimate insurance brokers but are actually trying to defraud you. Always verify the credentials of any insurance broker you deal with.

- Claims scams: These scams involve making false claims to an insurance company. For example, someone might claim their car was stolen when it was actually sold, or they might exaggerate the extent of their injuries after an accident.

Tips for Avoiding Insurance Scams

Here are some tips to help you avoid insurance scams:

- Be wary of unsolicited offers: If you receive an unsolicited offer for insurance, be cautious. Legitimate insurance companies will not contact you out of the blue.

- Verify the credentials of any insurance broker or company: You can check the credentials of an insurance broker or company with the Financial Services Council (FSC) or ASIC.

- Read your insurance policy carefully: Understand the terms and conditions of your policy before you sign up.

- Report any suspected scams: If you suspect you have been the victim of an insurance scam, report it to the relevant authorities, such as ASIC or the ACCC.

Making Insurance Claims

Filing an insurance claim in Australia is a process that involves notifying your insurer about an incident and providing them with the necessary documentation to support your claim. The process is designed to be straightforward, but it can be overwhelming if you are unfamiliar with the steps involved.

Types of Insurance Claims

Insurance claims can be categorized based on the type of insurance policy you have and the nature of the incident. Here are some common types of insurance claims in Australia:

- Property Damage Claims: These claims are filed when your property, such as your home, car, or belongings, has been damaged or destroyed due to an insured event, like a fire, flood, or theft.

- Medical Expenses Claims: These claims cover medical expenses incurred due to an accident or illness covered by your health insurance policy.

- Lost Income Claims: These claims cover lost wages or income due to an illness or injury that prevents you from working.

- Liability Claims: These claims are filed when you are held liable for causing damage or injury to another person or their property.

Filing an Insurance Claim

To file an insurance claim, you need to contact your insurer as soon as possible after the incident. You will need to provide them with the following information:

- Your policy details, including your policy number and contact information.

- Details of the incident, including the date, time, and location.

- A description of the damage or loss.

- Any relevant documentation, such as police reports, medical records, or repair quotes.

Tips for Maximizing Your Claim

Here are some tips to help you maximize your chances of a successful insurance claim:

- Report the incident promptly: Contact your insurer as soon as possible after the incident occurs. This will help you avoid any potential delays in processing your claim.

- Document everything: Keep detailed records of the incident, including photos, videos, and witness statements.

- Obtain quotes from multiple repairers: This will help you ensure that you are getting a fair price for the repairs.

- Be honest and accurate: Provide your insurer with all the relevant information about the incident, even if it might seem insignificant.

- Keep track of all communication: Keep a record of all communication with your insurer, including emails, phone calls, and letters.

Understanding Your Policy, How much is insurance in australia

It is important to understand the terms and conditions of your insurance policy before you file a claim. This will help you understand what is covered and what is not.

Common Claim Denials

Insurance claims can be denied for a variety of reasons, such as:

- The incident is not covered by your policy: For example, if you have a home insurance policy that does not cover flood damage, your claim for flood damage will be denied.

- You failed to meet the policy’s requirements: For example, if your policy requires you to have a security system installed and you did not, your claim for theft may be denied.

- You made a fraudulent claim: This is a serious offense that can result in criminal charges.

Appealing a Claim Denial

If your claim is denied, you have the right to appeal the decision. You should contact your insurer and explain why you believe the claim should be approved.

Claim Timeframes

The time it takes to process an insurance claim can vary depending on the complexity of the claim. However, insurers are required to process claims within a reasonable timeframe. If you are concerned about the progress of your claim, you should contact your insurer and inquire about the status.

Insurance Trends and Innovations

The Australian insurance landscape is constantly evolving, driven by technological advancements, changing consumer expectations, and a growing awareness of risk. This dynamic environment is giving rise to exciting trends and innovative solutions that are reshaping how insurance is purchased, priced, and delivered.

The Rise of Online Insurance Providers

The internet has revolutionized the way people access and purchase insurance. Online insurance providers are gaining popularity in Australia due to their convenience, transparency, and often lower premiums. These platforms offer a streamlined experience, allowing customers to compare quotes from multiple insurers, get instant coverage, and manage their policies digitally.

Telematics Data and Personalized Pricing

Telematics technology, which uses sensors and data from vehicles to track driving behavior, is transforming the auto insurance industry. Insurers are leveraging this data to personalize premiums based on individual driving habits. This approach rewards safe drivers with lower premiums, promoting responsible driving and encouraging risk mitigation.

Artificial Intelligence and Claims Processing

Artificial intelligence (AI) is playing an increasingly significant role in insurance, particularly in claims processing. AI-powered systems can automate tasks like damage assessment, fraud detection, and claims management, leading to faster processing times and reduced costs. This technology also allows insurers to analyze large datasets to identify patterns and predict potential claims, enabling proactive risk management.

The Future of Insurance

The insurance industry in Australia is expected to continue its digital transformation, with a growing focus on personalized experiences, data-driven insights, and innovative risk management solutions. Emerging trends include:

- Insurtech: The emergence of new insurance technology companies (insurtech) is disrupting the traditional insurance market. These companies are developing innovative products and services, leveraging technologies like blockchain, AI, and big data to provide more efficient and customized insurance solutions.

- Predictive Analytics: Insurers are increasingly using predictive analytics to identify high-risk individuals and businesses, allowing them to tailor their insurance products and pricing strategies accordingly. This data-driven approach helps insurers make informed decisions and manage risk effectively.

- Internet of Things (IoT): The widespread adoption of IoT devices is creating new opportunities for insurance. Connected devices can provide valuable data about individual behavior and risk factors, enabling insurers to offer personalized insurance policies and proactive risk management services.

Summary

In conclusion, understanding the intricacies of insurance in Australia is essential for securing financial protection and navigating the complexities of the market. By considering the factors that influence insurance costs, comparing quotes from multiple providers, and carefully reading policy documents, individuals can make informed decisions and obtain the best value for their insurance needs. With the right knowledge and proactive approach, you can navigate the Australian insurance landscape with confidence and peace of mind.

Query Resolution

How can I get the best insurance deal in Australia?

To secure the best insurance deal, compare quotes from multiple providers, consider your individual needs and risk profile, and look for discounts or promotions. It’s also crucial to read policy documents carefully to understand coverage details and potential limitations.

What are some common insurance scams to watch out for in Australia?

Common insurance scams include phishing emails, fake insurance providers, and fraudulent claims. Be cautious of unsolicited offers, verify provider legitimacy, and report any suspicious activity to the relevant authorities.

What are the benefits of having health insurance in Australia?

Health insurance provides coverage for medical expenses, including hospital stays, surgery, and specialist consultations. It can help reduce out-of-pocket costs and provide access to private healthcare services.