- Understanding Public Liability Insurance in Australia

- Factors Influencing Public Liability Insurance Costs

- Obtaining Public Liability Insurance Quotes: How Much Is Public Liability Insurance In Australia

- Public Liability Insurance Coverage and Limits

- Making a Public Liability Insurance Claim

- End of Discussion

- FAQ Compilation

How much is public liability insurance in Australia? This question is crucial for individuals and businesses alike, as it’s a vital safety net against potential financial repercussions arising from accidents or incidents causing harm to others. Public liability insurance provides financial protection by covering legal costs and compensation claims in the event of an injury or damage caused by you or your business. It’s an essential consideration for anyone who interacts with the public, whether you’re a tradesperson, a small business owner, or simply a homeowner.

The cost of public liability insurance varies significantly based on a multitude of factors, including your industry, business size, location, claims history, and the specific level of coverage you require. Understanding these factors and the process of obtaining quotes from reputable insurers is key to securing adequate protection at a reasonable price. This guide delves into the intricacies of public liability insurance in Australia, providing valuable insights into the cost, coverage, and claiming process.

Understanding Public Liability Insurance in Australia

Public liability insurance is a crucial type of coverage that protects individuals and businesses from financial losses arising from injuries or property damage caused to others. It acts as a safety net, offering peace of mind and financial security in the event of an unexpected incident.

Purpose and Scope of Public Liability Insurance

Public liability insurance in Australia aims to safeguard individuals and businesses against financial liability stemming from incidents that cause injury or property damage to third parties. This coverage extends to various situations, including:

- Slip, trip, and fall accidents on your property.

- Damage to property caused by your actions or negligence.

- Injuries sustained by visitors or customers due to your activities.

- Professional negligence claims.

Definition of Public Liability Insurance

Public liability insurance is a type of insurance that provides financial protection against legal claims made by third parties for injuries or property damage caused by your actions or negligence. It essentially acts as a shield against potential financial burdens arising from such incidents.

Benefits of Public Liability Insurance

Having public liability insurance offers numerous advantages for both individuals and businesses:

- Financial Protection: Public liability insurance covers legal costs, compensation payments, and other expenses incurred in defending against claims and settling claims.

- Peace of Mind: It provides a sense of security knowing that you are protected from significant financial losses in the event of an incident.

- Business Continuity: For businesses, public liability insurance can help ensure continued operations by safeguarding against potential financial disruptions caused by claims.

- Reputation Management: A strong public liability insurance policy can help protect your reputation and brand image by demonstrating a commitment to safety and responsibility.

Types of Risks Covered

Public liability insurance in Australia covers a wide range of risks, including:

- Personal Injury: This covers claims arising from bodily harm, including death, caused to a third party due to your actions or negligence.

- Property Damage: This covers claims for damage or loss to a third party’s property, such as buildings, vehicles, or personal belongings, caused by your actions or negligence.

- Professional Negligence: This covers claims arising from professional errors or omissions that result in financial losses or damages to a third party.

- Product Liability: This covers claims arising from defects or problems with products you manufacture, sell, or distribute, which cause injury or property damage to a third party.

Factors Influencing Public Liability Insurance Costs

Several factors influence the cost of public liability insurance in Australia. These factors are assessed by insurers to determine the level of risk associated with a particular business or individual, and subsequently, the premium charged.

Industry Type

The industry in which a business operates significantly impacts public liability insurance premiums. High-risk industries, such as construction, manufacturing, and hospitality, often face higher premiums due to the increased likelihood of accidents and injuries. For instance, a construction company is more likely to be involved in accidents involving heavy machinery and falling objects than a retail store.

Business Size

The size of a business also influences insurance costs. Larger businesses typically have more employees, handle more transactions, and operate in more locations, leading to increased risk exposure. Consequently, larger businesses often face higher premiums than smaller businesses. For example, a large national retailer with numerous stores and a large workforce is likely to have higher insurance premiums than a small local shop with a few employees.

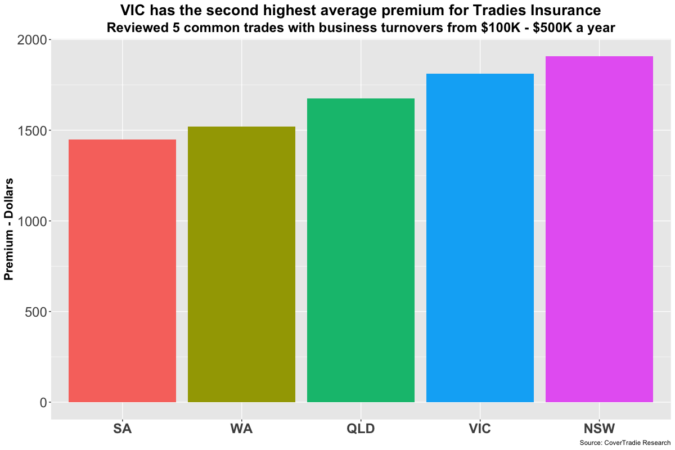

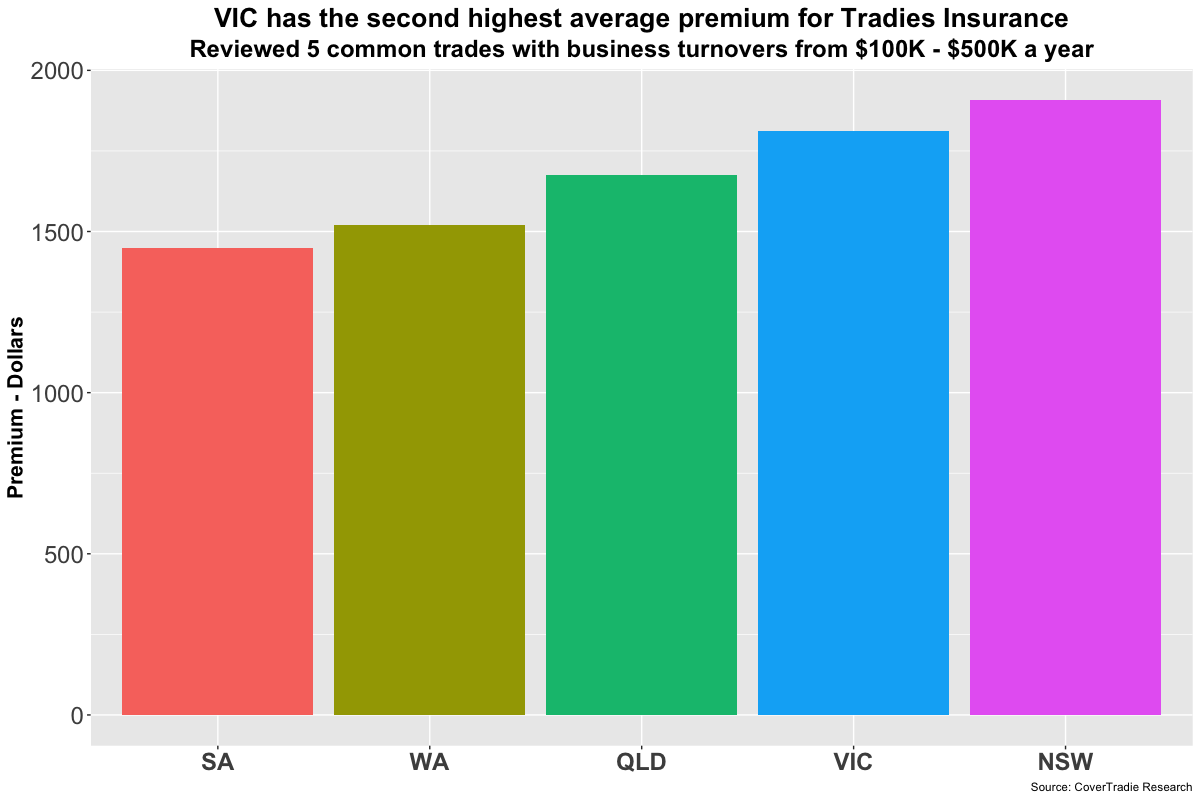

Location

The location of a business can impact insurance costs due to factors such as crime rates, population density, and the prevalence of natural disasters. Businesses operating in high-risk areas with higher crime rates or frequent natural disasters may face higher premiums. For example, a business located in a densely populated city with a high crime rate may face higher premiums than a business located in a rural area with low crime rates.

Claims History

A business’s claims history plays a significant role in determining its insurance costs. Businesses with a history of frequent claims, particularly for significant amounts, may face higher premiums. This is because insurers perceive them as a higher risk. Conversely, businesses with a clean claims history may qualify for discounts or lower premiums. For example, a business with a history of multiple injury claims may face higher premiums than a business with no claims history.

Risk Assessment

Insurers conduct risk assessments to evaluate the potential hazards associated with a business. This involves examining the business’s operations, work practices, safety procedures, and other relevant factors. Businesses with a high-risk profile based on the risk assessment may face higher premiums. For example, a business with inadequate safety procedures or a history of unsafe work practices may face higher premiums.

Excess or Deductible

The excess or deductible is the amount a policyholder must pay out of pocket before the insurer covers the remaining costs of a claim. A higher excess or deductible typically leads to lower premiums. Businesses with a strong financial position or a lower risk profile may choose to opt for a higher excess or deductible to reduce their premiums. Conversely, businesses with limited financial resources or a high-risk profile may opt for a lower excess or deductible to ensure they have adequate coverage in case of a claim.

Obtaining Public Liability Insurance Quotes: How Much Is Public Liability Insurance In Australia

Getting quotes for public liability insurance in Australia is a straightforward process. You can obtain quotes online, over the phone, or in person from insurance brokers or directly from insurance companies.

Reputable Insurance Providers

It’s essential to work with reputable insurance providers that specialize in public liability coverage. Here are some of the leading insurance companies in Australia that offer public liability insurance:

- AAMI

- Allianz

- Budget Direct

- GIO

- Insurance Australia Group (IAG)

- NRMA

- QBE

- Suncorp

- Youi

Comparing Quotes

When comparing quotes from different insurers, it’s important to consider the following factors:

- Coverage: Ensure the policy covers the specific risks associated with your business or activities. Some policies may have exclusions or limitations.

- Premium: Compare the cost of the premiums, but remember that the cheapest option may not always be the best.

- Excess: This is the amount you pay out of pocket before the insurance covers the rest. A higher excess can lower your premium but will result in higher out-of-pocket expenses if you need to claim.

- Claims Process: Understand how easy it is to file a claim and how quickly the insurer processes claims.

- Customer Service: Read reviews or ask for recommendations to ensure the insurer provides good customer service.

Understanding Policy Terms and Conditions

Before purchasing public liability insurance, it’s crucial to read and understand the policy terms and conditions. This will help you avoid any surprises later on. Pay attention to the following:

- Exclusions: These are specific events or situations that are not covered by the policy. For example, a policy may exclude coverage for certain types of activities or for claims arising from intentional acts.

- Limits: The maximum amount the insurer will pay for a single claim or over the entire policy period. Ensure the limits are sufficient to cover your potential liabilities.

- Conditions: These are specific requirements you must meet to be eligible for coverage. For example, you may need to maintain certain safety standards or keep accurate records.

Public Liability Insurance Coverage and Limits

Public liability insurance provides financial protection against claims arising from injuries or property damage caused by your negligence. This coverage is crucial for individuals and businesses alike, as it helps safeguard against potentially substantial financial losses. Understanding the different types of coverage and the concept of policy limits is essential for choosing the right insurance policy.

Coverage Offered by Public Liability Insurance Policies

Public liability insurance policies offer a range of coverage options to cater to various needs. The specific coverage offered may vary depending on the insurer and the policy type. Here are some common types of coverage:

- Bodily Injury: This coverage protects you against claims for injuries sustained by third parties due to your negligence. It covers medical expenses, lost wages, pain and suffering, and other related costs.

- Property Damage: This coverage protects you against claims for damage to third-party property caused by your negligence. It covers repair or replacement costs, as well as any associated expenses.

- Legal Defense Costs: This coverage covers the legal expenses incurred in defending against a claim, including lawyer fees, court costs, and expert witness fees.

- Product Liability: This coverage protects businesses against claims arising from defective products they manufacture or sell. It covers injuries or property damage caused by the product.

- Public Liability for Volunteers: This coverage provides protection for volunteers who are involved in activities for non-profit organizations. It covers injuries or property damage caused by their negligence while performing their duties.

Policy Limits and Their Impact on Claims Payouts, How much is public liability insurance in australia

Policy limits represent the maximum amount an insurer will pay for a single claim or for all claims during a policy period. They are crucial in determining the extent of financial protection provided by the insurance policy.

Policy limits are expressed as a monetary value, for example, $10 million per claim or $20 million per policy period.

If a claim exceeds the policy limit, the insured party is responsible for the remaining amount. Choosing appropriate policy limits is essential, as insufficient limits could leave you financially vulnerable in the event of a significant claim.

Common Scenarios Covered by Public Liability Insurance

Public liability insurance covers a wide range of scenarios involving negligence that may lead to injuries or property damage. Here are some common examples:

- Slip and Fall Accidents: If someone slips and falls on your property due to a hazard like ice, a loose floorboard, or a wet floor, public liability insurance can cover the resulting injuries.

- Dog Bites: If your dog bites someone, public liability insurance can cover the medical expenses and other costs associated with the injury.

- Damage to Third-Party Property: If your actions accidentally damage someone’s property, such as a neighbor’s fence or a parked car, public liability insurance can cover the repair or replacement costs.

- Professional Negligence: If you provide professional services and your negligence results in a loss for your client, public liability insurance can cover the resulting financial damages.

Importance of Selecting Appropriate Coverage Limits

Selecting appropriate coverage limits is crucial for ensuring adequate financial protection. The appropriate limits will vary depending on your individual or business needs, including:

- Nature of Activities: The type of activities you engage in, such as construction, sporting events, or professional services, will influence the potential risk of claims and the required coverage limits.

- Financial Exposure: The potential financial exposure you face in the event of a claim will also impact the required coverage limits.

- Industry Standards: Some industries have specific standards for public liability insurance coverage limits. It’s essential to research these standards and ensure your policy meets them.

Making a Public Liability Insurance Claim

Making a claim under your public liability insurance policy can be a straightforward process, but it’s important to understand the steps involved and the documentation required to ensure a successful outcome.

Filing a Claim

Once you have experienced an incident that might be covered under your public liability insurance policy, it’s crucial to contact your insurer as soon as possible. This will allow them to start the claims process and provide you with guidance on the next steps.

Documentation Required for a Claim

To support your claim, you will need to provide your insurer with specific documentation. This typically includes:

- A detailed written account of the incident: This should include the date, time, and location of the incident, as well as a clear description of what happened and the injuries or damages sustained.

- Contact information for all parties involved: This includes the names, addresses, and phone numbers of any witnesses, the injured party, and any other relevant individuals.

- Supporting documentation for the claim: This could include photographs, videos, medical reports, repair quotes, or any other relevant evidence that supports your claim.

- A copy of your public liability insurance policy: This will provide your insurer with the necessary details about your coverage and policy limits.

Tips for Maximizing the Chances of a Successful Claim

To increase the likelihood of a successful claim, consider the following tips:

- Act promptly: Notify your insurer as soon as possible after the incident occurs. This demonstrates your commitment to resolving the situation and helps to prevent any potential delays in the claims process.

- Be thorough and accurate: Provide your insurer with a detailed and accurate account of the incident, including all relevant information and supporting documentation.

- Cooperate with your insurer: Respond promptly to any requests for information or documentation from your insurer. This will help to keep the claims process moving smoothly.

- Seek legal advice: If you are unsure about any aspect of the claims process or if you feel that your claim is being unfairly handled, it’s advisable to seek legal advice from a qualified professional.

Potential Implications of Making a Claim on Future Insurance Premiums

It’s important to understand that making a claim on your public liability insurance policy could potentially affect your future insurance premiums.

Insurers may increase your premiums if you have a history of making claims, particularly if they are deemed to be frequent or unnecessary.

This is because claims increase the insurer’s risk exposure and the likelihood of having to pay out benefits.

End of Discussion

Navigating the world of public liability insurance can be daunting, but understanding the key factors influencing costs and the process of obtaining quotes can empower you to make informed decisions. Remember, it’s crucial to consult with a professional insurance broker or advisor to ensure you have the right coverage and limits tailored to your specific needs. By taking the time to explore your options and seeking expert guidance, you can secure the peace of mind that comes with knowing you are adequately protected against potential risks.

FAQ Compilation

What are the main types of public liability insurance policies available in Australia?

Public liability insurance policies come in various forms, including general liability, professional indemnity, and product liability. The specific type you need depends on your industry and the nature of your business activities.

How often should I review my public liability insurance policy?

It’s recommended to review your public liability insurance policy annually, or whenever there are significant changes to your business, such as expansion, new products or services, or increased risk exposure.

Can I claim public liability insurance for accidents caused by a third party?

Public liability insurance typically covers accidents caused by you or your business, not those caused by a third party. However, some policies may offer limited coverage for third-party negligence.

What happens if I make a claim on my public liability insurance?

Making a claim on your public liability insurance may result in an increase in your premiums in the future. The impact depends on the nature of the claim and your insurer’s specific policies.